IMO policies & action

Current policy emissions projections

International shipping accounted for about 3% of global GHG emissions in 2021, with CO2 representing the lion’s share of total shipping emissions (UNCTAD, 2022).

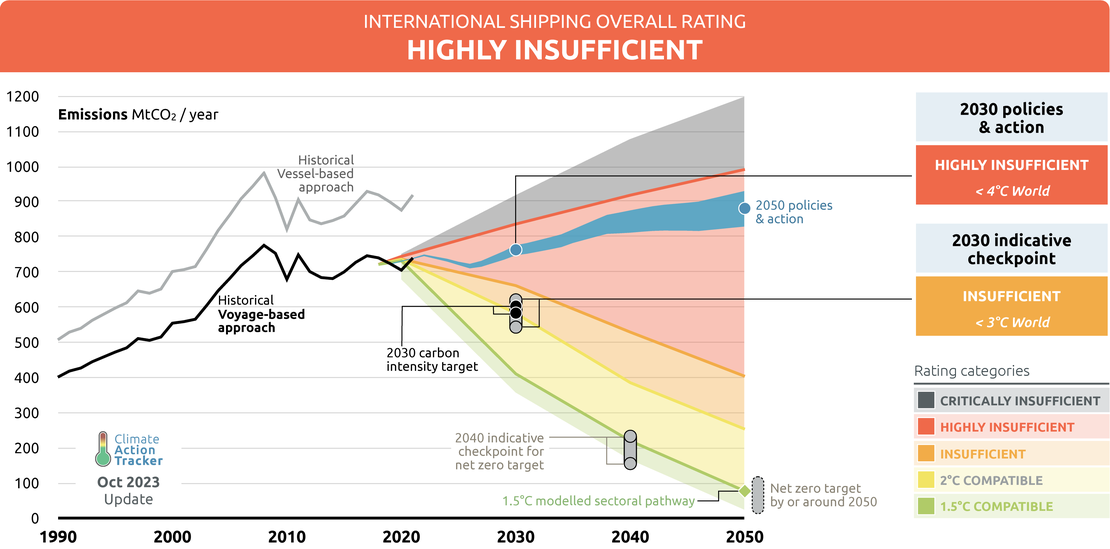

With the current level of policy action (perhaps better described as inaction), CO2 emissions in 2030 are projected to be between 750-776 MtCO2 (voyage-based approach), a 1-5% increase above today’s levels, and will continue to grow to mid-century. The CAT rates 2030 emissions under current policies as ‘Highly Insufficient’.

The pandemic’s impact on international shipping emissions was short-lived. Emissions dipped slightly in 2020, but rebounded in 2021, exceeding 2019 levels. Maritime trade has recovered to pre-pandemic levels, but is expected to be slower in the coming years as the global economy loses steam (UNCTAD, 2022). In 2021 and 2022 the volume of world merchandise trade grew from 2019 levels by 9.5% and 2.7%, respectively (WTO, 2023). China’s Zero Covid Policy contributed to the slower growth in 2022, but other factors, including Russia’s invasion of Ukraine and slower economic growth, also played a role.

International maritime passenger transport has not fully recovered to pre-pandemic levels. International tourist arrivals fell dramatically in 2020. While they have since rebounded, arrivals were still about 40% below 1990 levels in 2022 (UNWTO, 2023). However, the impact on emissions is much less pronounced given the small share passenger transport represents.

Energy efficiency measures, which came into effect at the beginning of 2023, will cut CO2 emissions in the near term, but are ineffective in the long-term, as CO2 emissions are projected to start increasing again later in the decade and beyond (Smith, Galbraith, et al., 2022). The near-term drop in CO2 is due to fuel switching from heavy fuel oil (HFO) to LNG, which means that total GHG emissions are expected to be higher, as a result of higher methane emissions. In fact, overall GHG emissions would likely have been lower in a world without the recent energy efficiency measures, which further highlights their limitations. These energy efficiency measures are reflected in the bottom end of our current policy projections, but with the asterisks around higher overall GHG emissions.

Methane emissions have been on the rise, before the added effect of the energy efficiency measures. Between 2012-2018, they rose by 150% (IMO - MEPC, 2020a). This increase was also mostly driven by the greater use of LNG-fuelled engines.

LNG is not an option to support the transition to alternative energy sources. Studies have shown that the adoption of LNG could actually increase international shipping’s climate impact when the whole lifecycle of all GHG gases are taken into account (Lowell & Bradley, 2013; Pavlenko et al., 2020). Investment in LNG facilities is growing but could lead to stranded assets or perpetuate a carbon “lock-in” effect as ships and onshore LNG infrastructure will make it more difficult to transition to low-carbon fuel.

2018 Initial Strategy and 2023 Revisions

With the adoption of its initial GHG Strategy in 2018, the IMO developed a work plan scheduling the course of actions for consideration over a period of time. The 80th MEPC session (MEPC80) in July 2023 was earmarked for governments to negotiate and agree to a Revised GHG Strategy (Smith & Shaw, 2023).

Initial Strategy

The Initial Strategy set several emission reductions targets: to reduce the CO2 intensity of international shipping by at least 40% and 70% from 2008 levels by 2030 and 2050, respectively, and to reduce GHG emissions at least 50% below 2008 levels by 2050.

Policy action to achieve these targets has been meagre. In 2021, the IMO adopted several efficiency measures, the Energy Efficiency of Existing ships Index (EEXI) and the Carbon Intensity Indicator (CII), but these will not curb long term emissions growth and would instead have a counterproductive impact on near-term ambition as they promote a switch to LNG-powered ships and higher GHG emissions levels overall.

2023 Revisions

The Revised Strategy set out new emission reduction objectives, introducing GHG emission reduction checkpoints (rather than firm targets) for 2030 and 2040, and strengthened the IMO’s long term target to net zero (see our targets section for details).

The MEPC80 meeting (July 2023) adopted no new measures pertaining to emission reductions. Rather, governments only agreed to setting a timetable of what measures to pursue in the future.

Outcomes of discussions on the Revised Strategy:

- Agreed to a fuel-based target of at least 5%, striving for 10%, of the energy used in international shipping to come from zero and ”near zero” emission fuels and technologies by 2030.

- Agreed to work towards developing further measures, including a fuel standard, to reduce the GHG intensity of shipping fuels over time, and an ‘economic instrument’ (i.e. a market-based measure) for adoption in 2025, with implementation expected from 2027.

- Agreed to expand coverage for targets and for any measures adopted in the future to cover the full life cycle emissions (Well-to-Wake instead of only Tank-to-Wake emissions) and GHG emissions (instead of only CO2).

- Adopted the Guidelines on Life Cycle GHG Intensity of Marine Fuels (LCA Guidelines) outlining methods for calculating Well-to-Wake GHG emissions.

- Agreed to account for “just and equitable transition” considerations, with text identifying a list of criteria to be considered when developing measures that may impact developing states, particularly SIDS and LDCs.

- Agreed to consider long-term measures beyond 2030 as part of the review of the Strategy in 2028.

- Agreed to develop tools to support capacity building and further studies to inform policy making decisions.

Despite proposals for a global fuel standard and a market-based measure being put forward to MEPC80 and the extensive evidence supporting them (particularly a GHG levy), governments decided to further delay their adoption. Prolonging the development and adoption of such key instruments points to the sector's lack of urgency in its effort to decarbonise.

Given the urgency of reducing global emissions and the decades of inaction in the sector, the IMO is missing a key opportunity to develop and implement stronger mitigation measures. Without these measures the chances of achieving the already insufficient 2030 targets become even less likely.

Energy efficiency measures

The IMO has adopted several energy efficient measures over the years, the most recent measure, the CII and EEXI, came into effect in January 2023, with the first ratings and reporting to be issued in 2024 (Maersk, 2022).

The EEDI requires a minimum energy efficiency level per activity to be tightened up in phases every five years, and is currently in phase two. Each phase defines a reduction factor for the EEDI to comply with, increasing at each phase, the last phase being phase three (IMO, 2013, 2017).

In 2019, the IMO tightened its energy efficiency design requirements regulating the amount of CO2 emissions related to installed engine power, transport capacity and ship speed (Bureau Veritas, 2021). Additionally, the SEEMP was established to improve energy efficiency planning tool for shipping companies to manage their fleets’ operational energy efficiency over time. It consists of three parts: Part I deals with establishing a ship management plan to improve energy efficiency, Part II establishes ship fuel oil consumption data collection plans and Part II establishes ship operations carbon intensity plan (DNV, 2022; IMO, 2022).

The CII gives a rating to existing vessels based on an efficiency measure of the CO2 emitter per cargo carrying capacity and nautical mile. The scale ranges from A (major superior) to E (inferior performance). Ships rated E, or rated as D for three consecutive years, will need to develop a plan to increase their operational efficiency as per Part III of the SEEMP (DNV, 2023). Newly built ships which comply with EEDI are also de facto compliant with the EEXI. While this measure would cover more than half of international shipping emissions from 2008, the estimated impact in reducing emissions by 2030 is marginal – less than 2% compared to if no measure were applied, mainly due to a continued low speed applied by the operators (ICCT, 2020b). The IMO will need to make further efforts to drive emissions reductions to meet its carbon intensity target by 2030.

Heavy fuel oil ban

In 2021, IMO member states adopted a ban to limit the use of heavy fuel oil (HFO) in the Arctic, which has been heavily criticised by environmental groups for allowing loopholes that reduces the effectiveness of the ban. Not only its entry to force has been postponed by five years (by 2029), but it would still allow 74% of the Arctic shipping activities to continue as business-as-usual (Ocean Conservancy, 2020). The is a major weakening of the policy’s effectiveness as 68% of the fuel consumed come from just five of the Arctic Nations (Russia, the US, Canada, Norway, and Denmark) (Roy & Comer, 2017).

Just transition for workers

At COP 26, the International Chamber of Shipping (ICS), the international Transport Worker’s Federation (ITF), the UN Global Compact and the international Labour Organisation (ILO), with support from the IMO, launched the ‘Maritime Just Transition Task Force’, to support the coordination between governments, industry and stakeholders to develop the skills needed by seafarers to operate with new technical challenges associated with the green transition of the maritime sector (IMO, 2023b). In 2022, at COP27, a 10-point action plan setting out recommendations on the skills needed by seafarers to support maritime decarbonisation (Maritime Just Transition Task Force, 2022).

What is the International Maritime Organization?

The IMO is a UN special agency composed of 174 members states and is responsible for preventing shipping pollution.

The IMO consists of an Assembly, a Council – the executive body – and five committees, the most relevant of which for climate action is the Marine Environment Protection Committee (MEPC).

The MEPC deals with issues related to preventing pollution from ships, including GHG emissions and energy efficiency measures. The MEPC adopts resolutions on these issues and establishes working groups.

Technical proposals relating to emissions reductions are considered and negotiated at its Inter-sessional Working Group on Reduction of GHG Emissions from Ships (ISWG-GHG), which forwards proposals for the MEPC’s consideration, agreement and the last stage, adoption. Any country who is party to the IMO can submit proposals to the MEPC.

The floor is also open to NGOs and industry observers registered with the IMO to make submissions, but only countries have the right to vote (Hayer, 2016; IMO, 2020). Following adoption, a resolution will then need to be accepted by contracting party governments within an agreed fixed period – after which the resolution enters into force.

Relationship with the UNFCCC

While the Kyoto Protocol stipulated in 1997 that developed countries should reduce their international shipping emissions by working through the IMO, the Paris Agreement is silent on the matter. The Agreement refers to setting or moving towards “economy-wide” reduction targets, which implies that emissions from international bunkers should be included in government climate targets under the Paris Agreement.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter