Decarbonising light-duty vehicle road transport

By Michael Petroni and Cindy Baxter

As transport demand and associated emissions continue to grow around the world, the most critical part of this sector in the global energy transition is road transport emissions, which contribute 72% of the sector's total emissions.

We've just published a new report that gives updated 1.5˚C compatible benchmarks for the transport sector: for the world as a whole, and including a specific focus on seven countries: the US, EU, China, India, Brazil, South Africa and Indonesia.

The role of electrifying light-duty vehicles

The mass electrification of light-duty passenger vehicles will play a major role in cutting road transport emissions.

While there are positive signs in some countries, all need to make a greater effort to accelerate EV market and fleet penetration. At current uptake rates, EV sales could be well on track to reach 90% by 2030, but this requires continued and additional policy support to keep up this growth to reach targets.

Governments will need to strengthen their 2030 EV targets to be 1.5°C compatible. Internal combustion engine (ICE) vehicles are still being sold, posing a growing problem for the future as stranded assets that will need to be removed from the roads - either that or targets will not be reached and emissions will continue to rise.

Benchmarks for achieving 1.5°C

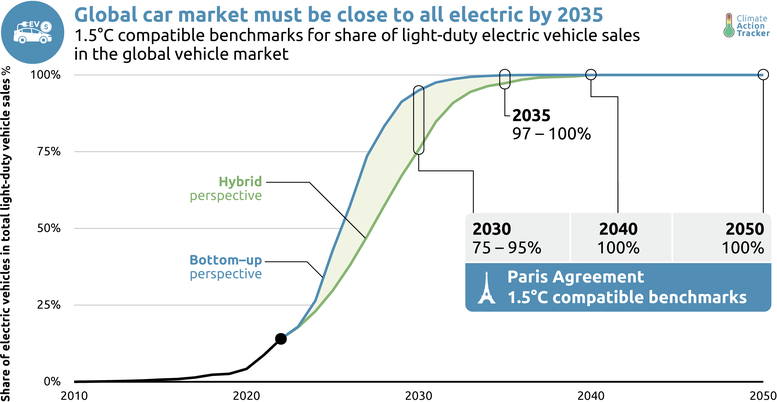

Our findings show that to align with 1.5ºC, the world should reach 100% EV sales by 2035:

- Globally, electric vehicles should achieve 75-95% of the light-duty vehicle market by 2030 and 97-100% by 2035.

- Developed countries and China should take the lead, phasing out the sale of internal combustion vehicles as early as 2030.

- While the pace of action could be slower in developing countries than in wealthier nations, developing countries should still aim to achieve 100% EV sales share by 2040 at the latest.

Even if countries were to achieve 100% EV sales as soon as possible, they will also have to take aggressive action to scrap or retire existing fossil fuel cars, or take them off the road. In some countries, the annual retirement rate of fossil fuel vehicles would need to roughly increase by a factor of seven in 2040 compared to historical retirement rates.

Challenges remain

But in 2023, half of new car sales were large resource and emissions-intensive SUVs.

- In the US, resource demand for EVs would be higher than in other countries due to the popularity of large SUVs.

- In Europe, passenger cars are becoming bigger and heavier, catering to new consumer preferences. This will prove challenging to meet their EV demand if fewer resources are available to manufacture them.

While not quantified here, increasing electric vehicle production and sales will put more pressure on critical material resources. Encouraging smaller, less resource-intensive electric vehicles and reduced overall demand for private vehicles through alternative transport modes will be essential to curbing the demand for critical minerals, helping ensure that supply chains can scale in a sustainable manner to meet demand.

While our report focuses on light-duty vehicles, it is clear that fewer cars, as well as electrifying the remaining fleet, will be essential for limiting warming to 1.5ºC.

In recent months, the politics surrounding the global EV trade has shifted. In May 2024, the United States increased tariffs on imported Chinese EVs from 25% to 100%. The European Union has also recently decided to move forward with setting their own tariffs on imported Chinese battery EVs sold within Europe, with duties ranging between 17.4% and 37.6%. The justification behind these tariffs from the US and EU is to counter the subsidies provided by the Chinese government to their domestic manufacturers, which the EU and US claim go against WTO rules and create an unfair playing field for US and EU auto manufacturers. How this will play out over the coming years is uncertain, but there is a risk that this could slow EV adoption within the US and EU by raising prices, despite the global need for rapid, affordable EV growth to meet climate goals.

What is needed

To achieve these targets, governments will need to implement cross-cutting policies for EVs, their infrastructure necessary to support them, and zero emission public transport to lay the foundations of a zero-carbon future for all.

While all governments need to act, the US, EU and China will need to take the lead globally: they have some of the highest transport emissions and are equipped with the established markets and resources to scale up EV transition this decade as early movers.

They will need to increase action toward decarbonising national grids through the deployment of more renewable energy to fuel the forthcoming demand for electric vehicles, coupled with a clear commitment to end the sales of traditional fossil fuel vehicles by 2035 and remove current vehicles from their national fleets. Further policy interventions from governments to incentivise EVs, while disincentivising the sale and use of ICE vehicles and expanding EV changing infrastructure will come at a high cost.

This has hindered the EV transition in lower income communities and developing countries, but in the long term has the potential to increase competitiveness, improve air quality and come closer to achieving a net zero future.

To this end, developed country governments should account for equity and fair considerations to support the transition to EVs and zero emission fuels in developing countries so that no one is left behind.

Find out more

To read the full report, including full details on all the benchmarks globally and for the seven countries, click here. You can also view similar 1.5°C compatible benchmarks for the power sector covering 16 countries and our investigation into the national circumstances and priority actions for decarbonising steel.

Stay informed

Subscribe to our newsletter