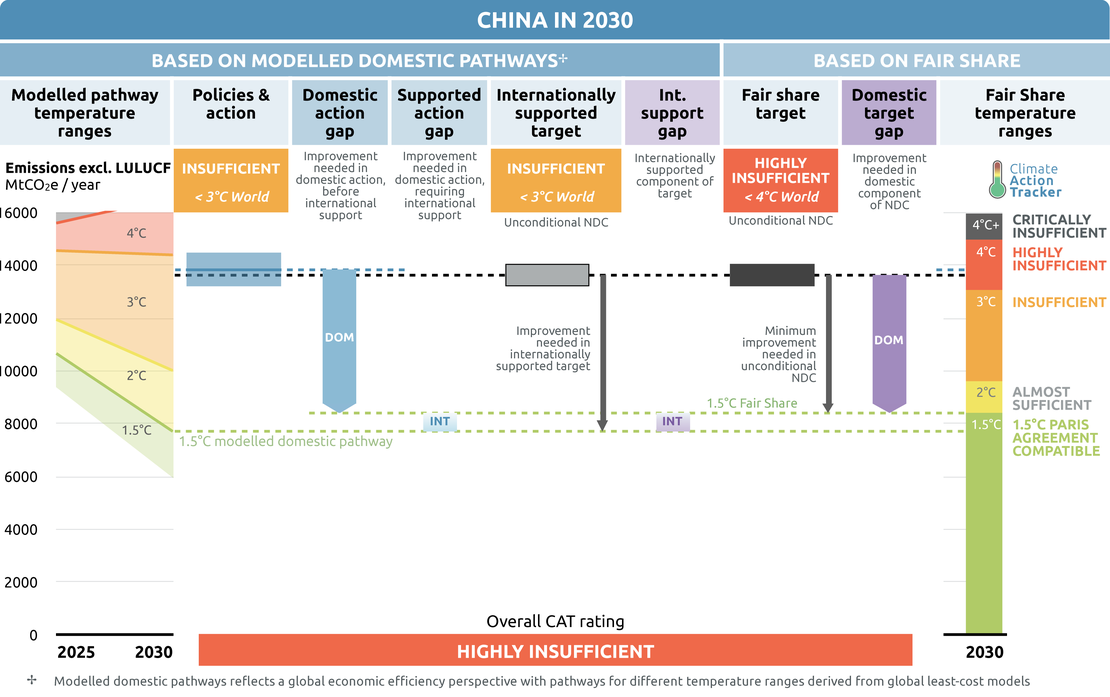

Policies & action

According to our analysis, China is within reach of meeting its most binding existing and proposed NDC targets under its current policies projections and expected to overachieve its proposed carbon intensity NDC targets. The projections have been revised to GHG emissions levels of 13.2 to 14.5 GtCO2e/year in 2030 after incorporating latest policy developments and analysis. The CAT rates China’s policies and action as “Insufficient” as current policy projections closely match China’s modelled domestic pathways consistent with global warming of over 2°C and up to 3 °C by the end of the century (if all countries had this level of ambition). The “Insufficient” rating indicates that China’s climate policies and action in 2030 need substantial improvements to be consistent with the Paris Agreement’s 1.5°C temperature limit. China is expected to implement additional policies with its own resources but will also need international support to implement policies in line with full decarbonisation.

Further information on how the CAT rates countries (against modelled domestic pathways and fair share) can be found here.

Policy overview

China’s policy projections (including COVID-19 impacts) have been updated to reach GHG emissions levels (excl. LULUCF) of between 13.2 to 14.5 GtCO2e/yr in 2030, representing an increase in total GHG emissions of 263% to 298% above 1990 levels. The projections suggest China can achieve its proposed NDC targets despite increasing emissions. This now looks more likely with announcements of a coal peak in 2025 from President Xi Jinping at the Leaders Climate Summit (Xinhua, 2021a).

The COVID-19 pandemic led to a lockdown of economic activity in China in 2020, with carbon-intensive manufacturing, construction, and transportation sectors heavily affected. This resulted in an emissions drop of approximately 25% for CO2 and over 30% for nitrous oxide and particulate matter in Q1 2020 (ECMWF, 2020; Evans, 2020; NASA, 2020). By the end of the year, China recorded a GDP growth of 2.3% and an increase in total energy consumption of 2.2% (Reuters, 2021).

The CAT estimates China’s 2020 emissions at 13.8 GtCO2e based on the latest statistics (see Assumptions tab). China fell back on old habits as its short-term pandemic recovery was characterised by surges in carbon-intensive construction and heavy industry activity dependent on fossil fuel consumption. In the second half of 2020, coal consumption rose by 3.2%, oil consumption by 6.5%, and gas consumption by 8.4%. Cement and steel production rose by 8.4 and 12.6% respectively, according to analysis treating China’s annual Statistical Communiques (Myllyvirta, 2021).

In April 2021, President Xi Jinping announced at the Leaders Climate Summit that China will “strictly control coal consumption” over the next 14th Five-year Plan (14th FYP) period (2021-2025) and “phase down coal consumption” over the 15th FYP period (2026-2030) (Xinhua, 2021a). This is significant as it is both the first time China has issued such strong intent on decoupling economic growth from coal and the first time it has suggested a peak year for coal consumption. However, while major global economies such as the US and the EU retired a record amount of coal-fired power plants in 2020, China commissioned 38.4 GW of new plants, representing 76% of the world’s total new coal plant commissions, signalling another year where China held back global progress (outside China, 37.8 GW was retired in 2020) (Global Energy Monitor et al., 2021).

Renewable energy continues to be a national priority amidst the proposed update of the non-fossil share (25% by 2030) and renewable capacity (1,200 GW by 2030) NDC targets. In 2021, the National Energy Administration (NEA) set a further target for renewables to make up half of the country’s installed capacity by 2025 and proposed raising minimum companies’ renewable energy purchases to 40% by 2030 (Daiss, 2021; Xu & Stanway, 2021). Significant boosts to nuclear power plant development are also expected throughout the year, with proposed targets of 70 GW installed in 2025 and 120 installed GW in 2030, as discussed in the drafting of the 14th FYP. China’s 15% gas target in primary energy supply, as outlined in Energy Supply and Consumption Revolution Strategy (2016-2030), has also been incorporated into the analysis as we now deem the target more feasible, after the signals on phasing out coal (Asia Pacific Energy, n.d.).

Industry subsectors have also been galvanised by China’s new climate targets. China's aluminium sector has drafted a target to peak carbon emissions by 2025 and reduce emissions from that peak by 40% in 2040, while the steel sector also targets peak in 2025 but intends to reduce its carbon emissions by 30% from the peak in 2030. In the transport sector, rapid uptake of electric vehicles (EVs) has continued with four million EVs registered in 2020 (Finance Sina, 2021a). Chinese industry officials raised the national new energy vehicle (NEV) sales target from 20% to 25% in 2025 and, last year, even discussed a ban on fossil fuel vehicles and increasing the NEV sales target to 50% to 60%.

China has also launched its national emissions trading system (ETS) in 2021, which initially applies to the power sector (coal and gas plants) and regulates 2,200 companies, covering an estimated 4 GtCO2 per year (ICAP, 2021). The policy instrument aims to encourage further CO2 emissions-intensity improvements of coal plants, as well as earlier retirement for a young coal-fired power plant fleet. However, new studies suggest China’s ETS was oversupplied by 1.56 billion tonnes from 2019 to 2020 – the equivalent of a year’s worth of EU ETS emissions (Gray, 2021). The ETS will expand to seven other sectors in the future (IEA, 2020a).

China’s strategy on its Belt and Road Initiative (BRI), which involves 126 countries that could account for as much as 66% of global carbon emissions in 2050, is still yet to be seen (Jun et al., 2019). From 2014-2019, Chinese banks invested over five times more in developing coal-fired capacity than wind and solar capacity in BRI countries; since 2000, loans have totaled upwards of USD 50bn (Reuters, 2019).

Of all coal-fired power plants under development outside of China, one quarter have been committed to by - or involve proposed funding from - Chinese financial institutions and companies (Shearer et al., 2019). But the global pandemic also impacted BRI, as investments dropped by roughly 50% (25 USD billion) in the first half of 2020 compared to 2019.

While this drop in overall investment led to the highest share of renewable energy investment in BRI since its inception, China’s position as the top global source for coal financing is solidified more than ever. This is particularly glaring as the second and third largest international coal finance lenders (South Korea and Japan) have signalled a move away from such lending in the post-pandemic era. Indeed, South Korea has committed to ending public financing of coal overseas entirely (Climate Action Tracker, 2020a, 2021a; Pearl, 2020). Green development guidelines for BRI projects drafted last year, if implemented, would increase regulations on building coal-fired power plants overseas (Lo, 2020).

Energy supply

Controlling coal consumption

Moving away from coal has seemingly become an urgent political priority for China, a sharp contrast from recent booms in coal development. In 2021, the Central Environmental Inspection Team (CEIT), the President’s environmental whistle-blower, issued a highly publicised criticism of the National Energy Administration (NEA) for negligent coal planning and regulation, stating that this has led to misguided commissioning of projects and China’s well-known overcapacity issues (CEC, 2019; Lo, 2021). The CEIT also criticised the NEA’s treatment of energy security (i.e. coal) as the nation’s top priority while falling behind in low-carbon energy growth. In May, the NEA’s former deputy director joined a growing list of people arrested for corruption (Xinhua, 2021b).

China also doubled down on its campaign to target malpractice in the coal industry, expanding its ongoing inspection of Inner Mongolia’s (China’s largest coal-producing province) practices over the last 20 years, to now cover all civil servants (Zheng, 2021).

In April 2021, President Xi Jinping issued the highest yet signal on coal, announcing at the Leaders Climate Summit that China will “strictly control coal consumption” over the next 14th FYP period (2021-2025) and to “phase down coal consumption” over the 15th FYP (2026-2030) (Xinhua, 2021a). However, this also implies that China intends to increase coal consumption until 2025 to meet its ‘carbon peaking by 2030’ target, and its refusal to add a phase-out year suggests coal will continue to play a core role in energy supply.

China’s increased coal consumption and development in the last half-decade has been inconsistent with the Paris Agreement and exacerbated during the COVID-19 pandemic recovery. In the first half of 2020, China had already permitted more coal capacity additions than the previous two years combined and built more than 10 GW of new plants (CEC, 2020).

Meanwhile, by June 2020, the coal plant construction pipeline increased by 21% to 250 GW, larger than the entire operating coal fleets of the United States (246 GW) or India (229 GW) (Shearer & Myllyvirta, 2020). The 2020 boom resulted from post-covid stimulus recovery in provinces, as coal plant permit regulations were loosened and lending increased (Global Energy Monitor et al., 2021; NEA, 2020; SASAC, 2019). In the first half of 2020 China had roughly 50% of the world’s coal capacity and pipeline and generated more than half (54%) of the world’s coal-fired electricity (Jones et al., 2020; Shearer, 2020).

Coal trends in China have gone in the opposite direction to global trends since 2018. While major global economies such as the US and the EU retired a record number of coal-fired power plants in 2020, China commissioned 38.4 GW of new plants, out of a global total of 50.3 GW commissioned. Since 2016, the country has added 34 GW of coal-fired power plants per year on average, while added coal capacity outside China has been declining since 2018 (Global Energy Monitor et al., 2021).

Politically, over the last decade the narrative around coal has been a back and forth affair. Controlling and decreasing coal consumption has been China’s explicit policy objective since the development of its National Action Plan on Climate Change (2014–2020), while the 13th Five Year Plan (FYP) period (2016–2020) introduced a slew of coal-related targets, such as a ban on new coal-fired power plants (lifted in 2018), and a cap of 1,100 GW of installed coal capacity. Much hope was placed on 2021’s 14th FYP to put more stringent regulation on coal development. While forthcoming power sector and climate change FYPs may do that later in the year, the first outline suggests that China will remain dependent on the dirtiest of fossil fuels in the next planning period for energy security reasons, a theme stretching across previous decades (Kemp, 2021).

Globally, coal in primary energy will need to decrease by 97% below 2010 levels by 2050 to be compatible with a 1.5°C pathway, while for China, a phase-out before 2040 would be needed (Climate Action Tracker, 2021b). According to the CAT’s current policy projections, coal is expected to generate at least 5,190 TWh in 2030, implying substantial more action is needed if China is to reach its carbon neutrality goal by 2060.

Our projections (see figure below) also shows coal’s share in China’s electricity generation decreasing from 63% in 2020 to between 46% and 52% in 2030. Of the world’s largest emitters, China and India still consume a large share of coal in the power sector and will need to decrease coal’s share in electricity generation substantially in the next decade to stay sector-aligned with long-term Paris temperature goals. However, while the USA and EU have been decreasing their coal intensity over time, they, too, are projected to miss their Paris-compatible benchmarks of phasing out coal (to zero) by 2030 (Climate Action Tracker, 2020b).

Note: current policy projection shown for China is the lower (more ambitious) end of the current policy range

Renewable energy and non-fossil targets

China announced a proposed update to its NDC, with enhanced targets for renewable and non-fossil energy targets. It proposed to increase the share of non-fossil fuels in primary energy consumption to “around 25%” in 2030, (up from “around 20%”), and increase the installed capacity of wind and solar power to 1,200 GW by 2030. While China has yet to officially submit its proposal to the UNFCCC, and more details on sectoral targets from the 14th F YP are yet to be finalised, reaching these targets have become a paramount priority for energy regulators.

In its 13th FYP period (2016–2020), China set the following targets for non-fossil capacity installed by 2020: 340 GW of hydropower, 200 GW of wind power, 15 GW from biomass and 120 GW of solar power, as well as 58 GW of nuclear capacity (NDRC, 2016). According to our analysis, China achieved the hydro, wind, biomass, and solar capacity targets but falls short of its nuclear capacity targets by 5 GW.

In 2021, the National Energy Administration (NEA) set a target for renewables to make up half of the country’s installed capacity by 2025 (Daiss, 2021). The NEA has now also proposed raising minimum company renewable energy purchases to 40% by 2030 (Xu & Stanway, 2021). The 14th FYP also set an interim target in the NDC with a 20% non-fossil share target in 2025. The CAT projects these policies having a significant impact on China’s current policies scenario, revising the higher bound downward from 14.7 to 14.5 GtCO2e in 2030. After a three-year freeze on nuclear plant approvals, China is proposing building new nuclear projects to reach 70 GW of capacity in 2025 (Reuters, 2018). Further proposals from industry suggest additional targets of 110 GW in 2030 and 180 GW in 2035. As the nuclear targets are not yet confirmed, these are not included in our policy projections.

The rate of renewables installations had been slowing in 2018 and 2019 before rebounding in 2020, due to the government’s decision to start phasing out renewable feed-in tariffs in 2018 and aim for zero-subsidy instalments by 2021 (Hove, 2020; Stanway, 2019). The decision resulted from both the cost of renewables falling globally and renewable subsidies mounting a deficit of over CNY 100 billion in China (Hang, 2019). As these technologies become more cost-competitive, policymakers have turned their attention to supporting offshore wind and utility-scale solar instead (Hove, 2020). In a flurry to get projects connected before the deadline, reports show that wind and solar power capacity rose by 72 GW and 48 GW, a YOY increase by 178% and 60% respectively (Murtaugh, 2021). While onshore wind projects may experience a dip in 2021, this is likely to be offset by offshore wind installations, while solar additions are forecast to remain stable (Xia, 2021). In 2021, the NEA claimed it will raise generation from wind and solar to 11% while the China Electricity Council (CEC) forecasts an addition of 140 GW of non-fossil capacity, mostly from solar, wind and nuclear (CEC, 2021; Daiss, 2021). These additions could surpass coal capacity additions for the first time to help supply energy for the 6-7% YOY increase in generation forecasted.

Our analysis projects renewable energy generation (mostly solar and wind) shares of 34% to 44% in 2030 under current policies (see graph below).

Industry

In 2020, industry accounted for an estimated 63% of all China’s CO2 emissions (direct and including electricity) (N. Zhou et al., 2020). In efforts to boost the manufacturing sector, the government moved to delay the need for companies to meet environmental regulations and waived electricity bills for large industries to keep production levels high (China - Energy Policy Tracker, 2020).

Steel and cement output from real estate and infrastructure construction, which had been largely responsible for growing emissions in the year leading up to the pandemic, got a boost when economic stimulus targeted infrastructure construction. While subsectors such as cement and oil product production dropped significantly in the first months of 2020, the second half of the year showed cement production reversing its trend, increasing by 8.4%, while steel production increased by 12.6%. China’s CO2 emissions surged 4% over the same period (Myllyvirta, 2021).

Given the Chinese industry’s gargantuan energy consumption, its subsectors play a large role in the achievement of national climate and energy targets. So far, key sectors have been rising to the challenge and aligning expectations with the 14th FYP and proposed NDC update. According to the draft version of the 'Nonferrous Metals Industry Carbon Peak Action Plan' - now in consultation with stakeholders - China's aluminum sector will target a peak in carbon emissions by 2025, although analysts claim this may be sooner, and to reduce emissions from that peak by 40% in 2040 (Bloomberg, 2021; EEO, 2021). Meanwhile, the steel sector also targets a peak in 2025 and aims to reduce its carbon emissions by 30% from the peak in 2030 (Finance Sina, 2021b).

It remains unclear how these targets will affect China’s New Infrastructure Plan, the country’s strategic goal to transition its industrial sector towards research and development and technological innovation, as the initiative places a heavy need for construction materials. China is also set to release the China Standards 2035 plan, which aims to use the technological advantage gained in Made in China 2025 to set domestic – and eventually global – industry standards for next-generation technologies such as 5G, the Internet of Things (IoT), and artificial intelligence (Koty, 2020). There have been no significant policies to date to attempt decarbonising these two difficult-to-abate sectors, although CCS/CCUS continues to be a priority research area for Chinese industry.

Since the 12th FYP, the government has been aiming for low-carbon industrial growth by implementing several energy efficiency and green growth strategies outlined in documents such as the Programme for the Construction of an Energy-Saving Standard System in 2017. These include enabling 80% of China’s energy efficiency standards to be on par with international standards by 2020, and the Industrial Green Development Plan (2016–2020), which promotes green supply chains (Gallagher et al., 2019).

China has further been active in tackling non-CO2 emissions, most notably in regulating hydrofluorocarbon (HFC) emissions from refrigeration and cooling activities embedded in many industrial activities. Currently, China produces – and consumes - more than 60% of the world’s HFCs. China’s NDC commits to targeted reductions of HCFC22 production of 35% by 2020 and 67.5% by 2025 below 2010 levels, and also refers to controlling HFC23, which is largely a by-product of HCFC-22 production.

In 2014, the last reported year in the Chinese inventory, F-gases accounted for 2.7% of total Chinese greenhouse gas emissions (Government of China, 2018). As there is not yet any clear regulation that assures implementation of these targets, the CAT has not included these reductions in the current policy projections.

In US-China bilateral climate discussions in 2021, both countries recommitted to implement the phasedown of hydrofluorocarbon production and consumption, reflected in the Kigali Amendment, a commitment also re-emphasised in a bilateral agreement between French President Macron and President Xi in 2019 (IGSD, 2019; US DOS, 2021). In our current policies scenario, HCFC-22 is phased out with existing efforts to satisfy the Kigali Amendment, although other HFC gases continue to increase without more substantive abatement policy, based on Lin et al., (2019). It is estimated that a full phaseout of all HFC gases could reduce China’s emissions by more than 650 MtCO2e/yr in 2050 compared to current policies (Lin et al., 2019).

Transport

China’s transport sector is a vast consumer of energy (trailing only the industry sector) and accounts for almost 20% of national primary energy consumption (N. Zhou et al., 2020). Urban passenger transport is the primary end-use sub-sector, with activity having increased ten-fold from 2005 to 2019 (Energy Foundation China, 2020).

Road transport, and specifically gasoline passenger cars, has been the largest source of emissions. China’s prioritisation of new energy vehicle (NEVs) uptake, including battery electric vehicles (EVs), plug-in hybrid vehicles (PHEVs), and fuel cell electric vehicles (FCEVs), has been documented as far back as the 1990s but only in the last half-decade has it boomed in China, with four million EVs now registered in 2020 (approximately 1.5% of the total car fleet) (Finance Sina, 2021a). This represents an increase of more than a million added NEVs from 2019, the third consecutive year China achieved that feat. To limit the global temperature increase to 1.5°C, China’s EV stock will need to make up 35% to 50% of the entire car fleet by 2040, when the last fossil fuel car will also need to be sold (Climate Action Tracker, 2020b).

As of 2019, the implemented NEV mandate required automakers to amass credits for the sale of their car fleets, with NEVs making up 10% of annual credits in 2019 and 12% in 2020. This system will be continually tightened, ensuring car manufacturers reach increasingly higher NEV production targets from 2021-2023. China’s high-level policy signals also back up these targets, having raised the national NEV sales target to 20% in 2025 (Xinhua, 2020). In 2020, industry officials briefly discussed a ban on fossil fuel vehicles before rebuffing the idea, although a NEV sales target of 50% -60% in 2035 is still possible (Bloomberg Green, 2020).

The growth in NEV sales faltered briefly for a period in 2019-2020 as the government halved purchase subsidies in 2019 and cut a further 10% in 2020, part of a phase-out of incentives that began in 2016 and planned to finish in 2020 (Sun & Goh, 2020; Vincent, 2020). A massive slump in NEV sales in the second half of 2019 followed while the auto industry was hit even harder after the onset of COVID-19. In February 2020, NEV car sales plummeted by 80% compared to the same time in 2019, comparable to the sales slump of other vehicle types (BBC, 2020; IEA, 2020b). The government targeted the NEV sector in its economic recovery packages, extending the subsidy scheme to 2022 and injecting CNY 2.7bn (USD 0.42bn) in BEV charging infrastructure (Cheng, 2020). The reduced emphasis on policy support for NEV industry in the latest 14th FYP suggests the government believes the industry has already matured to be purely demand-driven, and will continue managing the sector with a laissez-faire approach (Shen, 2021). Recent research also suggests that the market is reaching maturity, as BEV initial price parity with conventional cars and sport utility vehicles are likely to be achieved within China in 5-10 years, without yet accounting for fuel savings (Lutsey et al., 2021).

China is also giving high prioritisation to other forms of electrified transport. It already boasts 80% of the world’s public fast chargers (particularly important for electric buses in urban travel) and has outlined expansion of national high-speed rail and local electric public transport systems in its COVID economic stimulus packages. The uptake of electric buses has been rapid, with approximately 84% of the world’s electric buses in 2030 expected to be operating in China (BloombergNEF, 2019a; Eckhouse, 2019). More than 30 Chinese cities have announced plans to completely electrify their taxi and bus fleets by 2022 and municipalities involved in the EV Pilot Cities Programme, such as Shenzhen, virtually already reached these targets several years ago (UNEP, 2019). According to the IEA, 25% of the world’s electric two and three-wheelers in circulation (approximately 350 million) are in China (IEA, 2020b).

China manages its conventional petrol and diesel vehicles mostly through fuel economy standards and staged phase-out of inefficient vehicles. Previous fuel economy standards for passenger cars finished in 2020, while new standards for both cars and heavy-duty commercial vehicles (HDV) are due to start in 2021. For cars, the fuel economy standard will be upgraded to a fleet average target of 4L/100km in 2025 (previous standards targeted fleet average of 5L/100km in 2020) (IEA, 2020b).

Buildings

China has mandatory energy efficiency codes for urban residential and commercial buildings and promotes voluntary energy efficiency codes for rural residential buildings through financial incentives (GBPN, 2018). China’s 13th FYP includes targets for improving building energy efficiency standards and retrofitting, including targets to achieve a 65% energy efficiency level compared to 1980 and retrofit 500 million m2 of existing residential floor space (N. Zhou et al., 2020).

In 2018, more than 2.5 billion m2 of urban and commercial floor space was green-building certified, while China has also launched its Near Zero-emission Buildings Standard in 2019 (UNEP, 2019).

For compatibility with the Paris Agreement temperature goals, China’s emissions-intensity in residential and commercial buildings needs to be reduced by at least 65% in 2030, 90% in 2040, and 95-100% in 2050 below 2015 levels, while energy intensity needs to be reduced by at least 20% in 2030, 35-40% in 2040, and 45-50% in 2050 compared to 2015 levels. China will also need to achieve renovation rates of 2.5% per year until 2030 and 3.5% until 2040 to achieve a Paris-compatible buildings sector by 2050 (Climate Action Tracker, 2020c).

Forestry

China’s NDC pledges to increase forest stock volume by 4.5 billion m3 by 2030 compared to 2005 levels. In November 2020’s proposed NDC update, this target was raised to six billion. To reach China’s carbon neutrality goal by 2060, carbon sequestration through afforestation or other means are assumed to play a critical role (Jiankun, 2020). China’s drive for implementing forestry projects has been extensive, but not without setbacks. Initiatives such as the Three-North Shelter Forest Programme aiming to grow 35 million hectares (a forest the size of Germany) in northern regions by 2050 has faced trial and error due to poor planning and management (Bloomberg, 2020).

China has been a large proponent of nature-based solutions and was a co-lead of the nature-based solutions coalition for the Climate Action Summit in 2019, which received over 200 submissions for initiatives that could help preserve and sustainably manage global forests (IISD, 2019; Ministry of Ecology and Environment, 2019). In 2021, China will also host the UN Biodiversity Conference in Kunming.

China has implemented many national forest conservation policies, beginning with the National Forest Protection Program, which aims to recover native forests, and has more recently been expanded to ban commercial logging in native forests. In 2020, China revised its Forest Law for the first time in 20 years, with the most significant policy change the implementation of a ban (in effect as of July 2020) on Chinese companies purchasing, processing, or transporting illegal logs (Client Earth, 2020; Mukpo, 2020).

China is both the world’s largest importer of legal and illegal logs, with a large portion of its tropical timber imports in 2018 coming from countries with weak governance and accountability indicators, according to reports (Global Witness, 2019). As illegal trade could represent up to 30% of trade in all wood products and be worth up to USD 150bn a year, the revised Forest Law could have a large impact on curbing global deforestation (Interpol, 2019; World Bank, 2019).

For Paris Agreement compatibility, sinks from the forestry sector should not be used as an excuse to delay emissions reductions in other sectors (Climate Action Tracker, 2016).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter