Policies & action

The CAT policies and action emissions scenario is based on the projections published by the Australian Government prior to the election, which consider a number of current policies set by the Morrison Government as well as the impact of the COVID-19 pandemic. It does not account for the recent planned policy updates announced by the Labor Government (Australian Government, 2022a).

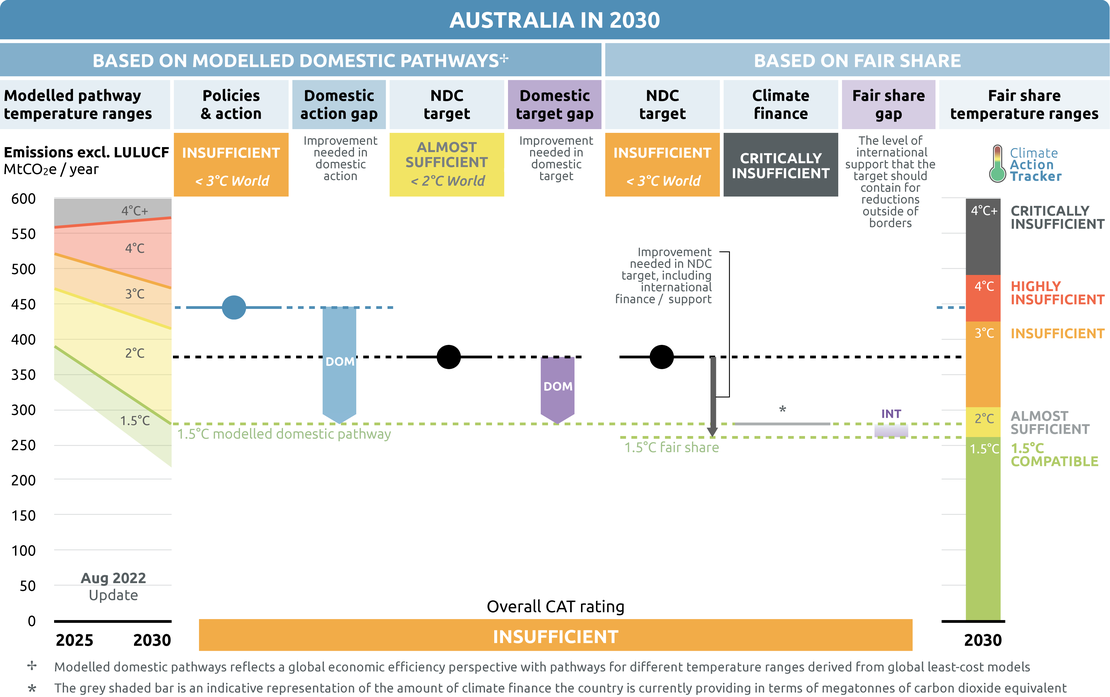

The CAT rates Australia’s policies and action as “Insufficient”.

Policy overview

Australia’s policies and action are on track to reaching 15% below 2005 levels, just below the NDC range excluding LULUCF. Australia’s total GHG emissions excluding LULUCF are projected to be 455 MtCO2e by 2030 excluding LULUCF using AR5 global warming potentials (GWP). This translates to 445 MtCO2e by 2030 using AR4 GWP.

The policies and action emissions scenario include the following policies:

- Measures announced in the 2021–22 Budget, including funding for “clean” hydrogen hubs (incl. from fossil fuel generation) and carbon capture and storage (CCS), support for farmers to reduce emissions through national soil carbon innovation challenge and trials for low-emission technologies, implementation of the Safeguard Crediting Mechanism, support for voluntary climate action through an expanded Climate Active framework, and investment to help Australian businesses and supply chains adopt energy efficiency measures.

- Technology Investment Roadmap and Low Emissions Technology Statement:

The Statement supports the fossil fuel industry as it lists CCS and hydrogen (without a green focus) as priority areas. CCS and fossil fuel hydrogen support can prolong the life of aging fossil fuel fleets in the energy system. Other priorities are energy storage, low carbon materials (steel and aluminium), and soil carbon. - Climate Solutions Fund (also known as Emissions Reductions Fund or ERF):

The ERF is a reverse auction mechanism designed to reduce emissions, through organisations and companies voluntarily abating greenhouse gases for carbon credits purchased by the government. - Large-scale Renewable Energy Target (expired in 2020) and the Small-scale Renewable Energy Scheme.

- National energy efficiency measures.

- National Energy Productivity Plan.

- Initiatives by ARENA and CEFC.

- The National Food Waste Strategy.

- Legislated phase-down of hydrofluorocarbons (HFCs).

- Energy Performance, refrigeration and air conditioning measures.

- State-based actions, as effective climate policy is more evident at the state and territory level, such as through state-based energy efficiency measure, state renewable energy targets and state waste policies.

The newly-elected Labor Government is planning further policies (Australian Government, 2022a). These policies have been announced but are not yet included in the policy and action scenario:

- AUD 20bn investment in the electricity grid to allow for renewable energy, in addition to AUD 300m for community batteries and solar banks.

- a National Reconstruction Fund with up to AUD 3bn to support renewables manufacturing and low emissions technologies.

- Powering the Regions Fund support new clean energy industries and decarbonising existing industry.

- The introduction of declining emissions baselines for the Safeguard Mechanism.

- The National Electric Vehicle Strategy and a new Driving the Nation Fund.

- An electric car tax discount, and emissions testing programme to inform consumer choice.

- Commitment for federal government agencies to reach net zero by 2030 (excluding defence and security).

The details of these policies are discussed in the sector sections below.

The newly-elected government has an opportunity to transition from the “gas-led” approach we have seen in recent years. However, the new federal resources minister Madeleine King has expressed support for the planned Santos Narrabri gas project in New South Wales, and Woodside’s Scarborough project in Western Australia (Mazengarb 2022). Government support for new gas projects indicates a discrepancy between the new NDC target and its continued backing of fossil fuels. The Woodside project will significantly add to Australia’s mitigation burden and its ability to meet the new NDC (Noakes, 2022).

As discussed below, many of the policies currently in place (implemented prior to the May 2022 election) may not have a positive impact on reducing emissions, particularly in light of the gas-led economic recovery and support for unproven CCS technology. The 2021 government emissions projections show emissions in most sector holding steady at similar levels from 2020 to 2030, bar the electricity sector which declines 49% (DISER, 2021d).

The government projections report suggests the electricity sector projections reflect a stronger renewable outlook, based on short term rooftop solar PV projections and large scale renewable energy pipeline. As found below, renewable energy policy and targets are to a large extent spearheaded by state governments, as the national government does not have a renewables target.

The policies and action scenario does not include the latest 2022-2023 Budget (Australian Government, 2022b). Like previous years, the 2022-23 federal budget has increased funding for LNG, gas, unproven carbon capture and storage, and ‘clean’ but not necessarily ‘green’ hydrogen. At the same time, it provides minimum new support for renewable energy. The Government has committed AUD 1.3bn to energy and emissions reductions measures in the federal budget, but a significant part of the spending flows to high-emitting energy projects.

The “Insufficient” rating indicates that Australia’s policies and action trajectory in 2030 needs substantial improvements to be consistent with limiting warming to 1.5°C when compared to modelled domestic pathways. If all countries were to follow Australia’s approach, warming would reach over 2°C and up to 3°C.

Further information on how the CAT rates countries (against modelled domestic pathways and fair share) can be found here.

Sectoral pledges

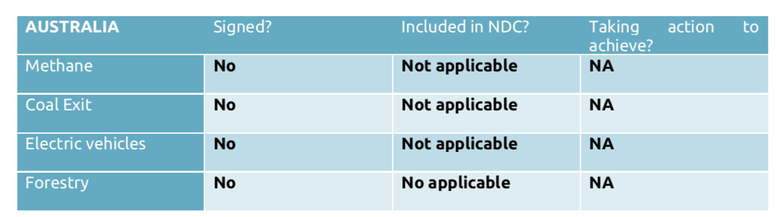

In Glasgow, four sectoral initiatives were launched to accelerate climate action including reducing methane, the coal exit, 100% EVs and forests. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, although assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets, and on forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”.

NDCs should be updated to include these sectoral initiatives, if they’re not already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

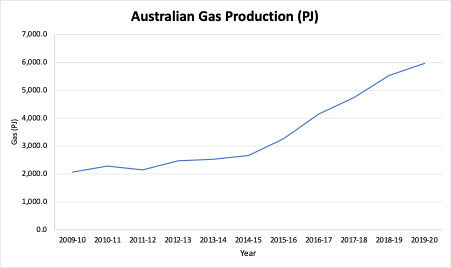

- Methane Pledge: About 25% of Australia’s total emissions are from methane and absolute methane emissions have seen little change since 2010. Methane emissions in Australia mainly come from agriculture and industrial processes. However, recent investigations have brought to light serious issues with Australia’s reporting on fugitive methane emissions from natural gas production and their impact on the country’s total GHG emissions. A clear upward trend in fugitive emissions is observable, coinciding with increased natural gas production in Australia (Hare, Ganti, et al., 2021).

- Coal exit: Coal is the dominant source in Australia’s electricity generation mix and the share of grid-connected coal capacity was 55% in 2020 (DISER, 2021c). The Australian government has no clear policy in place to phase out coal from its generation mix, despite the recent blackouts and energy crisis related to ageing coal fired power stations. The burning of coal for the 69 new coal mining projects in the country’s investment pipeline will increase emissions both domestically and internationally (Lewis et al., 2021). The international movement for a coal exit creates a huge stranded asset risk for any new investment.

- 100% EVs: Australia does not have any phase out date for fossil fuel vehicles. The Future Fuels and Vehicle Strategy expects EV’s to represent 30% of new vehicle sales by 2030 (Australian Government, 2021c). The uptake of EVs is very slow: high demand is seeing second hand vehicles selling for higher prices than new (Vorrath, 2022). The market share of electric vehicles in Australia is 1% of new vehicle sales. The government has announced plans for an EV strategy.

- Forestry: while the forest sector is currently a net sink, and regrowth of Australia’s previously harvested forests outweigh the forests that are currently harvested, the rate of forest clearing is still high. Previous studies have shown that increased global warming is expected to increase the incidence of Australian wildfires (IPCC, 2001; Lucas et al., 2007; Sharples et al., 2016). Emissions from fires causes more carbon in the atmosphere and creating a feedback loop for rising temperatures.

Continued support for fossil fuels

Although set by the previous government, the 2022-23 Federal Budget continues support for coal and gas projects: 114 new projects are in the pipeline, of which are 69 coal projects (Lewis et al., 2021). The new Labor Government has an opportunity to transition away from fossil fuels, but has already expressed support for new gas projects (Noakes, 2022).

The 2022-23 budget continues support for the gas industry with an AUD 50m subsidy to accelerate the development of priority gas infrastructure and AUD 247m to support increased private sector investment in low emissions technologies including hydrogen, the continued development of a Hydrogen Guarantee of Origin scheme (Armistead, 2022). However, the definition of clean /low emissions hydrogen is still ambiguous and fossil fuel driven hydrogen production will lead to carbon lock-in and not compatible of achieving a net zero by 2050 (Armistead, 2022). Australia’s policy support for the increased use of gas and hydrogen is also heavily dependent on the effectiveness of CCS, when the use of CCS at the commercial scale is yet not proven (Trigger, 2022).

As an initial response to COVID-19, the government appointed a National COVID-19 Commission which has now concluded. The Commission included mining industry stakeholders and produced recommendations for a gas-led recovery (Mazengarb, 2020; Parkinson, 2020).

The government plans to replace retiring fossil fuels with more fossil fuels, despite battery and renewable energy hub plans. The 2022-23 budget allocated AUD 53.3m for seven new priority gas projects across the country, along with CCS projects (Taylor, 2022) (see the gas section below).

Technology-neutral over climate focus

Australia’s long-term climate strategy is at risk of deprioritising effective low-emissions technology. The government also released the first “Low Emissions Technology Statement” (LETS) specifying the government’s technology investment priorities aims to invest AUD $18bn in the next decade in five priority areas, without a zero emissions target (Australian Government, 2020a) .

The Statement lacks a climate plan and props up fossil fuel industries such as “blue” hydrogen produced by gas and CCS. It does not rule out coal, nor does it prioritise electric vehicles and additionally prioritising hydrogen from natural gas without any promising development of CCS.

In October 2021, the Australian Government released the second iteration of its LETS. Building on its 2020 LETS that predominately discussed options, the 2021 LETS contains detail on programmes, investments and actions without any additional commitment to achieve net zero 2050. The only addition in 2021 LETS is the introduction of ultra low-cost solar electricity generation as another priority technology (Australian Government, 2021b).

The prior Morrison government made ongoing efforts to change the remit of ARENA to include CCS and blue hydrogen production: this was twice rejected by the Senate (Morton, 2022b). After Parliament rose ahead the elections, Energy Minister Angus Taylor introduced new regulations to change the rules, which will apply unless blocked by the Senate post-election (Morton, 2022b).

The only operating CCS project, the Gorgon gas project in Western Australia, has encountered numerous problems, resulting in capturing less carbon than contractually agreed, and commencing years later than planned (Morton, 2019).

Climate Solutions Package and the Emissions Reduction Fund

The 2019 Climate Solutions Package has been criticised in the media as a rebranding of old policies (Australian Government, 2019; Murphy, 2019). The package includes the rebranded Emissions Reduction Fund (ERF) (now also called the Climate Solutions Fund), unspecified energy efficiency measures, government investment into a “Battery of a Nation” project (new power links between Tasmania and the mainland), and the announcement of the electric vehicle strategy.

The ERF is a reverse auction mechanism that is supposed to reduce emissions in a cost-effective manner. As of the 14th auction in April 2022, the ERF has delivered a nominal total of 77 MtCO2e (less than 4 Mt since the October 2021 update) in abatement (CER, 2022). These figures exclude terminated or lapsed contracts in emission abatements as businesses have not delivered all the agreed abatements.

A recent change in the ERF - introduced without public consultation - will enable big emitters who were in fixed delivery contracts with the Federal Government to exit their contracts and sell carbon credits on an open market. This will put the emissions reductions at risk and additional abatement measures will cost additional taxpayers money (Bowyer, 2022).

The fund has also been plagued by a mismatch of its abatement profile, concentrated in the land sector, with Australia’s emissions driven by industrial, transport, and power sectors. There is a high risk of reversal of stored carbon in land sector projects being emitted again (Climate Change Authority, 2017). There are also serious doubts about the additionality of many of the ERF projects (Baxter, 2017). The ERF and Australian Carbon Credit Units (ACCUs) system have also been criticised as “fraudulent” by a former member of the Bushfire Royal Commission who also use to Chair the Integrity Committee of the ERF (ANU, 2022; Andrew Macintosh et al., 2022) The ERF and ACCUs are found to be ineffective in regulating polluting companies (See the forestry section for details on issues with stored carbon and ACCUs).

As of 2018, Australia’s GHG emissions (excluding LULUCF) per capita ranked eighth highest in the world (World Bank, 2022). In 2021, Australia was ranked highest globally for coal power emissions per capita (Ember, 2022).

States and territories

All states (and in addition, the Northern Territory and ACT) now have zero emissions targets for 2050 with strategies or action plans for implementation. The ACT and Victorian Government have legislated their targets. The ACT set an ambitious target earlier than 2050, to achieve zero net emissions by 30 June 2045 (ACT Government, 2019; Government of South Australia, 2020b; Northern Territory Government, 2022; Queensland Government, 2017; State of NSW, 2020; Tasmanian Government, 2022; The Government of Western Australia, 2020; Victoria State Government, 2021).

The state of Victoria ramped up its climate commitments in its Climate Change Strategy with a target to cut emissions 45 to 50% from 2005 levels by 2030 (Victoria State Government, 2021).

In September 2021 the NSW government released its new Climate Policy Framework, aiming to halve emissions by 2030 from 2005 - up from its previous 35% below 2005 levels by 2030 - and reach net zero by 2050 (ABC News, 2021).

Public Opinion

A public opinion survey shows climate change is one of the top concerns for people and most want more substantial action (ABC News, 2022). A poll showed that the majority of Australians do not think the current policies go far enough (Together We Can, 2022). Another study has found that 80% of Australians view action to reduce the country’s emissions as important, including almost 70% of conservative voters (Colvin & Jotzo, 2021).

A report by the Climate Council documents the compounding costs of Australia’s vulnerability to climate change (Climate Council, 2021). For instance, climate and weather disasters have cost Australia AUD 35 billion from 2010 to 2019 and will be largely uninsurable in flood and bushfire prone communities (ABC News, 2020; Climate Council, 2021).

Energy Supply

In June 2022, Australia suffered an energy crisis resulting from a combination of events such as the crisis in Ukraine impacting global energy prices, an ageing coal power plant fleet, impacts of COVID-19 on the coal plant workforce, and high energy demand during winter months causing energy supply issues and price spikes (AEMO, 2022a; Hannam, 2022).

The crisis led to blackouts across suburbs in the Eastern states and residents in the state of New South Wales were asked to conserve power. Capacity reserve issues have been mounting as Australia’s east coast power system has a heavy reliance on coal-fired power plants impacting reliability and power prices.

In response, the Energy Security Board recommended a new capacity mechanism where all generators would receive payments to have capacity available at certain periods, including the ageing coal fleet (ESB, 2022). The recommendations seem to be at odds with accelerating a renewable transition. There is increasing concern about the lack of reliability of ageing coal power plants, while renewable energy and increasing use of modern storage technologies are increasingly proving to contribute to reliability (CAT 2022).

The electricity sector represents 31% of total emissions excluding LULUCF (DISER, 2021d). Electricity sector emissions have been declining since 2016, with decreasing trends expected to continue as renewable energy replaces fossil fuels (DISER, 2021d). However, there is no explicit emissions reduction policy for the electricity sector, and instead an explicit push to support gas and coal-fired power generation.

Coal

Coal export prices are projected to peak this year due to the Ukraine crisis, weather and COVID-19 disruptions, and followed by an ongoing decline in price in conjunction with a slight increase in exports (DIESR, 2022). Coal production is expected to increase until 2023/24 (DIESR, 2022).

The coal industry is the major beneficiary of government spending with AUD 770m budgeted in 2021-22 across national and state governments (Armistead et al., 2022). The government has encouraged utilities to extend the coal-fired power generation lifespan beyond scheduled shutdown dates (Taylor, 2019). It also continues to support fossil fuel electricity generation, offering incentives through a power subsidy, considering support for a new coal fired power plant (“Underwriting New Generation Investment Scheme”) (Coorey, 2019; DEE, 2019c).

However, the government appears to have now accepted that new coal plants are unlikely to go ahead, with a 2021 report from the Office of the Chief Economist citing investor reluctance to fund new thermal coal projects as a reason for delays to new coal plant plans (Lewis et al., 2021).

This has borne out with a proposed new coal-fired power plant in Queensland for which the government provided AUD 4m for a feasibility study (Thornhill, 2020). The company, Shine Energy, has now admitted that the growth of renewables has rendered new baseload plants unviable, and is now promoting it as a backup plant (“load-following”) rather than baseload (Smee, 2022).

The world needs to phase out coal by 2030 (Climate Analytics, 2019a). Scenarios by the Australian Energy Market Operator (AEMO) show a cost-effective pathway towards high shares of renewable energy can be achieved with policy and planning (AEMO, 2020). The federal government has extended a grant of AUD 483m for the proposed Urannah dam in northern Queensland which has been designed to support a massive future expansion of coalmining in the Bowen Basin (See, 2022).

Fossil gas, LNG and oil

The crisis in Ukraine risks spurring new LNG projects in Australia as Europe looks to move away from Russian gas (Foley, 2022). The Australian government and LNG industry is heavily promoting the Russian gas crisis as its new rationale for expanded gas production, despite the new IEA’s Net Zero scenarios that show gas being phased out by the 2040’s at the latest (Hurst, 2022; IEA, 2021b).

The “gas-fired recovery” has received major financial support over the past two federal budgets and new gas projects are being planned across the country. The Global Energy Monitor finds that the gas-fired recovery includes plans of 12,200 km pipelines, representing USD 18.6bn of stranded asset risks (Langenbrunner et al., 2022).

In a recent development, Woodside’s Scarborough LNG project extension, which received federal approval in 2022, will add just under 1.4 GtCO2e of GHGs into the atmosphere, equivalent to 27 years of Australia’s coal power generation emissions at 2018-19 levels (Hare, Ganti, et al., 2021).

In the 2022-23 federal budget the government proposed a subsidy of AUD 600m for the production of “blue” hydrogen in the Pilbara and Darwin. Yet blue hydrogen actually produces more greenhouse gases in its entire supply chain compared to burning of natural gas (Hare, Ganti, et al., 2021).

The government also implicitly provided another AUD 300m to the National Water Grid to help meet demand for water of Middle Arm industrial users, a prominent LNG hub. AUD 200m is allocated for the infrastructure development of the hub’s supply chain (Australian Government, 2022b; Ogge, 2022).

The 2022-23 federal budget also includes a new fund of $53.3m for its “gas-led recovery” under the guise of “Future Gas Infrastructure Investment Framework” for which the government, in late 2021, announced its “National Gas Infrastructure Plan”. This will include the Southwest pipeline expansion project, and Heytesbury Underground Gas Storage project in Victoria, the Project Range, Surat Hub and Gas Infrastructure project (Bowen Basin) in Queensland, the East Coast grid expansion Stage 2, and a feasibility study into the most efficient infrastructure to deliver gas from the Beetaloo sub-basin (Northern Territory) to the east coast gas market.

The 2022-23 federal budget also included funding for feasibility studies into CCS for four different gas fields.

In 2021, the Government announced a public funded AUD 600m Kurri Kurri 660 MW gas fired power plant in Hunter Valley NSW to replace the Liddell coal station (Gooley, 2021). Local businesses have objected to the gas plans (Mazengarb, 2021a). Energy Australia proposed a 300 MW gas fired peaking power station with plans for green hydrogen which will receive AUD 83m combined from the New South Wales and federal governments (Murphy, 2021).

The plan for green hydrogen has been criticised for propping up fossil fuels as it supports the gas project without reducing emissions due to the low levels of green hydrogen blending (Joshi, 2021). The Australia Energy Market Operator (AEMO) reports highlights the uncertainty of the gas sector within the next 20 years, as scenarios show possible decline from economic activity, closure risks and hydrogen substitution (AEMO, 2021).

The government’s gas plans contradicts AEMO scenarios for integrated grid planning that show no expansion of gas-fired power generation is necessary (AEMO, 2020). And in 2022, AEMO forecasts a gradual decline in domestic gas use as consumers inevitably shift to electricity or zero emissions technologies (AEMO, 2022b).

While oil production has declined in Australia since 2010, natural gas production has vastly increased since 2011-12. There was substantial 188% growth from 2009-10 to 2019-2020 (DISER, 2021a). Australia has 10 operational LNG plants (DISER, 2021e).

The industry benefits from tax rebates, the most prominent being the fuel tax credit scheme (Australian Taxation Office, 2017). Another subsidy is the statutory effective life caps. This subsidy can be applied to oil and gas assets to accelerate the depreciation, and the taxable amount on the asset (ODI, 2015). These subsidies support fossil fuel industry and their exports, despite the need for global phase out.

What is not measured in national level greenhouse gas accounts is the emissions from LNG and coal at the export destination.

Renewables

The Australian energy crisis has resulted from capacity issues from ageing fossil fuel power plants, while accelerating renewable energy and storage uptake, along with responsive demand side management, offers a solution.

A number of studies show the technical and economic feasibility of a transition to 100% renewable energy by the 2030s through simple and affordable policies, such as incentives for dispatchable renewables and storage, funding for transmission links, and incentives or legislation for retiring high polluting coal power (Blakers et al., 2017; Diesendorf, 2018; Gulagi et al., 2017; Howard et al., 2018; Riesz et al., 2016; Teske et al., 2016).

Renewable energy generation has increased in recent years from 9% of total electricity generation in 2005 to 21% in 2019 (DISER, 2021d). Government projections (release prior to the election) indicate 61% of electricity will be generated with renewable energy by 2030 (DISER, 2021d). The projections show a year on year growth in renewable generation and consequently there is a projected 49% decline in electricity sector emissions from 2020 to 2030 (DISER, 2021d).

The newly-elected government has announced AUD 20bn investment in the electricity grid to allow for renewable energy, in addition to AUD 300m for community batteries and solar banks (Australian Government, 2022a).

The Labor government claims its policies will result in increasing renewables in the National Electricity Market (NEM) to 82% by 2030 (ALP, 2022; Reputex, 2021). The NEM is the largest electricity grid in Australia and covers Queensland, New South Wales, Australian Capital Territory, Victoria, South Australia, Tasmania. The NEM excludes the Western Australia (WA) Wholesale Electricity Market and other grids. The previous government had projected 69% renewable penetration by 2030 for the NEM (DISER, 2021d).

A major opportunity for reducing emissions in Australia is electrifying industry with renewable energy. This would include industry in WA (on-grid and off-grid) that is not covered by the Labor party commission modelling. The modelling assumptions are unclear whether it assumes all the Labor Party policy funding announcements are applied to just the NEM or accounts for funding to go elsewhere too (Reputex, 2021).

The renewable energy sector has experienced growth, but investments in renewables are predicted to decline and curtailment and delays to grid connections are becoming an increasing problem (De Atholia et al., 2020; RenewEconomy, 2020). Reasons for the decline in investment include policy uncertainty, regulatory risks, grid connector issues and lack of investment in the network (Clean Energy Council, 2020a, 2020b; McConnell, 2019).

Small-scale renewable energy is experiencing strong growth due to the uptake of rooftop solar by private households and small businesses. In 2020, 3 GW of new small scale solar systems were installed, a rise from 2.7 GW in 2019 and despite the impacts of the global COVID-19 pandemic (Clean Energy Council, 2021). It marks the fourth year of record breaking in capacity additions (Clean Energy Council, 2021).

In a 2020 study, the Climate Action Tracker found that accelerating towards a zero carbon power sector would create 46,000 additional jobs from 2021 to 2030, and with local manufacturing of wind turbines, solar panels and batteries, and that this could be scaled up to 76,000 jobs (Climate Action Tracker, 2020).

Nuclear

Nuclear power is prohibited by law in Australia under the Australian Radiation Protection and Nuclear Safety Act 1998 (the ARPANS Act), and the Environment Protection and Biodiversity Conservation Act 1999 (the EPBC Act) (Cronshaw, 2020).

Energy efficiency

The National Energy Productivity Plan 2015–2030 aims to improve energy productivity by 40% by 2030 through “encouraging more productive consumer choices and promoting more productive energy services” (Australian Government, 2015). However, research suggests that much more ambitious improvements are possible, with a doubling of energy productivity possible by 2030 with net benefits for GDP (Energetics, 2015).

The government introduced the Energy Efficient Communities Program in 2019 committing AUD 50m in grants for businesses and community organisations to improve energy efficiency and reduce electricity bills (DEE, 2019b). By 2020, this program’s budget was reduced to AUD 40m (Department of Industry Science Energy and Resources, 2020).

States and territories

States and territories are stepping up and committing to their own targets. Six out of eight states and territories in Australia have committed to a renewable energy target in or beyond 2025 (Climate Council, 2019). Some states have set ambitious targets for 100% of renewable energy:

- ACT has committed to 100% renewables by 2020

- Tasmania aims to be 100% self-sufficient in renewable energy by 2022 (Climate Council, 2019). It has set a new ambitious target for 200% renewable energy by 2040 (Gutwein, 2020).

- South Australia is a global leader in terms of the share of variable renewable energy (wind and solar PV) at 51% in 2018 (Department of the Environment and Energy, 2019a). It met its 50% renewable energy production by 2025 target in 2018 (Department of the Environment and Energy, 2019a). It also leads in storage technology with the world’s biggest lithium-ion batteries and one of the world’s biggest solar thermal plants. The state has plans for the world’s biggest “virtual power plant”, i.e. the installation of solar panels and batteries on more than 50,000 homes, and for investments into green hydrogen from renewable energy for storage and export (Morton, 2018)

- Queensland, Victoria, and the Northern Territories have committed to 50% renewables by 2030 (Department of Energy and Water Supply., n.d.; Langworthy et al., 2017; Victoria State Government, 2019)

- While New South Wales does not have a renewable energy target, its new climate policy includes as much as AUD 32bn into wind, solar and energy storage projects, though the creation of dedicated Renewable Energy Zones (Mazengarb, 2021b).

- Western Australia has no renewable energy target.

Around 35% of dwellings in South Australia, 36% in Queensland and 29% of Western Australia had solar PV by 2019, a trend that is showing no sign of slowing down (Climate Council, 2019). The following year, the installation of rooftop solar increased by 28% across the country, with 362,000 installations. As of December 2020, a total of more than 2.68 million rooftop solar power systems have been installed in Australia: one in four homes have solar panels on their roof, one of the highest uptakes of solar in the world (CSIRO, 2021).

This is not a boom driven by a pending reduction in subsidies, rather by high electricity prices, highly affordable solar power systems, and people’s desire to act on climate change.

Industry

Australia’s emissions from industry1 (stationary energy excluding electricity, fugitives2, and industrial processes) account for 35% of total emissions (excluding LULUCF), making it the largest emitting sector (DISER, 2021d).

The recently-elected government has announced a “Powering the Regions Fund” to support industries such as green metals (steel, alumina and aluminium); clean energy component manufacturing; hydrogen electrolysers and fuel switching; agricultural methane reduction and waste reduction (ALP, 2022; Australian Government, 2022a). There are many studies demonstrating Australia’s industry sector can decarbonise and transition away from fossil fuels (BZE, 2019; Climate Analytics, 2018; ClimateWorks Australia, 2014, 2020).

In 2017, the government legislated a phase down of hydrochlorofluorocarbons (HFCs) (Australian Government, 2020d). The phase-down will reduce the total quantity of permitted HFC imports every two years until an 85% reduction from 2011–2013 levels is achieved by 2036 (Government, 2017).

Hydrogen

In November 2019 the government released the National Hydrogen Strategy, developed by the Council of Australian Governments’ (COAG) Hydrogen Working Group (COAG Energy Council, 2019). Renewable energy-based hydrogen is an opportunity for the integration of large shares of renewable energy and decarbonisation of end-use sectors in particular in heavy freight transport and industry where direct electrification is not feasible.

The federal budget of 2022-23 has a large allocation for the expansion of hydrogen, announcing AUD 247m to support increased private sector investment in low emissions technologies including hydrogen, and the continued development of a Hydrogen Guarantee of Origin scheme (Armistead, 2022). However, this increased use of hydrogen is heavily dependent on the use of CCS which is yet not available at the commercial scale for industrial use.

However, the National Hydrogen Strategy refers to a “technology-neutral” approach and defines “clean hydrogen” as “hydrogen produced using renewable energy or using fossil fuels with substantial carbon capture”. There is a risk that it will be used to prop up the fossil fuel industry in Australia.

In comparison, there is a Hydrogen Energy Supply Chain coal to hydrogen project with a budget of AUD 500m from various Australian and Japanese sources, of which the Australian government and the Victorian government are contributing AUD 50m each (Seccombe, 2019). The pilot project will not implement carbon capture and storage, but may offset emissions, and carbon capture and storage will only be installed if the full project goes ahead as part of the CarbonNet Project for sequestration, on which the federal and Victorian governments have so invested some AUD 150 million (due in 2030) (Seccombe, 2019).

Both South Australia and Western Australia have renewable hydrogen strategies (Government of South Australia, 2017; WA Dept. of Primary Industries and Regional Development, 2019) and the Queensland government has released a Hydrogen strategy focusing on green hydrogen and export opportunities (Queensland Government, 2019). Experts say that with the right conditions, Australian hydrogen exports could be worth AUD 1.7 billion a year and could generate 2,800 jobs by 2030 (ACIL Allen Consulting, 2018).

Safeguard Mechanism

Australia’s Safeguard Mechanism began operations in July 2016, with a goal of limiting significant emissions increases from large industrial sources to a baseline emissions level. This mechanism applies to 215 facilities with direct emissions of more than 100 ktCO2e excluding the electricity sector.

In March 2019, baselines were increased, allowing emissions to increase (Department of the Environment and Energy, 2019b). So far, the safeguard mechanism has not been designed to reduce emissions, but rather to limit them. However, baseline changes have led to projected increase of emissions from these facilities by 12% in the two years of operation, cancelling out publicly funded emissions reductions under the Emissions Reduction Fund (Morton, 2020).

The newly-elected Government intends to reduce the emissions baselines (Australian Government, 2022a). However, the potential use of carbon offsets puts the emissions reductions into question. The Labor government commissioned Reputex to model GHG emissions reductions of the party’s policies. If the Labor Government were to follow this modelling, up to “40 Mt or around 19%” of the emissions reductions from the safeguard mechanism’s total of the 213 Mt reductions between 2023-2030 would be through carbon offsets (Reputex, 2021). Carbon offsets and Australian Carbon Credit Units (ACCUs) have been criticised for being scientifically flawed and greenwashing fossil fuel projects rather than phasing out the fossil fuel industry (Climate Analytics., 2022) (see forestry sector below).

The Government is also introducing a National Reconstruction Fund with up to AUD 3bn to support renewables manufacturing and low emissions technologies (Australian Government, 2022a). Based on the Labor Party commissioned modelling, this fund will produce emissions abatements of 33 MtCO2e by 2030, 24 Mt of which are covered under the safeguard mechanism (Reputex, 2021).

The Clean Energy Regulator is developing a carbon exchange to streamline trading of Australian carbon credit units (ACCUs). ACCUs are issued as part of the Emissions Reduction fund and the carbon market may support further engagement with the voluntary emissions reduction for businesses (Clean Energy Regulator, 2021).

Carbon capture and storage projects will now qualify under the emissions reduction fund (CER, 2021). This move has been highly criticised, as it adds to the mounting taxpayers dollars that have been spent on CCS—with few signs of commercial or environmental viability (Mazengard, 2020).

The federal and state government have both approved the start of what could prove to be the biggest coal mine in the world, the Adani mine in Queensland (ABC News, 2019a, 2019b). The Adani project was temporarily put on hold as the Federal Court upheld a challenge to the approval of the project relating to environmental impacts (EDO, 2021). However, it began exporting coal in late 2021.

1 | The Industry Sector includes direct combustion emissions from manufacturing, energy, and mining (but not from buildings, military, nor from agriculture and fisheries), and fugitive emissions (coal, oil, and gas), as well as industrial processes and product use emissions.

2 | Fugitive emissions in this section refers to emissions from the extraction, processing and delivery of fossil fuels.

Transport

The recently-elected government has made several transport policy announcements including developing a National Electric Vehicle Strategy and a new Driving the Nation Fund. The government plans to implement an electric car tax discount, and emissions testing programme to inform consumer choice (Australian Government, 2022a).

In 2021, transport emissions represented 18% of total emissions (excluding LULUCF) and were projected to increase 6% by 2030 prior to the recent policy announcements (DISER, 2021d). Cars represented over 45% of transport emissions in 2021 and are projected to represent 41% in 2030 (DISER, 2021d). Transport emissions should decline, particularly with the right policies in place related to increased energy efficiency and the rise of electric vehicles, but there a few effective federal policies.

The government released a Future Fuels and Vehicle Strategy in November 2021 (Australian Government, 2021c). The strategy rules out government subsidies for electric vehicles (EVs) and setting a date for phasing out fossil fuel vehicle sales. The strategy expects EV’s to represent 30% of new vehicle sales by 2030. The budgeted $2.1 billion in the plan will be directed at charging, manufacturing and recycling projects, and plans to reduce 8 MtCO2e by 2035. The strategy discussion paper released prior to consultation noted emissions will be relatively high for EVs given the fossil fuel intensive electricity grids in most states and territories backed by a government supporting a “gas-fired recovery” (DISER, 2021b).

The Strategy indicates the government will partner with the private sector to fund 50,000 charging stations in Australian homes, 400 businesses and support 1000 public access points to fast charging.

In terms of current policies, the emissions reduction fund has failed to contract emissions abatements in the transport sector since the second auction in November 2015, (there have been 12 further auctions since) (CER, 2022). Yet, the government is supporting fossil fuels with up to AUD 260m in grants for the construction of diesel storage (DISER, 2022).

Australia still has no fuel efficiency standards, while nearly 80% of new light duty vehicles sold globally are subject to some kind of emissions or fuel economy standard (Climate Analytics, 2019b). In 2020, the Federal Chamber of Automotive Industries (FCAI) announced a new industry-led CO2 emissions standard, that aims to reduce CO2 emissions on average by 4% per year for passenger cars and light SUVs (IEA, 2021a).

Australia has a very slow uptake of electric vehicles (EVs) compared with other countries. The market share of electric vehicles in Australia is 1% of new vehicle sales, in comparison to over 6% in other developed countries (see graph below). The sales of electric vehicles tripled in 2019 despite the lack of government support (Electric Vehicle Council, 2020). In 2020, only 0.78% of new vehicles sold were EV, compared, for example with 10.7% in the UK and 74% in Norway.

Country comparison of EV market share

In contrast to the federal government, most states (ACT, NSW, VIC, QLD, SA) offer different degrees of registration discounts for electric vehicles (Climate Analytics, 2021).

The State of South Australia plans to lead Australia in EV uptake with AUD 18.3m budgeted for the Electric Vehicle Action Plan with an aim for all new passenger vehicles sold to be fully electric by 2035 (Government of South Australia, 2020a).

The ACT government and Transport Canberra have trialled electric and hybrid buses and ACT has now released an Action Plan for zero-emissions vehicles. ACT—with a target to achieve net-zero GHG emissions by 2045—has introduced financial incentives for zero-emissions vehicles (exemptions from stamp duties, reduced registration fees), adopted zero-emissions vehicles in government fleet, and is investigating opportunities for production of hydrogen fuel and deployment of fuel cell electric vehicles in the government fleet (ACT Government, 2018).

Both NSW and Victoria have policies requiring that 50% of all new cars sold in 2030 must be EVs (Climate Analytics, 2021).

Buildings

The buildings sector accounts for 57% of Australia’s electricity usage and energy efficiency in buildings and appliance is essential to decarbonise (Climate Action Tracker, 2020). There is widespread undercompliance with the present minimal energy efficiency standards (Climate Action Tracker, 2020).

The National Construction Code was updated in May 2022, however the energy efficiency measures are scheduled for August 2022. The National Construction Code 2019 was deemed ineffective in providing adequate energy efficiency in buildings (Climate Action Tracker, 2020). Slow policy responses for long-lived assets mean that renovation rates need to be scaled up.

Australian efficiency standards are behind other countries with similar climates (Climate Action Tracker, 2020). Failure to ensure adequate levels of energy efficiency in buildings places further pressure on the electricity grid to decarbonise.

Agriculture

Agriculture accounted for 14% of Australia’s total emissions in 2021 (excluding LULUCF) (DISER, 2021d). Emissions from agriculture are expected to rise as drought conditions ease with the recent La Niña event which is linked to an increase in expected rainfall, and then emissions are expected to remain at relatively constant levels from 2025 to 2030 (DISER, 2021d).

Emissions in the agriculture sector are derived from enteric fermentation (digestive processes of some animals), liming and urea application, manure management, rice cultivation, agricultural soils and field burning (DEE, 2019a). Operating equipment, fuel and electricity in this sector are covered in the other relevant sectors such as electricity sector.

The Carbon Farming Futures programme ran from 2012 to 2017, and invested 139 million AUD in 200 projects and 530 farm trials (Department of Agriculture and Water Resources, 2017). It promoted research and best practice techniques to reduce emissions. The only policy to disseminate regional best practise and ramp up research came to an end and has not been replaced.

The Climate Change Authority has also noted the need for a ramp up of research in this sector, and recommends the allocation of additional funds for low emissions agricultural research and carbon farming, in addition to investment and incentives to support “climate-smart” and low emissions agriculture and environmental services (Climate Change Authority, 2020).

Forestry

While the forest sector is currently a net sink, and regrowth of Australia’s previously harvested forests outweigh the forests that are currently harvested, the rate of forest clearing is still high (Australian Government, 2020d).

Australia is heavily relying on domestic carbon offsets to compensate for the fossil fuel industry emissions under the safeguard mechanism. Carbon offsets are used by fossil fuel companies to greenwash emissions-intensive projects rather than focusing on real emissions reductions (Climate Analytics., 2022). Evidence suggests the use of carbon offsets that reflect carbon storage on land by, for example, tree planting, is scientifically flawed (Climate Analytics., 2022).

There is a limit to carbon storage in ecosystems and sequestration of carbon reflects the loss of carbon in the past (Mackey et al., 2013). Carbon offsets that are issued to activities such as tree planting can create low biodiversity value, creating issues such as maladaptation (Seddon et al., 2020). Other issues include displacement of people and local economies, expropriation of indigenous peoples territories, and food insecurity (AbibiNsroma Foundation et al., 2021; Forest Peoples Programme, 2021).

Australian carbon credit units (ACCUS) have been criticised for a lack of integrity in the accounting method (Roxburgh et al., 2020; The Australia Institute, 2021). The Australia Conservation Foundation and Australia Institute study found a fifth of ACCUs do not reflect actual abatement, as the assumed deforestation that the crediting projects avoided were never going to occur, i.e. they were not “additional” to the reduction, or avoidance, of emissions that would happened in the absence of financial support from the sale of carbon credits (The Australia Institute, 2021).

Another analysis suggests that 48% of New South Wales projects and 52% of Queensland projects experienced a decline in forest cover. The 59 projects that experienced a net decrease in forest cover in their project areas received 8.2m ACCUs, worth around AUD 200m (A Macintosh et al., 2022). The NDC 2022 update states the government will conduct a review into the Australian Carbon Credit Units (ACCUs), and has now appointed a former chief scientist to undertake that review (Duxfield 2022).

The Australian government estimated 830 MtCO2e of net emissions were attributable to the 2020 fire season (Australian Government, 2020b). Emissions from wildfires such as the devastating and unprecedented bushfires in 2019/2020 that burnt an estimated 7.4 million hectares of forest (mostly in national parks and conservation areas) are not accounted for in the inventory, as they are treated as a “natural disturbance” beyond control, and it is assumed that the equivalent amount will be sequestered during forest recovery (Australian Government, 2020b). However others have expressed doubt as to the forests’ ability to recover within the time frame given the increased likelihood of prolonged drought conditions due to climate change (Bowman et al., 2021; Readfearn, 2019).

Australia is the only developed country that is classified as a deforestation hotspot in the world (WWF, 2021). Although the forests in Eastern Australia are considered a global biodiversity hotspot, the area is increasing losing forest to the development of livestock as a main driver, but also to timber harvesting and fire and drought (WWF, 2021).

Government LULUCF emissions data is regularly recalculated for historical and projected emissions. The recalculations highlight how uncertain this sector is, and data changes have significant repercussions on Australia’s progress on meeting emissions targets. The CAT takes into account the uncertainty of these projections (see the assumptions section for details).

Waste

The waste sector emissions represent 3% of total emissions excluding LULUCF (DISER, 2021d). Emissions from the waste sector are the result of mainly methane related to landfill, wastewater treatment, waste incineration and treatment of solid waste.

The national waste policy does not focus on reducing emissions from this sector (Climate Action Tracker, 2020). The Emissions Reduction Fund (ERF) portfolio has at least 106 landfill and waste projects, and the safeguard mechanism limits emissions at large landfills, although this policy does not cover legacy emissions before July 2016 (Climate Action Tracker, 2020). There are also concerns over the success of the ERF, as it covers projects that would have abated emissions without the scheme (Climate Action Tracker, 2020; Morton, 2022a).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter