Current Policy Projections

Economy-wide

Before COVID-19, GHG emissions excl. LULUCF were expected to increase to 1,357-1,401 MtCO2e/year by 2030, about 40% higher than 2010 emissions. The lower economic activity resulting from the pandemic reduces projections to 1,191-1,326 MtCO2e/year. With these projections, Indonesia overachieves its unconditional NDC and conditional 2030 targets (excl. forestry), despite strongly increasing emissions and not achieving other national targets, e.g. the National Energy Policy, or NDC reductions for LULUCF emissions.

The full effect of COVID-19 on emissions is subject to much uncertainty as emissions projections are dependent on the economic impacts as well as the recovery measures. The dip in activity brings emissions downwards: Indonesian GDP retraction is expected to result in emissions reductions in the range of 2 to 6% in the same year.

As of late August 2020, the number of new confirmed COVID-19 cases was still increasing, which exacerbates the uncertainty around the duration and intensity of impacts on the economy beyond 2020. The economic decline observed in the first quarter of 2020 was mostly influenced by domestic demand, driven by a reduction in household consumption and a slowdown in investments (Bank of Indonesia, 2020). Indonesia has also seen a reduction in both coal exports and palm oil exports which affects two major economic sectors: mining and palm oil plantations (Christina & Ungku, 2020; Jong, 2020c; The Jakarta Post, 2020), with the reduction in coal demand particularly in India and China having a large impact on coal production (Wilda Asmarini, 2020).

As an attempt to minimise the effect of COVID-19 on the economy, the government has earmarked approximately USD 48 billion (IDR 720 trillion ) to fund the National Economic Recovery (Ministry of Finance Indonesia, 2020a). It does so with the establishment of numerous policy instruments such as tax incentives, direct investments and subsidies, and loans (Cabinet Secretariat of the Republic of Indonesia, 2020; Media Indonesia, 2020; Ministry of Finance Indonesia, 2020b). The post-COVID-19 economic recovery presents an opportunity to increase investment in low-carbon development, specially to foster renewable energy development (Amri et al., 2020). The current plans however make no attempt of putting the country in a low-emission pathway, latest developments suggest the opposite:

- Additional fossil fuel support picks up speed: in January 2020, Indonesia capped the price of domestic coal at USD 20 per tonne below market value to boost consumption (Harsono, 2020b). The Indonesian government plans to subsidise fuel for industries and businesses using roughly 14% of the budget reserved for the National Economic Recovery – PEN (Kontan.co.id, 2020). Two regulations (PP 36/2020 and PP 37/2020) are already in place to inject approximately USD 1 billion into state companies, including the national utility company, PLN. However, third-party estimates that PLN might need up to USD 7.2 billion in subsidies from the government to address their budgetary issues (Brown, 2020).

- Renewables uptake faces setbacks: Indonesia has postponed this year’s geothermal auctions, claiming delays on data improvement and regulation development (Richter, 2020). Solar PV panel demand, which is only starting to pick up in Indonesia, experienced a drop of 70% during the pandemic. The drop is attributed to both reduction in household spending as well as the reduction in government spending for rooftop installations (Harsono, 2020a).

- Biodiesel future is unclear: Indonesia has been rolling out an ambitious biodiesel target since 2016 (see Transport below), but discussion on the mode of continuation are ongoing amid low crude oil prices, which reduce the competitiveness of the domestic palm oil biodiesel (Munthe & Ungku, 2020). Government plans to produce ‘green diesel’ entirely with palm oil by 2023 were pushed back to 2026 (Diela et al., 2020).

- Environmental regulations being eased under the radar: the government has resumed discussions on the Omnibus bill on job creation, which transfers the decision-making power from local to the central government for deliberation about environmentally sensitive projects. The regulation is considered a setback as it downgrades the importance of environmental licenses and reduces the efficiency of monitoring mechanisms (Sembiring et al., 2020).

Indonesia has also been back and forth with the requirements on certification for wood production, which raised concern about increases in illegal logging (Iswara, 2020). In an attempt to boost wood exports, regulation 15/2020 discarded the SVLK verification system, which ensures the legality and sustainability of all wood exports. The regulation was supposed to take effect on May 27. However, regulation 45/2020, which took effect on May 11, reinstated the mandatory provision of the certificates for exports (Jong, 2020a; Myers, 2020).

While these developments had the intention of ensuring the country can overcome the current crisis, experts highlight the importance of increasing support for low-carbon options (Simamora, 2020). Greening recovery packages can reduce air pollution, create more and better jobs, lead to a more resilient and independent energy supply, and enhance access to energy (Climate Action Tracker, 2020).

In 2019, Indonesia published its RPJMN 2020-2024 medium term plan, which includes strategies and targets that will guide the country’s development for the next five years (Ministry of National Development Planning (Bappenas), 2019). The RPJMN, used as the lower range of our planned policies projections, could lead to emissions of 1,136 MtCO2e/year excl. LULUCF in 2030, down from 1,222 MtCO2e/year before the impacts of COVID-19.

Energy supply

Recent developments in Indonesia represent a mismatch in the context of energy policy. On the one hand, renewables are being supported to play a stronger role in the energy mix, for example, through policies that aim to foster the use of rooftop PV. On the other hand, Indonesia has been locking in fossil fuels to play a considerable role in the long-term despite the power outages, caused by gas power plants, that hit Jakarta, Java, and Bali in 2019 (Ed Adamczyk, 2019).

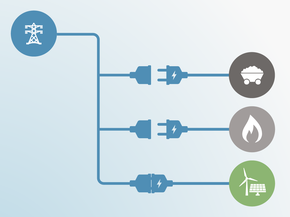

Indonesia is one of only five countries in the world that started new coal plant construction in 2020 and has the fourth largest coal pipeline with more than 30 GW of coal fired power generation in development (6% of the global share) (Shearer, 2020). Investment decisions to build coal-fired power plants have been on a declining trend since 2014 in Southeast Asia, except for Indonesia (IEA, 2017), where coal share in power generation is still increasing. The increase of coal in power generation is not in line with the decarbonisation needed to meet the goals of the Paris Agreement (see Figure below). While achieving the targets of the NEP and RPJMN 2020-2024 would result in emission reductions compared to current policy projections, it is to be noted that even under those targets the roles of coal especially, but also oil and gas, would remain locked-in across the coming decades, making a deep reduction of emissions extremely difficult and very costly.

Historical share of coal in power generation in comparison to Paris Compatible benchmarks for Indonesia

The RPJMN 2020-2024 includes more ambitious targets for the electricity sector than announced at the beginning of 2019. According to the electricity supply plan (RUPTL) published in January 2019, renewable power capacity was projected to increase by 8.0 GW until 2024; the RPJMN projects an increase over three times higher, reaching 37.3 GW in 2024. The target in the RPJMN is more ambitious but there is no update in targets regarding the expected emissions trajectory up to 2030, nor the participation of renewables in total primary energy supply.

The RUPTL 2020-2029 could address part of the uncertainty regarding the development of the Indonesian power sector but, as of August 2020, PLN has not released the updated version of the planning document. Country experts urge the government to use this plan as an opportunity to shift away from new coal-fired power plants, especially as a response to COVID-19 (Ratna, 2020).

Recent policies to foster renewables development have not been so successful, but some steps have been taken to improve their effect. Regulation 50/2017 stipulates new mechanisms for purchasing renewable electricity but caps power purchase prices at 85% of the local average generation cost in several regions (MEMR Indonesia, 2017b). The regulation is expected to be amended in 2020 and introduce back a feed-in tariff scheme (IESR, 2019). Regulation 49/2018 establishes a net metering scheme in which the users are compensated for only 65% of the electricity they put into the grid (MEMR Indonesia, 2018b). The regulation has been amended twice, improving the competitiveness of rooftop PV by easing the administrative process and reducing charges applicable for the industry sector (IESR, 2019). While these improvements are expected to improve the technology uptake, it does not address the cap in the compensation (IESR, 2019).

Both original and amended regulations result in prices that are still too low for investors to make a reasonable profit against highly subsidised coal and do not account for the broader social benefits of investing in renewables (Suharsono et al., 2019). While they support keeping consumer prices and overall subsidies at current levels, they do not bring Indonesia closer to meet its renewable targets.

The National Energy Policy (NEP), mentioned in the NDC, has a target to increase renewable energy to 23% of total primary energy supply (TPES) by 2025, from the 2018 share of 13% (MEMR Indonesia, 2018a). However, renewables uptake has not been consistent with this target. The total new renewable investment in 2018 was about USD 1.6 billion, while investments in upstream fossil fuels reached USD 19.3 billion (Ministry of Energy and Mining Resources, 2019). The situation is no different for power generation, where the fossil fuel share is at 90%. Indonesia saw 74 new contracts for renewable power plants signed between 2017 and 2018, adding about 1.5 GW to the pipeline, but the new electricity plan indicates that 12.2 GW of coal and gas power plants will be installed by 2020 (Republic of Indonesia, 2019a).

Under current policy projections, the NEP targets will not be met: the assumed role of coal in our projections is stronger than what it would be under the NEP (read more in Assumptions). The Electricity Supply Business Plan (RUPTL) 2019–2028, published in 2019, defines a target of 56.2 GW of new capacity in the next decade (of which 35 GW will come online by the end of 2022).

Planned coal capacities under the 2019 electricity supply plan compared with 2018 went up from 26.8 to 27.1 GW and RE from 14.9 to 16.7 GW while gas went down from 14.3 to 12.4 GW. An installed capacity of 27 GW of coal-fired power plants will emit up to 200 MtCO2e/year (depending on capacity factor and efficiency). It is unclear how these targets relate to the RPJMN 2020-2024, but unless the coal plants are shut down before the end of their lifetime, they will continue to emit similar amounts over the next several decades.

In order to meet the goals of the Paris Agreement, coal-fired installed capacity in Indonesia would need to decrease to about 10% of its current installed capacity before 2030 (Cui et al., 2019). Indonesia would need to phase out coal by 2040 to be consistent with the Paris Agreement (CAT, 2019; Climate Analytics, 2019).

This fossil fuel expansion is likely to bind the country to a carbon-intensive power sector for many decades. However, coal power expansion plans are increasingly under question. Energy demand seems to be growing at a slower pace than projected (Republic of Indonesia, 2018e, 2019b; The Jakata Post, 2018). Also, multiple stakeholders involved in the approval of coal-fired power plants have been involved in corruption schemes which casts doubt on the decision-making process, especially for projects close to brown coal mines (Hans Nicholas Jong, 2018).

The financial agreements for coal-fired power plants increase risk of locking-in costly capacity payments to thermal power plants while renewables become cheaper. The agreements between the state electricity company (PLN) and independent power producers (IPPs) ensure a minimum payment for each kilowatt available–not necessarily dispatched. These values might reach up to 40% of the tariff value that the government needs to pay to IPPs during the duration of the whole contract and are estimated to lead to an obligation to pay over USD 16 billion for coal idle capacity until 2026 (IEEFA, 2017).

Indonesia’s overall renewable energy potential remains largely untapped. The total renewable installed capacity reached 10.2 GW in the end of 2019 which is below the government target of 15.5 GW for 2018 (Suharsono et al., 2019). For power generation, hydropower remains the biggest source of renewable electricity, reaching a total installed capacity of approximately 5.4 GW at the end of 2019, followed by geothermal with 2.1 GW and bioenergy with 1.9 GW. Solar and wind reached together 0.3 GW, which represents a doubling of installed capacity in one year (IESR, 2019).

Indonesia’s biofuel target also applies to power plants running on oil and is among the most ambitious mandates globally (ICCT, 2016a) and helps the country avoid foreign exchange costs. However, there are issues around the impact on deforestation since Indonesia’s palm oil crops for biofuels are exempt from compliance with Indonesian Sustainable Palm Oil (ISPO) certification scheme (ICCT, 2016a) (see below under Transport, and Agriculture).

Industry

Cement, ammonia-based fertilisers and metal industries are the largest emitting industry subsectors in Indonesia (Republic of Indonesia, 2018d). The Indonesian government is focussed on reducing cement industry emissions by lowering clinker-to-cement ratio (Republic of Indonesia, 2018a). Voluntary guidelines have been developed to encourage the use of blended cement by using clinker substitutes such as fly ash, and by using biomass and other alternative fuel and raw materials (AFR) in the cement production process. Indonesia also has various CDM projects in the industry sector, ranging from clinker replacement in the cement industry to oil field flaring reduction (UNFCCC, 2018). In addition, there are plans for energy audits and conservation for all energy intensive industries (Republic of Indonesia, 2018d).

The CAT has not quantified the impact of those policies separately. The Third National Communication shows minor reductions for the year 2020 in comparison to the emissions reductions in other sectors.

Transport

Biofuels

Indonesia’s biofuel energy consumption mandate is one of the most ambitious in the world. Since 2016, the electricity sector must have 30% of the energy supplied by biofuels. Micro-business, fisheries, agriculture, transportation, industry and public service sectors, need at least a 20% share. The mandate has been continuously refined since its inception in 2006, which resulted in an increase in the share of road transport fuelled by biofuels, even though it is still well below the mandate of 30% (see Figure below). In the same regulation, the target share values for all sectors are set to reach 30% by 2020 with plans to increase the mandate to 40% between 2021 and 2022 (ESDM, 2015; ICCT, 2016a; Reuters, 2020). One of the main instruments for reaching the energy consumption mandate is a progressive fuel blending mandate between 2008-2025 (ICCT, 2016b). Indonesia originally aimed to produce diesel using only palm oil as of 2022 but has postponed target to 2026 (The Business Times, 2019). While Indonesia’s biofuels targets are ambitious, they are not without controversy due to concerns with palm oil production (see Agriculture section).

Share of zero emission fuels in all transport in comparison to Paris Compatible benchmarks for Indonesia

Electric vehicles

In the face of increasing concerns about air pollution, Indonesia is shifting its attention towards electric vehicles (EVs). An Electric Vehicles Development Plan and Targets are part of the General Plan of National Energy published in 2017 (Republic of Indonesia, 2017). This plan presents the vision of over 2,000 EVs, 700,000 hybrids, and over two million electric two-wheelers on the streets by 2025; these numbers increase to four, eight, and 13 million by 2050. An EV share of the total stock of light vehicles off about a third of the total fleet (including two- and three-wheelers) by 2030 would be a benchmark consistent with the Paris Agreement, reaching between 80% to 90% by 2050 (CAT, 2020).

In 2019, the government issued a regulation to boost the domestic electric vehicle (EV) industry and to support reaching these targets. The government also wants to have 20% of all the vehicles produced domestically to be low-carbon by 2025 (Indonesia Investments, 2018).

Regulation 55/2019 is the first attempt to grow a new market by providing incentives to manufacturers and consumers, although the specifics are still not well defined. The regulation provides targets for the local content share required to reach 80%, by 2026 for two or three wheeled-vehicles and by 2030 for four wheelers; it also indicates that charging stations can be privately owned (President of the Republic of Indonesia, 2019). Nonetheless, the regulation neither provides a clear roadmap for the rollout of the strategy nor presents details on the incentives supporting the uptake of EVs (IESR, 2019).

The government has also included a strategic plan to develop charging infrastructure in their most recent electricity supply plan (Republic of Indonesia, 2019b) and aims to have 1,000 charging stations around the country by 2025 (APERC, 2019). PLN wants to have 52 fast charging stations in Jakarta by 2020 (Silviana, 2019).

Transport infrastructure & public transit

Mitigation actions on transport infrastructure and planning in Indonesia are being guided by the Transportation Decree No. 201/2013 (Climate Policy Database, 2013). They include a major overhaul of the existing system with an "avoid, shift and improve" approach, including the construction of Bus Rapid Transit (BRT) corridors, implementation of traffic management technologies to reduce congestion, and construction of urban railway systems (Republic of Indonesia, 2018a). The Sustainable Urban Transport Program (SUTRI) Nationally Appropriate Mitigation Action (NAMA) is being implemented in seven pilot cities and will be a key instrument to support transformation in the transport sector. The NAMA aims to improve public transport and implement transport demand management measures, e.g. road pricing and public bicycle schemes (Ministry of Transportation, 2014).

Jakarta, the Indonesian capital, has approximately one million commuters every day. The city’s Transport Master Plan states that public transport should reach 60% of the passenger ridership by 2029 (Republic of Indonesia, 2018f). In March 2019 the first line of Jakarta’s Mass Rapid Transit system opened. A second line is expected to be completed by 2024. A key challenge now is securing the modal shift in commuter habits. The transit system is currently only used by 20% of commuters.

Buildings

The growing middle-class energy demand mean a continued relevance of the building sector in Indonesia. Emissions per capita in the sector have more than tripled since 1990 (see chart below). To mitigate the impacts of growing demand, the Indonesian government has set targets to reduce total final energy consumption in the buildings sector (both commercial and housing) by 15% compared to a BAU by 2025 (ASEAN Centre for Energy & GIZ, 2018).

Buildings emissions intensity per capita

Regulation 36/2005 under Law No. 28/2002 sets energy standards for buildings (SNI) concerning building envelop, air conditioning, lighting appliances, and energy audit procedure (GBPN, 2013). Also, Energy Performance Certificates are mandated for building users whose energy consumption is beyond 6,000 toe/year. These users are required to conduct an energy audit and implement its recommendation, and report result of the implementation energy measures to the government. Indonesia also has a mandatory labelling for lighting ballasts (since 2011), energy standards, and mandatory labelling for air conditioning (since 2016) that are also under development for refrigeration, cooking, washing machines, dishwashers and motors (CLASP, 2018; IEA, 2016). In addition, municipal actors have been active in promoting green building concepts. In 2012, Jakarta passed a mandatory Green Building regulation. Compliance with energy conservation and efficiency regulations for large buildings that is reinforced through the issuance of building permits and the shutdown of buildings that do not comply with the established criteria (ASEAN Centre for Energy & GIZ, 2018).

Agriculture

The overall emissions intensity of the Agriculture sector has been on a declining trend in Indonesia for the past 20 years (see Figure below). Nonetheless, the demand for biofuels has impacts on the agricultural and land use sector, as this demand may be met by expanding domestic palm oil industries. We have only quantified the impact the biofuels mandate would have in the transport under our current policy projection, but have included lifecycle emissions when assessing emissions reduction impact (see Assumptions).

The GHG emission per value added indicator refers to the ratio between GHG emissions from the agriculture sector and the value added in this sector. It is computed as the ratio of total GHG emission divided by the total value added

While oil palm plantations in Indonesia are required to be ISPO-certified (Indonesian Sustainable Palm Oil), plantations for biofuel production are specifically exempt from this. As the total area of palm oil plantations in Indonesia has risen more than tenfold in the period 1990–2015 (US Department of Agriculture, 2016), while forest cover declined by about 20% (World Bank, 2015), production of biofuels from palm oil is “predicated on a vision of biofuel expansion that would require extensive deforestation” (ICCT, 2016a).

Options to prevent this could require incentivising the creation of new palm oil plantations only on degraded lands, or support biofuel production from oil palm residues (ICCT, 2016a). Since 2011, the government has had a palm-oil moratorium on new palm oil plantations in an area of 66 Mha. This moratorium has since been renewed, but the president has now issued a presidential instruction making it permanent (Diela, 2019). The efficacy of the moratorium is ambiguous: while the policy is considered to be a good instrument to limit future deforestation in Indonesia (Mosnier et al., 2017) some research shows that deforestation has increased since it was implemented (Greenpeace Southeast Asia, 2019). The policy can only be successful if properly enforced.

As of January 2019, suppliers involved in deforestation are suspended from sourcing to Wilmar International (Wilmar International, 2018). This decision brings pressure on the government and industry to create more sustainable supply chains in Indonesia. The European Union, the second largest importer of Indonesian palm oil, is also supporting the country’s efforts to achieve sustainable palm oil by 2020 by working on strengthening and promoting existing schemes (EU, 2019).

Also, in 2018, Indonesia implemented a policy that mandates all state crops to maintain sustainable practices including banning the use of fire for land clearing (Republic of Indonesia, 2018a). The government allocates its highest agriculture mitigation target to developing palm plantation areas on non-forested land/abandoned land/ degraded land/other use areas, but the exact approach to achieving this is neither well-explained nor easily traceable (Republic of Indonesia, 2018d).

Forestry

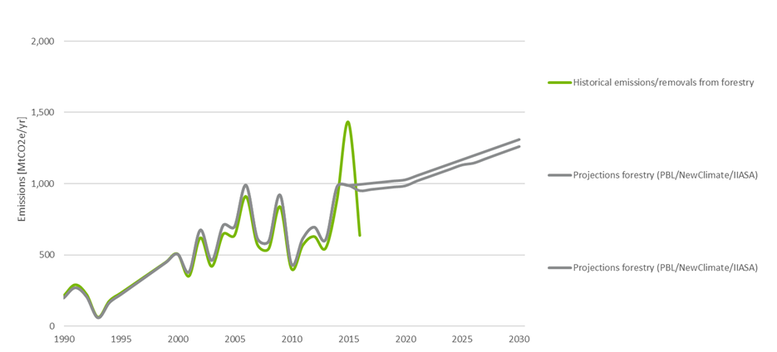

Indonesia alone contributed to 7% of the total global tree cover loss between 2001 and 2018 (Global Forest Watch, 2019). The country contributes to a large share of LULUCF emissions reaching around 1 GtCO2e/year, considering deforestation, forest degradation, peat decomposition, and peat fires (Alisjahbana & Busch, 2017; UNFCCC, 2015). Due to an unusually high occurrence of peat fires, the emissions from the LULUCF sector in Indonesia reached almost 1.5 GtCO2 in 2015. To put that in context: global emissions from LULUCF were about 4.1 GtCO2e in 2016 (FAOSTAT, 2018). Assessing a LULUCF emissions trajectory is somewhat complicated by the fact that these emissions have shown large fluctuations due, among other things, to the variability of emissions from peat fires to external factors such as the influence by El Niño. In the chart below we present the historical data according to country reported information and current policy projections range made by a third party consortium (Kuramochi et al., 2018).

In 2019, the Indonesian fires were again a special reason for concern: in just the one week of 13 September there were more than 70,000 fire alerts in the country (Global Forest Watch, 2019) causing a state of emergency in at least six Indonesian provinces and sparking complaints from neighbouring countries that were affected by the toxic haze (Walden, 2019). In 2018, about 1.2 Mha of Indonesia’s forests were lost compared to 1.3 Mha in 2017 and 2.42 Mha in 2016. While this reduction is a good sign, the biggest driver for deforestation is still commodity-driven deforestation (Global Forest Watch, 2019).

We made separate analyses of Indonesia’s LULUCF emissions in our 2015 and 2016 assessments. LULUCF emissions are a huge uncertainty factor in assessing the extent to which Indonesia is in line with meeting its NDC. The CAT does not assess the LULUCF component of the NDC; however, both conditional and unconditional targets depend heavily on the forestry sector. It compromises about 60% of the emissions reduction effort.

Emissions from this sector are projected to increase by at least 300 MtCO2e between 2020 and 2030, as presented in the current policies chart (Kuramochi et al., 2017, 2018), which takes Indonesia even further from reaching its sector NDC targets which, if they were to be met, require a decrease in LULUCF emissions. If the sector is taken into account, more ambitious actions would be needed to reach the NDC targets considering both the reinforcement and expansion of the current forestry moratorium (Wijaya et al., 2017).

As part of the National Action Plan for Greenhouse Gas Emission Reduction (RAN-GRK), Indonesia identified actions in the forestry sector. Those are sustainable peat land management, reducing the deforestation and land degradation rate, and developing carbon sequestration projects in forestry and agriculture (Mersmann et al., 2017).

These efforts are reinforced through the REDD+ Task Force, which in the short and medium term focuses on improving governance of forests, and in the long term aims at turning Indonesia’s forests and lands into a net carbon sink. In the Third National Communication, Indonesia describes 13 “core mitigation plans” that have been pursued since 2010, each with a quantitative emission reduction target attributed to them, adding up to reductions of 810 MtCO2e/year.

Laws in place to regulate the sector are the moratorium for new permits and improvement of forest and peatland governance and the National Strategy for Forest Law Enforcement in Indonesia from 2005, a programme to combat illegal logging. The policy constitutes not just a freeze on new licenses, but an order for the relevant central government ministries and regional governments to conduct a massive review of palm oil licensing data. Indonesia is also pursuing the One Map Policy, with the objective to create a transparent monitoring system of forest areas (Mulyani & Jepson, 2016).

Further analysis

Country-related publications

Stay informed

Subscribe to our newsletter