Current Policy Projections

Economy-wide

Currently implemented policies will lead to emissions levels of between 1,250 and 1,260 MtCO2e/yr (1–2% below 1990 levels) in 2020 and 1,080 and 1,140 MtCO2e/yr (10–15% below 1990 levels) in 2030, excluding LULUCF. The results indicate that under current policies, Japan will overachieve its 2020 pledge regardless of the future role of nuclear power, but might fall short of achieving its 2030 target in the NDC if no additional measures are implemented. The lower end of the range for current policy projections misses the NDC target by a less than 5 MtCO2e/yr.

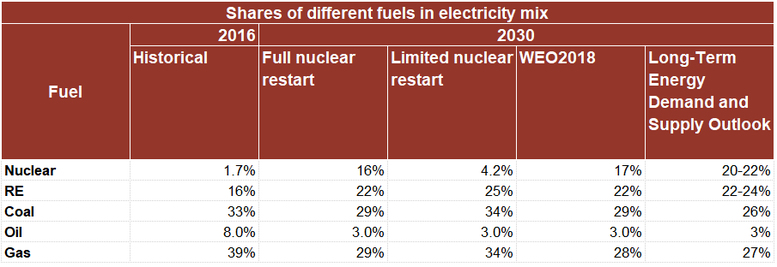

The range for each year depends partly on the future of nuclear power. The lower end projection is from a scenario in which all nuclear reactors that applied for restart as of September 2018 would be approved and the difference in nuclear power generation compared to the IEA WEO 2018 Current Policies Scenario (IEA, 2018b) is balanced by coal and gas power. The resulting electricity mix in 2030 is found to be similar to that in the WEO 2018 Current Policies Scenario. The upper end projection, by contrast, is from a scenario where there is no additional nuclear power generation in 2020 and 2030, except for 14 reactors (plus one under construction) which are approved for restart after necessary additional safety measures are taken, and the electricity supply gap is filled by renewables and fossil-fired power (coal and gas), proportional to the technologies’ shares for 2030 projected in the WEO 2018. The table below illustrates the fuel mix in the power sector in 2014, and under different assumptions for our projections, in comparison to the WEO 2018. Our upper end projection of renewable electricity share in 2030 (25%) is higher than that projected in the WEO 2018’s New Policies Scenario (23%).

Energy supply

After the 2011 Great East Japan Earthquake, the Japanese Government decided to revise its energy policy and committed to reducing its reliance on nuclear energy. In 2011, all nuclear power plants stopped operating and were not allowed to restart until they complied with higher safety standards. The 2014 Basic Energy Plan (METI, 2014) called for a reintroduction of nuclear energy. As of September 2018, 25 reactors in 15 nuclear power plants have applied for a restart (and two in construction applied for operation) under new, more stringent safety standards (JAIF, 2018)—14 reactors with a total of 14.3 GW have passed the safety examination and have been approved for restart (under the condition that all required safety measures are properly installed), of which five are currently in operation (Ibid.).

The electricity mix for 2030 assumed in Japan’s NDC is based on the 2015 Long-Term Energy Demand and Supply Outlook. The Outlook foresees that 20–22% of electricity will be supplied by nuclear energy, 22–24% by renewable energy and the remaining 56% by fossil fuel sources. The 2018 Basic Energy plan reiterated the 2015 Outlook target. This strategy stands in strong contrast to what would be compatible with a long-term, 2 °C-compatible strategy.

Two important aspects highlight why this is the case:

First, the energy strategy foresees a relatively large share of base load power plants (i.e. nuclear and coal fired power plants) of 46–48% in 2030 of total electricity production. Decarbonisation strategies in most countries foresee a significant increase of variable renewable energy resources, which requires a paradigm shift in how energy systems are structured and managed, and will increase their complexity. Such shifts take time and require the development and rollout of new technologies such as differently designed distribution networks (see e.g. Bloomberg (2015)).

Second, in the Outlook, fossil fuel power plants would play an important role in Japan’s energy mix in 2030 (56%), with 26% of total electricity generation expected to come from coal-fired power plants. This share could increase even further as the strong public opposition to nuclear power in the wake of Fukushima brings a challenge to foreseen nuclear contribution. There have already been a few district court rulings to halt the operation of the restarted reactors (JAIF, 2018). We project that the coal share could further increase to 34% by 2030 from 32% in 2015 if the nuclear reintroduction fails without a further push for renewables.

The Japanese government adopted its new Basic Energy Plan in July 2018 (METI, 2018d), but it does not provide vision nor strategy on how Japan can go beyond its 22–24% by 2030 renewable electricity target, which is likely to be achieved with existing policies. Instead it focusses on whether new nuclear reactors could be constructed toward 2050 and how to reduce the economic costs resulting from the renewable electricity support scheme. A more positive sign is that the documents refer to renewables as “main power sources”—this suggests an important policy shift from the current 2014 Basic Energy Plan’s “important low-carbon and domestic power source”. Nuclear power remains as an “important power source”.

For coal-fired power, there is also large uncertainty around the future construction of new plants. As of February 2018, Japan plans to construct a total capacity of 18 GW in coal-fired power plants (Climate Analytics & Renewable Energy Institute, 2018), which would together emit around 100 MtCO2e annually. It is uncertain whether all of the planned 18 GW will be actually built.

At the same time, new coal-fired power plant constructions are becoming increasingly difficult in Japan. In April 2018, J-POWER, an electric utility, cancelled its plans for two coal fired power plants in Takasago, Hyogo due to decreasing electricity demand in the region (J-POWER, 2018). The mandatory environmental impact assessment (EIA) process, under which the consistency with the NDC achievement is an important criterion, has also been functioning as a safeguard against additional construction of new coal-fired power plants (Oi, Ito, & Tanimoto, 2017)—one plan (Ichihara) was cancelled in March 2017 (Kanden Energy Solution, 2017) and three more (Taketoyo, Soga, and Misumi) have also received negative EIA results in the past year (MOEJ, 2018; Oi et al., 2017).

Another positive development from the private sector is the series of announcements from banks, insurance companies and trading companies since May 2015 to shift away from investing in coal power plants (Renewable Energy Institute, 2018). While many of the announcements do not rule out all types of investment into coal-fired power plants, these are important signs that the private sector is taking climate change mitigation and its implications on business into serious consideration.

Renewable electricity generation has grown steadily in recent years. In 2012, the Renewable Energy Act was introduced to support Japan’s stated NDC renewable electricity share target of 22–24% by 2030. It institutes a feed-in tariff (FIT) and general funding for distribution networks. The FIT has provided very favourable rates, particularly for solar PV, which led to a large increase in PV installations. The share of renewable energy in total electricity generation has increased considerably from 10% in 2010 to 16% in FY2017 (IEA, 2018a). However, the generous PV tariff rates has meant significantly increased costs particularly for households, and many FIT-certified companies also purposefully delayed installation of PV systems until prices dropped. Also no significant growth was observed for other renewables such as wind and geothermal (Renewable Energy Institute, 2017a).

Effective from April 2017, the Ministry of the Economy, Trade and Industry (METI) revised the scheme with a stated intention of avoiding a “solar bubble” and to achieve a more balanced growth of renewable energy while minimising the costs (METI, 2016). An important new instrument is the auctioning scheme for solar PV installations larger than 2MWe. The first two auctions were unsuccessful; in the first auction in November 2017 the Government sought bids for 500 MW but was only able to award 141 MW due to the lack of bidders and the secondary deposit to actually proceed with the project implementation was paid only for a 41 MW capacity (METI, 2017b). The second auction in 2018 called for a 250 MW capacity but no bidder made the maximum bid price set by the Government (Green Investment Promotion Organization, 2018).

March 2017 also saw a last-minute rush of biomass project applications before the tariff rates were lowered – the total biomass capacity approved under the FIT scheme to date amounts up to more than 12 MW (METI, 2017a). If all the approved capacity is implemented, though unlikely, the total biomass capacity would reach 16 GW (METI, 2017a), which is more than double the amount expected under the 2030 electricity mix target (Government of Japan, 2017). Many of the approved projects plan to co-fire imported palm oil with coal raising concerns about the overall environmental integrity of Japan’s renewable energy policy (METI, 2017a; Renewable Energy Institute, 2017b). Although it is technically possible to produce palm oil with low indirect land use-change (ILUC) risks (Peters et al., 2016), an increased use of palm oil will likely result in strong ILUC emissions increase, even when the palm oil is accompanied by a strong sustainability certificate (Valin et al., 2015).

Transport

CO2 emissions (including indirect emissions from electricity use) from the transport sector accounted for 18% of Japan’s total energy-related CO2 emissions in 2016 (GIO, 2018). Compared to 1990, the emissions in this sector have increased by 4% but have been on a decreasing trend since 2001 and the emissions have since reduced by 18% (GIO, 2018). This trend stands out from the rest of the Annex I countries (excluding those with economies in transition), which showed an average reduction of 0.6% over the same period (UNFCCC, 2018a).

Regarding vehicle decarbonisation, the current government target for ‘new generation’ vehicles (including hybrids, plug-in hybrids, battery electric vehicles, fuel cell electric vehicles, as well as ‘clean diesel’ vehicles and gas-powered vehicles) has been set at 50-70% of new sales by 2030 (METI, 2018d). On the fuel economy of passenger vehicles, Japan has been one of the best performers over the last few decades with the average CO2 intensity of 115 gCO2/km (normalised to NEDC) (ICCT, 2018), but no post-2020 performance standard has yet been set.

For the longer term, a panel under METI compiled an interim report on the long-term strategy for car manufacturing (METI, 2018c). This document included targets of reducing tank-to-wheel CO2 emissions by 80% below 2010 levels by 2050 for all new vehicles produced by Japanese car manufacturers and 90% by 2050 for new passenger vehicles, with the latter assuming a near 100% share of electric vehicles (including hybrids, plug-in hybrids, battery electric vehicles and fuel cell electric vehicles). While these targets are described to be consistent with the Beyond 2 ℃ scenario of the IEA Energy Technology Perspectives 2017 report (IEA, 2017), it is not consistent with the benchmark for 1.5°C identified by the Climate Action Tracker analysis (Kuramochi et al., 2018), i.e. last fossil fuel passenger car sold by 2035, because the expected shares of conventional and plug-in hybrids under the proposed targets are not clear.

While the proposed targets are not as ambitious as those set in some European countries (e.g. Norway 2025, France 2040 and the UK 2040) (DEFRA & DfT, 2017; Ewing, 2017; Staufenberg, 2016), Japan will become the largest car manufacturing nation (headquarters-based) to date to set a long-term phase-out strategy for conventional internal combustion engine (ICE) vehicles. The final strategy document will be largely based on this interim report. The outcomes of this METI panel are significant not only because of the ambition of the proposed targets but also because the panel members include CEOs of major car manufacturers (Toyota, Nissan, Honda and Mazda).

Industry

CO2 emissions from the industry sector (including indirect emissions from electricity use as well as emissions from industrial processes) accounted for 38% of Japan’s total energy-related CO2 emissions in 2016 (GIO, 2018). Emissions in the sector have reduced by 18% below 1990 levels (GIO, 2018).

The main GHG emissions reduction effort in the Japanese industry is Keidanren’s Commitment to a Low-Carbon Society (Keidanren, 2015), a voluntary action plan which has monitoring obligations under the Plan for Global Warming Countermeasures (MOEJ, 2016b).

Buildings

CO2 emissions (including indirect emissions from electricity use) from the commercial and residential building sectors together accounted for 33% of Japan’s total energy-related CO2 emissions in 2016 (GIO, 2018). Compared to 1990, the emissions in these two sectors have increased by 66% and 45%, respectively (GIO, 2018). Although these significant increases are partially attributable to the increased electricity CO2-intensity post-Fukushima, there’s an urgent need for strengthened action on the demand side in the building sector.

An important development here is the revised building energy efficiency standards that entered into force on April 2017 under the Buildings Energy Efficiency Act (MLIT, 2016). Under the revised standards, new non-residential buildings larger than 2000 m2 floor area must meet the energy efficiency standards, and the plan is that all new builds including residential buildings must meet the standards from 2020 onward. This is a major step forward in improving energy efficiency in the building sector because the standards were not previously mandatory: in 2015, the compliance rate for residential buildings was 46% (MLIT, 2017). It should, however, also be noted that the effective stringency of the standards for residential buildings is the same as the previous 1999 standards, which is lax compared to those in other developed countries such as France, Germany, Sweden, the UK, and the United States (MLIT, 2013).

Under the 2014 Basic Energy Plan, and remained unchanged in the 2018 version, Japan also aims to reduce the average net primary energy consumption of newly constructed buildings and houses to zero by 2030 (METI, 2014)—the target level may not be as ambitious as the EU Energy Performance of Buildings Directive (2010/31/EU; European Parliament, 2010a), which requires all new buildings to be nearly zero energy by the end of 2020 (European Parliament, 2010b), although the definitions of “near zero energy” vary across EU Member States (BPIE, 2016).

F-gases

Japan aims to reduce F-gas emissions through enhanced management of in-use stock and regulating consumption levels. Under the Plan for Global Warming Countermeasures (MOEJ, 2016b), Japan aims to increase the recovery rate of HFCs from end-of-use refrigeration and air conditioning equipment up to 50% by 2020 and 70% by 2030. The Act on Rational Use and Proper Management of Fluorocarbons (last amendment in 2013) addresses this, but the recovery rate has stagnated: the recovery rate of refrigerants in 2015 was only 38% (METI & MOEJ, 2017).

To meet the HFC reduction target under the NDC and the targets under the Kigali Amendment of the Montreal Protocol, the Ozone Layer Protection Act was amended in July 2018 and will enter into force in April 2019 —the amendment will set a ceiling on the production and consumption of HFCs, set guidelines to allocate production quota per producer as well as regulate exports and imports (METI, 2018b). The consumption levels are projected to be below the Kigali cap at least until 2029 (ibid.), when the Kigali cap lowers significantly. Since there is some time lag between consumption and emission, we assume that the amended Ozone Layer Protection Act will not affect HFC emission levels up to 2030.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter