Policies & action

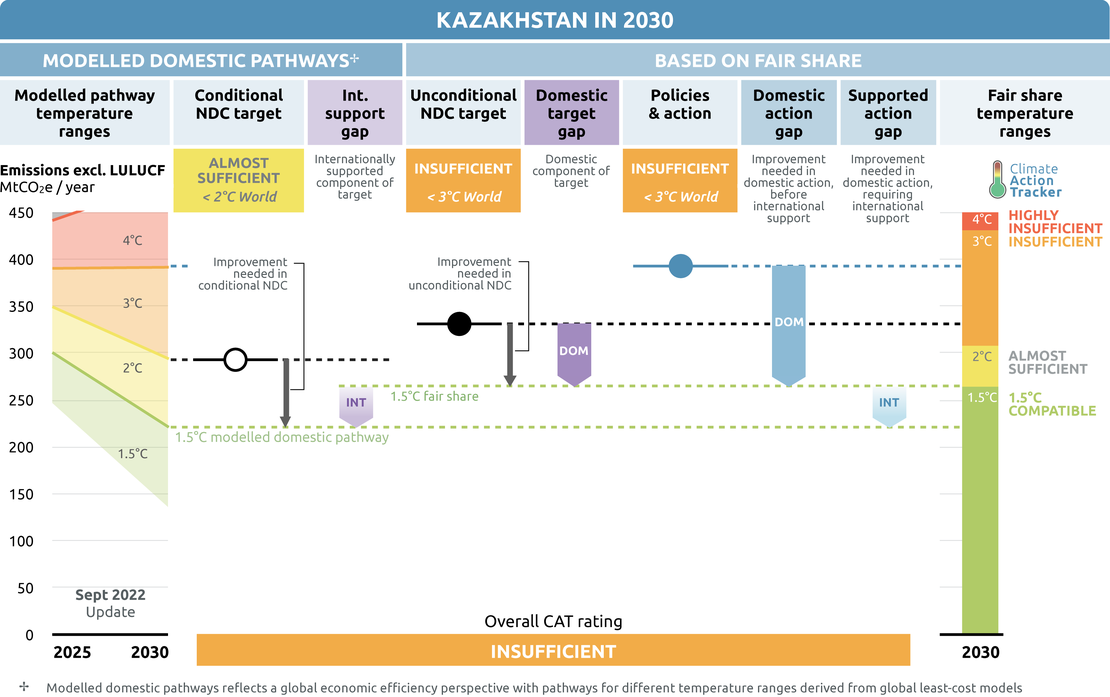

We rate Kazakhstan’s policies and action as “Insufficient” when compared to their fair-share contribution as this metric is more favourable than the modelled domestic pathways. The “Insufficient” rating indicates that Kazakhstan’s climate policies and action in 2030 need substantial improvements to be consistent with the 1.5°C temperature limit.

If all countries were to follow Kazakhstan’s approach, warming would reach over 2°C and up to 3°C. Kazakhstan is further off track when compared with modelled domestic pathways and needs to implement more stringent policies, for which it will need additional support.

According to our analysis and accounting for the COVID-19 related economic downturn, Kazakhstan’s current policies lead to an increase of 1.9% above 1990 levels by 2030 (393 MtCO2e – excluding LULUCF). Kazakhstan’s current policies are far from sufficient to meet its NDC targets and projected emissions are 62 MtCO2e higher than Kazakhstan’s unconditional NDC target in 2030.

If the CAT were to rate Kazakhstan’s projected emission levels under current policies for 2030 with respect to its domestic pathway, Kazakhstan would be rated “Highly insufficient”.

Policy overview

While Kazakhstan recognises the need to transition to a greener future, currently implemented policies are not yet sufficient to meet its targets and would lead to emissions of 376 MtCO2e by 2025 (a 2.5% decrease compared to 1990 levels, excluding LULUCF) and 393 MtCO2e by 2030 (an increase of 1.9% compared to 1990 levels). The current climate policy landscape prioritises energy sector emissions, given that energy-related activities accounted for 82% of the country’s annual GHG emissions in 2019 (Republic of Kazakhstan, 2022).

Kazakhstan’s new Environmental Code entered into force on 01 July 2021, and includes a section on greenhouse gas emissions and removals and corresponding measures. For instance, the 50 largest companies, which account for 80% of the country’s GHG emissions, are now required to implement best available technologies (BATs) by 2025 or face high emissions payment rates (Shayakhmetova, 2021).

Kazakhstan also codified the use of waste to energy technology, which is expected to reduce the volume of waste accumulated in landfills by 30% by 2025 (Nurbay, 2021). The impact of these measures on GHG emissions reductions is currently unclear.

The Kazakh Government estimates that the transition to a green economy will be accompanied by substantial economic and societal benefits. By 2050, the transition is expected to create more than 500,000 jobs, develop new industries and improve quality of life (Ministry of Energy of the Republic of Kazakhstan, 2017; Republic of Kazakhstan, 2015). The costs of the transition are estimated at USD 3-4bn or about 1% of GDP per year (IEA, 2015).

Sectoral pledges

In Glasgow, four sectoral initiatives were launched to accelerate climate action on methane, the coal exit, 100% EVs and forests. At most, these initiatives may close the 2030 emissions gap by around 9% – or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets, and on forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”.

NDCs should be updated to include these sectoral initiatives, if they’re not already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

| Kazakhstan | Signed? | Included in NDC? | Taking action to achieve? |

|---|---|---|---|

| Methane | No | Not applicable | Not applicable |

| Coal Exit | No | Not applicable | Not applicable |

| Electric vehicles | No | Not applicable | Not applicable |

| Forestry | Yes | No | Yes |

| Beyond oil and gas | No | Not applicable | Not applicable |

- Methane pledge: Kazakhstan did not sign the methane pledge. Methane made up 15% of Kazakhstan’s total emissions in 2019, half of which came from the agricultural sector and a quarter from the energy sector (Republic of Kazakhstan, 2022). Kazakhstan has few policies in place addressing methane emissions. The country emits more methane per tonne of produced coal than many countries, but also has relatively low capture and utilisation/flaring rates (Roshchanka et al., 2017). With the projected increase in natural gas production, Kazakhstan also faces risks of methane leakages from gas pipelines (IEA, 2022b).

- Coal exit: Kazakhstan has only endorsed Clause 4 of the coal exit at COP26. It has not committed to the coal phase-out nor ceasing permit issuance or construction of new coal-fired plants. Coal currently makes up over half of Kazakhstan’s primary energy supply, and accounts for 70% of electricity generation. Under current policies, coal will remain one of Kazakhstan’s main energy sources past 2030 (Republic of Kazakhstan, 2019).

- 100% EVs: Kazakhstan did not sign the EV pledge. The transport sector makes up around 8% of Kazakhstan’s total emissions, while oil dominates the transport sector’s energy consumption at 85%. Electricity made up only 3% of the sector’s energy consumption in 2020, which is primarily attributed to rail (IEA, 2022b). Kazakhstan plans to launch electric vehicle production in 2022 and expand charging infrastructure, and has already exempted EV owners from paying transport tax (Prime Minister of the Republic of Kazakhstan, 2021).

- Forestry: Kazakhstan signed the forestry pledge at COP26. The LULUCF sector is currently a minor emissions source in Kazakhstan, but this is attributed to emissions from cropland rather than forest conversion (Republic of Kazakhstan, 2022). The Kazakh government has announced a goal of planting over two billion trees by 2025 as part of its greening programme (Prime Minister of the Republic of Kazakhstan, 2021).

- Beyond oil and gas: Kazakhstan did not join the ‘Beyond Oil & Gas’ initiative launched at COP26 to end oil and gas exploration and production. On the contrary, Kazakhstan plans to increase the extent of natural gas in the energy mix under current policies (Republic of Kazakhstan, 2019).

Emission Trading Scheme

After a temporary suspension, the Emissions Trading Scheme (ETS) restarted operation on 1 January 2018 with new allocation methods and trading procedures for all market participants (ICAP, 2022). It covers centralised heat and power, extractive industries and manufacturing. The current emissions coverage amounts to 46% of total GHG emissions (ICAP, 2022). Kazakhstan should consider increasing the scope of its Emissions Trading Scheme to cover all sectors.

Despite several amendments to the ETS, it has not resulted in any changed operational decisions, investment decisions, nor emissions reductions to date. The generous benchmarks, number of free quotas, and low carbon price has resulted in few transactions under the system (IEA, 2022b).

The National Allocation Plan for the period 2022–2025 has set an emissions cap of 140.3 MtCO2e for 2022, while verified ETS emissions from the 128 companies covered amount to 162 MtCO2e (ICAP, 2022). Under the new plan, the extent of free quotas is expected to be reduced annually by 5.4% between 2022 and 2025, but benchmarking coefficients are expected to remain the same (IEA, 2022b; Kumenov, 2021b).

It is unclear whether the new allocation plan will achieve better results in reducing emissions. There are also questions around the reliability of current measurement, reporting, and verification (MRV) practices in the trading system (Beisembayev, 2022).

Energy supply

Kazakhstan’s economy is heavily reliant on fossil fuels – in 2019 around 14% of Kazakhstan’s GDP came from oil revenues and around 67% of merchandised exports were fuels (World Bank, 2022a, 2022b). Kazakhstan belongs to the top 14 countries endowed with large natural gas reserves (Central Intelligence Agency, 2019). Gross natural gas production has increased by 4% annually since 2010 (IEA, 2022a). In 2019, 90% of electricity was generated from fossil fuels; with coal accounting for 70% and natural gas for 20% (IEA, 2021).

In addition to efforts to transform its energy mix, Kazakhstan recognises the need for energy efficiency. Kazakhstan included energy efficiency-related targets in its 2013 “Concept for Kazakhstan’s Transition to Green Economy” to decrease the energy intensity of GDP by 25% by 2020, 30% by 2030 and 50% by 2050 below 2008 levels (Republic of Kazakhstan, 2015, 2019). These targets are cross-sectoral in nature and range from initiatives for district heating to thermal renovation of houses, to energy standards and energy efficiency categories for buildings and household appliances (Republic of Kazakhstan, 2015). While Kazakhstan did not reach its 2020 target, it is on track to meet its emissions intensity target for 2030 based on post-COVID-19 projections of GDP and emissions.

Fossil fuels

While coal production is planned to decrease in line with climate goals, plans to expand oil production increase Kazakhstan’s dependence on fossil fuels. In 2020, coal production had decreased by 6.8% compared to 2010 levels. While coal production is expected to gradually decrease over the next two decades, the government plans for oil production to reach over 100 million tonnes in 2025, an increase of 15.8% compared to 2020 levels (IEA, 2022b).

The government also plans to expand the energy sector to include coalbed methane exploration and production in the Karaganda region (kazinform, 2018) and in July 2019 signed a 15 year extension to the production sharing agreement of the Dunga fields, from 2024 to 2039, which will allow the production of an additional nine millions tons of oil (The Astana Times, 2019b).

These steps towards further exploitation of fossil resources fail to acknowledge the short-term steps necessary to keep the window open for a 1.5°C-consistent GHG emissions pathway. For Eastern Europe and the former Soviet Union, coal power generation should be phased out by 2030, and globally by 2040 at the latest (Climate Analytics, 2019).

In line with Kazakhstan’s climate neutrality plan, President Tokayev stated that the government was considering the complete phase out of all coal-fired power plants by 2050 at the earliest. Prioritising the modernisation of existing coal plants, as well as plans to replace coal with natural gas is short-sighted, considering that gas is not a long-term solution for the deep decarbonisation needed (Climate Action Tracker, 2017).

In January 2022, protests erupted throughout the country, initially over the dramatic price increase of liquified petroleum gas (LPG). Due to LPG shortages, the Kazakh government had been gradually transitioning towards a market-based model by removing subsidies, which concluded on the first day of the new year, and caused prices to spike where demand was high (Kumenov & Lillis, 2022). In response to the unrest, maximum prices have now been set for motor fuels and retail for LPG has stabilised (IEA, 2022b). The incident highlights the risks of Kazakhstan’s reliance on fossil fuels and their price volatility.

This issue was further underlined by the impacts of Russia’s invasion of Ukraine on Kazakhstan’s energy exports. Crude oil exports account for 14% of Kazakhstan’s GDP and 57% of total exports (O’Byrne, 2022). Most of these exports pass through Russia to Ukraine, where the oil was typically fed into a European pipeline network. Besides the closure of export routes, the incurred war risk insurance premium led to high prices that deterred buyers (O’Byrne, 2022) .

In July 2022, a Russian court ordered the temporary closure of the Caspian Pipeline Consortium (CPC), citing alleged environmental violations. Discussions on increasing Kazakhstan’s oil exports to mitigate the effect of sanctions on Russian oil flows are ongoing (Sarymbetova, 2022).

Renewable energy

Despite the large potential for renewables in Kazakhstan – estimated at more than 1,000 TWh per year (IEA, 2015) – they account for a minor share of energy and electricity production at less than 2% and 10.9%, respectively (IEA, 2022b). Fossil fuels are mostly complemented by hydropower, which accounted for roughly 9% of electricity generation in 2019 (IEA, 2021).

Other renewables, mainly wind and solar, have started to contribute to Kazakhstan’s energy mix in recent years. In 2019 the share of renewable sources in primary energy supply was almost 1.5% – predominantly based on hydro sources with 1.2% of the total energy supply (IEA, 2022a). Despite the recent increases in renewable electricity generation, the amount of electricity generated by renewable sources and share of renewables in the electricity mix declined in 2019 for the first time since 2011 – mainly due to a drop in hydro electricity generation.

In September 2019, the Government of Kazakhstan announced that the country had 900 MW of installed capacity in renewable energy and reaffirmed the 50% target of alternative and renewable energy share in electricity by 2050 (The Astana Times, 2019a). That same month, the Italian oil and gas company Eni was awarded the third renewable energy auction being held in Kazakhstan (following the first two auctions held in 2018) to build a 48 MW wind power plant in the Northern Zone that is expected to be finalised by 2022 (Eni, 2019).

In 2020, 25 renewable energy projects were launched, adding an additional 600 MW of capacity (The Astana Times, 2021). In November 2020, a contract for the construction of the 100 MW Zhanatas wind farm in southern Kazakhstan was signed (Konstantiov, 2020). Other renewable energy projects are also being introduced and developed, of which the contracts amount to up to 3,000 MW of additional renewable energy capacity (PrimeMinister.kz, 2019).

With support from the United Nations Development Program, Kazakhstan has also developed a wind energy development program through 2030, with a planned 2,000 MW of wind power (International Trade Administration, 2022).

Public finance flows for renewable energy have been increasing significantly in the past years, growing from USD 1.33m in 2010 to USD 145.93m in 2018 (IRENA, 2019), and the European Bank for Reconstruction and Development (EBRD) recently approved a EUR 300m extension of the Kazakhstan Renewables Framework to support solar, wind, hydro, biogas, distribution and transmissions projects. The first phase had supported the creation of 262 MW of renewable power-generation capacity across the country (EBRD, 2019).

Kazakhstan’s “Green Economy Concept” put forward a scenario of generating 30% of electricity from alternative and renewable energy sources (including nuclear) by 2030 and 50% by 2050, and reducing current CO2 emissions in electricity production by 40% by 2050, while also increasing the share of gas power plants to 30% by 2050 (Republic of Kazakhstan, 2015).

The government announced target indicators for the development of the renewable energy sector in November 2016. These targets include renewable energy contributing 3% to total electricity generation by 2020; totalling 1,700 MW of installed renewable capacity from wind (933 MW), solar PV (467 MW), hydro (290 MW) and biogas (10 MW) (Republic of Kazakhstan, 2016b).

Kazakhstan met its 2020 renewable energy target and in response, increased its 2030 target from 10% to 15% (Satubaldina, 2021a). Yet, as a country richly endowed with fossil fuels, the transition has been slow in the past, and even more stringent efforts are needed in order for Kazakhstan to achieve its climate and renewable energy targets.

To achieve its long-term targets, Kazakhstan will need to become an attractive investment option for private investors. To this end, Kazakhstan reformed its energy tariffs, which have been regarded as one of the key reasons for underinvestment (International Crisis Group, 2011). In January 2019, a capacity market was launched by the government with a feed-in tariff divided into two parts, including an electricity tariff (variable) and capacity tariff (fixed) (Mondaq, 2019).

Kazakhstan has also introduced a renewables auction system in place of fixed tariffs (International Trade Administration, 2022). Kazakhstan has also struggled with building up the flexible capacity needed in renewable energy systems and recently launched auctions for investments in new flexible generating capacity, including large gas-fired and hydropower projects (IEA, 2022b).

Despite these changes in policy, most investments are through development finance institutions. Around 70% of financing for renewable infrastructure projects originates from international development banks. The perception of low returns has likely resulted in a lack of large foreign investors coming forward, along with the small renewable energy market compared to neighbours like Uzbekistan (Kumenov, 2021a).

Due to a sharp increase in energy consumption rates, Kazakhstan is at risk of an electricity shortage in the next two years. To address risks of under-capacity in the electricity sector, the Ministry of Energy stated that an additional 19 GW of generating capacity is required, of which 10 GW should come from renewable energy sources (Ishekenova, 2022).

Kazakhstan officials have increasingly pushed for including nuclear energy in the energy mix. Kazakhstan hosts some of the world’s largest uranium deposits, and is the world’s largest uranium producer (International Trade Administration, 2022). Citing a potential power shortage by 2030, President Tokayev ordered the government to comprehensively assess the possibility of establishing a nuclear power industry in Kazakhstan (Abbasova, 2021) . Companies are currently bidding on the construction of a nuclear plant planned to be completed by 2035 (Auyezova & Sánchez, 2022).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter