Policies & action

The CAT rates the UAE’s policies and actions as “Insufficient” when compared with modelled domestic emissions pathways. The “Insufficient” rating indicates that the UAE’s climate policies and action in 2030 need substantial improvements to be consistent with limiting warming to 1.5°C. If all countries were to follow the UAE’s approach, warming would reach over 2°C and up to 3°C.

The UAE’s policies and action rating has improved compared to our previous assessment for two reasons.

First, the UAE’s newly published current policy scenarios (included in its LTS) lead to 17% lower emissions by 2030. This scenario includes a sectoral breakdown and detailed information at the measure level. This is a significant improvement compared to our previous current policy scenarios which were based only on the implementation of the Energy Strategy 2050.

Second, the UAE’s 5th National Communication to the UNFCCC also includes updated inventory data, which is 15% lower than our previous estimates, mainly due to differences in industrial process emissions and fugitive emissions. These also impact the absolute value estimated for the UAE’s 2030 emissions under current policies.

The UAE’s LTS, published in 2024, includes targets and current policy projections for all major sectors of the economy, and detail both existing and planned measures to achieve them. While this is a significant step in transparency, it also shows that the UAE plans to rely heavily on carbon capture and storage (CCS) technologies especially after 2030 and towards its 2050 target, which undermines the credibility of its climate policies and targets.

Policy overview

The CAT estimates the UAE’s 2030 emissions under current policies are set, in a best case scenario, to plateau close to 2022 levels, at around 214 MtCO2e, or continue to increase to about 259 MtCO2e. Under current policies, the UAE is set to miss its latest 2030 emissions reduction target. To meet its 2030 NDC target, the government needs to implement more ambitious policies and reduce its 2030 emissions by a further 15–40%. However, if the UAE implements the planned policies outlined in both its NDC and LTS, it could potentially reach its target. For more information, please see the Assumptions tab.

Since 2023, the UAE has published information on many relevant climate policies across all sectors of the economy. Both its NDC from 2023 and its LTS from early 2024 provide details on policies and action, both current and planned, in the power, industry, transport, buildings, agriculture and waste sectors (Government of the UAE, 2023a, 2024b).

This is a significant step in transparency, which allows for a better understanding of how the UAE plans to reduce its emissions to meet its NDC and net zero targets. However, it also shows a critical overreliance on carbon capture and storage both in the power and industry sectors, a smokescreen allowing the country to continue expanding its oil and fossil gas production and use while claiming to be on the way to net zero.

In recent years, the UAE has announced plans to invest in renewables both at home and abroad, including a USD 100bn commitment together with the United States (Associated Press, 2023). However, in parallel it continues to invest into fossil fuel production. The UAE is planning to significantly increase its oil production in the next years, and is pushing to reach “gas self-sufficiency”, with major investments in offshore gas production. In November 2022, ADNOC announced a USD 150bn investment plan to expand its oil and gas business in the next five years (The Guardian, 2023). As part of this plan, ADNOC awarded contracts worth USD 17bn in October 2023 for the Hail and Ghasha Offshore Development project. This project aims to produce 1.5 billion standard cubic feet per day (bscfd) of gas before the end of the decade (Reuters, 2023). For more details, see the Power sector section below.

The developments and the investment going towards new fossil fuel infrastructure are not consistent with limiting global warming to 1.5°C, instead are likely to lock the UAE into a high-emissions trajectory and undermine its transition towards renewable energy. Instead of ramping up its gas production towards self-sufficiency, the UAE should set out an ambitious plan to phase-out its dependency on gas for electricity and switch to renewables, which would reduce prices and price volatility for consumers, and avoid the risk of stranded assets (CAT, 2022).

Power sector

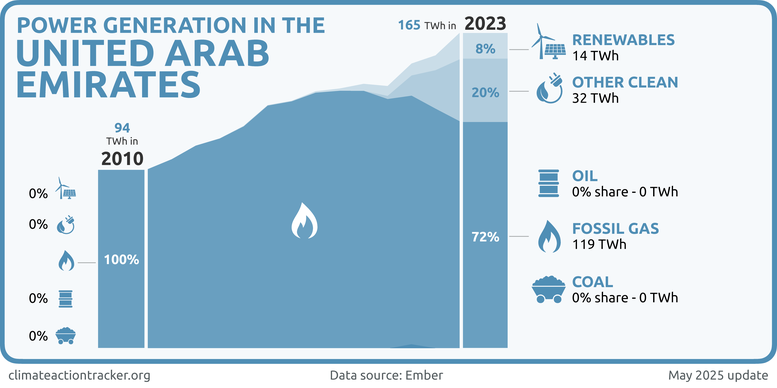

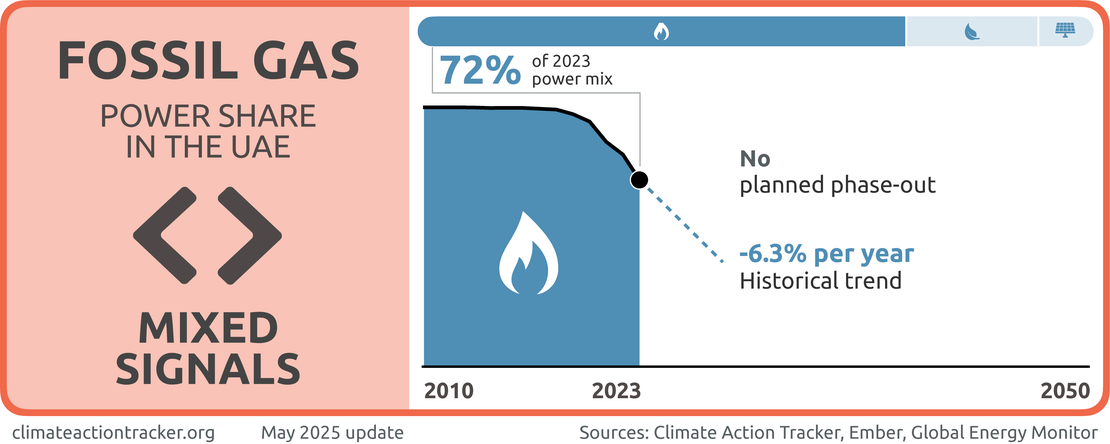

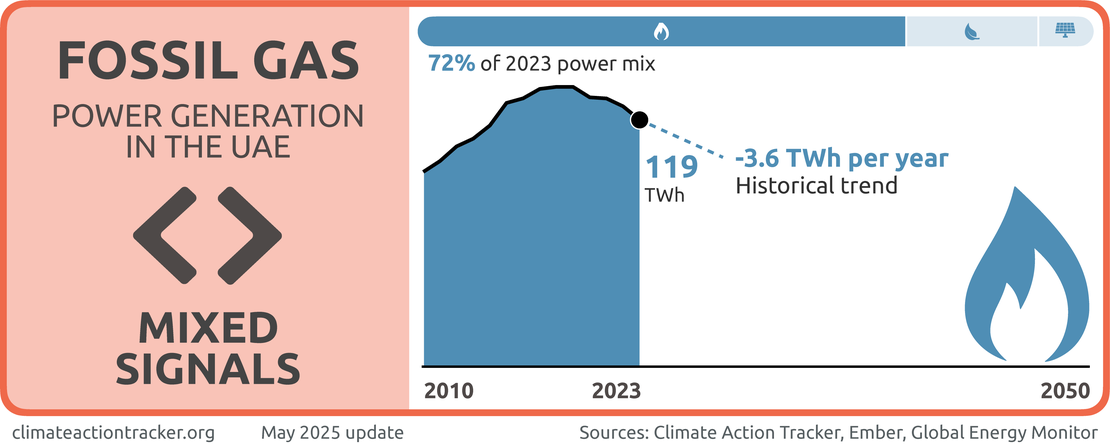

The UAE’s power sector remains heavily reliant on fossil gas, which accounted for 72% of total electricity generation in 2023. This is followed by nuclear energy (20%) and renewables (8%) (Ember, 2025).

The UAE’s 2023 NDC update sets a target to reduce electricity emissions by 11% below 2019 levels by 2030. Under this sectoral target, emissions from electricity are expected to be ~68 MtCO2e in 2030 (Government of the UAE, 2023a). In its LTS, the UAE includes additional information on its power sector plan, including a demand forecast of 211 TWh by 2030 and a grid coefficient of 0.27 tCO2e/MWh, a 51% reduction from the 2019 baseline level of 0.55 tCO2e/MWh.

According to the UAE’s latest version of its Energy Strategy 2050, as well as its NDC and LTS, the 2030 target will be mostly achieved by expanding renewables and nuclear. However, the achievement of the 2050 target of a zero-emissions grid coefficient is expected to rely heavily on the use of CCS on gas power plants, instead of a plan to phase out fossil fuels from power generation.

CCS technologies are neither commercially viable nor proven at scale, despite large public subsidies for research and development globally. Heavily relying on unproven CCS for power generation simply prolongs the use of fossil fuels and increases emissions, diverting attention and resources away from the necessary and urgent switch to renewable energy generation that drives down actual emissions.

The use of CCS should be limited to industrial applications where there are fewer options to reduce process emissions—not to reduce emissions from the electricity sector where renewables are cost-effective mitigation alternatives, not least because CCS does not remove 100% of emissions from power plants.

The UAE has also announced an investment of USD 54 billion over the next seven years to support its updated energy targets. However, it remains unclear if the recently announced investment plan is additional to the USD 160 billion the country had previously announced to support its 2050 energy targets (Associated Press, 2023).

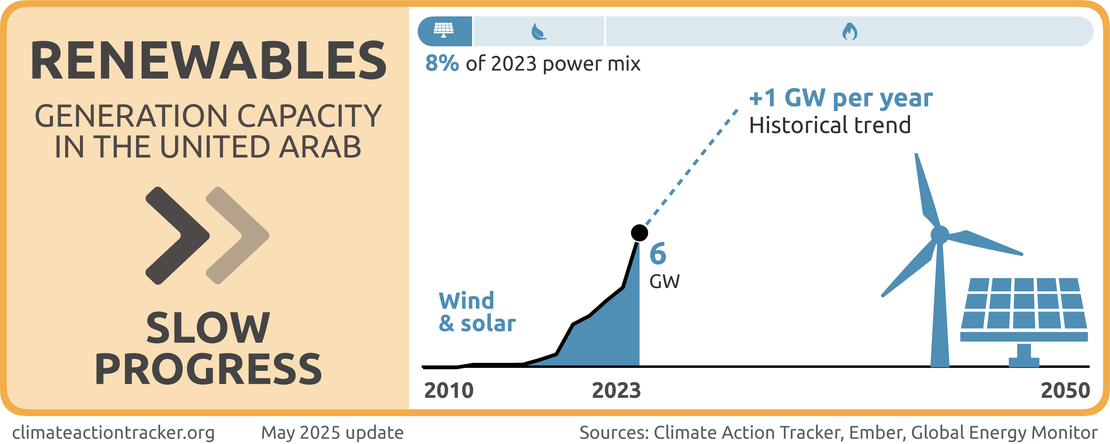

Renewables

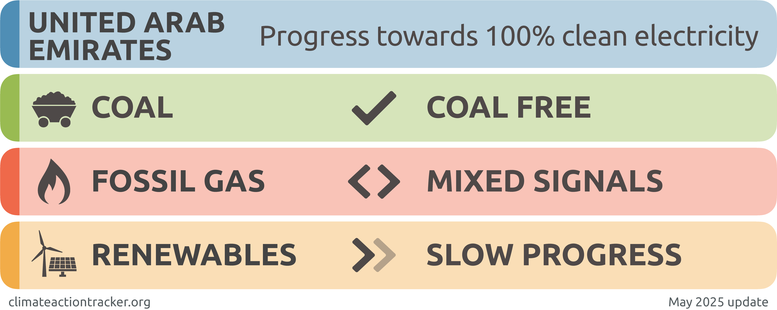

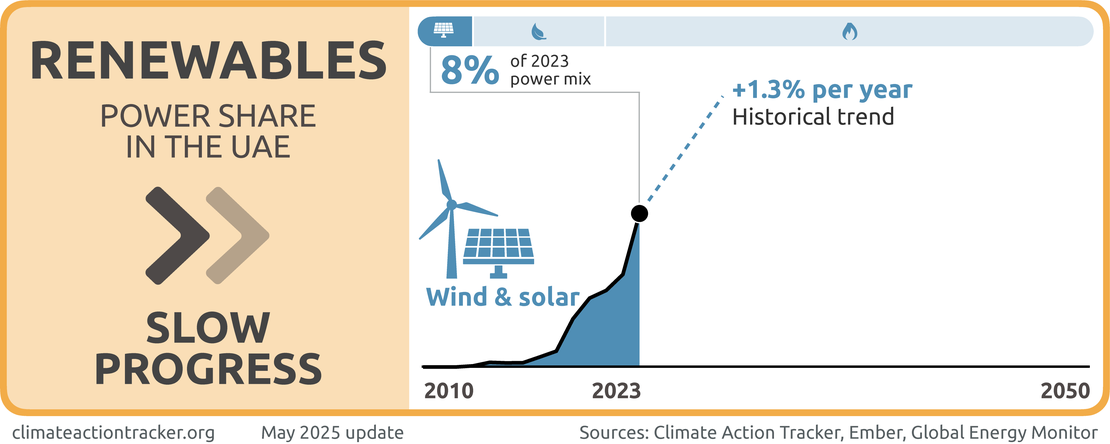

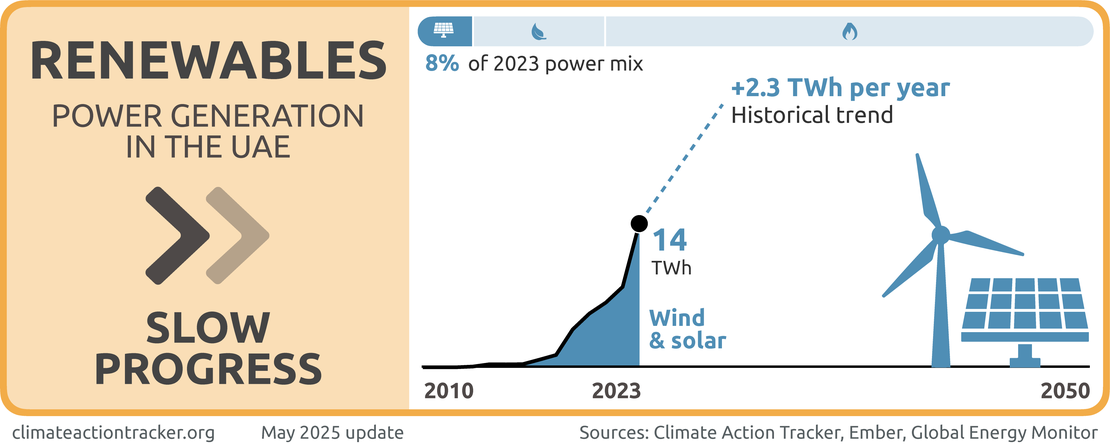

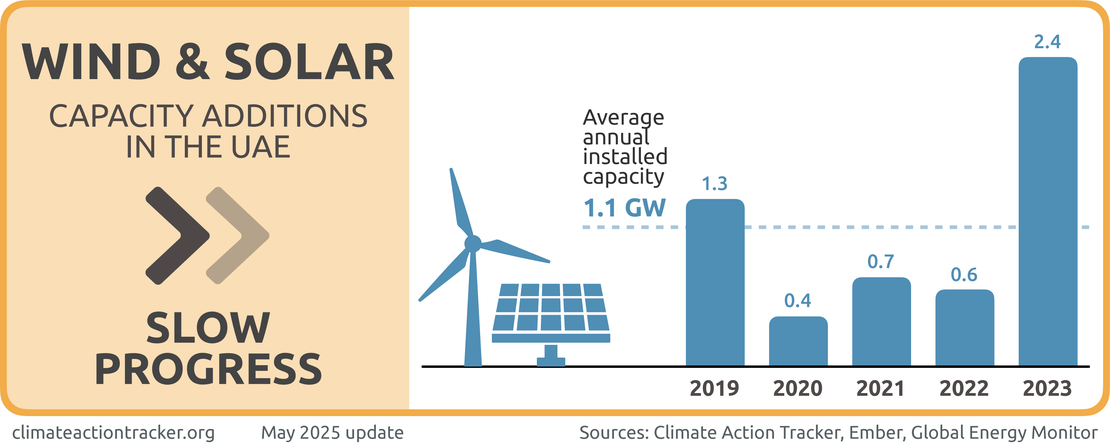

The UAE has taken steps to accelerate the deployment of renewable energy, mainly through large-scale investments into wind and solar. The share of electricity generated from renewables has increased in the past five years, going from 3% in 2019 to 8% in 2023 (Ember, 2025). While these efforts mark progress, the current pace of deployment remains slow and the related targets insufficient. As a result, we evaluate the UAE’s overall efforts to deploy renewable energy as “Slow Progress”.

As part of its energy strategy, the UAE is planning to expand its renewables capacity, mostly through solar power. The UAE plans to reach 19.8 GW of renewables installed capacity in 2030, with an expected 33 TWh of generation, up from 6 GW of total installed capacity in 2023 (Ember, 2025).

It also set out a target to produce at least 30% of its electricity through renewable sources by 2030. This falls significantly short of the CAT 1.5°C compatible benchmark for the UAE, which sets renewable power generation at 66% of the total by 2030 (Climate Action Tracker, 2023b; Government of the UAE, 2023b).

As part of its LTS, the UAE plans to roll out additional policies to support the deployment of renewable energy. These include CO2 emissions targets or caps for power producers through regulators at the emirate level, incentives for distributed power generation such as net metering, installing PV solar in public buildings, and tariff revisions to facilitate load balancing (Government of the UAE, 2024b).

The UAE also continues to invest in large scale solar power and storage. With its current and planned renewable energy developments, the UAE is expected to reach 9 GW of renewable power by 2030. Following the construction of the ~1.2 GW Noor Abu Dhabi solar PV plant in 2019, the UAE has continued to develop utility scale PV plants. The Al Dhafra Solar PV plant, added another 2 GW (Government of the UAE, 2023a; Tollast, 2022). In May 2022, a third solar PV project entered the tendering process. Once completed, the Al Ajban Solar PV will add 1.5 GW of capacity (Technical Review Middle East, 2022).

As part of its Energy Strategy 2050, the UAE has also committed to invest around USD 160bn over the next three decades in “clean” and renewable energy, which might include nuclear and fossil gas. As part of this plan, the UAE has signed a preliminary agreement with Engie Solutions (subsidiary of Engie) to develop further clean energy projects (Benny, 2022).

In November 2022, the UAE signed the Partnership for Accelerating Clean Energy (PACE) with the US, committing to mobilise USD 100bn to support the development of 100 GW of renewables both domestically and abroad by 2035. However, it is not yet clear which technologies will be supported under the “clean energy” concept, and how this new commitment will interact with existing finance plans in the UAE, that means, whether the planned investments will be additional to previous ones. In July 2023, the UAE announced it will be investing USD 54 billion to achieve its new 2030 clean energy target. Same as for the PACE announcement, it remains unclear whether this commitment is additional to existing ones (Associated Press, 2023).

In addition to these solar power projects, a contract for the UAE’s first pumped storage hydroelectric plant, with an expected capacity of 250 MW, was awarded in August 2019, and scheduled for commission in 2024 (Power Technology, 2022). Abu Dhabi’s virtual battery plant, currently with 108 MW of capacity, will also be expanded with an additional 300 MW in 2026.

Fossil gas

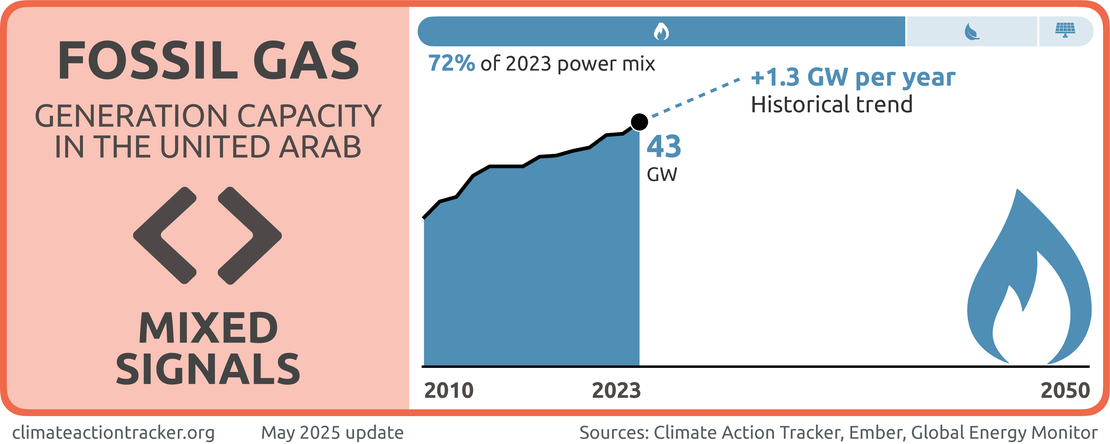

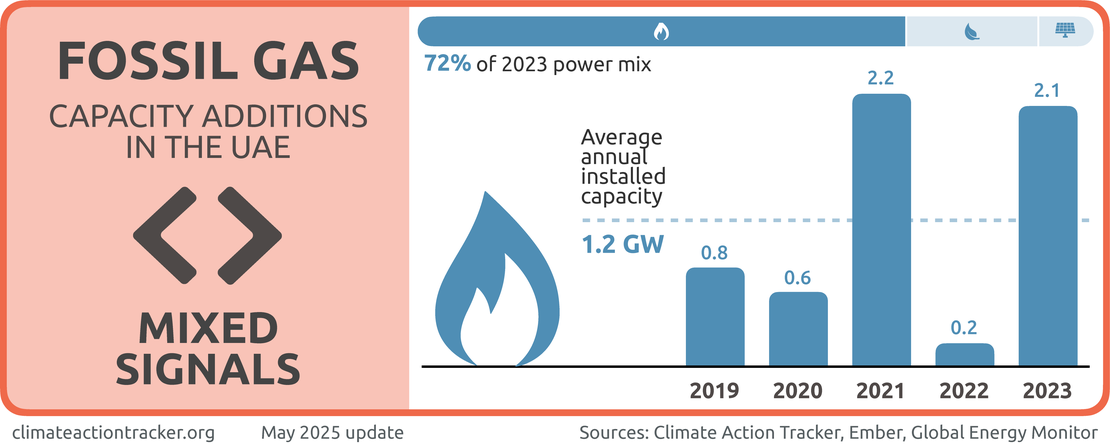

The UAE is sending “Mixed signals” on fossil gas. Since 2018, the share of gas in the power mix has steadily declined from 99% to 72% in 2023 (Ember, 2025). In absolute terms, gas-fired electricity generation has also decreased, falling from 135 TWh in 2018 to 119 TWh in 2023. However, fossil gas still dominates the power mix, and there are no plans to phase it out. The UAE added 2.1 GW of fossil gas power generation capacity in 2023, with around 9 GW of additional projects currently in the pipeline(Ember, 2025; Global Energy Monitor, 2025).

The UAE continues to invest in new gas infrastructure and has plans to further exploit domestic gas resources (see industry section below). The UAE’s continued investment in fossil fuel infrastructure is inconsistent with the goal of limiting global warming to 1.5°C. These developments risk locking the country into a high-emissions future and undermining the clean energy transition. Instead of ramping up fossil gas production, the UAE should adopt an ambitious plan to phase out its reliance on gas for electricity, avoiding stranded assets and aligning with global climate goals (CAT, 2022).

The UAE has recently unveiled plans to deploy carbon capture, and sequestration (CCS) technologies to capture CO2 emissions in its gas power plants. In a sustainable 1.5°C pathway, CCS with fossil fuels does not play a relevant role in energy sector decarbonisation, as renewable energy is much cheaper and has a much lower environmental footprint. The use of CCS needs be limited to industrial applications where it is proven there are no other options to reduce process emissions.

Coal

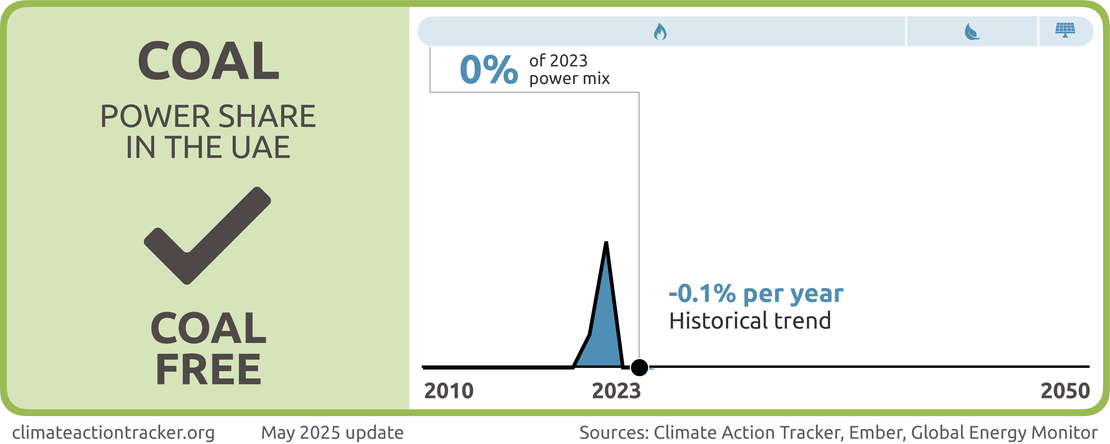

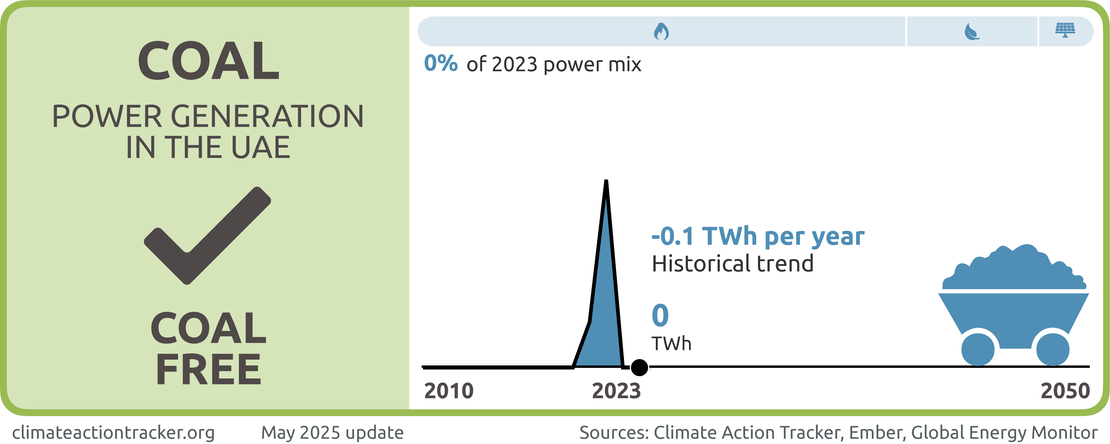

The UAE’s power sector is “Coal Free”. In May 2020, the construction of the first phase of the UAE and the Middle-East’s first coal power plant was completed. This consisted of the first two units of the 2.4 GW ultra-supercritical Hassyan power plant, with the second phase planned for Q3 2023 (Global Energy Monitor, 2022).

In February 2022, the UAE announced that it would be switching its coal power plant to fossil gas, in support of its net zero target, and has reported that the plant, originally designed as a dual-fuel plant, has now done so (Global Energy Monitor, 2022).

The UAE’s revised Energy Strategy 2050, as well as its NDC and LTS all confirm that the country is not planning to include any coal power in its electricity mix.

Nuclear

The UAE continues to develop nuclear power. The share of nuclear power in the country’s electricity mix increasing significantly, rising from around 1% in 2020 to 20% in 2023 (ember).

In October 2022, the third unit of the Barakah nuclear power plant went online, increasing total capacity to 4.2 GW. The last unit of the project, awarded to a South Korean consortium, came online in February 2023. Once the last unit is operational in 2025, the plant will increase its installed capacity to 5.6 GW (Government of the UAE, 2023a).

According to a Reuters report from April 2024, the UAE is planning to tender a new nuclear power plant between this and next year, potentially including four reactors similarly to the existing Barakah power plant (Power Technology, 2024).

Although nuclear electricity generation does not emit CO2, the CAT does not see nuclear as the solution to the climate crisis due to its risks such as nuclear accidents and proliferation, high and increasing costs compared to alternatives such as renewables, long construction times, incompatibility with flexible supply of electricity from wind and solar and its vulnerability to heat waves.

Transport

The transport sector accounted for ~19% of the UAE’s emissions in 2019. The UAE’s 2023 NDC update sets a target to reduce transport emissions by 1% below 2019 levels by 2030. Emissions from the transport sector are expected to be ~42 MtCO2e in 2030 under this target, and to reach zero emissions by 2050 (Government of the UAE, 2023a).

The UAE has set out some policies to manage transport emissions, including an increase in the fuel and emissions efficiency of its vehicle fleet, as well incentives for the use of public transport, and the uptake of EVs. The revised Energy Strategy 2050 includes new targets for the uptake of EVs, including reaching 691,100 EVs and hybrid vehicles by 2030 and over three million by 2050 as well as increasing the number of EV chargers to 879 by 2030 and 30k by 2050. The emirates of Abu Dhabi and Dubai have also set out a series of urban transport policies, aimed among others at incentivising the uptake of public transport and EVs (Government of the UAE, 2021). For example, in May 2022 the Abu Dhabi government set out a new EV charging station policy, defining standards and requirements in anticipation of growing demand for EVs. In Dubai, the Green Mobility Strategy 2030 includes a target to reach 30% EVs and hybrids in the government vehicle fleet by 2030 (Government of the UAE, 2022).

In its LTS, the UAE lists additional policies it proposes to reach its target for the transport sector towards 2050. The key pillars of the UAE’s transport decarbonisation plan are to reduce transportation needs, decarbonise passenger transport, freight transport, and mechanical vehicles (Government of the UAE, 2024b).

The first pillar will include the development of mixed-use buildings, improved infrastructure for cycling and walking, incentives for carpooling and increased use of public transport and rail. In total this will contribute 14% of the reductions needed to achieve the UAE’s target. The second pillar includes incentives for the uptake of EVs, the electrification of buses, taxis and motorcycles. In total this will contribute 22% of the emission reductions needed.

The decarbonisation of freight transport includes a shift towards more rail use as well as the electrification of heavy-duty trucks. These measures are expected to contribute 27% of the reductions needed. Finally, the electrification of mechanical vehicles is expected to contribute 28% of the reductions (Government of the UAE, 2024b).

Additionally, the UAE has set out plans to decarbonise its domestic maritime and aviation sectors, including electrification and use of sustainable fuels.

Industry

The industry sector, including oil and gas production, is the largest source of emissions in the UAE, accounting for 46% of the country’s total emissions, or 103 MtCO2e. This includes emissions from industrial processes as well as indirect emissions from power and heat generation (Government of the UAE, 2024b). The UAE’s LTS includes a target to reduce industry emissions by 5% below 2019 levels by 2030, and 93% by 2050, while its current policy projections estimate these emissions will rise by 18% above 2019 levels by 2030.

The UAE has a series of policies to reduce emissions from its industry sector, mostly focusing on increasing efficiency through adoption of best practices. To reach its target, the UAE plans to adopt a series of policies such as a cap and trade system, contracts for difference, regulated transport and storage for CCS, updated blended cement regulations, updated building codes, hydrogen production incentives and others (Government of the UAE, 2024b). On April 2024, the UAE also ratified the Kigali amendment, committing to reducing HFCs consumption by 87% by 2047 compared to its average consumption in 2024-2026 (IIR, 2024).

The UAE plans to reduce its industry emissions through different means. Around 20% of the reductions towards its net zero target will come from fuel substitution and process switches in key industries such as steel and cement (Government of the UAE, 2024b). For example, the UAE’s LTS mentions the switch to concentrated solar power for heat for industrial processes and switching from blast furnaces to hydrogen-powered direct reduced iron processes for steel.

However, a large share of the emissions reductions (32%) is expected to come directly from the deployment of CCS and from the decarbonisation of the power sector which will also heavily rely on CCS. Such overreliance on a technology that has not yet been proven at scale can seriously hinder the UAE’s progress towards transitioning its industry sector and can serve as a smokescreen to continue expanding fossil fuel production (Government of the UAE, 2024b).

Oil & gas production

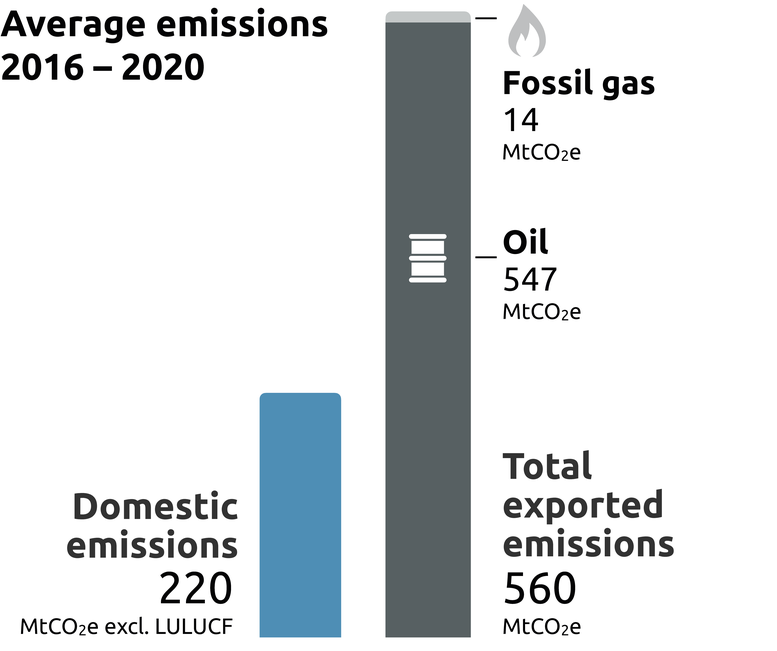

The UAE is the world’s seventh largest oil producer and 14th largest gas producer (US EIA, 2023a). It is also one of the world’s largest oil exporters. The UAE’s exported emissions from oil and gas are about 2.5 times larger than its domestic emissions (see graph below) (Climate Action Tracker, 2023c).

In 2022, oil production reached 4.2 million barrels per day, an increase of 12% compared to the previous year, and surpassed pre-pandemic levels (US EIA, 2023b). Following an OPEC+ decision in October 2022 (Deepthi Nair, 2022), to cut production by twomillion barrels per day (mbpd) in an effort to keep oil prices up the UAE announced it would cut over 140,000 barrels per day from May 2023 until the end of the year (Gulf Today, 2023). However, the government also recently announced it was bringing forward its oil production capacity of five mbpd target (up from 3.8 mbpd currently), from 2030 to 2025, signalling its intent to ramp up production in the short term (Di Paola, 2022).

The UAE is also developing oil and gas offshore exploration and production. This is part of its efforts to reach “gas self-sufficiency” (ICLG, 2022). In February 2022, the first offshore fields were discovered, which are estimated to contain between 43 and 57 billion cubic metres of gas (AFP, 2022).

During 2022, Abu Dhabi National Oil Company (ADNOC) Drilling was awarded almost USD 6bn in contracts to “maximise value from Abu Dhabi’s offshore oil and gas resources” (World-Energy, 2022). In October 2023, ADNOC awarded contracts worth USD 17 bn for the Hail and Ghasha Offshore Development project. This project aims to produce 1.5 billion standard cubic feet per day (bscfd) of gas before the end of the decade (Reuters, 2023). This is part of a USD 150bn ADNOC plan to increase production of oil and gas.

According to the IEA, the development of new fossil fuel infrastructure beyond what was already committed in 2021 is incompatible with reaching net zero by 2050 (IEA, 2021). The UAE’s plans to further develop and invest in new fossil fuel infrastructure are inconsistent with limiting global warming to 1.5°C. These plans are also likely to lock the UAE into a high-emissions trajectory and undermine its transition to renewable energy. Instead of ramping up its gas production towards self-sufficiency, the UAE should set out an ambitious plan to phase-out its dependency on gas for electricity and avoid the risk of stranded assets (CAT, 2022).

In October 2023, ADNOC announced plans to double its CCS target from 5 to 10 MtCO2e removed annually by 2030 as part of its decarbonisation plan (Energy Voice, 2023). In a sustainable 1.5°C pathway, CCS with fossil fuels does not play a relevant role in energy sector decarbonisation, as renewable energy is much cheaper and has a much lower environmental footprint. The use of CCS needs be limited to industrial applications where it is proven there are no other options to reduce process emissions.

Hydrogen

During COP26, the UAE unveiled its “Hydrogen Leadership Roadmap”, a strategy aimed at developing the domestic production of green and blue hydrogen aimed at export markets in Asia and Europe. The roadmap already includes seven projects which are either completed or underway (including blue ammonia production). The overarching target of the strategy is to reach a 25% market share in key markets such as India, Japan, Germany and others (H2 World News, 2021).

According to the UAE’s 2023 NDC update, several projects are already under way to support the country’s hydrogen ambitions, and a new Hydrogen Strategy is being prepared (Government of the UAE, 2023a). In its updated Energy Strategy 2050, the UAE also includes a target to produce 1.4 Mt of hydrogen annually by 2031. The UAE’s LTS includes additional information on its hydrogen development plans, including production targets of 7.3 Mt by 2040 and 14.9 Mt by 2050. Around half of the hydrogen is expected to come from fossil fuels with CCS (blue hydrogen), with the majority of the second half being green hydrogen and a small share coming from nuclear power (pink hydrogen) (Government of the UAE, 2024b).

Buildings

The buildings sector accounted for ~28% of the UAE’s emissions in 2019. The UAE’s 2023 NDC update sets a target to reduce building emissions by 56% below 2019 levels by 2030, while its LTS targets a 98% reduction below 2019 levels by 2050 (Government of the UAE, 2024b). Emissions from the building sector are expected to be 27 MtCO2e in 2030 under the NDC from 2023, while under current policies they are expected to be 35 MtCO2e (Government of the UAE, 2023a, 2024b).

As part of its Energy Strategy 2050, the UAE set out a target of reducing energy consumption by 40%. Several policies are in place to support this target in the buildings sector, including the National Water and Energy Demand Side Management Programme and a federal government building retrofit programme, aiming at 2000 retrofits by 2050. Some Emirates have also produced their own plans and policies to reduce energy consumption from the buildings sector, including Dubai’s plan to retrofit 30,000 buildings by 2030 (Government of the UAE, 2022).

The majority of the emissions reductions in the building sector towards the UAE’s NDC target are expected to come from energy efficiency measures including more efficient heating and cooling, as well as demand side management initiatives. The emissions reductions necessary to reach the LTS target of 1 MtCO2e in 2050 will come almost entirely from reducing power and heat emissions (Government of the UAE, 2024b).

Waste

According to the UAE’s latest National Communication to the UNFCCC, the waste sector accounted for 6% of the country’s emissions in 2021 (Government of the UAE, 2024a). The UAE’s LTS sets a target for waste emissions, which are set to increase by 8% above 2019 levels by 2030 and should decrease by 75% below 2019 levels in 2050. Emissions from the waste sector are expected to reach 14 MtCO2e in 2030, up from 13 MtCO2e in 2019 (Government of the UAE, 2023a). This includes emissions from landfills as well as emissions stemming from energy used to transport and treat waste.

In January 2021, the UAE launched its Circular Economy Policy 2031, establishing a Circular Economy Council, tasked with supervising the implementation of waste reduction policies that also target the manufacturing sector. In May 2022, the Sharjah Waste-to-Energy plant was launched, with a capacity of 30 MW. A further 200 MW plant is planned in Dubai and a 70 MW plant in Abu Dhabi, both expected to be operational in 2024 (Government of the UAE, 2023a; Sharma, 2022).

However, the UAE’s Circular Economy Policy has no concrete waste or emissions reduction targets. We were not able to check whether its previous target of diverting 75% of its waste from landfills by 2021 (Government of the UAE, 2019) has been achieved. The UAE’s LTS includes a target of diverting 80% of its waste by 2031 and 90% by 2035. It also plans to capture the remaining methane produced in its landfills and retrofitting its waste-to-energy plants with CCS.

Under its net zero scenario, the UAE expects waste to contribute around 3 MtCO2e by 2050.

Methane

The UAE signed the methane pledge at COP26, in which signatories agreed to cut methane emissions in all sectors by 30% globally over the next decade. According to the UAE’s latest inventory, methane represented ~7% of total GHG emissions in 2021, mostly stemming from upstream fossil fuel production and waste (Government of the UAE, 2024a). The UAE already includes methane in its NDC and has some policies in place designed to reduce both energy and waste-related methane emissions.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter