Policies & action

Chile’s current policies are almost sufficient when rated against modelled domestic pathways. The “Almost sufficient” rating indicates that Chile’s climate policies and action in 2030 are not yet consistent with the 1.5°C temperature limit but could be, with moderate improvements. If all countries were to follow Chile’s approach, warming could be held below—but not well below—2°C.

Chile’s upper end of its current policy projections sits in the “Insufficient” range, meaning a lack of implementation of mitigation policies and increased natural gas consumption from retrofitting coal plants could result in a worse rating for Chile. Our 1.5°C modelled domestic pathway is based on global least-cost mitigation and defines the minimum level of emission reductions needed at home to be 1.5°C compatible. It should be taken as the floor, and not ceiling, for domestic ambition.

According to our assessment, emissions under Chile’s currently implemented policies would reach 100–108 MtCO2e (excl. LULUCF) by 2030 (6–13% below 2021 levels). The CAT estimates that Chile reached peak emissions in 2021, ahead of the 2025 target in its NDC. However, this emissions level is still insufficient to reach both the conditional and unconditional 2030 NDC targets (88–95 MtCO2e), let alone be on a 1.5°C trajectory. Chile will need to implement additional policies in order to be 1.5°C compatible.

Since our previous assessment, Chile has continued to shut down coal plants according to its phase-out plan. Over 1.2 GW of coal capacity from 11 plants has been retired since 2019 and an additional nine units have committed to retire or convert to natural gas between 2024 and 2025. While considered a “transition fuel” by the Chilean government, gas is still a fossil fuel that needs to be phased out – therefore, Chile must be careful when repurposing the plants to avoid the risk of carbon lock-in and stranded assets. Recent scientific literature highlights that there is no room for investment in new oil, gas, and coal activities if global warming is to be limited to 1.5°C (Green et al., 2024).

While there were discussions in August 2022 around bringing forward the coal phase-out year to 2030, it has not been mentioned in the Second Phase of the Energy Transition strategy released in 2023 (Ministerio de Energía, 2022a). An early coal phase-out, where electricity generation is replaced by renewable sources rather than fossil gas, could significantly impact Chile’s current policies pathway and bring it considerably closer to a 1.5°C trajectory.

The transport sector makes up a significant share of Chile’s total GHG emissions, especially as its energy consumption continues to increase. The Electromobility Strategy, Energy Efficiency Law, and ban on ICE cars by 2035 are key policies expected to accelerate the low-carbon transportation transition, but Chile’s EV sales have yet to exceed 1%. More could be done to encourage EV uptake and decrease energy demand, for instance, by reforming diesel fuel subsidies and a incentivising a modal shift in transportation.

Maintaining the LULUCF sink is an important component of Chile’s climate targets, which is threatened by the increased frequency and severity of wildfires related to climate change. While Chile has ambitious commitments for reforestation and sustainable forest management in its NDC, the pace of implementation has been far too slow, and stronger policies to support reforestation and forest management are needed. At the same time, Chile should avoid relying on LULUCF sinks for its targets and prioritise cutting emissions in other sectors.

Further information on how the CAT rates countries (against modelled domestic pathways and fair share) can be found here.

Policy overview

Between 2010 and 2022, Chile’s emissions increased by 27%, from 88 MtCO2e to 112 MtCO2e, excluding LULUCF. When considering Chile’s current policies, we estimate that Chile’s emissions already peaked in 2021 at a level of 115 MtCO2e. According to our assessment, Chile’s emissions levels in 2030 under current policies will be between 100–108 MtCO2e/year (excl. LULUCF). Our analysis suggests that Chile will not meet its conditional nor unconditional NDC targets in 2030 under current policies, or be 1.5° compatible.

Compared to our previous assessment, emissions under current policies have increased due to higher historical emissions than previously projected, a stronger rebound after COVID, and changes to the current policy assumptions.

Chile’s key climate policies include the Energy Efficiency Law (Law 21.305/2021), a legal framework aiming to reduce energy consumption across the power, transport, buildings, and industry sectors. It also includes the coal phase-out, where all of Chile’s coal-fired units (28) are expected to retire or be retrofitted by 2040. An earlier coal phase-out could have a sizable impact on Chile’s current policy trajectory, but only if the coal capacity is replaced with generation from renewable energy sources. The CAT estimates that choosing to retrofit coal plants with gas could lead to at least 3 MtCO2e fewer in emission reductions in the short-term compared to retiring coal-fired units and using renewable electricity sources, and can lead to carbon lock-in risks and stranded assets.

The Electromobility Strategy guides climate policy in the transport sector and sets out an action plan to electrify 100% of the urban public transport vehicle fleet by 2050 and ban the sale of new cars with combustion engines in 2035. Chile has also introduced a carbon tax (Law 20.780/2014), although its price is likely too low to result in emissions reductions.

In June 2022, Chile passed the Framework Law on Climate Change (21455) (Congreso Nacional de Chile, 2022). It includes the 2050 GHG neutrality target and recognises the NDC target, making them legally binding. As a result, Chile now has a legal framework that assigns responsibilities and strengthens the legal and institutional basis for implementing climate change mitigation and adaptation policies across all sectors, and is moving towards a low emissions economy. It also presents a paradigm shift in Chile’s environmental policy, as climate action is now not only the responsibility of the environment ministry but is spread across 17 national ministries, as well as regional governments and municipalities, and even includes the private sector.

While most of the important regulations outlined in the Framework Law on Climate Change have come into force, Chile has been delayed in implementing two new regulations and modifying two existing regulations (Peña, 2024). The regulation on its Article 6 framework is heading into its consultation stage, but there has been no movement on its related law outlining the requirements and verification method around the GHG emissions reduction or absorption certificates. The law also mandates the relevant ministries to develop sectoral mitigation plans by 2024, but no plans have yet been released (CR2 and Centro de Derecho Ambiental, 2024).

Since our previous assessment, there have been no major changes to Chile’s climate policies. New laws to promote renewable energy and address critical barriers like a lack of transmission lines, such as the Law on Energy Storage and Electromobility and the Energy Transition Law, have been in the legislative process for a couple of years now.

Chile has nevertheless made progress in that time, publishing new sectoral strategies to guide its short-term climate plans such as the Initial Agenda for the Second Phase of the Energy Transition, the Ministry of Energy’s Decarbonisation Plan, the Roadmap for the Advancement of Electromobility, as well as the Green Hydrogen Action Plan 2023-2030.

Chile is on track with its 2040 coal phase-out plan, meeting its goal of retiring 11 plants by 2024, and has even accelerated its implementation. Nine of the remaining coal-fired units have currently committed to being retired or retrofitted between 2024 and 2025, although it is unclear whether the retirement or reconversion will be timely. However, the eight remaining coal plants have yet to make a firm commitment: it is still possible for them to continue operating until 2040. While there were some discussions in 2022 on adopting an even earlier, more ambitious phase-out date of 2030, this has not been mentioned in a while. To bring its current policies considerably closer to a 1.5°C trajectory, Chile could update its national commitment to phase out coal-fired power by 2030.

Power sector

The power sector is Chile's largest emitting sector, accounting for 27% of total GHG emissions, or 39% of energy sector emissions. The general share of electricity production sources in 2024 was around 30% hydropower, 22% solar, 16% coal, 12% fossil gas, 11.5% wind power, 3% other fossil fuels, and 0.6% of other renewables (Ember, 2025). Fossil fuels had made up around two-thirds to a half of electricity generation since 2000, with hydropower accounting for the remaining share up to 2014. Hydropower generation notably dropped since the early 2000s, which can be attributed to both drought conditions and the uptake of other renewable sources (i.e. wind and solar), and has since accounted for 20–30% of the power mix (Revista Energética de Chile, 2022).

Chile has several key strategies and policies guiding its energy planning. The updated Energy Strategy, titled Chile’s Energy Transition (also known as PEN for Política Energética Nacional), was published in March 2022, and replaces the previous 2050 Energy Strategy from 2017. It sets a long-term vision for energy planning and provides a roadmap including 66 targets covering various sectors.

Targets have become substantially more ambitious than in the previous iteration: the targeted renewables share in electricity generation has increased from 60% by 2035 to 80% by 2030 and from 70% to 100% by 2050, setting out the new goal of a 100% renewable power system for the first time (Ministerio de Energía, 2015, 2022c). According to the CAT’s power sector benchmarks, Chile should achieve a more ambitious renewables share between 96–98% in 2030 and decarbonise by 2035 to be aligned with a global 1.5°C pathway (Climate Action Tracker, 2023).

A follow-up roadmap to the Energy Route 2018–2022, the other key ministerial document, known as PELP 2023–2027 (Planificación Energética de Largo Plazo) was released last year. It includes three modelled pathways, one based on current policies that assumes the 2030 NDC target will be reached, and two more ambitious pathways aiming at GHG neutrality by 2050 and earlier.

The Energy Efficiency Law (Ley de Eficiencia Energética, Law No. 21.305) was officially established as a legal framework for energy efficiency in February 2021. The law aims to foster energy efficiency and covers the industry, mining, transport, and buildings sectors, thereby reducing total final energy consumption by 10% by 2030 and 35% by 2050 in addition to various sectoral-level targets. It will play a central role in reaching net zero emissions in 2050 and also in achieving mid-term targets, and claims to lead to a reduction of 28.6 MtCO2e by 2030 (Ministerio de Energía, 2021d).

Chile has also implemented a carbon tax of 5 USD/tCO2 for stationary sources (turbines or boilers above 50 MWth), which came into effect in 2017. Payments for 2017 began in April 2018 and accounted for more than USD 190m (El Mercurio, 2018). In 2021, the tax covered 32.5% of GHG emissions. As of 2022, Chile’s carbon tax is applicable to all ‘large emitters’ (>25 ktCO2e/year) without any sectoral exclusions (OECD, 2024). However, Chile’s carbon tax is considered to be relatively ineffective due to its low prices.

Both the current policy and 2050 Energy Strategy scenarios from the Mitigation Plan include considerable generation from hydro — which accounted for 30% of generation in 2024 (Ember, 2025). The construction of large hydropower projects in Chile is highly controversial, largely because of significant adverse environmental and social impacts. In 2014, Chile’s government overturned environmental permits for HidroAysén, a massive hydroelectric project in Patagonia, after a seven year campaign against it - the largest environmental campaign in Chile’s history (NRDC, 2016).

Coal

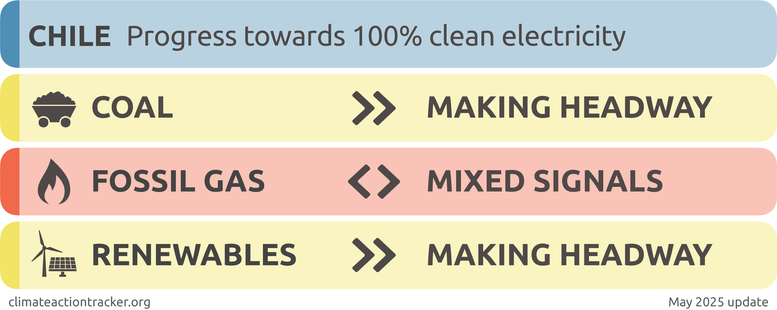

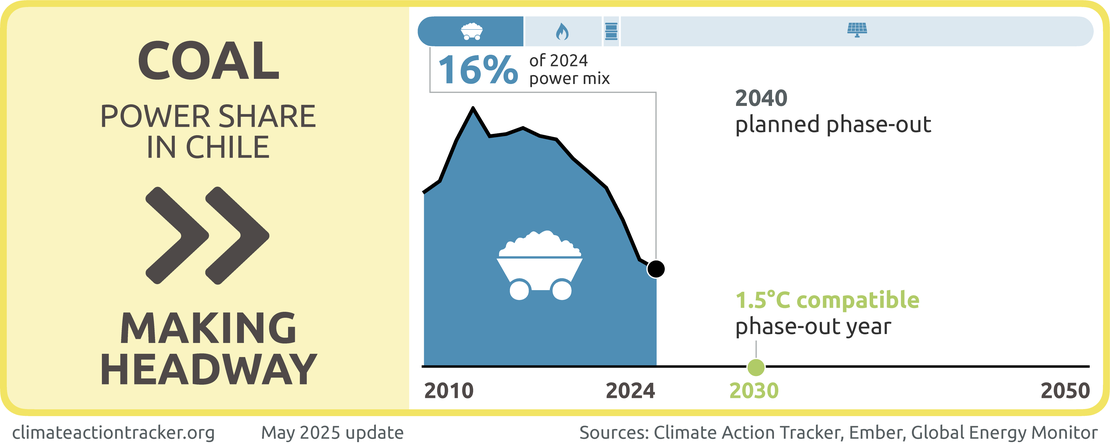

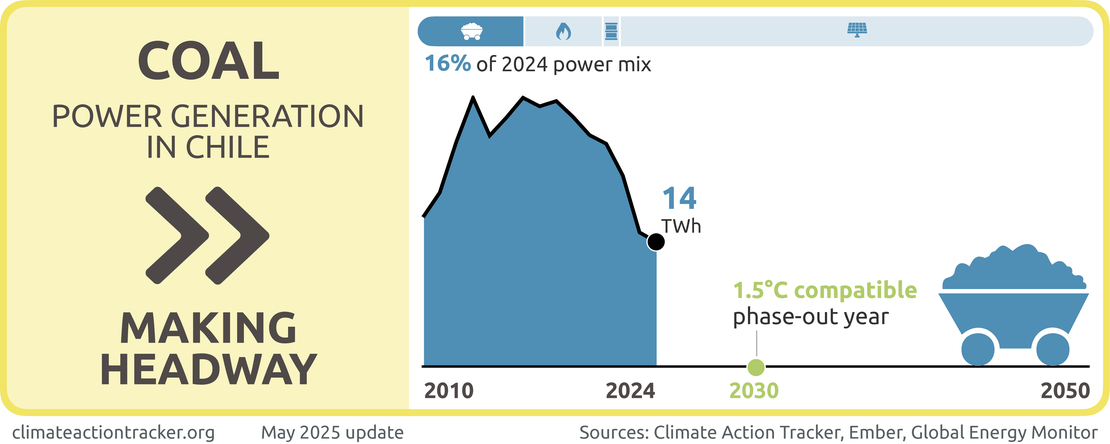

Chile is “making headway” in phasing out coal, with progress moving faster than expected. Coal generation has decreased in the last five years, falling from 28 TWh in 2019 to 14 TWh in 2024. Over the same period, the share of coal in Chile’s electricity mix also declined significantly—from 34% in 2019 to 16% in 2024 (Ember, 2025).

In June 2019, Chile announced its plans to completely phase out coal by 2040 and aim for GHG neutrality by 2050 (Ministerio de Energía, 2019). In line with this announcement, Chile signed the coal exit agreement and all of its clauses at COP26 and also prominently disclosed it in its updated NDC.

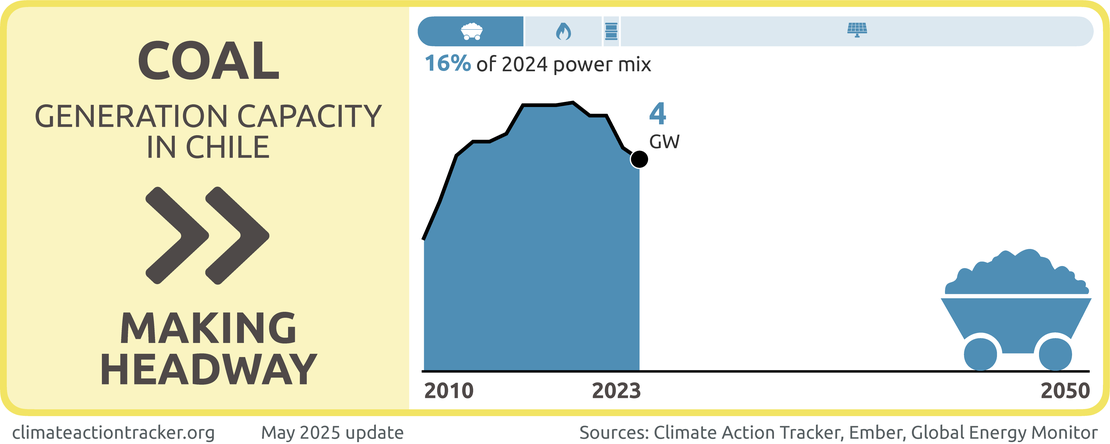

Since then, the coal phase-out has been progressing considerably faster than anticipated. The number of power plants to be shut by 2024 was increased to 11 in a 2020 updated plan (Ministerio de Energía, 2020c). In January 2024, the Ministry of Energy presented its Decarbonisation Plan, including a goal to retire or retrofit (with gas) 70%, or about 20, of Chile’s coal plants by the end of 2025 (Ministerio de Energía, 2023c).

The accelerated coal phase-out plan, while a very positive development, would mean Chile’s remaining coal-fired units are those without any concrete retirement commitments. At the moment, they are not obligated to stop operating until 2040, meaning that Chile could still use coal to meet its electricity demands until then. According to the CAT, an effective coal phase-out by 2030would align Chile with a 1.5°C global pathway. An early coal phase-out would also help bring Chile’s policies considerably closer to a 1.5°C trajectory if coal plants are completely retired in place of retrofitting them into natural gas plants (Climate Action Tracker, 2023).

As of July 2024, Chile has successfully retired 11 power plants with around 1.2 GW of installed capacity, achieving the 2024 goal. In 2023, only one coal-fired unit from the Ventanas power plant was retired, while in April 2024, the Norgener 1 and Norgener 2 units (totaling 276 MW) in Tocopilla were disconnected much earlier than their scheduled December 2025 date (Global Energy Monitor, 2024; Pizzoleo, 2024). After the approval of the Norgener plants’ retirement, however, the energy provider requested to continue operating in order to burn its remaining coal stock (Muñoz, 2024).

The first part of Chile’s Just Transition Strategy puts a focus on the retirement of coal plants. It aims to promote new job opportunities and investments, avoid significant increases in electricity rates, and develop new industries in communities that would be affected by the closure of coal plants. The strategy emphasises a participatory process with affected stakeholders and its implementation will be monitored by an Interministerial Committee (Ministerio de Energía, 2021a).

Nine of the remaining coal-fired units have made commitments to retire or reconvert between 2024 and 2025 (Ministerio de Energía, 2023c). However, the owners of the eight remaining units, representing 1.9 GW of coal capacity, have yet to make a firm commitment, so it is still possible for them to continue operating until the 2040 national commitment date (Global Energy Monitor, 2024).

In August 2022, when the energy minister presented the new Energy Agenda 2022, he mentioned that discussions were ongoing for an even more ambitious plan to retire all coal power plants by 2030 (Ministerio de Energía, 2022a), but these plans have not been mentioned in a while. In April 2023, the Ministry of Energy launched the Initial Agenda for the Second Phase of the Energy Transition, where only the 2040 coal phase-out was referenced. According to the CAT’s power sector benchmarks, a 2030 phase-out would align Chile with the global 1.5°C pathway (Climate Action Tracker, 2023).

Although some plants were shut down six to 12 months after the planned date, Chile’s coal phase-out plan has gone beyond its initial expectations. Chile should, however, be careful when retrofitting its coal power plants with gas. Recent scientific literature highlights that there is no room for investment in new oil, gas, and coal activities if global warming is to be limited to 1.5°C (Green et al., 2024).

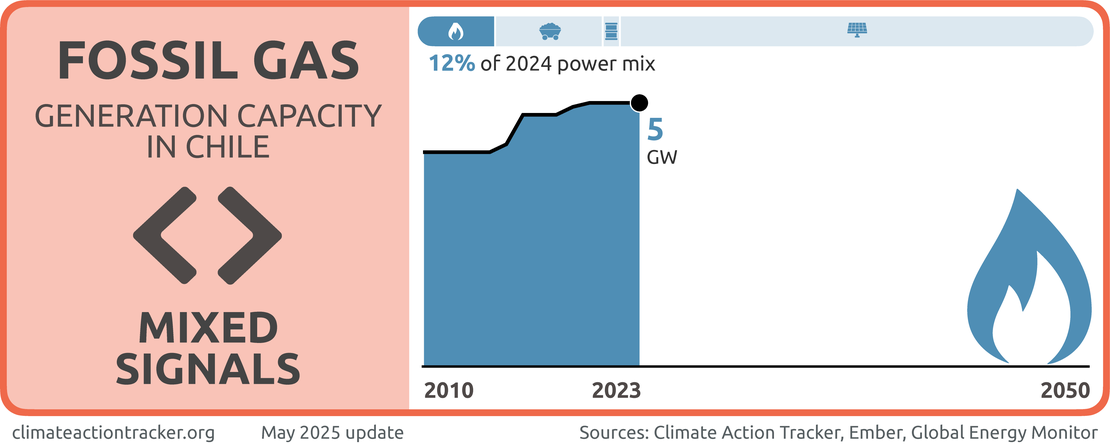

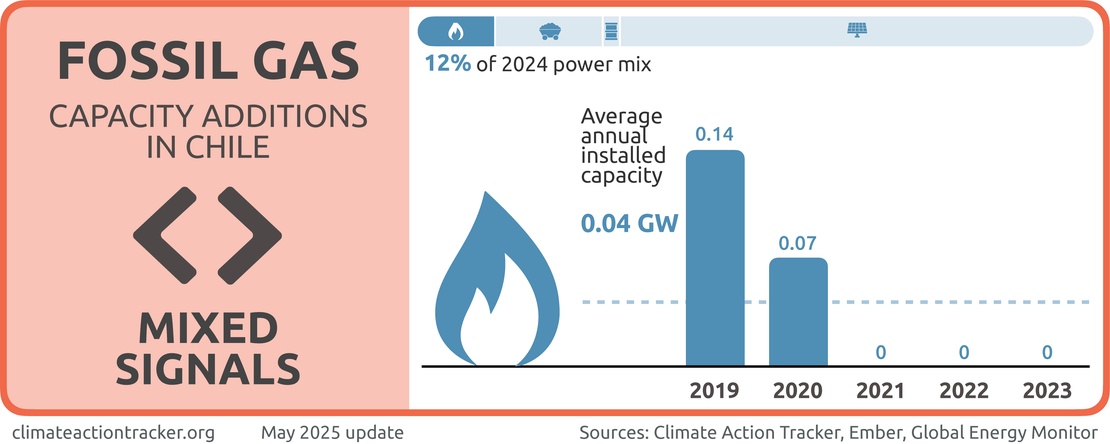

Fossil gas

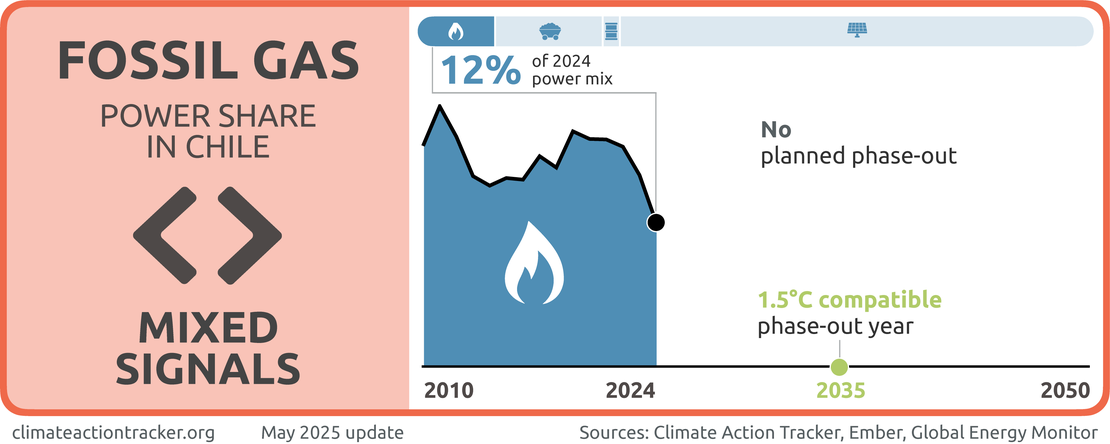

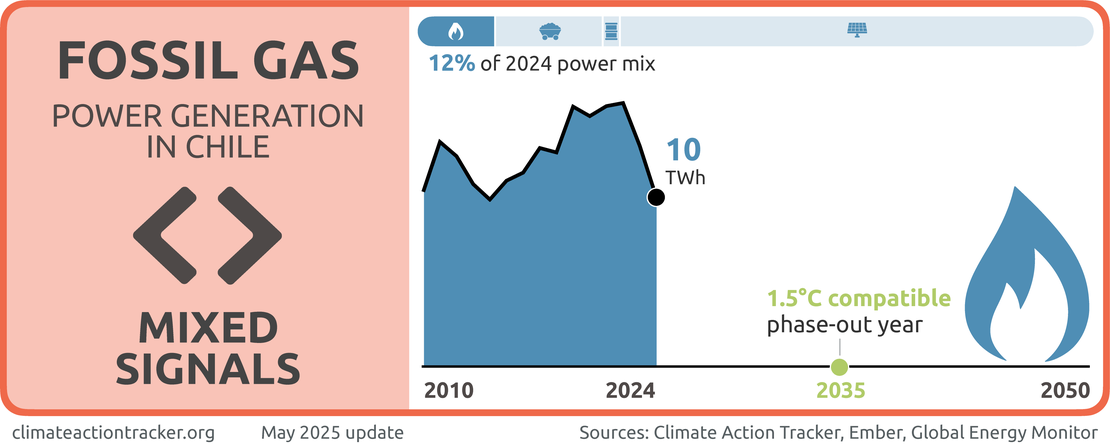

Chile is sending “mixed signals” on fossil gas. While the share of fossil gas in electricity generation has declined from 15–20% over the past decade to 12% in 2024, there are no plans to phase it out (Ember, 2025).

Chile produces less than 20% of its total gas supply, and primarily relies on imports, yet plans to increase its fossil gas production in the coming years. For instance, in February 2024, a Chilean energy company signed a deal with a California-based gas technology company to boost production by up to 200% (Geiger, 2024). There is no room for new investments in fossil fuel activities if global warming is to be limited to 1.5°C (Green et al., 2024).

Chile’s coal phase-out allows for power plants to convert to fossil gas power generation in place of complete retirement (Deza, 2024). Fossil gas should only play a minor role in Paris Agreement-compatible pathways: according to the CAT’s power sector benchmarks, fossil gas should only make up 1–4% of Chile’s electricity generation in 2030 to be aligned with a global 1.5°C pathway (Climate Action Tracker, 2023). This also raises questions around energy security, seeing as Chile continues to import most of its fossil gas.

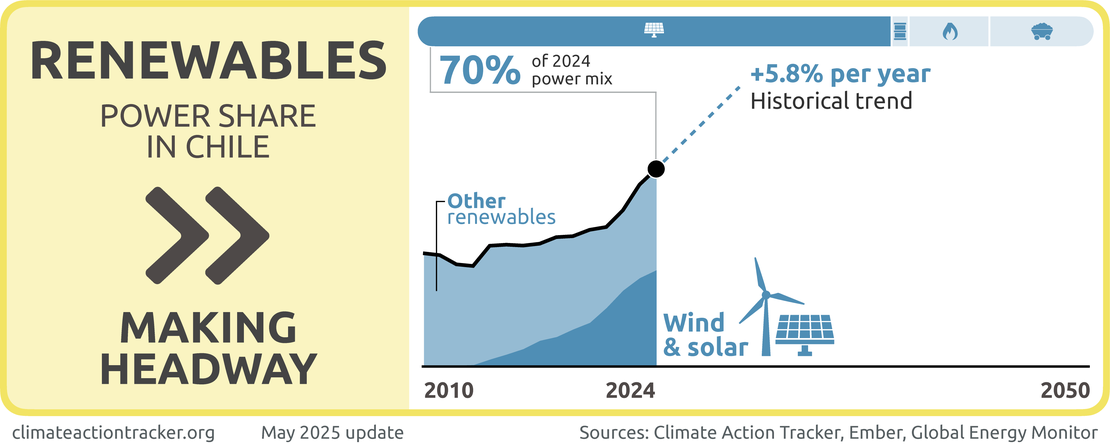

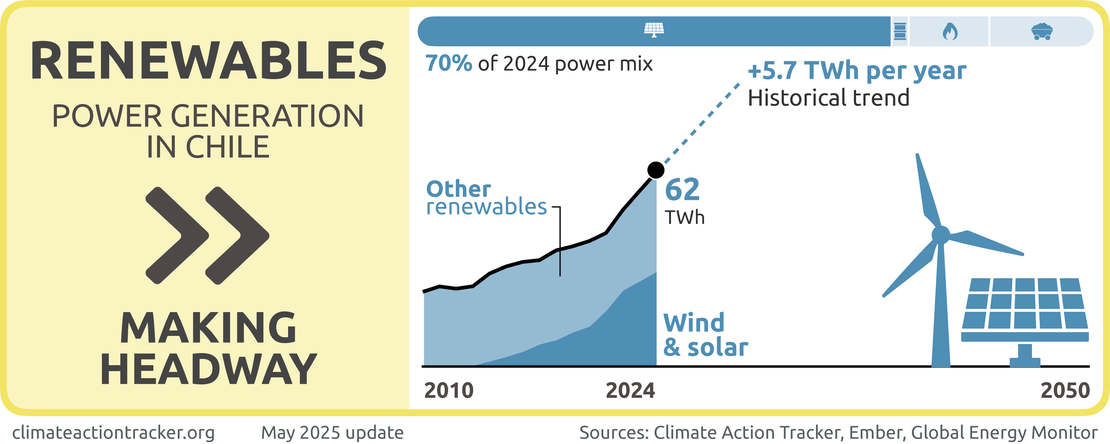

Renewables

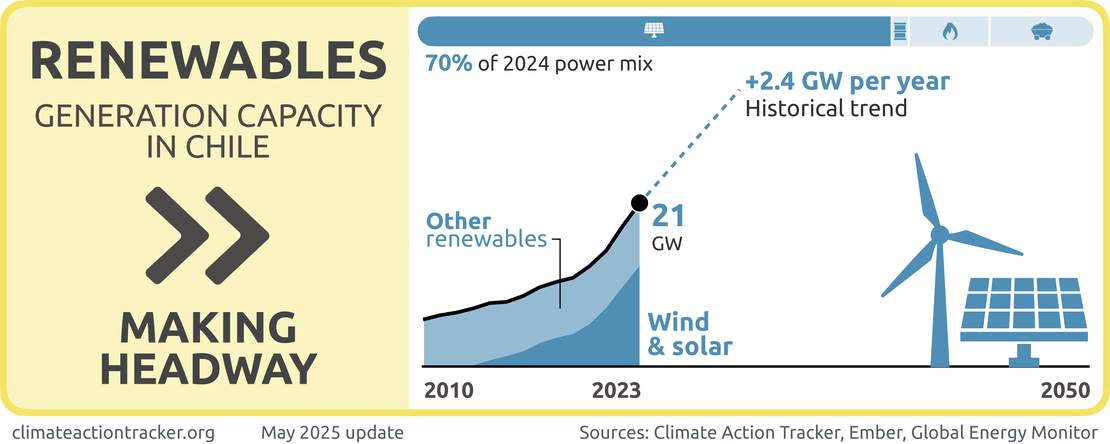

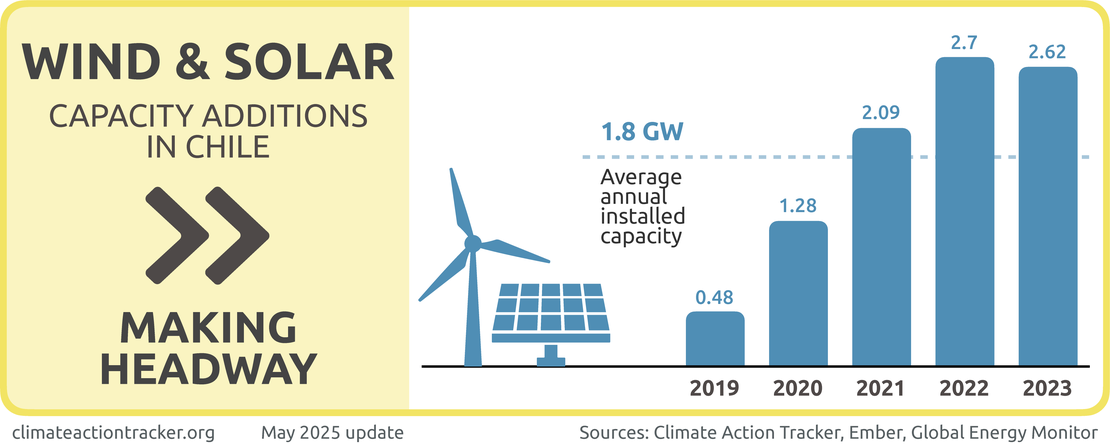

Chile is “making headway” in renewable energy deployment, with around 70% of its electricity derived from renewables in 2024, up from 46% in 2019. Renewable generation has significantly increased over the last five year, jumping from 39 TWh in 2019 to 62 TWh in 2024 (Ember, 2025).

Hydropower has historically accounted for a considerable share of Chile’s electricity production, accounting for almost 50% of electricity generated in 2000, but its share has decreased to 30% in 2024 (Ember, 2024). While wind and solar power made up less than 0.1% of electricity generation in 2013, their shares have significantly increased to reach 12% and 22% of total electricity production, respectively, in 2024.

Chile has set out a target of achieving an 80% share of renewable electricity generation by 2030 and 100% by 2050. According to the CAT’s power sector benchmarks, Chile should achieve a more ambitious renewables share between 96–98% in 2030 and decarbonise by 2035 to be aligned with a global 1.5°C pathway (Climate Action Tracker, 2023).

Various laws to foster renewable energy growth have been passed or are in the legislative process. The Law on Energy Storage and Electromobility (Law 21.505), published in 2022, will enable storage systems that are separate from generation facilities to be paid for providing energy to the grid, especially in times in high demand. One of the main objectives of this law is to reduce the reliance on coal by improving the energy security of the electricity system (Ministerio de Energía, 2022b).

The Energy Transition Law is a legislative initiative that will serve as an intermediary step for the structural reforms needed to achieve Chile’s carbon neutrality goal. Its three main pillars are promoting the efficient development of transmission projects, enabling the buildout of key infrastructure, and encouraging the competitive advancement of energy storage. The Bill Promoting Renewable Energies in the Electricity Matrix aims to establish renewable energy quotas for new electricity contracts, gradually increasing until reaching 60% in 2030 (Medinilla, 2023).

As a measure to foster decentralised renewable energy deployment, in early 2018, Chile reformed its Distributed Generation Law (also referred to as the “Net Billing” Law) (Law 20.571). The reform included a tripling of installed capacity from 100 kW to 300 kW, which aims to support and promote larger projects of self-consumption of electricity (Ministerio de Energía, 2018). Electricity surplus can be fed into the grid to obtain discounts in the owner’s electricity bill. The reform establishes, that if an owner has more than one establishment, these discounts are also applicable for those electricity bills. Otherwise, discounts from surplus can be accumulated.

Green hydrogen

Chile’s National Green Hydrogen Strategy, published in late 2020, set goals for Chile to produce the lowest-cost green hydrogen by 2030 and become a top three global exporter by 2040 (Ministerio de Energía, 2020a). Hydrogen plays a significant role in Chile’s carbon neutrality strategy, and is expected to contribute a quarter of the necessary emissions reductions in 2050 (Gobierno de Chile, 2024).

The strategy emphasises green hydrogen’s role in the decarbonisation of the transport, mining, and agriculture sectors. One of its first objectives is to use green hydrogen in heavy and long-distance transportation, and later to also replace liquid fuels in land transportation and aviation. Green hydrogen and its derivatives are also expected to be incorporated in the industry sector and produce green ammonia for low-carbon fertiliser production (Ministerio de Energía, 2020a).

To operationalise the Hydrogen Strategy, Chile published its Green Hydrogen Action Plan in April 2024, which outlines short-term measures to promote green hydrogen production and utilisation (Gobierno de Chile, 2024). A significant number of actions are focused around developing the enabling infrastructure for the green hydrogen industry and its regulatory and financial support. In the transport sector, a public-private partnership is in the process of developing Chile’s first locally-made hydrogen bus, which is expected to be piloted by the first half of 2025 (Gobierno de Chile, 2023c). The plan also explores converting thermal plants to run on hydrogen or hydrogen-based fuels through co-combustion or blending (Gobierno de Chile, 2024).

Industry

Chile is the world’s leading copper exporter, and the mining and industry sector is Chile’s largest consumer of final energy, accounting for 36% of energy consumption in 2021 and approximately 17% of total GHG emissions (IEA, 2024a). In 2021, 44% of mining electricity consumption came from renewable sources, and it is estimated that it will reach 62% in 2025.

Chile has established several targets to minimise emissions from the mining and industry sector in its energy strategy (PEN). They include:

- an emissions reduction target of 70% of direct GHG emissions from fuel use in the industry and mining sector by 2050 below 2018 levels,

- an improvement of energy intensity of large energy consumers by at least 25% in 2050 below 2021,

- a requirement that at least 90% of energy for heating and cooling in industry must come from sustainable sources by 2050,

- a goal of 100,000 new energy jobs by 2030, direct and indirect, from sustainable energy projects in new energy-related industries, and

- a requirement that 100% of medium and large companies in Chile must implement effective and monitorable energy efficiency and/or renewable energy measures.

These measures are also featured in Chile’s LTS (Gobierno de Chile, 2021; Ministerio de Energía, 2022c).

Mining companies themselves play an important role in meeting these targets. The Chilean Copper Commission (COCHILCO) has carried out surveys and compiled data on GHG emissions and energy consumption, the Green Mining Roundtable was launched in 2019, and the Chilean Economic Development Agency (CORFO) has supported the deployment of hydrogen vehicles for mining (Ministerio de Energía, 2020a). The deployment of green hydrogen and its derivatives in the mining sector is a key component of Chile’s Green Hydrogen Strategy and Action Plan (Gobierno de Chile, 2024).

The National Mining Policy 2050, developed by the Ministry of Mining, was approved in early 2023, and includes several objectives related to GHG emissions and environmental considerations. Notably, it includes a target to reduce emissions from large mining operations by at least 50% by 2030, and to become a carbon-neutral industry by 2040. It also outlines a zero-emissions fleet plan to be released by 2025 and implemented by 2030, as well as an objective for 90% of electricity contracts to come from renewable sources by 2030 and 100% by 2050 (Gobierno de Chile, 2023a). Along with being responsible for the monitoring and implementation of the above, the Ministry of Mining is also directed to establish GHG emissions targets for scope 1, 2, and 3 that comply with the 2030 target.

Among the provisions of the new Energy Efficiency Law approved in early 2021 is the promotion of energy management in the country's largest consumers. These include all large companies with consumption over 50 Tcal per year (210 TJ/yr), cumulatively accounting for more than one third of the country’s consumed energy. These so-called consumers with energy management capacity have to implement an energy management system that covers at least 80% of their emissions and will additionally have to prepare an annual public report on several performance indicators, including energy consumption and energy intensity (Ministerio de Energía, 2021d; Ministerio de Hacienda: Oficina de Partes, 2021)

Transport

The transport sector accounted for a third of Chile’s total final energy consumption (34%) in 2021, almost the same as the industry sector, as well as a third (33%) of its total GHG emissions, considering 99% of the sector’s energy consumption is from imported fossil fuels (IEA, 2023).

As with other sectors, Chile has established a number of targets to minimise emissions from the transport sector in its energy strategy (PEN). The most prominent target is that 100% of new light- and medium-duty vehicles sales must be zero emissions vehicles by 2035. In line with this target, at COP26 Chile signed the declaration on accelerating the transition to 100% EVs. However, Chile is not on progress to meet this target: its EV sales have yet to exceed 1% as of 2024. For Chile to achieve its transport electrification ambitions, it needs additional policies to support EV uptake.

In December 2017, Chile published its Electromobility Strategy, which sets out a goal and action plan towards achieving a 40% share of electric passenger vehicles as well as a 100% electrified public transport fleet by 2050 (Ministerio de Energía, 2017a). Chile’s Energy Strategy (PEN, or Política Energética Nacional), published in 2022, updated these targets and made them more ambitious, aiming for 100% zero emission vehicles in public transport and urban public transport by 2040, and 60% of private and commercial vehicles to be zero emissions by 2050 (Ministerio de Energía, 2022c).

Other transport goals include a 40% reduction in direct GHG emissions from the use of fuels in the sector (including land, sea, and air transport) by 2050 compared to 2018 (20% by 2040). Chile’s Energy Route 2018–2022 set out a short-term goal of a 10-fold increase in EVs in 2022 (compared to 2017 levels). While this was overachieved by more than double, the target was relative to a very low initial EV stock in 2017 at only 231 cars (Ministerio de Energía, 2021e; IEA, 2024b).

Chile is already beginning to implement actions towards achieving these targets. As of April 2024, Chile has reportedly reached over 2,500 electric buses in its public transport system, representing 38% of its total fleet (Carrara, 2024). Electric buses now represent around one-fifth of total bus sales in the country (IEA, 2024c). At the same time, the market share of EVs remains low, and decreased in past year from 0.5% to 0.3% of vehicles sold in 2023, and EVs make up only 0.1% of the total car fleet. EV sales have more than doubled, however, compared to 2019 and increased five-fold in the past six years, indicating a rapid upward trend. Public charging infrastructure is rather limited, with only 1,070 units (up from 660 in 2022) units in 2023 (compared to e.g., 51,000 in Germany) (IEA, 2024b).

In addition to promoting renewables in the energy matrix, the Law on Energy Storage and Electromobility (21.505) includes measures to encourage EV uptake. The law includes temporary exemptions or reductions for driving permit fees for electric and hybrid vehicles, thus matching those of ICE vehicles, and enables battery EVs to connect to the grid and store energy (Ministerio de Energía, 2022b).

Building on the Electromobility Strategy, in 2023, Chile presented its Roadmap for the Advancement of Electromobility. This plan contains concrete measures to 2026 aimed at accelerating the EV transition and addressing Chile’s current EV infrastructure gap. Its main pillars are building a robust public infrastructure charging network, promoting public transportation and decentralisation in priority regions, and improving EV education and road safety (Gobierno de Chile, 2023b).

The Energy Efficiency Law also targets the transport sector. It establishes energy efficiency standards for imported vehicles, which came into effect this year, and government subsidies are offered for electric taxis and home charging points. It aims to ensure interoperability of the EV charging system, facilitates access and connection to the charging network, and allows the Ministry of Transport to establish energy efficiency standards for vehicles (Ministerio de Energía, 2021c).

Building on its Green Hydrogen Strategy, the government has also presented its Sustainable Aviation Fuels 2050 Roadmap (SAF 2050). The roadmap sets out a goal of achieving 50% of SAF use in aviation by 2050 by promoting local, decentralised production of new energy sources. including biofuels and green hydrogen (Ministerio de Energía, 2024).

Chile’s electromobility targets, initial implemented measures, and the 2035 ban of non-EV sales are a great step in the right direction, especially since they are integrated into new strategies and laws such as the Energy Efficiency Law and Green Hydrogen Strategy. However, additional policies, especially targeting private car ownership, are needed to meet both these targets and global decarbonisation benchmarks, which foresee having only zero emission cars on the road by 2050 to be compatible with limiting temperature to 1.5°C (Climate Action Tracker, 2016). For the development of an integral policy making framework for transport, it is of great importance to consider social and economic consequences of the different policy options. The total emissions reduction potential of transport electrification also significantly depends on the decarbonisation of the electricity supply used to charge vehicles.

Buildings

Buildings consumed almost a quarter of the country's total energy in 2021, with a significant share of this used for heating, and were responsible for approximately 7% of Chile’s total GHG emissions (excl. LULUCF) in the same year (Comisión Nacional de Energía, 2021; Ministerio de Energía, 2022c; IEA, 2024a). It is therefore not surprising that the buildings sector is a central part of the Chile’s cross-sectoral Energy Efficiency Law.

The law establishes that residential buildings, public buildings, commercial buildings, and office buildings must have an energy rating to be commercialised (i.e. put on the market): this is applicable to construction and real estate companies as well as housing and urban planning services. As with appliances such as refrigerators, the energy efficiency label allows people to have better information when renting or buying homes. The label must be included in all sales advertising by companies (Ministerio de Energía, 2021d). This provision builds upon the existing Calificación Energética de Viviendas (CEV), established in 2011, and is also integrated into voluntary national building sustainability certifications (Ministerio de Energía, 2021b).

The Energy Efficiency Law also states that companies with high energy consumption (over 50 tcal) must annually report their energy consumption and energy intensity. It also introduces an Energy Management System (EMS), covering at least 80% of total energy consumption that includes an energy efficiency action plan, goals, and performance indicators. In 2023, the list of companies that must apply these regulations was published (Ministerio de Energía, 2023b).

As with other sectors, Chile’s energy strategy (PEN) also established a number of targets to minimise emissions from the buildings sector, including:

- a requirement that 10% of existing homes have a specific standard for thermal regulation by 2050, which should point towards net zero energy buildings;

- that 100% of new public buildings are "zero net energy consuming" by 2030, considering optimal energy performance of heating, hot water, cooling and lighting systems;

- that 100% of new residential and non-residential buildings are “zero net energy consumption” by 2050 (Ministerio de Energía, 2022c).

Even prior to the updated PEN and the Energy Efficiency Law, Chile has been pursuing strategies for the buildings sector such as the National Strategy for Sustainable Construction (ENCS), its main objectives being to incorporate sustainability criteria into buildings and infrastructure, reduce the sector’s energy consumption, reduce GHG emissions, and promote renewable energy use in construction (Ministerio de Vivienda y Urbanismo, 2013). In addition to being revalidated, the ENCS is currently in the process of being updated to respond to new national and international commitments, and better account for the impacts of climate change (Ministerio de Vivienda y Urbanismo, 2024).

Chile has also implemented different financial incentives and support programmes to improve building energy efficiency. For instance, under Law no. 20.571/2016, Chile aims to incentivise the use of solar heating through tax cuts for developers who implement this technology (Ministerio de Energía, 2017b). In 2023, the energy and housing ministries introduced subsidies for families to implement solar heating, photovoltaic systems, thermal insulation, and to replace wood-burning heaters (Ministerio de Energía, 2023a).

Methane

Chile signed the methane pledge at COP26. Chile’s methane emissions have remained relatively stable in recent decades, accounting for 15 MtCO2e in 2022 or 14% of total emissions (down from 24% in 1990) (Gütschow and Pflüger, 2023). The agriculture (38%) and waste (51%) sectors account for most of Chile’s methane emissions, with a smaller share coming from the energy sector (11%).

A 30% cut in methane emissions would therefore translate into roughly 4 MtCO2e or 4% of total emissions, which would further increase Chile’s chances of meeting its NDC target. As Chile has not yet submitted an updated NDC since signing this pledge, it is not included in its NDC. Nevertheless, Chile’s NDC specifically states that methane is considered in the GHG target, and includes a measure on building new waste treatment plants that better manage methane by 2035 (Government of Chile, 2020a). Chile’s former environmental minister Marcelo Mena is leading the Global Methane Hub, a hub which offers grants and technical support to implement the Global Methane Pledge.

Chile has over 20 Mha of tree cover and therefore has great natural sinks, particularly in the south of the country (Global Forest Watch, 2024). Although having lost 2.35 Mha, or 12%, in the last 20 years, on average Chile’s LULUCF sinks made up roughly two-thirds of its other emissions (Global Forest Watch, 2024). Net emissions from the sector have ranged from -48 to -78 MtCO2e between 1990 to 2020, with the exception of 2017. Chile should work toward maintaining this LULUCF sink.

Whereas the emission reductions from LULUCF sinks remained relatively stable from 1990 until 2016, the LULUCF sector became an emissions source of 15 MtCO2e in 2017, which can directly be attributed to some of Chile’s worst wildfires in modern history that swept across the country (Ministerio del Medio Ambiente, 2020). This shows how vulnerable these sinks are to extreme weather events, which are expected to increase in frequency and severity. The summer of 2023 was another destructive period with over 400 kha of forest burned (OECD, 2024). CO2 removal through LULUCF is a central part of Chile’s strategy to become GHG neutral in 2050. Therefore, it is extremely important to assure that forests keep acting as sinks and do not turn into emission sources.

At COP26, Chile signed the Leaders' Declaration on Forest and Land Use. While Chile has not updated its NDC since, the sector plays a key role in its current target. In its NDC, Chile committed to a 25% emissions reduction in the forestry sector by 2030, the sustainable management and recovery of 200,000 hectares of native forests, and the afforestation of an additional 200,000 hectares. These actions are estimated to account for 3.9 to 4.6 MtCO2e of annual removals by 2030 (Government of Chile, 2020a). The NDC also commits to identifying peatland and other wetland areas in the national inventory and evaluating their capacity for climate change adaptation or mitigation by 2030.

Chile’s 2020 NDC references the National Strategy for Climate Change and Vegetation Resources (ENCCRV), established in 2013 by the Ministry of Agriculture (MINAGRI) through the National Forest Corporation (CONAF), as one of the main tools in reaching the different targets on mitigation related to LULUCF, along with regulations and instruments granting incentives for forest owners to preserve or create new forests. Further, the NDC states that its afforestation target should be in line with Law Nº20.283 on Native Forest Recovery and Forest Promotion, under which afforestation is only undertaken in lands without vegetation and cannot be a substitution of native forests (Government of Chile, 2020a).

However, Chile’s current pace of implementing its LULUCF targets is significantly slower than what is needed to meet its commitments under its NDC. Between 2020 and 2022, only 2 kha were reforested, meaning an additional 198 kha of land would need to be reforested in the next eight years. Similarly, sustainable forest management activities have occurred on only 35 kha of native forests and if this trend continues, Chile will only reach 15% of its target by 2030 (Cortés Lehuei, 2024). Thus, stronger policies to promote reforestation and sustainable native forest management would be needed for Chile to meet its LULUCF targets set under its NDC. At the same time, Chile should avoid relying on LULUCF sinks to meets its climate targets, given the high chance of carbon loss through deforestation or natural disturbance, and should instead prioritise emissions reductions in all other sectors.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter