Policies & action

The EU’s emissions have decreased in recent years, with an accelerating trend since 2017 and a major dip in emissions in 2020, as a result of the pandemic. However, emissions increased by 5% in 2021 with the economic rebound.

In June 2021, the European Commission presented a package of proposals named “Fit for 55” that would allow the EU to reach its updated NDC target. Following the Russian invasion of Ukraine and the subsequent energy crisis, the Commission tabled the REPowerEU package of proposals in May 2022 that strengthened some of the earlier targets in the “Fit for 55” package, especially the renewable energy and energy efficiency targets.

In late 2022 and early 2023, provisional agreements between the Council of Ministers and the European Parliament have been reached on various pieces of the proposed legislation. Combined, they would result in emission reductions of 55% (excl. LULUCF). If the additional, indicative renewable energy goal is included, the emissions reduction would reach almost 57%, excluding LULUCF. If LULUCF is taken into consideration, emissions reduction would be between 60-61%.

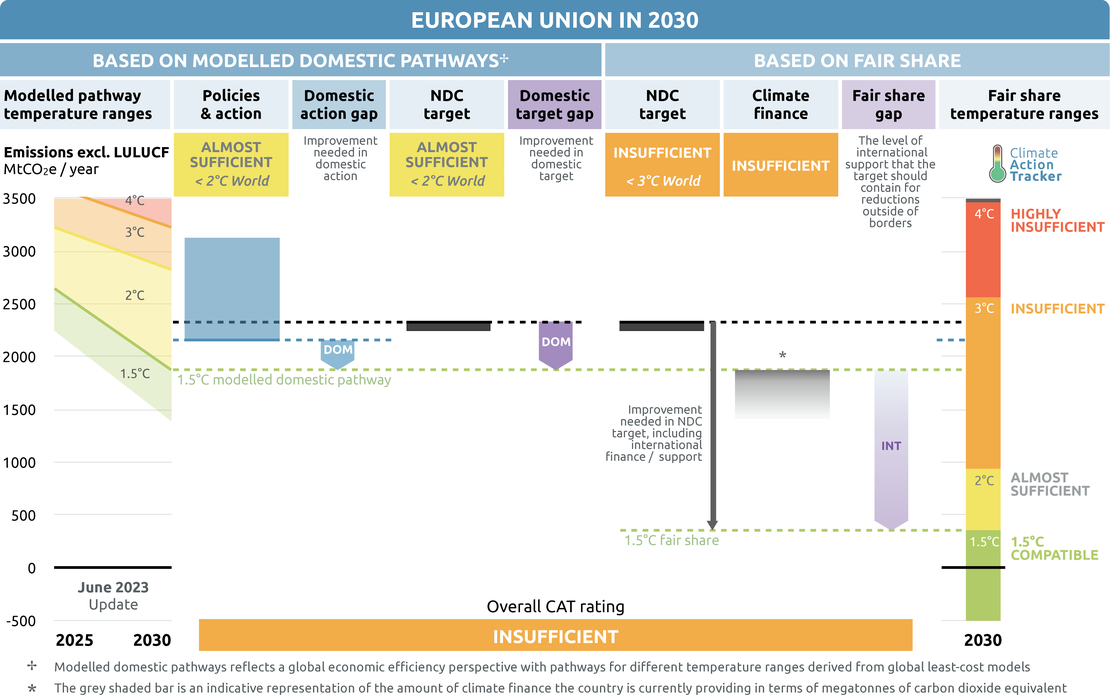

At the same time, the policies adopted and reported to the Commission by the member states by March 2022 would only result in emissions reductions of 35% below 1990 levels. This difference is the result of national policies lagging behind policies adopted at the EU level. We consider the lower emissions bound to be more likely and have based the CAT range on this estimate. The CAT rates the EU’s policies and action as “Almost sufficient”.

The “Almost sufficient” rating indicates that the EU’s climate policies and action in 2030 are not yet consistent with the 1.5°C temperature limit but could be, with moderate improvements. If all countries were to follow the EU’s approach, warming could be held below—but not well below—2°C.

Our current policy projections cover a wide range, starting with bottom-up national assessments to the full implementation of agreed EU policies. We consider the bottom end of the range to be more likely as the top end indicates the implementation lag. In other words, with its recent policy enactments, the EU is close to being 1.5°C compatible in terms of its domestic action – although much more is still needed to meet its fair share to 1.5°C.

That said, the EU’s response to the energy crisis created by Russia’s illegal invasion of the Ukraine remains a wild card and has not been captured in our analysis. If the EU and its member states replace dependency on energy imports from Russia with fossil fuel imports from other countries it could lock itself into a more emissions-intensive future and put 1.5°C at risk, as indicated in our November 2022 COP27 briefing.

Further information on how the CAT rates countries (against modelled pathways and fair share) can be found here.

Policy overview

After a pandemic-driven decrease of over 8% in 2020, emissions in the EU (incl. LULUCF) increased by 5% in 2021 (European Environment Agency, 2023).

We estimate the EU’s policies to lead to 2.2–3.1 GtCO2e emissions levels in 2020. The upper end of 3.1 GtCO2e reflects policies implemented by member states. This would mean an emissions reduction of 35% below 1990 levels, or only slightly below 2020 levels.

The elements of the Fit for 55 package and REPowerEU plan for which provisional agreement between the Council of Ministers and the European Parliament has been reached, (some still needs to be formally adopted), would result in emissions falling to 2.2 GtCO2e (excl. LULUCF) corresponding to an emissions reduction of between 55-57% below 1990 levels by 2030 excluding LULUCF and between 60-61%, incl. LULUCF.

“Fit for 55” package and REPowerEU Plan

The “Fit for 55” policy package to achieve the EU’s NDC target was first presented in July 2021 (European Commission, 2021e). In May 2022, some of the policy proposals were strengthened as part of the Commission’s response to Russia’s illegal invasion of the Ukraine and the ensuing energy crisis (the REPowerEU Plan) (European Commission, 2022e). Most of these policies have now been agreed at the EU level, but still need to be implemented by the member states.

Cross-sectoral policies are briefly discussed below. Measures related to renewables, transport, LULUCF, and buildings sectors are described in the respective sections.

EU ETS

The reform of the EU ETS, agreed in early 2023, increases the emissions reduction target in the sectors covered by the instrument from 43% between 2005 and 2030 to 62% (Council of the European Union, 2023f). While the new agreement accelerates emission reductions, especially in the electricity and industry sectors, the provision of free certificates presents a missed opportunity for even faster reductions.

While the EU ETS directive also includes the phase out of free emissions permits, it will only happen in a staged fashion resulting in slightly less than half of the free allowances being phased out by 2030 and the remaining ones by 2035. As a result, until 2030, industry will receive more than 4.9 billion emissions allowances for free, or around 40% of all allowances issued during this period. With the price of around EUR 100, this amounts to a subsidy of EUR 490bn. The proceeds from the sale of the remaining emissions allowances incurred by the member states are required to be spent on climate action.

The law also creates the legal framework for the introduction of a parallel emissions trading scheme for road transport and buildings (EU ETS II). The instrument is set to begin in 2027 unless the average fossil gas price remains above the February-March 2022 average, in which case it will be postponed to 2028.

Effort Sharing Regulation (ESR)

The “at least 55%” emissions reduction target also requires increased emissions reduction targets in sectors not covered by the EU ETS, especially the transport and buildings sectors, which are covered by the Effort Sharing Regulation (ESR).

In November 2022, the Council and the Parliament agreed on an amendment of the law which increased the emissions reduction for the sectors covered from 30% to 40% below 2005 levels by 2030.

The regulation sets binding national targets from emissions reductions between 10% (Bulgaria) and 50% below 2005 levels (Denmark, Germany, Luxembourg, Finland, and Sweden) (European Parliament and the Council of the European Union, 2023b). These national targets determine emissions trajectories for each year between 2023 and 2030, with some limited flexibilities in the form of borrowing from and banking for future years, and transfers between countries.

Renewable Energy Directive

The original “Fit for 55” package included a proposal to significantly amend the Renewable Energy Directive, strengthening the renewable energy target from 32% of the energy mix in 2030 to 40% (European Commission, 2021e). The Commission proposed an even stronger target of 45% in May 2022 as part of its REPowerEU Plan (European Commission, 2022b).

In March 2023, the European Parliament and the Council agreed to an overall binding target of 42.5%, with an additional 2.5% indicative top-up. The national contributions to meeting this target are to be specified by the member states in their integrated national energy and climate plans (drafts due by the end of June 2023), according to a formula provided by the Commission (Council of the European Union, 2023c).

Energy Efficiency Directive

The European Commission’s July 2021 package of proposals recast the Energy Efficiency Directive with more ambitious energy efficiency targets. The REPowerEU package further strengthened the energy consumption targets. The agreement between these two co-legislators was slightly less ambitious than the Commission’s REPowerEU proposal: by 2030 the primary energy consumption should fall to no more than 993 Mtoe whereas final energy consumption should not exceed 763 Mtoe (European Parliament and the Council of the European Union, 2023a) See Table 1). Only the energy consumption target for final energy is binding and only at the European level. To reach this target, the EU member states must include their contributions in drafts of their Integrated National Energy and Climate Plans (due by the end of June 2023). In addition, member states should ensure a reduction in energy consumption of, on average, 1.5% annually between 2024 and 2030.

| Status in 2021 | 2030 target levels prior to RED amendment | 'Fit for 55' Package proposal (July 2021) | REPowerEU Plan proposal (May 2022) | Position of the European Parliament | Position of the Council of Ministers | Final Agreement from March 2023 |

|---|

| Share of renewables in 2030 | 22% | 32% | 40% | 45% | 45% | 40% |

42.5% binding +2.5% indicative |

|---|---|---|---|---|---|---|---|

| Primary energy consumption in Mtoe | 1,462 | 1,128 | 1,023 | 980 | 960 | 1,023 | 993 |

| Final energy consumption in Mtoe | 968 | 846 | 787 | 750 | 740 | 787 | 763 |

Table 1. Based on (Council of the European Union, 2022b, 2023a; European Parliament, 2022; European Parliament & Council of the European Union, 2018; Eurostat, 2023)

Emergency measures

In reaction to Russia’s unprovoked, illegal invasion of Ukraine, the EU and its member states adopted measures aimed at reducing energy costs and consumption, including a fossil gas reduction target (agreed in July 2022) and an electricity reduction target (agreed in September 2022).

Member states initially agreed to reduce their fossil gas consumption by 15% between August 2022 and March 2023, but with many exceptions to this voluntary target (Council of the European Union, 2022d). In March 2023, the Council of Ministers decided to extend this agreement by another 12 months (Council of the European Union, 2023a). Along with the target, many member states adopted measures aimed at reducing energy consumption, such as curbing air conditioning in summer and heating of public buildings in winter, ensuring that doors of heated or cooled shops remained closed, and switching off advertisements after 10 p.m. (Politico, 2022). As a result of these measures, as well higher fossil gas prices and a mild winter, European fossil gas consumption fell by 13% in 2022 (IEA, 2023).

Member states agreed to the voluntary target of reducing 10% of their gross electricity consumption, with a mandatory target of 5% during peak hours between December 2022 and March 2023 (Council of the European Union, 2022a). Several countries adopted measures that compensate consumers for higher energy costs or reduced energy taxes ((Bruegel, 2022c). While justified by the extraordinary situation, many of the emergency measures, especially a reduction in taxes or even direct price subsidies, reduced the incentive to decrease the consumption of fossil fuels and move towards low carbon alternatives.

Sectoral pledges

In Glasgow, a number of sectoral initiatives were launched to accelerate climate action on methane, the coal exit, 100% EVs and forests. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade (Climate and Clean Air Coalition Secretariat, 2021). The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants (UN Climate Change Conference (COP26), 2021). Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets (UK Government/UNFCCC, 2021a), and on forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030” (UK Government/UNFCCC, 2021b). The Beyond Oil & Gas Alliance (BOGA) seeks to facilitate a managed phase out of oil and gas production.

NDCs should be updated to include these sectoral initiatives, if they aren’t already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

| EU | Signed? | Included in NDC? | Taking action to achieve? |

|---|---|---|---|

| Methane | Yes | Yes | Yes |

| Coal Exit | Yes | Yes | Yes |

| Electric vehicles | 14 EU member states | Yes | Yes |

| Forestry | Yes | Yes | Neutral |

| Beyond Oil and Gas Alliance | 8 EU member states | No | No |

- Methane pledge: The EU is one of the initiators of the Global Methane Pledge. In 2020, the European Commission published a strategy to reduce methane emissions, and in December 2021, tabled a proposed directive that would strengthen reporting and monitoring requirements, and introduced mandatory leak detection and repair, and a ban on gas flaring and venting (European Commission, 2021h, 2023g). The Council agreed to a weaker version of this proposal in December 2022, while the European Parliament recently adopted a stronger position in May 2023. Negotiations between the two to reach a compromise will take place later this year. In 2022, internal analysis from the Commission leaked to the media suggested that the EU was not on track to meet a 30% reduction in methane and that cuts in the agriculture sector would be key to getting it on track (Ainger, 2022).

- Coal exit: The EU signed up to the coal pledge at COP26. While a large majority of the EU member states either don’t use coal power or have an exit date before 2030, Poland, the second largest coal consumer in the EU, failed to move its coal extraction phase-out date forward from 2049. At the same time, the EU’s REPowerEU Plan includes EUR 2 bn to adapt coal power plants to operate longer and shift from gas to coal. While this undermines EU’s climate ambition, it is unlikely to have any lasting impact on coal power use: coal use was down in 2022 and early 2023 compared to previous years.

- 100% EVs: The EU did not sign the 100% zero emission cars and vans Glasgow pledge. However, in October 2022, the EU agreed to zero-emissions new passenger cars and vans by 2035 (Council of the European Union, 2022h).

- Forestry: The EU signed the forestry pledge at COP26 in Glasgow. In early 2023 the EU agreed to revisions to its LULUCF regulation, which governs the sector. It increased its 2030 target to 310 MtCO2e, up from the 225 MtCO2e limit referenced in its Climate Law. The revisions included individual targets for each member state towards the 310 MtCO2e level.

- Beyond oil & gas: The EU has not signed the Beyond Oil and Gas (BOGA) declaration but eight of its member states have. Four member states — Denmark, France, Ireland and Sweden — are core members of the Alliance and have committed to ending oil and gas exploration and development. The participation of Denmark, responsible for a fifth of the EU’s oil production, is of great importance.

Energy supply

Around 75% of the EU’s total GHGs emissions (excl LULUCF) are from energy consumption. In 2021, final energy consumption increased by almost 7% above 2020, but remained below pre-pandemic levels. The share of renewables decreased slightly, from 22.1% in 2020 to 21.8% in 2021, mostly due to higher energy consumption (Eurostat, 2023).

Electrification of various sectors offers significant potential for decarbonisation and could allow for better integration of a significantly higher share of wind and solar energy in the electricity mix by providing additional flexibility opportunities. The increasing importance of electrification also requires accelerating the decarbonisation of the electricity sector itself, in order to fully maximise the emissions reduction potential.

It is feasible for the EU to fully decarbonise its electricity sector by 2035 (Ember, 2022b). Analysis suggests that while it would require an additional up-front investment of between EUR 300–750bn, it would result in savings of around EUR 1tn by 2035. Such savings would be in addition to other significant benefits in emission reductions, such as health, and reducing EU fossil fuel dependency. According to the scenario, by 2030, between 70–80% of electricity would be from wind and solar PV, with the share of coal and fossil gas decreasing to less than 1% and 5%, respectively.

Unfortunately, the emissions intensity of electricity generation increased from 241 gCO2e/kWh in 2021 to 255 gCO2e/kWh in 2022 due to decreasing electricity from nuclear and hydro (due to drought) power plants and some, although limited, switch from fossil gas to coal (Ember, 2022a, 2023a). However, this trend of higher emissions intensity did start to reverse itself in the last four months of 2022 as coal use fell.

Renewables

The EU strengthened its renewable energy targets in March 2023, adopting a binding target to reach a 42.5% share of renewable energy in its energy mix by 2030, with an additional 2.5% indicative top up. Individual member states are now in the process of determining their respective contributions to reaching this target. They should communicate these targets in the drafts of their National Energy and Climate Plans due by 30 June 2023.

In 2022, an additional 57 GW of solar and wind energy capacity was added to the grid, compared to 37 in 2021 and 29 GW in 2020. As a result, the combined capacity of both sources exceeded 415 GW, with solar PV in the lead. The combined electricity generation from these two energy sources increased almost 14% and amounted to 22% of all electricity generated in the EU in 2022, 3% more than in 2021. Due to a significant decrease in electricity generation in hydropower plants due to drought, the overall share of renewables increased by only 1% and reached 38% in 2022 (Ember, 2022a, 2023a).

Wind

New wind installed capacity in the EU was up 40% in 2022 compared to the previous year: 16 GW was installed, of which 1.2 GW was offshore. Despite this growth, the total amount installed was almost 4 GW below WindEurope’s projections. In total, the EU’s combined installed wind energy capacity was 204 GW. Around 16% of electricity demand in the EU was satisfied by wind energy – 2% more than in 2021 and as much as coal (WindEurope, 2022b, 2023b).

According to the WindEurope projections, after slow growth in 2023 and 2024, development of wind energy will accelerate after 2025, resulting in 98 GW of additional installed capacity in the coming five years (WindEurope, 2023b). However, these projections, which would result in slightly less than 20 GW installed annually on average, are significantly below the 32 GW per year needed to reach the 510 GW installed wind energy capacity proposed by the Commission in its REPowerEU Plan (European Commission, 2022e).

The industry is experiencing several investment headwinds, from higher input costs due to the energy crisis, supply chain disruptions, as well as investment insecurity caused by the emergency measures, such as the additional taxation of proceeds from the sale of electricity. In 2022, investment in the sector fell to EUR 17bn, a level not seen in more than a decade, from EUR 41 bn in 2021 (WindEurope, 2023a).

The EU needs to ramp up efforts in this area in order to meet its wind targets. In December 2022, it simplified the permitting processes, which may help accelerate deployment (Council of the European Union, 2022f), but it will take a few years before that is reflected in higher installation numbers. The EU needs to add around 30 GW per year (rather than the 20 GW projected) to achieved its REPowerEU plan targets (WindEurope, 2023b).

Offshore wind

The EU’s 2020 offshore renewable energy strategy has installed capacity targets of at least 60 GW by 2030 and 300 GW by 2050. To achieve these targets requires an almost four-fold and an over 18-fold increase compared to 2022 levels, respectively (European Commission, 2020a).

In August 2022, leaders of eight Baltic countries committed to increasing the capacity of offshore wind in the Baltic Sea from less than today's 3 GW to almost 20 GW by 2030 (WindEurope, 2022a). In April 2023, nine countries bordering the North Sea, including the non-EU countries Norway and the UK, agreed to increase the installed capacity in the North Sea from 30 GW in 2022 to 120 GW by 2030 and 300 GW in 2050 (France24, 2023).

Solar

Conversely to wind energy, projections of installation of solar PV were exceeded: 41.1 GW were installed in 2022 instead of a projected 39 GW, bringing the total installed capacity to 210 GW (Solar Power Europe, 2022, 2023). Germany, Spain, and Poland are the largest PV markets, but the Netherland has the highest installed capacity on a per capita, with over 1000 Watt (or two solar panels) per person, almost twice the EU average.

Solar Power Europe projects further acceleration in annual capacity installations: almost 54 GW in 2023, 62 GW in 2024, 74 GW in 2025 and 85 GW, or double 2022 levels, in 2026. By 2030, the combined installed capacity could increase to between 920 and 1,184 GW, thus significantly exceeding European Commission’s REPowerEU 2030 target of only 750 GW.

Solar generation also increased in 2022 to 203 TWh. Solar power’s share of total electricity increased from 5.7% in 2021 to 7.3% in 2022 (Ember, 2023a).

Much of the EU’s solar PV installations are imported. This import dependency constitutes one of the major risks to its ability to continue scaling up solar PV installations. To support the development of an EU supply chain, the European Commission launched the European Solar PV Industry Alliance (ESPIA) in December 2022, with the goal of increasing EU solar PV manufacturing capacity for key solar PV components from 4.5 GW in 2022 to 30 GW in 2025 (ESPIA, 2023; Solar Power Europe, 2023).

Renewable Energy Financing Mechanism

The Renewable Energy Financing Mechanism (RENEWFM) was established in September 2020 (European Commission, 2022b). It allows member states to reach their national renewable energy targets by funding the development of renewables in other EU member states where it could be more cost competitive. It also provides member states with the flexibility to support certain types of renewables. For example, Luxembourg, which is landlocked, is planning to support offshore wind development in the North Sea through the mechanism (North Sea Energy Cooperation, 2022).

This mechanism was largely unused in its first few years, but that started to change in the latter half of 2022. In September 2022, member states agreed that some proceeds from the taxation of windfall energy sector profits could be used to finance development of renewables through this mechanism (Council of the European Union, 2022b). Its first relatively small tender (EUR 40 million) was launched in April 2023, financed by Luxembourg (European Commission & Directorate-General for Energy, 2023).

Permitting

The EU has taken steps to simplify and accelerate the permitting process for renewable energy projects, one of the major barriers for the industry, especially wind power (WindEurope, 2023b).

The Commission made several recommendations to speed up the permitting process in 2022 as part of its REPower Plan (European Commission, 2022e). Some of these have now been incorporated into the revised Renewable Energy Directive (REDIII) agreed to by in the provision agreement in March 2023. These include:

- Obliging member states to designate renewables acceleration areas (i.e. areas within which renewable energy projects can be rapidly deployed with little administrative burden)

- Determining that renewable energy projects are “in the overriding public interest” (which assists in prioritisation of these projects over other considerations); and

- Establishing time limits for the duration of the permitting process.

Renewables acceleration areas designations must be made within 27 months of the Directive’s entry into force. The Directive must still pass the European Parliament and the Council of Ministers before it becomes law, though substantive changes are not expected. If Parliament adopts the Directive by mid-2023, then member states would need to make such designations by late 2025 at the latest. In such areas, permit granting should not exceed six months for installations smaller than 150 kW and one year for offshore wind. Projects situated in such areas will not be required to submit an Environmental Impact Assessment – instead one for the whole area should be developed when such an area is designated.

As a stopgap measure to address the period before these designations take effect, and as a response to the energy crisis, the Council of Ministers adopted a temporary framework to simplify the renewable energy permitting process in December 2022 (Council of the European Union, 2022c). The Regulation will be binding for 18 months.

It states that renewable energy installations, electricity grids and energy storage are presumed to be in the overriding public interest. It also sets clear deadlines for the permit-granting institutions similar to those for wind: three months for roof-top or buildings-integrated solar PV and six months for repowering of existing wind or solar installations. Permits for heat pumps smaller than 50 MW should be granted within a month and in some cases only notification should be required. For ground source heat pumps, this period extends to six months. Member states may exclude certain regions from the requirements of the Regulation.

Coal phase-out

Fears of a coal renaissance have largely not materialised. There had been a concern that Russia’s invasion of Ukraine and the ensuing high fossil gas prices would continue the resurgence of coal power use witnessed in 2021 as economies reopened. The reactivation of coal units in many EU member states as a reserve before 2022/2023 winter and lower nuclear and hydro power generation added to this apprehension (nuclear power generation dropped by 119 TWh or 16% in 2022, and hydropower by 66 TWh or 19%, the latter due to widespread drought).

A significant decrease in electricity consumption and higher renewable energy generation helped to mitigate the increase in coal power. The share of coal in electricity generation increased by 1.5% and reached 16% (Ember, 2022a, 2023b). By the European winter 2022/2023, the trend had reversed: electricity generation from coal decreased by 11% between October 2022 and March 2023 compared to the same period last year (Ember, 2023b).

The energy crisis has not undermined the EU’s longer-term plans to phase out coal power. Most EU member states have a 2030 phase out target (a 1.5°C compatible timeline), but there are three laggards: Poland, Germany and Bulgaria (Beyond Fossil Fuels, 2023). Poland has set a 2049 target date, while Bulgaria is aiming for 2038-2040. Germany set a binding phase out date of 2038 in 2020 (BMWK, 2020). In November 2022 the German government and the major lignite extraction company RWE agreed to phase out coal extraction in North Rhein-Westfalen, one of the three coal mining regions of the country, by 2030 (Bundesregierung, 2022).

Fossil gas

The EU succeeded in cutting fossil gas consumption, exiting the winter with more stored fossil gas than in previous years. The energy crisis has not subsided, yet if the EU continues to expand its LNG capacity, it may swap one crisis for another.

In 2022, fossil gas consumption in the EU decreased by 12% (Bruegel, 2022a; European Commission, 2022d). The industry and household sectors accounted for most of the reduction, where demand fell by 15%. Fossil gas covered 20% of EU electricity generation in 2022 (Ember, 2023a). Between October 2022 and March 2023, electricity generation from fossil gas decreased by 13% compared to the same period in the previous year (Ember, 2023a).

The EU has agreed to extend its fossil gas demand reduction target until the end of March 2024 (Council of the European Union, 2023a). Continuing to focus on cutting demand and shifting to renewable sources (see discussion above and in the building section on heat pumps) is positive. Yet the EU seems equally determined to expand its LNG capacity. CAT analysis shows that the EU’s fossil gas strategy risks carbon lock-in and undermines global climate action. In 1.5°C compatible pathways, fossil fuel demand in Europe falls sharply to 2040 and is effectively phased out before 2050.

Between September 2021 and October 2022 investment decisions or announcements have been made toward the construction of 16 onshore LNG terminals with a combined capacity of over 89 bcm and 22 floating storage and regasification units (FSRU), with a combined capacity of almost 90 bcm (Bruegel, 2022b). Should all planned LNG terminals go online, their capacity would have increased from 183 bcm in 2022 to 289 bcm by 2025 and 304 bcm by 2030 (IEEFA, 2023), despite decreasing natural gas consumption.

The Baltic Pipe is also set to deliver 10 bcm of fossil gas annually from Norway, and additional imports via pipelines are planned from Algeria and Azerbaijan (Euronews, 2022). All of these investments are accompanied by the development of intra-EU pipeline connections.

There remains a mismatch between current energy needs and the time needed for all of these projects to go online, which makes them difficult to justify as low carbon alternatives when investment in energy efficiency can be brought online instead.

According to the European Commission’s own calculations the full implementation of the “Fit for 55" package, combined with the impact of higher energy prices, would result in a gas consumption reduction of 156 bcm (European Commission, 2022a), or around 40% of 2021 consumption. These fossil gas investments will either result in significant stranded assets or threaten the EU’s emissions reduction targets. To make matters worse, the EU and its member states are encouraging other countries such as Algeria, Angola, Azerbaijan, Egypt, Senegal or Congo to invest in fossil gas extraction (Bruegel, 2022b; Reuters, 2022).

The need for such a significant investment in fossil gas infrastructure has been countered by a recent assessment indicating that the EU can do without Russian gas without investing heavily into fossil fuel infrastructure (European Climate Foundation, 2022).

This can be achieved by accelerating deployment of renewables through fast tracking permitting for wind and solar projects and building human resources capacity for their installation. Investment in energy efficiency and the deployment of heat pumps could significantly reduce gas demand in the buildings sector.

Finally, electrification of the industry whenever possible could make it more resilient to future energy shocks. To fill the temporary gap in fossil gas supply the EU could rely on temporary FSRUs, better utilisation of existing unused capacity, and short-term contracts on gas deliveries.

Industry

Emissions from the industry sector are expected to decrease in 2022 due to a significant increase in fossil fuel prices, implementation of efficiency measures, and a decline in manufacturing. The future emissions trends in the sector will be determined by growth in industry production, electrification, increase in energy efficiency and in the longer term, replacing grey hydrogen with green.

In 2020 and 2021, the European Commission published several strategies aiming at decarbonising the industry sector and specific products, especially steel and chemicals (European Commission, 2020c, 2021c, 2021j). In February 2023, in reaction to existing or proposed funding for technologies and products needed for emissions reduction by other countries, the European Commission published its Green Deal Industrial Plan.

This non-binding communication defined four goals, the achievement of which it considers essential for boosting net-zero industry development in the EU: simplifying permitting for low-carbon product manufacturing, accelerating provision of funding for low-carbon projects, developing a skilled workforce for net-zero industry, and ensuring resilient supply chains for the components and materials needed for decarbonisation (European Commission, 2023d).

However, the plan lacked a proposal to significantly increase funding for the decarbonisation of the EU economy. While the Commission indicated it would propose the creation of a European Sovereign Fund “before summer 2023”, it did not offer any details.

To allow the achievement of some of the goals, in March 2023, the Commission proposed legislation: the Net Zero Industry Act. The proposal includes the goal of covering at least 40% of certain low carbon technologies by manufacturing plans situated in the EU by 2030. To achieve this goal, the proposal obliges member states to simplify the permitting-granting process and introduces time limits for its duration.

It also includes the objective of developing annual injection capacity of 50 MtCO2e by 2030 that should be used to mitigate emissions from hard to abate sectors. These capacities should be developed by oil and gas companies proportionally to their current oil and gas production levels. Finally, the proposal also envisions creating a Net-Zero Europe Platform to facilitate the exchange of best-practices between member states (European Commission, 2023i). To become binding, the proposal still needs to be adopted by the European Parliament and the Council of Ministers.

An important element of the EU’s decarbonisation strategy is green hydrogen. According to the Commission’s hydrogen strategy, the installed capacity of electrolysers in the EU should reach 40 GW by 2030, resulting in the production of up to 10 million tonnes of green hydrogen, complemented with similar capacity installed in neighbouring countries (European Commission, 2020b). One of the main obstacles in deployment of new investment in this area was the lack of clarity on the definition of green hydrogen. With a delegated act issued in February 2023, the Commission clarified this question (European Commission, 2023a). In March 2023, European Commission adopted a Communication proposing the creation of a European Hydrogen Bank that should stimulate investment in green hydrogen (European Commission, 2023e).

While emissions from the industry sector are covered by the EU emissions trading scheme and are thus affected by the increasing price of emissions allowances, the impact of this instrument is lessened by the fact that companies producing products on a so-called “leakage list” receive some free allowances.

The introduction of the Carbon Border Adjustment Mechanism decreases the threat of carbon leakage and, with it, the need to provide industry with free allowances. From 2027, importers of six emissions-intensive products will be obliged to purchase and surrender emissions allowances reflecting the GHG emissions embedded in those products imported to the EU in the preceding year (European Commission, 2023c). However, according to the recent reforms of the EU ETS, the free certificates for the industry will be phased out slowly and finish in 2034. The provision of free allowances has been made conditional on companies setting-up and implementing climate neutrality plans (Council of the European Union, 2023f).

Transport

Transport is the only major sector in the EU where emissions have increased over the the last 30 years: emissions in 2021 were 15% higher than in 1990. Emissions did drop by close to 14% in 2020 due to the pandemic, but rebounded in 2021.

Encouragingly, even with the rebound, 2021 emissions remained below 2019 levels (European Environment Agency, 2022, 2023). High fuel prices and an increasing uptake of electric vehicles (EV) may result in declining emissions in 2022. However, it is too early to say whether emissions from the sector have peaked: the economic rebound and trend to bigger vehicles may undermine the impact of increasing EV sales on emission levels.

There are numerous, and in some cases overlapping, ways in which the EU is trying to reduce emissions from the transport sector, including through the adoption of sectoral renewable energy targets and introducing CO2 emissions standards for new vehicles. These policies, combined with support for electric vehicles by most member states, resulted in an increase in their share of new car sales. From 2027, road transport emissions will also be covered by the EU ETS.

Electric vehicles

The share of new EV car sales has grown significantly in the last few years, reaching 22% in 2022. The portion of these vehicles that are battery-only has also grown, aided by the phase-out of hybrid plug-in subsidies in some member states. Battery electric vehicles represented 56% of all EV sales in 2022 (ACEA, 2021, 2022a, 2023).

There is significant regional variation in EV sales trends: Nordic EU countries lead the bloc with close to 40% EV sales. Sweden is top of the pack at 56%, but still beaten by its non-EU neighbour: Norway. Eastern and Southern European countries are far behind, where no member state has more than a 10% EV sales share. Western Europe falls in the middle, though Spain is an unfortunate exception. Like its eastern and southern counterparts, it too has less than a 10% EV sales share. Neighbouring France and Portugal, have more than double Spain’s level: both have a 22% share. Supportive policies – or a lack thereof – are a key factor behind these differences (ACEA, 2023).

Underdeveloped charging infrastructure remains a major hindrance to EV uptake. In March 2023, the Council of Ministers and the European Parliament reached a compromise on the Directive on the Deployment of Alternative Fuels Infrastructure that includes several mandatory national targets.

For example, for each battery electric light-duty vehicle registered in their territory, a total power output of at least 1 kW must be provided through publicly-accessible recharging stations. For plug-in hybrids, this factor amounts to 0.66 kW for each vehicle. There should also be a recharging point every 60 km along the motorways that constitute part of the Trans-European transport Network (TEN-T) consisting of fast charging points—at least 300 kW from 2025 and at least 600 kW from 2030 (Council of the European Union, 2023b; European Commission, 2021g).

The Directive also includes additional targets for hydrogen refuelling stations and charging stations for heavy-duty vehicles. It requires the construction of LNG refuelling stations for heavy duty vehicles and ships “unless the costs are disproportionate to the benefits, including environmental benefits“. This LNG requirement could significantly increase dependency of the transport sector on fossil gas

CO2 emissions standards

Passenger vehicles

In October 2022, the EU agreed to zero-emissions new passenger cars and vans by 2035, though Germany succeeded in getting a loophole for e-fuels added to the agreement in March 2023 after threatening to block the agreement entirely (e-fuels emit tailpipe CO2 emissions, though have the potential to be emissions neutral overall).

While the 2035 phase-out target is a significant improvement to earlier regulations (see table below), the major weakness of this agreement is that around half of the reductions will only take place after 2030. Car manufacturers also still have the option to exceed these limits and instead pay EUR 95 per gram CO2/km for each new vehicle sold (Council of the European Union, 2022h). These weaknesses need to be addressed by the member states by accelerating deployment of electric mobility in this decade and creating attractive alternatives to passenger cars.

| Vehicle type |

Emissions reduction below 2021 new car emissions average (2019 regulation) |

Emissions reduction below 2021 new car emissions average (Provisional agreement from October 2022) |

|||

|---|---|---|---|---|---|

| 2025 | 2030 | 2025 | 2030 | 2035 (new) | |

|---|---|---|---|---|---|

| Passenger cars | 15% | 37.5% | Unchanged | 55% | 100% |

| Light Commercial Vehicles | 15% | 31% | Unchanged | 50% | 100% |

The impact on passenger vehicle emissions from existing legislation has been mixed. After average emissions from new cars registered in the EU fell from 123 gCO2/km in 2019 to 108 gCO2/km in 2020, they increased again to 116 gCO2/km in 2021. In all Eastern European countries except for Romania, the emissions intensity of new cars exceeded 130 gCO2/km.

Emissions from new passenger cars sold in Western European countries were slightly lower than the EU average, with only Sweden, Denmark, and the Netherlands falling below 100 gCO2/km (ACEA, 2022b). Since these values are averages for all new vehicles sold, a large portion of the decrease has been caused by the increasing share of EVs, instead of increased efficiency of new combustion vehicles. By way of comparison, a 1.5°C compatible emissions intensity level for passenger transport for the EU would be 50 gCO2/km in 2030, though this includes buses and rail transport as well.

Heavy-duty vehicles

The EU is working on strengthening its emissions standards for heavy duty vehicles. In February 2023, the Commission tabled a proposal that, if adopted by the European Parliament, would strengthen the bloc’s 2030 target from 30% to 45% emissions reduction for new trucks, buses, and trailers. It also adds new targets beyond 2030: for new heavy duty vehicles sold between 2035-2039, emissions should decrease by at least 65%, 90% for those sold after 2040 (European Commission, 2023b). The European Parliament and the Council of Ministers will adopt their respective positions in the coming months, and then negotiations between these two co-legislators will commence. A final agreement is unlikely to be reached this year.

Sectoral renewable energy targets

In March 2023, the EU strengthened its renewable energy targets for the transport sector to 29% of final energy consumption in 2030 (up from 14%) (European Parliament & Council of the European Union, 2023a).

The EU has also recently strengthened its targets for the aviation and maritime sectors (its ReFuelEU and FuelEU initiatives) (Council of the European Union, 2023e). The share of sustainable aviation fuels must gradually increase, starting at 2% in 2025, up to 70% in 2050. The targets agreed are slightly higher than initially proposed by the Commission in 2021 (European Commission, 2021i). Shipping vessels above a certain size will be required to reduce their emissions intensity, again starting in 2025 with a 2% reduction, increasing to 80% in 2050. In addition, when at berth, ships will be required to connect to onshore power supply, if available. To reduce emissions-intensity, ships may also use onboard solar for electricity generation or wind for assisted propulsion (Council of the European Union, 2023d).

Buildings

The buildings sector has traditionally been heavily reliant on gas and oil, and, in the case of Poland and to much lesser degree other countries, coal, for heating. High energy prices triggered by Russia’s illegal invasion of Ukraine is having some impact on consumer behaviour and spurring policy action in the sector.

However, more needs to be done in the immediate term to address the energy crisis and bring down emissions (like scaling up heat pump manufacturing and workforce training, and eliminating counterproductive fossil fuel heating subsidies). The EU has advanced on some longer-term measures for the sector (e.g. agreeing to include it in the EU ETS), but many measures are still under discussion (and have been for some time).

In 2022, fossil gas consumption in households across the EU fell by 15% as a result of much higher prices (Bruegel, 2022a). Poland experienced significantly higher coal prices, due to an embargo on Russian imports (Wanat, 2022).

Higher fossil fuel prices increase the competitiveness of cleaner sources of energy, especially heat pumps, and can help spur investments in home insulation. The sale of heat pumps increased by 34% in 2021, reaching over two million (European Heat Pump Association, 2022). Growth continued in 2022, with sales reaching three million. In some countries, e.g. Poland and Czechia, the sale of heat pumps has doubled. However, the highest sales per capita were reached in the Nordic countries: Sweden, Denmark, and Finland (European Heat Pump Association, 2023a).

Unfortunately, this significant increase in demand has resulted in long waiting times for heat pump installations and for the approval of applications for public support. The EU and its member states urgently need to facilitate the scaling-up of manufacturing capabilities and train the much-needed workforce.

The EU also needs to address counterproductive policies in the sector. Some countries, e.g. Austria, Denmark, Italy, or Germany, have banned the installation of fossil fuel heating systems or are planning to, but, others, like Poland, are still subsidising the purchase of fossil gas heating systems (European Heat Pump Association, 2023b). Such subsidies are not only resulting in carbon lock-in, but also waste resources that should be used to support households in financing investments in clean sources of energy. The EU should ban any kind of support for the installation of fossil fuel-based boilers and decide on a phase-out date for them.

Apart from replacing fossil fuelled sources of energy in households, the EU and its member states should significantly increase the buildings sector’s renovation rate. Prior to the energy crisis, this rate hovered around 1% of the buildings stock per year (European Parliament, 2021), whereas it needs to be 3.5% to be compatible with the 1.5°C warming limit. In October 2020, the Commission launched its ‘Renovation Wave’ with several goals and measures to reduce emissions and energy consumption in the buildings sector. This included providing more adequate and targeted funding, increasing the availability of energy-efficiency and recycled building materials, the introduction of stricter and mandatory minimum energy performance standards, and increasing the role of digitalisation and renewables. As a result, by 2030, at least 35 million buildings are to be renovated and the renovation rate doubled.

To achieve these goals, in December 2021 the European Commission proposed revising the EPBD Directive(European Commission, 2021b). One of the major improvements concerns implementing EU-wide minimum energy performance standards to replace the existing standards determined by each member state.

The Commission’s proposal also included a definition of zero emissions buildings and states that, from 2030, all new or deeply-renovated buildings must fulfil the criteria for such a building: they should consume no more than 60 kWh/m2 (for Mediterranean climatic zone) and 75 kWh/m2 (for Nordic climatic zone) annually, all of which should come from renewable sources or district heating. It also introduced “renovation passports” that should increase transparency and help homeowners identify the best timing for different interventions resulting in lower energy consumption and higher shares of renewable energy.

The European Commission’s May 2022 REPowerEU Plan includes further amendments to the EPBD Directive. Solar energy installations must be on all new public and commercial buildings from 2027, on all existing public and commercial buildings from 2028, and on all new residential buildings from 2030 (European Commission, 2022b). As of May 2023, the negotiations over the directive between the Council and the Parliament were at an early stage.

According to the reform of the EU ETS agreed in early 2023, from 2027 the buildings sector will also be covered by the emissions trading scheme (EU ETS II). The requirement to purchase emission allowances to cover the sale of fossil fuels used in the transport and building sectors will further increase the incentive for home insulation and installation of clean sources of heating.

However, the EU and its member states need to ensure that households, especially those potentially affected by energy poverty, are supported in their decarbonisation efforts. While the creation of the Social Climate Fund, equipped with a maximum of EUR 65bn and supplemented by national contributions, mitigates this challenge to some degree (European Parliament & Council of the European Union, 2023c), it may not be enough to finance the necessary transition in the buildings sector.

Agriculture

Roughly 10% of the EU’s emissions come from the agriculture sector (excl. LULUCF). Emissions fell sharply in the 1990s, especially in Eastern European countries, but have fluctuated within a narrow band for the last 15 years (Eurostat, 2022).

Agricultural sector emissions are covered by the Effort Sharing Regulation (ESR), which applies to all sectors, except land use, not included in the EU ETS. According to the Regulation, combined EU emissions from the ESR sectors must fall by 40% below 2005 levels by 2030 (European Parliament and the Council of the European Union, 2023b). Each EU member state has a separate target based on the states’ per capita GDP and their cost-effective potential to reduce emissions.

The Common Agricultural Policy (CAP) is one of the main mechanisms through which emission reductions actions are supported in the EU (European Union, 2022). A new CAP began in January 2023 and runs until 2027 and 40% of the funding under this CAP has been earmarked for climate action.

About 60% of agriculture emissions are methane (Eurostat, 2022), almost entirely from animal agriculture (enteric fermentation (digestion process in ruminants) and management of livestock manure). The sector is also responsible for the majority of the bloc’s methane emissions overall.

The EU is one of the initiators of the Global Methane Pledge, launched in 2021 ahead of COP26. The pledge aims to reduce global methane emissions by 30% below 2020 levels by 2030. While reducing methane is one of the aims of the CAP, analysis of individual member state plans shows that only 11 have elected to reduce emissions from the livestock sector, covering less than 3% of the EU’s livestock units.

In 2022, internal analysis from the Commission leaked to the media suggested the EU was not on track to meet a 30% reduction in methane and that cuts in the agriculture sector would be key to getting it on track (Ainger, 2022). NGOs have called for greater action to cut methane emissions in the sector (Changing Markets, 2022). Analysis of the previous CAP 2014-2020 found that its main mitigation impact was through increasing CO2 removals, rather than actually cutting emissions (European Union, 2022).

Forestry

Since 1990, the land use, land-use change and forestry sector (LULUCF) has constituted a sink of emissions averaging around 300 MtCO2e. However, since 2017, the sink has decreased significantly, amounting to around 230 MtCO2e in 2021. This change has mostly been driven by Czechia, Estonia, and Latvia, who joined Denmark, Ireland, and the Netherlands as net emitters from the sector, as well as a significant reduction of the size of the sink in Germany, Poland, and Italy (Eurostat, 2022).

The EU recently agreed to revisions to its LULUCF regulation (European Parliament & Council of the European Union, 2023b), which governs the sector. It increased its 2030 target to 310 MtCO2e, up from the 225 MtCO2e limit referenced in its Climate Law. The revisions included individual targets for each member state towards the 310 MtCO2e level. While enhancing the size of the land sink is positive, it should not undermine the level of ambition in other sectors. The EU has increased its ambition across the board (revising its EU ETS, effort sharing, renewable energy and energy efficiency targets), yet by including this additional 85 MtCO2e contribution from the land sector as part of its ‘at least 55%’ target, it is not maximising the potential for reducing emission from fossil fuels.

In November 2022, the Commission proposed a voluntary certification scheme for carbon removals (European Commission, 2022c). LULUCF-related activities include forest restoration measures and wood products, though carbon removals encompass much more than just the land sector. An expert group has been established to assist with developing certification methodologies (European Commission, 2023h). The group first met in March 2023 and will consider carbon farming methodologies at its next meeting in June 2023 and Consideration of the Commission’s proposal will follow the regular legislative process. Under the revised LULUCF Directive, the Commission is tasked with producing a report on the benefits and drawbacks of including carbon storage products in the LULUCF Directive within a year of adopting the carbon removal certification regulations (European Parliament & Council of the European Union, 2023b).

Waste

Waste sector emissions have continuously fallen since the mid-90s, dropping by around 40% between 1990 and 2021 (Eurostat, 2022).

Regulation of waste sector emissions is covered by the Effort Sharing Regulation (ESR), along with those from transport, buildings, and agriculture. Combined, emissions from these sectors needs to decrease by 40% below 2005 levels by 2030 (European Parliament and the Council of the European Union, 2023b).

The main legislation influencing EU’s waste management policy is the Waste Framework Directive which aims to reduce the amount of waste that ends up in landfills by promoting recycling and reuse of products (European Parliament and the Council of the European Union, 2008).

The EU is also facilitating a transition towards a circular economy. In 2015, it adopted a respective action plan with a list of 54 actions that would, for example, make products more durable and make it easier to repair, upgrade, or remanufacture after their use. Product labelling should also make it easier for the European customers to make more informed decisions when taking into consideration products’ environmental impact (European Commission, 2015).

In March 2020, the EU adopted a new Circular Economy Action Plan that adapts the EU’s waste policy to the 2050 climate neutrality goal by building on and concretising many of the suggestions made in the initial action plan from 2015. It also suggests integrating life cycle assessments in public procurement. The impact of circularity on climate change mitigation should also be reflected in modelling tools applied at the national and European levels, and taken account for in the revisions of the National Energy and Climate Plan (European Commission, 2020d).

The Commission is working on a revision of the Waste Framework Directive, which is expected in by the middle of 2023 (European Commission, 2023f).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter