Country summary

Overview

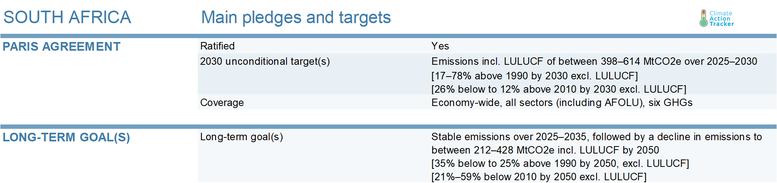

NDC update: In March 2021, South Africa proposed updated NDC targets. Here is our analysis of the announcement.

The COVID-19 pandemic has exacerbated South Africa’s health, social and economic challenges, currently facing the fifth highest COVID-19 caseload of all countries worldwide as of August 2020. Initial proposals by the South African government for post-COVID-19 economic recovery indicate its intention to focus on carbon-intensive investments instead of prioritising a ‘green’ recovery. The economic recovery choice has direct implications for the implementation of the recently adopted Integrated Resource Plan (IRP2019) if carbon-intense projects were prioritised at the expense of an accelerated rollout of renewables. According to an emerging body of literature from the CAT and other institutions, investments in low-carbon technologies would enable substantial opportunities in South Africa for value chain localisation, local air pollutant reduction and job creation. The CAT continues to rate South Africa “Highly insufficient”.

The CAT expects that South Africa’s GHG emissions in 2020 will be 9% to 11% lower than 2019 due to an unprecedented slowdown of domestic economic activity and international trade. For example, mining activity decreased by 21.5% in the first quarter of 2020. The South African Reserve Bank estimates a deep economic downturn of -7.3% of GDP in 2020, followed by a recovery of 3.7% of GDP in 2021. These forecasts are in line with estimates by other institutions such as the African Development Bank, the IMF and the World Bank.

The government has introduced several support programmes and emergency funds in direct response to the immediate COVID-19 health and economic crisis. As of August 2020, the South African government was still consulting business and labour on its draft “Economic Reconstruction, and Recovery Plan”.

A draft Mining and Energy Recovery Plan centres around direct investments in high-carbon sectors, such as gas, and lacks any ‘green’ conditions (e.g. any requirements for low-carbon technologies in new infrastructure investments). This focus on carbon-intense recovery measures stands in stark contrast to domestic and international calls to seize the opportunity for a ‘green’ and low-carbon economic recovery.

Prior to the pandemic, the South African Cabinet finally approved the long-awaited Integrated Resource Plan (IRP2019) in October 2019. The final plan marks a major shift in energy policy away from coal towards renewables, which is remarkable for a coal-dominated country like South Africa.

Implementing the IRP2019 will enable South Africa to achieve its 2030 NDC target. However, we rate South Africa’s NDC target as “Highly Insufficient” based on the upper end of the NDC range. In this context, South Africa should consider revising its target downward for 2030 to be resubmitted to the UNFCCC as part of the Paris Agreement’s ambition raising cycle of 2020.

Before the COVID-19 pandemic, our projections under currently implemented policies estimated that South Africa’s emissions trajectory for 2030 would decrease by around 50% compared to 2020 levels, but would end up at around 33% to 39% above 1990 levels excluding LULUCF. These projections fall well within the “Peak-Plateau-Decline” pathway that the South African government has defined as its NDC.

While it is challenging to project the eventual impact of the ongoing COVID-19 pandemic on future emissions, the CAT estimates that South Africa’s emissions may decrease further towards 2030 by around 8% to 10% below our pre-COVID-19 projection.

This decrease in emissions could be further strengthened and sustained if the government were to implement more stringent climate policies and a ‘green’ economic recovery, and shift away from carbon-intensive investments as planned in some of its COVID-19 recovery plans.

South Africa continues to experience recurring instances of rolling blackouts implemented by Eskom, South Africa’s only state-owned electricity utility. Constant operational problems at its power plants add to overall concerns on future reliability and sustainability of South Africa’s electricity supply and the successful implementation of the Integrated Resource Plan (IRP2019).

The IRP2019 aims to decommission over 35 GW (of 42 GW currently operating) of coal-fired power capacity by 2050. To be in line with the Paris Agreement goals, South Africa would need to adopt more ambitious climate action beyond the IRP2019, such as further increasing renewable energy capacity by 2030 and beyond, stopping the planned commissioning of 1.5 GW of new coal capacity, fully phasing out coal-fired power generation by latest 2040, and avoiding investing in natural gas.

Uncertainty around Eskom’s financial solvency also remains a contributing factor to overall planning uncertainty and ongoing delays in progress on renewable capacity extension. The government recently started a refinancing initiative to reduce the contribution of grid-connected renewables projects to the wholesale electricity price, while a long-awaited bid round for renewable energy projects will not be launched until the first half of 2021.

The South African government implemented a carbon tax in 2019 after two years of consultations, although its immediate impact is likely to be limited given there are tax exemptions for up to 95% of emissions during the first phase until 2022. It is also worth noting that the first payments of this tax have been delayed by three months due to COVID-19.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter