Policies & action

Egypt has taken its first steps toward investing in large-scale renewable energy projects, but these remain smaller in scale than investments into fossil fuel-based energy sources, in particular natural gas. Egypt is Africa’s second largest natural gas producer and it is making significant investments into new oil and gas production and exploration.

The CAT rates Egypt’s policies and action as “Insufficient”. The “Insufficient” rating indicates that Egypt’s climate policies and action in 2030 need substantial improvements to be consistent with the Paris Agreement’s 1.5°C temperature limit. If all countries were to follow Egypt’s approach, warming would reach over 2°C and up to 3°C.

Policy overview

Egypt’s main mitigation policies are set out in its 2030 low emissions development strategy, which was adopted in early 2019 (Amr Osama, 2019). In May 2022, Egypt launched its 2050 National Climate Change Strategy. The strategy does not include an overall emissions reduction goal.

Egypt adopted renewable energy targets for 2022 and 2035 as part of its Integrated Sustainable Energy Strategy to 2035 (ISES 2035) in late 2016. By 2035, 42% of all electricity is to be generated with renewable energy. At COP26, Egypt announced it would aim to bring this target forward to 2030, but this has not been confirmed in an official policy document.

Egypt Vision 2030, developed in 2014–2015, is the country’s overarching sustainable development strategy. Climate change does not feature prominently and the Vision does not include an economy-wide emission reduction target; however, it does have a few mitigation-related sectoral targets.

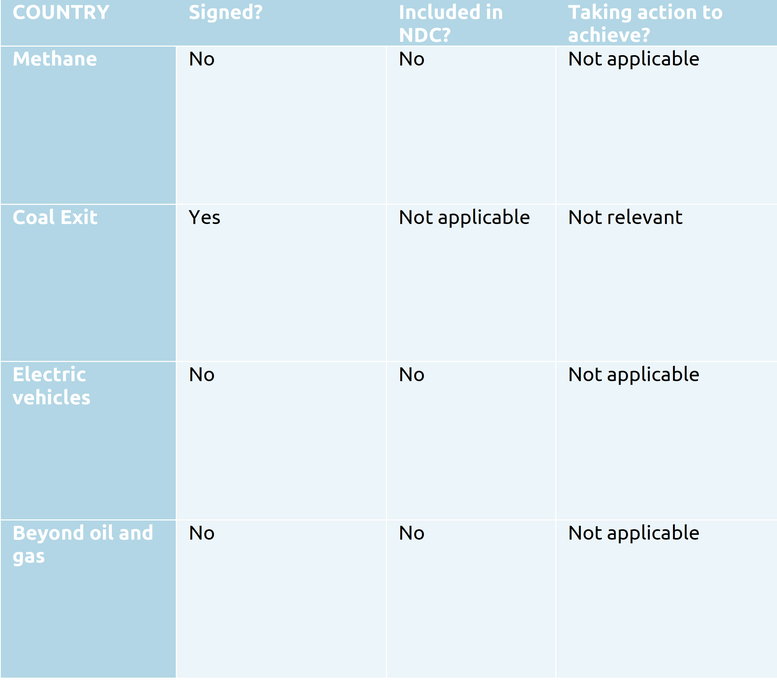

Sectoral pledges

In Glasgow, a number of sectoral initiatives were launched to accelerate climate action on methane, the coal exit, 100% EVs and others. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets.

NDCs should be updated to include these sectoral initiatives, if they aren’t already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

- Methane: Egypt has not signed on to the Global Methane Pledge, which aims to cut global methane emissions by at least 30% in the next decade. Half of Egypt’s methane emissions come from the waste sector and a third from agriculture, the remainder are from energy (Climate and Clean Air Coalition Secretariat, 2021).

- Coal Exit: Egypt is a signatory of the coal exit pledge. It does not have any coal plants currently. Its electricity generation is largely based on fossil gas, with coal being primarily used for industrial production (IEA, 2021a).

Energy supply

As part of its Vision 2030 sustainable development strategy, Egypt aims to reduce GHG emissions in the energy sector by 10% by 2030. No baseline is given, but we assume it to be 2015, as that is around the time the strategy was developed.

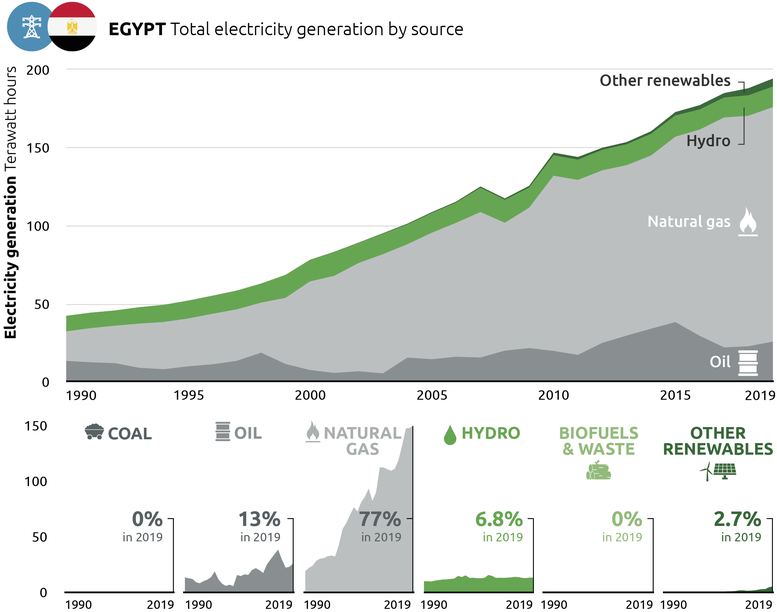

Egypt’s economy is highly dependent on the fossil fuel industry, which represented nearly a quarter of GDP in 2019–2020 (U.S. ITA, 2021). The energy sector is dominated by fossil fuels, with renewable energy supplying only 5% of total primary energy in 2019 (IEA, 2021).

Fossil gas

Egypt is seeking to develop its vast fossil gas resources to maximise domestic production, consumption and exports. It ranks among Africa’s top countries for many indicators related to natural gas (EIA, 2022). Egypt has:

- The third largest proven natural gas reserves in Africa, after Nigeria and Algeria

- The second largest natural gas production, after Algeria

- The highest natural gas consumption, making up over a third of Africa’s total gas consumption

- The highest CO2 emissions from natural gas, making up nearly 40% of the continent’s total CO2 emissions linked to natural gas.

Egypt’s fossil gas reserves are estimated at 1,780bcm (63Tcf) in 2020 (U.S. Energy Information Administration, 2022). In 2015, the Italian company ENI discovered the Mediterranean’s largest offshore gas field in Egypt’s waters (Government of Egypt, 2020a). The government estimates the reserves at around 850 bcm (30 Tcf)—although these are still unproven, and therefore not included in most official statistics at this stage.

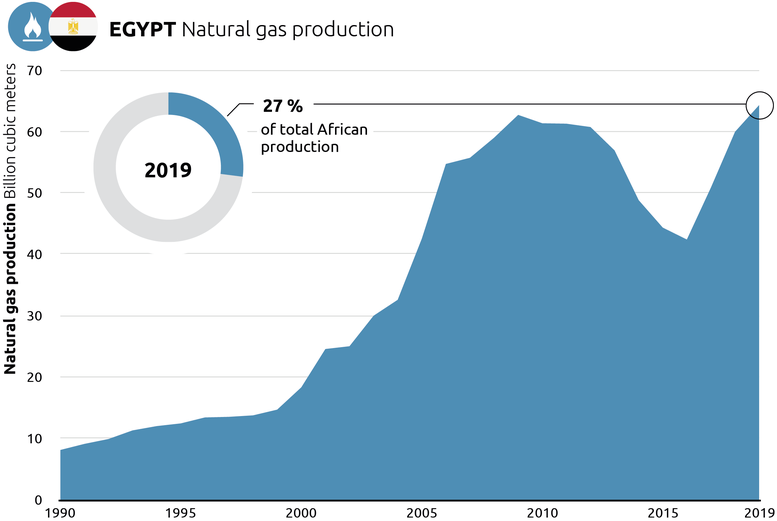

In 2019, Egypt’s fossil gas production reached a high of 64 bcm, representing over a fourth of total gas production in Africa. Egypt has significantly ramped up its fossil gas production in the past few years following plummeting production in the aftermath of the Egyptian revolution in 2011.

Despite this, Egypt’s natural gas exports remain much smaller than in other large producers on the continent, due to steadily increasing domestic demand. However, the Egyptian government has made clear that it intends to increase natural gas exports. Egypt exports natural gas both via pipeline and LNG.

Our analysis shows that a high share of renewables in the power sector (82% in 2035) could create an additional 1.8 million jobs compared to the government’s 2035 Energy Strategy — translating to nearly 130,000 additional jobs per year. A high share of renewable energy (82% by 2035) could also avoid more than 5,300 premature deaths linked to air pollution from natural gas in the next two decades compared to the 2035 Energy Strategy, which foresees over 50% of electricity to be generated with gas in 2035.

Oil

Egypt’s oil production has been on a slow decline over the past two decades (IEA, 2019).

In 2018, Egypt joined the World Bank’s Initiative to stop gas flaring in oil production by 2030(GGFR, 2022). The total volume it flares and the flaring intensity are both up since joining (though below its 2016 high) (GGFR, 2021a). While Egypt is not amongst the countries which flare the most gas, it still ranked 13th in terms of total volume flared in 2020 (GGFR, 2021b).

Electricity

The majority of Egypt’s electricity is from natural gas (IEA, 2019). Oil is a distant second, though together the two provide 90% of the country’s power. In absolute terms, the contribution from hydropower has changed little in the past three decades, but its overall share has fallen substantially as electricity demand has grown. In 2019, 7% of electricity was from hydropower, followed by wind (2%) and solar (1%).

It is difficult to assess Egypt’s electricity plans. Its Integrated Sustainable Energy Strategy to 2035 has not been updated since 2016 and its five-year plans are hard to access.

The Integrated Sustainable Energy Strategy to 2035 (ISES 2016), adopted by the Supreme Energy Council, Egypt’s top energy decision-making body, in October 2016, outlines the country’s vision for the energy sector. Eight scenarios were considered as part of the strategy development. The scenario ultimately adopted sets targets of generating 20% of electricity from renewable sources in 2022, increasing to 42% by 2035. The scenario includes nuclear and coal power. As discussed below, the nuclear plant has been delayed and the coal plants are shelved.

Renewable electricity

IRENA estimates that Egypt could derive more than half (53%) of its electricity from renewables in 2030, well above the government’s current renewable energy targets of generating 42% of electricity with renewables by 2030–2035 (IRENA, 2018).

In the shorter term, Egypt aims to generate 20% of its electricity from renewables by 2022. While Egypt has initiated some large-scale renewable energy projects, including the 1.6 GW Benban solar power plant, renewable energy installation would need to pick up to reach the 2022 and 2035 targets. By the end of 2021, Egypt had installed around 1.6 GW of wind capacity and 1.7 GW of solar capacity—in addition to the existing 2.8 GW

In November 2021, the government imposed a 5% import tariff on solar panels, which had previously been duty free (Enterprise, 2021d).

Nuclear power

Egypt is in the process of building its first nuclear power plant, though the project has suffered repeated delays and construction has not yet begun (Enterprise, 2021d; Nuclear Power Plants Authority, 2022b). The nuclear plant is being developed in cooperation with, and largely financed by, Russia.

The site for the 4.8 GW plant, consisting of four 1.2 GW units, was approved in 2019, with construction originally scheduled for late 2020. However, the request for construction permits of the first two units was only made in mid-2021. Approval was expected by year’s end but has now been pushed back to mid-2022 (Nuclear Power Plants Authority, 2022a). The request for the other two units was made in early 2022 (Enterprise, 2021d). The first reactor was originally supposed to come online in 2026, but has now been delayed until 2028, with all units operational by 2030. The plant has a design life of 60+ years.

Coal power

Egypt does not have any coal-fired power plants (Global Energy Monitor, 2020). The interest in coal power sprung out of the energy crisis in 2014 and the desire to reduce Egypt’s dependence on imported gas, and was included in the 2030 Vision. However, the discovery of gas fields and their subsequent rapid development has changed the situation dramatically, as Egypt became a net exporter of gas in 2019.

In 2020, the government announced it had indefinitely postponed plans to construct the 6 GW Hamrawein coal-fired power plant, instead pursuing alternative renewable energy projects (Daily News Egypt, 2020). As a signatory of the Clean Power Transition Statement, Egypt has committed to not building any unabated coal-fired power generation in the future (UN Climate Change Conference (COP26), 2021).

Hydrogen

Egypt is working on a national hydrogen strategy with the European Bank for Reconstruction and Development (EBRD, 2022). A number of pilot projects are in the works. The first green hydrogen facility is expected to be online in time for COP27 and will be used as feedstock in ammonia production (Abu Zaid, 2021).

Fossil fuel subsidy reform

The government had originally planned to phase out fossil fuel consumption subsidies entirely by mid 2022, but has pushed the date back to mid 2025, in part over concerns of rising consumer prices (Enterprise, 2021c).

Industry

Coal consumption in the industry sector increased substantially between 2016 and 2018, as the sector shifted away from natural gas due to limited supply (IEA, 2021). Coal consumption somewhat decreased in 2019 but remains relatively high.

Cement

Emissions from Egypt’s cement sector have been on the rise due to increased production and a switch from natural gas to coal during the energy crisis in 2014 (EBRD, 2016).

In April 2015, Egypt passed legislation that allowed cement producers to switch from natural gas to coal in response to a nationwide energy crisis (EBRD, 2016). At the time, it was estimated that the switch would cause a 15% increase in CO2 emissions from the sector by 2030 (EBRD, 2016). A strategy was developed to counteract this increase with a suite of measures, full implementation of which could even have led to a reduction in emissions, not just a return to the pre-fuel switching baseline (EBRD, 2016). The Egyptian, and the broader regional, cement industry has been plagued by oversupply for years (Vanderborght et al., 2016). While the strategy noted that no new capacity was needed until 2025, a new state-owned facility was opened in 2018, further exacerbating the oversupply issue (EBRD, 2017; Enterprise, 2021b) . The drop in demand in the early stages of the pandemic only made matters worse.

Around 90% of the sector currently uses coal in at least part of their manufacturing process. Soaring coal prices in 2021 has some considering a switch back to natural gas, but its prices are also increasing (Enterprise, 2021a).

The Egyptian Waste Management Regulatory Authority is working on regulations that would require cement companies to use alternative fuels and waste materials in their production instead of coal, one of the recommended measures in the 2016 strategy (Enterprise, 2021a).

Transport

Compressed natural gas use

Natural gas use in the transport sector is low but expected to increase. In 2020, the Egyptian government announced a nationwide programme to convert over 400,000 cars to run on compressed natural gas (CNG) by 2023, bringing the total number of cars running on natural gas to one million. The Central Bank of Egypt is supporting this initiative by providing loans with initial support amounting to nearly USD 1 billion (EIU, 2021). While CNG may be seen as a cleaner alternative to oil-fuelled cars, it is by no means a solution for air pollution. CNG-fuelled cars emit a significant amount of particle pollution—both ultrafine and PM2.5 (Transport & Environment, 2020).

Electric vehicles

The Egyptian EV market is in its infancy with only a few hundred cars on the road (Enterprise, 2020b). High prices, limited charging infrastructure and a challenging regulatory environment, both for the individual driver and the sector are all barriers to growth.

The government plans to subsidise the purchase of locally produced EVs and has set a goal of installing 3,000 charging stations by 2023 (Ministry of Public Business Sector, 2021). In April 2021, a committee was established by the Ministry for Public Enterprise to look into the location of the charging stations (Ministry of Public Business Sector, 2021a). Current numbers are difficult to come by; however, one of the leading installers has already built 70 stations with plans to expand to 300 by 2023 (Infinity, 2022).

The Ministry of Military Production, which has significant manufacturing capabilities, is developing an EV industry strategy that seeks to promote local production (New & Renewable Energy Authority, 2020). Egypt aims to be a key exporter of EVs by 2040. GM and Mercedes Benz are working with Egyptian partners to explore the possibility of local EV production (Ministry of Public Business Sector, 2021d). Negotiations between a Chinese automaker and Egyptian entities for local EV production faltered in late 2021, though some prototype testing did occur during the year. State-owned entities have also partner with local manufacturers to produce electric buses (Ministry of Public Business Sector, 2021b, 2021e).

Importing used cars is banned in Egypt; however, the ban was relaxed in 2018 to allow for the importation of used EVs that are not more than three years old (Ministry of Commerce and Industry, 2021).

Waste

In October 2020, Egypt adopted a new waste management law (Enterprise, 2020a). Effective waste management has been a challenge for the country for the last decade. In September 2021, a public-private partnership was formed to build the first waste-to-energy plant (Green Tech Egypt, 2021b, 2021a). A waste-to-energy feed in tariff to support such projects was adopted in 2019; however, as electricity is currently in oversupply, this measure may do little to support the industry in practice (Enterprise, 2020c; Riad & Riad, 2020).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter