Policies & action

Thailand’s commitment to climate policy has grown in recent years but it has not yet implemented sufficient action; it must deliver more on its mitigation policies to reach its climate targets.

Thailand is in the process of drafting a range of important climate-relevant documents, including its Climate Change Act and National Energy Plan.

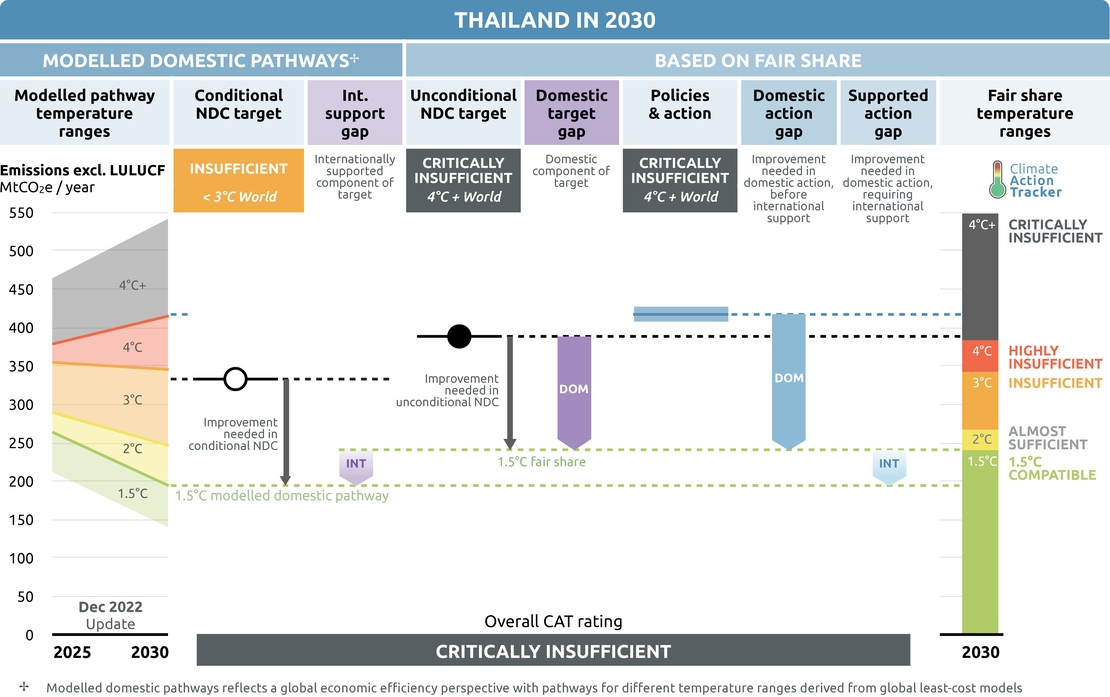

Thailand is at a crossroads in its climate ambition and emissions trajectory, as the details and targets in these upcoming plans, particularly on its efforts to shift away from fossil fuel dependence and align with Paris Agreement goals, will define the country’s climate planning for the foreseeable future. Until new robust climate policy is implemented and existing policies strengthened, we rate Thailand’s policies and action as “Critically insufficient” when compared to its fair share.

Under current policies, Thailand's total GHG emissions (excl. LULUCF) are projected to increase from 349 MtCO2e in 2021 to reach approximately 407 to 427 MtCO2e in 2030, an increase of 17–22%. Thailand’s emissions continue to grow substantially and is projected to miss its Second NDC targets. If Thailand implements its planned policies, including its most recent Power Development Plan and Alternative Energy Development Plan (which is under revision pending the finalisation of the National Energy Plan), its total emissions (excl. LULUCF) would reach approximately 360–379 MtCO2e in 2030. Implementing these policies, which mainly reflect efforts to replace coal with gas in the long-term energy mix, will allow Thailand to reach its unconditional NDC target but miss its conditional one.

Thailand’s “Critically insufficient” rating indicates that Thailand’s policies and action in 2030 reflect minimal to no meaningful action and are not at all consistent with the 1.5°C temperature limit. The country’s emissions rise in both its current and planned policy projections and is significantly off track compared with modelled pathways. If all countries were to follow Thailand’s approach, warming would exceed 4°C. Thailand needs to implement more stringent policies, for which it will also need additional support.

Sectoral pledges

In Glasgow, a number of sectoral initiatives were launched to accelerate climate action. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets. On forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”. The Beyond Oil & Gas Alliance (BOGA) seeks to facilitate a managed phase out of oil and gas production.

NDCs should be updated to include these sectoral initiatives, if they aren’t already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

| THAILAND | Signed? | Included in NDC? | Taking action to achieve? |

|---|---|---|---|

| Methane | No | N/A | N/A |

| Coal exit | No | N/A | N/A |

| Electric vehicles | No, but has 100% electric vehicle sales by 2035 | N/A | N/A |

| Forestry | Yes | No | Yes |

| Beyond oil and gas | No, and is planning to massively increase LNG imports | No | No |

- Methane pledge: Thailand has not signed the Global Methane Pledge. Around 25% of its GHG emissions are from methane, with about half emitted from agriculture and a quarter from energy and waste sectors. If Thailand were to adopt the global target of a 30% reduction, this would cut emissions by about 30 MtCO2e in 2030.

- Coal exit: Thailand has not signed the Coal Exit pledge despite a low share of coal in Thailand’s primary energy mix (13% in 2019), almost all imported. Thailand had previously shifted a planned dependency on coal in the future towards a dependence in fossil gas (33% of energy demand in 2019). This is a minor step in the right direction, but still exacerbates future fossil lock in and energy security issues.

- 100% EVs: Thailand has not signed the electric vehicles pledge, despite officials having signalled an even more ambitious target. Thailand recently raised its target of 30% share of electric vehicles in new vehicle sales by 2030 to 50%, with intentions of 100% electric vehicle sales by 2035.

- Forestry: Thailand has signed the forestry pledge. As of 2016 Thailand’s carbon sink capacity was reported as -91 MtCO2e/year. The country has not set out any forestry targets in its NDC or but has committed to increase forest cover of the country to achieve 55% of the total country area by 2037, as described in the 20-year National Strategy.

- Beyond oil & gas: Thailand has not signed up to the alliance, and currently has limited intention to phase out oil and fossil gas production. Thailand is a producer of both oil and fossil gas, but is also heavily dependent on imports of both fuels to satisfy domestic demand. Over 60% of Thailand’s power generation is from fossil gas. Thailand’s Ministry of Energy has stated its planning to import 36 mtpa of LNG by 2030, an increase of over 1100% from its LNG imports in 2016.

Policy overview

Thailand relies on an array of economic strategies to guide its approach to greenhouse gas emissions reductions, although so far ambitious mitigation targets and policy implementation have been lacking.

Thailand’s approach to climate action is steered by overarching economic and development considerations from the high-level 20-Year National Strategy, which has a central goal to transform Thailand into a 'developed country with security, prosperity and sustainability'. It also relies on its 4.0 policy initiative, a development strategy that aims to transform the economy by targeting policies towards the development of ten targeted “S-curve industries” including bio-technology, future automotive, and logistics (BOI, 2018; TDPK, 2020). The shorter-term 12th National Economic and Social Development Plan (NESDP 2017–2021) provides guidelines for the implementation of the National Strategy and sets economic, social and environmental targets to be achieved within five years (Office of the Prime Minister of Thailand, 2017).

Our policies and action projections incorporates policies included at the highest level, namely the energy sector policies from the National Strategy, its Master Plans, and Integrated Energy Blueprint (TIEB) (2015), which encompasses the key energy planning documents (Power Development Plan (PDP) and Alternative Energy Development Plan (AEDP) 2015, and others) (Ministry of Energy, 2019c, 2019a). Energy sector targets have since been revised in the PDP and AEDP 2018, but have not been enshrined as the next TIEB is still under development. The PDP and AEDP 2018 make up the key policy packages underlining our planned policy projections but are not considered implemented as they will be revised again in 2023.

The policies underlying both our current and planned policy projections, which include sectoral targets relevant to achieving the NDC, leave room for Thailand to increase ambition, as both trajectories reflect increasing emissions over the next decade and plan for a continued lock-in of fossil fuel-based energy sources. Thailand’s submitted LT-LEDS and forthcoming Climate Change Act, expected in 2022, give the country an opportunity to get itself on the right track towards Paris Agreement-compatibility (Government of the Kingdom of Thailand, 2020b; Wipatayotin, 2020).

Amid the ongoing COVID-19 pandemic, in June 2021 the National Economic and Social Development Council (NESDC) – in charge of the economic planning of Thailand – had announced its intention to revise the National Strategy as well as the NESDEP 2017–2021, due to the impact of the pandemic on economic growth (Arunmas, 2020; VietnamPlus, 2021). The government has so far been focusing primarily on economic recovery, rather than a green recovery, with no initial stimulus earmarked for clean energy projects (Greenpeace, 2020).

Thailand’s Climate Change Master Plan (2015–2050) defines targets, and has set a mid-term emissions reduction target in the energy and transport sectors of 7–20% below BAU by 2020. It also calls for renewable energy to provide a share of at least 25% of total energy consumption by 2021, and a reduction of energy intensity by at least 25% below BAU in 2030 (Ministry of Natural Resources and Environment, 2015). Our current and planned policy projections do not include this Plan’s targets, as the strategic documents that inform the Plan have since been outdated (e.g. PDP2010).

Thailand is implementing a domestic carbon reduction scheme, the Thailand Voluntary Emission Reduction Scheme (T-VER), and is into the third phase of its Voluntary Emissions Trading Scheme (V-ETS), both launched in 2013. Most T-VER projects to date cover renewable energy power generation, energy efficiency and waste projects, and have so far contributed to 5.8 MtCO2e of total emissions reductions from 153 registered projects (as of October 2020). The national ETS legislation process will be kickstarted with the implementation of the Climate Change Act due in 2023 (ICAP, 2021; IEA, 2021).

Energy supply

The energy sector is the main source of GHG emissions within the Thai economy. In 2021, the energy sector accounted for 82% (285 MtCO2e) of the country’s GHG emissions, excluding LULUCF (Gütschow and Pflüger, 2022). In 2022, Thailand has been attempting to shore up energy security primarily through means of boosting fossil fuel supply. It has recently approved the building of a new 1,400 MW gas-fired power plant, revived and delayed retirement of coal units, started construction of new LNG import terminals and gone abroad to secure gas fields in Myanmar as domestic gas production has been on the decline for several years. Fossil gas is continuing to be the primary fuel source for electricity (and second only to oil in total primary energy supply) for the next decades, with energy authorities heavily banking on LNG. LNG made up a minor portion of supply in 2016, but is expected to make up most of gas supply by 2030. The market volatility and high prices for LNG has begun to erode the case for long-term gas dependency—already, Thailand slashed its demand outlook in 2022 and needed to substitute gas for cheaper and more pollutive fuels in power plants to protect consumers.

In 2016, 90% of electricity was generated with fossil gas, hard coal and lignite—fossil gas comprised of 67% of the total, and 10% was generated from renewables (IRENA, 2017). The electricity mix has since become slightly less dependent on fossil fuels, with 82% of electricity generated from fossil fuels and 18% from renewables in 2020 (Ember, 2021). Thailand currently relies on imports for approximately 8% of its electricity, supplied mainly from Laos, Malaysia and Myanmar in the form of natural gas, coal, and hydro. Natural gas imports from Myanmar are increasingly affected by sanctions.

The Thailand Integrated Energy Blueprint (TIEB), adopted in 2015, is comprised of five documents: the Power Development Plan (PDP), the Alternative Energy Development Plan (AEDP), the Energy Efficiency Development Plan (EEDP), the Oil Plan and the Gas Plan. They are designed to help the country deal with the issues of increasing energy demand, import dependence and environmental concerns.

Thailand is currently in the process of developing its first-ever National Energy Plan (NEP) due in 2023 which will serve as a master document integrating the TIEB (and sub-documents) and 20-year national strategies. The National Energy Policy Council recently approved the NEP framework, and pushed for its support to revise the PDP2018 (revision 1) and increase renewable generation in the next decade to support a transition to carbon neutrality by 2065–2070 (Thansettakij, 2021).

The PDP, last revised in 2018 (approved 2019), is the roadmap defining targets for Thailand’s power generation, distribution, and consumption, with a goal to increase net electricity production capacity by 67%, from 46,090 MW in 2017 to 77,211 MW in 2037. It will add 56,431 MW of capacity (of which 37% should come from renewables) and retire 25,310 MW (Hong, 2019; Theparat and Praiwan, 2019). The plan also notes that by 2037, 65% of the energy mix will rely on fossil fuels (53% natural gas, 12% coal) and 35% on non-fossil fuels. Compared to the 2015 plan, the new plan reduces reliance on coal (23% to 12%) and increases dependence on gas (37% to 53%), while 9% of power is expected to come from imported hydropower.

Renewables targets are set in the AEDP2018. Overall, renewables should reach 30% of total energy consumption by 2036, up from 12% in 2014. Heat generated from renewable sources should double, from 17% to 30–35%. The policy further notes that the production of biofuels should increase, from 7% to 20–25% of demand in the transport sector. Power capacity from renewables was to increase from 9% to 20%, but in a 2018 revision of the plan, this target was raised to 33%, notably with a more than doubling of expected solar capacity (from 6,000 to 15,574 MW by 2037) and the introduction of waste to energy (900 MW).

The EEDP also set a target to reduce energy intensity by 30% by 2036, while the Oil Plan foresaw an increase of the share of biofuels to 20% and proposed the removal of fossil fuel subsidies. Finally, the Gas Plan highlights the need to curb demand, maintain national production levels and to secure LNG supply (Ministry of Energy, 2018).

More recently, the government has indicated an interest in promoting rooftop solar PV installations. It first introduced a feed-in tariff in 2013, but did not attract widespread interest. The goal is to reach 50 MW electricity capacity by 2025 to help achieve the PDP goals (Praiwan, 2020).

Transport

Thailand has been actively prioritising decarbonisation in the transport sector, and has recently adopted several policies promoting electric vehicle (EV) uptake, railway expansion as well as the development of public transport systems.

Following the adoption of its NDC target and a sectoral breakdown in 2015, Thailand has introduced priority measures for implementation in the transport sector. Its aim is to reduce emissions from the sector by 35 MtCO2 before 2030 off the back of over 30 planned projects, but mainly through taxing CO2 emissions, promoting low-carbon vehicles and increasing rail infrastructure (Ministry of Transport, 2019). The Sustainable Transport Master Plan identifies six main strategies to reduce GHG emissions, relying on ‘avoid-shift-improve,’ and shows a potential for reducing sectoral emissions by 26–29% by 2030 below BAU levels (Ministry of Transport, 2013).

Thailand has both an interest in increasing production – and promoting the domestic uptake – of electric vehicles. As a major car manufacturer and in light of the growing increase of worldwide EV sales, Thailand has set a new National EV Roadmap, with an overall goal to transform the country into an EV hub within the ASEAN region. The roadmap sets future production goals, with the first target for 2025 (250 000 EVs; 3,000 electric public buses; 53,000 electric motorcycles by 2025) and a longer-term target of EVs making up 30% of production by 2030 (Amir, 2020; Apisitniran, 2020).

In March 2021, the National New Generation Vehicle Committee chairperson announced a revision of the EV production policy, setting a target for Thailand to produce only EVs by 2035. This goal replaces the previous target which foresaw 1.1 million EVs on the road by 2025, and a rapid uptake that would lead to 5.4 million EVs by 2030 and 15.6 million by 2035 (Bangkok Post, 2021; Thanthong-Knight, 2021). However, the Electric Vehicle Association reported that as of 2020, only 4,799 EVs were registered in Thailand, an indication not only of a need for a rapid transition from internal combustion engine (ICE) vehicles, but also for the government to prepare the necessary infrastructure, including sufficient charging stations (Bangkok Post, 2021). The government has implemented further measures to incentivise EV production, with plug-in hybrid electric vehicle (PHEV) and battery electric vehicle (BEV) projects being eligible for tax holidays as well as Corporate Income Tax (CIT) exemptions (Medina, 2020).

Thailand has an excise tax on new vehicles, adopted in 2016, based on CO2 emissions intensity to help the adoption of cleaner and more efficient vehicles. The tax varies between 20–50%, depending on engine capacity and type of vehicle (Thailand Automotive Institute, 2020). The policy is expected to be revised in the near future as part of a push for quicker adoption of EVs, to meet the EV Roadmap’s objectives (GlobalData, 2021).

The government has implemented an excise tax on fuels, and intends revising it, which could lead to higher taxes on fuels that emit more CO2, a decision in line with the emissions-based vehicle tax (Wichit, 2019).

The Transport Infrastructure Development Strategy (2015–2022), with an earmarked budget of TBH 1.9tn (approx. USD 59bn), is expected to help Thailand develop several infrastructure projects, including intercity rail, public transport and water transport network development, highway capacity increase to connect the country’s key production areas to neighbouring countries, as well as air transport capacity enhancement (Thailand Board of Investment, 2020).

Thailand has adopted the Transit-Oriented Development policy in September 2020, in which it has announced its intention to develop 177 railway stations throughout the country, with TBH 2.7tn TBH (approx. USD 84bn) earmarked and the plan to place the railway system at the heart of the country’s transport and logistics network (Wancharoen, 2020). A Thai-sino high-speed train project is also underway, and three contracts were recently signed. Six stations are expected to be built and construction is underway on the 253km Bangkok-Nakhon Ratchasima line (Railway Technology, 2021). In the Bangkok Metropolitan Region, where public transport is insufficient for the growing population and still attracting limited commuters, the 2010–2030 Railway Development Master Plan will restructure, improve and enhance the efficiency of the rail network, while the Mass Rapid Transit Master Plan will see the creation of 12 lines (509 km) of new railways (Nanthachatchavankul, no date; Ministry of Transport, 2013).

Industry

The industrial sector’s non-energy emissions represented approximately 10% of Thailand’s GHG emissions in 2021 (approx. 37 MtCO2), , excluding LULUCF (Gütschow and Pflüger, 2022).

Under the Climate Change Master Plan (2015–2050), Thailand has a goal to reduce GHG emissions by 7–20% below 2005 levels in the energy and transport sectors by 2020, a target subjected to international support (Ministry of Natural Resources and Environment, 2015).

The Energy Efficiency Plan (2015–2036) sets a target of realising 14,515 ktoe of energy conservation in the industry sector to achieve a 30% energy intensity reduction by 2036 (Wongsapai, 2017). The Energy Conservation Promotion Act, amended in 2007, notes that ‘designated’ factories and buildings need to conduct an energy audit, and more generally promote energy conservation and efficiency, as well as energy recycling. It also seeks to stabilise the share of energy demand for the three most energy-intensive sectors at 40% by 2030 (EPPO, 2007).

To transition from a manufacturing to an innovation and value-based economy, the government has proposed the Thailand 4.0 initiative. The transition should encourage environmentally friendly growth and lead to the achievement of a low-carbon society (Setsirote, 2016). While the initiative lists 10 key industries that are expected to be developed (including low-carbon automotive, smart electronics or biofuels) and states that the Eastern Economic Corridor is at the centre of this transformation, it provides no clear targets for decarbonisation nor emission reductions.

Agriculture

The agriculture sector, emitting primarily non-CO2 gases, accounts for almost 20% (69 MtCO2e) of Thailand’s total GHG emissions in 2021 excluding LULUCF (Gütschow and Pflüger, 2022). Sixty percent of those emissions stem from rice production (Nama Facility, no date). This sector is particularly vulnerable to climate change, while facing several structural challenges, among them small farm sizes, poverty and indebtedness, ageing of the workforce, water scarcity, and soil degradation (UN Thailand, 2020).

To tackle some of those issues, the government has developed the 20-Year Agricultural and Cooperatives Strategy (2017–2036) and the Five-Year Agriculture Development Plan (2017–2021) under the goals of the 20-Year National Strategy and the 12th National Economic and Social Development Plan.

The Strategy contains several goals regarding farmer income, productivity increase and quality standards, as well as the need to develop ‘smart farming’ (an initiative in line with the Thailand 4.0 initiative) and to promote sustainable management of agricultural resources. In that last category, the government sets targets around the increase of certain types of farmland to promote a more sustainable revival and conservation of agricultural resources. While there are no specific targets for reducing GHG emissions in the agriculture sector, the Thai Rice NAMA (2018–2023) aims to reduce emissions from rice production by 26% over those five years (Nama Facility, no date).

An important development in the agriculture sector is related to biofuels. The production of cassava, sugar and palm has increased in Thailand, leading to an increase in utilised acreage (Ministry of Agriculture and Cooperatives, 2017). Part of the crops is used for the production of biofuels, which some report suggest could lead to lower emissions in Thailand compared to their fossil fuel counterparts (e.g. Lecksiwilai et al., 2017). In the absence of sustainability standards for biofuels, the benefits of using biofuels could be outweighed by issues related to unsustainable land use, deforestation or the use of pesticides (Silalertruksa and Gheewala, 2012; Lecksiwilai and Gheewala, 2020).

Buildings

The buildings sector represented 20.9% of final energy consumption in 2018, split between 7.8% for the commercial and 13.1% for the residential sector (Ministry of Natural Resources and Environment, 2020b). The government has since taken measures to bring down emissions from the buildings sector, both in the residential and commercial and public buildings.

Under the Energy Efficiency Development Plan (EEDP) (2015), the government identifies the need for buildings and appliances to be more energy efficient. It sets an energy consumption reduction target of 4,819 ktoe by 2036 in the commercial and public buildings sector, with an additional reduction of 2,153 ktoe in the residential sector (APERC, 2017). The target to reduce the energy demand in new buildings by 36% is included under the compulsory programme designed under the EEP. The AEDP (2015) contains a target for heat generated by renewables of 30–35% 2036. Three solar technologies (solar water heater, solar dryer and solar cooling) have also been promoted heavily in the plan (Misila, Winyuchakrit and Limmeechokchai, 2020).

The Building Energy Codes (BEC), adopted in 2009, aimed at improving energy efficiency for new or retrofitted buildings larger than 2000 m2, through better design of a building’s envelope, and its lighting, cooling and heating systems (APERC, 2017). It will be extended to a wider array of buildings while promoting the construction of energy-efficient buildings respecting certain certificates (such as LEED and TREES); it will also promote Zero-Energy Building (ZEBs) for new private and government constructions. For public buildings, it proposes that Energy Service Companies (ESCOs) will provide energy performance contracts and ensure energy savings (Ministry of Energy, 2017).

Further emission reduction measures include appliance standards. In 2011, the government adopted Minimum Energy and High Energy Performance Standards (MEPS/HEPS). It created mandatory MEPS to limit the energy consumption in air conditioners, refrigerators, and certain types of fluorescent lamps, while 28 appliances were covered by newly established HEPS (APERC, 2017). Considering the importance of refrigeration and air conditioning in Thailand’s buildings sector – due to hydrofluorocarbon (HFC) emissions with a high global warming potential– the government has implemented the ‘Refrigeration and Air Conditioning NAMA (RAC NAMA)’ to promote the production of climate-friendly and energy-efficient technologies. RAC equipment is expected to cut emissions by 19.4 MtCO2e over its lifetime (NAMA facility, no date).

Waste

The waste sector represented 8.5% (approx. 30 MtCO2e) of GHG emissions in 2021, excluding LULUCF (Gütschow and Pflüger, 2022). Thailand generated 26.9 million tonnes of municipal solid waste in 2015, of which only 31% were appropriately disposed of. In addition, 3.4 million tonnes of hazardous waste were produced, of which only 35% were properly disposed of (Government of the Kingdom of Thailand, 2020a). Wastewater treatment facilities have also been insufficient; the government noted that in 2013, of the 14 million m3/day of wastewater, only 3.2 million could be treated (Chokewinyoo and Khanayai, 2013). The lack of waste treatment is an important issue, as the national GHG inventory showed that 90% of total emissions from the waste sector came from methane emanating from landfills and wastewater in 2013 (Government of the Kingdom of Thailand, 2020a).

To address these waste issues, the government has adopted a number of policies. The National Solid Waste Management Master Plan (2016–2021) contains four important measures: 1) reduce waste generation and improve waste collection by applying the “3Rs” (Reduce, Reuse, Recycle) waste management principle, and improve the efficiency of waste separation to reduce disposal of waste; 2) increase waste recovery and disposal by introducing integrated technologies such as waste-to-energy systems; 3) improve the legal framework surrounding waste management and 4) encourage public involvement by promoting education, awareness campaigns and capacity building (Wichai-utcha and Chavalparit, 2019).

Projects aiming at collecting landfill gas to produce electricity have also been launched. In Bangkok for example, the Kamphaeng Saen Landfill was equipped with a landfill gas collection system and is expected to reduce GHG emissions by 78,209 tCO2e/year (UNFCCC, no date).

Forestry

Thailand recorded a large LULUCF sink in its latest inventory equivalent to around 20% of its emissions. Thailand should work toward maintaining this sink.

Thailand’s terrain is divided between 47% of agricultural land use, 21% of non-agricultural land use and 32% of forest areas (Government of the Kingdom of Thailand, 2020a). The country has lost over 2 Mha of forest cover since 2001, despite the nationwide logging ban adopted in January 1989, prompting a new series of laws against deforestation (Global Forest Watch, no date).

The National Economic and Social Development Plan (2017–2021) targeted forest reserves to be expanded up to 40% of the national territory, with an expansion of conservation areas to at least 25%, and an annual mangrove coastal reforestation of at least 10,000 hectares, all improvements from the previous Plan in 2012 (NESDB, 2017).

With the revision of the 20-Year National Strategy in 2018, the government stated it will increase forest areas to 55% of the country’s land by 2037 (Bangkok Post, 2018). According to the official inventory, Thailand’s forestry sector has been a net carbon sink since 2000 (when records start). The country’s increasing progressiveness of forestry policy in the last 20 years has also been reflected in the ongoing trend of an increasing forestry carbon sink (47% net increase in carbon sink from 2000 to 2016).

In 2016, Thailand received a grant from the Forest Carbon Partnership Facility to develop and implement activities to increase REDD+ readiness. The project was implemented between 2016 and 2019 and led to the publication of Thailand’s forest reference emissions level and forest reference level for REDD+ under the UNFCCC (Ministry of Natural Resources and Environment, 2020a).

In Thailand’s LT-LEDS, it expects to reach a level LULUCF removals of 120 MtCO2e by 2037, staying at the same amount until 2050 (ONEP, 2022).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter