Current Policy Projections

Economy-wide

Currently implemented policies will lead to emissions levels of between 1,188 and 1,244 MtCO2e/yr (1–5% below 1990 levels) in 2020 and 1,098 and 1,155 MtCO2e/yr (8–12% below 1990 levels) in 2030, excluding LULUCF. The results indicate that under current policies, Japan will overachieve its 2020 pledge regardless of the future role of nuclear power, but might fall short of achieving its 2030 target in the NDC unless additional measures are implemented. The lower end of the range for current policy projections misses the NDC target by about 40 MtCO2e/yr.

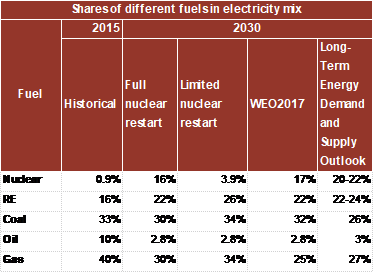

The range for each year depends partly on the future of nuclear power. The lower end projection is from a scenario in which all nuclear reactors that applied for restart as of April 2017 would be approved and the difference in nuclear power generation compared to the IEA WEO 2017 Current Policies Scenario (IEA, 2017a) is balanced by coal and gas power. The resulting electricity mix in 2030 is found to be similar to that in the WEO 2017 Current Policies Scenario. The upper end projection, by contrast, is from a scenario where there is no additional nuclear power generation in 2020 and 2030, except for 12 reactors (plus one under construction) which are approved for restart after necessary additional safety measures are taken, and the electricity supply gap is filled by renewables and fossil-fired power (coal and gas), proportional to the technologies’ shares for 2030 projected in the WEO 2017. The table below illustrates the fuel mix in the power sector in 2014, and under different assumptions for our projections, in comparison to the WEO 2017.

Energy supply

After the 2011 earthquake, the Japanese Government decided to revise its energy policy and committed to reducing its reliance on nuclear energy. In 2011, all nuclear power plants stopped operating and were not allowed to restart until they complied with higher safety standards. In 2014, the Government announced the new Basic Energy Plan (METI, 2014) that calls for a reintroduction of nuclear energy. As of February 2018, 25 reactors in 15 nuclear power plants have applied for a restart (and one in construction applied for operation) under new, more stringent safety standards (JAIF, 2018)—12 reactors with a total of 11.6 GW plus one currently under construction have passed the safety examination and have been approved for restart (under the condition that all required safety measures are properly installed), of which five are currently in operation (Ibid.).

The electricity mix for 2030 assumed in Japan’s NDC is based on the 2015 Long-Term Energy Demand and Supply Outlook, which supplements the Basic Energy Plan. The Outlook foresees that 20–22% of electricity will be supplied by nuclear energy, 22–24% by renewable energy and the remaining 56% by fossil fuel sources. This strategy stands in strong contrast to what would be compatible with a long-term, 2 °C-compatible strategy.

Two important aspects highlight why this is the case:

First, the energy strategy foresees a relatively large share of base load power plants (i.e. nuclear and coal fired power plants) of 46–48% in 2030 of total electricity production. Decarbonisation strategies in most countries foresee a significant increase of variable renewable energy resources, which requires a paradigm shift in how energy systems are structured and managed, and will increase their complexity. Such shifts take time and require the development and rollout of new technologies such as differently designed distribution networks (see e.g. Bloomberg (2015)).

Second, in the Outlook, fossil fuel power plants would play an important role in Japan’s energy mix in 2030 (56%), with 26% of total electricity generation expected to come from coal-fired power plants. This share could increase even further as the strong public opposition to nuclear power in the wake of Fukushima brings a challenge to foreseen nuclear contribution. There have already been a few district court rulings to halt the operation of the restarted reactors (JAIF, 2018). We project that the coal share could further increase to 34% by 2030 from 32% in 2015 if the nuclear reintroduction fails without a further push for renewables.

The new Basic Energy Plan is currently under development with its draft expected to be prepared in spring 2018. The recommendations and conclusions recently published by the expert panels under METI for the formulation of both a new Basic Energy Plan and a long-term energy strategy indicate that the electricity generation mix target for 2030 would remain the same as the one in the NDC (METI, 2018a, 2018c). A more positive sign is that the documents refer to renewables as “main power sources”—this suggests an important policy shift from the current 2014 Basic Energy Plan’s “important low-carbon and domestic power source”. Nuclear power remains as an “important power source”.

For coal-fired power, there is also large uncertainty around the future construction of new plants. As of October 2017, Japan plants to construct a total capacity of 17 GW in coal-fired power plants, which would together (METI, 2017a) emit around 100 MtCO2e annually. 7 GW of this capacity would replace existing plants, and it is uncertain whether all of the planned 17 GW will be actually built.

At the same time, new coal-fired power plant constructions are becoming increasingly difficult in Japan. Early in 2017, the electricity utility cancelled its plans for a coal fired power plant in Hyogo, naming decreasing electricity demand as the reason (Buckley & Nicholas, 2017). The mandatory environmental impact assessment (EIA) process, under which the consistency with the NDC achievement is an important criterion, has also been functioning as a safeguard against additional construction of new coal-fired power plants (Oi, Ito, & Tanimoto, 2017)—one plan (Ichihara) was cancelled in March 2017 (Kanden Energy Solution, 2017) and three more (Taketoyo, Soga, and Misumi) have also received negative EIA results in the past year (MOEJ, 2018; Oi et al., 2017).

Renewable electricity generation has grown steadily in recent years. In 2012, the Renewable Energy Act was introduced to support Japan’s stated NDC renewable electricity share target of 22–24% by 2030. It institutes a feed-in tariff (FIT) and general funding for distribution networks. The FIT has provided very favourable rates, particularly for solar PV, which led to a large increase in PV installations. The share of renewable energy in total electricity generation has increased considerably from 8.8% in FY2010 to 15.0% in FY2016 (Renewable Energy Institute, 2017a). However, the generous PV tariff rates has meant significantly increased costs particularly for households, and a large number of FIT-certified companies also purposefully delayed installation of PV systems until prices dropped. Also no significant growth was observed for other renewables such as wind and geothermal (Renewable Energy Institute, 2017a).

Effective from April 2017, the Ministry of the Economy, Trade and Industry (METI) revised the scheme with a stated intention of avoiding a “solar bubble” and to achieve a more balanced growth of renewable energy (METI, 2016). .However, an increasing number of biomass projects, mainly co-firing imported biomass with coal, have been approved since then and there have been serious concerns about the overall environmental effectiveness of the revised FIT scheme (Renewable Energy Institute, 2017b).

Buildings

On a sectoral level, CO2 emissions (including indirect emissions from electricity use) from the commercial and residential building sectors accounted for nearly 40% of Japan’s total energy-related CO2 emissions in 2015 (NIR 2017). Compared to 1990, the emissions in these two sectors have increased by 94% and 37%, respectively (NIR 2017). Although these significant increases are partially attributable to the increased electricity CO2-intensity post-Fukushima, there’s an urgent need for strengthened action on the demand side in the building sector.

An important development here is the revised building energy efficiency standards that entered into force on April 2017 under the Buildings Energy Efficiency Act (MLIT, 2016). Under the revised standards, new non-residential buildings larger than 2000 m2 floor area must meet the energy efficiency standards, and the plan is that all new builds including residential buildings must meet the standards from 2020 onward. This is a major step forward in improving energy efficiency in the building sector because the standards were not previously mandatory: in 2015, the compliance rate for residential buildings was 46% (MLIT, 2017). It should, however, also be noted that the effective stringency of the standards for residential buildings is the same as the previous 1999 standards, which is lax compared to those in other developed countries such as France, Germany, Sweden, the UK, and the United States (MLIT, 2013).

Under the 2014 Basic Energy Plan, Japan also aims to reduce the average net primary energy consumption of newly constructed buildings and houses to zero by 2030 (METI, 2014)—the target level may not be as ambitious as the EU Energy Performance of Buildings Directive (2010/31/EU; European Parliament, 2010a), which requires all new buildings to be nearly zero energy by the end of 2020 (European Parliament, 2010b), although the definitions of “near zero energy” vary across EU Member States (BPIE, 2016).

F-gases

Under the Plan for Global Warming Countermeasures (MOEJ, 2016), Japan aims to increase the recovery rate of HFCs from end-of-use refrigeration and air conditioning equipment up to 50% by 2020 and 70% by 2030. However, the recent progress under the Act on Rational Use and Proper Management of Fluorocarbons has stagnated: the recovery rate of refrigerants in 2015 was only 38% (METI & MOEJ, 2017a). To meet the HFC reduction target under the NDC and the targets under the Kigali Amendment of the Montreal Protocol, METI and MOEJ have together agreed to amend the Ozone Protection Act during in 2018—the amendment will set a ceiling on the production and consumption of HFCs, set guidelines to allocate production quota per producer as well as regulate exports and imports (METI & MOEJ, 2017b).

Global Warming Tax

Before the recently-initiated transformation of the electricity supply sector, Japan had already introduced effective policies for energy efficiency in transport, industry and buildings. These policies were recently complemented by additional policies in the building sector (top runner standard for building materials) and a Global Warming Tax. The latter is a low upstream environmental tax at a maximum price of JPY 289 (about USD 3) per tCO2 in 2016. The GHG impact of this complex new policy is difficult to quantify without proper modelling tools, and we thus have not been able to include this in our scenario. The government expected the impact to be 6-24 MtCO2/yr by 2020, on a baseline of 1,115 MtCO2 for energy related emissions (MOEJ, 2017a). The resulting emission levels are higher than our estimates for energy related emissions in the current policy projections. There is no ex-post impact assessment on this tax scheme available to date.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter