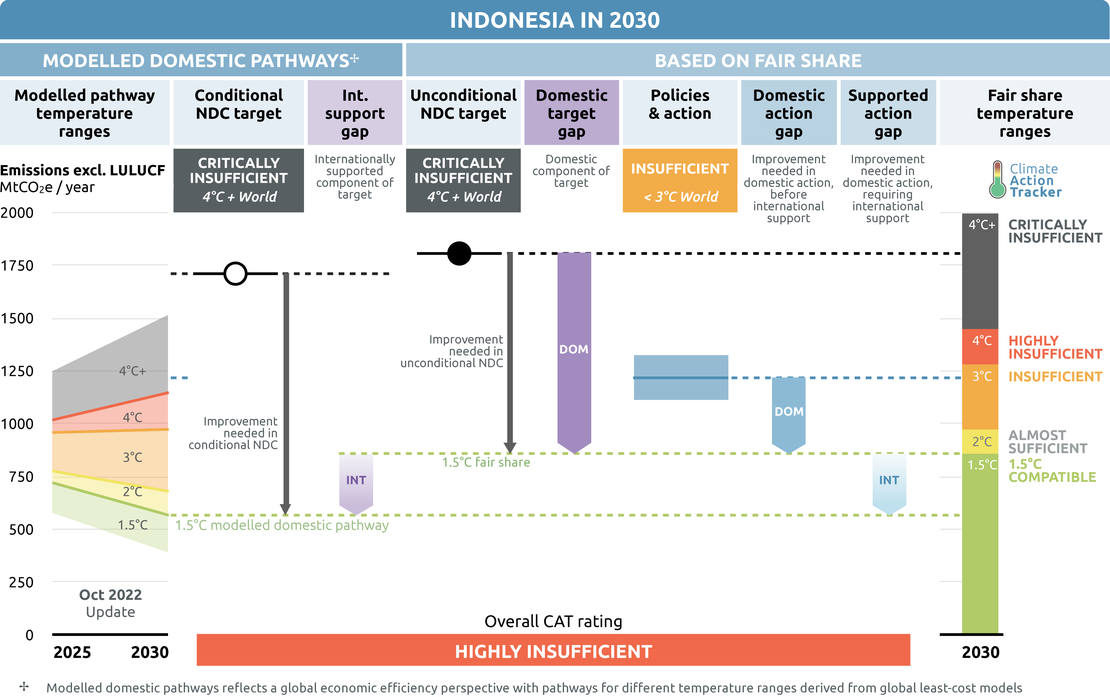

Policies & action

Indonesia’s current policies are “Insufficient” when compared to their fair share contribution. The projected emissions under current policies fall in the upper half of the “Insufficient” range.

Indonesia is expected to implement additional policies with its own resources but will also need international support to implement policies for a full decarbonisation.

The “Insufficient” rating indicates that Indonesia’s climate policies and action in 2030 need substantial improvements to be consistent with the 1.5°C temperature limit. If all countries were to follow Indonesia’s approach, warming would reach over 2°C and up to 3°C.

Further information on how the CAT rates countries (against modelled domestic pathways and fair share) can be found here.

Policy overview

Indonesia’s emissions (total excl. LULUCF) rebounded 2% in 2021 after dropping by 4% in 2020. Under current policies we estimate that emissions will reach 1114-1320 MtCO2e/yr in 2030 (excl. LULUCF), 351-415% above 1990 levels. At this level Indonesia will overachieve its unconditional NDC and conditional 2030 targets (excl. forestry), despite strongly increasing emissions.

Several major policies and plans have either been published or are in the pipeline, including the Presidential regulation on Feed-in Tariffs, the New and Renewable Energy Law, and carbon tax. Indonesia’s emissions trading system (ETS) is also in the early phases of its development and recorded 42.5 MtCO2e transactions at around 2 USD/tCO2e in its 2022 voluntary pilot phase (IESR, 2022b). The implementation and development of these policies and plans represent a key opportunity for Indonesia to increase its climate ambition, address the barriers facing renewable energy development, and shift to a low carbon development pathway.

By July 2022 Indonesia had 40 GW operating coal-fired power plants and a further 26 GW in the pipeline – 15 GW under construction, 2 GW announced, 2 GW permitted, and 7 GW pre-permit (Global Energy Monitor, 2022). Under the current electricity sector plan (RUPTL 2021-2030) coal is planned to account for 64% of the electricity generation mix by 2030, up from its 2021 level of 61%. This plan is not aligned with the goals of the Paris Agreement, for which unabated coal-fired power in Indonesia would need to drop to 10% of the mix by 2030 (Climate Action Tracker, 2020) and be phased out by 2040 (IPCC, 2018; IEA, 2021).

Coal phase out remains one of the most important tools for Indonesia’s decarbonisation. Presidential Regulation 112/2022, published in September 2022, sets out a 2050 phase out date for coal power (Government of Indonesia, 2022). Indonesia indicated at COP26 that it is open to phasing out unabated coal power in the 2040s with additional technical and financial support from the international community. Indonesia is currently exploring accelerated coal phase out through the Asian Development Bank’s Energy Transition Mechanism (ETM), Just Energy Transition Partnership (JETP), and bilateral cooperation agreements.

In stark contrast to the discussions around phasing out coal-fired power, Indonesia is moving forward with plans to expand its downstream coal industry with the aim of producing coal-based chemicals that replace oil and gas fuels and feedstocks. Indonesia plans to produce 4.6 Mt Dimethyl ether (DME) and 7.9 Mt coal-based methanol by 2025, increasing to 6.1 Mt and 14.1 Mt by 2045, respectively (MEMR, 2022c, 2022d).

Renewables development has been slow, and current plans do not make full use of Indonesia’s renewable energy potential. Renewables accounted for just 11% of added power capacity between 2019 and 2020, while the installed capacity in 2020 fell short of the targets set by the national energy plan (RUEN) – hydropower and geothermal reached 80% of these targets, while solar, bioenergy, and other renewables reached just 8%, 5%, and 4% of these targets, respectfully (Republic of Indonesia, 2021). The utilisation of renewable energy potentials is currently very low, ranging from just 0.03% for solar power to 5% for hydropower.

The recent record-low bids for renewables like floating solar PV (3.68 USDc/kWh) show that these technologies are already competitive in the Indonesian context (IESR, 2021b). While Indonesia has recently issued policies to improve the environment for renewables, particularly solar, many regulatory barriers remain (IESR, 2022b). The New and Renewable Energy Bill, expected in 2023, is an opportunity to address some of these issues.

The LULUCF sector contributes a large share of emissions, reaching around 1 GtCO2e/yr. Mitigation measures in the forestry sector, particularly the moratorium on new forest clearance for activities such as palm oil plantations or logging, have helped Indonesia to reduce tree cover loss since 2016, but commodity-driven deforestation is still a major concern, accounting for over 90% of forest cover loss in 2021 (Global Forest Watch, 2022). Indonesia outlines its vision of reaching net negative emissions in the forestry sector by 2030 in its LTS and further describes necessary measures in the Operational Plan for Forestry and Other Land Uses Net Sink 2030, published in 2022.

In the transport sector, Indonesia aims to increase biofuel blending mandates, expand mass public transport (MRT) systems, and support the growth of electric vehicles. Indonesia’s biofuel mandate is one of the most ambitious in the world.

After facing serious budget issues and delays, Indonesia plans to increase the biodiesel blending mandate to 40% in 2022 and produce biodiesel solely from palm oil (IESR, 2021b). However, while Indonesia’s biofuels targets are ambitious, they are controversial due to the environmental concerns with increased palm oil production, and deforestation.

In May 2022, an agreement was signed between Alstom and PT MRT Jakarta to explore the further development of Jakarta’s MRT system that was launched in 2019 (Alstom, 2022). The government has issued several regulations to support the expansion of Indonesia’s EV industry and fleet, however, the number of EVs on the road continue fall far short of government targets. Further regulatory development is needed to address barriers to EV uptake, such as the domestic content requirement.

The government allocated approximately USD 48bn in 2020 and 2021 (IDR 700 tn) to fund the National Economic Recovery (Ministry of Finance Indonesia, 2020a). It does so with the establishment of numerous policy instruments such as tax incentives, direct investments and subsidies, and loans (Cabinet Secretariat of the Republic of Indonesia, 2020; Media Indonesia, 2020; Ministry of Finance Indonesia, 2020b).

The post-COVID-19 economic recovery presents an opportunity to increase investment in low-carbon development, especially to foster renewable energy development (Amri, Roesad and Damuri, 2020; IESR, 2020; Sumarno and Sanchez, 2021). Greening recovery packages can reduce air pollution, create more and better jobs, lead to a more resilient and independent energy supply, and enhance access to energy (Climate Action Tracker, 2020a).

In 2020, at least USD 7.5 bn (IDR 109 tn) went to supporting different energy types through new and amended policies, representing around 16% of the government’s total recovery budget (Ministry of Finance, 2021; Sumarno and Sanchez, 2021). But the government failed to trigger a strong green recovery in its economic stimulus, allocating just 3.5% of the total budget to clean energy development (Energy Policy Tracker, 2020; IESR, 2021b).

The COVID-19 recovery packages more than double the existing subsidies to fossil fuels, amounting to almost USD 7bn in 2020 (IDR 97tn), covering electricity (51%), LPG (34%), and fuel (15%), equal to around 8% of the national budget in 2020 (IESR, 2021b). By mid-2021 the OECD and IEA estimate that fossil fuel subsidies announced during the pandemic reached USD 12-13 billion (OECD/IEA, 2021).

Sectoral pledges

In Glasgow, four sectoral initiatives were launched to accelerate climate action on methane, the coal exit, 100% EVs and forests. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets, and on forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”.

NDCs should be updated to include these sectoral initiatives, if they’re not already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

| INDONESIA | Signed? | Included in NDC? | Taking action to achieve? |

|---|---|---|---|

| Methane | Yes | No | Yes |

| Coal exit | Yes | No | Yes |

| Electric vehicles | No | No | Not applicable |

| Forestry | No | No | Not applicable |

| Beyond oil and gas | No | No | Not applicable |

● Methane pledge: Indonesia signed the methane pledge at COP26. Methane emissions are significant in Indonesia, accounting for 25% of Indonesia’s emissions in 2019. Methane emissions are split between the waste sector (56%), agriculture sector (30%), and the energy sector (14%). Methane emissions are covered in Indonesia’s NDC.

● Coal exit: Indonesia signed up to part of the Coal Exit at COP26: Clause 2 (phase out 2030/2040), but not Clause 3 (no new plants). Presidential regulation 112, issued in September 2022, sets a 2050 phase out date for unabated coal-fired power generation. At COP26 Indonesia stated that it is open to accelerating coal phase-out into the 2040s, conditional on additional international financial and technical assistance. It is currently exploring accelerated coal phase-out through the Asian Development Bank’s Energy Transition Mechanism (ETM), Just Energy Transition Partnership (JETP), and bilateral cooperation.

Coal is the dominant source of electricity in Indonesia, accounting for 61% in 2021 and is projected to grow to 64% in 2030. Indonesia’s coal pipeline is enormous at 26.3 GW - 15.4 GW in construction, 2.0 GW announced, 2.0 GW with permit, and 6.8 GW pre-permit (Global Energy Monitor, 2022).

● 100% EVs: Indonesia did not sign the declaration on accelerating the transition to 100% zero emission cars and vans at COP26. The uptake of EVs in Indonesia is slow and falls far short of the government’s targets.

● Forestry: Indonesia signed the forestry pledge at COP26 but later withdrew, stating that the pledge was at odds with Indonesia’s development goals.

● Beyond oil and gas: Indonesia did not sign the beyond oil and gas pledge at COP26.

Energy supply

Recent developments in Indonesia highlight the conflict between increasing support for, and deployment of, renewables, and the continued expansion of fossil fuel capacity, mainly coal, locking in Indonesia’s long-term fossil fuel dependency.

Two of the core documents that currently underpin energy sector development in Indonesia are the Ministry of Energy and Mineral Resources’ strategic plan 2020-2024 (based on the government’s mid-term development plan (RJPMN) 2020-2024) and PLN’s electricity supply business plan (RUPTL) 2021-2030. The RUPTL is considered in our current policy projections.

Several major energy policies and plans have either been published or are in the pipeline, including the Presidential Regulation on Renewables Tariffs, New and Renewable Energy Law, and carbon tax. Indonesia’s emissions trading system (ETS) is also in the early phases of its development and recorded 42.5 MtCO2 transactions at around 2 USD/tCO2 in its 2022 voluntary pilot phase (Cite IESR IETO 2022). These policies and plans represent a key opportunity for Indonesia to implement a low carbon development pathway for Indonesia’s energy sector and address the barriers facing renewable energy development.

The implementation of Indonesia’s carbon tax is expected in 2023 after facing delays. The carbon tax was introduced into Indonesia’s tax law at the end of 2021. Indonesia’s carbon tax is set around 2 USD/tCO2 and will initially focus on coal-fired power plants. The government plans to gradually increase the tax and expand the coverage to other sectors (IESR, 2022b).

Coal

Coal phase-out remains one of the most important topics for Indonesia’s decarbonisation. Coal-fired power plants accounted for 61% of the electricity mix in 2021 (BP, 2022). By July 2022 Indonesia had 40.1 GW operating coal-fired power plants and a further 26.3 GW in the pipeline – 15.4 GW under construction, 2.0 GW announced, 2.0 GW permitted, and 6.8 GW pre-permit (Global Energy Monitor, 2022). This pipeline is part of the government’s 2015–2019 35 GW Plan initiated to increase the electrification ratio while meeting the forecast growth in energy demand. Under the current electricity sector plan (RUPTL 2021–2030) coal is planned to account for 64% of the power mix by 2030.

Indonesia has set a 2050 phase out date for unabated coal power generation in Presidential Regulation 112, issued in September 2022 (Government of Indonesia, 2022). The regulation also mandates the formulation of a plan to achieve this target. While this is a positive development, the plan is still not aligned with the 1.5°C temperature limit, for which unabated coal-fired power in Indonesia would need to be phased out by 2040 (IPCC, 2018; Climate Action Tracker, 2020; IEA, 2021). Indonesia will need significant financial support to plan a Paris-compatible coal phase out.

Indonesia signed the Global Coal to Clean Power Transition declaration at COP26, indicating that it is open to phasing out unabated coal power in the 2040s with additional technical and financial support from the international community. Indonesia is currently exploring accelerated coal phase-out through the Asian Development Bank’s Energy Transition Mechanism (ETM), Just Energy Transition Partnership (JETP), and bilateral cooperation.

Coal phase out before 2045 would bring significant environmental, social, and economic benefits – the avoided costs from health care and coal subsidies outweigh the cost of stranded assets, decommissioning, employment transition, and revenue loss by 2–4 times (IESR, 2022a). By phasing out coal-fired power plants over 20 years old and re-evaluating its coal pipeline, Indonesia could avoid over 45,000 premature deaths in the next decade (Climate Action Tracker, 2021).

Coal is also Indonesia’s biggest export product and, with major export markets beginning to reduce their consumption, there is a clear need for Indonesia to diversify its economy and reduce the risks of relying on fossils fuel exports.

The financial agreements for coal-fired power plants increase risk of locking-in costly capacity payments to thermal power plants while renewables become cheaper. The agreements between PLN and independent power producers (IPPs) ensure a minimum payment for each kilowatt available – not necessarily dispatched. These values might reach up to 40% of the tariff value that the government needs to pay to IPPs during the duration of the whole contract and are estimated to lead to an obligation to pay over USD 16bn for coal idle capacity until 2026 (IEEFA, 2017).

In contrast to the discussions around phasing out coal-fired power, Indonesia is moving forward with plans to expand its downstream coal industry with the aim of producing coal-based chemicals that replace oil and gas fuels and feedstocks. The revised Coal and Mineral Law 2020 and supporting regulations set the legal basis for this, while the MEMR outlines the development plan in its Grand Strategy for Coal and Development and Utilisation of Coal Road Map (MEMR, 2022c, 2022d). Indonesia plans to produce 4.6 Mt Dimethyl ether (DME) and 7.9 Mt coal-based methanol by 2025, increasing to 6.1 Mt and 14.1 Mt by 2045, respectively.

Renewables

The overarching targets for the energy sector are set by the National Energy Policy (NEP). Indonesia aims to increase the share of renewables in primary energy to 23% by 2025 and 31% by 2050. The NEP also targets 23% renewable in electricity generation by 2025 and 31% by 2050. However, renewables uptake has not been consistent with this target – renewables accounted for 11.5% of Indonesia’s primary energy mix and 13.5% of its electricity mix in 2021 (MEMR, 2022a, 2022b)

The new electricity supply plan (RUPTL 2021–2030) aims to put Indonesia on a path to achieving its targets. Renewables in this plan account for 52% of the planned capacity between 2021-2030 and are set to reach 23% of the mix by 2030. In comparison with the previous revision, the forecast for total generation from renewables decreases by 22 TWh in line with the overall downwards revision of electricity demand in 2030. Hydropower and geothermal have been reduced by 17 TWh and 14 TWh respectively, while other renewables (mainly solar and wind) increase by almost 9 TWh by 2030 in the new RUPTL.

The utilisation of renewable energy potential remains low in current plans. The MEMR estimates Indonesia’s solar potential as 208 GW, while IESR estimates the technical potential for solar is almost three times greater (IESR, 2021a). Indonesia also has significant potential for hydropower (94 GW), wind power (61 GW), bioenergy (33 GW), geothermal (29 GW), and wave power (18 GW) (National Energy Council (DEN), 2019). Several studies have shown how Indonesia generate 100% of its electricity from renewables and reach net zero emissions by 2050 (IESR; Agora Energiewende, 2021; Silalahi et al., 2021).

The Presidential Regulation on Renewable Tariffs, issued in September 2022, aims to address many of the barriers facing renewable energy development in Indonesia (Government of Indonesia, 2022). The regulation details new tariff schemes based on feed-in tariffs, ceiling prices, and technology and capacity-based negotiations (IESR, 2022b). Small-scale (<5 MW) hydro, solar, wind, biomass, and biogas projects will receive feed-in tariffs to improve their bankability – this is a significant improvement from the current regulation (MEMR 50/2017, 4/2020) which limits the tariff to 85% of the local average generation cost. Large scale projects (>5 MW) will be given a location-dependent ceiling price to encourage the development of large-scale projects, particularly in less-developed regions (IESR, 2022b).

The delayed New and Renewable Energy Law is set to be passed before the November G20 Summit and aims to provide a legal framework for supporting the development of new and renewable energy through fiscal incentives, land, infrastructure, and government guarantees (Reuters, 2022). The draft bill lists solar, wind, hydro, and geothermal as renewables, and considers nuclear, hydrogen, coal bed methane, coal liquefaction, and coal gasification as sources of “new energy”.

Several regulatory improvements supported the continued growth of rooftop solar PV, which grew by 84% between 2020 and 2021, reaching 39 MWp (IETO 2022). Regulation 49/2018 established a net metering scheme in which the users are compensated for only 65% of the electricity they put into the grid (MEMR, 2018). The regulation has been amended twice, improving the competitiveness of rooftop PV by easing the administrative process and reducing charges applicable for the industry sector (IESR, 2019). Regulation 26/2021 is the latest revision, which broadens the scope to other electricity suppliers (private power utilities, PPU), revises the net metering scheme to 1:1, increases credit accumulation period from three to six months, and lays the groundwork for future carbon trading between users (IESR 2022).

Local content requirements (LCR) restrict the expansion of solar PV in Indonesia, particularly utility-scale projects. Regulation 5/2017 sets the minimum LCR at 40% in 2017 and was meant to increase it to 60% in 2019. However, Indonesia’s solar PV manufacturing industry is still in its infancy, and currently able to achieve a maximum of 47.5% local content. High LCRs impose higher costs and lower returns for PV projects due to lower efficiencies. Further regulatory development is important if Indonesia is to realise its plans to increase utility-scale solar PV in its domestic electricity supply and exports.

Industry

In 2019, industry accounted for 6% of Indonesia’s total emissions (excl. LULUCF). Cement, ammonia-based fertilisers and metal industries are the largest emitting industry subsectors in Indonesia (Republic of Indonesia, 2018c).

The Indonesian government is focussed on reducing cement industry emissions by lowering clinker-to-cement ratio (Republic of Indonesia, 2018b). Voluntary guidelines have been developed to encourage the use of blended cement by using clinker substitutes such as fly ash, and by using biomass and other alternative fuel and raw materials (AFR) in the cement production process.

Indonesia also has various CDM projects in the industry sector, ranging from clinker replacement in the cement industry to oil field flaring reduction (UNFCCC, 2018). There are also plans for energy audits and conservation for all energy intensive industries (Republic of Indonesia, 2018c). The CAT has not quantified the impact of those policies separately.

Transport

The expansion of zero emission fuels in the transport sector is essential for meeting the 1.5°C temperature limit. While Indonesia has strategies in place to support both the use of biofuels and electric vehicles, current outcomes fall short of national targets and plans (Figure 2).

Biofuels

Biodiesel exports plummeted from 1.3 billion litres in 2019 to just 0.04 billion litres in 2020 (Statista, 2021), partly due to lower global energy demand during the pandemic, but also due to the EU’s recent policy to ensure the sustainability of imported biofuels, and increasing domestic biofuel production in China (IESR, 2021b).

Domestic biodiesel consumption reached 8.5 billion litres in 2020, falling just short of the 9.6 billion litres target, in part due to lower demand during the pandemic (IESR, 2021b).

Indonesia’s biofuel consumption mandate is one of the most ambitious in the world. Since 2016 and prior to 2020, biofuels had to supply 30% of the energy in the electricity sector, and 20% in micro-business, fisheries, agriculture, transportation, industry, and public service sectors. In the same regulation, the target share values for all sectors increased to 30% in 2020, with plans to increase the mandate to 40% between 2021 and 2022 (MEMR, 2015; ICCT, 2016; Reuters, 2020).

Plans to increase the blending mandate have been postponed until 2022 due to lack of funding for the subsidy caused by low oil prices during the pandemic. Based on the World Bank’s oil price projections, Indonesia’s palm oil fund will be depleted as soon as 2021, compared to its pre-COVID estimate of 2027 (IESR, 2021b).

Biofuels in the development phase (bioethanol and ‘green diesel’) have faced delays. By early 2021 domestic bioethanol production had not started due to high production costs and lack of subsidy. Green diesel production from pure palm oil is planned to scale-up from 2022, following successful trials by Pertamina in 2021 (IESR, 2021b).

Deforestation is a key issue surrounding biofuel development in Indonesia since commodity-driven deforestation (such as oil palm plantations) are the main driver for tree-cover loss (see Forestry section). Until 2020, biofuel suppliers were exempt from the Indonesian Sustainable Palm Oil (ISPO) certification scheme. Presidential Regulation 44/2020, passed in March 2020, now mandates all oil palm plantations to be certified under the ISPO scheme. However, only 60% of total company plantation areas have been certified. The efficacy of the ISPO scheme has been questioned, since certified plantations are still involved in deforestation and social conflicts (Forest Watch Indonesia, 2017). The effective implementation of this policy at all levels of government remains a key challenge for managing the environmental and social risks of biofuel production in Indonesia.

As of January 2019, suppliers involved in deforestation are suspended from sourcing to Wilmar International, one of the world’s largest agribusiness groups (Wilmar International, 2018). Months later in June, the European Union, the second largest importer of Indonesian palm oil, introduced the Renewable Energy Directive (REDII), which imposes restrictions to ensure that the production of biofuel feedstocks is sustainable and does not drive deforestation through indirect land use change. These developments put pressure on the Indonesian Government and industry to create more sustainable supply chains in the country.

Electric vehicles

In the face of increasing concerns about air pollution, Indonesia is shifting its attention towards electric vehicles (EVs). An Electric Vehicles Development Plan and Targets are part of the General Plan of National Energy published in 2017 (Republic of Indonesia, 2017). This plan presents the vision of over 2,000 four-wheeled EVs, 700,000 hybrids, and over two million electric two-wheelers on the streets by 2025; these numbers increase to four, eight, and 13 million by 2050. An EV share of the total stock of light vehicles of about a third of the total fleet (including two and three-wheelers) by 2030 would be a benchmark consistent with the Paris Agreement, reaching between 80% to 90% by 2050 (Climate Action Tracker, 2020b).

However, the uptake of EVs falls far short of national targets. By September 2020, Indonesia recorded around 2,300 EVs (80% two-wheelers) – far short of the RUEN targets of 900,000 EVs by 2020 and 2.3 million by 2025 (IESR, 2021b). The RUEN 2020 targets were also missed for EV production (0.15% and 0.26% progress for electric cars and two-wheelers, respectively) and EV infrastructure (43% progress).

The government issued several regulations to boost the domestic electric vehicle (EV) industry and to support reaching these targets, but several barriers remain. The high local content requirement (LCR) for domestically manufactured EVs is considered a barrier to the growth of the industry. Regulation 27/2020 sets a minimum LCR of 35% for two-wheelers and 40% for four-wheelers in 2021. Government plans to increase this to 60% by 2024 have implications for the growth of the industry – a 60% LCR would mean that batteries and electric drivetrains need to be 100% local. As domestic battery production is yet to begin, this high LCR could constrain the expansion of Indonesia’s domestic EV industry (IESR IETO 2022).

Several regulations were introduced in 2020 to support Regulation 55/2019, providing fiscal incentives to lower the cost of EV ownership and infrastructure development (Regulation 73/2019, replaced by Regulation 74/2021), however, these are still insufficient to make EV purchase prices comparable with conventional vehicles in Indonesia (IESR, 2021b, 2022b).

In 2020, Indonesia had installed just 62 charging units, only 27 of which are open for public use, falling very short of PLN’s target for 180 units outlined in their public charging station roadmap (2020-2024) (IESR, 2021b). The target for charging stations is also not aligned with the number of EVs targeted in the RUEN – the ratio of charging stations to EVs in 2025 will be seven times lower the 1:10 ratio recommended by the IEA (International Energy Agency, 2018; IESR, 2021b).

Transport infrastructure & public transit

Mitigation actions on transport infrastructure and planning in Indonesia are being guided by the Transportation Decree No. 201/2013 (Climate Policy Database, 2013). They include a major overhaul of the existing system with an "avoid, shift and improve" approach, including the construction of Bus Rapid Transit (BRT) corridors, implementation of traffic management technologies to reduce congestion, and construction of urban railway systems (Republic of Indonesia, 2018b).

The Sustainable Urban Transport Program (SUTRI) Nationally Appropriate Mitigation Action (NAMA) is being implemented in seven pilot cities and will be a key instrument to support transformation in the transport sector. The NAMA aims to improve public transport and implement transport demand management measures, e.g. road pricing and public bicycle schemes (Ministry of Transportation, 2014).

Jakarta, the Indonesian capital, has approximately one million commuters every day. The city’s Transport Master Plan states that public transport should reach 60% of the passenger ridership by 2029 (Republic of Indonesia, 2018d). In March 2019 the first line of Jakarta’s Mass Rapid Transit system opened and a second line is expected to be completed by 2024. In May 2022 Alstom and PT MRT Jakarta signed an MoU to explore the further development of Jakarta’s MRT system (Alstom, 2022). A key challenge now is securing the modal shift in commuter habits. The transit system is currently only used by 20% of commuters.

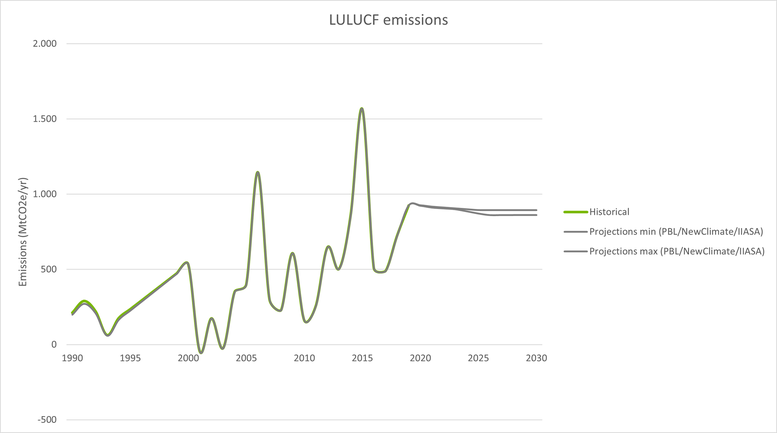

Forestry

Indonesia’s emissions from land-use, land-use change and forestry (LULUCF) have accounted for almost 50% of the country’s total emissions over the last 20 years. Reducing emissions from deforestation is a vital part of Indonesia’s climate action.

Indonesia’s annual LULUCF emissions reach around 1 GtCO2e/yr, considering deforestation, forest degradation, peat decomposition, and peat fires (UNFCCC, 2015; Alisjahbana and Busch, 2017). Due to an unusually high occurrence of peat fires, the emissions from Indonesia’s LULUCF sector reached almost 1.4 GtCO2 in 2015. To put that in context: global emissions from LULUCF were about 4.1 GtCO2e in 2016 (FAOSTAT, 2018).

Indonesia alone contributed to 7% of the total global tree cover loss between 2001 and 2020 (Global Forest Watch, 2021). However, Indonesia has made positive steps in this sector and managed to continue the decreasing trend of annual tree cover loss in the last five years – tree cover loss amounted to 841 kha in 2021, the lowest level since 2003 (Global Forest Watch, 2022).

While this reduction is a good sign, the biggest driver for deforestation is still commodity-driven deforestation, which accounted for over 90% in 2021. The underlying cause of commodity-driven deforestation is economic development. The expansion of commodity industries like palm oil is driven by global demand and fostered by national development policies (Dwisatrio et al., 2021).

Fires are another major source of LULUCF emissions in Indonesia and are used as a cheap and easy way to clear land for commodity plantations like palm oil. In 2019, the Indonesian fires were again a special reason for concern: in just the one week of 9 September there were almost 64,000 fire alerts in the country (Global Forest Watch, 2021), causing a state of emergency in at least six Indonesian provinces and sparking complaints from neighbouring countries that were affected by the toxic haze (Walden, 2019). The peak number of alerts in a single week decreased to 6,000 in 2020 and to below 4,000 in 2021 (Global Forest Watch, 2021).

Indonesia has made significant progress in reducing deforestation and forest fires, but these problems still persist. Weak implementation of commitments to international agreements, contradictory regulations and objectives, and poor coordination between government agencies and ministries are key challenges to achieving greater reductions in this sector (Dwisatrio et al., 2021).

LULUCF emissions are a huge uncertainty factor in assessing the extent to which Indonesia is in line with meeting its NDC targets. The CAT does not assess the LULUCF component of the NDC; however, both conditional and unconditional targets depend heavily on the forestry sector - it accounts for around 60% of the emissions reduction effort. However, emissions projections from this sector under current policies range from 600-779 MtCO2e/yr in 2030 (Figure 5) (Nascimento et al., 2021). To achieve its NDC targets, Indonesia must achieve a substantial decrease in LULUCF emissions.

The LTS envisages this sector becoming a net sink by 2050 under the current policies scenario, and by 2030 under the ambitious low carbon scenario compatible with the Paris Agreement (LCCP). In February 2022, the Ministry of Environment and Forestry published an operational plan for achieving net negative emissions in the forestry and other land use (FOLU) sector by 2030 (Ministry of Environment and Forestry, 2022). In this sector Indonesia aims to reach -140 MtCO2e net GHG emissions by 2030. The plan emphasises several key mitigation actions, including prevention of deforestation, conservation of natural forests, sustainable forest management (SFM), and enhancing carbon sinks from peatlands and mangroves.

As part of the National Action Plan for Greenhouse Gas Emission Reduction (RAN-GRK), Indonesia has identified actions in the forestry sector. Those are sustainable peat land management, reducing the deforestation and land degradation rate, and developing carbon sequestration projects in forestry and agriculture (Mersmann et al., 2017). These efforts are reinforced through the REDD+ Task Force, which in the short and medium-term focuses on improving governance of forests, and in the long term aims at turning Indonesia’s forests and lands into a net carbon sink. In the Third National Communication, Indonesia describes 13 “core mitigation plans” that have been pursued since 2010, each with a quantitative emission reduction target attributed to them, adding up to reductions of 810 MtCO2e/yr.

The moratorium on permits in primary forest and peat has been one of the main policies to limit deforestation since its introduction in 2011. The moratorium was renewed every two years and became permanent in 2019. The efficacy of the moratorium is ambiguous: while the policy is considered to be a good instrument to limit future deforestation in Indonesia (Mosnier et al., 2017) some research shows that deforestation has increased since it was implemented (Greenpeace Southeast Asia, 2019). The strict enforcement of this moratorium is essential for mitigating the environmental and social risks of biofuel and commodity production in Indonesia.

Indonesia has signed several international agreements on forest governance and the protection of biodiversity (UNFF, FLEGT, Amsterdam Declarations, Bonn Challenge and the New York Declaration on Forests, CBD, CITES) and made changes to the institutional arrangements and regulations relating to the reduction of emissions from deforestation and forest degradation (Dwisatrio et al., 2021).

Agriculture

The overall emissions intensity of the agriculture sector has been on a declining trend in Indonesia for the past 20 years. Nonetheless, the demand for biofuels has impacts on the agricultural and land use sector, as this demand may be met by expanding domestic palm oil industries.

In 2018, Indonesia implemented a policy that mandates all state crops to maintain sustainable practices including banning the use of fire for land clearing (Republic of Indonesia, 2018b). The government allocates its highest agriculture mitigation target to developing palm plantation areas on non-forested land/abandoned land/ degraded land/other use areas, but the exact approach to achieving this is neither well-explained nor easily traceable (Republic of Indonesia, 2018c).

Buildings

The growing middle-class energy demand means a continued relevance of the building sector in Indonesia. Emissions per capita in the sector have more than tripled since 1990 (see chart below). To mitigate the impacts of growing demand, the Indonesian government has set targets to reduce total final energy consumption in the buildings sector (both commercial and housing) by 15% compared to a BAU by 2025 (ASEAN Centre for Energy and GIZ, 2018).

In January 2022, the Ministry of Energy and Mineral Resources published a roadmap for energy efficiency, low-carbon buildings, and construction sector in Indonesia (MEMR, 2022e). The roadmap identifies priority short-term, medium-term, and long-term actions across several areas including urban planning, new buildings, and renewable energy.

Indonesia is making progress on green building through regulation and certification efforts. The government launched Regulation 21/2021 to addresses the performance assessment of all construction projects subject to green building requirements, which include new and existing buildings and green areas. Projects that fall under these requirements can obtain a certification through the Green Building Council of Indonesia.

The revision of Regulation 70/2009 on energy conservation, expected 2022, sets energy standards for buildings concerning building envelop, air conditioning, lighting appliances, and energy audit procedure. The energy management program is mandated for building users whose energy consumption is beyond 500 toe/yr.

MEMR Regulation 14/2021 aligns Indonesia’s Minimum Energy Performance standards (MEPS) and labelling for electrical appliances with international best practices. The regulation covers air conditioners, fans, refrigerators, and rice cookers (IETO 2022).

Further analysis

Country-related publications

Stay informed

Subscribe to our newsletter