Policies & action

Policies and action rating

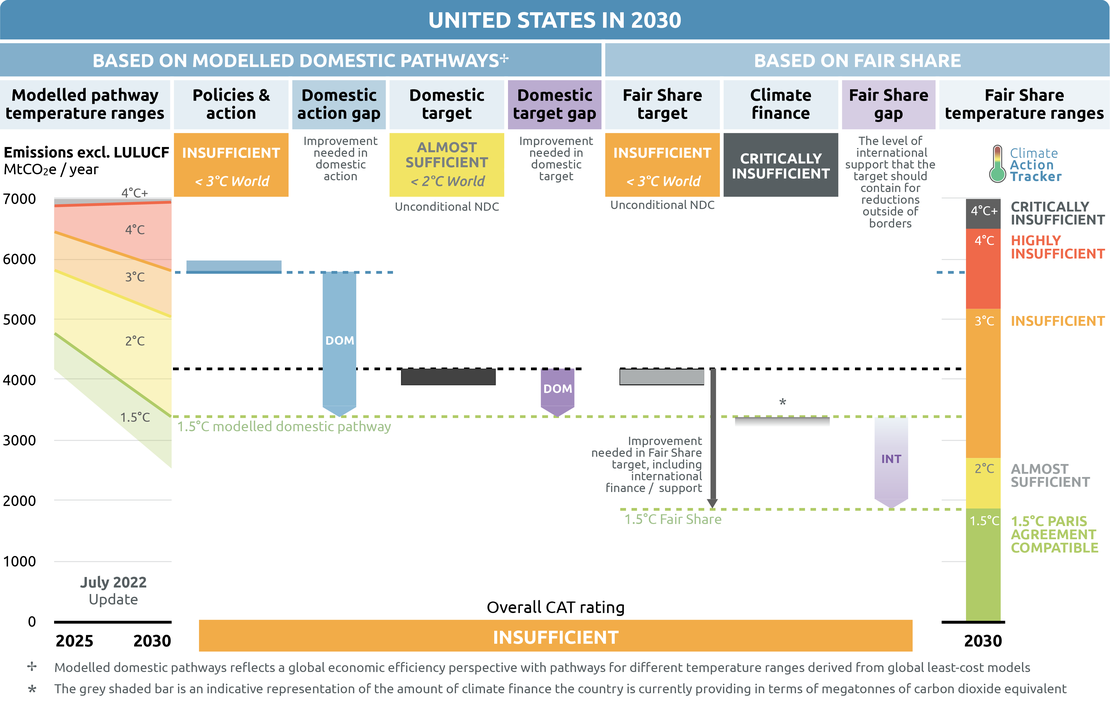

According to our analysis, the US will need to implement additional policies to reach its proposed targets. We project GHG emissions will reach 5.8 to 6 GtCO2e in 2030, 38%-43% higher than the NDC target (excl. LULUCF). The effects of the COVID-19 pandemic induced a drop in emissions that helped the US to meet its 2020 targets under the Copenhagen Accord.

In November 2021, President Biden signed into law the “Infrastructure Investment and Jobs Act”, which aims to spur economic recovery and update the country’s infrastructure while accelerating climate action. The USD 1.2tn act invests in developing EV charging infrastructure, upgrading the power grid, and improving energy efficiency and electrification in buildings. Although it is a step in the right direction, the US requires the Senate to pass the additional policies to get on track to meet its climate targets, such as the more ambitious “Build Back Better” bill.

The Biden Administration has reversed one of the most detrimental rollbacks of the Trump-era and set stricter fuel economy and GHG emissions standards for passenger vehicles for model years 2023-2026. The administration also enacted a bill to phase down the production and consumption of hydrofluorocarbons (HFCs) over the next 15 years.

President Biden’s approach to cope with inflation and other effects of high oil and gas prices in the short-term may compromise his long-term climate goals. Despite being the world’s largest producer of oil and gas and a net energy exporter, the current oil and gas crisis is hitting the US economy. This instability unveils the vulnerability of fossil fuel‑dependent economies and underscores the need to move away from fossil fuels and accelerate the transition to renewable-based economies in order to achieve sustained energy independency.

The range of policy projections for the US spans two rating categories: “Highly insufficient” and “Insufficient”. For such cases, the CAT evaluates which end of the range is more likely. Given the ongoing policy developments and the positive effect of the effects of the Infrastructure Investment and Jobs Act that are not captured in our current policy projections, the CAT finds it more likely that emissions will track toward the lower end of the range. If we rated the upper end of the range, policies and action would categorise as “Highly insufficient”, and this would also shift the overall US rating to “Highly insufficient”.

The “Insufficient” rating indicates that the US’ climate policies and action in 2030 need substantial improvements to be consistent with the Paris Agreement’s 1.5°C temperature limit. If all countries were to follow the US approach, warming would reach over 2°C and up to 3°C. The Biden administration has set the goal to decarbonise the power sector by 2035, which is consistent with a Paris Agreement pathway.

Further information on how the CAT rates countries (against Modelled domestic pathways and fair share) can be found here.

Policy overview

We project the economic recovery in 2021 leads to an increase in US GHG emissions by 6% compared to 2020 levels (excl. LULUCF). Rising energy demand in every energy end-use sector and a recovering economy brought US GHG emissions back to pre-pandemic levels in 2021 (see assumptions on 2021 emissions estimate here).

Energy-related CO2 emissions increased by 6% in 2021. Transport and electricity generation, the two largest GHG emitting sectors in the US, contributed most to the increase of energy-related CO2 emissions, increasing 11% and 7% in 2021, respectively, compared to the previous year (U.S. Energy Information Administration, 2022h).

According to our analysis, the US will need to implement additional policies to reach its proposed targets. If no further policies are implemented, the CAT projects that, after an increase in GHG emissions in 2021-2022, US emissions will remain relatively high and reach between 5.8 and 6 GtCO2e/year by 2030 (20%–22% below 2005 levels; and 7%–11% below 1990), excl. LULUCF. The CAT projects the US emissions level in 2030 would be between 38%–43% above the upper limit of the 2030 target if no further climate action or policies are implemented.

Our projections of US policies and action include policy provisions of the USD 1.2tn Infrastructure Investment and Jobs Act enacted in November 2021. However, we do not include the USD 1.75tn Build Back Better bill, as it has stalled in the US Senate and subject to negotiation.

Compared to CAT projections in September 2021, US emissions projections, based on existing policies, have decreased by 4%–5% in 2030. The main drivers of this decrease are:

- The reverse of policy rollbacks passed by the previous administration, mainly, stricter fuel economy and GHG emissions standards for passenger vehicles for model years 2023-2026 and a phase down in the production and consumption of hydrofluorocarbons (HFCs) over the next 15 years.

- Implementation of the Infrastructure Investment and Jobs Act, which among other things supports nuclear power plants that are at risk of shut down, reducing CO2 emissions in the electricity sector in 2030 by 1% compared to previous projections.

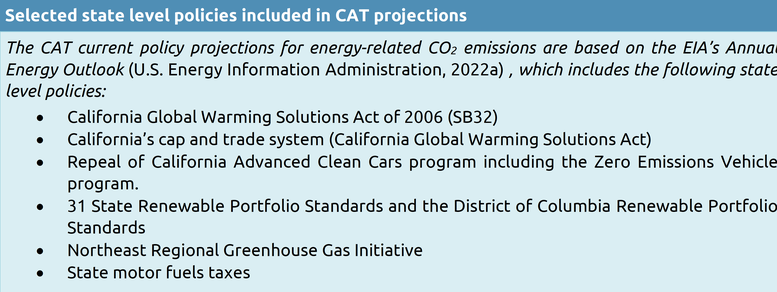

Increased state and local action, in addition to market pressures, may contribute to additional reductions. A pre-COVID-19 analysis of recorded and quantified commitments from sub-national and non-state actors in the US suggests that if these commitments were fully implemented they could lead to substantial emissions reductions (America’s Pledge, 2019). If subnational efforts are reinforced with strong federal climate policies over the next decade, the US could reduce emissions 49% below 2005 levels by 2030. These commitments are not included in the CAT current policy scenario unless they are supported by implemented policies (see table below).

The interest, engagement and commitment of non-federal actors in climate action enhances the feasibility and credibility of achieving ambitious climate targets, which require the buy-in and commitment of the private sector, civil society and subnational institutions. The importance of this alignment is evidenced by the impact of climate actions coming from non-federal actors, who compensated the inaction of the federal government in climate policy during the previous administration.

Recent developments

President Biden’s actions to address climate change in his first year in office were marked by a administration-wide approach to put climate change at the centre of the US agenda, enhancing domestic climate ambition, and reengaging in international diplomacy to line up the US as a global leader on climate change. On his first day in office, on January 20 2021, President Biden signed an Executive Order for the US to re-join the Paris Agreement, reversing the active undermining of climate ambition of the previous administration (The White House, 2021j).

The high priority that the Biden Administration places on climate change is explicitly stated in one of his first executive orders “Tackling the Climate Crisis at Home and Abroad”. The executive order reaffirms the goal to achieve net zero GHG emissions by 2050, encourages a government-wide approach to tackle climate change, mandates the use of federal purchasing power, property and public lands and waters to support climate action, and establishes high-level interagency groups to facilitate coordination, planning and implementation of climate action at federal level (The White House, 2021c).

With the first executive orders signed, President Biden directed agencies and departments to enact climate-friendly policies and to review and address the promulgation of the climate rollbacks of the previous four years. Twenty six agencies released climate adaptation plans that examine how climate change will affect their area of concern and how they intend to address it. The Biden Administration also directed heads of agencies to identify fossil fuel subsidies and take steps to stop them, suspended oil and natural gas drilling leases in the Arctic National Wildlife Refuge and revoked the permits for the Keystone XL pipeline, although the latter was overturned by a federal judge (The White House, 2021b, 2021c, 2021k; U.S. Council on environmental quality, 2021; U.S. Department of the Interior, 2021b).

In November 2021, President Biden signed into law the USD 1.2tn infrastructure investment bill (“Infrastructure Investment and Jobs Act”) with bipartisan support, which aims to spur economic recovery and upgrade the nation’s infrastructure while enhancing climate change mitigation and adaptation. The act includes USD 550 billion in new spending, while the rest is comprised of previously-approved funding (U.S. Senate, 2021b).

The US has moved forward in different sectors to reduce GHG emissions. In the transport sector, the Biden Administration reversed one of the most detrimental rollbacks of the Trump era and set stricter fuel economy and GHG emissions standards for passenger vehicles for model years 2023-2026 (U.S. Environmental Protection Agency, 2021b; National Highway Traffic Safety Administration, 2022).

In the industry sector, the Administration enacted a bill to phase down the production and consumption of hydrofluorocarbons (HFCs) over the next 15 years (U.S. Environmental Protection Agency, 2021a). The administration also reversed a Trump-era rollback that eliminated climate change assessment from infrastructure regulation, and set a new rule that requires federal agencies to assess climate impacts before they can approve major infrastructure projects, such as the construction of oil and gas pipelines (U.S. Council on environmental quality, 2021). While most of the rollbacks have been addressed in one way or another, many are still pending on final rulemaking (The New York Times, 2021b; Washington Post, 2021).

Less encouraging is the fact that the high ambition of the Biden Administration’s climate agenda has not been reflected in actions, as it has faced major setbacks in the legislative arena. Importantly, the USD 1.75tn Build Back Better bill (reduced to half of President Biden’s initial proposal) did not pass the US Senate. This bill presented by Democrats contains many of the climate-ambitious components that were left out of the first proposals of the Infrastructure Investment and Jobs Act. The Build Back Better bill includes billions on direct payments to utilities achieving clean energy goals, tax credits for wind, solar and nuclear, incentives to make homes more energy efficient, and incentives to boost the emergence of clean technologies like battery storage and green hydrogen through research and development (U.S. Congress, 2021b).

The implementation of an ambitious plan such as the Build Back Better bill would be key to helping the US transition to a low-carbon economy, reach its climate target of reducing GHGs 50%–52% below 2005 levels by 2030, and put it on track to a net-zero pathway by 2050. A recent study of the impact of the Build Back Better bill and the Infrastructure Investment and Jobs Act suggests these plans together could reduce energy and industrial CO2 emissions by half in 2030 compared to 2005 levels (ZERO Lab, 2021).

In March 2022, the US congress passed a USD 1.5tn spending plan for the fiscal year 2022 that includes, among other (DeLauro, 2022):

- USD 3.2bn for energy efficiency and renewable energy

- USD 1.65bn to support nuclear energy

- USD 463 million to increase the reliability of the electric grid and facilitate the integration of higher shares of clean energy

- USD 825 million for the Office of Fossil Energy and Carbon Management to advance mitigation efforts and facilitate the transition toward a net-zero carbon economy

Shortly after the US Congress passed the spending plan for 2022, the Biden Administration proposed an ambitious USD 5.8tn budget plan for 2023, with climate ambition at the centre of the proposal (Committee for a Responsible Federal Budget, 2022; The White House, 2022f). Although it represents an initial proposal, it does not mention any of the more ambitious environmental proposals from the stalled Build Back Better bill. This proposal is expected to be negotiated and scaled-back by the US Congress before it gets enacted. The midterm elections in November 2022 could impact the chances of the Democrats a winning a majority in Congress that would be aligned with implementing an ambitious climate change agenda. Without it, President Biden is likely to lose his opportunity to lead the transition to a low-carbon economy in the future.

President Biden took important steps to break with his predecessor and pursue a green recovery from the COVID-19 pandemic. The American Rescue Plan Act, signed into law in March 2021, included a number of climate-relevant provisions. The law provides over USD 30bn to assist mass transit systems and USD 350bn to state and local governments which implement and enforce local energy and climate measures (U.S. Congress, 2021a).

Russian invasion of Ukraine: Measures and implications in the US

Russia’s illegal invasion of Ukraine and sanctions imposed by the US and other countries have impacted global energy markets. This, in turn, has affected the US domestic economy, exacerbating the weaknesses of its dependence on fossil fuels and consequently leading President Biden to make short-term decisions that may compromise long-term climate goals.

In response to the invasion of Ukraine, the US banned imports of Russian energy commodities, mainly oil and gas. In 2021, the US imported 8% of total energy imports of crude oil and petroleum products from Russia, up from about 4% five years before (U.S. Energy Information Administration, 2022d). Through an executive order, the US also banned new investments and participation in foreign investments that flow into Russia's energy sector (The White House, 2022d). The US coordinated with other countries to scale up the sanctions, including economic sanctions on the gas pipeline designed to double the flow of Russian gas direct to Germany – Nord Stream 2 – and an agreement with the German government to prevent the pipeline from becoming operational (Congressional Research Service, 2022; The White House, 2022e).

As a result of prior tension and post-invasion sanctions, the US presented itself to Europe as an alternative to Russian energy and will significantly increase its natural gas exports to the continent. In March 2022, the White House announced a joint force with the European Commission to support the EU to move away from Russian energy, aiming to increase liquified natural gas (LNG) supplies to Europe (from the US and international partners) and reduce demand for natural gas (The White House, 2022b).

The agreement aims for Europe to demand an additional 50 billion cubic meters of LNG from the US until at least 2030, representing almost three times the volume exported to the continent in 2021, the highest ever recorded. This trend was already visible in the first two months of 2022, when US exported more than three times the volume of LNG to Europe than it exported in the first quarter of 2021 (U.S. Energy Information Administration, 2022c). The expansion of LNG import/export infrastructure risks a lock-in of fossil fuels, suggests a rollback of the US COP26 commitment to no longer support fossil fuels abroad, and brings into question US long-term ambitions for GHG neutrality.

The sanctions imposed on Russia’s energy exports have impacted global energy markets, which have in turn been reflected in higher domestic energy prices of fossil fuel products. Although the US is a net energy exporter and year after year reaches record highs in production that supplies sufficient volumes of crude oil and natural gas for domestic consumption, these two products are tied to global markets: a decline in global supply is reflected in a global increase of the price of the commodity.

The price of gasoline in the US reached USD 4.6 per gallon in May, up from USD 2.9 a year ago and an all-time high since 2008 (AAA, 2022). Similarly, the price of natural gas more than doubled since the beginning of the year and reached their highest level in a decade, at USD 8.5 per MMBTU in May (U.S. Energy Information Ad, 2022). As a result, year-on-year inflation rose by 8.3% in April due to the higher energy costs of heating, cooking, electricity, transport, etc. (U.S. Bureau of Labor Statistics, 2022).

The Biden Administration’s short-term decisions to contain the effects of inflation and high energy prices may compromise long-term climate goals. The US plans to release 1 million barrels of oil per day from the nation’s strategic reserves, which the Administration hopes will partially compensate for the loss of Russian oil on global markets. This measure, which will be sustained for six months, will put 180 million barrels of oil onto the market and is equivalent to an 8.5% increase in total US energy supply.

This instrument, which has been used twice before, is the largest-ever release of oil from the Strategic Petroleum Reserves (The White House, 2022a). In addition, the International Energy Agency (IEA) announced a historic collective release of oil with member countries over a six-month period, which includes the US with an additional 60 million barrels. Together, this will add a combined amount of 240 million barrels to the global market (International Energy Agency, 2022).

At the subnational level, several states have taken measures to cope with the increase of gasoline prices. California revealed a USD 11bn proposal that would give residents a USD 400 rebate per car and suspend a fraction of the gas tax for one year (Government of the State of California, 2022). Maryland and Georgia implemented the suspension of gasoline taxes for one and two months, respectively (Government of the State of Georgia, 2022; Maryland General Assembly, 2022). Several other states have also proposed cutting taxes from gasoline prices (Archie, 2022). The tax cuts or reductions to gasoline prices could lead to increased demand and represent a subsidy for the fossil fuel.

To further increase the supply of oil, President Biden announced plans to hold his first oil and gas leasing since he took office. The Interior Department announced plans to open roughly 144,000 acres up for lease and it will charge oil and gas companies 19% of royalties to drill on federal land, higher than the previous 12.5% (U.S. Department of the Interior, 2022c). The Biden Administration is also urging the US Congress to pressure the oil industry to increase drilling and production by imposing fees on oil companies for any federal acres they have leased but are not producing crude oil.

These measures not only contradict President Biden’s promise on his first day in office to ban new oil and gas drilling on federal lands, but are also counterproductive to the climate policy needed to achieve his long-term goal of tackling climate change. While achieving the stated aim of these decisions to bring energy prices down and to tame inflation in the short-term is debatable, they send a strong signal in the long term that may jeopardise the chance of the US to significantly reducing fossil fuel production and consumption in the future.

The impact of leasing on federal lands and releasing of national strategic reserve to manage the impact of supply and lower oil and gas prices is limited due to the greater participation of private and state actors in the industry and the scale of global markets of the commodities. However, the political signal could incentivise oil and gas companies to invest in new fields and infrastructure that could lock the country in to a high-carbon future or potentially lead to stranded assets. According to the IEA, countries should end investments in new oil and gas projects in order to meet the global target of net zero carbon emissions by mid-century (International Energy Agency, 2021). Any large-scale oil and gas leases are not compatible with the Paris Agreement.

The current global hydrocarbon crisis unveils the vulnerability of fossil fuel-dependent economies to fluctuations of global energy markets. Moreover, this crisis calls for a rethinking and broadening of the concept of energy independence beyond the domestic production and imports of energy resources. Despite being the world’s largest producer of oil and gas and a net energy exporter, the US remains dependent on commodities whose prices are largely driven by global markets, not just by local supply and demand.

The actions taken by the US to increase fossil fuel supplies, increase LNG exports and relieve short-term pressures caused by the Russian invasion of Ukraine also increase the economy’s dependence on fossil fuels, increasing its vulnerability to global fossil fuel prices in the medium and long-term.

The vulnerability of fossil-fuel dependent economies to global markets, such as the US, underscores the need to move away from fossil fuels and accelerate the transition to renewable-based economies in order to achieve sustained energy independency.

Renewable energy, which is more competitive than ever, and the electrification of end-use sectors are a sustainable solution to hedge the economy from fluctuant global markets. While companies may be incentivised to invest in oil and gas to profit from high consumer prices in the short term, high prices make fossil fuels less competitive and macroeconomically reliable than cleaner alternatives in the medium and long term.

Despite the actions in the short term to contain the impact of the sanctions to Russia, the Biden Administration recognises the importance of reducing dependence on fossil fuels and speeding up the transition to clean energy in the long run to be truly energy independent (The White House, 2022d). However, this has not been reflected through more ambitious actions and investments, which need to be passed in legislation. In this context, investment plans such as the one proposed in the Build Back Better bill are far more important than the current actions in order to transition towards clean energy systems that strengthen energy independence.

In an attempt to boost clean energy manufacturing and reduce dependence on foreign energy, the Biden Administration authorised the use of the Defense Production Act to foster domestic supply chains of key minerals used in batteries for the power grid and EVs, such as manganese, lithium, cobalt, graphite and nickel (U.S. Department of Defense, 2022). The Defense Production Act allows the President to use emergency authority to prioritise the development of specific materials for national production. This directive targets the transport and power sectors, the two largest contributors of GHG emissions in the US. Large-scale battery production enables the decarbonisation of transport through EVs and of the power sector through the deployment of large-scale storage that facilitates the integration of renewable energy.

Our projections do not include any of the long-term implications of the measures taken by the US in the context of the Russian invasion of Ukraine.

Finance

Domestically, the US Treasury has taken a lead role in redirecting financial flows to support climate action with a new “Treasury Climate Hub” and “Climate Counsellor” to coordinate the different climate activities in domestic finance, economic policy, international affairs, and tax policy.

An Executive Order from the White House has called for “consistent, clear, intelligible, comparable, and accurate disclosure of climate-related financial risk” (The White House, 2021d). The US Securities and Exchange Commission had already started a public consultation on disclosure so as to enable investors to make better informed decisions considering climate risks (U.S. Securities and Exchange Commission, 2021). In line with the new policy, the US EPA has already urged the Federal Energy Regulatory Commission (an independent body), to consider lock-in and stranded asset risks for gas pipelines (S&P Global Market Intelligence, 2021).

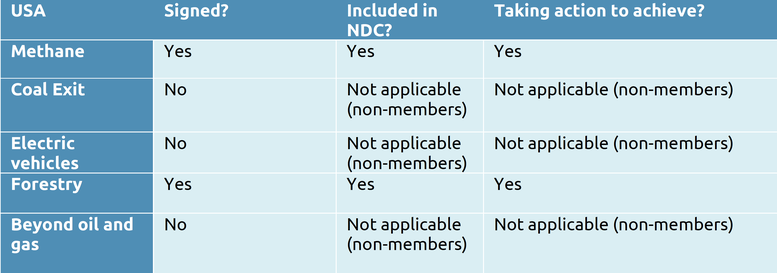

Glasgow sectoral initiatives

Several sectoral initiatives were launched in Glasgow to accelerate climate action on methane, the coal exit, 100% EVs and forests. At most, these initiatives may close the 2030 emissions gap by around 9% — or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets, and on forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”.

NDCs should be updated to include these sectoral initiatives, if they aren’t already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

- Methane pledge: The US is one of the signatory countries of the Global Methane Pledge. After the announcement the pledge, the Biden Administration announced a Methane Emissions Reduction Action Plan that seeks to reduce emissions from all major sources through regulations, financial incentives and public-private partnerships (The White House, 2021l). Methane is an important source of GHGs emissions in the country, representing 11% of total GHGs in 2020 — split between the oil and gas industry (~39%), agriculture (~36%) and waste (~19%) sectors (U.S. Environmental Protection Agency, 2022b).

- Coal Exit: The US did not adopt the coal phase out statement. However, the US joined as one of several countries providing funding for South Africa to finance a faster transition away from coal. (Mason et al., 2021). Although coal was the main source of electricity in the US less than a decade ago, its share in the energy mix has been decreasing due to market forces that have increased the extent of cheaper renewables and gas in the mix. The EIA's long-term energy projections show that the US will have no new coal-fired power plant capacity additions in the future (U.S. Energy Information Administration, 2022a).

- 100% EV: The US did not adopt the EV target during COP26. The transport sector accounts for around 27% of total national emissions and represents the largest emissions source by sector. Despite the absence of the federal government, US non-state actors signed the declaration including states (Atlanta, British Columbia, California, New York, Washington), cities (Charleston, Dallas, Los Angeles, New York City, San Francisco, Seattle) and automakers (Ford and General Motors) (UK COP 26 Presidency, 2021a). President Biden set a goal to make 50% of all new vehicles sold in 2030 zero-emissions vehicles (The White House, 2021h).

- Forestry: The US signed the forestry pledge at COP26. The US is also a signatory of the New York Declaration of Forests, which aims at halting natural forest loss by 2030, improving governance, increasing forest finance, and reducing emissions from deforestation and forest degradation as part of a post-2020 global climate agreement (Forest Declaration Platform, 2022).

- Beyond oil and gas: The US has not joined the ‘Beyond Oil & Gas’ initiative to end oil and gas exploration and production. On the contrary, it is currently increasing both oil and gas production.

In addition to these initiatives, the US, together with 25 other countries and financial institutions pledged to end international public support for the unabated fossil fuel energy sector by the end of 2022 and instead prioritise support for the clean energy transition (UK COP 26 Presidency, 2021b). However, the Biden administration is contradicting this pledge with the recent measures taken to cope with the effects of Russian energy sanctions.

COP26 also saw a bilateral cooperation declaration between the US and China, the two largest GHG emitters. In the US-China Joint Glasgow Declaration, both countries commit to cooperate on a variety of issues related to climate change, including reduction of methane emissions, carbon removal technologies and knowledge sharing on regulatory frameworks to accelerate the energy transition with renewable energy, energy efficiency and electrification of end-use sectors (U.S. Department of State, 2021c).

Electricity generation

Electricity supply contributed to 25% of the total 2020 US GHG emissions (U.S. Environmental Protection Agency, 2022b). Total annual emissions in the power sector have declined steadily since 2010. The decline is mainly driven by a shift from coal to lower or non-emitting sources of generation, such as natural gas and renewables (see below).

In November 2021, President Biden signed into law the USD 1.2tn Infrastructure Investment and Jobs Act, which includes investments to modernise the nation’s electricity grid, deploy energy storage systems, and develop infrastructure to facilitate the integration of higher shares of renewables. The Infrastructure Act has enabled the US government to launch several programmes aimed at decarbonising the power sector, such as reinforcement of the grid, energy efficiency, support for distributed energy resources and the rescue of nuclear power plants.

The Biden Administration has announced a target of a carbon-free electricity system no later than 2035. This target has been reiterated in several official documents, including the submission of the Nationally Determined Contribution (NDC), all executive orders relevant to climate change signed and other national plans, including Biden’s proposed infrastructure plan (“American Jobs Plan”).

In one of his first Executive Orders, President Biden ordered federal agencies to develop a procurement plan for carbon-free electricity, as an initial step towards meeting this goal (Biden, 2020; The White House, 2021c; US Government, 2021). In addition to the Executive Orders, however, this target will require other policy changes including laws that must be passed by the US Congress.

The goal of carbon-free power supply by 2035 is aligned with the Paris Agreement, based on the benchmarks defined by the CAT. Our analysis indicates that to be compatible with the Paris Agreement 1.5 ̊C temperature limit, emissions in the US power sector need to be rapidly reduced to reach zero in the 2030s (Climate Action Tracker, 2020).

Based on our calculations, total GHG emissions in the US in 2021 are already 15% below 2005 levels (excl. LULUCF). This trend was primarily driven by emission reductions in the US power sector, which decreased by 36% in 2021 compared to 2005 levels – equivalent to 80% of total emissions reductions since 2005 (U.S. Energy Information Administration, 2022h).

In June 2022, the US Supreme Court ruled to limit the EPA’s ability to regulate carbon emissions from power plants (Supreme court of the United States, 2022). Cheaper renewables are decarbonising the US power sector, driving coal out of the electricity market, and the ruling is unlikely to change that. This brings President Biden's 2035 100% emissions free electricity sector target even further into question. The decision also sets a worrying precedent for more cases coming through the courts that could affect other aspects of future climate action.

Emission reductions in the sector have been mainly driven by market forces that increased the extent of cheaper renewables and gas in the energy mix, replacing dirtier coal. A full decarbonisation of the power sector by 2035, as pledged by President Biden, would alone reduce emissions by 20%-25% below 2005 levels by 2030. If this plan were accompanied by ambitious electrification policies in other sectors, such as defining a 2030 target of 100% national EV sales or the full electrification of building heating, it would put the US on track to meet the new target under the Paris Agreement of 50%-52% below 2005 levels (incl. LULUCF).

Electricity emissions intensity

However, additional policies are needed to reach the proposed goal. The emissions intensity of total electricity generation in the US has decreased over the past 15 years, from 636 gCO2/kWh in 2001 to 433 gCO2/kWh in 2016. If no additional policies are implemented, the CAT projects that the emissions intensity of electricity generation would be around 254 gCO2/kWh in 2035, a long way from the goal of 0 gCO2/kWh.

Policy developments

In November 2021, President Biden signed into law the USD 1.2tn Infrastructure Investment and Jobs Act, which includes a USD 65bn investment to modernise the electricity grid that would increase the flexibility and reliability of the system to facilitate the integration of higher shares of renewables. Although it is the single largest federal investment in power transmission in history of the country, it is only a fraction of the sum requested by President Biden in his infrastructure plan proposed in March (USD 100bn). The legislation also includes more than USD 300m to develop technology to capture and store carbon dioxide emissions from power plants (U.S. Senate, 2021b).

The Infrastructure Investment and Jobs Act has enabled the US government to launch or support several programmes aimed at decarbonising the power sector and framed with President Biden’s goal of 100% clean electricity by 2035 and a zero emissions economy by 2050, including the following:

- “Building a Better Grid” Initiative: The US Department of Energy launched this initiative to support the upgrade and development of long-distance, high-voltage and interconnected grids. The strengthening of the national grid and the increase of transmission capacity is the backbone to unlocking more clean energy while maintaining the reliability of supply (U.S. Office of Electricity, 2022)

- Nuclear power plants bailout: USD 6bn in credits aimed at keeping open nuclear plants that are facing imminent shutdown due to a lack of financial viability. The financial viability of several nuclear power plants has declined as renewable energy and natural gas prices have dropped in the last decade (U.S. Department of Energy, 2022e)

The EIA’s Annual Energy Outlook 2022, used as the reference scenario for the current policy projections, projects that this measure would lead to increased nuclear electricity generation and reach 16% of the generation mix in 2030 – as opposed to two percentage points lower without the measure (U.S. Energy Information Administration, 2022a). Nuclear energy has accounted for about 20% of the US power supply over the past several decades (U.S. Energy Information Administration, 2022f).

Although nuclear is considered a carbon-free technology, nuclear power plants are not flexible, which limits the integration of high shares of variable renewable energy (e.g. wind and solar) and could limit the possibility of achieving a fully decarbonised power system. - Rebate programme to upgrade grid: The Department of Energy established a new program that provides USD 20 million in rebates to provide utilities with the resources to upgrade electric systems to support a cleaner and more efficient power grid (U.S. Department of Energy, 2022f).

- Action Plan to accelerate permitting: An action plan to strengthen and accelerate federal permitting and environmental reviews through early cross-agency coordination (The White House, 2022g). Additionally, the DOE released a guidebook to support local government in helping fast-track consumers’ access to solar home systems by cutting residential solar permits to less than one day (U.S. Department of Energy, 2022d).

- Clean Hydrogen for electricity generation: The Department of Energy announced USD 24.9m in funding for R&D projects to support the advancement of clean hydrogen for electricity generation. The funding is not aiming at green hydrogen production (i.e. with renewable electricity) but hydrogen production from fossil resources with carbon capture and storage (CCS) - known as “blue” hydrogen (U.S. Department of Energy, 2022b).

Current policy projections show that even with the implementation of the Infrastructure Investment and Jobs Act, emissions reductions in the electricity sector will be moderate and will not put the US on track to meet its NDC emissions reduction target.

Through Executive Orders, the Biden Administration aims to use government purchase power and set a target to double clean energy permits on public lands to reach 25 GW of renewable power generated by 2025. To date, the Bureau of Land Management has approved more than 120 renewable energy projects with a combined generation capacity of 12 GW (The White House, 2021c; U.S. Department of the Interior, 2022b).

The US Department of Interior announced a plan to deploy 30 GW of offshore wind by 2030 and gave access to USD 3bn in federal loans for offshore wind and transmission projects. The Bureau of Ocean Energy Management completed an environmental review for the first offshore wind project in the country, an 800 MW offshore wind energy project off the coast of Massachusetts, expected to come online by 2023. In February 2022, the Biden Administration held and awarded the first offshore wind auction, totalling USD 4.37bn in six offshore wind leases off the coasts of New York and New Jersey (The White House, 2021f; U.S. Department of the Interior, 2021c, 2021a, 2022a)

At the subnational level, 31 states and the District of Columbia have enacted mandatory renewable portfolio standards (RPS). Of these, nine states and D.C. have enacted 100% clean electricity goals into legislation. Delaware and Oregon were the latest states to establish an RPS (40% renewables by 2035 and 100% clean energy by 2050, respectively) (U.S. Energy Information Administration, 2022g).

The ongoing record-breaking cost reductions of renewable technologies and state-level RPS, which provide regulatory certainty, have driven the steady increase in the share of renewables in the US electricity generation mix since the turn of the century, reaching 20% in 2021. The CAT projects that this share will continue to increase in the future, reaching 35% in 2030 and 42% 2050. However, these penetration levels are not enough to meet President Biden’s goal of a carbon-free power sector by 2035.

Share of renewable electricity generation

President Biden is urging Congress to pass a nationwide clean electricity standard, which would require power providers to get a certain amount of their energy from fossil fuel-free sources (Reuters, 2021c; The White House, 2021i). The design and level of ambition of the clean electricity standard is unclear and could also include nuclear and carbon capture and storage (CCS). Further, this measure also faces a long and uncertain road, given it would also need to be passed by the US Congress.

A clean electricity standard at federal level is key to achieving the US climate target of reducing GHG emissions by 50%-52% in 2030 below 2005 levels. A recent study suggests that even with the adoption and full implementation of the Build Back Better bill but without a nation-wide electricity standard, emissions could increase by 350 MtCO2e by 2030 and fall short of 2030 target (ZERO Lab, 2021).

Developments in the sector

Following a dip in emissions during the COVID-19 pandemic, carbon dioxide emissions in the power sector bounced back to pre-pandemic levels as the economy recovered. After decreasing by 10% in 2020, US carbon dioxide (CO2) emissions in the sector increased by 7% in 2021 compared to the previous year. This is explained by a 2% increase in electricity demand and the strong link between economic activity and fossil fuel consumption (U.S. Energy Information Administration, 2022h).

Emissions in the power sector rose because of increased electricity generation and the higher carbon intensity of electricity generation. In 2021, electricity generation and emissions from coal-fired power plants increased for the first time since 2014 by 16% and 15%, respectively. While this is partly driven by rising electricity demand, the marked increase in coal-fired generation last year is mainly attributable to the significantly higher and more volatile prices of natural gas in 2021, which made coal more competitive (U.S. Energy Information Administration, 2021b).

Coal-fired power generation had declined year on year over the last decade, while natural gas and renewable energy sources, mainly wind, increased their share in the generation mix. In 2016, natural gas became the main source of power generation, which was previously dominated by coal. In 2019, onshore wind passed hydropower to become the number one source of renewable electricity. Generation from wind and solar continued growing in 2021 by 29% and 12% compared to 2020, respectively. These changes were mainly driven by market forces that increased the use of cheaper renewables and gas.

As a result, the average capacity factor of coal power plants dropped from 72% in 2008 to 47.5% in 2019, and until 2021, electricity emissions intensity had been consistently decreasing since 2010 (see figure above). In 2017, the electricity sector, for the first time, dropped from the first to the second-highest GHG emissions source in the country, with first place now taken by the transport sector. In 2021, because of increased electricity generation from coal, the average capacity factor of coal-fired power plants increased to about 51%.

Although high natural gas prices resulted in more coal-fired generation in 2021, this is not expected to affect the trend of lower coal use in the future. The power sector has retired about 30% of its generating capacity at coal plants since 2010, and no new coal-fired capacity has been introduced in the US since 2013 (U.S. Energy Information Administration, 2021a). The EIA’s Annual Energy Outlook 2022, used as the reference scenario for the current policy projections, shows that there will be no new capacity additions of coal-fired power plants in the US (U.S. Energy Information Administration, 2022a).

Coal plant retirements were already accelerating before the pandemic. In 2019, a total of 13 GW of coal-fired plants retired, the same amount as in 2018 and as twice as much as in 2017. Between 2008 and 2021, coal-fired generating capacity decreased from 313 GW to 210 GW.

In the first two months of 2022, two coal-fired power plants have been retired, totalling about 105 MW of capacity, and an additional 10.9 GW of coal-fired capacity is expected to be retired by the end of the year. Cheaper renewables and gas in recent years have put coal-fired power producers under economic pressure, with eight of them filing for bankruptcy in 2019. The Tennessee Valley Authority, a US-owned utility, plans to shut its four remaining coal plants by 2035, totalling 6 GW of capacity combined (Krauss, 2019; Reuters, 2021a; U.S. Energy Information Administration, 2021c, 2021d).

Oil and gas

In 2018, the US became the world’s largest producer of crude oil (U.S. Energy Information Administration, 2018a). While in 2019 crude oil production increased by 12% and exports increased by 12% from the previous year, this trend was interrupted by the COVID-19 pandemic in 2020, when production decreased by 8% and exports grew by only 7% compared to 2019 levels. The production and export of oil in 2021 remained relatively stable, decreasing and increasing by 1% from 2020 levels, respectively (U.S. Energy Information Administration, 2022e).

The US is already the largest producer of natural gas (U.S. Energy Information Administration, 2018b). In 2019, the US became the world’s third-largest liquified natural gas (LNG) exporter, behind Qatar and Australia (U.S. Energy Information Administration, 2019). US LNG exports continue reaching a record high each year, despite the economic slowdown caused by the pandemic. LNG exports increased by 51% in 2021 relative to 2020 levels and almost doubled compared to 2019 levels. The boost in exports in 2021 is mainly due to the increased demand in Europe and Asia and the expanded US LNG export capacity, which is set to be the world’s largest by the end of 2022 (BP, 2021; U.S. Energy Information Administration, 2021f, 2022b, 2022i).

Exports are expected to increase even more due to government sanctions on Russia, the largest gas exporter. US LNG exports are presented to Europe as an alternative to support the EU to move away from Russian energy. In an agreement with the European Commission, the two parties announced that US LNG exports to the continent are intended to increase to almost three times the volume of LNG exported in 2021 until at least 2030 (The White House, 2022c). In the first two months of 2022 alone US delivered to Europe more than three times the volume delivered the first quarter of last year and setting already a quarterly record of exports to Europe (The White House, 2022e; U.S. Energy Information Administration, 2022b). Additionally, the US eased sanctions on Venezuelan oil in a bid to bring more of the country’s crude product to Europe.

Although natural gas is often seen as a ‘cleaner’ source of energy, extracting, transporting and burning it in demand sectors still emits GHGs both through fugitive emissions during production, as well as through the use of energy in the supply chain. To achieve the Paris Agreement’s long-term temperature goal, the power sector needs to rapidly transition to being carbon-free by around 2035. This requirement for a complete CO2 emissions phase-out results in a dwindling role for natural gas in the power sector (Climate Action Tracker, 2017).

As one of his first actions as head of government, President Biden revoked the permit of the Keystone XL pipeline that was projected to carry oil from Canada, directed heads of agencies to identify fossil fuel subsidies and take steps to stop them, and suspended oil and natural gas drilling leases in the Arctic National Wildlife Refuge. The Biden Administration’s decision to pause drilling of oil and gas in federal lands was later overturned by a federal judge in June 2021 (Partlow and Eilperin, 2021; The White House, 2021c, 2021b; U.S. Department of the Interior, 2021b).

However, President Biden was not true to his word on a temporary moratorium when announcing recent measures taken to address the effects of the sanctions on Russian energy — releasing Strategic Petroleum Reserves and encouraging oil and gas companies to increase drilling. The Biden Administration has also defended a new oil and gas project in the North Slope of Alaska (The New York Times, 2021a).

An investigation of the world largest oil and gas projects shows that the US is among the countries with the biggest expansion plans of oil and gas projects and gives some of the world’s biggest subsidies for all fossil fuels per capita. With twenty-two mega-project plans in place, the US accounts for more than a fifth of potential emissions from major carbon emitting energy projects in the world. Together these mega-projects have the potential to emit 140 GtCO2e in their lifetime, almost four times more than the entire world emits each year (Carrington and Taylor, 2022).

The latest IPCC report states that we must halve GHG emissions globally by 2030 if we want to keep global warming to 1.5°C within reach (IPCC, 2022). Investments and developments in new oil and gas infrastructure would prevent the US from meeting its 2030 climate target and net-zero emissions by 2050, let alone meeting the global temperature target, and will lead to significant stranded assets in a Paris Agreement-compatible future.

The USD 1.2tn Infrastructure Investment and Jobs Act includes a USD 21bn investment to plug and clean up abandoned coal mines and oil and gas wells, which continue to emit significant amounts of methane and other pollutants long after they are no longer active (U.S. Senate, 2021b). This was one of the few components that increased compared to the original investment plan proposed by the Biden Administration before its negotiation in the US Congress (USD 16bn).

The US Department of Energy will award USD 35m in funding for 12 projects focused on developing technologies to reduce methane emissions in the oil, gas, and coal industries (U.S. Department of Energy, 2021).

Transport

In 2020, GHG emissions from the transport sector accounted for about 27% of total emissions in the US and, since 2017, has been the largest contributor in GHG emissions. Total GHG emissions in the sector increased 24% (345 MtCO2) between 1990-2019 explained by the increased demand for travel, where the average number of vehicle miles travelled (VMT) per passenger cars and light-duty trucks increased by 47.5% in the same period (U.S. Environmental Protection Agency, 2022b).

Similar to other sectors, the lockdown and travel restrictions caused by the measures taken to cope with the pandemic severely impacted the US transport sector. While energy-related CO2 emissions fell by 15% in the transportation sector in 2020 relative to the previous year because of restricted travel, working from home and reduced commuting, emissions in the sector increased by 11% from the previous year as travel restrictions were eased (U.S. Energy Information Administration, 2022h).

Passenger transport

President Biden has signalled his intention to push for cleaner mobility, focusing on the electrification of light-duty passenger vehicles (LDV). As part of his plans to accelerate the adoption of cleaner vehicles, President Biden set a goal to make 50% of all new vehicles sold in 2030 zero-emissions vehicles, including battery electric, plug-in hybrid electric, or fuel cell electric vehicles (The White House, 2021h). The target was backed up by major automakers including Ford and General Motors, which in a joint statement, announced their “shared aspiration” to achieve sales of 40%-50 % electric vehicles by 2030 (Shepardson, 2021).

This goal is not aligned with the Paris Agreement. The CAT indicates that to be compatible with the Paris Agreement, 95%-100% of sales of new light-duty vehicles (LDV) in the US should be zero-emissions at the national level by 2030.

EV market share

Current plans and policies to decarbonise the US road transport sector are insufficient to reach Biden’s goal of 50% EV sales by 2030, let alone to meet the 1.5°C Paris Agreement temperature goal.

Electric vehicles represented 4% of new car sales in the US in 2021 due to a larger selection of electric vehicle (EV) options and growing consumer interest, compared to 2% in previous year (Canalys, 2022). Platts Analytics estimates that the cumulative number of EVs in the US displaced the use of 36,000 barrels per day of gasoline, up 19% from 2019 and is expected to grow steadily (Ryser, 2021).

The Biden Administration finalised two rules that establish federal standards to regulate GHG emissions and fuel economy of new passenger cars and light trucks. These two rules combined are the key policy instrument at the federal level to regulate GHG emissions of light-duty vehicles (LDV) in the US. These measures reverse the the single most detrimental rollback of the previous administration, the Trump-era SAFE rule that significantly weakened GHG emissions and fuel economy standards.

In December 2021, the Environmental Protection Agency (EPA) finalised a rule that establishes more stringent GHG emissions standards for LDVs for model year (MY) 2023 through 2026. The final standards are consistent with the proposed rule of April 2021 for MYs 2023 and 2024, and more stringent than those proposed for MYs 2025 and 2026, making them strongest vehicle emissions standards ever established for LDVs.

The new rule aims to reduce the fleet average CO2 emission targets (CO2/mile) by 28% over the period 2023–2026, which is substantially higher than the 7% reduction of the SAFE rule from the previous administration. According to the EPA, the new standards require automakers to achieve a vehicle milage of 52 miles per gallon (mpg) by 2026 across all models and will result in more than 3 GtCO2e of avoided emissions through 2050, nearly double the GHG emissions in the transport sector in 2020. In annual terms, the estimated impact is 77 MtCO2 of avoided emissions in 2030 and 172 MtCO2 in 2050, or 5% and 11% of GHG emissions from the transport sector in 2020, respectively (U.S. Environmental Protection Agency, 2021b).

In April 2022, the National Highway Traffic Safety Administration (NHTSA) finalised the rule that establishes more stringent fuel economy standards for LDVs, known as the Corporate Average Fuel Economy (CAFE). The new standards will increase fuel efficiency 8% annually for MY 2024-2025 and 10% annually for model year 2026, achieving a fleet average of 49 mpg by 2026, improving by nearly 10 mpg relative to MY 2021. This rule significantly improves the 2020 Trump-era SAFE LDV rules for MY 2021–2026, which required a fleet average of 40.5 mpg in MY 2026 (National Highway Traffic Safety Administration, 2022).

The higher ambition of the new rules was backed by equally ambitious actions by state governments and automakers, showing the readiness of the industry to adhere to more stringent standards. The rulemaking accounted for California’s zero emission vehicle (ZEV) mandate (and its adoption by a number of other states) in developing the baseline for the proposal, and has also accounted for the Framework Agreements between California and BMW, Ford, Honda, VWA, and Volvo to continue annual nation-wide reductions of vehicle GHG emissions through (MY) 2026, with greater rates of electrification than would have been required under the 2020 Trump-era rule. These five major manufacturers voluntarily bound themselves to stricter GHG requirements and nearly all automakers have rolled out new EV models since 2020.

In a departure from the approach taken by the previous administration, the new rules also contain an extensive cost-benefit assessment in terms of emissions savings, monetary saving accounting for pollution and health damage, and an estimation of climate relevant indicators such the impact of the rules on global temperature by the end of the century and increase in sea level.

Although these two rules are a step in the right direction, they are simply an attempt to reinstate the Obama-era standards, and may not be ambitious enough to put the US on track to meet its sectoral and emissions reductions target by 2030. Our current policy projections include these new rules affecting the GHG emissions of LDVs.

As a reactive measure to reduce the high gasoline prices resulting from the sanctions imposed on Russian oil and gas, EPA announced plans to allow year-round sales of gasoline containing 15% of ethanol (E15). This increases the blending of ethanol in gasoline through the summer, lifting a restriction on burning ethanol during summer that would temporarily reduce the consumption of gasoline (U.S. Environmental Protection Agency, 2022a).

Current federal tax credits provide a USD 7,500 subsidy towards the purchase of an EV for the first 200,000 sold, and these are often further complemented by manufacturer incentives (Electrek, 2021). The Biden climate plan included incentives to develop electric automobile industry and infrastructure, including public investment in half a million EV charging stations. President Biden also initiated a process to make use of the federal purchasing power to spur clean energy in the sector and replace the entire federal vehicle fleet with zero-emissions models, but has not yet provided a timeline for its implementation (Biden, 2020; The White House, 2021c).

The single most effective policy instrument at the federal level for the US transport sector to become 1.5˚C compatible would be a 2030 phase-out of fossil fuel LDV sales (Climate Action Tracker, 2021c). This is the kind of ambitious policy required across all sectors for the US to meet its new 2030 NDC and its 2050 net-zero target. This has been acknowledged by the US in its NDC, with a commitment to develop further ambitious policies over time.

Although there are no nationwide targets to ban the sale of new vehicles with internal combustion engines (ICE), much progress has been made at the non-federal level where states and automakers have set targets of 100% new zero-emission vehicles sales by 2030–2035. The US states of Washington (2030), California (2035), and Massachusetts (2035) have also announced bans on ICEs, and GM, one of the big three US manufacturers, recently pledged to only sell electric LDVs by 2035 (Associated Press, 2021; California Air Resources Board, 2021; Reuters, 2021b; Scientific American, 2021). Six US states, six cities and two major automakers signed the 100% EVs declaration in Glasgow agreeing to 100% of new car and van sales to be electric in 2035 (UK COP 26 Presidency, 2021a).

In December 2021, the NHTSA finalised the CAFE Preemption rulemaking to withdraw the Trump-era SAFE I Rule, which prevented California and other states to set stricter vehicle GHG, fuel economy standards, and establish ZEV programs (National Highway Traffic Safety Administration and Department of Transportation, 2021). Within the US, the state of California has been implementing ambitious policies for road transport for over 30 years and provides a demonstration of what is possible nationally with its ZEV Program launched in 1990. California has continuously updated and expanded the policy over time In its latest iteration, California requires 22% of LDV sales to be ZEVs by 2025.

California’s leadership and ambition has sparked similar actions in other states. Thirteen other states and the District of Columbia, representing 31% of vehicles sales in the US, have adopted part or all of California’s tighter standards, including nine states that adopted ZEV targets (America’s Pledge, 2019).

The Department of Transport will collaborate with the Department of Housing and Urban Development to encourage modal shift and transit-oriented development, with an emphasis on access to public transport. This implies that there would be a shift to not only focussing on fuel-efficiency standards and tailpipe emissions but also actively promoting modal shifts, EVs through public procurement, tax credits, and support for charging infrastructure.

Freight transport

The Heavy-Duty Vehicle National Program sets GHG emissions and fuel efficiency standards for heavy-duty vehicles, which the EPA estimates will reduce emissions by 200 MtCO2/year by 2050 (U.S. Environmental Protection Agency and U.S. National Highway Safety Administration, 2016). To be compatible with the Paris Agreement’s long-term goal, freight trucks need to be almost fully decarbonised by around 2050 (Climate Action Tracker, 2018).

At state level, California passed a rule that requires warehouses operators to slash emissions from trucks, which would curb diesel emissions from trucks and spur electrification of freight trucks. The options in the rule to reduce or offset emissions include replacing diesel trucks with ZEVs trucks, installing zero-emissions charging or fuelling infrastructure (e.g., electric charger, hydrogen fuel stations) or installing onsite clean energy systems such as rooftop solar panels (South Coast Air Quality Management District, 2021).

Policies on shipping and aviation are not clear. Notably, for aviation, the White House’s statement outlined “the development and deployment of high integrity sustainable aviation fuels and other clean technologies that meet rigorous international standards, building on existing partnerships”, as well as the intention to work with partners in the International Maritime Organization and participating in ICAO’s offsetting scheme, CORSIA (The White House, 2021g)

Investments to spur the transition in the transport sector

In November 2021, President Biden signed into law the USD 1.2tn Infrastructure Investment and Jobs Act, which includes some components relevant to the decarbonisation of the transport sector, including investments to modernise roads and public transit and to boost the EV market (U.S. Senate, 2021b). The following elements are included in the Act:

- USD 7.5bn to develop EV charging stations across the country. As part of the budget, the administration unveiled a plan (National Electric Vehicle Infrastructure Formula Program) to allocate USD 5bn to states to fund EV chargers over five years. Under the plan, states must submit their EV infrastructure deployment plans to be approved for eligibility. The remaining USD 2.5bn is allocated to funding in the form of grants for corridor and community EV charging (U.S. Department of Transportation, 2021). The Biden Administration aims to build half million EV chargers across the country by 2030.

- USD 7bn to bolster the country’s battery supply chain. The Biden Administration announced a USD 3.1bn plan to boost domestic manufacturing of batteries. It consists of a funding plan that will provide grants aimed at building, retooling or expanding the manufacturing of batteries and battery components, as well as establishing battery recycling facilities (U.S. Department of Transportation, 2021). The goal is to strengthen the EV manufacturing industry, replace more than 50,000 diesel vehicles, electrify 20% of the school bus fleet and fully electrify the federal fleet.

- USD 39bn to modernise public transit. This could be positive if it triggers a modal shift to cleaner transportation modes (e.g., rail, buses, etc).

- USD 66bn to ‘climate-friendly’ passenger and freight railways.

- USD 110 bn to invest on roads, bridges and other transportation projects. Further investments in highway infrastructure may, however, result in added transport emissions.

- $7.5 billion for clean buses and ferries. This amount of funding is not enough to electrify about 50,000 transit buses within five years, as originally proposed.

- The combination of new working from home policies implemented by many employers and the plan’s proposal to build high-speed broadband infrastructure (USD 66bn) to expand coverage may have a long-lasting impact on commuting behaviour.

The Act also includes research in climate science, innovation and demonstration projects, including electric vehicles and smart charging infrastructure.

In an attempt to boost clean energy manufacturing and reduce dependence on foreign supply chains and volatile energy markets, the Biden Administration authorised the use of the Defense Production Act to foster domestic supply chains of key minerals used in batteries for EVs, such as manganese, lithium, cobalt, graphite and nickel (U.S. Department of Defense, 2022). The Defense Production Act allows the president to use emergency authority to prioritize the development of specific materials for national production. Large-scale battery production boosts the EV industry and enables the decarbonisation of transport sector.

Industry

Direct GHG emissions from the industry sector accounted for 24% of total US emissions in 2020, making it the third largest contributor to US GHG emissions after the transport and electricity sectors (U.S. Environmental Protection Agency, 2022b).

In 2020, as a result of the slowdown in manufacturing operations due to the COVID-19 pandemic, US GHG emissions in the industry sector dropped by 6.3% compared to the previous year. We estimate that GHG emissions in the industry sector will increase 4% in 2021 as a result of economic recovery.

The Biden Administration requested the US Senate’s consent to ratify the Kigali Amendment, which aims to phase down hydrofluorocarbons (HFCs) worldwide (The White House, 2021a). The US signed the amendment in 2016 in the last days of the Obama Administration but this was not ratified during the Trump presidency and its ratification is still pending (United Nations Treaty Collection, 2016). HFCs are among the world’s most potent GHGs, with warming potentials hundreds of times higher than CO2. In 2020, HFCs represented 4% of total GHG net emissions in the US.

In December 2020, the US Congress enacted legislation to tackle HFCs as part of its coronavirus relief, under the American Innovation and Manufacturing (AIM) Act. The AIM Act directs the US Environmental Protection Agency (EPA) to phase down the production and consumption of HFCs (U.S. Congress, 2020).

Accordingly, on October 2021, the EPA finalised the rule that establishes the mechanism to achieve the objectives of the AIM Act and sets national limits on HFCs for the first time in the US. The rule aims to gradually reduce the production and imports of HFCs by 85% over the following 15 years after its implementation (2021–2036) (U.S. Environmental Protection Agency, 2021a).

The rule targets the minimisation of HFCs released from equipment, reducing their use in the near future through specific end-use sector requirements to use climate-friendlier alternatives and facilitating the transition to next-generation technologies through sector-based restrictions. EPA also included an assessment of the health-related and climate change impacts of HFC emissions in the rule . The implementation of the AIM Act is included in our CAT current policy projections.

The reduction target and the schedule of the AIM Act is aligned with the Kigali Amendment. The EPA estimates that the rule would reduce emissions by 4.7 GtCO2e by 2050, which is nearly equivalent to three times US power sector emissions in 2019. In 2036 alone, the final year of the proposed regulation, the rule is expected to prevent 187 MtCO2e of emissions. According to another study, the phase down of HFCs may be one of the most effective emissions reductions measures taken in over a decade and has the potential to reduce emissions by 900 MtCO2e over the next 15 years (Rhodium Group, 2020).

The remaining 15% not covered by the rule is intended for critical uses of HFCs in industry where there are no alternatives. Although there is no single alternative that replaces all HFCs, there are alternatives to HFCs that are economically viable and with significantly lower global warming potential (GWP). The selection of an alternative depends on the specific application. For example, ammonia has the lowest GWP of all refrigerants and has strong synergies with green hydrogen production in an emissions-free economy. For domestic refrigeration, isobutane is a viable substitute, having been used to cool fridges in the EU, for example, for nearly three decades (Gschrey et al., 2018).

In order to spur decarbonisation solutions in the industry sector, the Department of Energy launched an initiative in June 2021 that aims to accelerate breakthrough clean hydrogen solutions. It seeks to reduce the cost of clean hydrogen by 80% to 1 USD/kg per in one decade. Currently, hydrogen from renewable energy costs about 5 USD/kg. The initiative establishes a framework and foundation for clean hydrogen deployment, which includes support for demonstration projects (U.S. Office of Energy Efficiency and Renewable Energy, 2021).

Buildings

In 2020, direct GHG emissions from buildings accounted for 13% percent of total US GHG emissions, with 7% from commercial buildings and 6% from residential. Direct GHG emissions in buildings have remained relatively constant in the last decades, increasing 8% between 1990–2019 (U.S. Environmental Protection Agency, 2022b).

The economic slowdown and restrictions resulting from the COVID-19 pandemic impacted energy consumption and emissions in the buildings sector in 2020. Although electricity consumption increased in 2020, mainly in the residential sector due to restricted mobility and working from home, the emissions associated with energy use in the commercial and residential sectors fell by 12% and 6% in 2020, respectively, from the previous year. This is a result of lower carbon intensity of the electricity grid due to a higher share of renewable sources and a lower share of coal in the energy mix (U.S. Energy Information Administration, 2021e). In 2021, in line with the recovery of the economy, energy-related CO2 emissions in commercial sector increased 4%, while emissions in the residential sector CO2 emissions remained unchanged (U.S. Energy Information Administration, 2022h).

The US has numerous federal and state level policies in the building sector, primarily focused on energy efficiency. These policies include the National Appliance Energy Conservation Act of 1987, with appliance standards that were updated in 2015, and the Energy Policy Act of 1992 and 2005, which includes whole house efficiency minimums. The EPA runs the Energy Star programme, which uses a voluntary labelling system to increase consumer awareness of energy efficiency (EPA & U.S. Department of Energy, 2019).

The Trump administration weakened over a dozen energy efficiency standards, including the phase out of incandescent bulbs, which were set to be phased out at the end of his term if President Trump had not rolled back the rules for appliances. On his first day in office, President Biden signed Executive Orders revoking former President Trump’s Executive Orders and directed all agencies to review and rescind the climate rollbacks of the previous four years (The White House, 2021c, 2021k).

However, given the volume of rollbacks across sectors and the large number of appliances, and therefore rules, the DOE has not reinstated stricter rules. Around 33 energy efficiency standards for home appliances and equipment are overdue for updates and as many as 30 more will come due by the end of Biden’s term (Washington Post, 2021). The update and upgrade of all these standards to improve energy efficiency would be a crucial step forward to meet climate goals. More importantly, the administration could do so and significantly reduce GHG emissions without the need for new legislation and cumbersome negotiation with the US Congress.

The US does not have federal targets for constructing net zero energy buildings (nZEBs), although California and Massachusetts have set state-level targets. This is in contrast to the EU, for example, which requires all new buildings to be “near” nZEBs starting in 2021 (European Commission, 2020). For Paris Agreement-compatibility, all new buildings globally should be nZEBs starting in 2020, and renovation rates should increase to 3%–5% per year (Climate Action Tracker, 2016).

The CAT estimates that to be Paris compatible, emissions from the US buildings by 2030 should be around 60% lower in residential buildings and 70% lower in commercial buildings than in 2015 (Climate Action Tracker, 2021d, 2021b).

Buildings emissions intensity (per floor area, residential)

Buildings emissions intensity (per floor area, commercial)

Economic recovery

The USD 1.2tn Infrastructure Investment and Jobs Act, signed into Law by President Biden in November 2021, includes USD 225 million for state and local implementation of energy codes. With these resources, the Department of Energy (DOE) released a new building energy code for federal buildings that aims to improve energy efficiency. It also proposes new standards for residential appliances, including room air conditioners and pool heaters. The DOE estimates the new codes and proposed standards can potentially reduce emissions equivalent to the annual emissions of 14.4 million homes over a 30-year period (U.S. Department of Energy, 2022c).

The Infrastructure Investment and Jobs Act includes USD 3bn in funding to provide energy efficiency and electrification upgrades in homes (U.S. Department of Energy, 2022a). Improved energy efficiency and electrification, coupled with the decarbonisation of the power supply, are essential to achieve deep decarbonisation of the buildings sector.

Agriculture

Greenhouse gas emissions from the agriculture sector made up 11% of national emissions in 2020, which increased by about 11% percent between 1990–2019. This increase has been driven by a 9% increase in nitrous oxide emissions from managed soils, a 60% increase in combined methane and nitrous oxide emissions from manure management systems, and an 8% increase in methane emissions from enteric fermentation of animals. Emissions from other agricultural sources have remained relatively flat since 1990 (U.S. Environmental Protection Agency, 2022b).

In its updated Nationally Determined Contribution (NDC) the US commits to reduce emissions from forests and agriculture and enhance carbon sinks through a range of programmes and measures for ecosystems ranging from forests to agricultural soils. Actions mentioned in the NDC include, for example, reducing emissions and sequestering more CO2 by scaling up support to climate smart agricultural practices (e.g., cover crops, rotational grazing, and nutrient management practices) (US Government, 2021).

In one of the Executive Orders, “Tackling the Climate Crisis at Home and Abroad”, the Biden Administration explicitly mentions measures in agriculture to address climate change. It requests the Secretary of Agriculture to submit recommendations for an agricultural and forestry climate strategy and to create a Civilian Climate Corps initiative intended to conserve and restore public lands and waters, increase reforestation, promote carbon sequestration in the agricultural sector and source sustainable bioproducts and fuels (The White House, 2021c).

Accordingly, the US Department of Agriculture (USDA) is developing a climate-smart agriculture and forestry strategy and plans to engage with a range of stakeholders to explore opportunities to encourage the voluntary adoption of “climate-smart” agricultural and forestry practices.

The Growing Climate Solutions Bill was reintroduced in April 2021 in the US Senate. The US Senate passed the bill in June 2021, and it still has to be passed by the House of Representatives (U.S. Senate, 2021a). The bill directs the US Department of Agriculture (USDA) to provide technical assistance and a certification programme to remove barriers and assist producers and forest owners seeking to participate in voluntary carbon markets and be rewarded for climate-smart practices. This initiative aims to create new sources of income for agricultural activities tied to climate practices. The bill, which has bipartisan support in the House of Representatives and the backing of major agricultural lobbies, has a good chance of becoming law.

The US Department of Agriculture (USDA)’s “Building Blocks for Climate Smart Agriculture & Forestry” outlines a set of voluntary activities involving farmers and companies. The Obama-era measures targeted reductions in emissions from agriculture (e.g. improved fertiliser use and other agricultural practices, avoiding methane from livestock) and land use and forestry (e.g. improved soil management, avoid deforestation and reforestation) (The White House, 2016).

Forestry

In 2020, the net CO2 removed from the atmosphere from the LULUCF sector was 14% of total US GHG emissions. While episodic in nature, forest fires exacerbated by drought and extreme weather events such as heat waves have been growing and resulted in increased GHG emissions (although they are not included in the US GHG Inventory, as per UNFCCC rules). Additionally, forest fires and land use change have caused the extent of carbon sinks to decrease since 1990. Between 1990 and 2020, total carbon sequestration in the LULUCF sector decreased by 12% due to a decrease in the rate of net carbon accumulation in forests, as well as an increase in CO2 emissions from urbanisation (U.S. Environmental Protection Agency, 2022b).

In the submission of the Nationally Determined Contribution (NDC) the US commits to reduce emissions from forests and agriculture and enhance carbon sinks through a range of programs and measures for ecosystems ranging from forests to agricultural soils.

Actions mentioned in the NDC include, for example, that federal and state governments will invest in forest protection and forest management, engage in intensive efforts to reduce the scope and intensity of wildfires, and restore fire-damaged forest lands. Alongside these efforts, the US will support nature-based coastal resilience projects including pre-disaster planning as well as efforts to increase sequestration in waterways and oceans by pursuing “blue carbon” (US Government, 2021).

In October 2019, the government proposed reversing a long-standing rule that limits logging in the largest national forest, Alaska’s Tongass National Forest (U.S. Department of Agriculture, 2019). The proposed rule would open up nearly half of the 16.7 million-acre Tongass National Forest to logging, reducing the sinks from forestry and land use. A broad coalition of Indigenous groups, local businesses, and environmental organisations sued to block the rollback (NRDC, 2021).

Waste

The EPA finalised standards to reduce methane emissions from new, modified, and reconstructed municipal solid waste landfills in 2016. In August 2019, the EPA passed a rule to amend the standards, postpone the compliance period, and postpone the due date for state plans to limit methane emissions from landfills (U.S. Environmental Protection Agency, 2022b). This could mean increased emissions from landfills in the future.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter