Country summary

Assessment

Turkey continues with its plan to meet increased energy demand by building new coal-fired power plants and, as the Ministry of Energy and Natural Resources announced in May 2019, is holding tenders for coal mines promoting domestic coal. This stands in strong contrast to the need to reduce the use of coal in electricity globally by two thirds over 2020–2030 and to zero by 2050.

While the stated aim for this coal expansion is improved energy security, water shortages in the region are already casting doubt on the operating efficiency, output and reliability of thermal power plants, and these stresses are expected to intensify. The ongoing reduction in the costs of renewable energy technology and storage means that reliable power can be obtained cost-effectively without resorting to coal-powered generation. Turkey has also begun constructing its first nuclear power plant amid international protest at the earthquake risk.

However, while Turkey has some strong renewable energy goals, there are now delays in both project construction and auctions, throwing those goals into doubt.

On the positive side, the Turkish government has committed to investing almost US$ 11 billion in energy efficiency measures and its National Energy Efficiency Action Plan, if fully implemented, is expected to reduce Turkey’s emissions by 14% below current policy projections by 2030. However, because of the underlying growth in coal projected, the resulting emissions level would still fall within our “Critically Insufficient” emissions range.

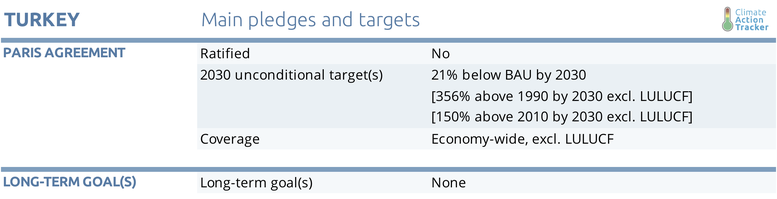

Aside from the Energy Efficiency Action Plan, Turkey has made little progress on climate action implementation. It still hasn’t ratified the Paris Agreement. The government appears to be standing still in developing measures that might reduce its GHG emissions: its 7th National Communication (NC7) projections in 2018 have identical projections as the previous version (NC6) as well as the 2015 INDC BAU.However, the NC7 describes more precisely the policies included within the NC6.

The CAT emissions trajectory in this update shows that Turkey will overachieve its “Critically Insufficient” Paris Agreement target, based on revised economic assumptions and updated historical data in our methodology.

The CAT has reviewed its lower range of current policy projections for Turkey, which is based on the observed historical GDP elasticity showing emissions Turkey could reach in 2030 if current energy productions and GDP growth were to remain similar to historical trends. The difference observed between historical trends and the official base line used to define Turkey’s INDC is of 421MtCO2e which could be significantly reduced if Turkey would revise its Business as Usual projections and underlying assumptions.

For full details see pledges and targets section.

Turkey remains one of the only two G20 countries that have not ratified the Paris Agreement (the other is the Russian Federation). Its Intended National Determined Contribution (INDC) submitted in 2015, contains a greenhouse gas reduction target (including land use, land use change and forestry (LULUCF)) of up to 21% below business-as-usual (BAU) in 2030 (The Republic of Turkey, 2015). Excluding LULUCF emissions, the target in the INDC is equivalent to a 90% increase from 2017 levels (latest historical year included in our analysis).

We rate Turkey’s INDC target “Critically Insufficient”. Turkey’s commitment is not in line with interpretations of a “fair” approach in line with holding warming below 2°C, let alone with the Paris Agreement’s stronger 1.5°C limit. This means that if most other countries followed Turkey’s approach, global warming would exceed 3–4°C.

Turkey is also embarking on building Nuclear Power Plants (NPP), having announced that three NPP will come into operation between 2023 and 2030. The first, a four unit, 4.8GW NPP at Akkuyu, is the result of a partnership with Russia’s Rosatom. The basemat from its first unit (1.2 GW) was completed in May 2019 and this unit is expected to be fully operational by 2023. The full four unit NPP is expected to be operational by 2025. The European Parliament recently voted against the construction of the Akkuyu plant, calling for the inclusion of neighbour countries in the process and pointing out the risks of severe earthquakes in that region. tion, which reached 101.5 million tonnes.

Turkey is also embarking on building Nuclear Power Plants (NPP), having announced that three NPP will come into operation between 2023 and 2030. The first, a four unit, 4.8GW NPP at Akkuyu, is the result of a partnership with Russia’s Rosatom. The basemat from its first unit (1.2GW) was completed in May 2019 and this unit is expected to be fully operational by 2023. The full four unit NPP is expected to be operational by 2025. The European Parliament recently voted against the construction of the Akkuyu plant, calling for the inclusion of neighbour countries in the process and pointing out the risks of severe earthquakes in that region.

Akkuyu is expected to be followed by a second NPP at Sinop in Northern Turkey. However, this is facing difficulties as the Japanese construction partner is pulling out from the project. Discussions are underway with Chinese interests for the third NPP.

In 2016, the government introduced the Renewable Energy Resource Areas (YEKA) strategy, a tender process to procure the production of renewable energy on ‘Renewable Energy Designated Areas,’ (REDAs). The first auction in March 2017 was awarded for a solar PV power plant production, but construction has not yet started. A 1GW wind onshore was awarded by auction in August 2017 and the turbine factory in the Aegean city of Izmir is expected to be up and running by the end of 2019. A third wind onshore auction (1GW) has recently (May 2019) been awarded to the German-Turkish consortia (Enercon-Enerjisa).

While there was a successful tender process in 2017, the 1.2 GW off-shore wind auction initially announced for June 2018 has been postponed to 2019 at the earliest. This was followed by the cancellation of the second solar PV YEKA auction, originally planned for January 2019. So even though the Ministry of Energy and Natural Resources has new plans for an additional 10 GW of solar PV and 10 GW of wind capacity to be installed in the coming decade, if the delays for renewables experienced so far were to continue, we are not confident this timeline will be met.

Due to its strategic location and the forecasted increasing demand on Liquified Natural Gas (LNG) worldwide, Turkey is aiming to become a gas trading hub by developing its storage and regasification capacities: two new floating storage and regasification units (FSRU) planned by 2023 when the second FSRU was commissioned in January 2018. The CAT, however, cautioned in June 2017 that natural gas has a limited role to play as a bridging fuel in the power sector and runs the risk of overshooting the Paris Agreement long-term temperature goal if fully operational or creating stranded assets.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter