Country summary

Assessment

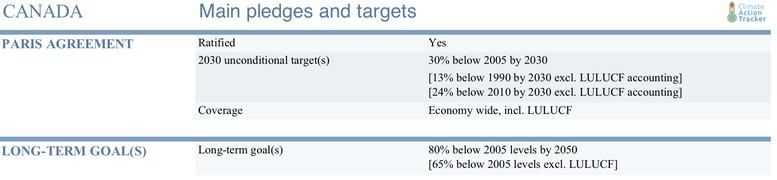

NDC update: In April 2021, Canada proposed updated NDC targets. Here is our analysis of the announcement.

The Canadian government is at a crossroads: it could either continue with the slow implementation of an inadequate climate plan, or adopt a recovery package that accelerates the transition to a zero emissions future. During the last election (October 2019), the government made a number of promises to scale up climate action, including exceeding the country’s 2030 NDC target and achieving net zero emissions by 2050, but has done little to deliver on this in the intervening months. The CAT rates Canada as ‘Insufficient’.

We expect GHG emissions to be 11 to 13% lower in 2020 compared to 2019, due to the economic slowdown of the pandemic. Oil and gas supply could drop by 8% this year, but is expected to rebound in 2021. Road transport dropped from March to June around the height of lockdowns across the country. Domestic aviation was down 72% in April compared to the same time last year and has been slow to recover.

Prior to the pandemic, Canada was far from meeting its ‘Insufficient’ NDC under its current or planned policies. While 2030 projections are uncertain and are likely to be lower due to slower economic growth, the country still may not meet its NDC with the combined effect of current or planned policies and the pandemic. Much greater action is needed to ‘exceed’ its NDC as promised.

Whether and how any behavioural changes from the pandemic affects GHG emissions in the long-term is unclear; however, previous CAT analysis has shown that the extent to which recovery measures support green climate action has a much greater impact on lowering emissions in 2030 than the temporary drop in emissions due to the lockdown and associated economic impact.

There has been little support for a green recovery in the measures implemented to date. Much of Canada’s CAD 200+ billion COVID-19 Economic Recovery Plan is focused on helping affected individuals and businesses address the immediate health and economic impacts of the pandemic. The package has provided CAD 2.5 billion in support to the oil and gas sector to clean up orphan and inactive wells and to reduce fugitive methane emissions. Depending on how this support is structured, it could undermine the polluter pays principle. CAD 330 million has also been provided to the country’s airports. On the positive side, large employers who wish to access support will need to publish annual climate-related financial disclosure reports and outline how they are contributing to achieving Canada’s NDC and other Paris commitments. The government has also provided some resources to help redistribute food and avoid food waste.

The true test to determine whether the recovery will be green comes on September 23, 2020 when the government will outline its legislative agenda for the next Parliamentary session. As a minority government, it will need the support of other parties to implement this agenda or Canadians could face a snap election.

Implementation of the Pan-Canadian Framework on Clean Growth and Climate Change, the government’s climate strategy, continues; however, the pandemic has caused some delays in advancing or implementing regulations. Advancing action on transport regulations has also been marred by uncertainty due to the recent rollbacks in the USA on fuel economy standards for cars and light-duty trucks, to which Canadian standards are aligned.

As a founding member of the Powering Past Coal Alliance, Canada came under fire recently for its hypocritical stance on coal mining. The Minister of Environment and Climate Change declined to subject a coal mine expansion to a federal environmental impact assessment last year, though he reversed his decision in July. The Alliance is committed to phasing out coal-fired electricity in the OECD by 2030 and globally by 2050 (though our research shows that it is a decade too late). The coal from this mining project would be exported to Asia to power its electricity consumption.

The exodus of companies and investors from the oil sands projects continue. French energy giant, Total, wrote down two of its assets as ‘stranded’, withdrew from a leading industry advocacy group over divergent public positions, and halted any further increase in capacity of its existing assets, while Deutsche Bank announced it would no longer provide financing for oil sands projects.

Canada continues to expand its LNG production and anticipates exporting large quantities of LNG beginning in 2024 through to 2040. In early 2020, renewed protests by Indigenous groups over the construction of a natural gas pipeline on their territory led to solidarity protests and blockages across the country and were linked to Berkshire Hathaway’s decision to pull out of investing in an LNG facility in another part of the country.

In 2019, Canada adopted a 2050 target of net zero emissions; however, it has yet to enshrine that target into law or release a plan to achieve it.

Mandatory carbon pricing has been in effect across the country since 2019. The government is working on a GHG offset system for activities not covered by carbon pricing, with an initial focus on voluntary projects in the agriculture, waste and forestry sectors. Its carbon pricing legislation faces a number of legal challenges in federal and provincial courts. Consideration by the country’s top court was delayed by the pandemic; however, the case will now be heard in late September 2020.

Canada has committed to reducing methane emissions from its oil and gas sector by 40-45% below 2012 levels by 2025. Regulations supporting this target came into effect in early 2020, but enforcement of the need to detect and repair leaks has been hampered by the pandemic. It is also unclear what impact, if any, government recovery measures focused on supporting methane reductions will have on the compliance costs of these regulations.

The latest challenge to the Trans Mountain pipeline was dismissed by the country’s top court in July. The government has said it will use some of the revenue from the pipeline to cover the costs of its commitment to plant two billion trees over the next decade. Nature-based solutions can contribute to climate protection when parred with initiatives to decarbonise the economy, not expand fossil fuel developments.

Transport is the second largest source of emissions in Canada, after the oil and gas sector, with transportation representing about a quarter of the country’s emissions (Environment and Climate Change Canada, 2020a; Government of Canada, 2020a). Canadian fuel economy standards for light and heavy-duty vehicles are aligned with federal-level regulations in the USA. While Canada has begun a review of its own regulations for 2022-2025 model years, it decided to wait until the final ruling in the USA before proceeding with any changes.

In 2019, Canada adopted sales targets for zero-emissions passenger vehicles of 10% by 2025, 30% by 2030 and 100% by 2040 and has allocated funding to support expanding EV charging infrastructure. In 2019, EV sales grew by 25% compared to 2018; however, the total portion of sales remain small at 5%. In 2020, the government launched a programme to support awareness raising with respect to EV usage.

The Clean Fuel Standard was announced in 2016, as part of government’s overarching climate plan, to reduce emissions from fuels used in transportation, buildings and industry. The standard is expected to cut emissions by 30Mt annually from 2030. Developing and implementing the standard has been slow and is now further delayed by the pandemic, though the start date in 2022 for liquid fuels remains unchanged

A little over a tenth of Canada’s emissions are from the buildings sector (excluding electricity) (Environment and Climate Change Canada, 2020a). The government had made some progress in the sector through updating its energy efficiency regulations for a number of residential and commercial products (water heaters, furnaces, etc) and advancing changes to its model building and energy codes. However, more needs to be done.

75% of Canada buildings that will exist in 2030 have already been built, thus making accelerating energy efficient renovations and retrofits crucial to decarbonising the sector and can play a key role in the recovery through job creation. While the CAT has not undertaken building stock analysis for Canada, we estimate that the USA and the EU would need to renovate 3.5% of their existing building stock per year in order to be compatible with the Paris Agreement’s 1.5C temperature limit. Historic data on renovations is hard to come by, but is extremely low.

Electricity generation is currently responsible for around one tenth of Canada’ emissions; however, prior to the pandemic, it was the sector that was projected to contribute the most to emission reductions by 2030 (Environment and Climate Change Canada, 2020a). The country has the regulatory framework in place to phase out unabated coal by 2030, but will replace a lot of the capacity with natural gas.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter