Country summary

Assessment

India has emerged as a global leader in renewable energy, where investments top those into fossil fuel. After adopting its National Electricity Plan (NEP) in 2018, India remains on track to overachieve its “2˚C compatible” rated Paris Agreement climate action targets.

At the Secretary General’s summit in New York, India announced its intention to reach a target of 450 GW of renewables by 2030. The emissions reduction potential of this target is within the range of the CAT’s current policy projections. For three consecutive years, renewable energy investment topped that of fossil fuel-related power investments and in 2018, solar investments exceeded those in coal. Given the price-competitiveness of solar PV, these should be India’s preferred choice of distribution companies.

A significant caveat on the outlook for India is the ongoing expansion of coal. The Paris agreement 1.5 Celsius limit means that there needs to be a phase-out of coal in the power sector by 2040, at the latest globally.

The National Electricity Plan (NEP) in 2018 included more than 90 GW of planned coal-fired capacity which will increase emissions unnecessarily, and risk becoming stranded assets. Abandoning these plans is more than feasible when we consider recent developments such as a 50% decrease in the cost of solar power in just two years and several utilities shelving plans to build coal plants.

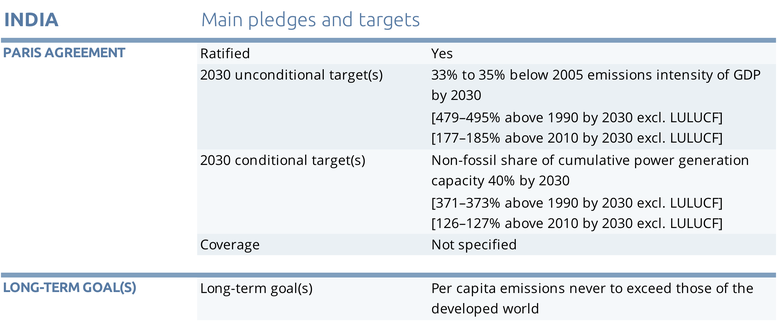

Despite the negative trend in the power sector due to coal, India’s Paris Agreement target is within the range of what is considered to be a “2°C compatible” fair share of global effort. This means that India’s unconditional Paris Agreement climate commitment in 2030, even while it allows the country’s total emissions to increase, is consistent with holding warming to 2°C. India could become a global climate leader with a “1.5˚C compatible” rating if it abandons plans to build new coal-fired power plants.

Right now, the nation has over 200 GW of coal-fired capacity in operation; if all the planned capacity is built, this could increase to over 300 GW over the next few years. This is an important consideration, as India’s CO2 emissions rose by 4.8% in 2018, largely driven by emissions from coal power plants. Estimates show India could achieve the more ambitious part of its Nationally Determined Contribution (NDC) goals—a 40% non-fossil-based power capacity by 2030 more than a decade earlier than targeted.

While interventions in the electricity sector have largely been driven by strong policy commitments, action in the transport sector is governed by uncertainty over the targeted penetration of electric vehicles. Despite this, recent policy announcements indicate that the government is prioritising charging and manufacturing infrastructure development to facilitate a transition to a low carbon transport system.

Our analysis shows that India can achieve its NDC target with currently implemented policies. We project the share of non-fossil power generation capacity will reach 60–65% in 2030, corresponding to a 40–43% share of electricity generation. India’s emissions intensity in 2030 will be ~50% below 2005 levels. Thus, under current policies, India is likely to achieve both its 40% non-fossil target and its emissions intensity target.

The ramp-up of renewables in India can provide access to affordable power at scale, and quickly. A 2018 report by the national coal mining company, Coal India, confirms declining future costs of solar and renewable electricity storage, which is likely to foster low-carbon investments. Investment in renewable power in India topped fossil fuels for the first time in 2017, according to the International Energy Agency. The government has signalled its intention to increase its previous 2022 capacity target for renewables from 175 GW to 228 GW, further committing to a 450 GW target by 2030.

There is still substantial uncertainty in India about coal power capacity and whether all renewable projects in the pipeline will be completed on time and integrated into the grid. In 2017, coal consumption increased by 4.8% or 27 million tonnes and the new NEP still forecasts coal-fired power capacity additions (CEA, 2018).

Expansion plans for coal-based generation have been found to be inconsistent with lower demand projections in independent studies, which is likely to exacerbate the issue of low utilisation rates of coal power plants, impacting their profitability and threatening to compound the already perilous financial position of distribution companies. Other drivers of stranding risk include coal shortages, water scarcity and air pollution regulation - as well as the competitive price of renewables.

Since 2010, the Indian Government has doubled the coal tax three times, reaching 400 rupees per tonne (around USD 3.2 per tonne) of coal produced and imported in the 2016–2017 budget. The tax is effectively a carbon tax levied at source, with the revenue feeding into the National Clean Environment Fund that provides finance for renewable energy projects. It generated revenues of USD 12 billion between 2010 -2018. However, subsidies to coal amounted to USD 2.3 billion in 2016 alone. Removing subsidies for coal (and other fossil fuels) is an essential step to ensure effectiveness of the levied tax.

The government is also attempting to harness the potential of off-grid solar PV pumps to not only provide reliable electricity for pump sets, but also to provide additional income generation opportunities for famers.

On transport, the Faster Adoption and Manufacturing of Electric Vehicles in India scheme came into effect in April 2019, and provides incentives to purchase electric vehicles, while also including provisions to ensure adequate charging infrastructure. India’s charging infrastructure has been a point of contention, with many civil servants expressing concern at the lack of charging stations when the government announced that 500,000 civil service cars would be electric.

The Government is in the process of implementing carbon pricing mechanisms to encourage energy efficiency in industry. A pilot system for small to medium enterprises is expected soon, and 37 companies are in the process of adopting an internal carbon price, with leaders including major cement producer Dalmia Bharat Cement Ltd.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter