Policies & action

We rate Argentina’s policies and actions as “Critically insufficient” when compared with modelled domestic emissions pathways. This rating indicates that Argentina’s climate policies reflect minimal to no action and are not at all consistent with the Paris Agreement’s 1.5°C temperature limit.

Argentina’s policies and action rating compared to modelled domestic pathways is now lower than in our previous assessment due to an update in our projections for the agriculture sector. Newer projections expect higher agricultural and livestock production by 2030, leading to ~2% higher emissions under current policies.

Argentina’s policies and action also remain inadequate to achieve its NDC target, let alone be 1.5°C compatible. The CAT estimates that under current policies Argentina will miss its target by 54 MtCO2e. To be 1.5°C compatible, Argentina’s policies and action projections should be at least 175 MtCO2e lower in 2030.

Policy overview

Under current policies, total emissions (excluding LULUCF) are still projected to grow significantly after 2022, namely by about 15% above 2022 levels by 2030, reaching about 405 MtCO2 in 2030 (excl. LULUCF).

In 2022, emissions in Argentina rebounded above 2019 levels after a sharp drop in 2020 due to COVID-19. This puts Argentina’s emissions projections under current policies at approximately 15% above its 2030 target. Our analysis of current policies is based on projections developed by the National University of Central Buenos Aires (UNICEN) (Blanco & Keesler, 2022; Keesler & Blanco, 2024). These projections include relevant policy developments up to 2022. Later developments, such as the power sector reforms, power subsidies reform and large fossil fuel investments proposed by the current government could have a significant impact on how emissions develop in the next few years, but are not yet reflected in our current emissions projections.

According to UNICEN’s modelling results, if Argentina were to implement additional policies to scale-up low carbon energy sources and reduce energy demand, it could almost reach its NDC target (Blanco & Keesler, 2022). This would require, reaching a carbon-free power grid by 2050, reaching 100% EV sales by 2050, and increasing energy efficiency. However, to be consistent with limiting warming to 1.5°C, Argentina would also need to speed up the achievement of those measures, plus develop more ambitious policies, especially to stop deforestation, and reduce livestock-related emissions.

UNICEN also models a carbon neutrality scenario for Argentina’s AFOLU sector. This scenario shows the sector could become carbon neutral by 2050 by increasing the GHG efficiency of livestock production by 10%, reducing synthetic fertiliser use by 90%, increasing the collection of crop residues by 25%, reducing grasslands and forests burning by 90%, reducing deforestation by 90%, and increasing both commercial forestry and forest restoration. Critically, this scenario also includes the reduction of livestock for domestic consumption ‘following the trends of the latest years in domestic consumption’ (Keesler & Blanco, 2024).

Argentina’s energy sector is its biggest source of GHG emissions, reaching 174 MtCO2eq in 2020 (54% of the total). Total energy supply increased 81% between 1990 and 2021, and fossil fuels still account for around 89%, mostly gas (50%) and oil (36%).

President Milei’s administration, which took office in December 2023, has substantially restructured Argentina’s national government, with a focus on reducing the size of the public administration, and cutting expenditure. In this process, the former Ministry of Environment has been reduced to the sub-secretary level, under the Secretary of Sport, Tourism and Environment (EcoNews Global, 2023).

During his presidential campaign, President Milei stated he does not believe in man-made climate change and that his government would not support climate policies, including threats to leave the Paris Agreement (Colombo, 2023). More recently, his administration stated that Argentina will not be leaving the Paris Agreement, but the outlook looks bleak on increasing or even maintaining climate ambition in Argentina for the next four years (Spring, 2023).

The new government plans to continue developing the Vaca Muerta fossil gas fields, as well as the fossil gas pipeline and the LNG terminal, both planned by the previous administration. To support these large investments, the government set out an incentive package called RIGI or Incentive Regime for Large Investments (KPMG, 2024).

In January 2023, the government started negotiating contracts with oil and fossil gas producers at Vaca Muerta to ensure the future pipeline will work at capacity (Government of Argentina, 2022e). In June 2023, the fossil gas pipeline was finished ahead of schedule and began operations. It is expected to carry 11 mm3/d during 2023, and to reach 22 mm3/d in 2024, which represents around 15% of the country’s current consumption (Diamante, 2023). This has the potential to prevent Argentina from meeting its climate targets through higher upstream energy emissions as well as the lock-in effects of fossil fuel infrastructure. In July 2024, a compressor plant was installed to increase the carrying capacity of the pipeline by 5 m3/d, and a second section of the pipeline is still under construction (Government of Argentina, 2024d).

During the second half of 2023 the Argentinian government produced three strategic climate policies: the National Strategy for International Climate Financing 2023, the National Strategy for the Use of Carbon Markets 2023 and the National Strategy for Sustainable Finance, 2023 (ENFS) (Banco Central de la República Argentina, 2023; Government of Argentina, 2023d; MECON, 2023). However, these are so far only high-level documents meant to structure future work on designing climate finance roadmaps and possibly a cap-and-trade system in the Argentinian power and industry sectors. It remains uncertain whether these policies will be designed and implemented by the Milei administration.

In December 2022, the government published its new National Climate Change Mitigation and Adaptation Plan until 2030 (Government of Argentina, 2022d). This strategy was published shortly after Argentina submitted its Long-term Strategy to the UNFCCC, and reiterates both Argentina’s NDC and LTS targets, as well as expanding on many of the measures presented in Argentina’s Fourth BUR earlier in 2022. So far, the strategy seems to still be in place, but whether its implementation will continue during Milei’s administration is uncertain.

The strategy includes detailed information on Argentina’s climate measures and targets covering all major sectors. Some highlights of this strategy include targets for the decarbonisation of the transport sector, incentives to increase energy efficiency in buildings, and measures to reduce food loss and waste. This strategy, however, does not include any new renewable energy targets or measures, and it does not include any significant measures to reduce emissions from the AFOLU sector, especially from livestock.

Power Sector

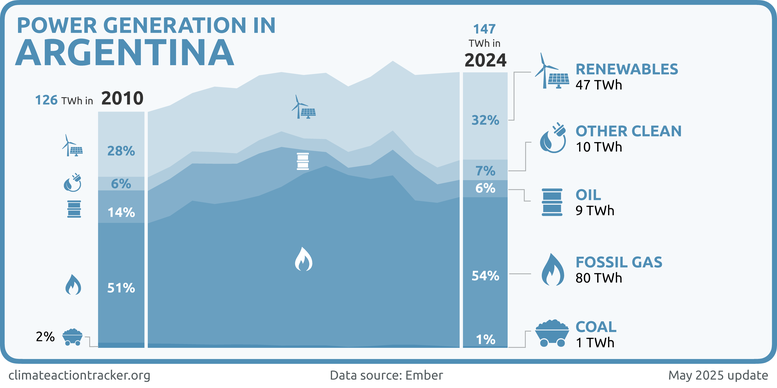

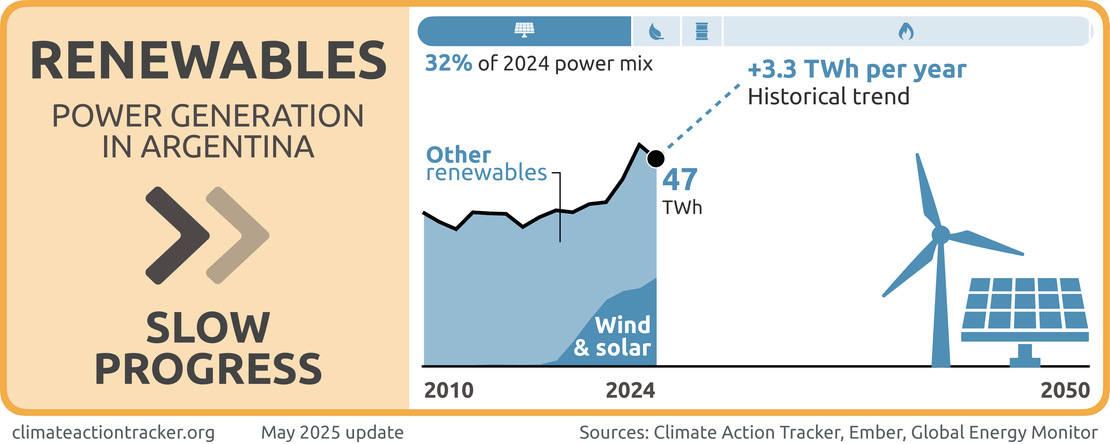

While the energy sector accounts for roughly half of GHG emissions in Argentina (200 MtCO2e in 2022), the power sector only accounts for 55 MtCO2e or 16% of the total (Government of Argentina, 2024a). Electricity generation in Argentina roughly tripled in the period 1990-2022, reaching 147 TWh in 2024. While the sector is still dominated by fossil fuels, especially fossil gas (54%), wind and solar PV have taken off in recent years, reaching almost 14% of total generation in 2024, from roughly 0.5% in 2015 (Ember, 2025).

In recent years, Argentina has shifted its energy sector development focus away from renewables and towards fossil gas and nuclear power. The Milei administration hasn’t yet given any clear communication on its development priorities for the power sector, aside from declaring an state of emergency in the power sector, announcing plans to reduce electricity subsidies and reform the power market to incentivise private sector investment (Government of Argentina, 2024b). So far, it has cut subsidies from 2% of GDP in 2022 to 1.5% in 2023 mostly through policies implemented by the previous administration, with further cuts to 0.8% in 2024 (Raszewski, 2023; Tobias, 2024). Depending on how changes in subsidies affect total power demand, this could potentially have a significant impact on our emissions projections under current policies.

The government is also considering a cap-and-trade system to reduce emissions in the power sector, but has not yet set out official plans (Government of Argentina, 2024c).

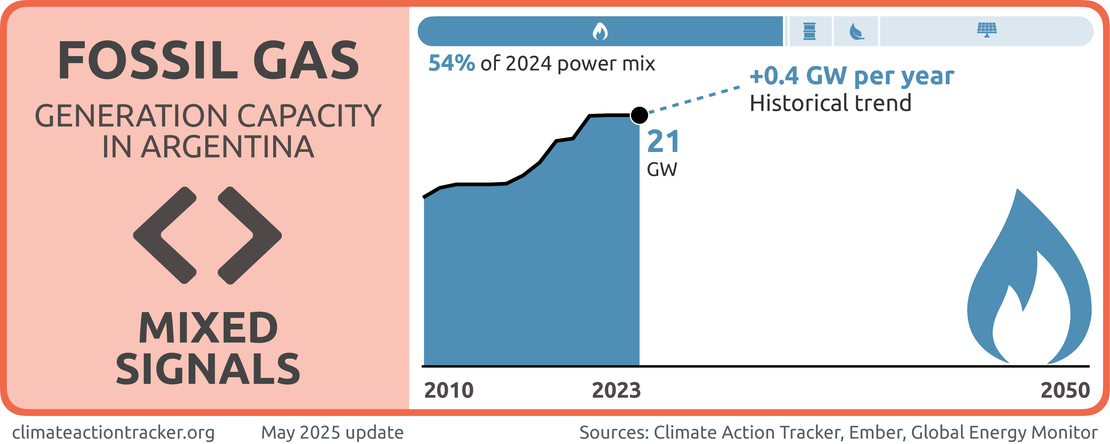

Fossil gas

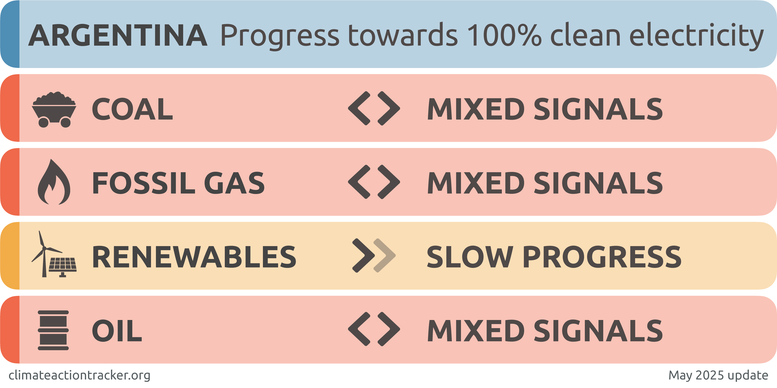

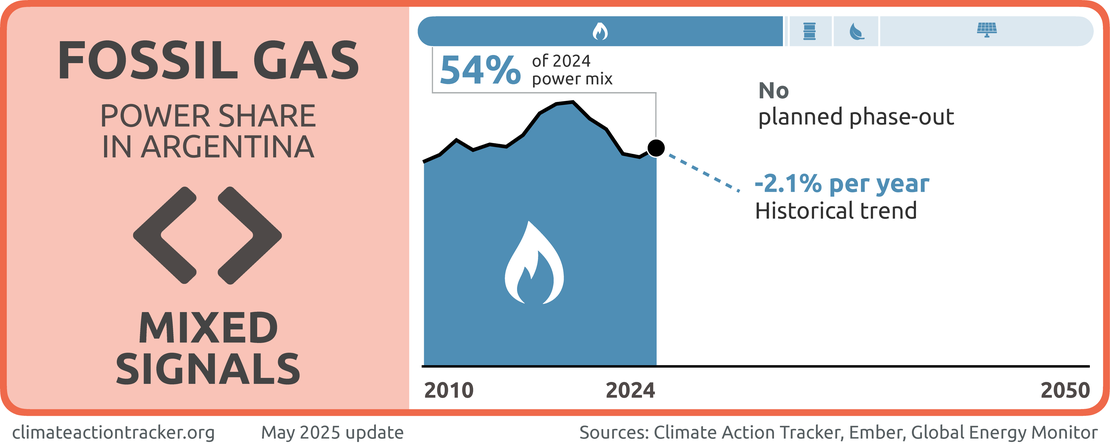

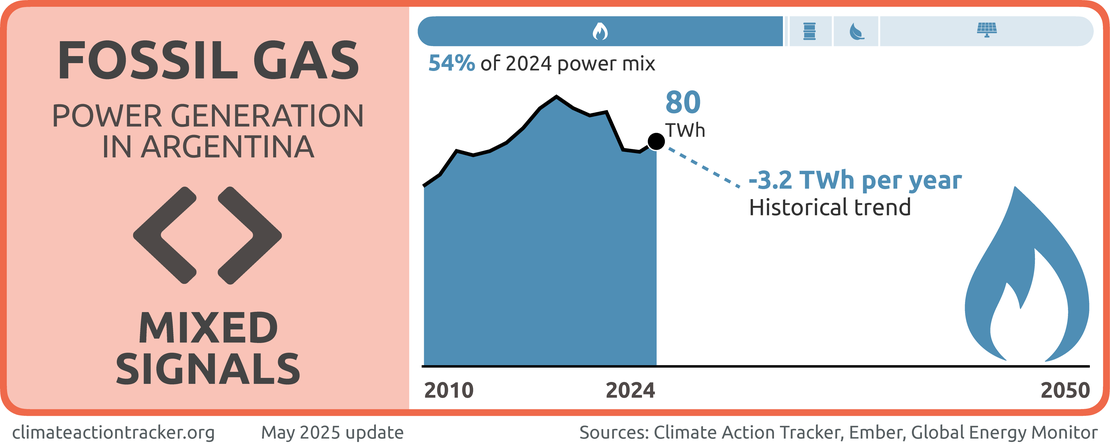

Argentina is sending “Mixed Signals” on fossil gas, which remains the largest source of electricity, accounting for 54% of power generation in 2024 (Ember, 2025). Over the past 25 years, fossil gas has been Argentina’s primary response to rapidly growing electricity demand. Although its share in the power mix has slightly declined in the last five year, the government has no plans to phase out fossil gas.

On the contrary, fossil gas is expected to remain central to the country’s energy strategy, with ongoing expansion plans. Currently, Argentina operates 10.4 GW of gas-fired capacity, with an additional 0.6 GW under construction and 0.7 GW planned. With Recent initiatives to expand shale gas extraction, coupled with investments in transport infrastructure and continued government subsidies, explain why Argentina continues to prioritize new gas power projects.

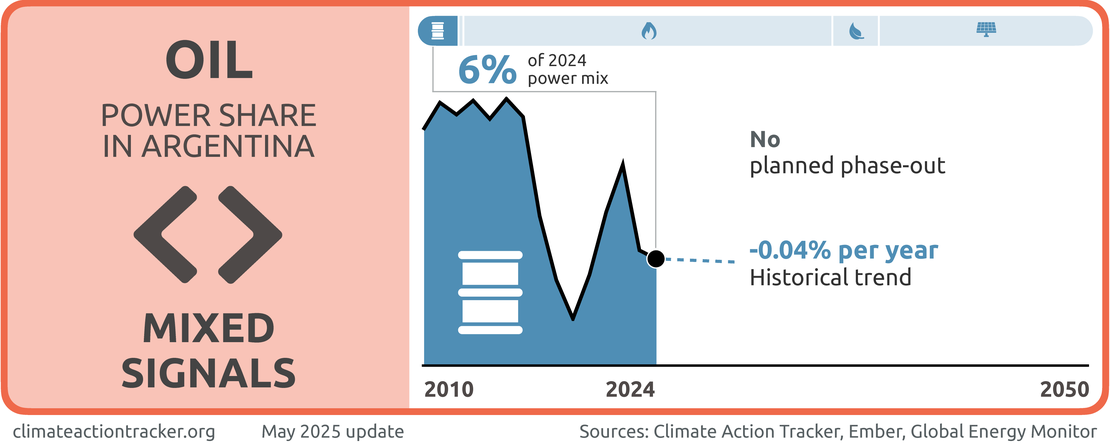

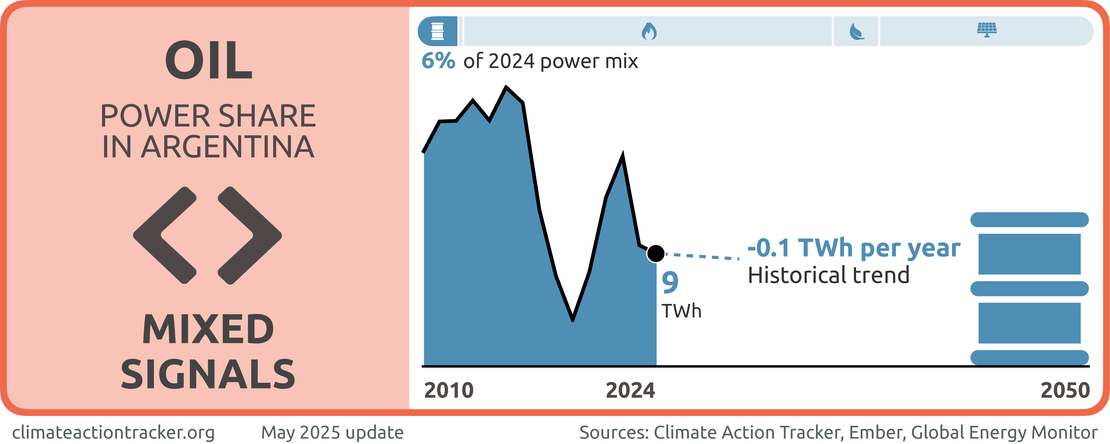

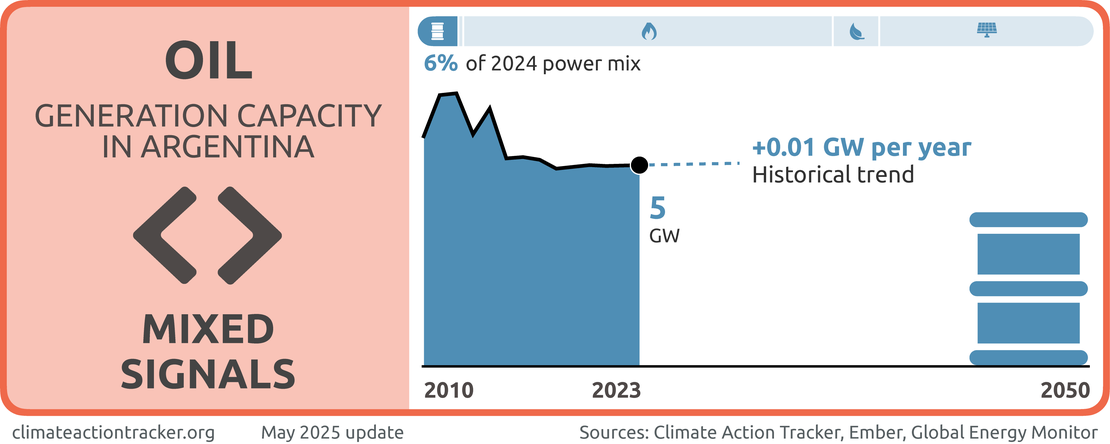

Oil

Argentina is also sending “Mixed signals” on oil generation. The share of oil in electricity generation has fluctuated in the last five years, falling to 6% in 2024. While there are no plans to expand oil generation capacity or build new plants, there is also no formal phase-out strategy in place.

Oil is primarily used as a backup fuel during periods of peak demand or when fossil gas supplies are limited. In Argentina, supply constraints are largely due to the lack of transport infrastructure connecting production sites to power plants. Although oil-fired power generation has steadily declined over the past decade, it has again increased in recent years. However, Argentina’s gas development plans include the expansion of pipeline capacity, which is expected to reduce the reliance on fuel oil in the future (Noticias & Protagonistas, 2023).

Renewables

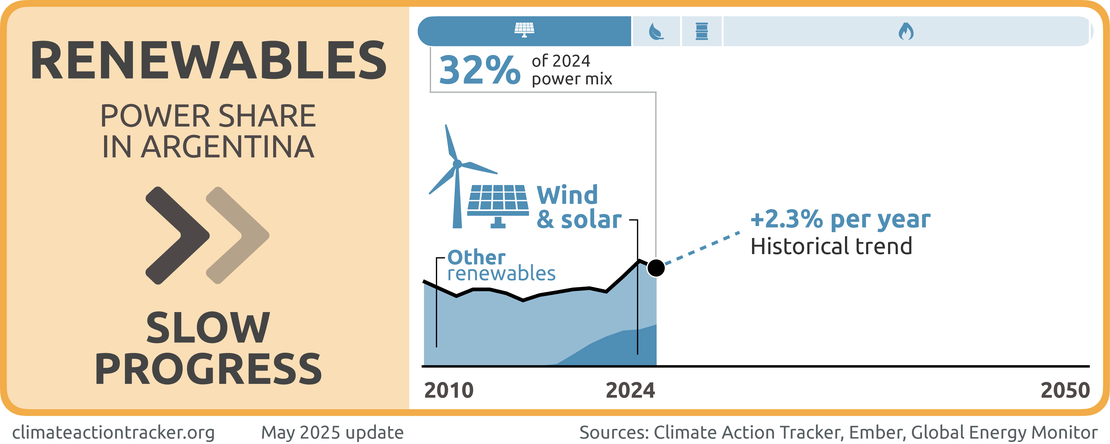

Argentina is making “Slow Progress” on deploying renewables. While the use of renewables in power sector is on the rise, the current pace of deployment remains too slow.

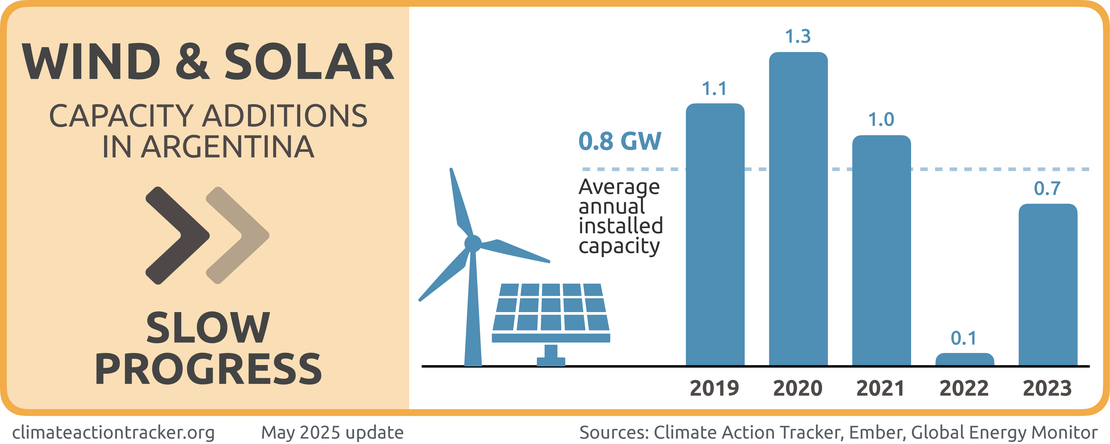

In 2024, renewables, including large hydro, contributed roughly 30% of the country’s power generation. The share of wind and solar in electricity generaion has increased in the last five year, rising from 4% in 2019 to 14% in 2024 (Ember, 2025). However, in recent years, the focus appears to have shifted away from renewables, with growing uncertainty around future policy direction and investments in the sector.

Argentina set a target for renewable electricity generation (excluding large hydro) to reach 20% of total generation by 2025, included in Law 27.191 published in 2015 (Government of Argentina, 2015b & Government of Argentina, 2016b). However, after major policies to support the target such as the renewables auction system (RenovAr) were abandoned in 2019, it is now unclear whether Argentina will reach its target.

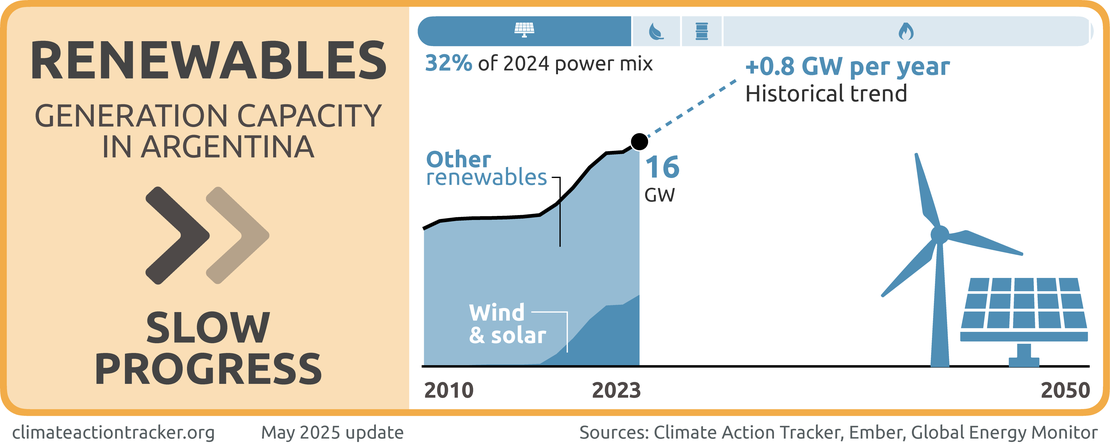

However, in the period up to 2030, Argentina plans to develop 2.3 GW of modern renewables on top of the current 5 GW, and 2 GW of large hydro on top of the current 10.4 GW (Government of Argentina, 2022d, 2023b; IRENA, 2023).

At the end of 2023, 74.6 MW of installed capacity were added to the grid through two wind farms and one landfill biogas plant (Government of Argentina, 2023b). A new solar park was also commissioned in July 2024, with an expected installed capacity of 200 MW and operations planned to start in 2026 (Ojeda, 2024). While these are positive steps in decarbonising Argentina’s power grid, they fall short of the pace needed. According to UNICEN’s carbon neutrality scenarios, Argentina should fully decarbonise its power sector in the 2030s (Blanco & Keesler, 2022).

Under current policies, it is expected that renewables will reach approximately 25% of total power generation by 2030, with 11 GW of total installed capacity. To be on track to reach its 2050 carbon neutrality target in 2050, research suggests that Argentina should reach 25 GW of renewables installed capacity instead (Blanco & Keesler, 2022).

Nuclear

In 2024, nuclear power contributed 7% of Argentina’s total power supply (Ember, 2025).

In July 2022, as part of its nuclear plan, the government announced a deal with Chinese manufacturers to start the construction of a new nuclear plant with a capacity of 1.2 GW before the end of 2022 and plans for the development of an additional plant. The project will cost USD 8.3 billion and will be 85% Chinese financed (Government of Argentina, 2022b). The government also plans to retrofit at least two simple-cycle fossil gas power plants to combined-cycle to improve efficiency and add 420 MW of generation capacity (Government of Argentina, 2022d).

Although nuclear electricity generation does not directly emit CO2, the CAT doesn’t see nuclear as the solution to the climate crisis, due to its risks such as nuclear accidents and proliferation, high and increasing costs compared to alternatives such as renewables, long construction times, incompatibility with a flexible supply of electricity from wind and solar, its vulnerability to heat waves, and the creation of nuclear waste.

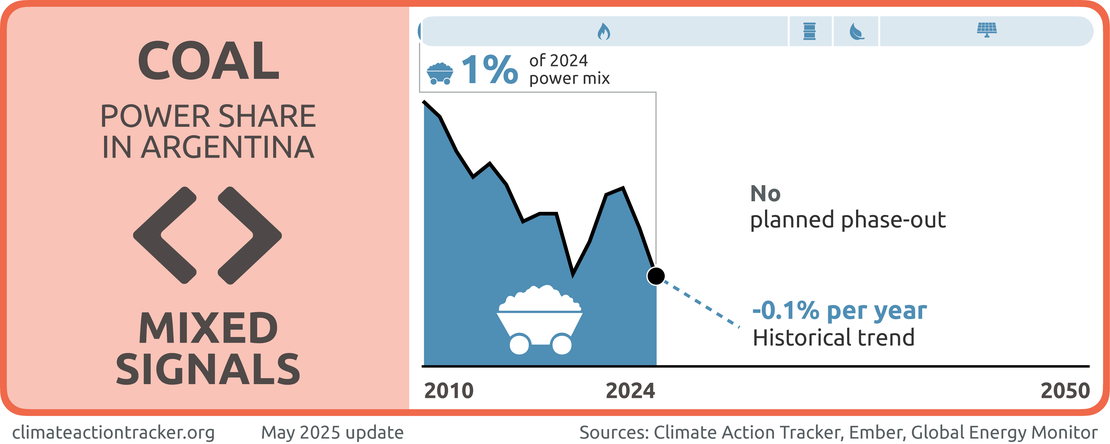

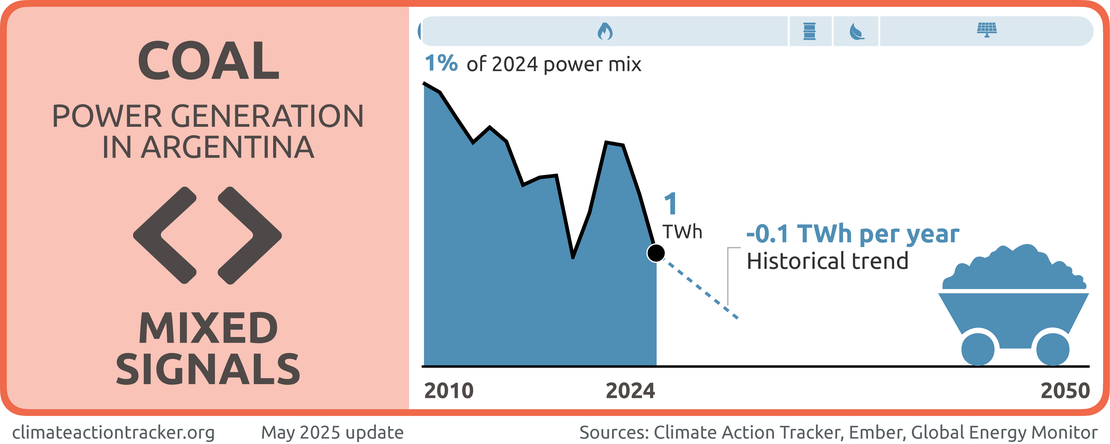

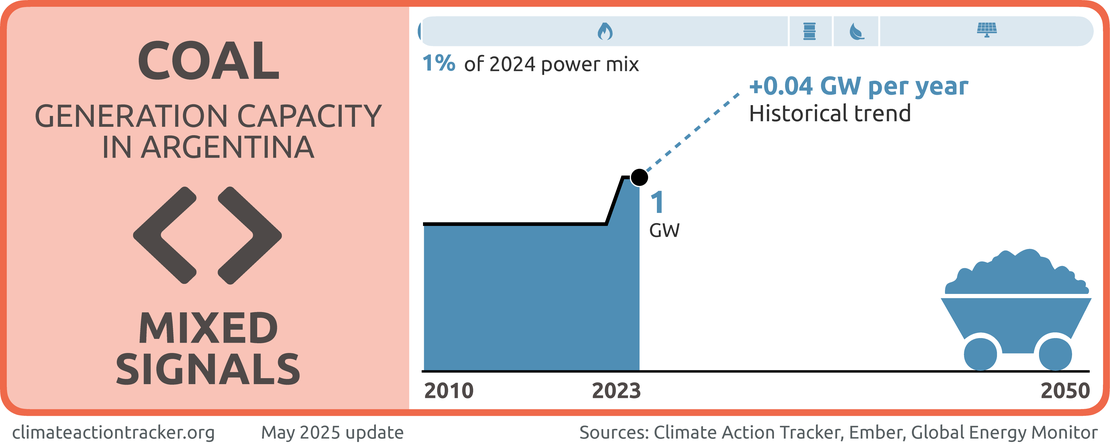

Coal

While coal plays a minor role in Argentina’s power sector – accounting for just around 1% of power generation in 2024 – the government’s stance is sending “Mixed Signals” (Ember, 2025).

Argentina currently operates one single coal-fired plant: the 375 MW San Nicolas power plant in Buenos Aires, which has been in operation since the 1990s. It is scheduled for retirement next year (Global Energy Monitor, 2025b). However, Argentina has no clear policy to fully move away from coal. The government plans to build a new 240 MW plant in Río Turbio, near existing coal mines. The project has faced repeated delays, and its final capacity remains uncertain. So far, 120 MW appears to have been connected to the grid (Global Energy Monitor, 2025a).

Industry

In 2022, emissions from industry, including industrial processes, oil and fossil gas production and excluding indirect emissions from power consumption in industry, reached 48.4 MtCO2e in Argentina, or 14% of total GHG emissions (Government of Argentina, 2024a). In 2022, industry represented 22% of total energy demand (IEA, 2023).

The biggest subsectors by production value are food and beverage manufacturing (31%), construction (14%) and the manufacturing of chemical substances and products (12%). The industrial sector is also the biggest consumer of fossil gas after thermoelectric generation plants. However, most process-related emissions stem from steel and cement production (Government of Argentina, 2023a).

The government seeks to promote energy management systems for industrial companies. In 2018, the Ministry of Energy passed Provision 3/2018, which establishes that companies benefitting from reduced electricity prices under Resolution 1-E/2017 have to implement the ISO norm 50001 on energy management systems, including the development of an energy management action plan, energy performance targets and indicators to monitor progress (Ministry of Energy and Mining, 2018). In its 2022 climate strategy, the government reinstates its existing plans and measures for reducing energy consumption in businesses (Government of Argentina, 2022d).

Oil and fossil gas

Argentina continues to develop its oil and gas sector, mostly focusing on increasing production in the Vaca Muerta shale fields, as well as investing in transport and export infrastructure. In 2024 both oil and fossil gas production continued to increase compared to previous years, with large contributions from Vaca Muerta.

In the first half of 2024, gas production increased 5% compared to the same period in the previous year, reaching 25,000 million cubic meters. Oil production also continues to increase, reaching 692 thousand barrels per day in May 2024 (an 8.8% increase compared to 2023), with Vaca Muerta accounting for almost 70% of the total (Ambito, 2024b, 2024a).

Major ongoing developments in the oil and fossil gas industry include:

- The construction of a new segment of the Nestor Kirchner fossil gas pipeline (Iden, 2023; Redacción Central, 2020)

- The construction of a compressor plant in Tratayén, which increased the carrying capacity of the existing Nestor Kirchner fossil gas pipeline by 50% (Government of Argentina, 2024d)

- Development plans for the Vaca Muerta south fields (Ciruzzi, 2024)

- Plans to develop an LNG port in Rio Negro (LNGPrime, 2024)

- Agreement with Golar LNG and Pan American Energy to deploy a 2.45 mt/year Floating Liquified Natural Gas plant in Argentina to channel exports from Vaca Muerta (Enerdata, 2024)

- Offshore exploration activities off the coast of Buenos Aires failing to find fossil fuels, with some players withdrawing among decreasing interest (Terzaghi, 2024)

These developments will most likely impact total emissions in the country through increases in fugitive emissions, as well as creating lock-in of fossil infrastructure and disincentives for a deeper transformation of the energy sector. An increased dependence on internationally-traded goods can increase Argentina’s vulnerability to external shocks.

The increased production of fossil fuels could also lead to higher energy consumption. As part of its push towards domestic oil and fossil gas production, the government also plans to set out measures to reduce flaring and leakage, but so far as not provided any specific measures or targets (Government of Argentina, 2022d). Over the period 2012-2022, flaring has doubled from 600 MM3 to 1200 MM3 (GFMR, 2023).

Hydrogen

Argentina has begun setting out plans to produce green hydrogen, both with the aim of domestic use and exports. In 2023, it set out its National Strategy for the Development of a Hydrogen Economy. This strategy sets out targets to produce 5 mt/y of “low emissions hydrogen”, which will require 30 GW of electrolysis capacity, and 55 GW of renewable electricity generation capacity by 2030. Roughly 80% of all production is expected to be exported (Government of Argentina, 2023c).

In 2022, it was announced that Australian firm Fortescue will invest USD 8.4bn in the Argentinian province of Rio Negro to develop green hydrogen. The first phase of the project will generate 650 MW and include a wind farm and a port for transportation. It will initially be destined for export, but capacity can be expanded to 8 GW in future phases, enabling the dedication of some production for the domestic market. This project fits into a provincial plan to produce 2.2 Mt by 2030 (Garcia Pastormerlo, 2021). In its 2022 climate strategy, the government also included plans to prepare a National Hydrogen Strategy with more clear milestones for Argentina’s domestic hydrogen industry (Government of Argentina, 2022d).

In 2023, the EU also announced plans to finance the development of green hydrogen in Argentina. The original plan to invest EUR 200 million to develop green hydrogen for export to Europe is now under discussion with the current administration, who pledged to present new legislation this year to streamline processes related to hydrogen production, certification and export (Collins, 2024).

Transport

In 2022, emissions from the transport sector in Argentina represented 16% (~56 MtCO2e) of Argentina’s GHG emissions (excluding LULUCF) according to the Fifth BUR, and approximately 32% of energy demand (IEA, 2024b).

Argentina has set out policies to reduce emissions in all key areas of the transport sector, but under current policies, emissions in the sector are still expected to rise towards 2030.

Electric vehicles

In its 2022 climate strategy, the government included several targets related to electric vehicles (EVs). These include:

- The installation of over 86,000 charging stations and 2,500 fast-charging stations

- Targets to increase the sales of light- and heavy-duty hybrid and EVs to 100.000 and 150.000 respectively by 2030

- Target to replace 100% of public administration vehicles with EVs or hybrid vehicles by 2030 (around 146,000 vehicles)

- Incentivising the conversion of private vehicles to compressed natural gas (CNG) (Government of Argentina, 2022d).

The uptake of EVs remains low in Argentina, but it is now picking up due to incentive policies such as tax breaks. In 2021, the Argentinian Association of Automobile Dealerships reported 5,871 new sales of low-emissions mobility light-duty passenger vehicles, of which 99% were hybrid cars and only 1% plug-in EVs (Bloomberg Linea, 2022). In 2022, sales increased by 33%, reaching 7,849 new sales, of which 97% were hybrid and 3% pure electric (Della Vecchia, 2023). In 2023, sales reached 9601 cars in total, of which 3.7% were pure electric (Inside EVs, 2024). Overall, the low-emissions mobility market remains marginal in Argentina, with total 2023 EV and hybrid sales being under 1% of all vehicle sales (La Nación, 2023).

Public transport

In its 2022 climate strategy, the government includes measures to support the development of rail infrastructure, including adding 83km of electric train tracks by 2026 (Government of Argentina, 2022d).

Since 2008, the government has incentivised the use of public transport in large urban areas through the development of Bus Rapid Transit Systems (BRTS). As of 2020, 18 BRTS were in place, with a goal to reach 20 by 2030 (Government of Argentina, 2022c).

Biofuels

In its 2022 climate strategy, the government included biofuels targets: to increase bioethanol blending to 15% in 2025, and to meet 20% of total fuel demand with biofuels by 2030. The government also plans to support second generation biofuels and aims for 2 Mt of organic waste to be used for biofuels by 2028 (Government of Argentina, 2022d).

This contrasts with its current mandates to reduce biodiesel blending from 10% to 5%, with the option of being further reduced to 3% if biofuel input prices increase so much that they significantly impact final fuel prices for consumers. A recent study has calculated that this reduction can lead to a cumulative increase emissions between 7.9-11.7 MtCO2e in the period 2021–2030 compared to the previous 10% mandate (Magnasco & Caratori, 2021). However, a reduction in the production of first-gen biofuels can also have positive effects in land-related emissions, reducing the pressure to expand agricultural lands and demand for the commodities used as feedstock (Rulli et al., 2016).

Vehicle efficiency standards and labels

In March 2021, the government also introduced a new mandatory light-duty vehicle label to reflect fuel efficiency and emissions in all new vehicles under 3,500 kg.

Buildings

In 2020, emissions from the buildings sector in Argentina represented 8% (~27 MtCO2eq) of Argentina’s GHG emissions (excluding LULUCF), according to its fifth BUR. They grew by 60% between 1990 and 2018, mostly through increases in electricity and heat demand from the residential buildings sector. In 2020, the sector was responsible for 47% of power demand, 23% of gas demand and 27% of total energy demand in Argentina (Government of Argentina, 2023a).

In 2017, the government adopted Law 27,424 to promote the use of renewables in the building sector. This law encourages self-consumption of electricity through the introduction of net-metering (Government of Argentina, 2017). Argentina’s 2022 climate strategy also includes targets for solar water heating in residential housing, as well as the for installation of four million square metres of solar panels in businesses by 2030 (Government of Argentina, 2022d).

In 2018, the government adopted an energy efficiency labelling scheme for residential housing, aiming at improving access to information for consumers and incentivise efficiency improvements. Until 2022, this system was run by provinces, with slightly different standards being applied. Starting in 2023 the programme is handled by the national government, with the overarching aim of reaching six million households by 2030 (Government of Argentina, 2023e).

In its 2022 climate strategy, the government also lists several measures aimed at reducing energy consumption from household appliances. These measures include credit lines to upgrade fridges, heat pumps, lighting, and others. It also includes quantitative targets for specific appliances, such as 9.6 million fridges replaced by 2030, and 7.8 million heat pumps installed (Government of Argentina, 2022d).

Agriculture

Agricultural emissions in Argentina were 102 MtCO2e in 2022, accounting for roughly one third of Argentina’s total emissions (excl. LULUCF), and 7% of total energy demand (Government of Argentina, 2024a). Emissions from this sector have increased by 13% over the last 10 years due to growing agricultural and livestock production.

The agricultural sector is a major economic powerhouse of the country, especially for its export market. Key commodities produced in Argentina are soybeans, wheat, maize, and cattle. In total, agricultural commodities represented 71% of Argentinian exports in 2020, and USD 38.6 billion in value. In 2022-2023 the sector was hard hit by droughts, costing the country an estimated 3% of its GDP (Reuters, 2024).

Despite the high emissions in the sector, Argentina’s national action plan for agriculture and climate change only includes three concrete measures planned for the agriculture, livestock and forestry sectors up to 2030, including afforestation (area from 1.38 million to 2 million hectares between 2018 and 2030), crop rotation (increasing the area under cereals such as wheat and maize and decreasing the area under oilseeds such as soybeans and sunflower) and biomass utilisation for energy generation, particularly for off-grid use (Secretaria de Ambiente y Desarrollo Sustentable, 2019).

As part of its 2022 climate strategy, the Argentinian government has set out some additional livestock-related measures. These include a 5% increase in the GHG-efficiency of livestock until 2030 (without a clear baseline), and the promotion of silvopastoral systems through REDD+ payments. However, it remains unlikely that these measures will significantly bring down livestock-related emissions (Government of Argentina, 2022d).

A recent study analyses the potential of supply-side mitigation options to reduce emissions in the agriculture and land use sector including feed optimisation, livestock health monitoring, the use of cover crops and crop rotation, synthetic fertiliser management and the use of silvopastoral systems. It found that the combined technical mitigation potential for these measures was around 28.1 MtCO2e, or around 14% below the reference scenario in 2030. The gap to the sectoral net zero scenario, that is the amount that Argentina would need to further reduce its emissions to be on track to a net zero AFOLU sector, was of around 103 MtCO2e in 2030 (Gonzales-Zuñiga et al., 2022).

This shows the need for transformation in the sector: even when implementing best practices and increasing the efficiency of agricultural production, the sectoral gap to a 1.5˚C compatible emissions pathway is very large. Argentina will need a deeper transformation of its wider food system if it is to keep its emissions in line with limiting warming to 1.5˚C.

Argentina’s average share of emissions from Land Use, Land-Use Change and Forestry (LULUCF) over the past 20 years is more than 20% of the country’s total emissions. Between 2014 and 2019, however, emissions from LULUCF started falling up to as low as to 3% of total emissions, only to bounce back to 22% in 2020. This indicates that Argentina’s recent approach to curbing land use emissions might be working and would need to be maintained, updated, and reinforced. Argentina signed the Glasgow declaration on forests and land use during COP26.

LULUCF emissions in Argentina were around 51 MtCO2e in 2022 according to its first BTR (Government of Argentina, 2024a), accounting for ~20% of national GHG emissions. LULUCF emissions were exceptionally high in 2020 but have otherwise been on a downward trend partially thanks to the implementation of the 2007 Native Forests Law (Law 26.331). They decreased by 41% in 2020 compared to 2007 levels but remain a significant source of emissions in Argentina.

Argentina has around 54 million hectares of native forests, as well as 1.3 million hectares of cultivated forests. According to its fourth BUR, in 2018 some 187,000 hectares were lost due to the expansion of agricultural land, to forest fires, and the overexploitation of forest resources (Government of Argentina, 2022c). The government acknowledges that some of this land clearing is illegal, and that better enforcement of forestry regulations is needed. According to the Forest Declaration Assessment, deforestation in Argentina remains at high levels with 140,000 ha lost in 2023 (The forest declaration Assessment, 2024).

The Native Forests Law aims at slowing the reduction of Argentina’s native forest surface, focused on achieving net-zero deforestation. The law set minimum budgets to be spent on forest protection and established a capacity building scheme and requirements for provinces to comprehensively monitor and track forest areas. It also established the National Fund for Enriching and Conserving Native Forests that disburses funds to provinces that protect native forests (Law 26331, 2007).

As early as the late 1990s, Argentina implemented Law 25.080 to promote investments in afforestation and prevent forest degradation (Ley 25.080, 1999). According to Argentina’s fourth BUR, this law, amended by Law 26.432 in 2008, has contributed to a total of 1.3 million hectares of forest area, with a target of 1.6 million in 2030 (Government of Argentina, 2022c). However, independent sources claim that the programme has been de-funded and ecosystem services payments have been greatly decreased in real terms, and its effectiveness to continue to support afforestation and preservation is at risk (Escobar, 2021).

Alongside the implementation of its PANByCC, Argentina launched its ForestAr 2030 initiative, which aims to develop a broad stakeholder dialogue and strategy to conserve natural forests and to deliver on the country’s commitment to reducing climate change while achieving other sustainable development benefits. In the context of this initiative, the government created the National Plan for the Restoration of Native Forests through Resolution 267/2019, which seeks to restore 20 million ha of native forest per year by 2030 (Resolución 267/2019, 2019).

Recent studies show that for Argentina’s AFOLU sector to get close to carbon neutrality, the LULUCF sector would need to become a net emissions sink as fast as possible, and reach around -71 to -138 MtCO2e per year just to neutralise emissions from agriculture by 2050 (Frank et al., 2023; Keesler & Blanco, 2024). To achieve this, Argentina would need to set out stronger forestry policies, including ambitious targets and well-designed implementation and enforcement mechanisms, as well as improved coordination with subnational governments.

Waste

Between 1990 and 2022, Argentina’s waste emissions more than doubled, accounting for 7% (23.3 MtCO2e) of Argentina’s total GHG emissions in 2020. Waste production is in the order of 1kg per person per day in Argentina (Government of Argentina, 2022c). A recent study has also shown that Argentina was home to around 100 super emitter events from waste sites in and around Buenos Aires between 2019 and 2023, reaching up to 230 tonnes of methane per hour (The Guardian, 2024).

In 2021, the Environment Ministry released Resolution 290/2021 establishing the National Programme to Strengthen the Circular Economy. This policy aims at improving waste collection and treatment systems, reducing waste and increasing recycling rates.

According to Argentina’s Fourth BUR, there has been progress on segmented waste collection and treatment. Big urban centres have also implemented systems to capture and store or destroy methane from waste, while in the rest of the country, solid urban waste is still disposed of in open landfills without sanitary treatment.

Argentina’s 2022 climate strategy also includes measures and targets for the waste sector. In particular, it aims at eradicating open landfills by 2030, and to reduce food loss by 10-30% and waste by 5-10% by 2025 below 2015 levels. These targets are also part of Argentina’s National Plan for Food Loss and Waste Reduction (Government of Argentina, 2022d).

Methane

While Argentina’s carbon emissions have almost doubled since 1990, its methane emissions have only increased moderately, reaching roughly 12% above 1990 levels in 2020 (Government of Argentina, 2023a). Nevertheless, methane still accounts for 29% of all national GHG emissions in terms of global warming potential, above the global average of around 20% (Global Methane Initiative, 2022). In 2023, Argentina ranked 13th worldwide in terms of methane emissions, with most emissions coming from the agriculture sector (IEA, 2024c).

While methane is covered in Argentina’s NDC target, the NDC contains no specific targets nor actions aimed at reducing methane emissions. Current methane emissions are 100.7 MtCO2e (in AR4 GWP), with two thirds related to livestock. Argentina is one of the 95 countries that signed the methane pledge. Meeting the 30% methane reduction target would mean a 28.5 MtCO2e reduction by 2030.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter