Country summary

Overview

Indonesia is one of the most populous countries in the world, with substantial emissions from the forestry sector, and a massive coal-fired power generation pipeline. Indonesia is currently developing both its next five-year plan and its long-term vision. Only one of the long-term scenarios under consideration would see absolute emissions decrease by 2045. Shifting the investments planned for the next five years towards zero-carbon solutions is crucial to putting Indonesia on a development pathway compatible with the Paris Agreement.

Indonesia is a fossil fuel exporter: coal, oil, and gas were responsible for about half the country’s non-tax revenue in 2018. However, fossil fuel net exports have been declining since 2013 and international market prices for both coal and oil finished 2018 at lower levels than they began the year.

To reduce Indonesia’s dependency on international fossil fuel demand, the Government is incentivising domestic coal utilisation for industry and power generation to maximise coal extraction profits. Besides the damage to the climate from continued coal use, this support is not without risk. Indonesia has consistently overbuilt capacity that, combined with inflated energy demand projections, is likely to result in high shares of idle capacities. Yet it is still planning to install over 6 GW of coal-fired power generation by 2020 and about 27 GW by 2028, which is estimated to lead to an obligation to pay over USD 16 billion for idle capacity by 2026.

Questions remain as to whether Indonesia will achieve its 2025 renewable energy (RE) target. The government has implemented some policies to support reaching this target, e.g. by regulating the installation of rooftop solar. However, various design elements of these policies and the general investment environment still favour large-scale fossil-fuelled power and prevent a swift and large-scale expansion of renewables.

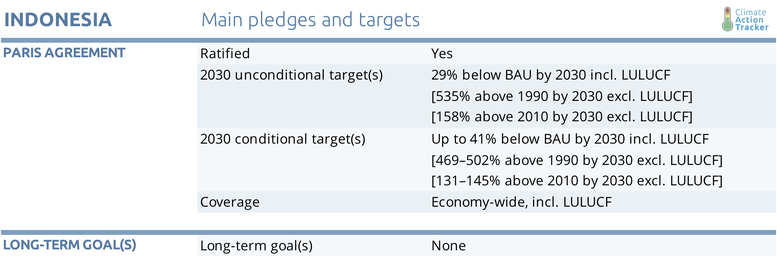

Based on current policies projections, Indonesia is very likely going to overachieve its Paris Agreement targets excluding the forestry sector. However, the CAT rates the Indonesian NDC target (excluding forestry) as “Highly insufficient”. This overachievement puts Indonesia in a position to significantly increase the ambition of its NDC. Including the 2025 renewable energy target in the target is the first step, though further action would be needed to become 1.5°C compatible.

With international support, Indonesia pledges to achieve a 41% reduction from BAU in 2030 (roughly equivalent to doubling of today’s emissions levels). See the pledges and targets section for details and analysis.

While Indonesia’s relative reductions below BAU anchored in its NDC may sound ambitious, a second look reveals a different picture for two reasons: first, Indonesia aims to meet a large share of its commitments through reductions in the forestry sector. This means that other sectors will see substantially lower relative reductions of emissions below BAU. Second, the BAU for the targets projects an increase substantially above our projections under current policies. In fact, Indonesia will achieve its targets (excl. forestry) without any additional efforts while still doubling today’s emissions.

The CAT rates Indonesia NDC excl. the forestry sector as “Highly insufficient” (for full details see Fair Share section). Indonesia’s NDC could be easily strengthened by ensuring its existing renewable energy targets are met. Indonesia’s National Energy Policy (NEP) has a target to increase renewable energy to 23% of total primary energy supply (TPES) by 2025 and 31% by 2050. These targets are mentioned in its NDC; however, it is not clear if they form part of the contribution. There is a widespread belief among many stakeholders within the country that the 2025 target will not be achieved (Bridle et al., 2018). Such a view is supported by the CAT current policy projections which show that Indonesia will not meet its 2025 NEP target. If Indonesia did meet this target, it would overachieve both its unconditional and conditional NDC targets to an even greater extent than already envisaged.

Indonesia works on five-year planning cycles. It has stated that its next five-year plan, covering 2020-2024. In March 2019, the Ministry of National Development Planning (BAPPENAS) also released its low carbon development plan, containing three long-term (2045) emission pathways.

Only one of these long-term scenarios would bend GHG emissions downwards by 2045, halving emissions (including forestry). While the CAT does not include the forestry sector in its analysis, an increase in emissions up to 2050 is not in line with any “fair” interpretation of a 1.5°C Paris Agreement compatible development pathway.

For power generation, geothermal power plants remain the biggest source of renewable power in Indonesia, reaching a total installed capacity of 1,950 MW at the end of 2018, followed by bioenergy generation with 1,850 MW.

Solar and small hydro reached together 330 MW and wind jumped to 75 MW with the opening of the country’s first wind farm (Sidrap). The primary energy mix for power generation is still vastly dominated by fossil fuels with a share of almost 90% for coal, oil, and gas. 74 new contracts for renewable power plants were signed between 2017 and 2018, adding about 1.5 GW to the pipeline, but the new electricity plan indicates the installation of 12.2 GW of coal and gas power plants until 2020.

The transport sector has also seen progress in the past year. In March 2019, the first line of Jakarta’s Mass Rapid Transit system opened. The project was supported by Japanese financing. A second line is expected to be completed by 2024. A key challenge now is securing the modal shift in commuter habits. The transit system is currently only used by 20% of commuters.

Indonesia’s biofuel blending mandate is one of the most ambitious in the world. Since 2016, the electricity sector must have 30% of its energy supplied by biofuels. Micro-business, fisheries, agriculture, transportation, industry and public service sectors, need at least a 20% share. In the same regulation, the target share values for all sectors are set to reach 30% by 2020.

However, while Indonesia’s biofuels targets are ambitious, they are not without controversy due to concerns with palm oil production: plantations for biofuel production are specifically exempt from a key sustainability certification. As the total area of palm oil plantations in Indonesia has risen more than tenfold in the period 1990–2015, while forest cover declined by about 20%, production of biofuels from palm oil is “predicated on a vision of biofuel expansion that would require extensive deforestation”.

In 2018, a three-year moratorium was placed on new licenses for oil palm plantations, and a new suspension stopping supplies from companies involved in deforestation is now forcing national and regional government to look to more sustainable solutions.

The issue of forest clearance for palm oil is a major problem in Indonesia, which alone contributed to 7% of the total global tree cover loss between 2001 and 2017 and contributes to a large share of Land Use, Land Use Change and Forestry (LULUCF) emissions reaching around 1 GtCO2e/year, considering deforestation, forest degradation, peat decomposition, and peat fires

Due to an unusually high occurrence of peat fires, the emissions from the LULUCF sector in Indonesia reached 1.6 GtCO2 in 2015. To put that into context, global emissions from LULUCF were about 4.1 GtCO2e in 2016.

In 2017, 0.8% of Indonesia’s forests were lost compared to 1.5% in 2016 - a 1.12 Mha reduction in deforestation. While this is a good sign, the biggest driver for deforestation is still commodity-driven deforestation, which resulted in around 1.5 Mha of tree cover loss in 2015.

Further analysis

Country-related publications

Stay informed

Subscribe to our newsletter