Policies & action

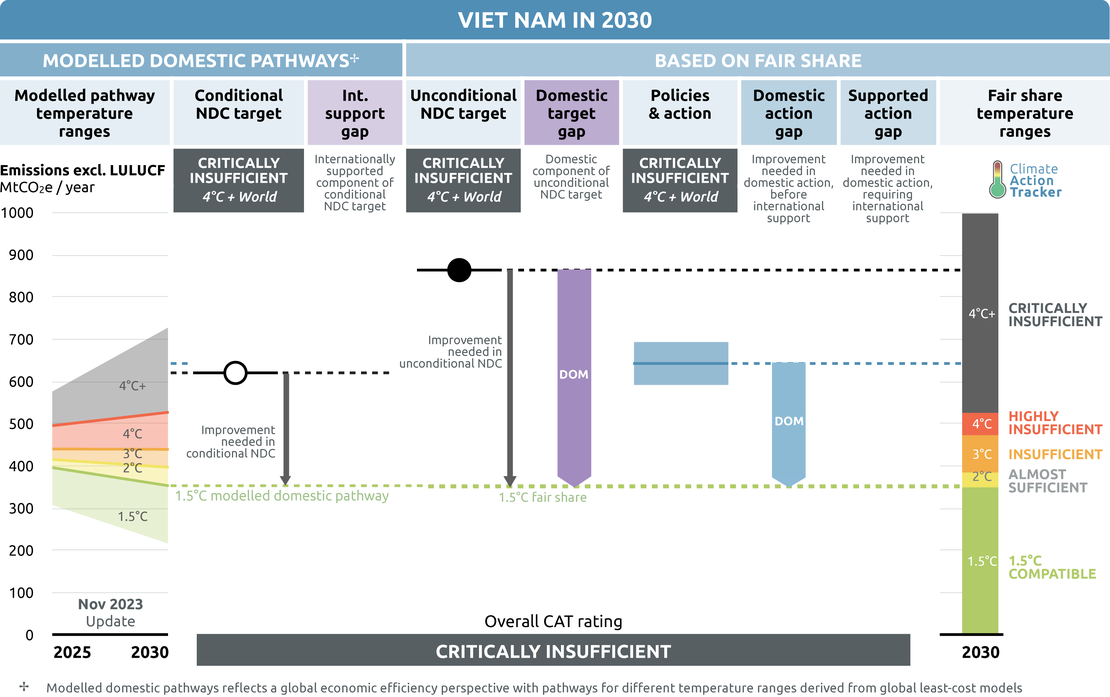

Viet Nam’s current policies and action are rated “Critically insufficient” when compared to its fair share contribution. The “Critically insufficient” rating indicates that Viet Nam’s policies and action in 2030 reflect minimal to no action and are not at all consistent with the 1.5°C temperature limit. If all countries were to follow Viet Nam’s approach, warming would exceed 4°C.

Viet Nam’s emissions under current policies will reach around 592-692 MtCO2e in 2030 (excl. LULUCF) whereas a 1.5˚C fair share pathway is 350 MtCO2e in 2030.

If Viet Nam receives all the international support committed under the Just Energy Transition Partnership (JETP), it would go some way to closing the gap, but further action is needed. This is represented under the planned policy scenario where emissions could reach up to 568 MtCO2e by 2030.

Further information on how the CAT rates countries (against modelled domestic pathways and fair share) can be found here.

Policy overview

The CAT estimates that Viet Nam's emissions, excluding LULUCF, will range from 592 to 692 MtCO2e in 2030 under current policies. This estimate reflects a reduction of 0 to 10 MtCO2e compared to our assessment from last year, mainly due to lower historical emissions than previously estimated. Emissions in 2030 are projected to be 37 to 60% higher than the emissions in 2021.

The architecture of Viet Nam’s climate action framework to 2050 is articulated in the National Climate Change Strategy to 2050, setting the goal of reaching net zero by 2050. Since COP27, important policy documents covering the energy sector have emerged, including the long-awaited Power Development Plan 8 (PDP8) and the Master Plan for National Energy, building on the foundations of the Climate Change Strategy. In December 2022, Viet Nam signed the Just Energy Transition Partner (JETP), which comes as a policy support for achieving the goal outlined in PDP8.

Earlier National Energy Development Strategy (Resolution no. 55) was issued to support renewable energy uptake and law on Environmental Protection provided the legal framework for domestic carbon market. Energy efficiency is addressed through the Viet Nam National Energy Efficiency Program 3 (2019-2030), with a legislated target of reducing total final energy consumption.

Viet Nam's energy landscape is undergoing a transformation as the country works to reduce its reliance on coal. This includes the expansion of renewable energy sources, their integration into the energy grid, and a determined push to phase out coal power by 2050. Nevertheless, the government is considering fossil gas as a “transition fuel” and is actively working to expand fossil fuel import infrastructure. Rapid historical and planned growth in coal and gas imports pose energy security concerns.

Just Energy Transition Partnership (JETP)

In December 2022, Viet Nam joined the Just Energy Transition Partnership (JETP). This partnership will provide USD 15.5bn in support until 2026-2028, from a group of donor countries to help Viet Nam reach its net zero commitment by 2050. The JETP Resources Mobilization Plan detailing the conditions of the partnership is expected to be released in November 2023.

Key elements of the agreement include the peaking of power sector emissions in Viet Nam at 170 MtCO2e in 2030, and a targeted share of 47% of renewable energy generation by the end of the decade. The JETP aims at bringing forward Viet Nam’s peak emissions target from 2035 to 2030. The agreement also includes a biennial revision of the targets. The ambition and goals of the JETP are reflected in the PDP8, discussed below.

The JETP primarily aims to gradually eliminate coal from power generation. This involves re-skilling programs, halting investments in coal power plants, and initiating discussions for closing unabated coal-fired facilities. However, the JETP's tunnel vision towards coal might inadvertently facilitate the substitution of coal with other fossil fuels, which contradicts its climate action objectives. This manifests as an emphasis on fossil gas-based power generation in PDP8, which will increase drastically over the rest of this decade.

As the modalities of the South African and Indonesian JETPs are becoming more precise, concerns are arising regarding the share of loans in the financial packages (Australian Institute of International Affairs, 2023). The delivery of financing through concessional and commercial loans, instead of grants and other financial instruments, can aggravate the debt burden of developing nations, potentially generating debt traps.

The JETP agreement clearly emphasises the necessity of engaging in "regular consultation" with media, non-governmental organisations, and other stakeholders to ensure a wide-reaching social consensus. Nonetheless, the recent upsurge in detentions and arrests of environmental activists in the country appears to contradict the principles of justice and equity that are fundamental to this agreement (Le Monde, 2023; The Washington Post, 2023).

Power Development Plan 8 (PDP8)

The long-awaited Power Development Plan 8 (PDP8), adopted in May 2023, sets out the planning of the power sector for the rest of the decade. The plan defines numerous targets for 2030 and 2050, taking into consideration Viet Nam's abundant renewable energy potential. It emphasises the need to modernise power sector infrastructure, enhance electricity generation, and support the country in achieving its 2050 net zero goals.

The plan aims at reducing coal generation from 114 TWh in 2021 to zero by 2050. In the PDP8, Viet Nam's coal capacity target for the year 2030 stands at slightly over 30 GW (20% of the capacity mix), compared to 23 GW in 2021 (30% of the capacity mix). This is a significant reduction from the previous target of the PDP7 and the 2022 draft PDP8.

The PDP8 renewable targets lack ambition, and the rollout of solar and wind is planned to occur at a much slower rate than during the last few years. Renewable energy will account for 31 to 39% of the power generation mix in 2030 (including hydro), and 47% in the case of a full and substantial implementation of the JETP, compared to 43% in 2021. The share of non-hydro renewable energy capacity is planned to remain at current levels of 28% by 2030. However, the overall installed capacity is set to increase to 43 GW by 2030, up from current levels of 21 GW.

Viet Nam plans to lean heavily on fossil gas as a transition fuel. The share of fossil gas in the power generation mix is set to increase significantly, with capacity rising to 37 GW by 2030 compared to 8 GW in 2021. The 2030 target includes 22 GW of LNG power plants, marking the start of LNG imports in Viet Nam.

The PDP8 defines additional 2030 emissions and renewable penetration targets contingent on the “full and substantial” implementation of the JETP, that would further accelerate the transition to a clean energy system. Power sector emissions with support from the JETP are included under the Planned Policy scenario. A successful implementation of the JETP would lead to a 4% to 18% reduction in Viet Nam's total emissions compared to the emissions under current policies.

Integrating a high share of variable renewable energy will require upgrading the country's electricity grid. The lack of planning in transmission and distribution has resulted in severe grid failures, leading to a pause on new renewable capacity deployments in 2022. Variable renewable energy deployment has been concentrated in the centre and south of the country. To fully utilise its potential and reduce curtailments, Viet Nam will need to support the growth of its energy storage infrastructure through regulatory mechanisms, continuous development of infrastructure, and potential connections with other countries. The ongoing transformation of Viet Nam’s power market can lift the barriers obstructing investments towards clean energy sources.

Designed with an annual GDP growth aligned with historical expansion of around 7% until 2050, putting PDP8 into action will require investments estimated at USD 135bn by 2030 to achieve this target.

Master Plan on National Energy (2021-2030)

The Master Plan on National Energy for the period 2021-2030 integrates the PDP8 into a broader roadmap for the energy sector, aimed at reaching Viet Nam’s development goals while meeting its net zero target by 2050 (Viet Nam Government, 2023b). It sets an energy-related GHG emissions target of 399-449 MtCO2e by 2030, (51-73% above 2021 levels) and 101 MtCO2e by 2050 (62% below 2021 levels).

Like the PDP8, the National Energy Plan places a significant emphasis on fossil fuels, with clean energy taking a back seat. The plan outlines targets for coal, gas, and oil production. Domestic coal production will remain prominent until mid-century, while coal imports are projected to peak in 2035 before being phased out by 2050. Despite this focus on fossil fuel development, the share of renewable energy in the total energy supply is expected to increase only marginally.

The Energy Master Plan takes into account the production of alternative fuels through the establishment of targeted metrics for biofuels, biogas, synthetic fuels, and technology-neutral hydrogen production.

In contrast to the PDP8, which mentions carbon capture, utilisation, and storage (CCUS) qualitatively, the Master Plan lays out a more comprehensive plan for its expansion. By 2040, the goal is to reach a capture capacity of 1 MtCO2 through the implementation of this technology, with an eye towards potential future expansion to 3 to 6 MtCO2 by 2050.

The Master Plan on National Energy estimates capital investments for the energy sector at USD 630-813bn for the period 2021-2050, including USD 173-202bn for the period 2021-2030.

Sectoral pledges

In Glasgow, several sectoral initiatives were launched to accelerate climate action on methane, the coal exit, 100% EVs and forests. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets, and on forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”. The Beyond Oil & Gas Alliance (BOGA) seeks to facilitate a managed phase-out of oil and gas production.

NDCs should be updated to include these sectoral initiatives, if they’re not already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

| VIET NAM | Signed? | Included in NDC? | Taking action to achieve? |

|---|---|---|---|

| Methane | Yes | Yes | Yes |

| Coal Exit | Yes | Yes | Yes |

| Electric vehicles | No | N/A | N/A |

| Forestry | No | Yes | Yes |

| Beyond Oil and Gas Alliance | No | No | N/A |

- Methane pledge: Viet Nam is one of the signatories of Global Methane Pledge and committed to reduce methane emissions by 30% by 2030 compared to the base year of 2020. Around 21% of Viet Nam’s emissions are from methane. Absolute methane emissions have been declining since 2011. Methane emissions mainly come from the agriculture sector. Viet Nam has planned to adopt advanced solutions in agriculture production to reduce methane emission from cultivation and husbandry. In August 2022, Viet Nam released its national methane emission reduction plan with the goal of reducing methane emissions by at least 30% below 2020 levels by 2030.

- Coal exit: During COP26, Viet Nam pledged to phase out unabated coal-fired power generation and stop construction of new plants. Viet Nam’s coal capacity grew by around 57% between 2014 and 2021. The Vietnamese government adopted a plan to not develop new coal-fired power plants after 2030 and will gradually reduce its coal fleet after 2035. However, Viet Nam has a further 15.6 GW coal capacity in the pipeline – 7.4 GW under construction and 8.3 GW at pre-construction level. Viet Nam is exploring options to accelerate its phase-out of unabated coal power through the Just Energy Transition Partnership platform.

- 100% EVs: On 22 July 2022 Viet Nam adopted a green energy transition roadmap, the overall objective of this strategy is to develop a green transport system which will 100% operate through electricity or green energy by 2050 in consistent with its net zero target. With more than 87% of households owning a motorcycle there is a high potential for the electric two wheeler market in Viet Nam. The electric two wheeler fleet reached two million units at the end of 2022. Electric passenger vehicle market sales are still modest, at 8,400 units during the year 2022.

- Forestry: In 2016, Viet Nam’s sink capacity was 39 MtCO2e/year. In its National Climate Change Strategy to 2050, Viet Nam set a target to maintain forest coverage at 43% and ensure the preservation of national forest areas; improve forest quality and sustainable forest management.

- Beyond Oil and Gas Alliance: This alliance was created with the aim to restrict any kind of fossil fuel expansion by ending licensing of new projects and phasing out existing oil and gas projects. Viet Nam has not joined this alliance, and its gas expansion plans are at odds with the alliance’s goal.

Energy supply

The energy sector emissions accounted for 60% of Viet Nam’s total emissions in 2021 (Gütschow et al., 2022a). Total final energy consumption grew 147% from 2010 to 2019 (IEA, 2021c). In the updated NDC, more than half of the emissions reduction through the decade come from this sector (Viet Nam Government, 2022a). After having achieved universal electrification in 2015, Viet Nam has experienced several energy challenges in recent years amid a context of high economic growth (World Bank, 2019).

In 2023, a record-breaking heat wave resulted in a high demand for electricity and plunged the northern regions of Viet Nam into a major power outage, with losses amounting to 0.3% of GDP. Some businesses reported having loss up to 10% of their revenues (World Bank, 2023). These disruptions were primarily linked to the influence of El Nino, an exceptional drought, high fuel costs, the local dependence on hydropower and relatively lower adoption of wind and solar energy compared to other regions (World Bank, 2023).

Viet Nam is already among the ten countries most affected by climate change (World Bank, 2023). The building of a clean, resilient energy system is crucial both for mitigating contribution to global warming and limiting its adverse consequences.

Coal power

With 23 GW of installed capacity in 2021, coal accounts for 30% of Viet Nam’s capacity mix. Although coal will keep playing a key role in the country’s power mix, with a capacity target of 30 GW by 2030 in the PDP8 (see Policy Overview section above), this new objective is a considerable improvement over the PDP7 goal of reaching 55.3 GW of coal-fired capacity by 2030 and 37 GW in the draft version of PDP8 (Energy Tracker Asia, 2022b; Viet Nam Government, 2021).

With current policies, power generation from coal is expected to increase by 8-46% above 2021 levels through the decade, and decrease by 18% in case of a full and substantial implementation of the JETP. Coal will account for 22-30% of the generation mix in 2030 under current policies, and 16% in the case of a full and substantial implementation of the JETP, compared to 47% in 2021 (Ember, 2023).

An increasing number of coal projects are already being cancelled in Viet Nam, mainly due to a lack of financial viability, with 45 GW of coal-fired projects shelved between 2010 and 2022 including one-fifth cancelled in 2021-2022 (Global Energy Monitor, 2021, 2022b). 7.3 GW of coal fired plants are still at the construction or pre-construction stages as of April 2023 (Global Energy Monitor, 2023).

The PDP8 contains a list of coal-fired power projects that are encountering delays and/or financial difficulties, amounting to a total capacity of 7.2 GW not factored into the plan’s 2030 power mix structure. The PDP8 urges the Ministry of Industry and Trade to collaborate with investors to expedite the progress of these projects before June 2024, before considering termination.

The PDP8 mentions converting plants older than 20 years into ammonia and biomass facilities, contingent on financial feasibility but without a specified price threshold. Such retrofitting presents substantial risks as it supports existing operations with uncertain reconversion prospects, thereby reducing the visibility of the coal phase-out timeline. Vietnamese climate and energy practitioners identified incomplete regulations as the primary barriers to coal power phase-out in Viet Nam, ahead of concerns regarding power supply security and electricity prices (Do & Burke, 2023).

Viet Nam is a signatory of the global pledge to phase out unabated coal-fired power generation and stop construction of new plants (UN Climate Change Conference, 2021). The country is now receiving international support from the International Partners Group (IPG) through the Just Energy Transition Partnership (JETP) platform which aims to accelerate its coal phase-out plan and to achieve net zero by 2050 (European Commission, 2022a).

Coal Supply

Domestic coal production has experienced a threefold increase over the span of two decades, in line with the fast growth in coal consumption over the same timeframe (Do & Burke, 2023). This expansion remains insufficient to satisfy the economy’s growing demand, leading Viet Nam to become a net coal importer in 2015.

The Master Plan on National Energy aims at decreasing coal production from 48 million tonne per year (Mtpa) in 2021 to 41-47 Mtpa in 2030, 39 Mtpa by 2045 and 33 Mtpa by 2050 (Do & Burke, 2023; Government of Viet Nam, 2023). Imports are projected to increase from 55 Mt in 2021 to 73 Mtpa by 2030, 85 by 2035, before decreasing to 50 Mtpa by 2045 (Do & Burke, 2023; Government of Viet Nam, 2023). The ratio of domestically produced to imported coal will therefore shift from 46% in 2021 to 36-39% in 2030. In the seven first months of 2023, Viet Nam already spent over USD 4bn on imported coal (VietNamNet, 2023).

The Master Plan on National Energy forecasts imports to suddenly drop from 50 Mtpa in 2045 to zero by 2050 (Viet Nam Government, 2023b). While this is an ambitious goal, albeit too late to respect the Paris Agreement’s goal of limiting global warming under 1.5°C degrees, a complete elimination of coal imports within just five years might be overly optimistic and may not be realistically achievable, in contrast to a comprehensive and gradual planning of the transition.

Fossil gas

Fossil gas currently plays a minor role in Viet Nam’s energy system. It accounted for 6% of the primary energy consumption and 11% of power generation in 2021 (Energy Institute, 2023). However, Viet Nam is planning for a rapid growth in fossil gas consumption and will start importing LNG for power generation.

The PDP8 and JETP focus on reducing coal-fired generation, compared to earlier plans, results in a subsequent increase in fossil gas-fired generation. The projected installed fossil gas capacity in 2030 has increased significantly between PDP7 to PDP8, from 19 GW in PDP7 to over 37 GW in the PDP8, compared to 8 GW in 2021 (Ember, 2023; Viet Nam Government, 2023a).

Viet Nam is planning to increase domestic production of gas up to 5.5-15 billion cubic metres per year by 2030, and 10-15 for 2031-2050 (Viet Nam Government, 2023b). The domestic gas production was 7.2 billion cubic metres in 2021 (Energy Institute, 2023).

Viet Nam’s fossil gas generation goals will necessitate fuel imports capacity of 16-18 billion cubic metres per year by 2030 and 11-13 by 2050 (Viet Nam Government, 2023b). The share of LNG is going to be approximately 60% of the total fossil gas-fired power generation capacity (22.4 GW) at the end of the decade (Viet Nam Government, 2023a). In May 2023, the state-owned company PetroViet Nam Gas built the first LNG import terminal in the country (Enerdata, 2023). The current plans for the development of LNG terminals raise concerns that their capacity will not be sufficient to meet the demand implied by the PDP8. Viet Nam has not yet finalised any long-term LNG supply contract (Center on Global Energy Policy, 2023).

Fossil gas is not a transition fuel and hinders progress towards reaching both national and international climate objectives (Climate Analytics, 2021). PDP8 further plans that gas plants project will be transitioned to hydrogen when financial conditions allow it, despite uncertainties regarding the mode of production of the hydrogen consumed.

The massive efforts Viet Nam’s government is directing towards the gas sector development are not 1.5°C compatible and raise the spectre of significant stranded asset risks, with a phase-out timeline contingent upon the technological and economic viability of hydrogen as a fuel. Increasing dependency on imported energy will risk the country's vulnerability to energy security threats in a complex geopolitical landscape.

Renewable energy

In 2021, renewable energy sources accounted for 23% of the country's primary energy consumption and 43% of electricity production, including hydro (Energy Institute, 2023). Hydroelectricity generated 31% of Viet Nam’s electricity in 2021, compared to just 12% from other renewable sources, including wind and solar (Energy Institute, 2023).

The PDP8 targets 31-39% of renewable power generation by 2030 (47% in the case of a “full and substantial implementation” of the JETP) and 68-72% by 2050. This represents a significant increase compared to the goals set in the 2022 National Climate Change Strategy, aiming to achieve a combined renewable energy capacity share, including hydro, of at least 33% of the electricity mix by 2030 and 55% by 2050 (Viet Nam Government, 2022d).

The target set by the PDP8 is nevertheless underwhelming considering Viet Nam’s significant renewable potential, and the strong growth of rooftop solar PV deployment in the last few years. As per the PDP8, solar energy has a technical potential of 963 GW, onshore wind stands at 221 GW, and offshore wind is estimated at 600 GW (Viet Nam Government, 2023b). This represents a renewable energy potential that is more than twenty-four times larger than Viet Nam's installed power capacity in 2021 (Ember, 2023).

The PDP8 targets indicate a slowing down of the deployment of photovoltaic panels, in contrast to the momentum of recent years. The PDP8 aims at deploying 6.7 GW of solar PVs (including rooftop solar) during the rest of the decade, while 12 GW have been installed between 2019 and 2020 (see section on solar energy). However, wind energy is anticipated to undergo rapid expansion, with a 2030 target of 27.9 GW compared to an installed capacity of 4.1 GW in 2021 (Ember, 2023; Viet Nam Government, 2023a).

In addition to the PDP8 and the 2022 National Climate Change Strategy, Resolution 55 supports policies to promote clean energy (Viet Nam Government, 2020). Resolution 55 includes a new renewable energy target for renewables to represent 15-20% in 2030 and 25-30% in 2045 in the total primary energy supply, in line with the targets from the Master Plan on National Energy (Viet Nam Government, 2020a, 2023b).

Solar

Solar PV deployment in Viet Nam has experienced rapid growth, particularly until 2021. At the end of 2021, the installed solar capacity was 16.7 GW, including 7.6 GW of rooftop solar (Ember, 2023).

Through the PDP8, the government aims to achieve a target of 12.8 GW of solar power capacity (excluding rooftop solar), representing 8.5% of the total installed capacity by 2030. This target reflects a 41% increase compared to current levels. The share of solar capacity is then projected to rise to 35-37% by 2050 (Viet Nam Government, 2023a).

The government mentions the deployment of 2.6 GW of rooftop solar capacity throughout the decade but does not incorporate a targeted installed rooftop PV capacity in its forecasted 2030 power mix. The PDP8 also includes a goal of implementing rooftop solar systems for self-consumption in 50% of office buildings and 50% of houses, with the implementation of net metering systems (Viet Nam Government, 2023a).

Viet Nam added more solar power capacity than all other ASEAN countries combined in 2020 (Ember, 2022). Between 2019 and 2020, Viet Nam's solar capacity increased by 11.7 GW (EVN, 2021). The solar boom experienced in Viet Nam can be attributed to a well-designed policy mix, which includes generous feed-in-tariffs and the exemption of renewable energy producers from income tax, import tariffs, and land lease payments. Viet Nam accomplished its 2025 solar targets as early as 2020 (Ember, 2022). The average investment cost and levelised cost of energy for solar in Viet Nam are the lowest among the ASEAN countries, at respectively USD 690 per KW and USD 0.046 per kWh (IRENA, 2022).

Although the policies implemented have been successful at driving investment in Viet Nam’s renewable energy sector, the lack of planning in transmission and distribution resulted in a severe grid failure (GREENCIC, 2023). Viet Nam's solar PVs boom has led the National Load Dispatch Centre to announce a pause in new renewable capacity deployments in 2022 (IUCN, 2022).

The solar deployment has been concentrated in the centre and south of the country, with solar energy comprising over 60% of installed capacity in some regions (IUCN, 2022). The lack of accurate production forecasts contributes to the challenges experienced by the grid (VNEEC, 2023a). Prioritising the fast-tracking of approvals and investments in upgrading the power grid’s transmission and distribution infrastructure, as well as fostering interconnectivity among regions are key to maximise the potential of renewables (World Bank, 2023).

Hydro

Hydro power is the largest source of renewable energy in Viet Nam, representing 16% of the primary energy supply and 31% of the electricity generation mix in 2021 (Ember, 2023; Energy Institute, 2023). The riverscapes of Viet Nam are among the most exploited in the world (Sasges & Ziegler, 2023).

The PDP8 reiterates Viet Nam's commitment to harnessing the full potential of its hydro resources. The projected total hydro capacity is expected to reach 29 GW in 2030 and 36 GW in 2050, which signifies a significant increase from the 22 GW capacity recorded in 2021 (Ember, 2023). According to the National Climate Change Strategy, Viet Nam will pursue the development of small hydro plants that adhere to environmental protection standards, while also expanding medium and large-scale hydroelectric projects (Viet Nam Government, 2022b).

Climate change risks disrupt water flows, intensify seasons, and heighten evaporation, directly impacting Viet Nam's hydroelectric production. The 2023 droughts caused the water levels in multiple reservoirs around the country to drop below the levels required for turbine operations (Asia News Network, 2023). The mean hydropower capacity factor in Mainland Southeast Asia is set to drop by 6-8% below 1970-2000 levels by the end of the century (IEA, 2021a).

Wind

Although not as generous as those for solar power, the implementation of feed-in-tariff mechanisms specifically designed for wind energy sources has still attracted new investments in wind power projects (Do et al., 2021). The installed onshore capacity reached 4.1 GW at the end of 2021 (Ember, 2023). The PDP8 targets a deployment of 21.9 GW by 2030 (Viet Nam Government, 2023a).

Viet Nam's vast coastlines offer substantial potential for offshore wind energy, estimated at 600 GW in the PDP8. The plans outlined in the PDP8 include a target of 6 GW of offshore wind capacity by 2030. The total wind power capacity is expected to increase to 130-169 GW by 2050, with 70-92 GW of offshore wind (Viet Nam Government, 2023a).

Industry

Industrial process emissions are mainly from cement production, followed by steel and ammonia production (MNRE, 2019). This sector is projected to be the second largest in terms of emissions by 2030 based on the current policy pathway. It is also set to be the sector with the biggest health impact (EREA & DEA, 2021). Viet Nam’s first NDC excluded industrial process emissions, but its 2020 and 2022 NDC updates did (Viet Nam Government, 2022a).

In 2015, the Minister of Industry and Trade approved the Green Growth Action Plan 2015-2020 for the industry sector, and the Ministry of Construction has an action plan until 2020 to reduce cement industry GHG emissions (MNRE, 2019). The plan aims to reduce emissions by 20 MtCO2e by 2020 and 164 MtCO2e by 2030 compared to BAU levels (MNRE, 2019). The policy targets energy-related emissions, but not process-related emissions.

The Viet Nam National Energy Efficiency Program 3 (VNEEP3) sets energy efficiency targets for the industry sector, to reduce 2030 average energy consumption in subsectors compared to 2015-2018 levels (MOIT, 2019). For instance, the chemical industry has a target to reduce average energy consumption by at least 10%, and the cement industry has a target to reduce average energy consumption to produce one tonne of cement from 87kgOE in 2015 to 81 kgOE in 2030 (MOIT, 2019). VNEEP3 sets targets for newly built industrial parks to apply energy efficiency and conservation solutions by 2025 among other targets (MOIT, 2019).

Transport

The transport sector accounted for 23% of Viet Nam's total final energy consumption in 2018 (APEC, 2022). In July 2022, Viet Nam adopted a roadmap for the transition to green energy in the transport sector, with electrification and use of green energy, targeting 100% of clean transportation by 2050 (Viet Nam Government, 2022c).

In the urban transport sector, this roadmap sets the goal that by 2025 new buses will be using electricity or green energy, that all new taxis will be electric vehicle by 2030, and that 100% buses and taxis will be either electrified or will use green energy by 2050. This roadmap includes interim targets for electrification of railways and shipping. Battery electric vehicles are already exempt from registration fees from three years starting March 2022 (Le & Posada, 2022).

The roadmap promotes blending and use of E5 gas for 100% of road motor vehicles. The government has a roadmap to mix A92 gasoline with at least 5% bioethanol, and compulsory energy labelling for LDVs and motorcycles.

Two wheelers are the main mode of transport in Viet Nam, meeting 73% and 82% of the travel demand in Hanoi and Ho Chi Minh City (Le & Posada, 2022). As of 2022, the registered number of two wheelers had already reached 65 million and roughly two-thirds of the population own a motorcycle (Nguyen, 2022). Viet Nam is the second largest electric two wheeler market in the world, after China (MotorcyclesData, 2022). As of the end of 2022, there were two million electric two wheelers on Viet Nam’s roads, accounting for close to 3% of the national fleet (Viet Nam News, 2023).

Sales of electric vehicles (EV) are modest, reaching 8,400 units in 2022. EV penetration is at the same level as two wheelers, at 2.9% (CNBC, 2023). The manufacture and adoption of electric vehicles have been given preferential treatment by the Vietnamese government (Le et al., 2022b).

To reduce energy use of this sector the National Strategy for Climate Change to 2050 includes measures for restructuring the transport market, including the transition from road transport to inland waterway and coastal transport; make the transition from road to railway, increase railway goods transport percentage; increase transport efficiency via building and expanding road network (Viet Nam Government, 2022b).

Buildings

Energy demand in the building sector has risen in the past decade as result of Viet Nam’s successful implementation of universal electrification and increase in use of electrical home appliances (APEC, 2022; APERC, 2019). In recent times use of biomass has seen a significant drop because of increase electrification (APEC, 2022). The residential sector accounts for 18% of the total final energy consumption in 2017 (IEA, 2019).

The government has introduced some energy efficiency policies, including the VNEEP3 (MOIT, 2019). An official Prime Minister Decision (No.04/2017/QD-TTg) in 2017 sets out mandatory energy labelling and minimum energy efficiency standards roadmap for equipment and appliances (MOIT, 2019). In the National Green Growth Strategy there are specific tasks relating to the development of green buildings, and energy efficiency of buildings (MNRE, 2019).

Agriculture

In 2021, agriculture represented 18% of Viet Nam’s GHG emissions (Gütschow et al., 2022a). A decision by the Minister of Agriculture and Rural Development approved a programme to reduce GHG emissions in the agriculture sector to 2020, promoting low carbon agriculture (MNRE, 2019). As per the Methane Emissions Reduction Action Plan, the objective is to limit methane emissions from agriculture, setting goals to limit cultivation emissions to 30.7 (42.2) MtCO2e and animal husbandry emissions to 15.2 (16.8) MtCO2e by 2030 (2025) (Viet Nam Government, 2022c).

The National Strategy for Climate Change to 2050 calls for a 43% emissions reduction from this sector from its 2030 BAU level and limit the emissions at 64 MtCO2e by 2030 from current level of 78 MtCO2e (Gütschow et al., 2022a). Under broad measures and action in the agricultural sector this strategy has also proposed promoting agricultural restructuring, adopting smart agricultural solutions adapting to climate change and utilising advantages of tropical agriculture and develop organic agriculture. In the short run until 2030, Viet Nam’s focus would be on shifting cultivar and domestic animal compositions to smartly adapt to climate change while securing food supply of its population.

Forestry

Viet Nam’s land use, land use change and forestry sector is currently a net sink. Viet Nam’s LULUCF sector is intended to play a large role in meeting Viet Nam’s updated NDC. Under the government reported business-as-usual scenario (BAU), the LULUCF sector is estimated to be a sink of 49 MtCO2e in 2030 (Viet Nam Government, 2022a).

In its 2050 National Climate Change Strategy, Viet Nam has set a target for land use and forestry sector to reduce 70% of emission and increase 20% of carbon absorption and achieve a total sink capacity of 95 MtCO2e by 2030. It also includes maintaining forest coverage at 43% and improve forest quality and sustainable forest management (Viet Nam Government, 2022d).

The 2017 Law on Forestry regulates the management of forests, and notes that an assessment is needed to limit forest loss and conserve the forests (MNRE, 2019). The National Action Programme on the Reduction of GHG Emissions Reduction of Deforestation and Forest Degradation, Sustainable Management of Forest Resources, and Conservation and Enhancement of Forest Carbon Stocks (REDD+) by 2030, was approved in 2017 (MNRE, 2019).

Waste

In 2021, the waste sector represented 5% of Viet Nam’s GHG emissions excluding LULUCF (Gütschow et al., 2022a). In 2018 the Prime Minister approved the National Strategy for General Management of Solid Waste to 2025 with a 2050 vision, which included energy recovery and GHG reduction (MNRE, 2019).

According to the 2050 National Climate Change Strategy, the emissions reduction from the waste sector would be 61% by 2030 and 91% by 2050. This is supported by policy plans such as implementing solutions for managing and reducing waste from production to consumption, expand responsibilities of manufacturers; increase reuse and recycling of waste.

Viet Nam will also adopt advanced solutions in treating wastes and wastewater to reduce methane emissions (Viet Nam Government, 2022d). The Methane Emissions Reduction Action Plan includes the goal of cutting methane emissions from solid waste management and wastewater treatment by 13% at 22 MtCO2e by 2025, and by 30% at 17.5 MtCO2e by 2030, compared to an implied 2020 baseline level of 25.3 MtCO2e (Viet Nam Government, 2022c).

The PDP8 promotes power generation through organic and solid waste combustion, with estimated potentials of 7 GW and 1.8 GW. The plan aims for 2.3 GW by 2030 and 6 GW by 2050 (Viet Nam Government, 2023a).

Endorsed through a resolution in June 2022, the Circular Economic Development Project strives to cut GHG intensity as part of the GDP by 15% below 2014 levels by 2030. It sets a target reutilising, recycling, and treating 85% of plastic waste, alongside a 50% reduction in plastic waste releases in the oceans. The project establishes objectives of capturing and managing 50% of solid waste in urban areas, achieving complete organic waste treatment in urban regions, and attaining 70% in rural zones (Viet Nam Government, 2022a).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter