Exploring new electric vehicle roadmaps for China in a post-COVID-19 era

Attachments

Summary

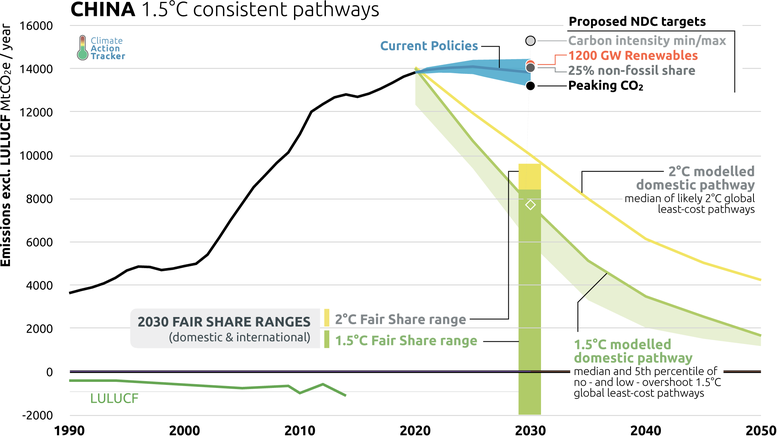

Over the last two years China’s long-term mitigation options have gathered increasing international interest and scrutiny, as the country, currently the world’s largest emitter, has announced and formalised a series of climate targets.

In 2020, China announced its aim to achieve carbon neutrality before 2060, a move that we estimated would lower global warming projections by around 0.2 to 0.3°C by the end of the century. The government then proposed strengthened NDC targets and issued the primary components of its 14th Five Year Plan (2021-2025), including a peak date for coal. It has not yet submitted a strengthened NDC to the UNFCCC.

China’s economic stimulus response to the COVID-19 pandemic initially signalled a greener recovery than in previous economic downturns, but its response instead devolved into a carbon-intensive recovery based on heavy industry, construction, and further coal development.

Transitioning to electrified transport

China is currently the global leader in battery electric vehicle (BEV) sales annually, a position it has held since 2015 when it surpassed the US. The one positive policy priority in China’s COVID-19 recovery focused on transitioning the transport sector towards development of public transport systems and electrified transport. New energy vehicles (NEVs), which include battery electric vehicles (BEVs), plug-in hybrid vehicles (PHEVs), and hydrogen cars, received large boosts in the form of extended purchase subsidy schemes, investment in charging infrastructure, and lowering market entry barriers for BEV producers.

Decarbonising the transport sector is critical to China’s road to carbon neutrality as it is the country’s second largest emitting sector after industry and accounts for almost 20% of national primary energy consumption. Within the sector, China’s massive light-duty vehicle (LDV) car fleet is the primary consumer of energy and emitter of carbon dioxide (and other pollutants), and is projected to grow until 2050, where it remains the primary mode of transport. This subsector thus contains significant opportunities to help the country achieve its climate targets while attaining other socioeconomic benefits such as the reduction of air pollution.

Exploring three scenarios

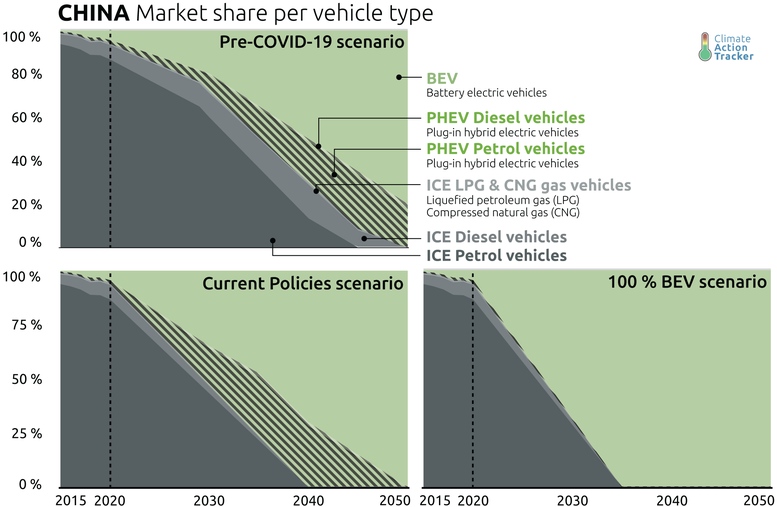

In order to inform on emission reduction and electricity demand implications, we explore several sets of scenarios for the evolution of the passenger vehicle stock in China.

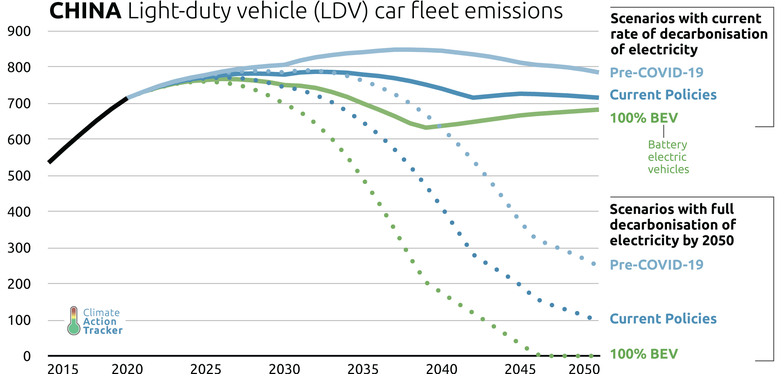

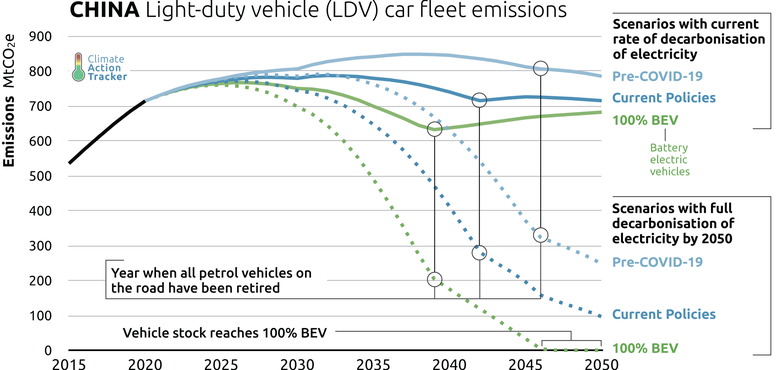

For each of the three scenarios — Pre-COVID-19, Current Policies, 100% BEV — we explore two sets of separate emission pathways (“Renewable Electricity” and “Fossil Electricity”), which assumes either strict decarbonisation of the power sector until 2050 or decarbonisation at current rate.

Pre-COVID-19 Scenario

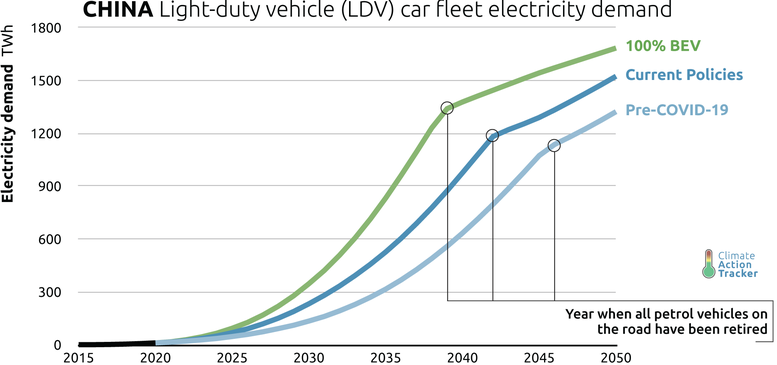

The Pre-COVID-19 scenario emissions from passenger cars peak in 2037 and result in levels of 250 to 790 MtCO2/yr in 2050, depending on the carbon intensity of electricity. Electricity demand from the BEV and PHEV fleet reaches 1,320 TWh/yr in 2050; by way of comparison, this is roughly equivalent to India’s current annual electricity consumption

This scenario does not account for policy developments since the start of the pandemic.

Current Policy scenario

In our Current Policy scenario, which accounts for both implemented and stated policies made since April 2020 until January 2021, emissions from passenger cars peak in 2032 and result in levels of 100 to 720 MtCO2/yr in 2050. This is a 9% to 61% reduction under the pre-COVID-19 scenario. Electricity demand reaches 1,520 TWh/yr.

100% Battery Electric Vehicles

In our 100% Battery Electric Vehicles (BEV) scenario, which explores the implications of China reaching 100% BEV sales by 2035, emissions from passenger cars peak in 2026. It results in levels of 0 to 680 MtCO2/yr in 2050 which is a 13% to 100% reduction under the pre-COVID-19 scenario. Electricity demand reaches over 1,680 TWh/yr, which is roughly the current annual electricity consumption of both India and Germany combined.

Key conclusion 1

China’s aggressive post-COVID-19 policies to support new energy vehicle (NEV) penetration are positive, but more effort is required to make a large impact on reducing carbon emissions in the light-duty vehicles (LDV) sub-sector.

Under a Current Policy scenario, all of China’s new implemented and planned policies since April 2020 have the potential to substantially reduce carbon emissions from LDV.

However, LDVs emissions levels could still reach over 700 MtCO2/yr in 2050 without additional mitigation action in NEVs or in decarbonising electricity. This throws China’s carbon neutrality target into doubt.

Key conclusion 2

Decarbonisation of the light duty vehicle (LDV) fleet will be a dedicated long-term effort in China. It is on the timescale of several decades and requires immediate action to build momentum.

China’s Current Policy scenario and 100% battery energy vehicle scenarios represent some of the most ambitious NEV penetration pathways internationally. However, the emission reductions are negligible in the short term and minor in the medium. This is due to the time needed to retire the immense size of the vehicle stock and low starting share of NEVs on the road.

In 2030, only a maximum of 110 MtCO2/yr of emission reductions separate the least and most ambitious scenarios; we only start to see large impacts from NEV penetration and decreasing electricity emissions close to 2040. Rapid early retirement and replacement of ICE vehicles are needed.

Key conclusion 3

Emission reductions from ambitious electric vehicle policies in China are negligible unless coupled with a transformational shift to a low-carbon electricity sector

The future electricity demand of China’s NEV fleet will be gargantuan at approximately 1,300 to 1,600 TWh/yr in all three scenarios. Their significance is driven by the emissions intensity of the power sector.

Without also decarbonising electricity production, the Current Policy and 100% BEV scenario would only reduce emissions by 9% to 13% from the Pre-COVID-19 scenario by 2050. That is compared to 88% to 100% if the power sector is decarbonised.

Key conclusion 4

For China to achieve its long-term carbon neutrality goal by 2060, achievement of a 100% BEV vehicle stock is required, along with power sector decarbonisation.

The 100% BEV & Renewable Electricity scenario, coupling full modal share from BEVs with a fully decarbonised power sector is the most ambitious scenario in this analysis. It could reduce carbon emissions from LDVs to zero, and emissions in the transport sector by 790 MtCO2/yr in 2050.

Given the power sector is the most technologically mature sector ready to be decarbonised, China’s policy intentions to transform its national LDV fleet, and existing market trends, this mitigation roadmap could be an attractive and feasible target for Chinese policymaking. If this roadmap were achieved, these emission reductions from one sub-sector intervention would be equivalent to around 15% of China’s projected emissions in 2050.

To find out more, please read the full analysis by clicking the button below. You can also visit the main country assessment page for China by clicking here.

Stay informed

Subscribe to our newsletter