Policies & action

NOTE: Our analysis was published before the release of Canada's Climate Competitiveness Strategy and the Canada-Alberta Memorandum of Understanding (MOU). The CAT will integrate our analysis of the strategy and MOU into our next assessment.

Canada’s emissions are finally starting to trend downwards, as governments implement their climate policy agendas. In 2023, national emissions were 694 MtCO2e—an 8.5% reduction below 2005 levels. However, there remains a significant gap between current policies and Canada’s NDC target. While implementing and strengthening planned policies will contribute significantly to closing this gap, further action is needed—not only to meet Canada’s stated targets, but also to achieve the deeper reductions required to align with the 1.5°C temperature limit.

Our rating of Canada’s policies and action has worsened to 'Highly Insufficient', with the latest emissions projections now higher than previous updates—widening the gap between current policies and Canada’s 2030 and 2035 NDC targets. This shift is due to both an upward revision to historical emissions—driven by updates to global warming potentials, improved estimates of methane emissions from oil and fossil gas, and the reclassification of LULUCF categories—and recent policy setbacks, such as the removal of the consumer carbon price in April 2025. As a result, Canada remains far from 1.5°C compatibility on a global least cost basis. If all countries were to follow Canada’s approach, warming could reach over 3°C and up to 4°C.

Policy overview

The speed and scale of Canada’s climate policy implementation continues to fall short of what is needed to urgently address the climate crisis. Emissions in 2030 are projected to be 646 MtCO2e (excl. LULUCF) or 15% below 2005 levels. This is a far cry from the 426–484 MtCO2e level Canada needs to reach to meet its NDC target.

In March 2022, Canada released its latest climate change plan, building on earlier strategies released in 2016 and 2020 (Environment and Climate Change Canada, 2020a, 2022a; Government of Canada, 2016b). It came on the heels of a critical report in November 2021 by Canada’s Commissioner of the Environment and Sustainable Development outlining 30 years of the government’s failure to meet its targets and reduce greenhouse gas emissions (Commissioner of the Environment and Sustainable Development, 2021; Office of the Auditor General of Canada, 2021).

Since 2022, Canada has implemented a number of major policies, including the national ZEV sales mandate, the clean fuel regulations, and the clean electricity regulations. However, many key measures are still in development or delayed, including strengthened methane regulations for the oil and fossil gas sector and the oil and gas emissions cap.

In addition to slow implementation, the federal government has also taken moves that undermine progress, namely removing the consumer-facing carbon price on April 1, 2025 via regulatory change (Government of Canada, 2018a, Government of Canada, 2025). The consumer-facing carbon price was expected to deliver between 15 and 19 MtCO2e of reductions in 2030 (Linden-Fraser et al., 2025). Our current and planned policy projections are based on the federal government’s 2024 emissions reductions and modified to exclude the impact of the consumer-facing carbon price. Despite this setback, the industrial carbon pricing system remains in place and is expected to account for 20-48% of Canada’s emission reductions in 2030 (Beugin et al., 2024).

A federal election was held on April 28, 2025, with the Liberal Party prevailing (Elections Canada, 2025). New Prime Minister Mark Carney was known during his financial career for being forward-looking on the risks posed to the economy by climate change, but there is still uncertainty around the new government’s priorities. Carney’s platform outlined commitments to finalise the clean technology investment tax credits, invest in energy retrofits and EV infrastructure, and strengthen industrial carbon pricing. However, he also committed to (and followed through with) removing the consumer carbon price, signalled support for new fossil fuel infrastructure—directly contradicting the imperative to phase out fossil fuels—and pledged to make Canada a “world leader” in CCS. As a minority government, the Liberals will need to rely on the support of other parties to drive forward their policy priorities, further complicating the outlook for climate action.

Industry

Canada’s industrial carbon pricing system is the country’s main policy for reducing emissions from industry. Mandatory carbon pricing has been in effect across Canada since 2019, following the passage of the Greenhouse Gas Pollution Pricing Act. The legislation requires each province and territory to implement a system for pricing emissions from large industrial facilities, or else be subject to the federal “backstop” system.

These systems set performance standards for large facilities, requiring them to pay for emissions above a set threshold. Facilities that reduce their emissions below the standard can generate credits, which may be sold or banked for future use. The initial carbon price was set at CAD 20/tCO2e in 2019 and has risen annually, with plans to reach CAD 170/tCO2e by 2030. While the carbon price is heading in the right direction, it is still below the CAD 218–371 (2015$) needed to be compatible with 1.5°C (Boehm et al., 2023). The Supreme Court of Canada upheld the constitutionality of the federal regime in 2021, reinforcing Ottawa’s authority to set minimum national standards.

However, while the industrial carbon pricing system continues to play a central role in Canada’s climate policy framework, and is projected to deliver a substantial share of emissions reductions, its overall effectiveness is increasingly undermined by design flaws and political pushback. The Canadian Climate Institute has identified significant weaknesses to the current systems that undermine their effectiveness, including gaps in coverage, insufficient stringency, and negative interactions with other policies.

Saskatchewan recently suspended its own industrial pricing system, further threatening the system (Quon & Edwards, 2025). Along with the removal of the consumer price, some facilities that had opted into the industrial system could now choose to exit and pay no carbon price at all. These developments underscore the urgent need to strengthen Canada’s carbon pricing architecture to ensure robust emissions reductions.

The federal government established a GHG Offset system in 2022 for activities not covered by carbon pricing (Government of Canada, 2022e). Credits generated under the system can be used to reduce the compliance costs of industrial facilities covered by industrial carbon pricing. In addition, to help reinforce the carbon price signal and provide investment certainty for clean technologies, the last government introduced Contracts for Difference (CCfDs) through the Canada Growth Fund (Environment and Climate Change Canada, 2023a).

In 2021, the federal government announced the CAD 8 billion Net Zero Accelerator Fund to support large-scale industrial decarbonisation projects. The government also introduced a suite of clean technology investment tax credits to incentivise adoption of emissions-reducing technologies across the sector.

Oil and gas production

At nearly a third of total emissions, oil and fossil gas production represents Canada’s largest source of emissions (Environment and Climate Change Canada, 2025). Emissions are projected to decline only slightly under current policies by 2030, as production from oil sands, fossil gas, and LNG is expected to increase, with the associated emissions partially offset by policies such as carbon pricing, methane regulations, and the Clean Fuel Regulations (Environment and Climate Change Canada, 2025). Canada’s exported emissions from oil and fossil gas are continuing to rise, surpassing its total domestic GHG emissions, and sitting at about 939 MtCO2 in 2022 (Bernstien, 2024). This comes at a time when the IEA has called for no new investments in oil, fossil gas and coal if we are to stay below the 1.5°C limit of the Paris Agreement.

While the previous Liberal government committed to set a cap on emissions from the upstream oil and gas sector, and released draft regulations in November 2024, the regulations have been slow to advance and now face an uncertain future under the Carney government (CBC News, 2025). The federal government has also published draft amendments to strengthen regulations to reduce methane emissions in the sector (see our Methane section) (Government of Canada, 2023b).

The government’s continued investments in new oil and fossil gas infrastructure underscores its ongoing reliance on fossil fuels. In April 2022, the government approved an offshore oil and gas megaproject, Bay du Nord (Impact Assessment Agency of Canada, 2022a). The project is required to achieve net zero operations from 2050 onwards, notably excluding downstream emissions, and production could continue until 2058 (Impact Assessment Agency of Canada, 2021, 2022a). While the company delayed the project in 2023 amidst concerns over high costs, it now appears to be moving forward, with oil production slated to begin in 2031 (Moore, 2025).

The federal government is also advancing several major LNG projects, including LNG Canada Phase 2 in British Columbia, which was selected as a project of “national interest” to be fast-tracked under new federal legislation (McKenna & Zimonjic, 2025). Prime Minister Mark Carney also indicated that approving a new oil pipeline to British Columbia is ”highly, highly likely,” demonstrating a willingness to advance major fossil fuel infrastructure projects (Beer, 2025). However, no such project has actually been proposed.

The costs of current oil and gas expansion projects continue to rise. The Trans Mountain oil pipeline expansion, which began commercial operation in 2024 (Calgary Herald, 2023; Trans Mountain Corporation, 2022), is estimated to have a price tag of approximately CAD 34bn—over six times more than when the government first purchased the pipeline (CAD 5.4 bn) (Lindsay, 2021; Williams, 2023).

Costs associated with the pipeline for the country’s first LNG export terminal, on the west coast, are also soaring (Jang, 2022; Simmons, 2022). While this pipeline is not government-owned, there are questions as to whether it will be able to recoup all of the subsidies provided (Simmons, 2022). The facility shipped its first LNG export cargo in July 2025 (Stephenson, 2025).

In 2024, a federal anti-greenwashing regulation led oil and gas industry associations to scrub their websites of unsubstantiated claims about emissions reduction (Noakes, 2024).

Net-Zero Producers Forum

Canada is part of the ‘Net Zero Producers Forum’, along with other oil and fossil gas majors: Norway, Qatar, Saudi Arabia, the UAE and the US (Natural Resources Canada, 2021a; U.S. Department of Energy, 2021). The forum’s stated aim is to develop ‘pragmatic net zero emission strategies’, including reducing methane emissions and supporting the use of CCS, but it does not tackle the core issue of phasing down production. Since its formation, the forum has held two ministerial meetings and recently launched a working group focused on CCS, but there remains little evidence of substantial action or new policy commitments.

Beyond Oil and Gas Alliance (BOGA)

The province of Quebec is a member of BOGA, but Canada as a whole is not. In April 2022, Quebec passed a law banning any further production and mandated that existing drill sites be shut down within three years (Government of Quebec, 2022). The move is largely symbolic as the province is not a producer of oil and gas (Canada Energy Regulator, 2022).

Coal mining

While Canada has made substantial progress in phasing out coal use at home, the country’s coal mining and export policies continue to raise concerns. In 2021, the federal government committed to banning thermal coal exports from - and through - Canada by 2030 (Liberal Party of Canada, 2021b; Prime Minister of Canada, 2021b).

The reference to ‘through Canada’ is important, as many American west coast miners export their coal through Canada due to resistance to developing the export infrastructure in their own country (Institute for Energy Economics and Financial Analysis, 2021; Kuykendall, 2021). However, as of 2025, progress on implementing the ban remains stalled. While the ban was included in the previous trade minister’s mandate letter, no concrete action has been taken to enforce it (Global Affairs Canada, 2022; Prime Minister of Canada, 2021a).

On the contrary, Canadian coal exports have continued to rise in recent years, leading to criticism from opposition parties and environmental groups over the government‘s failure to follow through on its promise (The Canadian Press, 2024a, 2024b). The federal NDP attempted to address the government’s inaction by introducing Bill C-383 in February 2024, which would have banned thermal exports, but the bill failed to progress past its first reading (Prohibiting the Export of Thermal Coal Act, 2024).

Canada continues to face criticism for its hypocritical stance on coal mining, particularly for allowing the expansion of thermal coal mines without subjecting them to federal impact assessments, despite its leadership role in the Powering Past Coal Alliance (Rabson, 2020). In June 2021, the government stated that new mines or expansions of existing mines would likely cause unacceptable environmental effects, yet in late 2024, the federal government allowed the massive Vista Coal Mine expansion to proceed without a federal impact assessment (Government of Canada, 2021i, Ecojustice, 2023; Impact Assessment Agency of Canada, 2022b).

Methane

16% of Canada’s emissions come from methane. The oil and gas sector is the largest source (45%) of Canada’s methane emissions, followed by agriculture (28%) and waste (19%) (Environment and Climate Change Canada, 2025). Canada has committed to reducing methane emissions from the sector by 40–45% below 2012 levels by 2025 and at least 75% by 2030, as outlined in its 2022 national methane strategy (Environment and Climate Change Canada, 2018, 2021a, 2022d).

The federal government introduced regulations to support the 2025 target in 2018, with the three major oil and gas producing provinces (Alberta, British Columbia, and Saskatchewan) introducing their own regulations under equivalency agreements. While methane emissions in 2023 were down 24% below 2012 levels, the country does not appear to be on track to achieve the 2025 goal of a 45% reduction. (Government of Canada, 2018b, 2023e, 2020c, 2020a, 2020b).

Additional federal regulations to achieve the 2030 goal were drafted in 2023 but have not yet been finalised (Government of Canada, 2022k). These regulations are included in our planned policies scenario. In spite of the federal government’s delay, British Columbia has moved forward to amend its own methane regulations in 2024 to help meet the province’s target of a 75% reduction by 2030 below 2014 levels and a near elimination of all industrial methane emissions by 2035 (British Columbia Energy Regulator, 2025).

While strengthening its methane targets and regulations is a step in the right direction, emissions could be even higher than currently reported. Canada reports on methane emissions from the oil and gas sector using bottom-up methods based on internationally agreed standards (Environment and Climate Change Canada, 2021b).

Research based on ”top-down” atmospheric measurements rather than energy statistics, suggests that emissions could be much higher (Chan et al., 2020; Liggio et al., 2019; MacKay et al., 2021). In April 2024, Canada updated its methods for estimating upstream oil and gas methane emissions by integrating some direct measurements. This change resulted in an upwards revision of emissions of between 31–39% over the last decade (Environment and Climate Change Canada, 2022e). The government has committed to continue to work to improve measuring and monitoring efforts as part of its national methane strategy (Environment and Climate Change Canada, 2022d).

The federal government also released draft regulations in June 2024 to cut methane emissions from landfills by 50% below 2019 levels by 2030, but these rules have not been finalised (Environment and Climate Change Canada, 2024).

Canada signed the Global Methane Pledge at COP26 and in 2025, agreed to co-convene the pledge with the European Union (European Commission, 2025).

Transport

Transport is the second largest source of emissions in Canada, after oil and gas, representing nearly a quarter of the country’s emissions (Environment and Climate Change Canada, 2025). In its latest projections, Canada foresees transport emissions reductions of 9% below 2005 levels by 2030 (Government of Canada, 2024a).

Canada is taking steps to reduce transport emissions, but not at the speed needed for such a large source of the country’s emissions. A 2022 ‘action plan’ on road transport did little more than rehash existing targets, plans and funding schemes, and implementation has been slow (Transport Canada, 2022a).

Electric Vehicle Targets

Light-Duty Vehicles

The Government of Canada has committed to achieve 100% zero-emissions vehicle (ZEV) sales for all new passenger car and light-duty trucks sales by 2035, with interim targets of 20% by 2026 and 60% by 2030 (Environment and Climate Change Canada, 2022a). In December 2023, the government adopted the necessary regulations to make these targets legally binding (Government of Canada, 2023g).

Plug-in hybrids (PHEVs) are included in the definition of electric vehicles, but their contribution to the sales target is capped at 20% from 2028. The sales targets increase in stringency annually, though at a slower pace in earlier years. The GHG impact of the regulations grows over time as the sales targets ramp up and new EV sales replace internal combustion engines on Canadian roads, but the regulations only contribute to minor reductions by 2030 (less than 5 MtCO2e).

In 2024, ~15% of all passenger car and truck sales were EVs, up from 11% in 2023, of which 11% were battery electric (Statistics Canada, 2025). Canada is progressing well towards its (fairly low) 2026 interim target of 20%. While the regulations continue to face significant pushback from industry, the new Environment Minister has reaffirmed that they will stay in place as is (Murray, 2025).

The CAT has not developed EV benchmarks for Canada; however, our US benchmark suggests that Canada’s targets are not 1.5°C compatible: 95–100% of all US passenger cars and light-duty trucks sold in 2030 should be zero emission vehicles.

The government aims to electrify its own light-duty vehicles LDV fleet by 2030 (Natural Resources Canada, 2022a).

Medium and heavy-duty vehicles

Canada has also set targets for its medium and heavy-duty vehicles (MHDVs), with the goal of achieving a sales target of 35% ZEVs by 2030, including battery electric, plug-in hybrid, or hydrogen fuel cells. In its 2030 Emissions Reduction Plan, the government also committed to developing regulations to require 100% MHDV ZEV sales by 2040 for some models, with interim 2030 regulated sales requirements. (Environment and Climate Change Canada, 2022a). While the government undertook stakeholder consultation on the regulations, no draft regulations have yet been published (Government of Canada, 2022g, 2023a).

Infrastructure and support programmes

In 2016, the government began supporting the development of EV-related infrastructure and charging networks(Natural Resources Canada, 2021b, 2021c, 2023). Canada has about 36,000 chargers at 14,000 locations across the country (Natural Resources Canada, 2025). Analysis suggests that Canada will need between 440,000-470,000 chargers by 2035 to support its 100% sales target for light-duty vehicles (Dunsky Energy + Climate Advisors, 2022).

The government missed an opportunity to support residential charging infrastructure by not including them in the most recent national model building codes, although some municipalities and provinces are taking action (Kozelj, 2024; Zhang & Kanduth, 2024). Making buildings EV-charger-ready through minor changes at the time of construction can significantly reduce the costs when the necessary equipment is actually installed (Efficiency Canada & Carleton University, 2022).

Beginning in 2019, the federal government provided CAD $5,000 rebates for the purchase or lease of ZEVs (Environment and Climate Change Canada, 2020a; Transport Canada, 2022b). In January 2025, the programme closed as funding ran out. However, the new Environment Minister has indicated that a new consumer rebate program is in the works (Jarratt, 2025). Several provinces also have consumer ZEV rebates. In addition to support for light-duty vehicles, the federal government also launched a four-year, half billion CAD programme in 2022 to support the purchase of medium and heavy duty electric vehicles (Transport Canada, 2022c).

Vehicle emission standards

Canadian fuel economy standards for light and heavy-duty vehicles are currently aligned with federal-level regulations in the US (Environment and Climate Change Canada, 2020a; Government of Canada, 2021h, 2018c). In 2020, the federal government committed to aligning Canada’s light-duty vehicle standards with the most stringent standards in North America post-2025, whether that be federal or state level. While fuel efficiency improvements have been the largest driver of emissions reductions in passenger transport to date, progress has slowed and new Canadian standards face an uncertain future with the Trump administration rolling back US policies (Shepardson, 2025; Stiebert et al., 2024).

Clean fuel standards

In July 2023, the Clean Fuel Regulations finally took effect, putting in place requirements for producers and importers of gasoline and diesel to reduce the carbon intensity of their fuels from 2016 levels, with increasing annual reductions through 2030 (Bakx, 2023; Government of Canada, 2022p).

The regulations create a credit market for compliance, which allows those not subject to the regulations (like EV charging stations or low carbon fuel producers (e.g. biofuels)) to participate. The regulations aim to improve production processes in the oil and gas sector, foster production of low carbon fuels and enable end-use fuel switching in transport. The fuels used by remote communities, and in international shipping, and domestic and international aviation are exempt from the regulation. The renewable fuel content requirements, 2% for diesel and 5% for gasoline, as set out in the Renewable Fuels Regulations, have been incorporated in these new regulations (Government of Canada, 2010).

These regulations were first proposed in 2016 as part of the Pan-Canadian Framework (Government of Canada, 2016a). Originally, standards were also supposed to be prepared for gaseous and solid fuels; however, these were delayed due to industry concerns over trade impacts and have since been shelved (Environment and Climate Change Canada, 2020a; Government of Canada, 2017).

Aviation

Domestic air travel accounted for 14 MtCO2e in 2023, approximately 2% of total emissions (Environment and Climate Change Canada, 2025). However, this figure only includes flights that begin and end within Canada, missing a significant share of Canadian air travel. According to the federal government’s 2022 Aviation Climate Action Plan, domestic and international operations of Canadian airlines released 22 MtCO2e in 2019, with 70 per cent of those emissions coming from international flights (Government of Canada, 2022a).

Most of these emissions are not covered by existing climate policies. While the consumer carbon price covered emissions from intra-provincial aviation, it was removed on April 1, 2025. In addition, while the clean fuel regulations create incentives for the production or import of sustainable aviation fuels into Canada, it does not cover jet fuel (Government of Canada, 2022b).

The federal government’s Aviation Climate Action Plan charts a pathway to achieving net-zero emissions by 2050. However, the Plan relies heavily on a shift to Sustainable Aviation Fuel (SAF), representing around 70% of the fuel used in 2050 and delivering almost half of the needed reductions. Combined with increased efficiency in equipment and operations, the Plan expects this shift to offset the expected growth in air travel and bring emissions back to their 2005 levels (around 12 MtCO2e). However, according to the Plan, these residual emissions would then need to be balanced by negative emissions, such as direct air capture. The Plan assumes a 90% reduction in lifecycle emissions compared to conventional jet fuel.

In 2023, the airline industry produced a SAF roadmap which is considered an integral part of the government’s aviation action plan. The roadmap charts the requirements for this nascent technology to be able to grow to 25% fuel share by 2035. The roadmap assumes around 50% lifecycle emissions savings in SAF in contrast to the 90% reduction in the aviation plan.

Buildings

12% of Canada’s emissions are from the buildings sector (excluding electricity) (Environment and Climate Change Canada, 2025). Under the climate plan, the government hopes to cut emissions from the sector by 37% below 2005 levels, by 2030. However, emissions have stagnated since 2005 and the government’s most recent emission projections show building sector emissions declining by only 12% by 2030 under current policies and 17% with planned policies (Government of Canada, 2024a). Provinces, and not the federal government, have jurisdiction over building regulations; however, the federal government plays a critical role in setting direction, providing funding, and developing national standards.

According to the latest government data, 41% of residential heating systems used electricity in 2022, though only 6% of that share came from heat pumps. The remaining home heating systems relied on fossil gas, oil, coal, propane, or wood. This mix varies significantly across provinces (Natural Resources Canada, 2025).

In July 2024, the federal government released the Canada Green Building Strategy, outlining its strategic priorities as well as its suite of existing and planned actions to decarbonise the sector (Natural Resources Canada, 2024). The Strategy outlines several funding programmes targeting residential and commercial buildings, including the Canada Greener Homes Grant and Loan, the Oil to Heat Pump Affordability Program, and the Deep Retrofit Accelerator Initiative. The Strategy also includes a commitment to introduce a regulatory framework to phase out the installation of oil heating systems in new construction as early as 2028, though notably excludes any mention of phasing out natural gas. The Strategy also includes measures to incentivise the adoption and implementation of the highest tier of the national model building codes.

The current version of the building codes were published in 2020 and adopted in 2022, after a two year delay (National Research Council Canada, 2020, 2022a, 2022b). They adopted a tiered system for the first time, which includes a ‘net zero energy ready’ level. (‘Net zero energy ready’ means that the building is efficient enough that a renewable energy system, once added, would be able to provide all of the building’s energy needs). The aim is to move to progressively more stringent tiers so that by 2030 all new buildings are net zero energy ready.

Provinces agreed to implement this code by 2024 and most have followed suit (Efficiency Canada & Carleton University, 2022). While the codes are heading in the right direction, they are missing key elements: there are no GHG emission requirements, nor provisions to support renewable or EV readiness, though GHG emissions will be addressed in the next update cycle (Efficiency Canada & Carleton University, 2022; Natural Resources Canada, 2022b).

As 80% of the buildings stock that will exist in 2030 has already been built (Environment and Climate Change Canada, 2022a), accelerating energy-efficient renovations and retrofits is crucial to decarbonising the sector. Canada has several programmes which support its goal of a 3–5% deep retrofit rate, including CAD 200m for a Deep Retrofit Accelerator Initiative for large buildings (Natural Resources Canada, n.d.), but additional measures are likely needed to achieve this goal. While we have not undertaken this analysis for Canada, the CAT estimates the USA and the EU would need to renovate at least 3.5% of the existing buildings stock per year to be compatible with the 1.5°C temperature limit.

Power sector

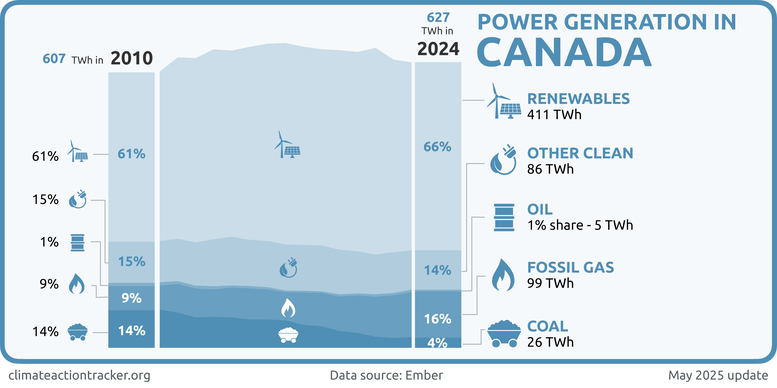

Electricity generation is responsible for 7% of Canada’s emissions. Its share of the country’s emissions has been falling since 2015 as Canada shifts away from coal (Environment and Climate Change Canada, 2023b). Canada’s Clean Electricity Strategy and Clean Electricity Regulations were finalised in December 2024, pushing back Canada’s initial net zero electricity grid target from 2035 to 2050 (Government of Canada, 2024b).

To be 1.5°C compatible, Canada would need to phase out all fossil fuels in the power sector by 2035 (Climate Action Tracker, 2023a). The CAT does not see a role for CCS in the power sector, given its high cost, low technological maturity and residual emissions (Climate Action Tracker, 2023b).

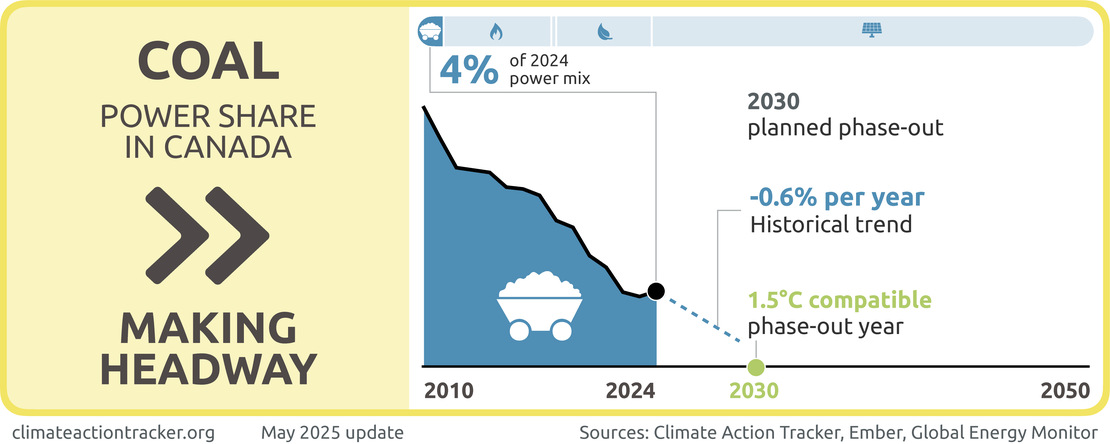

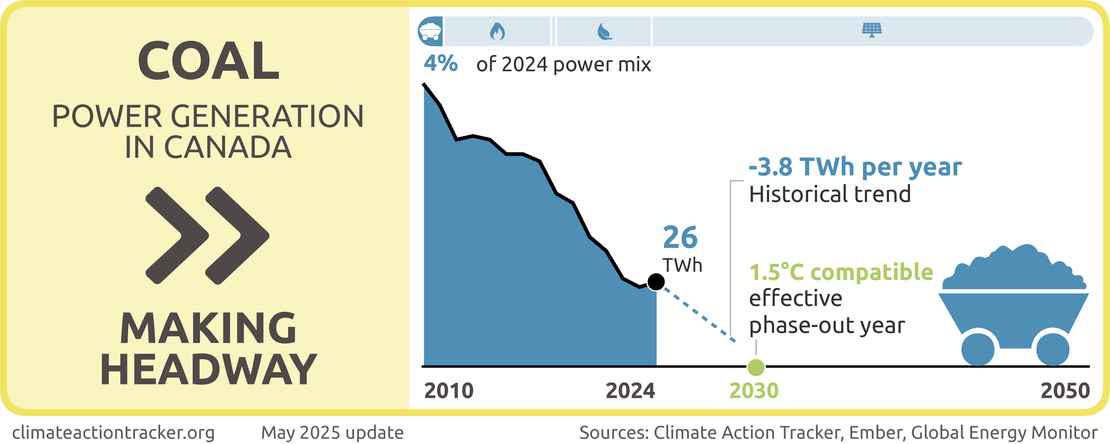

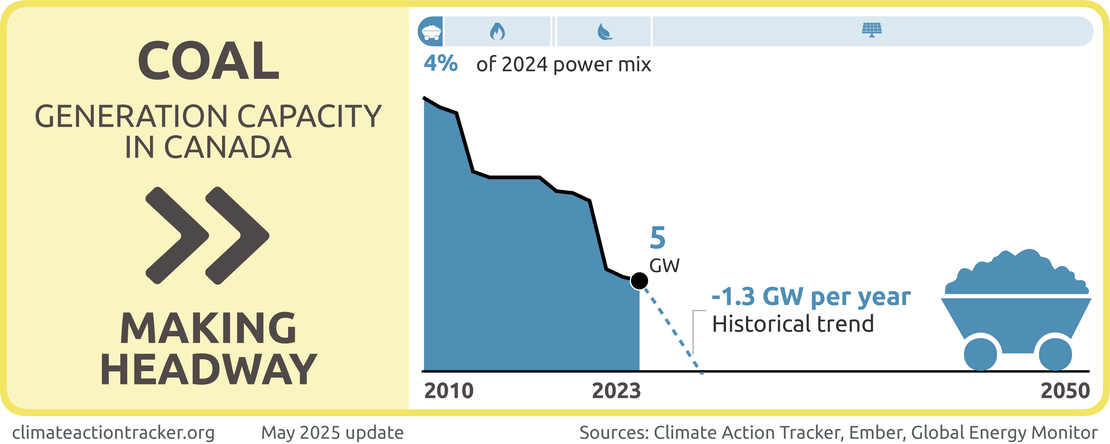

Coal

We evaluate Canada as 'Making headway' on coal power. Coal generation has decreased significantly over the last five years, with coal's share of the overall power mix also steadily declining. Canada co-founded the Powering Past Coal Alliance in 2017 and has had a regulatory system in place since 2018 to phase out “unabated” coal power by 2030. Canada is on track to achieve this phase-out target. Currently only three of Canada’s ten provinces still generate power from coal. Alberta phased out coal-fired generation in 2024, well ahead of its initial commitment of 2030 (Natural Resources Canada, 2023b).

While Canada's coal phase-out efforts are positive, there are some limitations. Current regulations still allow for plants which emit up to 420 gCO2/kWh, roughly half the emissions intensity of conventional coal power (Government of Canada, 2018d). However, the regulations are designed to allow for coal-fired power generation with carbon capture and storage (CCS) technology.

The CAT does not see a role for coal power with CCS for three main reasons:

- CCS does not remove 100% of emissions from power plants

- Heavily relying on unproven CCS for power generation simply prolongs the use of fossil fuels, diverting attention and resources away from the necessary and urgent switch to renewable energy generation that drives down actual emissions.

- The use of CCS should be limited to industrial applications where there are fewer options to reduce process emissions—not to reduce emissions from the electricity sector where renewables are cost-effective mitigation alternatives

Canada’s experience with CCS at Saskatchewan’s Boundary Dam coal plant since 2014 demonstrate these challenges, as it has been plagued with technical and operational problems and has still not met its annual CO2 capture target (Rives, 2022; SaskPower, 2022b, 2022a; Schlissel, 2021; Taylor, 2019).

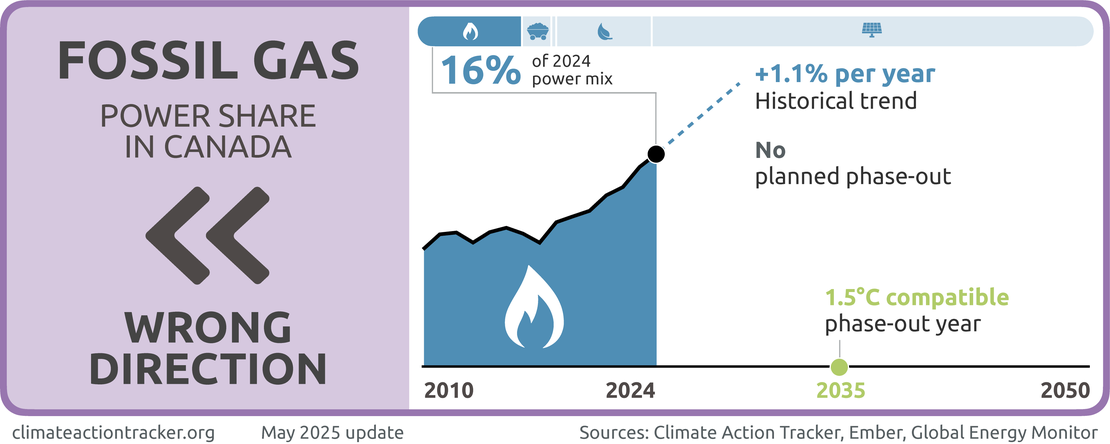

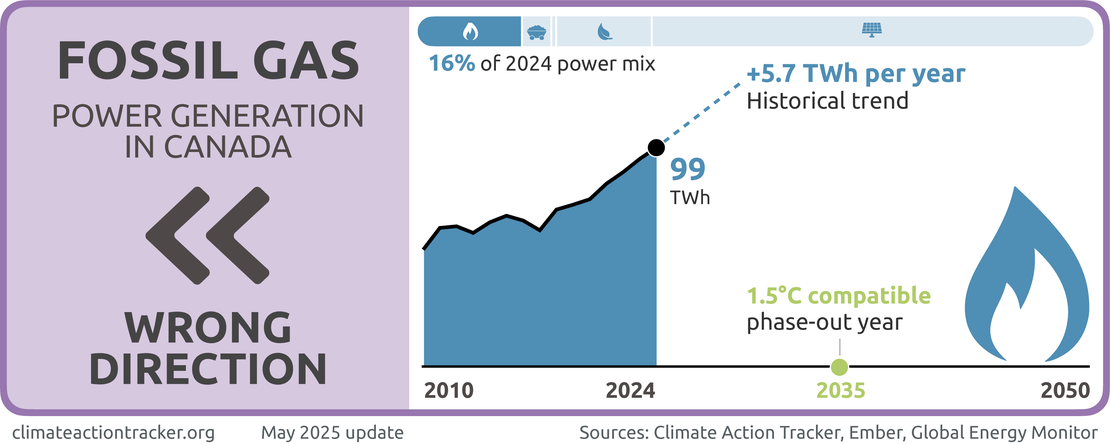

Fossil gas

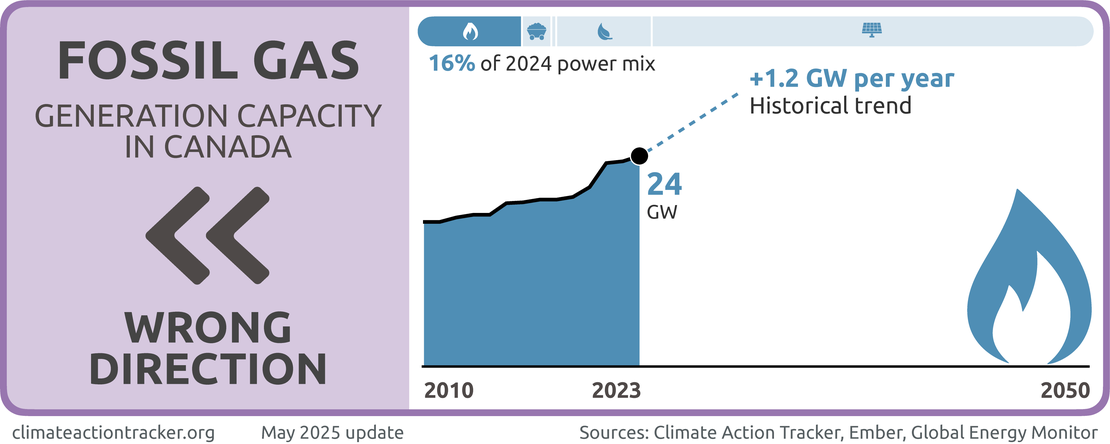

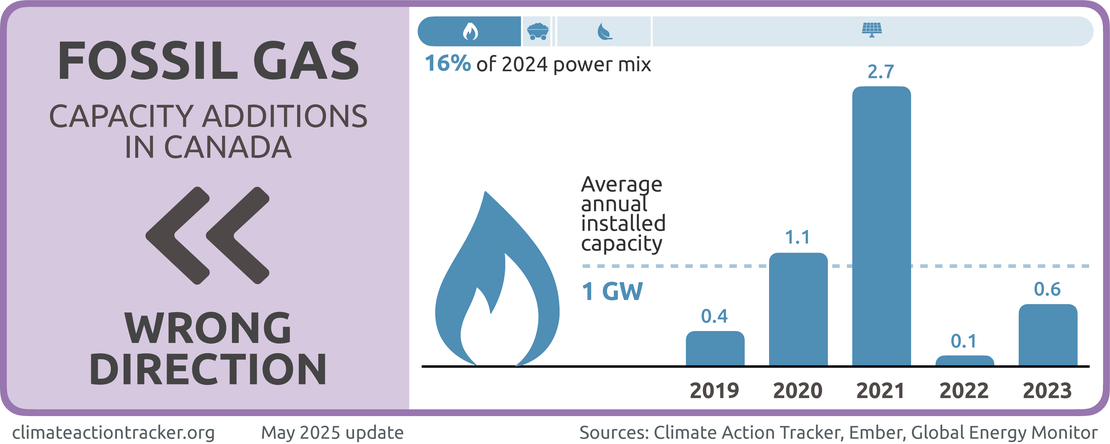

Canada is moving in the 'Wrong direction' on fossil gas. Canada is moving in the wrong direction on fossil gas. Electricity generated from fossil gas has increased over the last five years, with its share of the overall power mix also rising steadily. This trend runs counter to what is needed for 1.5°C compatibility, which would require developed countries like Canada to phase out unabated fossil gas by 2035.

Canada introduced new Clean Electricity Regulations in December 2024 to operationalise the 2050 net zero emissions electricity grid target established in the Clean Electricity Strategy. The Regulations update emissions performance standards for all grid-connected fossil-generated electricity above 25 MW capacity (Government of Canada, 2022g, 2023a, 2018e). Government projections estimate the Regulations will result in 180 MtO2e emissions reduction between 2024-2050.

The regulations contain concerning exemptions and flexibility provisions. Exemptions will apply in cases of emergencies, when fossil gas without CCS may be used, and for remote northern communities (where much of the power is diesel generated). For older facilities, only emissions that exceed the sector benchmark of 370 gCO2/kWh need to be offset. Planned units which are under construction by 31 December 2027 and meet certain criteria will be allowed to operate without an Annual Emissions Limit until the end of 2049 (Government of Canada, 2024b).

Canada continues to build and rely on fossil gas in its power sector. Cascade Power, a 900 MW fossil gas plant, which began operating in 2024 could fall under such an exception (Cascade Power, 2021). SaskPower is also building new fossil gas plants to come online in 2024–2026 (SaskPower, 2022a). Continuing investment in fossil gas infrastructure is concerning, especially given that the cost of fossil gas is expected to increase further, while renewable electricity generation continues to get cheaper. Fossil gas in generation has increased significantly over the last five years, rising an average 5.74% per year. This is not compatible with the 1.5ºC limit, which would require developed countries like Canada to phase out unabated fossil gas by 2035.

Renewables

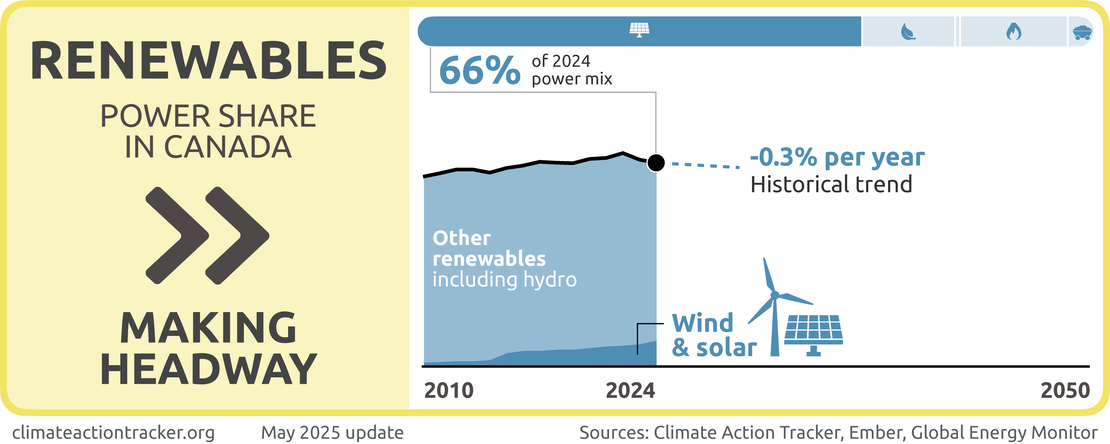

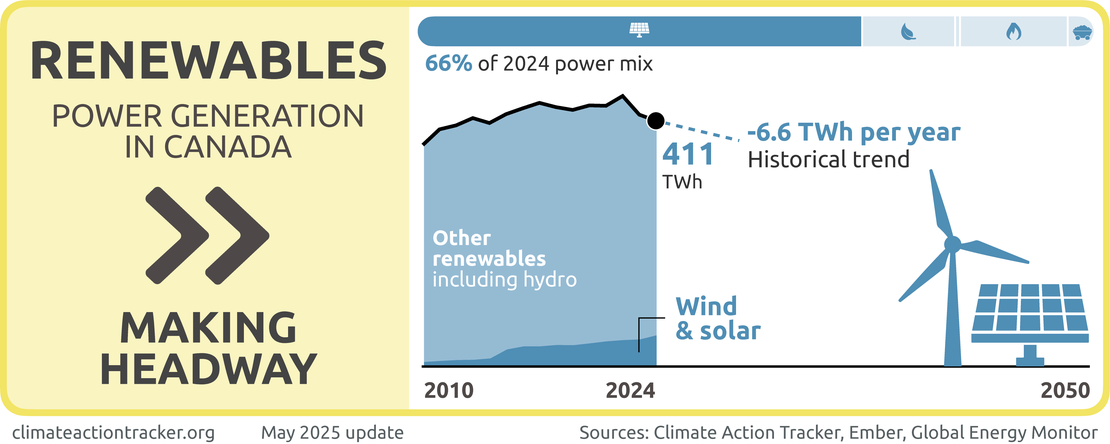

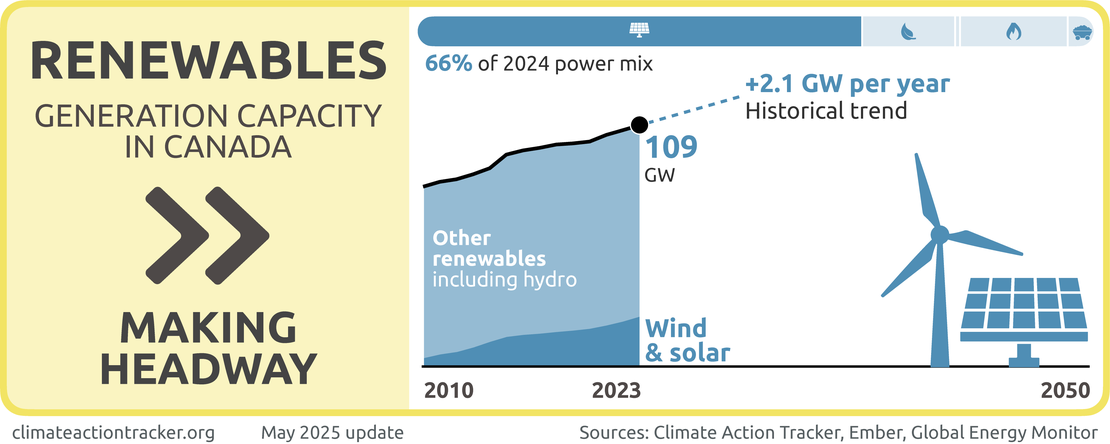

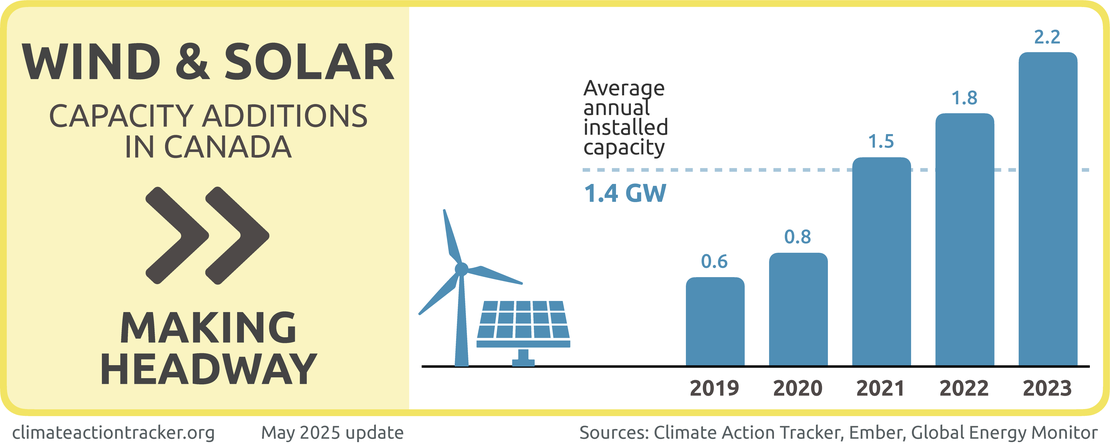

Canada is 'Making headway' on renewables:

- The share of wind and solar in the power mix has been increasing over the last five years, with a nearly 3 TWh increase per year in overall power generated from these sources.

- Two-thirds of Canada’s electricity is already renewable, due to a long legacy of hydropower that still supplies 60% of demand.

- Both wind and solar power are increasing fast, with wind growing from 2% of total generation in 2014 to 7% in 2024 and solar, once negligible, providing 1.3% of total generation in 2024 (Ember, 2025) .

- Nuclear power has been slowly declining over the last decade, but still provides 14% of total generation as of 2024, leaving less than 20% of power to be supplied from fossil sources (Ember, 2025).

Despite this strong starting position for achieving an early carbon-free grid, under current policies, Canada is expected to use fossil gas for power generation beyond 2030, betting on CCS to deliver on its promise of a net zero emissions grid by 2050. To be fully 1.5°C compatible, Canada would need to accelerate its renewable deployment to phase out all fossil fuels in the power sector by 2030 (Climate Action Tracker, 2023a).

Canada has several funding programmes for ‘clean electricity’ projects, including renewables, nuclear and CCS-projects as well as programmes to fund storage and grid strengthening (Environment and Climate Change Canada, 2022a). However, the CAT does not see a role for CCS in the power sector, given its high cost, low technological maturity and residual emissions (Climate Action Tracker, 2023b).

Hydrogen

Canada released its Hydrogen Strategy in 2020 (Natural Resources Canada, 2020). It sees the shift to hydrogen as a key contributor in meeting both its 2030 NDC and net zero goals. The Strategy estimates that Canada could reduce emissions by 22–45 MtCO2e by 2030, representing 15% of total reductions, by supplying 6% of final demand, primarily in the transport and industry sectors.

By 2050 it foresees savings of 90–190 MtCO2e through the use of hydrogen representing 26% of total reductions, by supplying 30% of final demand. The Strategy is not limited to green hydrogen (produced with renewable energy only), but includes hydrogen produced from fossil fuels with CCUS.

In contrast, Canada’s latest climate plan only includes a 15 MtCO2e reduction from hydrogen use by 2030. As much of the hydrogen would be produced using fossil gas, an additional 30 MtCO2e of CCUS capacity would be needed to capture the associated emissions (Office of the Auditor General of Canada, 2022b). For comparison, Canada’s only commercial CCS abated coal-fired power plant in operation was designed to capture 1 MtCO2e per year and has not yet achieved this target (see above for details).

Canada’s Commissioner for the Environment and Sustainable Development has heavily criticised the estimates in the Hydrogen Strategy, finding the underlying assumptions on policy implementation and price development ‘unrealistic’ (Commissioner of the Environment and Sustainable Development, 2022b; Office of the Auditor General of Canada, 2022b). One example is the assumption that a blending level of 7.3% can be achieved in the medium term: in the absence of blending obligations for 2030 a carbon price of at least CAD 500/tCO2, rather than the anticipated CAD 170/tCO2, would be required to achieve this.

Russia’s illegal invasion of Ukraine has reinforced the need for securing green hydrogen production and supply. In August 2022, Canada and Germany established a Hydrogen Alliance through which Canada would aim to start exporting hydrogen to Germany in 2025 (Government of Canada & Government of the Federal Republic of Germany, 2022).

Agriculture

Agriculture was responsible for around 10% of Canada’s total emissions in 2023 and 28% of methane emissions (Environment and Climate Change Canada, 2025). Under Canada’s current policies, the sector’s emissions are projected to remain at 2023 levels in 2030, or 69 MtCO2e, while proposed policies see emissions decline to 65 MtCO2e.

The previous federal government committed to publish a Sustainable Agriculture Strategy. While the government conducted consultations in 2022 to inform the development of the Strategy, it was never finalized. Canada’s current agriculture sector climate policies are primarily targeted programmes and investments that encourage technology adoption and emissions reductions, including the Agricultural Climate Solutions program to implement farming practices to reduce emissions.

In 2020 Canada announced a voluntary target of reducing emissions from fertiliser use by 30% below 2020 levels by 2030, a key source of N2O emissions (Environment and Climate Change Canada, 2020a). Direct emissions from synthetic nitrogen fertiliser have increased substantially since 2005. The government concluded consultations on the approaches to achieve the target in August 2022, but has not yet announced the next steps (Government of Canada, 2022c, 2022m, 2022n).

Some agricultural activities will be eligible for the federal government’s GHG offset system, established in June 2022. Credits generated under the system can be used to reduce the compliance costs of industrial facilities covered by the government’s carbon pricing system (OBPS). Protocols for projects related to livestock feed management and enhancing soil organic carbon are currently being developed and ones for manure management and anaerobic digestions are planned (Environment and Climate Change Canada, 2022d; Government of Canada, 2022c).

Waste

Waste sector emissions accounted for around 3% of Canada’s total emissions in 2023, but 19% of the country’s methane emissions (Environment and Climate Change Canada, 2024). Municipal landfills are the primary source of emissions. Efforts to reduce methane emissions to date have only been able to balance out the increased waste generated from a growing population and thus current methane levels from landfills are at about the same level as 20 years ago (Environment and Climate Change Canada, 2022d).

Canada anticipates cutting methane emissions from the waste sector by 45% between 2020 and 2030 (Environment and Climate Change Canada, 2022d). The government issued draft regulations for consultation in 2024, but has yet to publish final regulations (Environment and Climate Change Canada, 2024).

In June 2022, the government finalised the details around generating offset credits from landfill methane recovery and destruction projects (Government of Canada, 2022j). These credits can be used to reduce the compliance costs of industrial facilities covered by the government’s carbon pricing system (OBPS).

Forestry

Canada’s vast forests have historically been a source of emissions with forest lands contributing 24 MtCO2e in 2023, according to the latest national inventory. However, as per UNFCCC guidelines, Canada’s official emissions inventory does include emissions from forest fires, which continue to intensify across the country, with 2023 setting a tragic record: 16.5 Mha of land were burnt, an area larger than the country of Greece and over double the previous record from 1989 (Natural Resources Canada, 2023a). According to the government estimates, forest fires on managed lands released 980 MtCO2e in 2023, far exceeding the country’s total reported emissions from all other sources that year (Linden-Fraser, 2025).

Canada’s net zero strategy assumes a 100 MtCO2e of sequestration from LULUCF and nature-based solutions in 2050 to assist with achieving the country’s net zero target. In 2030, the federal government’s projections assume 28 Mt MtCO2e of sequestration from LULUCF and nature-based solutions in the current policies scenario and 41 MtCO2e in the planned policies scenario, though has not provided details on where those reductions will come from.

However, as the country’s forests have never been a net sink, Canada will need to take significantly more action in this sector if it is to achieve the scale of removals outlined in its emissions projections.

Two Billion Trees

Canada has a number of initiatives to support nature-based solutions (Environment and Climate Change Canada, 2020a, 2022a). Its flagship plan, launched in 2021, is to plant two billion trees during the 2020s (Government of Canada, 2021a; Liberal Party of Canada, 2019; Natural Resources Canada, 2021c).

In April 2023, the country’s Auditor General expressed concern over the slow rollout of the plan, concluding that the target would not be met without significant changes (Office of the Auditor General of Canada, 2023). The government contends that it is now back on track (Natural Resources Canada, 2023e), yet the programme’s website still lacks basic tree planting information (how many planned versus actually planted,) nor any information about GHG sequestration.

The programme was designed to sequester up to 2 MtCO2e by 2030 and up to 11–12 MtCO2e by 2050, but the auditors concluded that it will be a tiny net source of emissions (0.1MtCO2e) to 2030, due to emissions from planting activities and site preparation, and only sequester 4.3 MtCO2e in 2050 (Office of the Auditor General of Canada, 2023). Even if achieved, these emission reductions are uncertain, as their long-term storage capacity faces several risks, including forest fires, pest outbreaks, and drought.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter