Current Policy Projections

Overview

In 2016, EU’s emissions (excl. LULUCF) were 24% below 1990 levels. After the recession caused a steep decline in 2009, emissions increased again due to the economic recovery in 2010. Despite economic growth, emissions decreased steadily between 2011 and 2014, before stagnating in 2015 and 2016, mainly due to higher road transport demand (European Environment Agency 2018a). To some degree, this rise was tempered by the increasing role of renewables: emissions were lower by 447 MtCO2 and 483 MtCO2 in 2015 and 2016 respectively when compared with a scenario with no additional renewable energy capacity since 2005 (European Environment Agency 2017a). Early estimates for 2017 indicate that emissions from energy use increased by 1.8% (Eurostat 2018a).

According to our analysis, the future emissions projections under the EU’s currently implemented policies continue the past downward trend with similar—or slightly increasing—reduction rates each year, depending on the scenario adopted. While emissions decreased by an average of 0.86% per year between 1990 and 2016, they are projected to decrease by between 1% (EEA estimates) and 1.4% (PRIMES projections) per year until 2020. For the period to 2030 the projected decrease is 0.6% and 1.4% per year respectively. According to the two scenarios, emissions are estimated to be between 3.9 and 4.0 GtCO2e (a 28–31% reduction below 1990) in 2020 and between 3.4 GtCO2e and 3.9 GtCO2e (31–40% below 1990) in 2030. The share of renewables projected by PRIMES (just over 24% in 2030) is projected to be significantly below the EU’s new target of 32%.

Current policy projections include the EU ETS, the Effort Sharing Directive, the Energy Efficiency Directive and a wide range of other EU-wide regulations influencing GHG emissions such as the Renewable Energy Directive and the F-gas Regulation. It also includes the most important national policies. However, these scenarios do not include the effects of the recently-agreed policies, including the major ETS reform and the new renewable energy and energy efficiency targets which still need to be implemented.

While the respective sectoral policies are described in more detail in the corresponding sections, this section describes the main overarching policies and decisions affecting multiple sectors, the most major of which was the reform of the EU ETS. This is the EU’s flagship climate policy mechanism covering around 45% of emissions from around 12,000 installations, mainly power plants and industry, and 1400 aircraft operators. Its effectiveness has been hampered by the low price of emissions allowances resulting from their oversupply which, in 2017, amounted to almost 1.7 GtCO2 (European Commission 2018b), equivalent to 94% of the EU ETS emissions in that year.

Whereas between 2005 and 2017, emissions from the sectors currently covered by the EU ETS decreased by 26.1% (European Environment Agency 2018b), 2017 was also the first year since the recovery after the 2008/2009 economic crisis when emissions from the sectors covered by the EU ETS increased. This increase, amounting to 0.3%, was largely due to higher emissions from lignite coal and gas-fired power plants, as well as from the industry sector (Sandbag 2018). The low price of allowances, which in 2017 averaged 5.84€/tCO2 (Montel 2018), failed to provide enough incentive for a switch to less carbon-intensive fuels or increased efficiency in industrial production.

To decrease the oversupply of allowances, in 2015 a decision establishing a market stability reserve was adopted (European Parliament and the Council of the European Union 2015a). After the European Parliament and the Council reached a political agreement in November 2017, in early 2018 the EU adopted a directive reforming the EU ETS during Phase 4 (2021–2030) (European Parliament and the Council of the European Union 2018a).

The reform of the EU ETS formally adopted in February 2018 offers an opportunity to increase the effectiveness of this mechanism by:

- Increasing the steepness of the EU ETS emissions cap decrease: instead of 1.74% in the current phase the cap should decrease by 2.2% after 2020.

- Decreasing the oversupply of allowances by transferring 12% of the allowances in circulation to the Market Stability Reserve (MSR) as long as their amount exceeds 833 million. This share will be doubled in the years 2019–2023. Should the number of allowances fall below 400, an additional 100 million allowances will be released from the MSR. This number will also double in the years 2019–2023.

- Cancelling all allowances in the MSR exceeding the number of allowances auctioned during the previous year (European Parliament and the Council of the European Union 2015a, 2018a).

The transfer of the oversupply of allowances to the MSR reduces the threat that coal-phase outs—or the introduction of a carbon tax in some countries—could lead to a lasting oversupply of allowances in the EU ETS, resulting in a lower price and higher emissions in other countries. However, keeping in mind the significant oversupply of allowances available on the market, estimated by the Commission at 1.7 GtCO2 (European Commission 2018b) impact on the price of allowances may only be visible in the longer term. Nonetheless, six months after the EU ETS reform was agreed, the price of allowances exceeded €10 for the first time since 2013 and reached €21 in August 2018 (EEX 2018). If this continues, buoyed by the MSR from 2019 onwards, prices may reach the threshold required to support a switch from coal to gas, currently estimated at around €28 (Carbon Tracker 2018).

The price of allowances influences not only the fuel mix in the EU, but also the amount of resources available for a transition away from coal. According to a 2010 Commission‘s decision, in the framework of NER300 programme, revenues from the sale of 300 million allowances should be awarded to finance commercial demonstration renewable energy and CCS projects (European Commission 2010).

Building on the experiences with the NER300, in Phase 4 of the EU ETS an “Innovation Fund” will be created, funded from auctioning 400 million allowances to support the development of innovative renewable sources of energy, storage technologies, and “environmentally safe carbon capture and utilisation”. In addition, EU countries with a GDP per capita below 60% of the EU average will also benefit from a “Modernisation Fund” financed from auctioning 2% of all allowances. In addition to funding energy efficiency, renewables, energy storage and modernisation of the energy grid, it will also support a just transition in carbon-dependent regions (European Parliament and the Council of the European Union 2018a).

In some EU countries, the EU ETS is complemented with an additional carbon tax levied to reach a carbon price floor. Such a mechanism was introduced in the UK in 2013 with the targeted carbon price floor of £30/tCO2 (€33/tCO2). However, in 2014 this floor price was capped at £18/tCO2 (€20/tCO2) until 2020 (in 2016 extended until 2021) (Hirst 2018). In July 2018 the Dutch government published a draft of a law that—if adopted—would introduce a minimum carbon levy starting with €18 in 2020 and rising by €2.5 until it reaches €43 in 2030 (Dutch Government 2018).

To reach the “at least 40%” emissions reduction target, the European Council agreed in October 2014 that emissions in the non-EU ETS sectors, especially transport and buildings, would have to decrease by at least 30% by 2030 below 2005 levels (35% below 1990). Importantly, the emissions reductions should take place not only in 2030, but according to a linear trajectory translated into annual emissions levels for each of the EU member states. The Effort Sharing Regulation adopted in May 2018 also includes specific, national emissions reduction goals ranging from emissions stabilisation for Bulgaria to emissions reduction by 40% for Sweden and Luxembourg (European Parliament and the Council of the European Union 2018f).

Reducing overall energy consumption will make it easier and cheaper to reduce the EU’s CO2 emissions (European Commission 2017h). For 2020 the EU has a nonbinding target of a 20% reduction of energy consumption below baseline projections. In October 2014 the EU heads of state agreed to a 27% energy efficiency goal for 2030 (Council of the European Union 2014). In its package of energy and climate measures presented in November 2016 the Commission suggested increasing this goal to 30% (European Commission 2016d). In June 2018 the Parliament and the Council increased this target to 32.5% (European Commission 2018a). This would result in reducing EU energy consumption from 1,641 Mtoe in 2016 to 1,273 Mtoe of primary energy and from 1,108 Mtoe in 2016 to 956 Mtoe of final energy consumption (Council of the European Union 2018b). Whereas this target–like the one for 2020–has a non-binding character, in the framework of the Governance Regulation the member states are obliged to inform the Commission about the measures they will adopt to reach this goal. Also the Commission may adopt new measures at the European level to close the gap (European Parliament and the Council of the European Union 2018c).

Energy supply

Emissions from the energy sector are influenced to a varied degree by the development of renewables, fuel switching, and decreasing energy use from improving energy efficiency. Two thirds of emissions in the EU’s power sector in 2017 were coming from coal-fired power plants (Agora Energiewende and Sandbag 2018). To be compatible with the Paris Agreement’s temperature limit the EU needs to significantly reduce this amount in the coming decade (Climate Action Tracker 2016b; Climate Analytics 2017a). Contrary to this need, power production from the most carbon-intensive source of energy, lignite coal, increased by 2% in 2017 after only a modest decline in the preceding years. This was caused mainly by increases in lignite generation in Greece, Bulgaria, Romania and Czechia (Agora Energiewende and Sandbag 2018).

In addition to the aforementioned EU ETS reform, energy sector emissions will also be influenced by the implementation of the renewable energy directive with its recently-agreed goal of increasing the share of renewables to 32% (European Parliament and the Council of the European Union 2018d). However, the EU needs to find new ways to boost the development of renewable sources of energy, as the current rate of increase will not make it possible to replace fossil fuel at a speed required by the Paris Agreement-compatible emissions pathway. The additional RES-E capacity installed in the years 2014–2016 was over 40% lower than the capacity installed in the period 2010–2012 (WindEurope 2017), flying in the face of global trends of accelerating renewable capacity growth. With 15.7 GW installed in wind and 6 GW in solar, last year saw an increase in renewables’ deployment in the power sector (WindEurope 2018). As a result, the share of electricity from renewables reached 30% in 2017, an increase by 0.2% in comparison to 2016 (Agora Energiewende and Sandbag 2018). But this growth is expected to be temporary: from 2019 new installations in Germany will no longer benefit from feed-in tariffs. Instead they will have to participate in the auctioning system with a limited total capacity (BMWi 2017). Should the threat of a significant slowdown in the development of wind energy in Germany materialise (Maslaton 2017), the EU would remain far behind other countries and regions in terms of renewables investment.

In 2017 the EU’s investment in renewables fell to €49 billion (US$57 billion), the lowest level since 2006. This means a 58% decrease from the record year in 2011, and less the half the investment in renewable energy in China. (BNEF 2018). The EU’s investments in clean energy were only 0.9% above those of the United States—and the lowest since 2007 (BNEF 2018).

This negative trend results from decreasing investments in the two countries that contributed the most to the previous growth, the UK (-56% from 2016) and Germany (-26% from 2016) (BNEF 2018). The decrease in Germany, contrary to the overall increase in installed capacity, can be explained by the significant cost reduction of onshore wind energy with the prices falling to €0.0573 kWh in the auction in May 2018 (BMWi 2018). Investment in clean energy in Spain, France and Italy has been steadily increasing since 2015 but remained significantly below that of the UK or Germany.

A related set of measures with significant short-term impact on emissions are the considerations or commitments of some governments to phase out coal from the power sector: France by 2021, Sweden by 2022, the United Kingdom, Ireland, Italy, and Austria by 2025, Denmark, the Netherlands, Finland and Portugal by 2030 (BeyondCoal 2018). These phase-out positions cover 26% of present EU coal capacity. While the level of commitments and the probability of implementation differ between these countries, such declarations send a clear signal that the end of the age of coal in the EU is approaching, at least in some countries.

In addition, the new Spanish Minister for the Ecological Transition, Teresa Ribera, initiated a discussion on closing coal power plants in Spain sooner rather than later (Platts 2018). However, member states with the highest share of coal-fired power plants such as Germany and Poland that cover about 50% of EU coal capacity have not yet taken similar decisions. Whereas Germany has mandated a newly created commission to address this issue and propose the date for coal phase-out (CLEW 2018), Poland is instead planning the construction of new coal-fired power plants (Reuters 2017a).

Faced with the decreasing competitiveness of their coal-fired power plants from decreasing utilisation rates (The Carbon Tracker Initiative 2017), some EU member states (e.g. Poland) are planning to introduce capacity markets which can be considered as subsidies for conventional power plants. To prevent this, in its proposal for regulation on the internal market for electricity, the Commission suggested excluding units with emissions higher than 550gCO2/kWh from capacity payments (European Commission 2016e).

In December 2017, the EU member state representatives significantly weakened this requirement. According to the Council’s position, new installations with emissions higher than 550 gCO2/kWh will be allowed to receive payments for readiness in the framework of capacity markets until 2025. For existing plants with emissions higher than 500 gCO2/kWh this will be possible until 2030 or even 2035 if a contract for payments has been concluded before 31 December 2030 (Council of Ministers 2017). This may allow countries planning and building new coal-fired power plants, especially Poland, to misuse capacity payments to finance otherwise unprofitable, carbon intensive investments (Reuters 2017b).

The role of coal in the European power sector may also decrease due to the adoption of the new “Best Available Technique (BAT)” conclusions for Large Combustion Plants by the European Commission in July 2017 (European Commission 2017b). These new standards, issued by the Commission in accordance with the Industrial Emissions Directive (European Parliament and the Council of the European Union 2010c), and which all coal-fired power plants in the EU need to meet by 2021, are being exceeded by 82% of the installations. The combined cost of their upgrade amounts to between €8-14.5 billion (DNV GL-Energy 2017).1 Faced with such costs, and increasing competition from renewables, many operators may decide to shut down their plants instead of upgrading them. This is already the case for seven of Spain’s 15 coal power plants (Platts 2018).

While the role of coal in the EU is decreasing, its member states must avoid increasing their reliance on natural gas. While, in the short-term, replacing coal with natural gas contributes to emissions reductions, reliance on unabated natural gas in the longer term is not compatible with the Paris Agreement’s temperature limit (Climate Action Tracker 2017).

According to estimates prepared for the European Commission, despite the recent increases resulting from fuel-switching, natural gas demand is set to decrease: while no quantification of the impact of the recently adopted renewable energy and energy efficiency targets on the natural gas demand is available, the closest EUCO3030 scenario—assuming 30% share of RES and 30% reduction in primary energy consumption—would lead to a decrease in natural gas demand by almost 24% in 2030 in comparison to 2015 (E3MLab & IIASA 2016). Although increased gas use from fuel-switching may be expected to (partially) offset and/or delay this decrease, the more ambitious targets recently adopted—especially the energy efficiency target—can be expected to result in a steeper decrease in gas demand.

This casts doubts on the utilisation of EU resources to co-finance the construction of new natural gas pipelines and LNG terminals (European Commission 2018c), as well as the support of some member states—especially Germany—for the Nord Stream 2 pipeline, which is built on a premise of continuing natural gas use for the decades to come (DIW 2018). A complete divestment from fossil fuel investments, including in new natural gas infrastructure, as recently adopted by the Irish government (Reuters 2018b), is an example to be followed by the EU member states but also the European institutions.

1 | Minimum estimate assumes costs of either NOx or SO2 reductions taking the higher number of the two single measures (SO2 for EU). Maximum estimate assumes cost of NOx, SO2 and dust without cost overlap.

Industry

The EU ETS covers all installations with annual emissions exceeding 25 ktCO2, which apart from the power plants also includes emissions from the energy intensive industries, such as cement, steel and chemicals. However, to decrease the threat of carbon leakage, conditional on the fulfilment of additional criteria, companies in the latter sectors receive free allowances up to the average emissions of the 10% most efficient installations in the sector or subsector in the years 2007–2008 (European Parliament and the Council of the European Union 2014a). The proposal for the EU ETS reform post 2020 aims at adapting the benchmarks for free allocation of allowances to reflect the technological improvements since 2007–2008 (European Commission 2015b). Reflecting more recent improvements in the energy efficiency of the best 10% of installations would also decrease the amount of free allowances received, thus increasing the pressure to increase investment in energy efficiency.

At the same time, part of the resources in the Innovation Fund should be spent on “industrial innovation in low-carbon technologies and processes”. This includes deployment of carbon capture and storage (CCS) as well as utilisation (CCU) (Council of the European Union 2017).

The Industrial Emissions Directive (IED), adopted in 2010, also plays a role in reducing emissions from large industrial installations. The IED aims at reducing the emissions of a number of pollutants, including greenhouse gases, by requiring around 50,000 installations undertaking industrial activities to receive a permit showing that they operate according to the Best Available Techniques (BAT) (European Parliament and the Council of the European Union 2010c). This results in higher energy efficiency and lower emissions. While around 11,000 installations covered under the EU ETS are exempted from complying with standards relating to GHG emissions, it does influence emissions from the almost 40,000 remaining installations that—according to the EID—require a permit to operate.

Transport

Despite the decreasing emissions intensity of passenger cars in the EU (European Commission 2017g), emissions in the transport sector, excluding aviation, increased by almost 18.3% between 1990 and 2016, driven by increasing activity in road transport, both for passengers and freight (European Environment Agency 2018a). Of special concern is the accelerating increase in the emissions from this sector: by 0.9% in 2014, 1.6% in 2015 and 2.8% in 2016 (European Environment Agency 2017b, 2018a)

This trend runs contrary to the EU’s goal of reducing emissions by 60% below 1990 levels by 2050 adopted in the Roadmap of the European Commission from 2011 (European Commission 2011a). This target stands in contrast to the goal of climate neutrality under discussion in the framework of the EU long-term strategy. If the EU were to allow residual domestic emissions by 2050, e.g. from the transport sector, under a carbon neutrality regime it would have to compensate these emissions with significant levels of negative emissions elsewhere. This raises the question of responsibility for these negative emissions outside the EU and mechanisms for their financing, monitoring and verification.

As the transport sector—except for intra-European aviation—is not covered by the EU ETS, the European Union is trying to reduce emissions from the sector in three ways: (i) adopting sectoral renewable energy targets, (ii) introducing CO2 emissions standards for new vehicles, and (iii) promoting low carbon vehicles both for LDV and HDV vehicles. Some member states (e.g. Austria, Denmark, France, Finland, Sweden, Germany, Netherlands, UK, Ireland, and Luxembourg) are also promoting low-carbon modes of transport or announcing plans to ban combustion engines in the coming decades. Member states also have to adopt national policies to reduce emissions in the transport sector, as it is the main sector next to the building sector covered by the Effort Sharing Regulation.

Sectoral renewable energy targets

Sectoral renewable energy targets have been implemented through the Renewable Energy Directive adopted in 2009 which introduced a 10% target for energy from renewable sources in transport by 2020 (European Parliament and the Council of the European Union 2009b). Due to impact that the first generation of biofuels may have on emissions from the LULUCF sector in other countries, in 2015 the role of first generation biofuels and bioliquids in achieving this target was limited to 7%, with the rest having to be met by advanced biofuels and greater use of electricity in the transport sector (European Parliament and the Council of the European Union 2015b). The draft of the renewable energy directive agreed upon by the European Parliament and the Council in June 2018 introduces a new goal of 14% share of renewables in the transport sector in 2030. This target has been flanked by limiting the share of first-generation biofuels at the level no higher than 1% above their share in 2020. Uncertified biofuels that may create the risk of high indirect land-use change emissions cannot be counted toward meeting the 2030 target. The directive also encourages use of energy from second-generation biofuels and electricity. Energy from second-generation biofuels can be counted at twice their energy content and should amount to at least 3.5%. While there is no specific sub-target for electricity in the transport sector, the contribution of renewable power is to be considered at four times its energy content.

CO2 emissions standards for vehicles

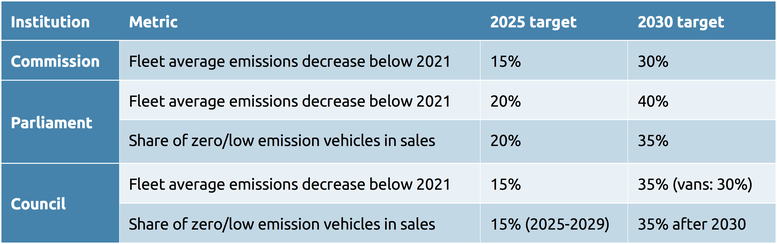

In November 2017, the Commission presented a proposal for new emissions standards for 2030 for passenger cars and light commercial vehicles (European Commission 2017f). In May 2018 a proposal for new heavy-duty vehicles followed. In early October the European Parliament and the Council presented their own positions for passenger cars and vans that also included share of zero or low-emissions vehicles (Council of the European Union 2018c; European Parliament 2018b). The respective positions of all three institutions are presented in the table below. These proposals are expected to be reconciled during interinstitutional negotiations (trilogues) in the coming months. A global Paris Agreement- compatible pathway would imply a phase out of ICE vehicles from sales by 2035 (Kuramochi et al. 2018).

Table 1. Emissions reduction goals for passenger and light duty commercial vehicles

In recent years, it has become clear that the increasing stringency of the emissions standards was accompanied by an increasing gap between test results and real-world performance: according to some estimates in 2015 this gap reached 42% or 31 gCO2/km per vehicle (Transport&Environment 2018). To limit and possibly remove this gap, the proposal suggests replacing the current testing regime by the Worldwide Harmonised Light Vehicles Test procedure (WLTP) and empowers the Commission to introduce the acts necessary to implement this procedure (European Commission 2017e).

Promoting low-carbon vehicles

One of the options available for car manufacturers to reduce the average emissions of their cars is to increase the availability and sale of zero and low-emissions vehicles (Climate Action Tracker 2016a). However, the underdeveloped charging infrastructure remains one of the major limits hindering their market uptake. In 2014 the European Commission adopted a directive obliging member states to ensure that enough publicly available charging stations (at least one for every ten vehicles projected to be on the road) are built in the EU by the end of 2020. It also encouraged member states to facilitate building charging stations in maritime and inland waterways, as well as at airports to allow ships and planes to use electricity while stationary instead of running their engines (European Parliament and the Council of the European Union 2014b).

Another measure to promote e-mobility has been introduced in the recast of the Energy Performance Buildings Directive (EPBD) agreed upon by the European Parliament and the Council in December 2017. According to EPBD, new residential buildings and those undergoing major renovations, with more than ten parking spaces, shall be equipped with an adequate pre-cabling or pre-tubing to enable the installation of recharging points for electric vehicles for every parking space (European Parliament 2017).

To stimulate the cleaner vehicle market, in November 2017 the Commission presented a proposal that included minimum targets for clean vehicle procurement in the public sector (e.g. buses, light duty vehicles) in 2025 and 2030. The level of the target is to be determined by the member state’s GDP per capita and urban population density. According to the Commission’s proposal, at least 29% of buses procured in Romania and 50% of buses procured in 13 other EU member states would have to be “clean vehicles” defined as vehicles with zero emissions art tailpipe or vehicles using bio-methane (European Commission 2017a).

In its Opinion, the European ENVI Committee further strengthened the proposal by suggesting introducing binding targets for some categories of vehicles as soon as 2020 and replacing “clean vehicles” by “ultra-low emissions vehicles” with even stricter emissions standards: maximum 50 g/km for buses in 2020, 25 g/km in 2025 and 0 g/km in 2030. This would require proving that the electricity used to power the buses is “fully based on renewables” (ITRE Committee 2018). The final shape of the directive and its impact will be determined by negotiations between the Council and the European Parliament.

Support for low carbon modes of transport in some member states has led to an increase in the sale of electrically-chargeable vehicles in the first half of 2018 to over 143,000 vehicles—or 1.7 % of all passenger cars sold in the EU. However, the share varies strongly by country, with the share of new battery and plug-in hybrids reaching 5.6% in Sweden, 4.6% in Finland and 4.2% in the Netherlands. The biggest car market in the EU, Germany, trails behind at 1.8% of all new cars being electric, only slightly above the European average (ACEA 2018a) .

This was less than China where electric vehicles reached a market share of 2.1% (Clean Technica 2018) and much less than frontrunner Norway, where in the first six months of 2018 almost every second car sold was electrically charged (ACEA 2018b). Meeting the Paris Agreement-compatible emissions trajectory requires a complete phasing out of the sale of combustion vehicles well before 2035 (Sterl et al. 2016), a goal that would require a much more decisive action by the European Union.

Decarbonisation of the transport sector in the EU is further strengthened by the discussions about banning the sale of cars with combustion engines by some member states, e.g. Denmark and the Netherlands by 2030 (Dutch Government 2017; Euractiv 2018b), and the United Kingdom and France by 2040 (WEF 2017). But the EU as a whole has not yet addressed this issue, and now appears to be falling behind developments in China, Norway and California. During an informal meeting of the EU energy ministers in September 2018 representatives from 25 EU member states agreed to increase cooperation on research into the potential for hydrogen for decarbonisation in different sectors (Reuters 2018a).

Buildings

In the EU, the Energy Performance Buildings Directive (EPBD Directive) first adopted in 2010, regulates emissions from the buildings sector and obliges member states to introduce minimum energy performance requirements and ensure that, from 2021, all new buildings are “nearly zero energy buildings” (NZEB). While defining a NZEB as a building with a very high energy performance, whose energy needs are covered largely from renewable sources of energy, it left the definition of the exact energy consumption level of such building to the member states (European Parliament and the Council of the European Union 2010b). According to the Commission’s estimates, the EPBD Directive has already contributed to additional emissions reduction of 63 MtCO2 in 2013 (European Commission 2016c). To strengthen climate action in this sector, in December 2017 the European Parliament and the Council agreed on a Commission proposal amending the EPBD Directive, obliging each member state to submit a long-term renovation strategy leading to full decarbonisation of its building stock by 2050, with specific milestones for 2030, targeting especially the worst-performing building stock (European Parliament and the Council of the European Union 2018b).

It remains to be seen whether this will help to address the issue of the low rate of deep renovation of the existing building stock which currently amounts to between 1–2% of the total stock. With 2% in France, 1.5% in Germany, to 0.12% in Poland and 0.08% in Spain, there is much variety among the EU member states in terms of the deep renovation rate of residential buildings (ZEBRA2020 2017). An increase of the renovation rate to 5% would be necessary to make emissions from the building sector compatible with the 1.5°C temperature increase limit (CAT 2016). Since 35% of the EU’s building stock is over 50 years old and the overall lifetime reaches beyond 100 years in many cases in Europe, increasing the renovation rate could significantly reduce energy consumption and emissions (European Parliament 2016). A report prepared for the European Parliament noted that to increase the rate of renovation it is necessary to raise awareness about efficiency options, raise the ambition of the renovation regulations, and increase the availability of the funding instruments for deep renovation (European Parliament 2016), measures which have not found widespread use so far.

Much more effective has been European legislation dealing with the energy efficiency of household appliances. The Ecodesign and the Energy Labelling directives, adopted in 2009 and 2010, respectively (European Parliament and the Council of the European Union 2009a, 2010a) is set to reduce emissions by 315 MtCO2eq in 2020 and 515 MtCO2eq in 2030 (European Commission 2017c). The working plan for 2016–2019 includes measures that, combined, would lead to primary energy savings equivalent of over 100 TWh in 2030 (European Commission 2016a).

Forestry

LULUCF emissions have not yet been included in either the EU ETS or non-EU ETS sectors. This has changed with the adoption of the EU regulation that aims at including the GHGs emissions and removals from this sector in its 2030 climate and energy framework by allowing the use of net removals from this sector to comply with the targets in the non-EU ETS sectors by up to 280 MtCO2 in the period 2021–2030 (European Commission 2016f). The Regulation includes a no-debit rule meaning that emissions from deforestation could be offset by either afforestation or improved management of the existing forests (European Commission 2016f). However, this target is weakened by the possibility of using 2021-2025 LULUCF emissions reductions to offset emissions in the second half of the decade.

The regulation also introduces flexibility on the accounting of emissions reductions from managed forests amounting to up to 360 MtCO2 in the period 2021-2030. Finland will be granted additional compensation of 10 MtCO₂ for the 2021–2030 period “in view of the special circumstances of its forestry sector”. However, EU member states will only be activating this ‘managed forest land’ flexibility mechanism if the EU collectively meets the ‘no-debit’ rule (European Parliament 2018c).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter