Finance

Introduction

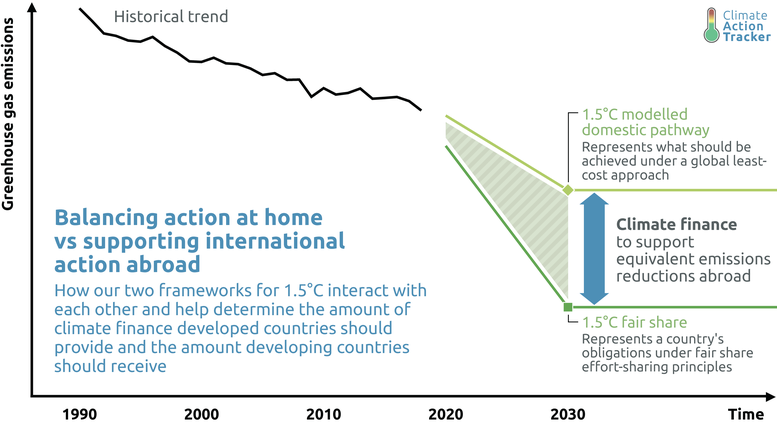

To fully incorporate fair shares into the new Climate Action Tracker (CAT) rating we require an assessment of international climate finance. Governments are expected to either meet their fair-share obligations through a combination of domestic mitigation and financial support for emissions reductions in other countries, or to receive financial support to mitigate emissions beyond what would be required by effort-sharing frameworks. Some countries, whose effort-sharing and modelled domestic pathways are very similar, would be expected to give or receive minimal support.

The CAT’s fair-share levels and modelled domestic pathways provide a guide as to what is needed or expected from each country in terms of domestic mitigation and overseas support. A country could choose to go beyond its 1.5°C modelled domestic pathway and would thereby reduce the total finance it would be expected to provide.

Countries climate finance commitments are evaluated differently depending on whether they are expected to give or receive financial support. Those expected to give support are evaluated based on the transparency and adequacy of that support. Those expecting to receive support are encouraged to develop plans to use potential financial support in an effective manner. Initially, the CAT only provides a rating of those countries that are expected to provide support.

Some countries intend to achieve emissions reductions both domestically and through international cooperation, including through Article 6 mechanisms. In addition to those commitments, countries should also advance on their efforts to align domestic finance with the goals of the Paris Agreement (Article 2.1). The CAT’s assessment of those activities will be discussed elsewhere, and we focus here only on international climate finance. For a clarification note on the scope please see the box below.

Important note on the CAT’s finance rating scope

The CAT quantifies and evaluates national climate change mitigation commitments, and assesses, whether countries are on track to meeting those.

The finance component of the CAT rating is in line with our overall method, which does not evaluate progress on climate change adaptation or progress related to non-state and subnational actors. The CAT also expects countries to meet their adaption obligations and mobilise non-state and subnational action, but a direct evaluation remains outside our scope.

The CAT recognises the importance of assessing adaptation and loss and damage. We support the call for an increase in adaptation finance in the post-2020 period, especially considering its priority to the world’s least developed countries (Carty, Kowalzig, and Zagema 2020). Although we do not track progress on adaptation finance, we assume that half of the committed finance should support adaptation projects (UNFCCC 2021).

While both the Convention and the Paris Agreement state that mobilised private finance should be considered climate finance, the CAT focuses on public finance. We exclude private finance due to methodological inexactness regarding quasi-public entities, lack of projection-level, transparent data, and the overall limitations on measurements of mobilised finance (Bhattacharya et al. 2020). The private finance included in the data sources used in our analysis is also negligible and often falls outside the CAT operationalisation of international climate finance contributions (more details in Section 3.1). Finally, the CAT tracks actions and targets from government and attributing mobilised finance to government actions is difficult.

The CAT evaluates a government’s financial contributions to assess its sufficiency. The CAT rating should incentivise donor countries to increase the transparency, volume, and predictability of their international climate mitigation-related finance contributions.

We set the expectation that developed countries should provide financial support sufficient to enable more expensive and challenging emissions reduction actions. Mitigation costs vary across sectors and countries and change over time; with costs likely to increase as emissions get closer to zero.

Developed countries should support emissions reduction actions that are additional to what developing countries can achieve unilaterally. In some countries, these measures will represent most emissions reductions. In others, additional emissions reductions will be more challenging and require more expensive emission reduction strategies.

Summary of the method

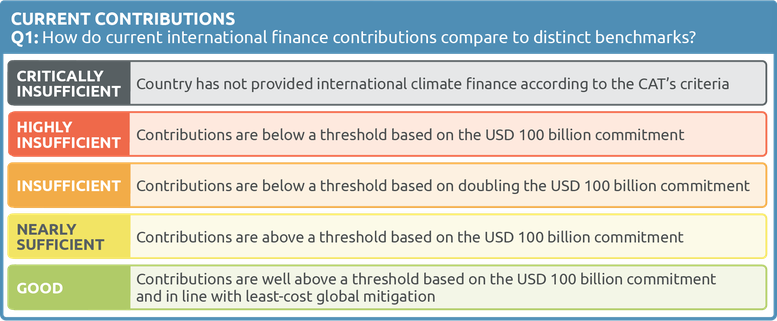

A multi-criteria approach is used to identify key aspects of climate finance that, if adhered to, would advance the quality of international climate finance contributions. This approach speaks to specific components of climate mitigation finance and allow us to set expectations for improvement. Each component receives a rating ranging from ‘Highly insufficient’ to ‘Good’. These ratings are combined to give an overall finance rating.

Evaluating the adequacy of international contributions at the country level poses many challenges.

- First, to determine the absolute total level of finance needed is difficult.

- Second, currently available climate finance data sources are not consistently reported and do not provide sufficient details on the type of finance provided to assess its quality.

- Third, an assessment of the effect of the contributions, e.g. in terms of emissions reductions, is unavailable.

The CAT assesses several components that do not define sufficiency but do identify good practice to rate countries international contributions.

The four components are:

- Current contributions: measures the level of international climate finance provided since Paris and compares it to a benchmark associated with the country’s fair share. This is the most significant component of the CAT climate finance rating since it considers the absolute amount of finance provided for mitigation. This component does not account for the effectiveness of the finance provided.

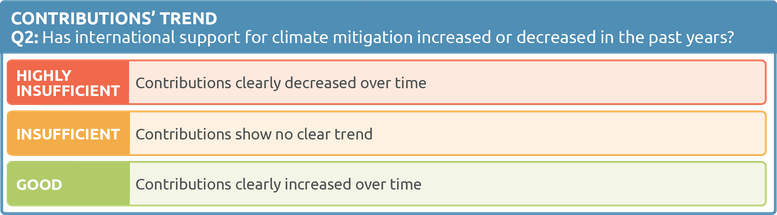

- Contribution trend: measures whether international climate finance provided has increased in the last five years. Overall climate finance needs to be scaled up. This component measures whether a government’s financial contributions develop in the right direction. However, this component does not compare the country’s trend against a ‘good practice’ benchmark for increase.

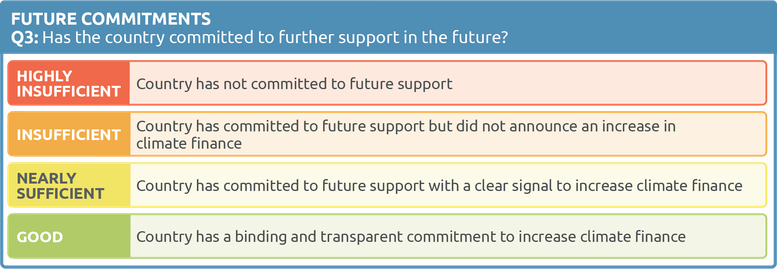

- Future commitments: evaluates a government’s future commitments and pledges, if any exist, in terms of their transparency and reliability. The previous components looked at past contributions. This component rates a government’s future commitments. It captures more recent developments, that are still not reflected in the government’s realised contributions. It also captures intentions to scale up climate finance. This component is important but represents a smaller share of the CAT finance overall rating. Once these commitments are realised they will be reflected in the current contributions component.

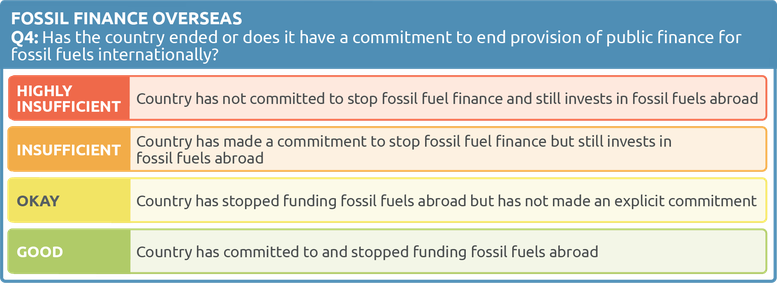

- Fossil fuel finance overseas: investigates whether countries provide support for fossil fuels abroad. Fossil fuel finance clearly undermines international climate finance efforts. The construction of coal-fired power plants or support for the development of fossil fuel extraction is at odds with the goals of the Paris Agreement. The CAT also considers this in its climate finance rating.

The first component has the highest influence in the overall CAT finance rating, the others are included to qualify the overall contributions to account for trends, announcements and the contradicting support for fossil finance. For more details on how these four components are combined into one rating, please see our overview rating. In the following sections we present more information for each component.

A detailed description of each of the components is available here.

The lack of consistent and reliable data on climate finance remains one of the biggest challenges in tracking international climate finance (Roberts et al. 2021). There are different interpretations of what constitutes adequate climate finance.

Our main data source to consider financial contributions from developed countries is the OECD’s DAC database, which contains project-level information about international climate-related development finance. It contains both bilateral and multi-lateral commitments and disbursements. In the calculation of this metric, we use the mitigation-related finance contributions only.

More information

Link to full methods and an explanation of which countries we rate.

References

- Bhattacharya, A., Calland, R., Averchenkova, A., Gonzalez, L., Martinez-diaz, L., & Van Rooij, J. (2020). Delivering on the $100 Billion Climate Finance Commitment and Transforming Climate Finance. https://www.un.org/sites/un2.un.org/files/2020/12/100_billion_climate_finance_report.pdf

- Carty, T., Kowalzig, J., & Zagema, B. (2020). Climate Finance Shadow Report 2020: Assessing progress towards the $100 billion commitment. https://unfccc.int/sites/default/files/resource/bp-climate-finance-shadow-report-2020-201020-en.pdf

- Roberts, J. T., Weikmans, R., Robinson, S. ann, Ciplet, D., Khan, M., & Falzon, D. (2021). Rebooting a failed promise of climate finance. In Nature Climate Change (Vol. 11, Issue 3, pp. 180–182). Nature Research. https://doi.org/10.1038/s41558-021-00990-2

- UNFCCC. (2021). António Guterres: 50% of All Climate Finance Needed for Adaptation. UN Climate Change News. https://unfccc.int/news/antonio-guterres-50-of-all-climate-finance-needed-for-adaptation

Stay informed

Subscribe to our newsletter