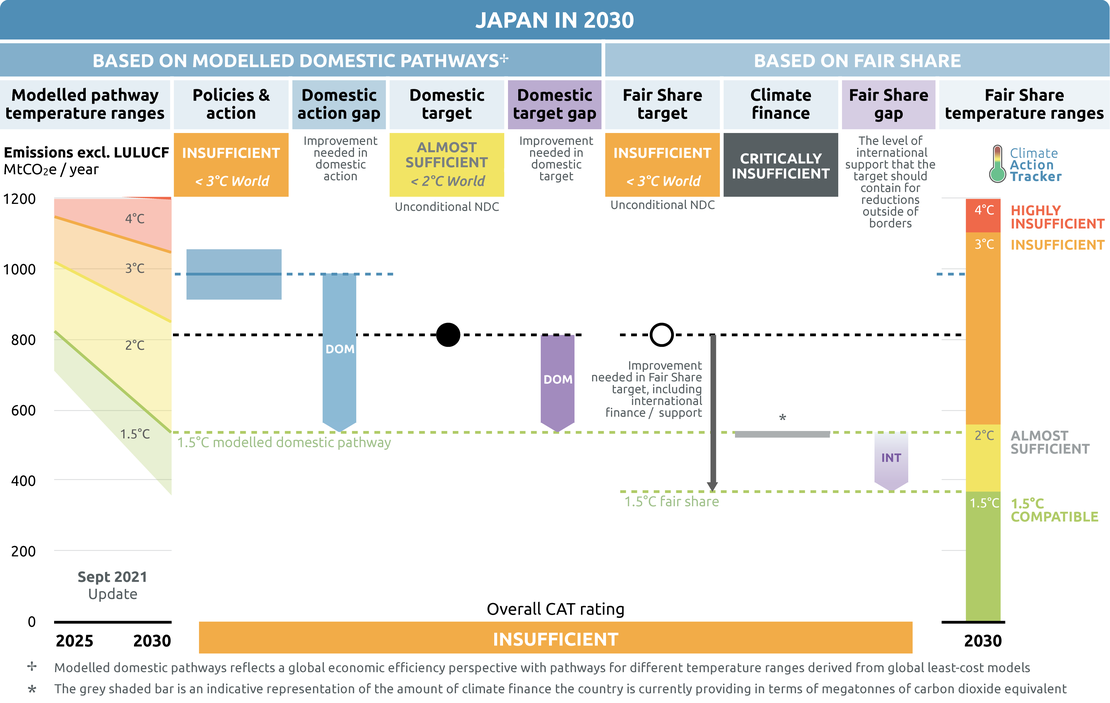

Policies & action

We project that the implemented policies will lead to emissions levels of 25%–35% below 2013 levels in 2030, excluding LULUCF, and considering the impact of the COVID-19. Japan will significantly overachieve its first NDC target with current policies but needs to implement additional policies to reach its new NDC target.

We rate Japan’s policies and action as “Insufficient”. The “Insufficient” rating indicates that Japan’s climate policies and action in 2030 are not yet consistent with the 1.5°C temperature limit but could be, with moderate improvements. If all countries were to follow Japan’s approach, warming could be held at—but not well below—2°C.

Further information on how the CAT rates countries (against modelled domestic pathways and fair share) can be found here.

Policy overview

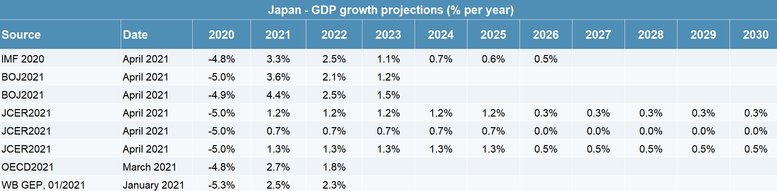

The COVID-19 pandemic continues to have a significant effect on Japan’s economy and consequently on emissions. In 2020, Japan’s GDP fell by about 5% (Bank of Japan, 2021; IMF, 2021; JCER, 2021; OECD, 2021; World Bank, 2021). Japan’s energy and industry CO2 emissions are estimated to have reduced by 5.6% in 2020 compared to 2019 (Carbon Monitor, 2021).

The impact of COVID-19 on CO2 emissions was estimated to be the largest in the aviation sector (-27.8% for domestic and -55.4% for international aviation), followed by industry (‑10.3%). This adds to an already declining trend in GHG emissions (excluding LULUCF), which saw, on average, a 2.5% annual reduction between 2013–2019 (GIO & MOEJ, 2021).

The post-COVID GDP projections up to 2030 vary widely across sources (see Table 1). The Japan Center for Economic Research (JCER) developed three scenarios, with a worst-case scenario (‘risk scenario’) that sees a prolonged pandemic through the emergence of variants, leading to Japan not reaching the pre-COVID GDP peak of 2018 before 2035. The most optimistic scenario (‘reform scenario’), however, foresees the effort to decarbonise the economy as a vector for growth, led by digital transformation (JCER, 2021).

Responding to the COVID-19 crisis, the Japanese government has agreed on USD 2.78 trillion in fiscal measures, but only a very small fraction of this is allocated to green measures (Vivid Economics, 2021). It is therefore not possible at the time of writing to estimate the impact of COVID-19 response measures on future GHG emissions in Japan. METI acknowledges the structural changes that the COVID-19 is causing on energy demand and supply (METI, 2020c) and we expect that, together with the revised Basic Energy Plan, there will be more green response measures in the coming months.

Taking into account the above-mentioned external post-COVID GDP projections and assuming that the emissions-intensity up to 2030 remains consistent with our pre-COVID projections, currently implemented policies will lead to emissions levels of 910–1,060 MtCO2e/year (25–35% below 2013 levels) in 2030, excluding LULUCF. These results indicate that Japan is on track to overachieve its first NDC target under current policies but falls far short of the new 46% target. The uncertainty range of emissions is largely due to the potential impact of the COVID‑19 on the Japanese economy as well as the future development of the power sector.

Looking at the power sector more specifically, the lower end projection is from a scenario in which all 25 nuclear reactors that applied for restart (including the two that have applied to resume construction) as of August 2020 would be approved and complete their 60-year extended lifetime. The upper end projection, by contrast, is from a scenario where only 16 reactors currently approved for restart, on the condition that necessary additional safety measures are taken, will be in operation until 2030 at a capacity factor half of that assumed under the lower end projection taking the possible court cases and unplanned inspections into account (see Assumptions section for details).

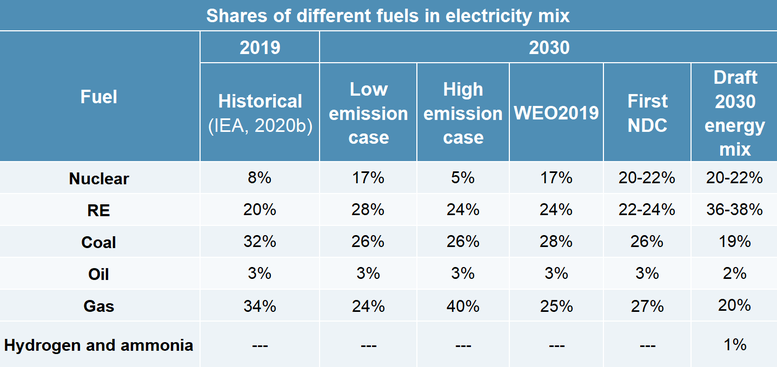

The table below illustrates the fuel mix in the power sector in 2019, and the different assumptions for our projections, in comparison to the IEA World Energy Outlook (WEO) 2019. Both our upper and lower end estimates of renewable electricity generation (in TWh) in 2030, based on the projections by the Central Research Institute of Electric Power Industry (CRIEPI) (Asano & Obane, 2020) and METI (2021a), are higher than the projection in the WEO 2019’s Current Policies Scenario.

Before the recently initiated transformation of the electricity supply sector, Japan had already introduced effective policies for energy efficiency in transport, industry, and buildings. One longstanding policy is the Energy Conservation Act, the main energy efficiency law implemented in 1979. To achieve the energy savings target under the NDC, an amendment to the Energy Conservation Act was enforced in 2018 (METI, 2018a). The amendment establishes a new certification system which allows for an inter-business initiative to enhance systemic energy savings, in addition to energy savings at individual operator level, and ensures the coverage of e-commerce retailers under the Act.

Other policies include the Global Warming Tax, an upstream environmental tax of JPY 289 (about USD 2.6) per tCO2 since 2016, which is low. The latest ex post assessment by the Ministry of the Environment estimated that the impact of the Global Warming Tax was 3.2 Mt/year in 2019, compared to a counterfactual no-tax scenario (MOEJ, 2021b). Back in 2017, the government expected the impact to be 6–24 MtCO2/year by 2020, on a baseline of 1,115 MtCO2/year for energy related emissions (MOEJ, 2017).

Energy supply

In October 2021, Japan approved a new Basic Energy Plan, with a revised 2030 electricity mix target of 36–38% renewable electricity (previously 22–24%), 20–22% nuclear (unchanged), 20% gas (previously 27%) and 19% coal (previously 26%) to align with the updated 2030 climate target (METI, 2021b). While the indicated share of decarbonised electricity is roughly in line with our 1.5oC benchmark, keeping 19% of coal-fired power generation is completely inconsistent with the virtually full coal phase-out needed by 2030 (Climate Action Tracker, 2021).

The reported share of nuclear power, unchanged from the current Basic Energy Plan published in 2018 (METI, 2018d), seems unrealistic. As of May 2021, 25 reactors in 15 nuclear power plants have applied for a restart (plus two in construction applied for operation); 16 reactors with a total of 16 GW have passed the safety examination and have been approved for restart (under the condition that the plans for the construction work are approved by neighbouring local governments and the required safety measures are properly installed), of which nine are currently in operation (JAIF, 2021).

It is likely, however, that the nuclear power plant operations would be disrupted by legal action to stop them; there have already been a few district court rulings to halt the operation of the restarted reactors (National network of legal teams for nuclear phase-out, 2020). We estimate, based on these developments, that the nuclear power share will range between 5% and 17% in 2030 (see Table 1).

For coal-fired power, the Japanese government is finally starting to officially shift, albeit gradually, away from developing coal power, both domestically and overseas. The 19% coal-fired power generation share in 2030 is, even though far from being 1.5oC-consistent, a considerable step forward. As our July 2020 analysis showed, however, the most recent policy announced by the Minister of Economy, Trade and Industry (METI) Hiroshi Kajiyama in July 2020 would ensure that Japan’s coal-fired power generation will only be reduced to the level indicated in its first NDC (26%) but nothing more (METI, 2020e).

Analyses by other NGOs and think tanks came to similar conclusions (Kiko Network, 2020; Renewable Energy Institute, 2020; Tamura & Kuriyama, 2020). Decreasing the coal-fired power generation share to 19% would therefore require Japan updating this policy to be more climate stringent. The government has recently announced its plan to increase coal-fired power plants’ efficiency standards from 41% to 43%; however, the fact that the standard would apply to operators rather than individual plants signifies that less efficient plants could still be operated if the operator is able to maintain a 43% efficiency with more efficient plants (Nikkei, 2021). It is also important to note that such efficiency standards should not distract from the need to phase out coal-fired power plants as early as possible.

Japan has also been a major funder of coal-fired power plants overseas, alongside China and South Korea (EndCoal, 2020). Among G20 members, Japan has been the largest supporter of international fossil fuels projects through export credit agencies (DeAngelis & Tucker, 2020). The Japanese government’s policy on overseas coal power finance, however, also shows a sign of change.

In the G7 environment ministers’ meeting communiqué of May 2021, Japan agreed to “stress that international investments in unabated coal must stop now and commit to take concrete steps towards an absolute end to new direct government support for unabated international thermal coal power generation by the end of 2021, including through Official Development Assistance, export finance, investment, and financial and trade promotion support” (G7, 2021). This follows Japan’s updated strategy document of July 2020 on infrastructure exports, which stated that it will - in principle - not finance coal-fired power plants in countries that do not have a decarbonisation strategy in place (Government of Japan, 2020).

The private sector is also showing signs of change on financing coal power overseas. On 25 June, 2020, there was a first-ever climate motion put to shareholders of a listed company in Japan to align its business to the Paris Alignment; the motion received about 35% of the total votes submitted (Sheldrick & Umekawa, 2020). After announcing in spring 2020 that they would, in principle, no longer finance coal-fired power plants overseas (METI, 2020a), the three largest lenders to such plant developers globally, namely Mizuho, MUFG and SMBC Group, indicated they would stop financing coal mining in May 2021 (Reuters, 2021c, 2021a, 2021b).

While SMBC highlighted the end of funding even for ultra-supercritical (USC) technology, MUFG has further announced its intention to reach net zero emissions in its finance portfolio by 2050, following shareholders demanding the bank determines and discloses a plan showing alignment with the Paris Agreement (Kiko Network, 2021b; Sheldrick, 2021a). Certain technologies, such as CCUS or ammonia/hydrogen cogeneration, could potentially still be financed (see for example Kiko Network, 2021a).

Renewable electricity generation has grown steadily in recent years. The share of renewable energy in total electricity generation in Japan has increased from 10% in 2010 to 19% in 2019, but still remains below the OECD average (IEA, 2021). In 2012, the Renewable Energy Act was introduced to support RE deployment in Japan and remains the main policy to achieve Japan’s renewable electricity share target of 36-38% by 2030 under its updated NDC. It institutes a feed-in tariff (FIT) and general funding for distribution networks.

The FIT has provided very favourable rates, particularly for solar PV, which led to a large increase in PV installations; by March 2020, 50.2GW of solar PV was installed as a result of the FIT scheme and another 24GW has been approved for operation (METI, 2021a). However, the generous PV tariff rates has meant significantly increased costs particularly for households, and many FIT-certified companies also purposefully delayed installation of PV systems until prices dropped. Also no significant growth was observed for other renewables, such as wind and geothermal (Renewable Energy Institute, 2017).

Effective from April 2017, the Ministry of the Economy, Trade and Industry (METI) revised the FIT scheme for the first time with a stated intention of avoiding a “solar bubble” and to achieve a more balanced growth of renewable energy while minimising the costs (METI, 2016). An important new instrument was the auctioning system; as of October 2020, Japan had conducted five auctions for solar photovoltaic, two for biomass and one for zone-specific offshore wind (IRENA, 2021).

Bidders have only been awarded 574MW out of the total of 1663MW auctioned in the five solar PV auctions (IRENA, 2021). The government is now planning to further revise the FIT scheme largely by shifting it into a feed-in-premium (FIP) scheme in 2022 (IRENA, 2021); a shift from FIT to FIP is a trend observed in several European countries, such as Germany and France, which spearheaded the introduction of FIT policy in the early 2000s (METI, 2019b).

Another area where important policy effort is being made is the deployment of offshore wind power. In April 2019, a new law entered into force to facilitate the use of maritime areas for offshore wind power generation (METI, 2019a). In July 2020, a METI committee was set up to formulate a plan to install 10 GW of offshore wind power capacity by 2030 (METI, 2020b; The Mainichi, 2020), compared to the current total installed capacity of 65 MW (2018 figure; IRENA, 2020). While we do not consider this plan in our emissions projections, it would lead to an additional renewable electricity generation of about 26 TWh/year or 2.5% of total electricity generation in 2030 (assuming a 30% capacity factor).

Hydrogen and ammonia: Japan shows a strong commitment to develop hydrogen as a major decarbonised fuel, for which a national strategy was established in 2017 and further updated in 2019 (METI, 2017, 2019c). However, a progress evaluation group under METI recently indicated that the lack of clarity on the environmental value of hydrogen is hindering investment on hydrogen-related technologies and expressed concern that the fuel cell vehicle (FCV) market is expanding too slowly (METI, 2020d).

In March 2020, one of the world’s largest low-carbon hydrogen production facilities started operation in Fukushima; the Fukushima Hydrogen Energy Research Field is powered by an onsite solar PV plant of 20 MW capacity (Hiroi, 2020). Australia’s national hydrogen strategy also identifies Japan as a potential major importer of Australian hydrogen (COAG Energy Council, 2019); a Australian-Japanese coal-to-hydrogen pilot project has started as of March 2021, aiming at exporting liquified hydrogen towards Japan (Kyodo News, 2021).

In addition to hydrogen, the Green Growth Strategy highlights the potential role of ammonia in the effort to reduce GHG emissions. The document indicates, for example, the possibility of using a 20% ammonia blend with coal to reduce emissions in thermal power plants. JERA, Japan’s largest power generation company, has already set up a plan to create a pilot programme with the intention of using this blended fuel by 2035 (JERA, 2020).

It is important to note that hydrogen and ammonia technologies are less developed than commercially available low-carbon technologies, which could be deployed at scale before 2030 and could therefore help Japan get on the right trajectory to achieve its 2050 net zero goal.

Transport

Direct CO2 emissions from the transport sector accounted for 19% of Japan’s total energy-related CO2 emissions in 2019 (GIO & MOEJ, 2021). For the first time, emissions levels have gone under 1990 levels after having been on a decreasing trend since 2001 (GIO & MOEJ, 2021). This trend stands out from the Annex I countries (UNFCCC, 2020), which showed an average increase of 3% over the same period (UNFCCC, 2020).

Regarding vehicle decarbonisation, the government has announced a target of reaching 100% of “electrified vehicles” – a category that includes non-plug-in hybrids (HVs) and plug-in hybrid vehicles (PHV) – in the sale of passenger vehicles by, latest, 2035 (NHK, 2021), replacing the previous target of reaching 50-70% of ‘new generation’ vehicles (including hybrids, plug-in hybrids, battery electric vehicles, fuel cell electric vehicles, as well as ‘clean diesel’ vehicles and gas-powered vehicles) in the share of sales by 2030 (METI, 2018d).

This policy, which still allows for non-plug-in HVs to be sold in 2035, could be further strengthened to become consistent with the 1.5°C-compatible benchmark to phase out all fossil-fuel passenger (ICE) cars from new sales by 2035 (Kuramochi et al., 2018). Japan’s commitment to transition away from ICE vehicles could further impact the global car manufacturing sector; considering the importance of the industry at the national and international levels, it could define a globally ambitious and innovative strategy favouring the development and deployment of zero-emission vehicles. Additional pressure from investors have also started to impact car manufacturers’ strategies; Toyota has for example recently announced that efforts will be made to assure stakeholders that the company’s activities were in line with the Paris Agreement (Sheldrick, 2021b).

Additionally, an interim report compiled by METI—resulting from a consultation panel including CEOs of major car manufacturers (Toyota, Nissan, Honda and Mazda)—incorporated targets of reducing tank-to-wheel CO2 emissions by 80% below 2010 levels by 2050 for all new vehicles produced by Japanese car manufacturers and 90% by 2050 for new passenger vehicles, with the latter assuming a near 100% share of electric vehicles (including hybrids, plug-in hybrids, battery electric vehicles and fuel cell electric vehicles) (METI, 2018c).

In terms of the fuel economy of passenger vehicles, Japan has been one of the best performers over the last few decades with the average CO2 intensity of 115 gCO2/km (normalised to New European Driving Cycle) (ICCT, 2018). New fuel economy standards were set for trucks and buses to improve by 13-14% by 2025 compared to 2015 levels, and for passenger cars to improve by 32% by 2030 compared to 2016 levels (METI; MLIT, 2019).

Industry

CO2 emissions from the industry sector (including indirect emissions from electricity use as well as emissions from industrial processes) accounted for 37% of Japan’s total energy-related CO2 emissions in 2019 (GIO & MOEJ, 2021). Industry CO2 emissions were estimated to have dropped by 10% in 2020 compared to the previous year due to the COVID-19 pandemic (Carbon Monitor, 2021).

Within the sector, the iron and steel, the chemical, and the cement industries are the three largest emitters, which respectively emitted 40%, 15% and 8% of industrial emissions in 2019; emissions in the sector have reduced by 24% below 1990 levels (18% below 2005 levels) (GIO & MOEJ, 2021). A progress report for 2018 shows that the industry CO2 emissions from the member companies of Keidanren, the most influential business association in Japan, including indirect emissions from electricity use in FY2018 was 13.3% lower than in 2005, with the majority of the emissions reductions (10.1%) attributable to the changes in industrial activity levels (Keidanren, 2020a).

The main GHG emissions reduction effort in the industry is Keidanren’s Commitment to a Low-Carbon Society (Keidanren, 2015), a voluntary action plan which has monitoring obligations under the Plan for Global Warming Countermeasures (MOEJ, 2016b). Keidanren has since launched its Challenge Zero Initiative, in collaboration with the Japanese government, inviting companies to submit strategies to decarbonise their activities; a number of actors have already disclosed measures to be implemented, including in the steel and chemical industries (Keidanren, 2020b).

Among the industrial sectors that pledged to 2050 net zero goal is the iron and steel sector. The Japanese Iron and Steel Federation (JISF) announced in 2021 that it would aim to reach net-zero CO2 emissions by 2050 (JISF, 2021). The stance of JISF on climate change seemed to have changed considerably since 2018, when they published a long-term decarbonisation vision that drew global emissions pathways reaching zero in 2100 to achieve the 2°C temperature goal (JISF, 2018).

The Japanese steel sector had been hard-hit by COVID-19. In 2020 a third of 25 blast furnaces had to halt operation due to the slump in steel demand (Suga, 2020). As a result, total crude steel production in 2020 fell by 16% from the previous year to 83 million tonnes (World Steel Association, 2021), a level lower than in 2009 (88 million tonnes) following the global financial crisis (World Steel Association, 2017). Similarly, COVID-19 may have a long-lasting blow on the Japanese steel sector; after the 2007–2008 global financial crisis the crude steel production level in Japan never recovered the pre-crisis level of 120 Mt/year but instead remained at about 105 to 110 Mt/year (Worldsteel Association, 2018). The president of Nippon Steel, the largest steel producer in Japan, said in September 2020 that Japan’s crude steel production level would not return to 100 Mt/year, partially driven by the focus on an expansion of overseas operations (Jiji Press, 2020).

Buildings

CO2 emissions (including indirect emissions from electricity use) from the commercial and residential building sectors together accounted for 32% of Japan’s total energy-related CO2 emissions in 2019 (GIO & MOEJ, 2021). Compared to 1990, the emissions in these two sectors have increased by 48% and 24%, respectively (GIO & MOEJ, 2021). Although these significant increases are partially attributable to the increased electricity CO2-intensity post-Fukushima, there’s an urgent need for strengthened action on the demand side in the buildings sector.

An important recent development here is the revised building energy efficiency standards that entered into force on April 2017 under the Buildings Energy Efficiency Act (MLIT, 2016). Under the revised standards, new office buildings larger than 2000 m2 floor area must meet the energy efficiency standards.

Additionally, from April 2021, medium-sized office buildings will be obliged to comply with standards for surfaces between 300 and 2000 m2, while architects and contractors will be required to evaluate and communicate conservation standards to house owners (MLIT, 2021). It provides local governments with the possibility of establishing local ordinances where national standards are not sufficient to ensure compliance, while adding major housing companies, providing custom-built detached houses and rental apartments, to the scope of the Top Runner Programme (MLIT, 2019). This is a major step forward in improving energy efficiency in the buildings sector because the standards were not previously mandatory: in 2015, the compliance rate for residential buildings was a mere 46% (MLIT, 2017).

It is important to note that METI is currently in the process of revising targets for energy conservation, including for the buildings sector. In a preliminary document, it noted that conservation efforts in the residential and commercial sectors could be raised by about 10%; enabling measures are also under consideration (METI, 2021a). It should, however, also be noted that the effective stringency of the standards for residential buildings is the same as the previous 1999 standards, which is lax compared to those in other developed countries, such as France, Germany, Sweden, the UK, and the United States (MLIT, 2013).

Under the 2014 Basic Energy Plan, and remaining unchanged to date, Japan also aims to reduce the average net primary energy consumption of newly constructed buildings and houses to zero by 2030 (METI, 2014). The share of ZEHs and “Nearly -ZEHs” (more than 75% reduction in net primary energy consumption) in total new residential buildings in 2018 was 13% (Sustainable open Innovation Initiative, 2019b), far below the 50% target for 2020 set in the 2014 Basic Energy Plan. The deployment of ZEBs is still in an initial phase (Sustainable open Innovation Initiative, 2019a).

F-gases

F-gas emissions have increased by more than 40% between 2013 and 2019 (GIO & MOEJ, 2021). Japan aims to reduce F-gas emissions through enhanced management of in-use stock and regulating consumption levels. On the management of in-use stock, under the Plan for Global Warming Countermeasures (MOEJ, 2016b), Japan aims to increase the recovery rate of hydrofluorocarbons (HFCs) from end-of-use refrigeration and air conditioning equipment up to 50% by 2020 and 70% by 2030. The Act on Rational Use and Proper Management of Fluorocarbons (“F-gas Act”; last amended in 2013) addresses this, but the recovery rate has stagnated: the recovery rate of refrigerants in 2019 was only 38% (METI & MOEJ, 2021). To resolve this, the F-gas Act has been further amended (the bill passed the Diet in May 2019 and entered into force in April 2020) (House of Councillors, 2019), including several penalty and obligatory measures to increase the F-gas recovery rates up to the targeted 50% by 2020 (MOEJ, 2019; Yoshimoto, 2019).

To meet the HFC reduction target under the NDC and the targets under the Kigali Amendment of the Montreal Protocol, the Ozone Layer Protection Act was amended in 2018 and measures took effect in April 2019. The amendment sets a ceiling on the production and consumption of HFCs, establishes guidelines to allocate production quota per producer as well as regulates exports and imports (METI, 2018b). The consumption levels are projected to be below the Kigali cap at least until 2029, when the Kigali cap lowers significantly. Since there is some time lag between consumption and emission, we assume that the amended Ozone Layer Protection Act will not affect HFC emission levels up to 2030 (METI, 2018b).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter