Policies & action

CAT rates India’s current policies and action as “Insufficient” when compared to its fair share contribution. The “Insufficient” rating indicates that India’s climate policies and action in 2030 are not yet consistent with the 1.5°C temperature limit, and need substantial improvements. If all countries were to follow India’s approach, warming could be over 2°C and up to 3°C.

The CAT estimates that India’s emissions will be around 4.4–4.6 GtCO2e in 2030 under current policies – an increase of around 8–11% since our last update. With each update, projected emissions for 2030 under current policies continue to rise, indicating that India is moving further away from a 1.5°C-compatible pathway. This underlines the need for more effective policy design and implementation.

India will need to implement additional policies using its own resources to make a fair contribution to addressing climate change, but it will also require international support to implement all the policies necessary for achieving 1.5°C compatibility.

Please refer to the assumption section here for details on CAT current policy and action projection.

Further information on how the CAT rates countries (against modelled domestic pathways and fair share) can be found here.

Policy overview

India’s climate policy is articulated through a range of policy documents, sector-specific strategies, and legislative frameworks, with the National Action Plan on Climate Change (NAPCC) serving as the overarching policy framework. Recent and notable policy documents and laws include the National Electricity Plan 2023 (NEP2023), the National Green Hydrogen Mission and the recently amended Energy Conservation Act (Ministry of Law and Justice, 2022; Ministry of New And Renewable Energy, 2023; Ministry of Power, 2022b).

A sustained and comprehensive policy push played a pivotal role in the steady increase in the deployment of renewable energy in the power sector. Between 2023 and 2024, investments in renewable energy projects increased by an impressive 91.5% (IEEFA, 2025b). Large-scale projects in particular are gaining momentum, with 73 GW of capacity, primarily solar, tendered so far, surpassing the government’s annual target of 50 GW (IEEFA, 2025a). Meanwhile, the addition of 22 GW of rooftop solar in the fiscal year 2023-24 was higher than in any previous year (Niti Aayog, 2024).

As a result, the majority of the additional electricity demand was met through renewable sources for the first time in 2024. Although renewable energy generation is increasing, its overall share in total electricity generation (including large hydro) remains around 25%, since it started from a smaller base compared to conventional sources, showing no improvement since last year (Niti Aayog, 2024). Moreover, overall progress towards the NEP2023 target remains slow, with more than 100 GW of new renewable capacity still needed to meet the ~340 GW interim target set for 2026-27.

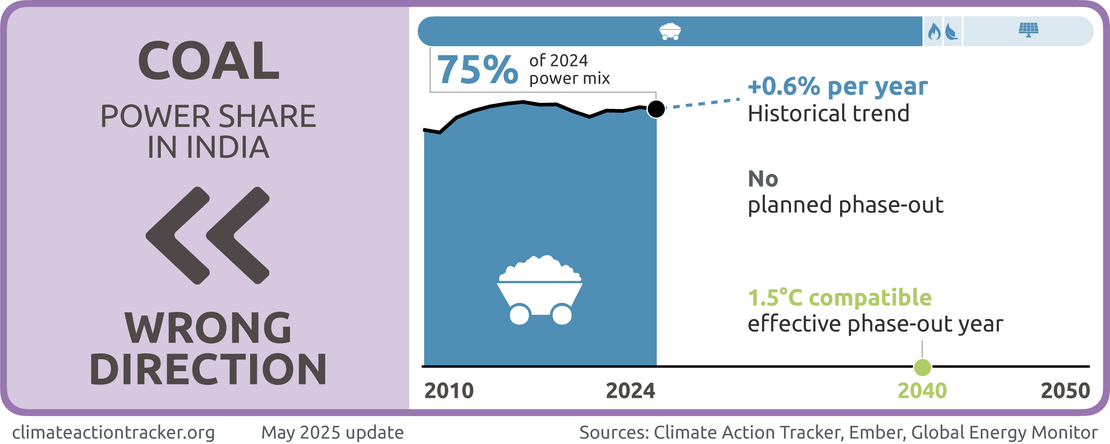

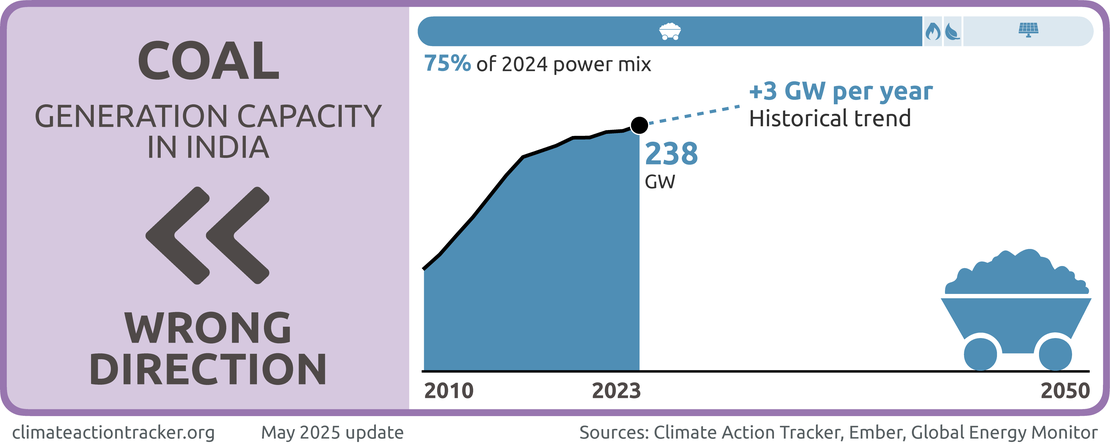

The growth in renewables has caused the share of coal in total capacity to fall below 50% for the first time in 2023, reaching 47% in 2024 (Niti Aayog, 2024). However, India has not yet committed to phasing out coal power, although the National Electricity Plan 2023 indicated a pause in coal capacity additions in the short term, with no capacity addition until 2027 (Ministry of Power, 2023b).

But this target is not being realised, as the capacity currently under construction exceeds the planned level. Approximately 27 GW is under construction and 92 GW is in the pre-construction stage (as of July 2025) (Global Energy Monitor, 2025b). This is way more than what is proposed under NEP2023 under long term capacity addition between 2027-2032 of 24 GW.

Although the government has abandoned plans to increase fossil gas capacity, it has increased the utilisation of existing gas power plants to meet growing electricity demand. Gas-based power generation increased by around 30% between 2022 and 2024.

Rising temperatures and the corresponding increase in cooling demand are some of the key drivers behind India’s growing electricity consumption. In 2025, India experienced extreme summer temperatures once again, as in previous years. The peak demand in June 2025 reached 241 GW, lower than last year’s peak of 246 GW due to unusual rains (Michael et al., 2025; Ministry of Power, 2025).

In order to meet the increase in demand, there has been a steady rise in the domestic production and import of both coal and fossil gas. While this may be necessary in the short term, it poses significant long-term risks to energy security due to the volatility of global fossil fuel markets, potential supply disruptions, and the environmental and socio-economic consequences of continued reliance on fossil fuels.

Lastly, the union budget for 2025-26 outlines a significant push for nuclear energy as part of India’s long term energy transition strategy, setting a target of 100 GW of nuclear capacity by 2047 and allocating INR 200 billion (USD 2.3 billion) to support its development (Department of Atomic Energy, 2025). At present India has 8 GW of nuclear capacity.

India is making significant strides in the non-power sectors to advance its decarbonisation agenda. The government’s updated National Green Hydrogen Mission sets a target of producing 5 million tonnes of green hydrogen annually by 2030, aiming to decarbonise hard-to-abate sectors such as refineries and fertiliser production. Several financial and other policy support measures are under discussion, including a potential purchase mandate for industry.

India is also preparing to launch its national compliance carbon market by mid-2026 under the Carbon Credit Trading Scheme (CCTS). The scheme will set emissions intensity targets for energy-intensive industrial sectors, building on the earlier Perform, Achieve, and Trade (PAT) system, but will not impose absolute emissions reduction caps.

In transport, while overall adoption of EV is slow, with support of the PM E-DERIVE scheme, which replaces FAME II and provides incentives for battery-powered vehicles mainly two and three wheelers. Electric bus deployment is expanding but plans to shift long-haul trucks to LNG risk locking in fossil fuel use.

Power sector

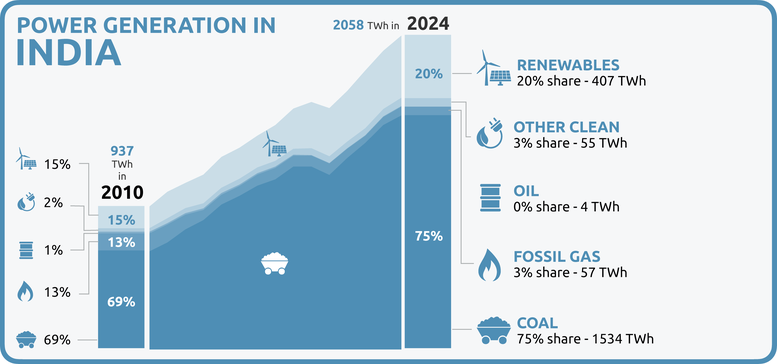

India relies heavily on fossil fuel-based power generation, predominantly coal, which accounts for 75% of the country's current electricity generation. Renewables (including large hydro) make up the second largest share of India’s power generation at ~20% (Niti Aayog, 2024). Over the past five years, both coal and renewables have increased significantly in terms of absolute power generation, but their respective shares of power generation have remained close to constant.

This indicates that the steady growth in renewable power generation has largely served to meet rising electricity demand, rather than displacing fossil generation and thereby driving a structural shift toward power sector decarbonisation.

In recent years, extreme heat has pushed electricity demand to record highs. Peak electricity demand reached approximately 241 GW in June 2025, lower than the previous high of 246 GW in September 2024, mainly due to unusual rainfall (Down to Earth, 2025).

India has made significant progress in renewable energy deployment, with around 220 GW of renewable energy capacity installed (including large-scale hydropower), representing 46% of the country’s total generation capacity (Niti Aayog, 2024). This includes 48 GW of large hydro, 12 GW of bioenergy, 48 GW of wind, and 98 GW of solar power, with about half of solar capacity installed in the last three years alone.

The consistent dominance of renewables in capacity additions signals policy effectiveness, investor confidence, and declining technology costs. However, the slower reflection of these trends in actual power generation highlights persistent structural challenges such lack of grid integration because of limited storage capacity, and seasonal dependence on hydropower.

In 2024–25, the bulk of additional electricity demand is being met by renewable energy. Of the total 86 TWh increase in total generation, solar and wind have contributed 26 TWh (30% of total additional generation), large hydro 14 TWh (17% of total additional generation), resulting in non-fossil sources (including nuclear) to contribute 57% of total additional demand. This marks a significant shift from previous years.

For the detailed methodology on our power sector evaluation, please see here.

Coal

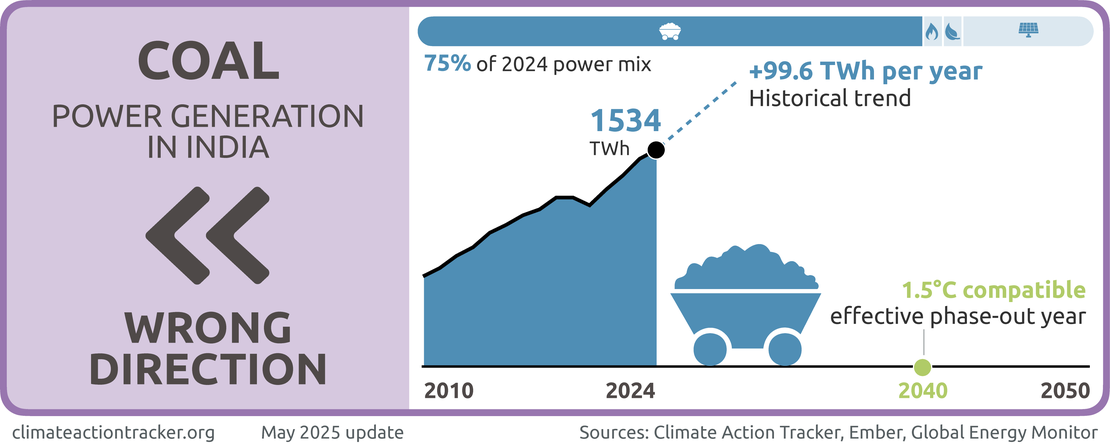

India’s electricity generation relies heavily on coal, representing over 75% of the country’s power mix. While the expansion of renewable energy has reduced coal’s share in installed capacity to below 50%, its contribution to actual generation remains high. Furthermore, almost 27 GW of new coal capacity is currently under construction and 92 GW in pre-construction (Global Energy Monitor, 2025b). Coal-based generation increased from 1295 TWh in 2023-2024 to 1332 TWh in 2024-25. This continued reliance on coal is clearly inconsistent with the 1.5°C temperature limit.

Given the substantial operational and planned coal capacity, and the absence of a clear phase-out strategy, we assess progress in this sector as moving in the “Wrong direction.”

To be 1.5°C compatible, India's coal power generation would need to be significantly reduced by 2030 (to reach 17–19% of total generation) and effectively phased out by 2040 (Climate Action Tracker, 2023). India will need international support to achieve a transition at this scale.

The Indian government has no plans to shut down any coal power plants before 2030 (Global Energy Monitor, 2024) and is instead planning to increase coal capacity. In 2023, when India adopted its National Electricity Plan (NEP 2023), there was an indication of a pause in new coal capacity, with no new additions until 2027. However, a further 24.2 GW has since been planned for 2027–2032.

Between 2021-2025, around 11 GW coal capacity has become operational and another 27 GW of new coal power plants is under construction (Global Energy Monitor, 2025b). Although India’s annual coal capacity additions have declined significantly since 2015, when they were around 15-20 GW annual capacity additions, new capacity additions in 2023 and 2024 were still around 5 GW. With continuous additions to the coal capacity and an absence of any effective plan for early retirement, it is unlikely that India will see any “phase-down” soon.

India’s coal power sector is facing several challenges, including operational inefficiencies and technological hurdles, as reflected in falling plant load factors. The sector is also becoming less cost-competitive than renewables, and is under financial stress (Chakravarty & Somanathan, 2021), (Buckley & Shah, 2018; Business Standard News, 2021). More than 500GW of coal projects have been cancelled since 2010, primarily due to lack of financial viability.

These factors create a strong case for the early retirement of the existing capacity. However, one challenge to phasing out coal is India's young fleet: the average age of coal plants is between 13 and 15 years (IEA, 2020a). Without an effective early retirement plan in place, existing capacity could remain operational for another 40 to 50 years. There is a significant risk that India’s coal infrastructure will become stranded assets in a 1.5°C compatible world (Malik et al., 2020; Montrone et al., 2021).

Similar to previous years, this year India is again dealing with record summer temperatures, leading to a peak demand of electricity of 241 GW in June 2025, surpassing previous high of 246 GW from 2024 (Michael et al., 2025).

With extreme heat pushing electricity demand to record highs, coal power generation also reached a new record of 122 TWh in May 2024, leading to a steady increase in power sector emissions (Ember, 2025a). In 2024, power plants consumed a total of 875 million tonnes of coal, marking a significant increase from the 835 Mt consumed in 2023 (Ministry of Power, 2025).

In 2024, an estimated 19% of the total electricity demand in India was attributed to hotter temperatures compared to 2023 (Ember, 2025b). As climate change continues to influence weather patterns in India, it is crucial to develop a robust power sector demand and supply plan, as India has a significant unmet cooling demand due to low air-conditioning ownership. This should be based on a transition to renewable energy to meet the peak load, supported by storage infrastructure. Without transferring the peak load to renewable energy sources with infrastructural support, India's dependence on coal will remain to meet summer demand.

Coal production for power

India is the world’s second-largest coal producer after China, but remains a net importer due to the sheer scale of its demand. Approximately 90% of domestically produced coal is used for electricity generation. In response to rising electricity demand, the government has implemented measures to ramp up domestic production, which reached 1 billion tonnes in 2024-25 and has increased since. This upward trend has been consistent over the past decade, with production rising steadily from 565 Mt in 2014 (Ministry of Coal, 2023a).

The fact that coal continues to play a central role in India’s energy strategy is directly attributable to its domestic reserves – unlike in the case of oil and gas, of which it is not a significant producer (Mining Technology, 2023; Ministry of Petroleum and Natural Gas, 2023). In pursuit of expanding domestic supply, India held its eleventh coal mine auction in December 2024, with 20 new blocks on offer (Mining Technology, 2024). Over the past decade, more than 160 coal blocks have been auctioned, representing a combined peak capacity of 575 million tonnes per year.

Fossil gas

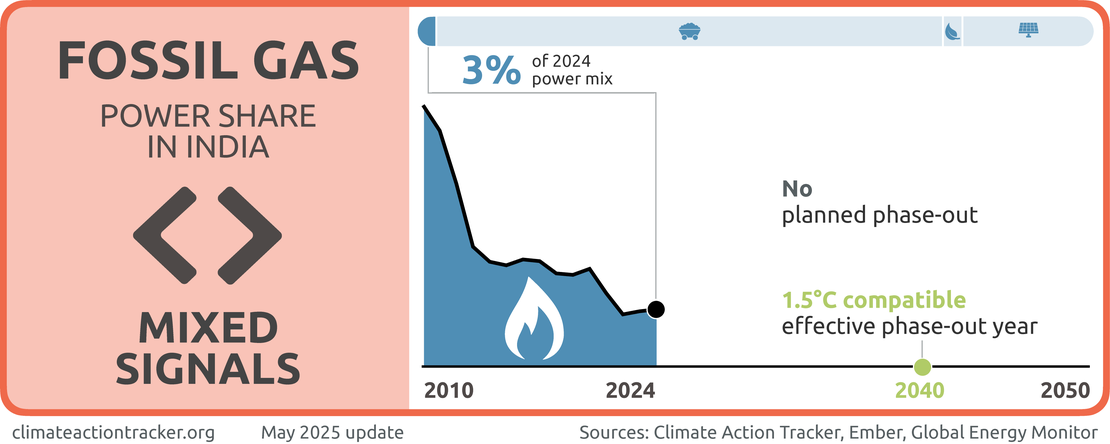

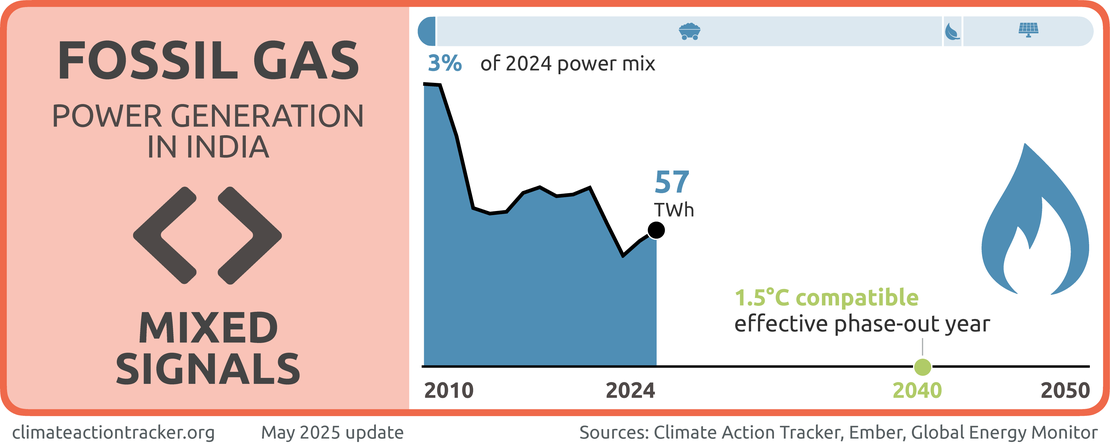

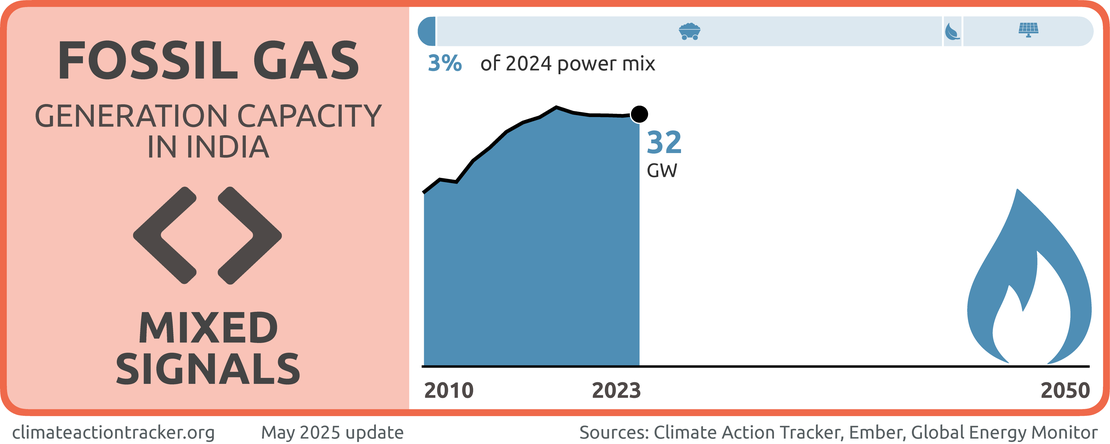

Although the share of fossil gas in total power generation remains low and has declined over the last five years, the absolute amount of fossil gas-fired generation has increased year-on-year since 2022, primarily to meet rising summer peak demand. At the same time, two additional fossil gas-fired power plants are currently in the pipeline – totalling 1.27 GW of capacity.

We evaluate India’s progress in phasing out fossil gas in the power sector as “Mixed signals.”

India has 25 GW of operational gas power capacity. However, its utilisation declined, from share in total generation declining to 2% in 2024 from 11% in 2010, partly due to the limited availability of domestic gas supply (IEA, 2023b). As in previous years, a surge in summer electricity demand has led to gas-fired power plants being brought back online temporarily to help meet peak loads. The government even invoked emergency laws, directing power producers to operate under-utilised gas-based plants at higher capacities between May 26 and June 30 of 2025 (Bloomberg, 2025; Reuters, 2025). A significant share of gas-based generation is fuelled by imports, with 45% of total gas used in power plants being sourced from abroad (S&P Global, 2024).

In 2016, India announced its intention to be a “gas-based economy” and has set a target of increasing the share of gas in its energy mix to 15% by 2030 (Indian Express, 2016). However, since then, the share of gas in primary energy has increased only marginally to 6.83% in 2020 and fell to 5.9% in 2023 (IEA, 2024b; Niti Aayog, 2025).

India is emerging as one of the main buyers of LNG in Asia, following China and Japan, with a record import of 2.72 million tonnes in June 2023 – marking a 54% increase compared to the same month in 2022 (Reuters, 2024b). These financial resources could instead be directed towards scaling up renewables and enhancing India’s energy independence and security.

A recent report by the IEA projects a 60% increase in India’s gas demand, of which 70% will come from power sector (IEA, 2025). However, this report also mentions that the gas prices would likely need to be below USD 6/MBtu for gas-fired generation to be competitive with coal. As of 2023, the cheapest domestically produced gas is priced at USD 6.5/MBtu (IEA, 2025).

Gas infrastructure

The government plans to support the expected import growth through the expansion of LNG terminals and re-gasification capacity, and infrastructure development to facilitate LNG transportation (The Economic Times, 2020; Times of India, 2020).

India's LNG regasification capacity has expanded significantly, increasing by 90% over the last decade. As of late 2024, the total capacity is 65 bcm/yr across seven terminals (IEA, 2025). To meet projected demand, India plans to add nearly 40 bcm/yr of additional regasification capacity by 2030 (Global Energy Monitor, 2024b).

As of 2024, more than 23,500 km of gas pipelines are operational. Under the "One Nation, One Gas Grid" initiative, the Petroleum and Natural Gas Regulatory Board (PNGRB) has approved about 33,600 km of new pipelines, with the total length expected to reach around 35,200 km towards the end of the decade. These pipelines are being developed with the potential to accommodate green hydrogen in the future.

Industry is the biggest consumer of fossil gas in India. Besides being used for energy purposes, it is used as a feedstock for manufacturing fertiliser and petrochemicals. While fossil gas only accounted for 4% of industrial final energy consumption in 2023, the current policies scenario shows a doubling of gas use by 2030 and a four-fold increase by 2050 (IEA, 2024a).

India’s plans on fossil gas combustion and infrastructure expansion are not consistent with a 1.5°C world. India could save billions if it ditched its gas plans and shifted to a 1.5°C compatible pathway (Climate Action Tracker, 2022). Investing in capital-intensive gas infrastructure further exposes India to risks such as a carbon lock-in, stranded assets, and increased energy import dependency (Climate Action Tracker, 2022).

Taxes and subsidies for fossil fuels

In India, subsidies are available for both fossil fuels and renewable energy in the form of direct subsidies, fiscal incentives, price regulation and other government support, but total subsidies for fossil fuels, including both demand and supply side are eight times higher than those for renewables. Overall, India’s fossil fuel subsidies have declined by approximately 70% over the past decade, primarily due to an 80% reduction in oil and gas subsidies in a phased manner (IISD, 2024). While coal subsidies declined between 2014 and 2021, they then began increasing again, doubling in 2023 compared to 2021. Coal India Ltd., a public limited company and the largest government owned coal producer in the world, receives an annual USD 2bn in subsidies (The New York Times, 2022).

A tax on coal (“coal cess”) was introduced in 2010-11, when the government set up the National Clean Energy Fund (NCEF) to provide financial support to clean energy initiatives and technologies. However, the purpose of the NCEF has changed over time. Since 2017, with the introduction of the Goods and Services Tax (GST), the coal cess has been replaced with the GST Compensation Cess, which is no longer directed into the NCEF and at that time the fund value of NCEF was around USD 6.6bn (IISD, 2019). Recently an inter-ministerial committee has proposed a higher cess on imported coal (Business Standard, 2024b) (For more details please refer to our previous updates).

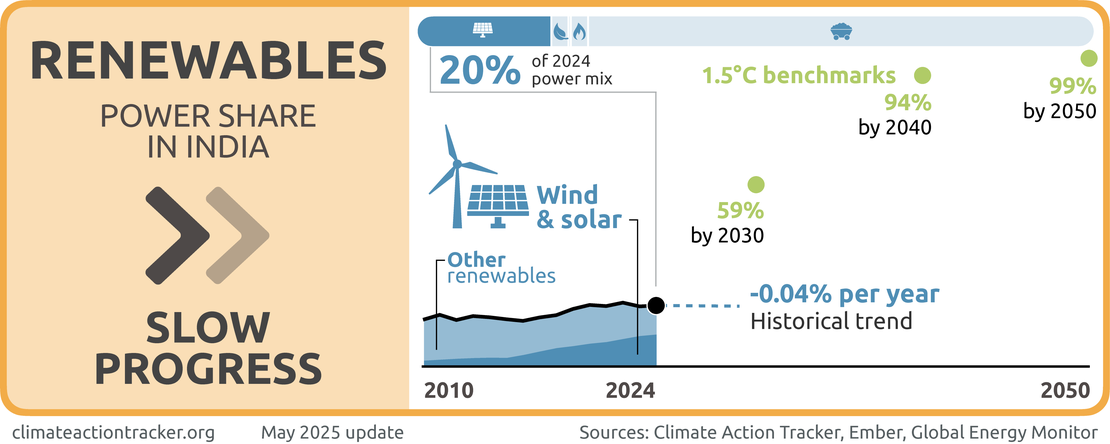

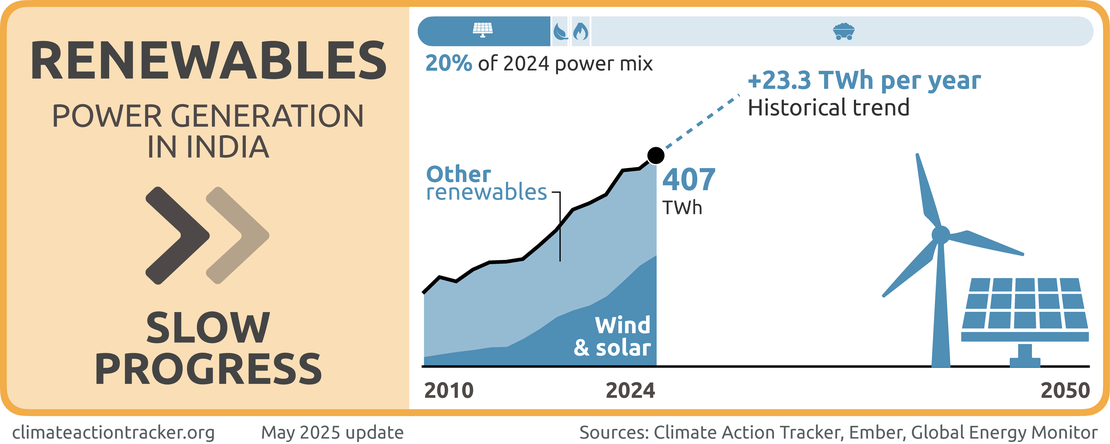

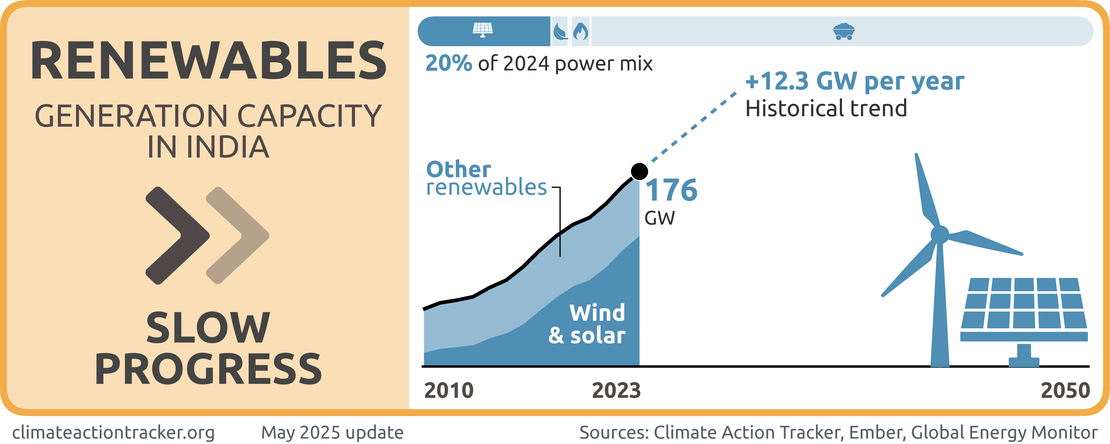

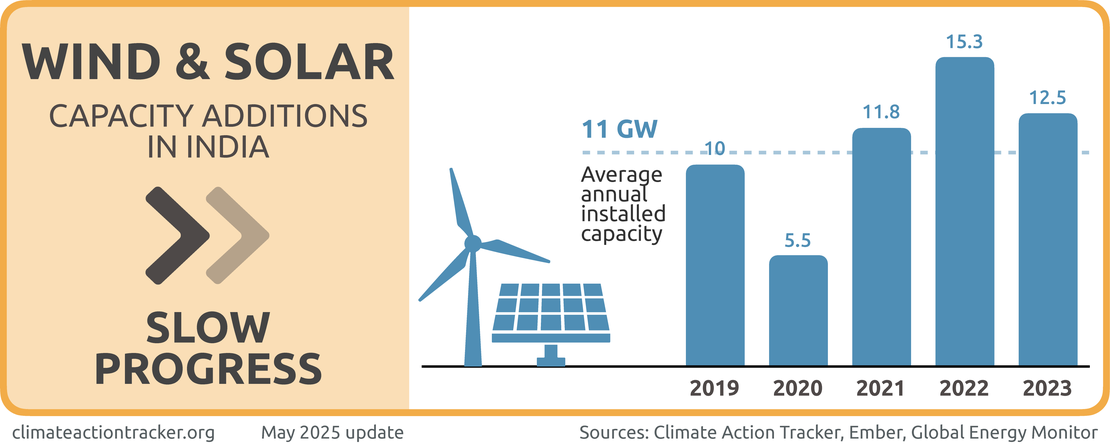

Renewables

India is making notable progress in renewable energy (excl. hydro) deployment – both in terms of total installed capacity and total electricity generation. Renewable capacity (including large hydro) amounts to 220 GW, representing 46% of its total generation capacity (Niti Aayog, 2024). This includes 48 GW of large hydro, 12 GW of bioenergy, 48 GW of wind, and 98 GW of solar - about half of solar capacity was installed in the last three years alone. However, these capacity additions are not yet reflected in the power mix: the share of renewables (including large hydro) has been rather stable at around 22% (Niti Aayog, 2024).

We evaluate India’s progress in renewables in the power sector as “Slow progress” (for detailed methodology on power sector evaluation please see here).

The National Electricity Plan 2023 (NEP 2023), adopted in May 2023, envisages adding considerable solar and wind capacity by 2031-32: 311 GW and 82 GW respectively (Ministry of Power, 2023b). The plan is consistent with India’s target of achieving 500 GW of non-fossil capacity by 2030. The NEP 2023 also specifies interim targets for 2026-27: 186 GW for solar and 73 GW for wind.

As of March 2025, India has cumulative capacity of added 98 GW of solar and 48 GW of wind. To stay on track with NEP 2023, the annual growth rate of capacity installation needs to average around 50% for solar and 20% for wind. However, current year-on-year growth rates are only 20% for solar and 10% for wind, indicating a shortfall in the pace of deployment.

This gap is even more pronounced in electricity generation. NEP 2023 envisages annual growth rates in generation of 80% for solar and 30% for wind, but actual average annual growth has been around 25% for solar and just 7% for wind. This indicates a slow progress for renewable energy installations and calls for a stronger implementation strategy.

Solar and wind have become the lowest-cost electricity sources in India, even without subsidies. Large-scale auctions have contributed to the rapid development of renewable energy at decreasing prices (Schlissel & Woods, 2019). The solar tariff has declined by around 60% between 2016 to 2024 (from USD 0.0786/kWh to USD 0.028/kWh), mainly because of falling capital costs (MERCOM, 2022). Solar with storage has also become competitive in India: the reverse auction in 2024 saw solar PV with storage posting the lowest bid of USD 0.041/kWh; lower than the average cost of coal generation at USD 0.051/kWh (Andy Colthorpe, 2024; Ember, 2023).

Access to capital for the sector has improved significantly. This is attributed to key policies like long-term Power Purchase Agreements (PPAs), ‘must-run’ status, and transmission waivers, which have successfully helped mobilise private capital at scale. Total investment in the renewable energy sector saw a 91.5% year-on-year increase in the quarter ending December 2024, totalling over USD 4.66 billion, mainly from private sector (IEEFA, 2025d). These examples highlight growing investor confidence and the increased availability of capital for clean energy expansion in India.

Renewable Energy Certificates (RECs) are in place that promote renewable energy and facilitate Renewable Purchase Obligations (RPOs), which legally mandate a percentage of electricity to be produced from renewable energy sources. The Ministry of Power has revised the minimum renewable purchase obligation for the power distribution companies, gradually increasing it from 24.6% in 2023 to 43.33% in 2030 (MERCOM, 2023). Per technology, these increases were: 0.81% to 6.94% for wind, 0.35% to 2.82% for hydro and 23.44% to 33.57% for solar (Business Standard News, 2022). The Ministry of New and Renewable Energy (MNRE) has also issued clarifications that Renewable Energy (RE) Generating Stations have been granted ‘must-run’ priority dispatch status which will allow grid operators to prioritise the dispatch of electricity from renewable energy (PIB India, 2021).

As positive as the recent growth and future plans for renewables are, they are not sufficient for 1.5°C compatibility. To be 1.5°C compatible, 70-75% of India’s electricity generation should come from renewables in 2030 (Climate Action Tracker, 2023). International support is critical to achieve this. India is already on track to achieve its 2030 targets under current policies. With international support, this could be strengthened.

Solar energy

Large-scale renewable energy projects in India continue to gather momentum with 59 GW of mainly solar power out for tender, surpassing the government annual target of 50 GW (IEEFA, 2025b). There has also been a record increase in wind-solar hybrid energy storage systems, comprising over half of the complex auction volumes.

Despite this robust auction activity, actual installations are not keeping pace, with only a 16% year-on-year increase in installed capacity to 209 GW by December 2024 (IEEFA, 2025b). This slowdown is attributed to key bottlenecks hindering project execution, such as delays in transmission infrastructure and securing right of way, persistent policy-related challenges like offtake risks and PPA renegotiation, particularly for state-bid projects. While access to capital has improved, addressing these implementation and policy barriers is crucial to bridging the gap between auction success and projects coming online. Around 40GW of renewable energy capacity is being delayed due to unsigned Power Sale Agreements.

This increase in utility-scale renewable energy projects requires more inclusive land acquisition and rehabilitation policies, as an increasing number of farmers’ disappointments are now being reported from previous solar park projects where the promise of additional income, jobs or compensation in return for fertile land was not delivered (DownToEarth, 2023a; Pulitzer Center, 2023).

India is also experiencing a significant surge in rooftop solar installations, with a near doubling of capacity additions between 2023-24 and 2024-25 (Niti Aayog, 2024). This marks a major shift - from being a laggard to a leader in the sector globally. The growth is driven by various favourable policies and financial mechanisms, particularly for households, which are receiving substantial support through the PM Surya Ghar rooftop solar scheme (Economic Times, 2024a). Despite regulatory challenges and limited support from local electricity distribution companies (DISCOMs), the sector is poised for robust growth due to declining solar module costs and innovative business models like virtual net metering and peer-to-peer trading (Economic Times, 2024c). In recent years, floating solar power plants have become part of India's plans for solar expansion (IEEFA, 2023b).

Domestic PV manufacturing

The Indian government has taken a multifaceted approach to encourage solar module manufacturing, recognising its importance for a self-reliant energy transition in India. In 2022, it approved a USD 2 billion production-linked incentive (PLI) scheme to attract an additional USD 11 billion in private investment (The Economic Times, 2023c). As of March 2025, India’s module and cell production capacity stood at around 80 GW and 7 GW respectively, and were expected to reach 95 GW by the end of 2025 and 110 GW by 2026, making India the second-largest manufacturer globally (Carbon Brief, 2025),(IEEFA, 2023e). This growth puts the country in a good position to meet its planned solar capacity of 311 GW by 2030 (Ministry of Power, 2022b). However, India still relies on imports of solar cells, accounting for half of China’s exports in this area (Carbon Brief, 2025).

To increase the demand for domestically-produced solar modules, the government has imposed a customs duty of 40% on imported solar modules and 25% on solar cells, alongside an increased the goods and services tax (GST) on renewable energy equipment (IEEFA, 2022). However, due to a shortfall in domestic supply, the government is now considering reducing the customs duty to 20% (Reuters, 2023a).

India also seeks to capitalise on export opportunities, particularly to markets seeking alternatives to China, such as the USA. India's solar panel export value saw a dramatic increase, rising 23 times to USD 2 bn in FY2024 compared to FY2022 (The Sentinel, 2025). While exports of finished and semi-finished products are growing, dependence on imported cells – especially from China – remains a key challenge.

Wind energy

Wind is the second cheapest energy source after solar with a tariff range of INR 2.8-3.1/kWh (USD 0.034/kWh to USD 0.04/kWh) in 2022 (GWEC, 2022).

Wind power is supported via the Generation Based Incentive, while state-level feed-in tariffs apply for all renewables. Recently the government has approved viability gap funding (VGF) of around USD 893m for offshore wind energy projects of 1 GW capacity (Deccan Herald, 2024).

Hydropower

Besides solar and wind energy, large hydropower is also an important part of India's power sector. In March 2025, the total capacity of large hydroelectric power stood at 48 GW. According to the (NEP) 2023, this capacity is projected to increase to up to 62 GW in 2031. Small hydro added another 5 GW in 2024. The government has developed a Standard Operational Procedure (SOP) for small and large hydro projects to ensure environmental sustainability (CEA, 2024c). In 2024-25 hydropower generation has seen a rebound after a slowdown due to drought in the region.

Energy Storage

Grid-scale energy storage technologies will play a critical role in addressing peak demand. There is a notable shift towards more capital-intensive projects such as Battery Energy Storage Systems (BESS) and Pumped Storage Plants (PSPs), in addition to hybrid projects and Round-The-Clock (RTC) power tenders (IEEFA, 2025d).

The NEP 2023 indicates a need for 236 GWh of BESS capacity to integrate planned renewable energy by 2030. However, as of March 2024, India had only installed 0.2 GWh of BESS capacity – a vast gap to the target (IEEFA, 2025d). Regulatory uncertainties and project cancellations are the primary reason for the slow progress.

In 2023, a total 4 GW of energy storage tenders were awarded, half of them for pumped storage (IEEFA, 2023f). The Ministry of Power has now released a detailed framework for promoting energy storage systems (ESS), including both pumped and battery storage (Ministry of Power, 2023c). This guideline also advocates for Viability Gap Funding (VGF) in ESS projects, for up to 40% of capital costs, along with other regulatory and economic incentives, which has significantly improved project viability. This support has led to tariffs approximately 40% lower than non-VGF projects for two-hour storage durations (IEEFA, 2025c). Government has announced a VGF funding of INR 54 billion (~USD 630 million) for BESS to support round the clock renewable capacity (Goswami, 2025).

Guidelines for pumped storage projects (PSPs) have now been finalised and adopted and should help spur additional development (Ministry of Power, 2023a). India has around 4.7 GW of installed PSP capacity, but its electricity authority estimates that the total PSP potential is over 100 GW. However, concerns expressed by environmental experts over the exemption from environmental clearance of PSPs located in old dams and off-the-river have not been taken into account (Ministry of Power, 2023a; Mongabay, 2023).

In July 2022, India introduced an Energy Storage Obligation as part of its broader renewable energy purchase requirements (Ministry of Power, 2022c). The Energy Storage Obligation (ESO) required that an increasing percentage of renewable energy comes from stored wind and solar power, starting at 1% in 2023-2024 and rising to 4% by 2029-2030. However, in the latest revision of RPO rates, the ESO appears to have been dropped (MERCOM, 2023).

The National Green Hydrogen Policy (more below) also envisages using green hydrogen as a storage option.

Industry

In 2023, industry was the largest emitting end-use sector, accounting for 61% of total CO2 emissions (excluding LULUCF) (IEA, 2024b). This includes both energy-related emissions and industrial process emissions, the latter of which accounted for 9% of total emissions (Gütschow et al., 2025). Industry also accounts for the largest share of total primary energy demand (38%), having grown at an annual rate of 5% over the last 10 years (IEA, 2024b).

Pathways compatible with a 1.5°C temperature increase show that the share of electricity in the industrial energy mix must increase from 15% to 48% by 2030 (Climate Analytics, 2021). The electrification of industry is essential to reduce the use of fossil gas and limit the need for green hydrogen, the production of which requires various conversion steps and leads to much lower process efficiency compared to the direct use of renewable electricity.

Energy efficiency

The Indian government amended the 2001 Energy Conservation Act in late 2022 (having last made revisions to the law in 2010). The Act regulates energy consumption by equipment, appliances, buildings and industries. The major amendments include:

- An obligation to use non-fossil sources of energy for industry, transport, buildings

- Carbon trading

- Energy conservation code for buildings, both commercial and residential

- Standards for vehicles and vessels

- Allotment of regulatory powers of State Electricity Regulatory Commissions

- Changes in the governing council of the Bureau of Energy Efficiency

Specifically, the Act mandates the use of non-fossil fuel sources for industries such as mining, steel, cement, textile, chemicals and petrochemicals. The amendments also allow industries to buy renewable energy directly from the producers, providing them with price certainty.

The main instrument to increase energy efficiency in India’s industry is the Perform, Achieve and Trade (PAT) Mechanism, which has been in place since 2012 and is implemented under the National Mission on Enhanced Energy Efficiency. It covers 13 energy-intensive sectors and nearly 25% of the energy use. The first cycle of the PAT scheme resulted in savings of 5.6 GWh and 31 MtCO2e between 2012 and 2015 (BEE, 2018). The second cycle of PAT (2016-17 to 2018-19) resulted in total reduction of approximately 61.34 MtCO2e emissions, resulting in savings of INR 800bn (USD 9.3 bn). As India is now adopting a carbon market including all the industries covered under PAT, this scheme will be phased out.

Industry is the biggest consumer of fossil gas in India where, apart from being used for energy purposes, it is used as a feedstock for manufacturing fertilisers and petrochemicals. Green hydrogen is going to play an important role in the decarbonisation of these industries (Ministry of Petroleum and Natural Gas, 2023).

The India Hydrogen Alliance (IH2A) has urged the Indian government to implement mandatory green Hydrogen Purchase Obligations (HPOs) to meet the National Green Hydrogen Mission target of producing 5 million metric tonnes of green hydrogen annually by 2030 (Business Today, 2025). Without such mandates, less than 1% of this target is currently being met, putting over USD 80 bn in planned hydrogen investments at risk.

Micro, Small and Medium Enterprises (MSMEs) contribute around 30% of India’s Gross Domestic Product (GDP), 40% of its exports and 20-25% of its heavy industry energy consumption (IEEFA, 2023d). MSMEs are significant energy consumers, responsible for approximately 110 MtCO2 of emissions annually (WRI, 2024). With energy consumption for this sector projected to rise by 50% by 2030, enhancing energy efficiency within this sector is crucial for India's clean energy transition.

The 2024 Budget announced special reforms for MSMEs, including easier access to loans and a modern and inclusive approach to credit assessment and extending financial support for shifting to cleaner energy and implementing energy efficiency measures (Climate Group, 2024).

The Ministry of Steel has launched a Green Steel Mission & Roadmap potential to shape the future of India’s steel industry (Ministry of Steel, 2024). One of the most promising policy directions is the use of green hydrogen in steelmaking. The roadmap sets a target to reduce the sector’s energy intensity from 2.54 to 2.2 tCO2 per tonne of crude steel by 2030 and promotes Green Public Procurement (GPP) to create early demand by positioning the government as a lead customer for green steel.

Green hydrogen

India’s push toward green hydrogen is strongly driven by its energy-intensive industrial sector, particularly steel and fertiliser production. The government has allocated an annual green hydrogen production capacity of 862,000 tonnes to 19 companies and awarded 3,000 MW of electrolyser manufacturing capacity to 15 firms. Pilot projects have been initiated across various sectors, including steel, mobility, and shipping, to demonstrate the viability of green hydrogen applications.

The National Green Hydrogen Mission, launched in 2021 and updated in January 2023, focuses on scaling up production and deployment with USD 2.4 billion in government support (Ministry of Power, 2022a). This includes production-linked incentives for the manufacturing of electrolysers and green hydrogen production (Ministry of New And Renewable Energy, 2023). With this plan, India expects to reach 5 Mt per annum of green hydrogen capacity by 2030 (The Economic Times, 2023a). A key financial measure, the Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme, has an outlay of USD 2.1 bn, split between financial incentives for electrolyser manufacturing and hydrogen production (PIB, 2023).

India also aims to become a major exporter of green hydrogen, targeting 10% of the global green hydrogen market by 2030 (Ministry of New And Renewable Energy, 2023). To support this, the government is actively engaging with international partners – including Singapore, Europe, and Japan – to explore export opportunities (DownToEarth, 2023b; European Investment Bank, 2023). Several Indian and international companies are investing in green hydrogen production to meet domestic and international demand, which is expected to bring down costs in the coming years.

Additional support comes from a 25-year waiver of the inter-state transmission charges, now extended to green hydrogen plants commissioned before 2031 (Reuters, 2023b). India’s largest oil refiner, Indian Oil Corporation, estimates that these policy measures will help to reduce the cost of green hydrogen production by 40–50% (Business Standard, 2022). Additional support includes the recently launched Green Hydrogen Certification Scheme. Green hydrogen and green ammonia plants have also been exempted from environmental clearance (The Economic Times, 2025a).

Carbon markets

India amended its Energy Conservation Act in December 2022, laying the groundwork for a domestic carbon market. India is set to establish its own carbon market by mid-2026 as the government has adopted regulations for its compliance carbon market under the Carbon Credit Trading Scheme (CCTS). The Ministry of Power (MoP) oversees the regulatory framework of the CCTS, with the BEE serving as the designated administrator responsible for implementing and managing the scheme.

India’s carbon market:

- Sets annual emissions intensity targets rather than absolute emissions caps,

- Includes nine high-emission industries as under PAT, with plans to expand to others like coal power,

- Covers CO2 and PFCs, with scope for adding more GHGs,

- And the BEE will set sector-specific emissions intensity pathways aligned with national climate goals.

The pilot carbon market, which will likely include four heavy industries -petrochemicals, iron and steel, cement, and pulp and paper - is expected to become fully operationalised in 2026 (Reuters, 2023c). These heavy industries, which previously had energy efficiency targets under the PAT scheme, had rather lax targets, resulting in an over-supply and under-pricing of energy saving certificates (ESCerts). The new rules intend to set a transparent and adequate target.

Carbon capture and storage

India is considering CCUS as an emissions reduction strategy to achieve deep decarbonisation in hard-to-abate sectors, and to allow a continued use of coal (Press Information Bureau, 2022a). Major Indian companies are exploring and implementing CCUS technologies, for which they have partnered with global technology firms (ONGC, 2024).

A number of pilot projects and initiatives are currently underway, supported by both government and private sector funding (Economic Times, 2024b). However, the commercialisation of CCUS in India by 2050 is considered highly unlikely without significant R&D incentives and international financial support (Climate Action Tracker, 2024b). In its Long-Term Low Emission Development Strategy (LT-LEDS), the Indian government has recognised that CCUS is not a viable option for retrofitting existing thermal power plants, citing high costs and limited economic feasibility (Government of India, 2022a).

Transport

Transport is responsible for 13% of India’s energy-related CO2 emissions in 2022 (IEA, 2025a), and accounts for 17% of total primary energy consumption (IEA, 2025b). The transport sector is dominated by fossil fuels (96% in 2021), mostly oil (93%).

For India to align with 1.5°C compatible pathways, the share of electricity in all domestic transport would need to reach 5% by 2030 and 25-76% by 2050 (Climate Analytics, 2024).

Road transport

At COP26, India signed the 100% EV declaration, aiming to increase the share of electric vehicle (EV) sales penetration to 30% in private cars, 70% in commercial vehicles, 40% in buses, and 80% in two- and three-wheelers by 2030 (Clean Energy Ministerial, 2019; The Economic Times, 2021).

Total annual EV sales reached 2 million vehicles in FY2024-25, of which over 60% were two-wheelers and 26% were three-wheelers (JMK Research, 2025). EV sales grew by ~16% in FY2024-25 over FY2023-24 with a 19% growth in two wheelers and 11% in three wheelers. However, despite this increase, EV penetration remains relatively low: around 6% in the two-wheeler segment, ~20% in three-wheelers, and just ~2.5% in four wheelers. To be compatible with 1.5°C, the share of total EV sales (including two- and three-wheelers) must reach at least 35% by 2030, and 100% by 2040.

The installation and financing of five million fast chargers are critical to accelerating India’s e-mobility transition. However, as of 2024, the country had only 25,202 public charging stations, falling far short of the revised EV guidelines, which call for at least one charging station per square kilometer by 2030 (Business Standard, 2024a; ICCT20, 2025). Expanding the EV charging network remains a government priority and is expected to create opportunities for small vendors engaged in the manufacture, installation, and maintenance of charging infrastructure (Indian Express, 2024).

To support both EV adoption and expand charging infrastructure, the Faster Adoption and Manufacturing of Electric Vehicles in India (FAME) was launched in April 2019, providing financial support of INR 100bn (USD 1.35bn) to incentivise the purchase of EVs and the installation of charging infrastructure (Business Today, 2019). The second phase of FAME ended in March 2024 with a total outlay of INR 115 bn (USD 1.4 bn). The next phase (FAME III) has been replaced by the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DERIVE) scheme which will provide INR 36.79 bn (USD 438m) in incentives for battery-powered two-wheelers, three-wheelers, ambulances, trucks, and other advanced EVs (ICCT20, 2025).

Despite these efforts, EV adoption remains modest. With a sales share of just 6%, EVs in the passenger car market are far from reaching the 30% target set for 2030. According to NITI Aayog, the main barriers are high upfront costs, limited range and insufficient charging infrastructure. To address these issues, NITI Aayog has proposed "soft mandates," i.e. policies that encourage gradual change rather than abruptly enforcing targets. However, in order to reach the 30% target, these policies must be supported by a robust regulatory framework, accelerated infrastructure development and financial instruments that reduce the barriers to adoption for both private fleet operators and individual consumers.

A major push includes the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) scheme, which has total funding for electric vehicles, including a significant INR 43.91 bn (~USD 511 mn) for subsidies supporting the procurement of 14,028 electric buses in nine cities (ICCT20, 2024).

Back in 2015, the government launched the National Electric Bus Programme (NEBP) aiming to deploy an additional 50,000 electric-buses by 2030, but as of 2024, only 3,616 buses were registered (UITP, 2022).

Recently, the PM E-DRIVE scheme was allocated INR 10.9 bn (~USD 10.9 mn) for the procurement of public buses in major cities, to be rolled out from April 2024 to March 2026 (The Economic Times, 2025). Under FAME I (2015-2019), 425 buses received approval for purchase subsidies, increasing to 7,120 buses under FAME II (2019-2024), with incentives available to state and city transport undertakings and other public entities (ICCT20, 2024). However, this is far from achieving the target of 50,000 new electric buses under NEBP.

Heavy-duty vehicles, particularly trucks, accounted for 45% of India's road transport emissions in 2022 – despite only representing a small portion of the overall vehicle fleet (Verma, 2024). As of 2022, India has around four million trucks in operation, but this is projected to increase to 17 million by 2050 (Reuters, 2024a). Adopting zero-emission fuel trucks is the central decarbonisation strategy. The government launched its Bharat Zero Emission Trucking (ZET) Policy Advisory in 2024, outlining potential interventions to achieve 100% ZET deployment by 2050. The government is further planning to replace its diesel-fuelled long haul trucks with LNG in the coming five to seven years (Reuters, 2024a) – risking a sustained lock-in of fossil fuel use (Jain, 2025).

India strengthened its fuel emissions standards in April 2020 with the adoption of the Bharat Stage VI (BS VI) emissions standard for all major on-road vehicles (the same as Euro VI standards) (DieselNet, 2021). BS VI standard for light- and heavy duty vehicles (LDVs), is applicable to all to LDVs as well as two- and three-wheeler with a Gross Vehicle Weight (GVW) of not more than 3,500 kg, and BS VI for heavy duty vehicle is applicable to all vehicles exceeding the 3,500 kg GVW threshold including commercial trucks, buses and on-road heavy-duty vehicles such as refuse haulers and cement mixers.

The Indian government has advanced different targets and policy frameworks to introduce alternative fuels in the transport sector. Blending of 20% ethanol in petrol is part of such an initiative, for which the target year was brought forward to 2025 from the earlier target of 2030 (NITI Aayog, 2021). Again, such measures risk delaying the transition to zero-emission alternatives.

Green hydrogen derived fuels will be crucial to decarbonise hard-to-abate modes of transport where electrification is not possible: mainly shipping and aviation. Hydrogen will likely also play a role in the freight trucking sector, in competition with electric trucks. Demand for green hydrogen is expected to grow in India’s transport fleet in 2025: the government awarded EUR 2.3 million in project funding to Indian vehicle manufactures to develop 22 hydrogen internal combustion engines and 15 fuel cell electric trucks (IFRI, 2025).

The government has also launched a voluntary vehicle scrappage policy in April 2022 to phase out old vehicles from Indian roads (Garg, 2022). The 2023-24 budget includes provisions for scrapping of Central and State Government vehicles that are over 15 years old, as well as tax incentives for private individuals who scrap their old vehicles (Times of India, 2023). Unfortunately, there is no requirement to replace them with electric vehicles.

Railways and waterways

In July 2020, Indian Railways, one of the world's largest railway networks which is fully owned and operated by the government, announced plans to achieve net zero emissions by 2030. In February 2023, it has achieved 100% electrification of its network (International Railway Journal, 2023).

Indian Railways is planning to increase its use of renewable energy and to install 30 GW of renewable energy capacity by 2030 (Bloomberg, 2022). As of 2024, only 209 MW of solar capacity installation has been added on rooftops of various stations and administrative buildings.

Indian Railways further seeks to introduce hydrogen-fuelled trains on its narrow-gauge heritage routes from 2024 and has issued tenders for procuring 35 trains powered by green hydrogen (Railway Technology, 2023; The Economic Times, 2023b). In early 2025, trial runs of the hydrogen-powered trains began (Fuel Cell Works, 2025).

The Maritime India Vision 2030 outlines a target for Indian ports to reduce carbon emissions by 30% of per tonne of cargo handled by 2030 and 70% by 2047 (Ministry of Ports Shipping and Waterways, 2021). In November 2022, the National Centre of Excellence for Green Port & Shipping was launched. It is tasked with providing policy and regulatory support to the Ministry of Ports, Shipping and Waterways to develop a regulatory framework and roadmap to foster carbon neutrality and circular economy in India’s shipping sector (Press Information Bureau, 2022b).

Buildings

In 2021, per capita building-related emissions in India were nearly four times lower than the G20 average – due to low heating demand but also a low penetration of modern electrical appliances (CTR, 2022). However, energy consumption in residential buildings is projected to increase by more than eightfold by 2050 driven by increasing cooling demand, underscoring the urgent need for greater energy efficiency (Climate Analytics, 2021). Given the continued dominance of coal in India’s electricity mix, decarbonising the power sector will also be essential to fully realise emission reduction potential in the energy end-use sectors.

Energy demand from the urban buildings sector is increasing as summer temperatures rise. It is projected that by 2050, 45% of India's peak electricity demand could come from space cooling (CEEW, 2022). Government-adopted initiatives like the Energy Conservation Building Code (ECBC), voluntary initiatives on green building guidelines and a push for the adoption of thermal performance standards in building design and construction materials, can help reduce the internal heat load and lower space cooling requirements (BEE, 2021).

The Energy Conservation Act 2022 amendment has expanded the scope for the buildings sector: it now includes offices and residential buildings with a minimum connected load of 100 kW. The amendment of the Energy Conservation Act has upgraded the ECBC to the “Energy Conservation and Sustainable Building Code,” which specifies norms and standards for energy efficiency, use of renewable energy, and other sustainability-related requirements for different types of buildings.

Energy Efficiency Services Limited (EESL), an initiative of the Ministry of Power, is implementing the Buildings Energy Efficiency Programme to retrofit commercial buildings in India with energy-efficient devices. This programme has delivered an estimated cumulative energy saving of 790 GWh since 2009 with avoided peak demand of 75.64 MW, cumulative emissions reduction of 0.57 MtCO2 and an estimated cumulative monetary savings of INR 6 bn (USD 72 mn) in electricity bills since its inception in 2009 (EESL, 2022).

Agriculture

Agriculture is the second-highest GHG emitting sector in India after energy, accounting for around 14% of total emissions in 2023 (excluding LULUCF) (Gütschow et al., 2025).

India is the world's second-largest emitter of nitrous oxide (N2O) after China, contributing around 11% of global emissions in 2020, primarily due to the use of nitrogen-based fertilisers. The government has implemented measures to reduce N2O emissions associated with fertiliser (urea) use and has programmes in place to assist farmers in reducing emissions and building resiliency (Department of Fertilizers, 2022).

India is also a major emitter of methane (CH₄) from rice cultivation and enteric fermentation in livestock. Although India does not have a dedicated national methane policy, various programs indirectly address methane emissions. These include the National Mission for Sustainable Agriculture (NMSA), which promotes climate-resilient farming and efficient water use in rice paddies; the National Livestock Mission, which supports improved fodder and feeding practices; and the GOBAR-Dhan scheme, which facilitates biogas production from agricultural and cattle waste.

The agricultural sector further accounts for a non-negligible share of energy use, such as for water pumping in irrigation systems. Heavily subsidised electricity for the agricultural sector has led to the widespread use of inefficient pumps, resulting in excessive consumption of both water and electricity (Sagebiel et al., 2015).

To address this, the Bureau of Energy Efficiency (BEE) launched the Agricultural Demand Side Management (AgDSM) programme in 2023 to reduce power consumption and ease the subsidy burden on power utilities (BEE, 2023). Another major intervention is the PM-KUSUM (Pradhan Mantri Kisan Urja Suraksha evam Utthan Mahabhiyan), which targets the installation of 10 GW of decentralised, grid-connected solar power on barren land and the deployment of 17.5 million solar pumps (MNRE, 2020).

Forestry

In 2015, India’s first NDC set a target of 2.5–3 GtCO2e of an additional carbon sink by 2030, reconfirmed in its 2022 update. To achieve this target, a comprehensive forest policy is essential. Between 2001 and 2023 the net carbon sink from Indian forests accounted for -88.1 MtCO2e/year (Global Forest Watch, 2024). In 2022, in response to a question in the Indian parliament, the minister claimed that India had already achieved 1.97 GtCO2e of additional carbon removals compared to 2005, which would put it on track to achieving its target (Government of India, 2022c). However, it is unclear whether this is an additional carbon sink and whether it is contributing to India’s NDC target on carbon sink by 2030.

As of 2021, forest and tree cover accounts for 24.6% of India’s land mass compared to 21% in 2005, against a national target of 33% forest cover of its geographical area, as proposed in 1952 National Forest Policy. However, at the same time between 2010 and 2023, India lost around 134 kha of natural forest, equivalent to emissions of 81.9 MtCO2e, mainly because of developmental activities such as road construction(CNBCTV18, 2022). While increase in total forest cover is important, it cannot replace the richness and resilience of the natural forest.

In August 2023, the Forest (Conservation) Amendment Bill 2023 was passed by the parliament (PIB India, 2023b). This amendment of the 1980 Forest Conservation Act (FCA) acknowledges the role of forest carbon sinks towards achieving the net zero target by 2070. However, it has been criticised by various quarters, including government opposition members, former officials, and civil society (ETEnergyWorld, 2023). One issue is the absence of a legal definition of forests, causing uncertainty of coverage given the amendment allows the removal of FCA protections for private forested land and unrecorded forested parcels.

The amendment also exempts the construction of 'linear projects', such as roads, railways, transmission lines, or pipelines within 100 km of disputed national borders from the Forest Conservation Act (FCA). This exemption is particularly relevant for the Himalayan region in the north and northeast of the country, given its vulnerability as part of a global biodiversity hotspot (Third Pole, 2023). The bill also eliminates pre-clearance checks, such as seeking consent from indigenous people for affected lands, and opens up forests for activities like eco-tourism zones and zoos, raising concerns about potential ecological impact (Third Pole, 2023).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter