Country summary

Assessment

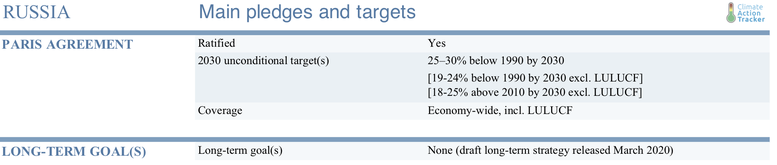

NDC update: In November 2020, the Russian Federation submitted an updated NDC. Our analysis of its new target is here.

Due to the COVID-19-related economic slowdown in Russia, we expect 2020 greenhouse gas (GHG) emissions to be between 8-10% lower than in 2019. The Russian government has failed so far to target a green recovery with its economic stimulus measures. In its newly adopted Energy Strategy to 2035, Russia continues to focus on expanding its domestic production and consumption of fossil fuels, with a strong emphasis on expanding natural gas exports. Conversely, measures supporting the uptake of renewable energy continue to fall short and Russia is not on track to meet its modest near-term targets. There continues to be a general lack of action by Russia across the board on climate policy. In early 2020 Russia proposed a weak update to its 2030 emissions target which would not require any new policies to meet it. As a result, we have given Russia a rating of “Critically Insufficient.”

The travel restrictions put in place to stem the spread of the COVID-19 virus are a significant driver of the expected 8-10% drop in emissions this year, contributing to a 40% year-on-year reduction in Russian gasoline consumption in April 2020. This is not expected to signal an ongoing emissions decline, however, as we expect to see a strong rebound in 2021, followed by either rising or static emissions levels until at least 2030. The latest actual emissions data shows a considerable spike in GHG emissions in 2018, a worrying sign as it is the second consecutive jump in annual emissions after four consecutive years of relative stability.

In the absence of a green COVID-19 recovery, Russia has rather chosen to focus on tax cuts, credit holidays, direct subsidies for businesses, and income support for citizens. An approval given to remote working and shorter work weeks in certain circumstances will contribute to lowering transport emissions, but this may be rescinded once the pandemic crisis eases. The lack of a climate mitigation-based recovery comes despite Russia’s Audit Chamber warning in January that climate change could knock up to 3% per year off Russia’s GDP by 2030.

Russia’s ratification of the Paris agreement in 2019 was followed in early 2020 by the release of its draft long-term climate strategy. This strategy includes 2050 emissions projections which, even under the most ambitious scenario, envisage a level of greenhouse gas (GHG) emissions roughly at current levels. It is more than likely that Russia will achieve both its current Paris Agreement target and its proposed new 2030 target under current policies.

In the wake of Russia’s ratification of the Paris Agreement, the much-anticipated climate legislation introduced to parliament in December 2018 that would have imposed emissions quotas and penalised big polluters has been gutted. The influential Russian Union of Industrialists and Entrepreneurs effectively lobbied for the legislation to be reduced to a five-year emissions audit.

Russia has made little progress in climate action implementation in general. The government’s long-delayed Energy Strategy 2035 that was recently adopted aims to support and develop fossil fuel industries, while largely ignoring renewable energy: indeed the Russian Ministry of Energy has explicitly identified the promotion of renewable energy to be a direct threat to planned fossil fuel expansion.

Russia is not only dragging its feet on policy implementation, but also threatening to hamstring international climate efforts. The EU announced in mid-2020 that it was investigating the imposition of a carbon border tax that would penalise trading partners that are climate policy laggards. Russia responded that it is “extremely concerned” by the proposed measure, and believes that it contravenes WTO rules, indicating a likely future challenge to the global trade body.

The CAT rates Russia’s current 2030 emissions target (25-30% below 1990 levels) as “Critically Insufficient”. If Russia were to adopt its proposed updated 2030 target of a 33% reduction below 1990 levels, this would improve Russia’s rating to “Highly Insufficient”. This demonstrates that its NDC update should be much more ambitious to ensure Russia is contributing its fair share to limiting warming to 1.5°C.

Russia is likely to meet its NDC, because it is so weak.

Due to the economic slowdown caused by the COVID-19 pandemic, we estimate that GHG emissions (excluding LULUCF) in 2020 will fall by between 8-10% below 2019 levels. After a 2021 rebound caused by a recovering economy, emissions under currently implemented policies are expected to either stay roughly static, or rise as much as 9% above 2020 levels by 2030. This represents a 32-37% decrease in emissions below 1990 levels, a level that is below the NDC targets which amount to a 19-24% decrease below 1990 levels (excluding LULUCF).

Even if Russia adopts its proposed updated 2030 target of a 33% reduction below 1990 levels, this means it will likely achieve it without the need for any additional climate policies. With this approach, the Russian economy is at risk of losing global competitiveness in the medium to long term in a market that is rapidly moving towards the development of low-carbon technologies.

A first step towards contributing to the Paris Agreement’s goals would be for Russia to reassess its proposed 2030 target and present one that sets out actual emissions reductions beyond the current policy scenario. This would not only be more credible from an international perspective, but would also help to align national policy developments with the long-term emissions reductions needed to avoid dangerous levels of climate change, which represent high risks to the national economy.

Russia’s continued reliance on the consumption and export of emissions-intensive forms of energy not only poses a challenge for the Russian economy in the future, it is also expected to exacerbate the impacts it faces from a changing climate.

Many impacts of climate change are already visible in Russia, and are proving to be disproportionately larger relative to the rest of the world. Temperatures in Russia have risen 2.5 times faster than the global average since the mid-1970’s and massive wildfires have burnt through an unprecedented area of Russian forests each year since 2016. In 2020, a temperature of 38°C was recorded inside the arctic circle at the town of Verkhoyansk, the highest since records began in 1885, while melting permafrost continues to release large quantities of methane and place towns and infrastructure that sit atop it at risk. These risks were underscored by Russia’s climate adaptation plan for the period to 2022, released in January 2020.

Russia’s Energy Strategy 2035, which was adopted in June 2020, aims primarily to grow its fossil fuel sectors, with a specific focus on expanding natural gas production and exports. The document suggests that the fuel and energy complex (FEC) will become the central pillar of Russia’s economy over the next decade, while largely ignoring the globally ascendant renewable energy sector. In fact, the Russian Ministry of Energy has explicitly identified the promotion of renewable energy to be a direct threat to Russia’s FEC and its planned expansion. In 2018 (the last year for which data is available) Russia’s energy sector accounted for 79% of all emissions without LULUCF.

Installed renewable power generation capacity sat at approximately 54 GW by the end of 2018, equivalent to 20% of the country’s total power generation capacity, with hydropower representing the majority by far of the installed renewable energy capacity (52 GW).

While renewable energy investments in Russia have increased in recent years, there was no registered increase in renewable energy capacity over 2017 and 2018. A recent positive development, however, is Russia’s decision in late 2019 to extend the support programme for renewable energy beyond 2024, with 400 billion roubles (5.6 billion USD) allocated to construct 5.3 GW of renewable energy capacity between 2025 and 2035 (Lyrchikova, 2019). This is roughly double the 2024 renewable energy capacity target under the previous scheme of 5.6 GW.

Under current policy projections, there is a slight upward trend in the share of renewable sources in primary energy demand, from around 3.3% in 2017 to 4.5% by 2030. Russia has a 2.5% Renewable Energy Target for 2020 and a 4.5% target for 2024 (excluding large hydro) for the electricity sector, which we estimate would increase the share of RE sources slightly to 4.5% of primary energy demand by 2030. However, in 2019, just 0.16% of Russia’s electricity came from non-hydro renewables compared to the global average of over 10%, indicating it is very unlikely Russia will meet even its modest short-term renewable energy targets.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter