Policies & action

Bolsonaro’s administration is at odds with the urgent need for climate action in Brazil and its response to the COVID-19 pandemic and ongoing energy crisis has not been in line with a green recovery.

Current energy infrastructure planning, which foresees a very important role for fossil fuels over the decade, and the developments in the LULUCF sector reflect a worsening of national climate policy implementation and ambition. According to our most recent assessment, Brazil will need to implement additional policies to stop its emissions from rising over the next decade.

President Bolsonaro and his team of Ministers have publicly expressed their opposition to many of Brazil’s existing climate policies and have passed legislation that weakens the institutional and legal framework to fight deforestation and other environmental offences, as well as reforms that substantially weaken the participation of civil society, including pro-environment groups, in policy making and oversight of policy implementation (Associated Press, 2019; Observatório do Clima, 2019d, 2019e; The New York Times, 2019).

On a more positive note, market trends for renewable power generation are heading in the right direction, with a steady increase in wind and solar capacity.

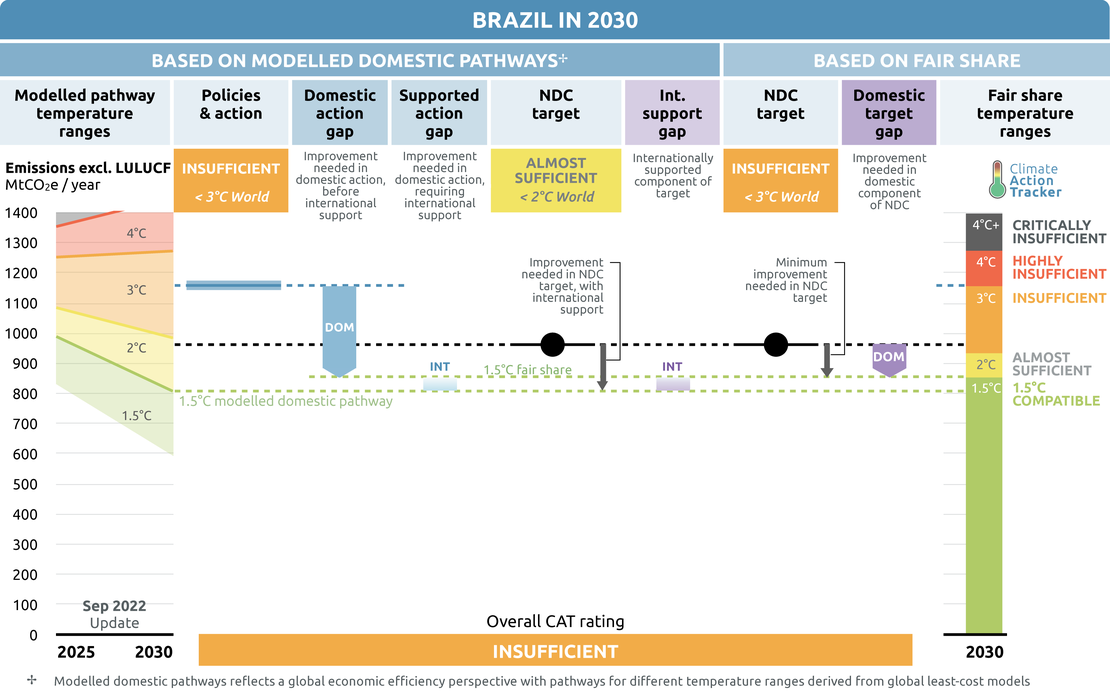

The CAT rates Brazil’s policies and action as “Insufficient” when compared to modelled domestic pathways. The “Insufficient” rating indicates that Brazil’s climate policies and action in 2030 need substantial improvements to be consistent with limiting warming to 1.5°C. If all countries were to follow Brazil’s approach, warming would reach over 2°C and up to 3°C.

Brazil claim that they achieved their 2020 target much earlier, although the numbers are lower than the target, there are certain considerations that need to be considered. A detailed analysis of the 2020 target was presented in a previous version. Brazil is expected to reach its 2025 target but is not on track to meet its 2030 target as emissions are projected to continue to increase in the coming decade.

Brazil is expected to implement additional policies with its own resources but will also need some international support to implement policies in line with full decarbonisation.

Policy overview

By 2030, we expect Brazil’s currently implemented policies will take total emissions (excluding LULUCF) to 1145-1171 MtCO2e by 2030 (respectively, 25-28% above 2005 levels and 88-92% above 1990 levels). Under this scenario, emissions in the energy and industry sectors will gradually increase after the post-COVID-19 economic recession, and emissions in agriculture are expected to continue to increase until at least 2030.

The main policy instruments included in our current policy projections pathway are the energy efficiency national plans and the incentives for the uptake of renewables in the energy sector, including capacity auctions in the power sector and the ethanol and biodiesel mandates (WEO, 2021). In addition to the policies included in the World Energy Outlook stated policies we estimate the impact of The Resolution No. 5 of June 2018, which includes the annual national emissions intensity targets of the national biofuels policy RenovaBio (Conselho nacional de política energética, 2018).

Brazil has enacted sectoral plans to reduce emissions in other sectors of the economy, including the Mitigation and Adaptation to Climate Change for a Low-Carbon Emission Agriculture (ABC Plan), the Steel Industry Plan, the Low Carbon Emission Economy in the Manufacturing Industry Plan, The Sectoral Transport and Urban Mobility Plan and the Low-Carbon Emission Mining Plan. Most of those policies, however, are still not part of national development planning or are outdated and are not explicitly included in our current policy projections emissions pathway.

To peak and then rapidly decrease emissions, as required to limit warming to 1.5°C, Brazil will need to reverse its current trend of weakening climate policy, by sustaining and strengthening policy implementation in the forestry sector and accelerating mitigation action in other sectors— including a reversal of present plans to expand fossil fuel energy sources.

The most alarming driver of the recent growth in Brazil’s emissions is deforestation, driven by a continued roll-back of forest protection policies that are enabling ever higher illegal deforestation rates (INPE-EM, 2020; SEEG, 2020). Brazil had a 2020 commitment to reduce deforestation in the Amazon by 80% from 1996-2005 levels. Not only was this not achieved, but emissions have risen (Silva Junior et al. 2021). The target was to limit deforestation to 3,925 km2 in 2020, but official data from PRODERS/INPE measured deforestation of 10,851 km2 (SEEG, 2021). The last NDC update included a target of reducing illegal deforestation to zero in the Amazon by 2028. In order to achieve the new goal, Brazil needs to implement stronger measures.

Both legal and illegal deforestation has increased in the Amazon. Legal deforestation is driven by land-use change permits for road projects, large infrastructure, cattle ranching and mining. Illegal deforestation is caused by the hunting of endangered native species and uncontrolled fishing, illegal traditional mining and logging and enabled by worsening monitoring and enforcement systems in remote areas of the Amazon.

The protected areas of indigenous communities are the most affected, not only generating a high social and environmental impact but also aggravating violence. According to several reports, the number of victims among environmentalists, activists and the media has increased. Remote areas of the Amazon are also considered a route for illicit trade and drug trafficking (Fellet, 2022; Neves, 2022).

Agriculture is the second largest source of emissions in Brazil and has been a key driver of deforestation. In the past decade, the country had achieved some success in delivering funding programmes aimed at lowering emissions from agriculture. The ABC Plan had a relevant role in the adoption of low-carbon agriculture technologies. The government has developed an updated ABC+ plan, that covers the period up to 2030, but the document still presents little detail.

A record drought has lowered reservoir levels and left Brazil’s hydro-dominated power system in crisis. This is particularly challenging as the country is only just starting its recovery from the COVID-19 pandemic and highlights the vulnerability of Brazil’s energy system to worsening climate change impacts (Cuartas et al. 2022).

Market developments tell a positive story of the competitiveness of renewables in Brazil, with recent auctions delivering contracts to renewable projects only. But the government is also increasing its gas generation capacity and plans to raise oil and gas production. Unless additional policies are put in place, emissions in the energy sector will resume a rising trend as Brazil’s economy recovers from the impacts of COVID-19, locking Brazil into a more carbon intensive energy system and leaving much of its considerable potential for renewable power generation untapped.

In transport, biofuels have contributed significantly to improving the emissions intensity of the road transport sector in Brazil, but full decarbonisation of the transport sector will require a fast uptake of electric vehicles (EVs). Brazil is an EV laggard, with only a very small penetration rate and without a clear strategy to substantially increase the number of EVs on the road.

The carbon market legislation in Brazil was discussed within the scope of PL 528/21, a legal project to fulfil the National Policy on Climate Change (2009), aimed at setting up the Brazilian Market of Emission Reduction (MBRE). Interestingly, the text of the law as it stands specifically points out that strong regulation is needed to maintain the environmental integrity of reducing emissions in order to avoid double-counting, which is critical for credibility systems. Brazil’s negotiating stance on the Paris Agreement’s Article 6 covering carbon market rules was to allow double-counting. PL 528/21 was processed under an ‘urgency’ status and had public hearings and consultations in the Environment and Sustainable Development Committee of the Chamber of Deputies. The Brazilian carbon market was established under presidential decree Nº 11.075/22, and established the procedures for the preparation of Sectoral Plans for the Mitigation of Climate Change, and creates the National System for the Reduction of Greenhouse Gas Emissions.

Brazil mentions in its NDC that in addition to its national efforts, it is open to the use of carbon credits and that any transfer that occurs with mitigation outcomes in the territory must have the consent of the federal state.

Sectoral pledges

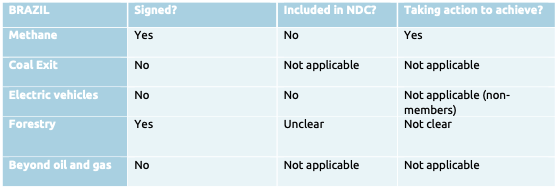

In Glasgow, a number of sectoral initiatives were launched to accelerate climate action. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, through assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets, and on forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”. Members of the Beyond Oil & Gas Alliance (BOGA) seek to facilitate a managed phase out of oil and gas production.

NDCs should be updated to include these sectoral initiatives if they aren’t already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

- Methane pledge: Brazil signed the methane pledge at COP26. Methane represents almost 30% of Brazil's total GHG emissions incl. LULUCF, with more than 75% coming from agricultural activities, followed by energy and waste.

In March 2022, the federal government launched the ‘zero methane’ programme. However, it focuses on actions to reduce emissions in the waste sector and to use methane for energy use, such as biogas and biomethane. In order to achieve a 30% reduction in all methane in accordance with the 2005 base year of the NDC, methane emissions by 2030 must be reduced by 150 MtCO2e. For some sectors, such as meat production, this initiative was not well received. The Ministry of Agriculture stated that this measure would affect the economic growth of the sector. - Coal exit: Brazil has not adopted the coal exit. Despite the fact that Brazil has an energy matrix with a high percentage of renewable energy, coal still represents 5% of the energy sector’s national total. The latest the Ten-Year Energy Expansion Plan, (PDE as in its Portuguese acronym) PDE 2031 also considers the expansion of 350 MW/year of coal-fired power projects, through the modernisation of the existing plants or their replacement with more modern plants, in the South region, as of 2028 (Ministério de Minas e Energia, 2021).

- Forestry: Brazil signed the forestry pledge at COP26. Brazil has more than 59% of its territory with forests with high value for biodiversity (FAO, 2019). However, deforestation continues to be the main source of emissions, mainly caused by agricultural land use expansion. It represents the sector with more CO2 emissions accounting for 27% of the national total net emissions. The NDC update mentions stopping illegal deforestation by 2028 (more information can be found in the Land use and forest section).

Energy supply

In the face of an ongoing global energy crisis, the Brazilian government appears to be making a dash for gas, and energy plans for this decade maintain a substantial role for fossil fuels. This could limit options for the required deep decarbonisation of the economy in the longer term.

Brazil’s long-term energy plans (PDE 2031) see an expanded role for fossil gas and oil, with the production of both types of fossil fuel set to increase by 2031. According to the PDE 2031, investments in exploration and production of fossil fuels could reach over USD 500 bn over the period to 2030, and new platforms will be contracted (Ministério de Minas e Energia, 2021).

A large part of this expansion in fossil fuel production is expected to come from unconventional resources not yet exploited, which have a much larger associated carbon footprint in their exploration and extraction. This stands in stark contrast with the objectives of the Paris Agreement, which would require a large share of the global fossil fuel reserves to remain unexploited.

Alongside increased production, the ten-year energy plan also forecasts an increase of natural gas power generation over the decade, with gas’s share of the energy mix rising from 12% in 2021 to 14% by 2030 (Climate Transparency, 2021; Ministério de Minas e Energia, 2021). As part of its move to draw more investment into gas generation, the government is in the process of opening up the gas market to enable more competition (Business Wire, 2021).

If these fossil fuel focused energy plans come to fruition, they risk locking Brazil into a carbon intensive energy system for decades.

Brazil is in the throes of an energy crisis, driven by a drought that has lowered hydropower reservoir levels and hampered electricity production in 2021 (Spring et al., 2021). Hydropower is Brazil’s main source of power generation, and made up two thirds of the generation mix in 2020 (Climate Transparency, 2021), but as the impacts of climate change worsen, the vulnerabilities of Brazil’s hydropower capacity to drought are being exposed.

In response to the crisis, the government has raised electricity prices and ramped up fossil fuel power generation. In April 2021, in an attempt to lower the cost of electricity, the government authorised the state power operator to buy electricity from LNG power plants earlier than planned, and the Ministry of Mines and Energy published an ordinance to bring online three gas power plants that had not yet been contracted (Pierry, 2021). Imports of LNG have risen to record levels, and new LNG terminals are opening to increase import capacity (Valle, 2021). A new gas pipeline from the Vaca Muerta shale reserves in Argentina is under discussion (Offshore Technology, 2021).

These moves stand in contrast to positive trends in the growth of renewables in Brazil. Trends in the carbon intensity of Brazil’s energy sector and power generation show that Brazil has made progress in the right direction, and that this progress needs to accelerate this decade. Plans to expand fossil fuel risk decelerating this progress.

The carbon intensity of energy was 32 tCO2/TJ in 2020 (Climate Transparency, 2021), 13% lower than five years prior. Over the next eight years to 2030, Brazil’s carbon intensity of energy is projected to drop by 9% to 29 tCO2/TJ (see figure below), indicating a slow-down in Brazil’s planned decarbonisation for the energy sector.

Emissions intensity of primary energy

The carbon intensity of Brazil’s electricity generation is already low, having dropped by almost 40% over the past five years to 61.7 gCO2/kWh in 2020, largely a result of the shift from oil-based generation to biomass and wind power (Climate Transparency, 2021). However, under current policies Brazil is not on track to achieve a 1.5°C compatible power sector. To be on a 1.5° pathway, Brazil’s emissions intensity of its power sector would need to decline to below 20 gCO2/kWHh by 2030, and to zero by 2040 (see figure below).

Electricity emissions intensity

In Brazil’s original NDC, submitted in 2016, the government set targets for a 45% share of renewables in the primary energy mix and a 23% share of renewables (other than hydropower) in the power supply mix by 2030. These targets were not updated, nor even included, in the NDC Brazil submitted in 2020, nor in 2022. According to Brazil’s ten-year energy plan, by 2031 renewables are expected to make up 48% of primary energy and 84% of electricity generation, with roughly a doubling of large-scale wind and solar generation as well as a significant growth in distributed solar and biomass power generation (PDE 2031).

The first energy auctions held since the pandemic started, which occurred in July and September 2021, saw contracts going only to renewables projects, despite registrations from coal-fired and gas projects. Only a small fraction of registered projects received a contract, and the size of the market was much smaller than in pre-pandemic auctions. Biomass and PV took the largest shares of the capacity, with 301 MW and 263 MW respectively. Wind power registered the lowest price, at 160 BRL/MWh (equivalent to 28.9 USD/MWh) – lower than all other sources. Considering recently awarded contracts, onshore wind capacity could exceed 30 GW by 2026 (Spatuzza, 2021), considering 2022 total national installed capacity for all sources it could represent about 17% of it.

As part of the government's response to hydropower shortages, an emergency power auction was held in October 2021, which led to new 17 projects, among them a natural gas thermopower that represents 90% of the projects and the rest of the projects were solar and biomass (Ferrez A., 2021, ARGUS media, 2021).

Transport

Transport makes up a large share of Brazil’s energy sector emissions, and emissions have been increasing over recent decades, mainly due to increased vehicle ownership. Brazil is currently the world’s second largest producer and consumer of biofuels.

In the Third National Communication, Brazil identifies the Sectoral Transport and Urban Mobility Plan for the Mitigation and Adaptation to Climate Change (PSTM) as its key policy to tackle transport sector emissions (Ministry of Science Technology and Innovation of Brazil, 2016b). This Plan aims at contributing to mitigating GHG emissions through initiatives that lead to the expansion of cargo transport infrastructure and using more energy-efficient modes; and in the sector of urban mobility, increasing the use of efficient systems of public passenger transportation.

The Resolution No. 5 of June 2018 approved the annual national emissions intensity targets under RenovaBio, a new national biofuels policy (Conselho nacional de política energética, 2018). The policy aims to increase the use of all biofuels in Brazil, including ethanol, biodiesel and biomethane to increase energy security and reduce emissions.

Originally, the required proportion of biofuel required nationally in diesel was set to rise gradually, reaching a maximum of 15% by 2023. However, as a result of the COVID-19 pandemic, the Brazilian Ministry of Mines and Energy has repeatedly reduced the required biofuel share to between 10-12% to ease pressure on fuel prices from a reduced supply of soy for biodiesel (Araújo, 2021; New Climate Institute, 2020). As of September 2021, the MME had chosen to maintain the required quota at 10% despite the scheduled increase to 13% originally indented for 2021. About 71% of Brazilian biodiesel is made from soy. The government made clear its intention to make this measure temporary and eventually return to the scheduled biofuel quota increases originally enacted under RenovaBIo (Ministerio de Minas Energia do Brasil, 2021).

While biofuels have contributed significantly to improving the emissions intensity of the road transport sector in Brazil, full decarbonization of the transport sector will require a fast uptake of electric vehicles (EVs) as well. In terms of EVs, Brazil is a laggard, with a very small penetration rate and without a clear strategy to substantially increase the adoption of this technology.

In the reference case scenario of the Ministry of Energy’s long-term scenarios, EVs will continue to account for an insignificant share of the market until at least 2035, reaching a very modest 11% penetration rate (72% if hybrids are included) in 2050 under the reference scenario (Ministério de Minas e Energia., 2019). According to last yearbook from 2021 on electric mobility by the National Platform for Electric Mobility (PNME) the share can reach up to 20% in 2030, if conditions in infrastructure and market price improve.

For comparison, the 1.5°C compatible share of EV sales in Brazil would need to be above 85% by 2040 (see figure below). Increasing electrification of the transport sector would also reduce Brazil’s dependency on biofuels, particularly those produced from soy, thereby reducing pressure on Brazilian land for soy farming.

EV market share

Agriculture

Agriculture is the second biggest contributor to Brazil’s GHG footprint, responsible for almost half of the country’s emissions once the LULUCF sector is excluded (PRIMAP 2021). Most of these emissions are methane from livestock and N2O from soils (Ministry of Science Technology and Innovations, 2020). If the indirect emissions of the agriculture sector (mostly related to deforestation resulting from the expansion of the agricultural frontier) were considered, this would be by far the single largest emissions source in Brazil.

Historically, there is a strong relationship between agriculture expansion and deforestation emissions in Brazil. Between 1895 and 2018, 89 million hectares (890,000 square kilometres) of native vegetation were lost in Brazil, while the territory dedicated to agriculture and cattle ranching grew by 47 million hectares (Observatório do Clima, 2019e). The expansion of soybean plantations has become a direct driver of deforestation as soy has become more financially attractive than cattle ranching (Ionova, 2021). Forests are either directly converted to soybean farms, or soybeans are planted on old pasture, driving deforestation for more pastureland (Kimbrough, 2021).

It is important to note that expanding the agriculture frontier through deforestation is not necessary to increase productivity and the expansion of this industry. Brazil has considerable potential to add value and productivity to already available, but currently under-utilised, land by investing in more sustainable and efficient agriculture methods (Observatório do Clima, 2019a; Stabile et al., 2020).

Given the importance of agriculture and deforestation in Brazil’s emissions profile, mitigation policies in these sectors play a pivotal role in Brazil’s ability to achieve its national emissions reduction targets. However, the government has not brought forward any new low-carbon agricultural policies or regulations, despite the potential for low-cost mitigation options that could also raise productivity. The government relied on an updated ABC+ plan that will run from 2020 to 2030 which include a combination of adaptation and mitigation strategies.

Inventory emissions data available shows that the land use and forestry sector had been by far the largest source of GHG emissions in Brazil since the early 1990s. This picture changed significantly after 2004, when effective anti-deforestation policies, including the National Forest Code, the Action Plan for Deforestation Prevention and Control in the Legal Amazon (PPCDAm) and the Cerrado (PPCerrado), were implemented and resulted in a reduction on LULUCF emissions of about 86% between 2005 and 2012 (Ministry of Science Technology and Innovation of Brazil, 2016a).

Brazil’s remarkable progress in forestry emissions mitigation observed since 2004 has stopped, with deforestation and resulting emissions increases picking up speed again since 2013. The year 2019 saw an area of over one million hectares deforested in the legal Amazon – 34% larger than in 2018, and 120% larger than the historic low reached in 2012 (INPE, 2020).

An even greater area is estimated to have been deforested in 2020. A recent study revealed that deforestation in 2020 grew around 10% from 2019, reaching around 11,088 km2 (Silva Junior et al., 2021). Recent data from Imazon’s Deforestation Alert System suggests that deforestation between August 2020 and July 2021 was equivalent to 10,476 km2, 57% more than that between August 2019 and July 2020. According to Imazon, in July 2021 alone, 2,095 km2 were deforested, 80% more than in the same month in 2020 (Imazon, 2021).

This leaves Brazil far off-track from meeting its National Policy for Climate Change (PNMC) commitment to reduce deforestation by 80% from 1996-2005 levels by 2020 (implying a maximum of 0.4 Mha or 4,000 km2 deforested per year) (Observatório do Clima, 2019b, 2020b). On the contrary, the most recent data indicates an ongoing upward trend in deforestation rates that keeps worsening.

The rising trend in illegal deforestation and environmental offences is linked to an accelerated weakening of Brazil’s institutional and legal frameworks for environmental protection. Weak land tenure has enabled land grabbers to occupy and, in many cases, deforest undesignated public forest.

Of the region’s two million square miles, 50% is designated public land, 22% is private land, and 29% consists of public land with no official designation (Brito, 2021). In 2019, 35% of deforestation took place in such public lands (Observatório do Clima, 2020a). If private registrations of public land are legalised, deforestation in these areas alone could lead to the emission of a further 1.2 – 3.0 GtCO2 (Azevedo-Ramos et al., 2020).

In the past, loopholes in Brazil’s legislation have given land grabbers the opportunity to register ownership of illegally grabbed land, and a proposed measure from December 2019 would legalise registrations of public land grabbed before December 2018. This measure has experienced considerable push-back from investors, NGOs and even public prosecutors as it would likely trigger high rates of conflict and deforestation in protected forest and indigenous reserves. However, ruralist legislators have sought to push it through the fast-track legislation process put in place for COVID-19 recovery measures (IMAZON, 2020; Observatório do Clima, 2020a).

Meanwhile, the Bolsonaro administration has continued to cut budgets for environmental monitoring and enforcement, leading to a deterioration in the ability of national and local authorities to monitor, inspect, and prevent environmental crimes. The COVID-19 pandemic has further weakened enforcement capacities, as enforcement personnel have been encouraged to self-isolate, reducing their numbers on the ground (Observatório do Clima, 2020a).

Under pressure from international investors, the Bolsonaro administration has sent in military personnel to boost enforcement capacity, undermining the authority of experienced environmental agents, and the transparency and effectiveness of the operation has been called into question (Unearthed, 2020).

In late September 2021, the government introduced the Brazil Cost Reduction Project through the Ministry of Economy, with proposals for rolling back various protections enacted under the Ministry of the Environment, to “reduce the costs of doing business” in the country. The proposal includes stripping protections covering the Atlantic Forest biome, reducing the requirements to conduct an environmental impact assessment and cancelling consultations with agroforestry enterprises (Observatório do Clima, 2021).

Other measures that have weakened Brazil’s environmental protection frameworks include:

- Revoking a policy from 2011 that required authorisation by the federal environment agency (IBAMA) for the export of timber, therefore allowing the export of timber without inspection (Mongabay, 2020b)

- Stripping the protected status of indigenous lands that have not yet had their protection confirmed (April 2020) (Imprensa Nacional, 2020)

- Transferring the body responsible for identifying, demarcating, and registering Indigenous territory to the Ministry of Agriculture (The New York Times, 2019)

- Easing rules for converting environmental fines to an alternative form of compensation (Climate Policy Initiative, 2019b; Observatório do Clima, 2019c)

- Changes in the forest code to extend deadlines for enforcement measures (Climate Policy Initiative, 2019a)

- Abolishing most committees and commissions for civil participation and social control in the Federal Government (Observatório do Clima, 2019d)

- Revoking a zoning regulation for the sugarcane industry that restricted expansion to degraded land and pasture, opening the door for sugarcane cultivation in the Amazon (Mongabay, 2019)

Past experience has shown that Brazil could be a world leader in tackling deforestation, if the right policies were put in place, and the Bolsonaro administration is under increasing pressure both internationally and domestically to tackle deforestation as part of a green COVID-19 recovery (Mongabay, 2020a).

Brazil has already missed its 2020 deforestation target. If the Brazilian government continues to roll back environmental policies and fails to adequately enhance enforcement capacities, Brazil will miss its NDC target of zero illegal deforestation in the Brazilian Amazon by 2028 by a wide margin (Rochedo et al., 2018; Soterroni et al., 2018).

The international community has shown its concern for the amazon forest but will need to strengthen support and efforts due to its global importance. At the last Summit of the Americas, the USA and Brazil announced a working group to fight illegal deforestation.

Given the key role of the Land Use and Forestry sector in Brazil’s NDC and the huge global importance of its forests for environmental services, biodiversity, and carbon sequestration, the Brazilian government urgently needs to strengthen mitigation action in this sector, instead of weakening it.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter