Decarbonising Colombia’s transport sector

Summary

Decarbonising Colombia’s transport sector, a major contributor to the country’s emissions, will be critical towards achieving its net zero target. While Colombia has been making progress on promoting electric mobility, it could do more to establish 1.5°C compatible targets and to support EV uptake, particularly through expanding its charging network.

Under the Glasgow Climate Pact, governments agreed to revisit - and strengthen - their targets by COP27 and, for Colombia, stronger action in the transport sector could help it do this. Pushing the uptake of zero-emission transport now is also critical for long-term decarbonisation. Here, we take a closer look at the action the government of Colombia is taking now - and what more it could do.

Introduction

Colombia updated its NDC in December 2020, and has also committed to achieving net zero emissions by 2050, recently submitting its long-term strategy to the UNFCCC. It is working on a climate action law to support implementation of these targets.

Its 2030 target falls short of 1.5°C compatibility. Under the Glasgow Climate Pact, governments agreed to revisit and strengthen their targets by COP27.

The transport sector is a major contributor to Colombia’s greenhouse gas (GHG) emissions (excluding the land sector), responsible for 41% of the country’s energy-related CO2 emissions in 2019. In its updated (December 2020) NDC, Colombia committed to greening its passenger vehicle fleet, with a cumulative target of getting 600,000 EVs on the road by 2030, which has a mitigation reduction potential of 4 MtCO2e, the most of any of the transport measures proposed.

How does this EV target stack up, and what more can be done to accelerate the transition to electric vehicles?

Is the 600,000 EV target Paris Agreement compatible?

Globally, sales of battery electric passenger vehicles need to reach at least 75% share of the market by 2030 and 100% by 2040. Phasing out the sale of fossil fuel vehicles in the next 10-20 years is necessary in order to ensure that the global passenger car fleet will be almost 100% emissions free by 2050.

Translating Colombia’s 600,000 EV target into a share of passenger vehicles sales is not a straightforward task. At most, it may amount to around 50% of sales in 2030, which misses the mark of what a likely Paris Agreement compatible benchmark would be. If a stronger target was adopted and sales were to reach 95%, following an S-curve growth pattern throughout the decade, EVs would number around 2.4 million in 2030.

Such a sales target would not be unheard of in Colombian climate policy. The National Energy Plan’s most ambitious energy transformation scenario reaches 100% EV sales by 2025, which would be Paris Agreement compatible.

The government should consider strengthening its EV targets as part of improving its NDC in 2022. An additional 12 MtCO2e of emissions reduction may be possible if the EV target is increased to 2.4 million by 2030. That’s equivalent to almost a month of Colombia’s current emissions.

Where do things stand today?

In Colombia, EV sales are growing, more than doubling in 2018 and 2019, but from a very small base. As of October 2021, Colombia had 4,100 EVs (government figures are slightly higher at 5000).

At first glance, the 600,000 EV target may seem like a tall order starting from these levels. However, EVs are likely to follow an S-curve in their adoption, rather than a linear trajectory. Norway is a prime example of this growth pattern, going from around 15% EV share to 50% in just five years (2016-2020).

Supporting the rapid uptake of EVs will not be accomplished by strong targets alone, but also by creating the right enabling environment for consumers.

Colombia’s EV law

Colombia has adopted a number of measures to support EV uptake. In 2019, it passed legislation to promote electric mobility. The law provides tax and other incentives to promote EV ownership and usage, including reduced insurance and maintenance fees, improved access to parking, and the elimination of import tariffs.

It also sets targets for government fleets and public transportation systems. A minimum of 30% of the government fleet must be composed of EVs by 2025, while cities are required to increase their share of electric bus purchases - from 10% in 2025 to 100% in 2035. Bogotá has made great strides here, earning itself the title of the Latin American capital with largest fleet of electric buses in operation.

How many charging stations are enough?

“Range anxiety”, or a lack of confidence in the distance one can travel on a single battery charge, is a key factor limiting EV adoption. One remedy for this is to have a robust network of fast charging stations as it gives drivers peace of mind from having options to recharge.

This begs the question: How many fast-charging stations are needed? Or: Did Colombia’s EV law get it right?

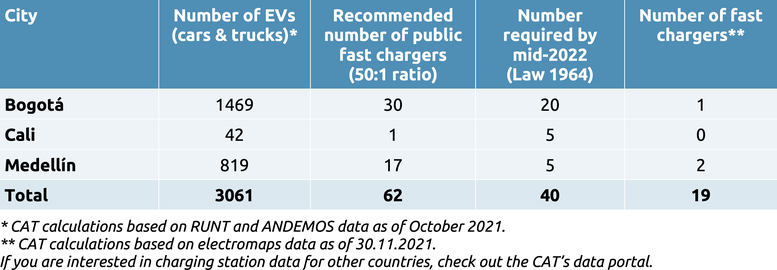

Colombia has established targets for fast public charging stations. By mid-2022, Bogotá should have at least 20 rapid charging stations, while five other designated cities are required to have at least five, bringing the total number of mandated charging stations to 40.

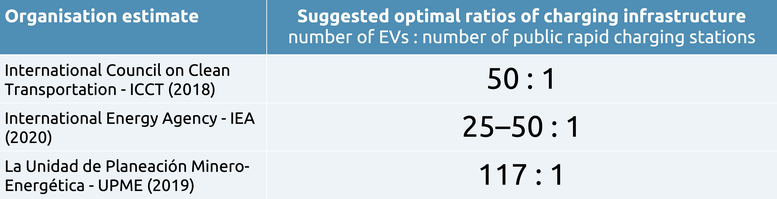

Figuring out how many fast-charging stations are needed depends on a number of factors. For the most part, markets with less overall EV adoption, less consumer confidence in EVs and less access to home charging points should aim for a lower ratio (meaning a higher absolute number of stations) of one public fast charging station for anywhere between 25-50 EVs.

By contrast, a 2019 study commissioned by the planning arm of the Ministry of Mines and Energy recommended a ratio of EVs to public rapid charging stations of 117:1, assuming widespread access to home and workplace charging under future development.

Table 1: Summary of optimal ratios of EVs per rapid fast charging for emerging/low EV markets in countries with low access to residential charging. Note the IEA defines fast charging as >22kW, whereas the other studies and the EV law define it as >50kW.

Links to sources: ICCT (2018) | IEA (2020) | UPME (2019)

There are reasons to believe that the 117:1 ratio may be setting the number of stations too low to support an initial rapid update. The study itself recognised that incentivising home charging in Colombia may be difficult, given the large proportion of the population who rent rather than own their own homes.

Also, while Colombia’s EV law aims to improve technical support for installing charging points for EVs in residential and commercial buildings, no concrete targets have been set around how many buildings will be outfitted or by which date. Public consultation on such measures will only likely begin in the latter half of 2022.

Colombia is not on track to meet its EV fast charging station targets nor international benchmarks relative to its market size (Table 2). 12,000 public rapid charging stations would be needed nationally to support its 600,000 EV target using international benchmarks and many more are required to support EV sales consistent with a 1.5°C pathway.

Table 2: Comparison of recommended chargers for EV fleet size to current number in Colombia’s three most populated cities

Links to sources: RUNT | ANDEMOS | electromaps | CAT data portal

Colombia missed an opportunity in its post-COVID recovery package to support the necessary charging infrastructure, with no projects in the package focusing on electric mobility, notwithstanding a significant allocation for the transport sector. Yet if more decisive action can be taken towards implementing publicly accessible rapid charging, the chances for building momentum and trust in electric mobility will increase, giving the country the opportunity to surpass its goal of reaching 600,000 EVs on the road in 2030 and be better aligned with a 1.5°C compatible pathway.

Natural Gas is not needed for the transport transition

Recent legislative developments seem to be heading in the wrong direction, in support of natural gas. In August 2021, Colombia passed law 2128 which declared the use of natural gas to be in the national interest. The law includes a suite of measures, similar to those in the EV law, to promote the uptake of natural gas-powered vehicles and mandates that 30% of the new public transit fleet additions are to be powered by natural gas for the next ten years.

The new law undermines many of the positive steps Colombia had been making towards decarbonising the transport sector. It also frustrates the abilities of its cities to go faster than the national government in decarbonising their mass transit systems.

The government should heed suggestions to reverse the natural gas target in the Climate Action bill working its way through the congress.

More electric vehicles on the road will mean a shift from fossil fuels to electricity in final demand. The additional electricity demand should be met through an expansion of renewable energy technologies. Colombia has a higher share of renewables in its electricity mix, with hydropower supplying around 71% of power in 2020. Full decarbonisation of the power sector is needed in order to achieve the greatest emission reductions. For Colombia, that means ditching its current plans, which still envisage a role for natural gas and coal through to 2034.

To be 1.5°C compatible, Colombia needs to phase out unabated coal by 2023 and unabated gas by the end of the decade. Its power sector needs to be fully decarbonised by 2034 at the latest.

While Colombia has been making progress on promoting electric mobility, more can be done to establish 1.5°C compatible targets and to support EV update, particularly through expanding the country’s charging network. Stronger action in the transport sector can help Colombia strengthen its NDC by COP27.

Assumptions

EV target conversion

Colombia’s total fleet is around 16.5 million vehicles, with about a 60:40 split between motorcycles and other types of vehicles. Total vehicle sales in 2030 are projected to be around 1.4 million. The EV target is cumulative and covers only passenger cars and trucks, taxis and buses, but not motorcycles. Assuming that the 60/40 split holds in 2030 and that half of the target (i.e. 300,000 vehicles) are added in the final year, only about 50% of relevant sales would be EVs in that year.

Colombia’s National Energy Plan estimates that the number is more likely around 30% under current trends (though the relationship between this projection and attainment of the 600,000 target is unclear). Either way, it is unlikely the 600,000 EV target is 1.5°C compatible.

Mitigation potential

We estimated the cumulative EV levels using an S-curve growth pattern starting from 0.3% in 2021 to 95% in 2030, based on projected vehicle sales throughout the decade, assuming the 60:40 split, which yields a cumulative total of around 2.4 million vehicles.

We did not estimate the emissions potential directly, but rather multiplied the government’s estimate of 4 MtCO2e for 600,000 by the additional vehicles to derive the 12 Mt figure.

Stay informed

Subscribe to our newsletter