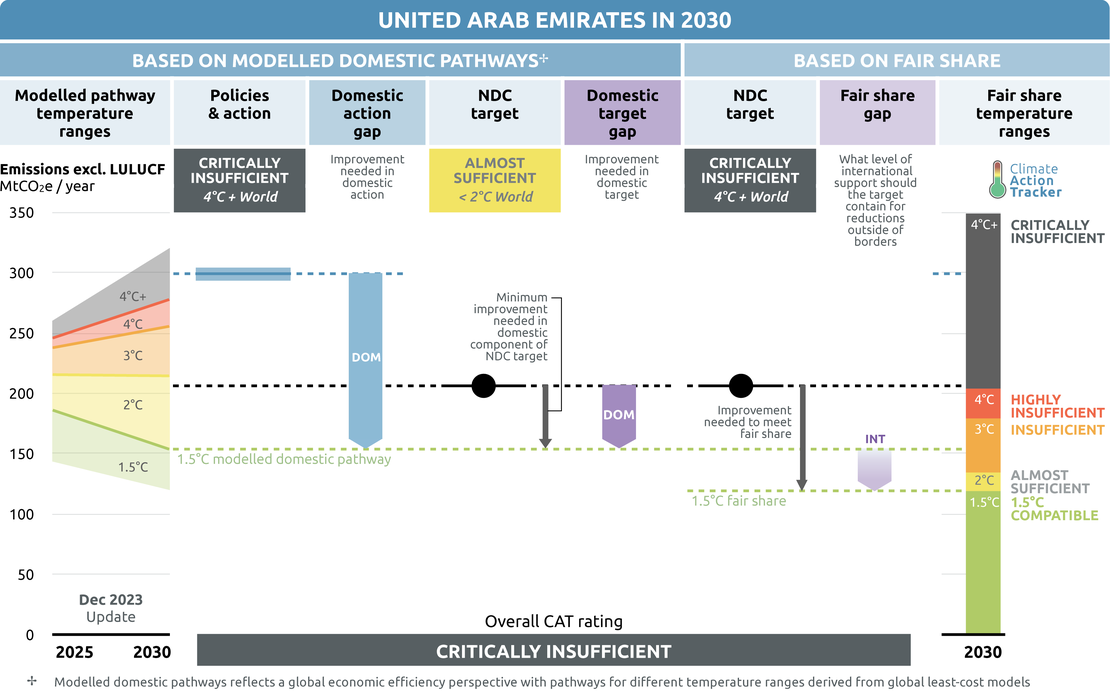

Policies & action

The CAT rates the UAE’s policies and actions as “Critically insufficient” when compared with modelled domestic emissions pathways. The “Critically insufficient” rating indicates that the United Arab Emirates’ policies and action reflect minimal to no action and are not at all consistent with the Paris Agreement’s 1.5°C temperature limit. If all countries were to follow the UAE’s approach, warming would exceed 4°C

The UAE’s policies and action rating has been downgraded compared to our previous assessment, for two reasons. First, we have updated the UAE historical data, resulting in higher emissions (excluding LULUCF) compared to the previous assessment. The latest estimates of F-gas emissions in the UAE are significantly higher, leading to higher historical industry emissions. Second, we updated our modelled domestic pathways to the pathways assessed in the IPCC AR6. Our newer pathways better capture national circumstances show that the UAE needs to cut emissions faster to align with 1.5°C.

Current policies are still set to lead to increasing rather than decreasing emissions in 2030, due to a continued expansion of fossil fuel production and use. The UAE is also currently developing both nuclear and solar power and is well on track to meet its 30% “clean” energy capacity target by 2030 and its 50% target for 2050, but these developments will not reverse the emissions increase.

Emissions appear to have decreased between 2015 and 2020, notably due to efficiency increases in the use of gas in the electricity sector and more recently due to the COVID-19 pandemic. However, there are significant uncertainties when it comes to historical emissions. The UAE’s last GHG inventory dates from 2014, and there are large discrepancies in historical emissions reported by other sources, particularly for energy-related CO2 emissions. Using other data sources with higher historical emissions would also lead to an upwards revision of the projections under policies and action.

Policy overview

The CAT estimates that the UAE’s 2030 emissions under current policies are set to increase to 294–304 MtCO2e, or 16-20% above 2022 levels.

In July 2023, the UAE revised its 2050 Energy Strategy, a plan first launched in 2017, which aims to diversify the energy mix and improve energy efficiency (WAM, 2017). The revised strategy no longer includes its previous 12% “clean coal” target by 2050. Because its “clean energy” target of 50% of installed capacity in 2050 has not been increased, we interpret that the fossil gas power capacity target was increased from 38% to 50%. (Government of the UAE, 2023b).

With its current policies, the UAE will miss its new NDC by a large margin. It would need to implement more policies and reduce its 2030 emissions by a further 30-32% in order to reach its NDC target. We have slightly revised our current policy projections to reflect both the removal of the UAE’s coal capacity target, as well as its new target for power installed capacity in 2030. The reduction in emissions estimated from the intended switch of coal to gas is partially offset by the new information about the UAE’s 2030 targets, which show that total installed capacity in 2030 will be higher for all technologies (including gas) than previously thought. Overall, the change leads to only slightly lower emissions (~1%) compared to our previous estimate. However, due to revised historical emissions estimates, current policy projections are now 15-16% higher than in our previous assessment.

The UAE is planning to significantly increase its oil production in the next years, and it is pushing to reach “gas self-sufficiency”, with major investments in offshore gas production. In November 2022, ADNOC announced a USD 150bn investment plan to expand its oil and gas business in the next five years (The Guardian, 2023). As part of this plan, ADNOC awarded contracts worth USD 17bn in October 2023 for the Hail and Ghasha Offshore Development project. This project aims to produce 1.5 billion standard cubic feet per day (bscfd) of gas before the end of the decade (Reuters, 2023). In parallel to this, the UAE is also making substantial investments in nuclear and renewable energy. For more details, see the energy supply section.

The developments and the investment going towards new fossil fuel infrastructure are not consistent with limiting global warming to 1.5°C, instead are likely to lock the UAE into a high-emissions trajectory and undermine its transition towards renewable energy. Instead of ramping up its gas production towards self-sufficiency, the UAE should set out an ambitious plan to phase-out its dependency on gas for electricity and switch to renewables, which would reduce prices and price volatility for consumers, and avoid the risk of stranded assets (CAT, 2022).

Our current policy scenarios are based on the implementation of the UAE’s Energy Strategy 2050. We present a range based on how the UAE will implement this strategy: the upper bound shows emissions in 2030 if the UAE only implements its 2030 installed capacity targets, and the lower bound shows emissions in 2030 if in addition, the UAE implements its 40% efficiency target.

For more information, please see the assumptions tab.

Sectoral pledges

In Glasgow, a number of sectoral initiatives were launched to accelerate climate action. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets. On forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”. The Beyond Oil & Gas Alliance (BOGA) seeks to facilitate a managed phase out of oil and gas production.

NDCs should be updated to include these sectoral initiatives, if they’re not already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

| UAE | Signed? | Included in NDC? | Taking action to achieve? |

|---|---|---|---|

| Methane | Yes | Yes | Unclear |

| Coal exit | No | N/A | N/A |

| Electric vehicles | No | N/A | N/A |

| Forestry | Yes | Unclear | Yes |

| Beyond oil and gas | No | N/A | N/A |

- Methane pledge: the UAE signed the methane pledge at COP26. Methane is a significant source of GHG emissions in the country, representing ~23% in 2021, mostly stemming from upstream fossil fuel production and waste. The UAE already includes methane in its NDC, and has some plans in place to reduce both energy and waste-related methane.

However, the government has not set out any additional policies or measures following its participation in the methane pledge. If the UAE were to reduce its methane emissions by 30% below 2021 levels, this would result in a 15 MtCO2e or 7% reduction of its total emissions (excl. LULUCF). If this reduction were additional to current policies, it would reduce the gap between current policies and the NDC target by around a quarter.

- Coal exit: the UAE has not adopted a formal coal phase out but it no longer has any coal in its power sector planning. The UAE’s 2050 Energy Strategy first launched in 2017 included plans to develop coal power plants. However, in February 2022, the UAE announced that it would be switching its only coal power plant to fossil gas. According to the UAE’s 2023 NDC, its updated Energy Strategy no longer includes a coal target. The updated 2050 Energy Strategy is still vague on this: it still includes a mention of the 12% coal target in 2050 but in a separate section mentions that the first coal plant has been converted to run on fossil gas.

- 100% EVs: the UAE has not adopted the 100% EVs initiative.

- Forestry: the UAE signed the Leaders’ declaration on forest and land use at COP26. Land use and forestry emissions do not play a large role in the UAE. However, the sector is covered in the NDC, and the UAE has pledged to plant 100 million mangrove seedlings, of which it has already planted about 64 million, by 2030 in an effort to restore maritime ecosystems and sequester carbon (Government of the UAE, 2023a).

- Beyond oil and gas: the UAE has not adopted the beyond oil and gas initiative and is planning for a significant increase in oil and gas production.

Energy supply

Oil & gas production

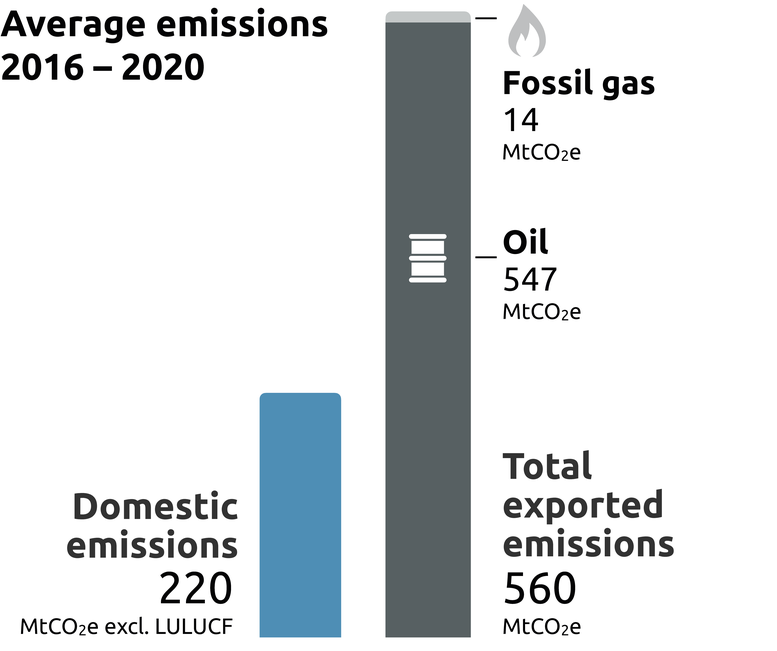

The UAE is the world’s 7th largest oil producer and 14th largest gas producer (US EIA, 2023a). It is also one of the world’s largest oil exporters. The UAE’s exported emissions from oil and gas are about 2.5 times larger than its domestic emissions (see graph below) (Climate Action Tracker, 2023).

In 2022, oil production reached 4.2 million barrels per day, an increase of 12% compared to the previous year, and surpassed pre-pandemic levels (US EIA, 2023b). Following an OPEC+ decision to cut production by two million barrels per day (mbpd) in an effort to keep oil prices up in October 2022 (Deepthi Nair, 2022), the UAE announced it would cut over 140,000 barrels per day from May 2023 until the end of the year (Gulf Today, 2023). However, the UAE also recently announced it was bringing forward its oil production capacity of five mbpd target (up from 3.8 mbpd currently), from 2030 to 2025, signalling its intent to ramp up production in the short term (Di Paola, 2022).

The UAE is also developing oil and gas offshore exploration and production. This is part of its efforts to reach “gas self-sufficiency” (ICLG, 2022). In February 2022, the first offshore fields were discovered, which are estimated to contain between 43 and 57 billion cubic metres of gas (AFP, 2022). During 2022, Abu Dhabi National Oil Company (ADNOC) Drilling was awarded almost USD 6bn in contracts to “maximise value from Abu Dhabi’s offshore oil and gas resources” (World-Energy, 2022). In October 2023, ADNOC awarded contracts worth USD 17 bn for the Hail and Ghasha Offshore Development project. This project aims to produce 1.5 billion standard cubic feet per day (bscfd) of gas before the end of the decade (Reuters, 2023). This is part of a USD 150bn ADNOC plan to increase production of oil and gas.

According to the IEA, the development of new fossil fuel infrastructure beyond what was already committed in 2021 is incompatible with reaching net zero by 2050 (IEA, 2021c). We consider these developments and the investments into new fossil fuel infrastructure inconsistent with limiting global warming to 1.5°C. They are also likely to lock the UAE into a high-emissions trajectory and undermine its transition to renewable energy. Instead of ramping up its gas production towards self-sufficiency, the UAE should set out an ambitious plan to phase-out its dependency on gas for electricity and avoid the risk of stranded assets (CAT, 2022).

In 2020, ADNOC announced a 2030 target to reduce its GHG intensity by 25%. The company mentioned efficiency increases, zero routine flaring, and CCS as the main measures planned for the achievement of its target (Government of the UAE, 2022). The UAE’s 2023 NDC update also includes an ADNOC target to reach net zero by 2050, but without specifying which emissions are covered, by how much emissions will be reduced and how much would be offset (Government of the UAE, 2023a).

In October 2023, ADNOC announced it would be doubling its CCS target from 5 to 10 MtCO2e removed annually by 2030 as part of its decarbonisation plan (Energy Voice, 2023). In a sustainable 1.5°C pathway, CCS with fossil fuels does not play a relevant role in energy sector decarbonisation, as renewable energy is much cheaper and has a much lower environmental footprint. The use of CCS needs be limited to industrial applications where it is proven there are no other options to reduce process emissions.

Electricity supply

The UAE’s latest NDC update sets a target to reduce electricity emissions by 11% below 2019 levels by 2030. Under this sectoral target, emissions from electricity are expected to be ~68 MtCO2e in 2030 (Government of the UAE, 2023a). Our current policy scenario based on the Energy Strategy 2050 shows that the UAE is possibly on track to meet its power sector target.

In 2017, the UAE announced its Energy Strategy 2050, a plan aimed at diversifying the electricity mix and improving energy efficiency (Government of the UAE, 2017). The strategy foresees shares of 44% renewable energy, 38% gas, 12% “clean coal” and 6% nuclear in the country’s installed electricity capacity in 2050. As of 2020, gas accounted for 88% of installed capacity, nuclear at 4% and renewables 8% (IRENASTAT, 2023).

We estimate the implementation of this policy would lead to rising energy-related emissions due to the increase in gas-fired generation. In 2023, the government updated the Energy Strategy, and according to the 2023 NDC update, it no longer includes coal (Government of the UAE, 2023a). Because the government didn't increase its 2050 “clean energy” target, we assume that the 12% capacity previously allocated to coal power is now going to be met with fossil gas generation capacity. The UAE has also announced an investment of USD 54 billion over the next seven years to support its updated energy targets. However, it remains unclear if the recently announced investment plan is additional to the USD 160 billion the country had previously announced to support its 2050 energy targets (Associated Press, 2023).

These recent announcements lead to a small downward revision in our current policies scenario. However, this is partially offset by new information on the UAE’s total installed capacity in 2030. The new 2030 targets for “clean energy” and some information provided in the NDC on installed capacity plans allow us to better estimate the total installed capacity in 2030. Our new installed capacity estimate is slightly larger than the previous one, and that means emissions are also proportionately higher. If the UAE were to provide information on the total energy generation and the installed capacity behind its Energy Strategy, it could improve the accuracy of current policy projections.

Coal

In May 2020, the construction of the first phase of the UAE and the Middle-East first coal power plant was completed. This consisted of the first two units of the 2.4 GW ultra-supercritical Hassyan power plant, with the second phase planned for Q3 2023 (Global Energy Monitor, 2022).

In February 2022, the UAE announced that it would be switching its coal power plant to fossil gas, in support of its net zero target, and has reported that the plant, originally designed as a dual-fuel plant, has now done so (Global Energy Monitor, 2022).

Nuclear

The UAE continues to develop nuclear power. In October 2022, the third unit of the Barakah nuclear power plant went online, increasing total capacity to 4.2 GW. The last unit of the project, awarded to a South Korean consortium, came online in February 2023. Once the last unit is operational in 2025, the plant will increase its installed capacity to 5.6 GW (Government of the UAE, 2023a).

Solar and other renewable energy

As part of its energy strategy, the UAE continues to invest in large scale solar power and storage. With its current and planned renewable energy developments, the UAE is expected to reach 9 GW of renewable power by 2030. Following the construction of the~1.2 GW Noor Abu Dhabi solar PV plant in 2019, the UAE has continued to develop utility scale PV plants. The Al Dhafra Solar PV plant, added another 2 GW (Government of the UAE, 2023a; Tollast, 2022). In May 2022, a third solar PV project entered the tendering process. Once completed, the Al Ajban Solar PV will add 1.5 GW of capacity (Technical Review Middle East, 2022).

The Emirate of Dubai has also launched its own large-scale combined PV and CSP project: the Mohammed bin Rashid Al Maktoum Solar Park launched in 2012 should reach 5 GW of solar PV and CSP by 2030. The fifth tender round (900 MW) of this solar park, completed in October 2019, raised the total tendered capacity to nearly 2.9 GW (Gulf Today, 2019). DEWA, Dubai’s electric utility, has signed a power purchase agreement (PPA) for this 900 MW phase of which commercial operation has started in Q3 2021 (Dubai Electricity & Water Authority (DEWA), 2022).

As part of its Energy Strategy 2050, the UAE has also committed to invest around USD 160bn over the next three decades in “clean” and renewable energy, which might include nuclear and gas. As part of this plan, the UAE has signed a preliminary agreement with Engie Solutions (subsidiary of Engie) to develop further clean energy projects (Benny, 2022).

In November 2022, the UAE signed the Partnership for Accelerating Clean Energy (PACE) with the US, committing to mobilise USD 100bn to support the development of 100 GW of renewables both domestically and abroad by 2035. This agreement is meant not only to contribute to the energy transition worldwide, but also to help diversify the UAE revenue streams and to leverage the country’s resources as a foreign policy tool (Economist Intelligence Unit, 2022). However, it is not yet clear which technologies will be supported under the “clean energy” concept, and how this new commitment will interact with existing finance plans in the UAE, that means, whether the planned investments will be additional to previous ones. In July 2023, the UAE announced it will be investing USD 54 billion to achieve its new 2030 clean energy target. Same as for the PACE announcement, it remains unclear whether this commitment is additional to existing ones (Associated Press, 2023).

In addition to these solar power projects, a contract for the UAE’s first pumped storage hydroelectric plant, with an expected capacity of 250 MW, was awarded in August 2019, and scheduled for commission in 2024 (Power Technology, 2022). Abu Dhabi’s virtual battery plant, currently with 108 MW of capacity, will also be expanded with an additional 300 MW in 2026. Dubai will install a 700 MW molten salt storage system by 2024 (Government of the UAE, 2023a).

Hydrogen

During COP26, the UAE unveiled its “Hydrogen Leadership Roadmap”, a strategy aimed at developing the domestic production of green and blue hydrogen aimed at export markets in Asia and Europe. The roadmap already includes seven projects which are either completed or underway (including blue ammonia production). The overarching target of the strategy is to reach a 25% market share in key markets such as India, Japan, Germany and others (H2 World News, 2021).

According to the UAE’s latest NDC update, several projects are already under way to support the country’s hydrogen ambitions, and a new Hydrogen Strategy is being prepared (Government of the UAE, 2023a). In its updated Energy Strategy 2050, the UAE also includes a target to produce 1.4 Mt of hydrogen annually by 2031, without specifying what share will be green hydrogen.

Transport

The UAE’s latest NDC update sets a target to reduce transport emissions by 1% below 2019 levels by 2030. Emissions from the transport sector are expected to be ~42 MtCO2e in 2030 under this target (Government of the UAE, 2023a). The country has set out some policies to manage transport emissions, including an increase in the fuel and emissions efficiency of its vehicle fleet, as well incentives for the use of public transport, and the uptake of EVs.

Current fuel quality standards in the UAE are Euro 5, and vehicle fuel efficiency standards are Euro 4, with a plan to transition to Euro 5/6. As part of its plan to increase fleet emission efficiency, the UAE has also taken up a federal plan to convert vehicles to compressed natural gas (CNG), especially aimed at public transport, government and commercial vehicles (Government of the UAE, 2022). While CNG may be seen as a cleaner alternative to oil-fuelled cars, it is by no means a solution for air pollution. CNG-fuelled cars emit a significant amount of particle pollution—both ultrafine and PM2.5 (Transport & Environment, 2020).

The revised Energy Strategy 2050 includes new targets for the uptake of EVs, including reaching 691,100 EVs and hybrid vehicles by 2030 and over three million by 2050 as well as increasing the number of EV chargers to 879 by 2030 and 30k by 2050. The emirates of Abu Dhabi and Dubai have also set out a series of urban transport policies, aimed among others at incentivising the uptake of public transport and EVs (Government of the UAE, 2021b). For example, in May 2022 the Abu Dhabi government set out a new EV charging station policy, defining standards and requirements in anticipation of growing demand for EVs. This is part of its 2016 Low Emission Vehicle Strategy, which is in place to support the transition towards electrification of the transport sector (The National News, 2022). In Dubai, the Green Mobility Strategy 2030 includes a target to reach 30% EVs and hybrids in the government vehicle fleet by 2030 (Government of the UAE, 2022).

The UAE is also currently developing its national train network, with a total of 1,200 km of planned railways. 264 km of railways for freight services have been operational since 2016 and a further 600 km are currently under construction (Government of the UAE, 2021a). Recently, the UAE has announced it will extend its railway network to connect with neighbouring Oman.

Buildings

The UAE’s latest NDC update sets a target to reduce building emissions by 56% below 2019 levels by 2030. Emissions from the building sector are expected to be 27 MtCO2e in 2030 under the new NDC (Government of the UAE, 2023a). At first sight, this target seems incompatible with the UAE’s Energy Strategy 2050 targets of 70% fossil gas power in 2030. However, without further information on current energy consumption in the buildings sector, it is not clear to how much of the target can be achieved through efficiency gains.

As part of its Energy Strategy 2050, the UAE set out a target of reducing energy consumption by 40%. Several policies are in place to support this target in the buildings sector, including the National Water and Energy Demand Side Management Programme and a federal government building retrofit programme, aiming at 2000 retrofits by 2050. Some Emirates have also produced their own plans and policies to reduce energy consumption from the buildings sector, including Dubai’s plan to retrofit 30,000 buildings by 2030 (Government of the UAE, 2022).

Energy efficiency standards and labels for air conditioners and other electrical equipment have been introduced in the UAE, and inefficient light bulbs have been banned from import since 2014 (Ministry of Energy, 2015).

Waste

The UAE’s latest NDC update sets a target for waste emissions, which will increase by 8% above 2019 levels by 2030. Emissions from the waste sector are expected to be 14 MtCO2e in 2030 (Government of the UAE, 2023a).

In January 2021, the UAE launched its Circular Economy Policy 2031, establishing a Circular Economy Council, tasked with supervising the implementation of waste reduction policies that also target the manufacturing sector. In May 2022, the Sharjah Waste-to-Energy plant was launched, with a capacity of 30 MW. A further 200 MW plant is planned in Dubai and a 70 MW plant in Abu Dhabi, both expected to be operational in 2024 (Government of the UAE, 2023a; Sharma, 2022).

The UAE’s Circular Economy Policy has no concrete waste or emissions reduction targets. We were not able to check whether its previous target of diverting 75% of its waste from landfills by 2021 (Government of the UAE, 2019) has been achieved.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter