Policies & action

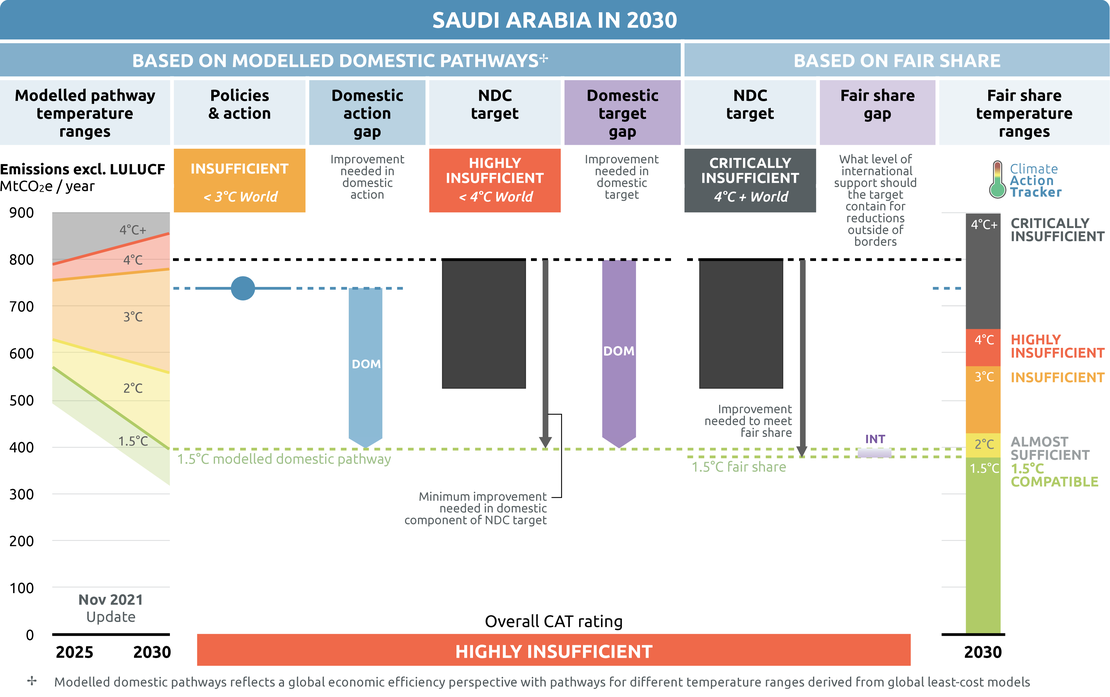

We rate Saudi Arabia’s policies and actions against modelled domestic pathways as “Insufficient”. The “Insufficient” rating indicates that Saudi Arabia’s climate policies and action in 2030 need substantial improvements to be consistent with the 1.5°C temperature limit.

If all countries were to follow Saudi Arabia’s approach, warming would reach over 2°C and up to 3°C. According to our analysis, Saudi Arabia can reach the upper end of its 2030 pledge with its implemented policies. Based on our assessment, we expect Saudi Arabia’s emissions to increase by around 30% above 2010 levels in 2030.

Policy overview

It is difficult to assess whether Saudi Arabia’s current policies reach its NDC since there is no business-as-usual baseline available for the target and there is limited data availability for the current policies trajectory. This is further explained in the Assumptions section. Based on these assumptions, we expect Saudi Arabia’s emissions to be around 740 MtCO2e in 2030—a three to four-fold increase from 1990 levels.

If Saudi Arabia were to reach its 50% target for renewable energy in the electricity mix, we estimate 2030 emissions could decrease to around 640 MtCO2e—a 100 MtCO2e decrease compared to current policies.

In 2020, we estimate Saudi Arabia’s GHG emissions to have decreased by nearly 10% compared to 2019 due to the repercussions of the COVID-19 pandemic. The Saudi economy shrank by 4.1% in 2020 (IMF, 2021), notably due to the freefall in oil prices resulting from a decrease in international demand.

Fossil fuel subsidies

The “Vision 2030” strategy has the objective to reduce fossil fuel subsidies. Subsidies however remain high: in 2019, Saudi Arabia still had the world’s third largest fossil fuel subsidies at nearly USD 30 billion, with most subsidies dedicated to oil, followed by subsidies to fossil electricity production and natural gas (IEA, 2021b).

The government is planning to gradually reach parity of domestic end-user prices with international gasoline prices between 2018 and 2025. In the same period, Saudi Arabia plans to increase local diesel prices to 90% of international prices (Bloomberg, 2017). In 2018, the government introduced a 5% VAT on fuel (General Authority of Zakat & Tax, 2018). In 2020, the government increased VAT for goods and services from 5% to 15%, including for products in the hydrocarbons sector (SPA, 2020).

Circular carbon economy & voluntary carbon market

Saudi Arabia is promoting the concept of a Circular Carbon Economy (CCE) to reduce emissions from oil and gas production (Luomi et al., 2021). This, however, only addresses a fraction of relevant emissions as most emissions come from fuel combustion rather than oil and gas extraction and processing.

Many of the world’s largest economies, and largest oil consumers, have already committed to net zero emissions by mid-century (Hale et al., 2021). Saudi Arabia’s current diversification plans away from heavy dependency on oil do not adequately address scenarios in which global oil consumption significantly declines in the coming decades, in line with what is required to meet the objectives of the Paris Agreement (IPCC, 2018).

In early September 2021, Saudi Arabia’s sovereign wealth fund PIF and the Saudi Stock Exchange Tadawul announced they would set up a voluntary carbon market in the Middle East and North Africa. The establishment of a carbon market should, however, not distract from mitigation efforts domestically. For more information on the role of voluntary carbon markets under the Paris Agreement, see Fearnehough et al. 2020.

Energy supply

Oil and gas sector

Oil extraction has been the backbone of the Saudi economy for decades, and still represents the primary source of revenue for the government (KPMG, 2020). Saudi Arabia is OPEC’s leading oil producer, and holds 17% of proven oil reserves worldwide (bp, 2021). The government has put in place strategies to diversify the economy, but to date Saudi Arabia remains dependent on hydrocarbons revenue (Alsweilem, 2015; Barbuscia, 2019).

Both the “business-as-usual” and the “2030 renewable energy target” scenarios outlined in KAPSARC’s Energy Policy Solutions project hydrocarbon exports to increase significantly until 2050 (KAPSARC, 2021). This is not in line with the objectives of the Paris Agreement. According to the IEA, no new investments into oil and gas fields can be made beyond the ones already committed in 2021 if the world is to reach net zero by 2050 (IEA, 2021a)—in line with what is needed for a 1.5°C compatible scenario (IPCC, 2018).

In December 2019, the Saudi government listed a small share of the state-owned oil company Saudi Aramco on the stock market. As of October 2021, Saudi Aramco was publicly listed as one of the most valued companies, only behind Apple (Time, 2021). Shortly before the Saudi government released its updated emissions pledge, Saudi Aramco’s CEO announced the company would aim to increase oil production capacity from 12 to 13 million barrels per day by 2027. Such a development is not compatible with the Paris Agreement, and the risk for stranded assets remains high. Research by the Climate Accountability Institute shows Saudi Aramco has contributed more than any other company to global carbon dioxide emissions since 1965 (Heede, 2019; Taylor & Watts, 2019).

Saudi Aramco has committed to net zero operational emissions by 2050, but this move fails to address the implications of 2050 net zero targets put forward by many of the world’s leading economies and oil consumers, which could lead to a drastic decrease in global oil consumption (IEA, 2021a).

Energy consumption

Saudi Arabia has one of the world’s highest rates of per capita energy consumption, although it has decreased somewhat in recent years (Climate Action Tracker, 2019). The Saudi government expects the overall demand for energy, including for oil and natural gas, to continue increasing until 2030 and beyond (KAPSARC, 2021). Electricity consumption per capita is also high and electricity prices continue to be subsidised—in April 2020, the government announced additional subsidies for electricity consumers in the industrial, commercial and agricultural sectors (IMF, 2020).

Electricity supply & renewable energies

In 2019, Saudi Arabia still produced nearly 100% of electricity with fossil fuels – around 56% with natural gas and 43% with oil (IEA, 2021c). The share of natural gas has increased since 2015, when it stood at just 37%, thereby contributing to some emissions reduction in the electricity sector. But gas is nevertheless still a fossil fuel and needs to be phased out as part of the global decarbonisation needed to reach the 1.5˚C temperature warming limit.

Saudi Arabia’s renewable energy sector has been mired in uncertainty and ambitious plans that have yet failed to materialise. In 2013, the government announced its plan to build 54 GW of renewable power and 17 GW of nuclear power by 2032 to cover 40–45% of future electricity production (Al-Ghabban, 2013). After already announcing an eight-year delay of these plans in 2015, Saudi Arabia further revised the renewable energy targets in 2016 and again in 2019. In the “Vision 2030” announced in 2016, the target was reduced to an ‘initial phase’ of only 9.5 GW installed capacity by 2023 (Borgmann, 2016; Kingdom of Saudi Arabia, 2016).

In early 2019, the Ministry of Energy released an updated “Vision 2030” renewable energy target of 27.3 GW by 2023 and 57.8 GW by 2030. The current version of the Vision 2030 strategy (as of late October 2021) states it aims for 50% of electricity to be generated with renewable energy and 50% with natural gas in 2030. The plans related to the development of nuclear energy remain unclear.

The government will need to vastly increase the pace of renewable energy development to meet any of the latest 2030 targets announced. In 2020, the installed renewable energy capacity stood at only around 0.4 GW, generating well less than 1% of electricity (IRENA, 2021). Our current policy projection assumes renewable energies continue to develop at the current, slow pace, reaching only 5 to 6 GW by 2030. This assumption is in line with KAPSARC’s “business-as-usual” scenario. Our planned policies scenario reflects a 30% share of renewable energy share in electricity production in 2030, in line with KAPSARC “2030 renewable energy target” scenario. For further details, see the Assumptions section.

In 2019, Saudi Arabia’s Renewable Energy Project Development Office (REPDO) completed a study claiming that 13.5 GW of renewable energy could be integrated without major grid upgrades (National Renewable Energy Program, 2018). Beyond this, and in order to achieve the renewable energy targets the government has set by 2023 and 2030, large-scale investment in grid infrastructure will be necessary. Saudi Arabia is moving ahead with grid interconnection plans with neighbouring countries, which could facilitate a future uptake and integration of renewables. In August 2020, Saudi Arabia and Jordan signed an agreement to connect the two countries with a 164 km grid interconnection project (ME Utilities, 2020).

Hydrogen

In July 2020, a U.S. based company announced it would build a renewable energy-powered hydrogen plant in Saudi Arabia (Parnell, 2020). The USD 5bn plant would be the world’s largest green hydrogen plant. The Saudi government is aiming to become a main player in the global hydrogen market. Without a massive scaling up of renewable electricity to produce ‘green’ hydrogen, this could jeopardise emissions reductions, as Saudi Arabia would need to rely on natural gas to produce ‘blue’ hydrogen.

On the other hand, redirecting large shares of renewable energy to hydrogen production could make it more difficult to decarbonise the electricity, buildings, and transport sectors.

Transport

The King Abdulaziz Public Transport project is a major initiative to modernise transportation in the city of Riyadh. The capital is set to become the second city in Saudi Arabia with a metro network after the Makkah metro opened in 2010 (Saudi Gazette, 2020b). The Riyadh metro system is set to become operational in 2021–2022 (Arab News, 2021). A bus network will also be launched around the same time as the city’s metro (Saudi Gazette, 2020a).

The Saudi government has also taken steps to invest in rail transport; however, it remains unclear whether the new networks will be electric or diesel-powered. In 2010, it launched the Saudi Railway Master Plan, aiming to construct a 9,900-km network by 2040 (Oxford Business Group, 2020). The first phase, running until 2025, includes constructing and upgrading 5,500 km of tracks for freight and passenger transport, including interlinkages to the wider Gulf Cooperation Council (GCC) railway network. As of 2020, 1,500 km of new tracks have been built and the total length of the network stands at 5000 km. This includes the flagship Haramain high-speed railway linking the two holy cities of Makkah and Medina. The project was completed in 2018 and can serve up to 60 million passengers annually (Kalin, 2018).

The development of electric mobility has been slow. In 2018, Saudi Arabia’s Public Investment Fund announced its intent to establish an electric vehicle (EV) industry in the country following an agreement to invest more than USD 1 billion in the US-based EV manufacturer Lucid Motors (Reuters, 2018). More recently, the company announced it would start manufacturing EVs in Saudi Arabia from 2024 onwards (Saudi Gazette, 2021).

Buildings

In the buildings sector, Saudi Arabia has introduced energy efficiency measures such as insulation standards for new buildings, and tightened minimum energy performance standards for air conditioners (ACs) to reduce local oil consumption. Since the introduction of these measures and standards in 2012, the standards for ACs have been further refined and the insulation standards continue to be enforced.

Contrary to other countries in the region such as the UAE, per capita emissions in the buildings sector have mostly continued to increase over recent years and remain far above world average.

Land use and forestry

Saudi Arabia has announced it aims to plant 450 million trees by 2030—with a long-term target of 10 billion trees, and collaborative efforts to plant 50 billion trees in the Middle East. In 2012, the latest year for which national data is available, the land use and forestry sink stood at just 9 MtCO2e (UNFCCC, 2020), with forests covering a mere 0.5% of Saudi Arabia’s total land area in 2020 (World Bank, 2021).

The current pace of tree planting is too slow to reach the 450 million trees target by 2030. Since around 2020, Saudi Arabia has reportedly planted 18 million trees (Independent, 2021).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter