Decarbonising steel: national circumstances and priority actions

Attachments

Iron and steel production currently contribute around 7-8% of global greenhouse gas (GHG) emissions, so decarbonising this sector is fundamental to reaching net zero and meeting the Paris Agreement's 1.5°C warming limit.

While decarbonising the steel sector is now technically feasible, different countries face different challenges in making this happen at the pace needed. This so-called “hard-to-abate” sector has seen rapid developments in recent years.

The main challenge for the sector is shifting infrastructure from today's predominant blast furnaces that run on GHG-intensive coal-derived coke to electric arc furnaces (EAFs) running on clean power that process scrap steel, or direct reduced iron (DRI) produced with zero carbon feedstocks, such as green hydrogen.

Steel can be primarily produced from iron ore, as well as recycled from scrap steel. Primary steel production involves two main routes - the BF-BOF route and the DRI-EAF route, where the iron ore is reduced into iron and then refined, formed, and treated into crude steel. Steel can also be recycled from scrap steel through an EAF, also known as secondary steelmaking

Different countries face different challenges

This report highlights that the specific challenges different countries face differ substantially according to the status of the steel industry and its likely future development. Determining the fastest possible speed of action therefore needs to take these challenges into account.

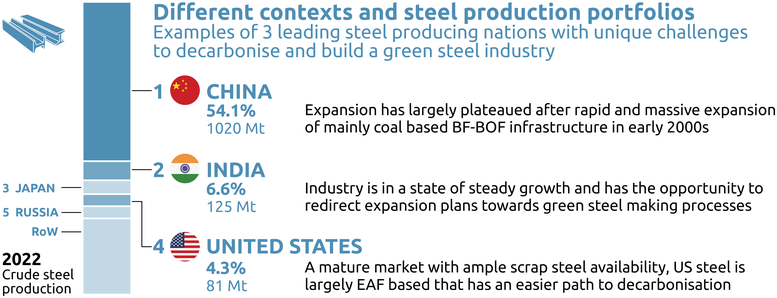

We explore the specific challenges for three countries – China, India and the US – to highlight what is needed to make progress in decarbonising their steel sector. Three big differences between them are:

- The existing infrastructure for various technologies

- Future trends in steel production and capacity

- Factors that limit the potential for lower GHG-intensive steel production, such as scrap steel availability and access to high-grade iron ore

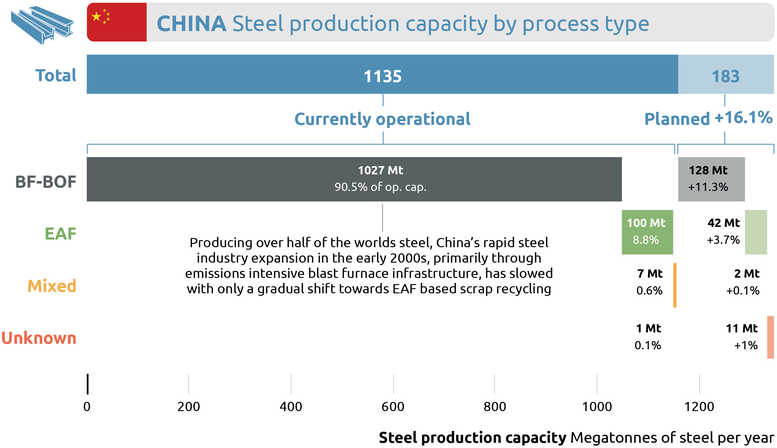

China

China’s is the world’s largest producer of crude steel, with a high contribution from the coal-based Blast Furnace to Basic Oxygen Furnace (BF-BOF) production route and, with that, a high emissions intensity. Existing infrastructure in China is relatively young, so switching to cleaner production will require it to decommission some existing steel plants.

Steel production in China is unlikely to increase in the coming decades, and scrap steel is becoming more available, allowing China to shift toward electric arc furnaces that recycle this scrap – a much cleaner technology.

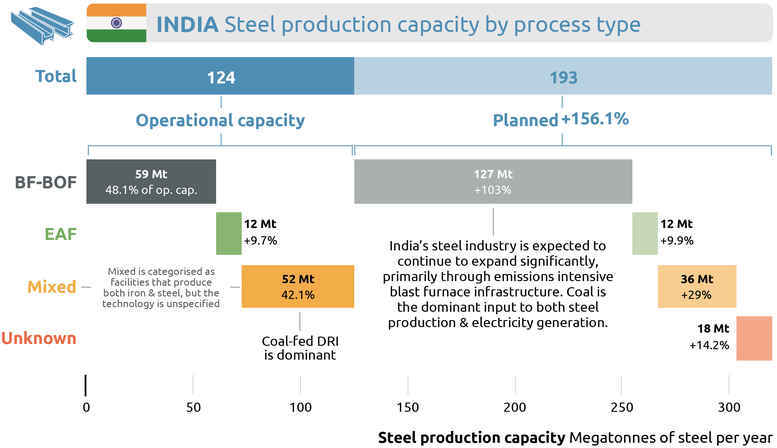

India

India’s steel industry is the world's fastest-growing, and one of the most emissions-intensive. The sector is expected to continue to grow in the coming decades to meet increasing demand for roads, buildings and other infrastructure. The presently planned steel production infrastructure to meet that demand is carbon-intensive and, if built, risks locking in emissions.

As India doesn’t have a lot of scrap steel available, it will still need to produce raw steel to meet demand. Clean technologies for producing raw steel, such as green hydrogen-based DRI, are in a prototype phase, with some plants under construction. India is in a fortunate position with respect to domestic availability of high-grade iron ore but still faces challenges with scaling up green hydrogen. India will need international support to shift its development to cleaner technology routes.

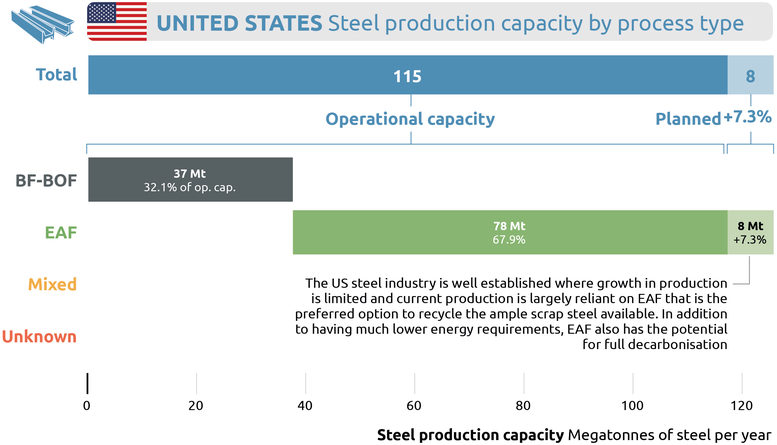

United States

Steel production in the US has a relatively low emissions intensity because its steel industry is older and there is a high amount of both Electric Arc Furnace (EAF) capacity, and scrap steel available for recycling. To further reduce emissions from this sector, the US could close its remaining blast furnaces and prioritise decarbonising its power sector. The Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law are boosting US steel demand while promoting emerging clean technologies, such as green hydrogen.

Find out more

Read the full report for further details on decarbonisation options for the steel industry and the case studies of China, India and the United States. By understanding the unique challenges and opportunities of each nation, policymakers, industry leaders, and stakeholders can develop tailored strategies for decarbonising the steel sector. While not exhaustive, these insights provide valuable guidance for navigating the complexities of steel sector decarbonisation.

You can also view the equivalent report for the power sector and what is required for the world and 16 countries to decarbonise the power sector in-line with meeting the Paris Agreement's 1.5°C warming limit.

Stay informed

Subscribe to our newsletter