Policies & action

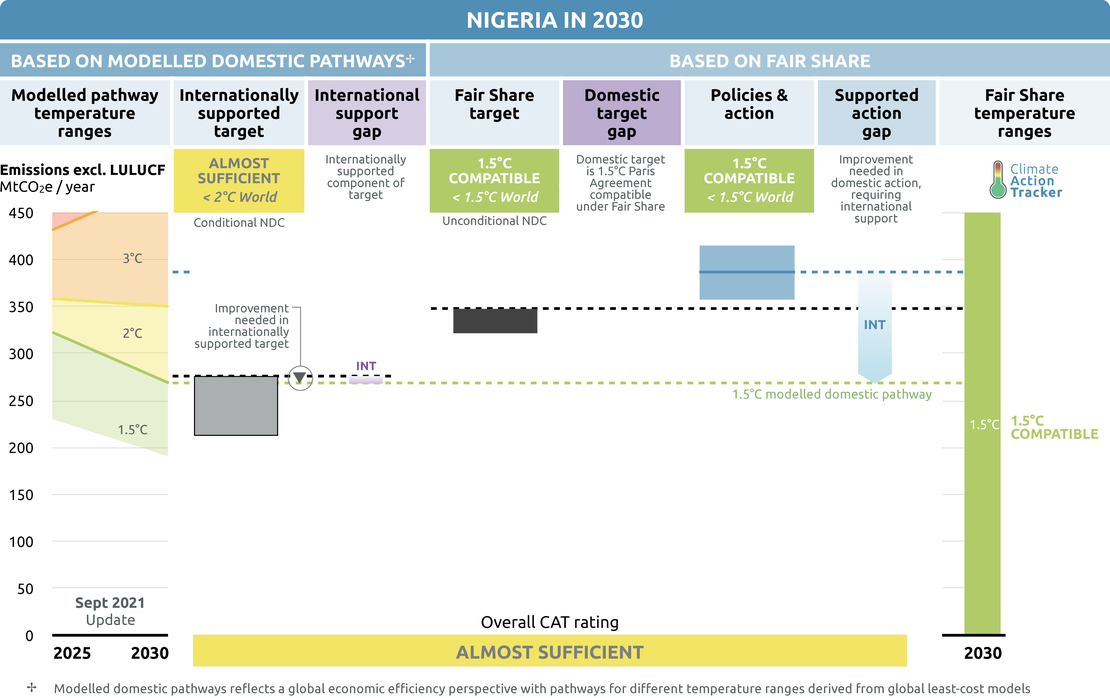

The CAT estimates that Nigeria’s greenhouse gas emissions would reach 25-45% above 2010 levels excluding LULUCF in 2030 under current policies and including the impact of COVID-19. In June 2021, Nigeria approved a revised National Climate Change Policy that outlines mitigation and adaptation priorities.

In response to COVID-19, Nigeria adopted its short-term Economic Sustainability Plan that includes positive climate initiatives such as the installing solar power on 5 million homes, though also includes a national gas expansion programme. Globally, unabated natural gas in power generation needs to peak before 2030 and be halved by 2040 below 2010 levels.

The government recently approved the Petroleum Industry Bill to reform the oil and gas sector and attract investment in the sector. While expected improvements in transparency are welcome, new investment into oil and gas infrastructure is not in line with the Paris Agreement temperature limit and will increase the risk of stranded assets. According to the IEA, no new oilfield development is needed if we are serious about the world reaching net zero emissions in 2050.

Nigeria also has plans to expand its domestic coal production. The draft 2018 National Energy Policy seeks to increase coal in the energy supply; however, there have not been signs of implementation. We therefore do not account for increased coal use in our current policies projections. To be compatible with the Paris Agreement, coal power generation across Africa would need to be phased out by 2034.

Nigeria’s current policies are rated 1.5˚C compatible when compared to its fair-share contribution. The “1.5˚C compatible” rating indicates that Nigeria’s climate policies and action are consistent with limiting warming to 1.5°C. Nigeria’s climate policies and action do not require other countries to make comparably deeper reductions.

While Nigeria’s policies and action are 1.5˚C compatible in the fair share space, they do not put Nigeria on track to meet either of its targets. It is also off track when compared with modelled domestic pathways. Nigeria will need to implement additional policies with its own resources to meet its unconditional target, but will also need international support to implement policies in line with full decarbonisation to meet and exceed its conditional target.

Key steps to reducing the gap between current policies and Nigeria’s NDC targets include progressing towards and ramping up its renewable energy target and halting the expansion of natural gas.

Policy overview

In June 2021, the government approved a revised National Climate Change Policy (NCCP) and National Climate Change Programmes for Nigeria for the period 2021-2030 (Department of Climate Change, 2021).

The NCCP outlines mitigation and adaptation policy measures, enabling conditions and means of implementation necessary to achieve Nigeria’s climate objectives. While the NCCP is meant to align with the updated NDC, it presents historical emissions more than double the historical emissions for the same year in the NDC. The NCCP further identifies AFOLU as the largest emissions source (66.6%), while the updated NDC indicates AFOLU is about a quarter of emissions.

Previously, Nigeria’s climate change policy was governed by the 2012 National Climate Change Policy and Response Strategy (NCCPRS) (Department of Climate Change, 2012). In 2019, Nigeria adopted a National Action Plan on Short-lived Climate Pollutants, with 22 measures to reduce emissions, including reducing methane from fugitive emissions and leakages from oil production and processing and natural gas transportation and distribution (Federal Republic of Nigeria, 2019).

While Nigeria’s GDP contracted by 1.8% in 2020, the economy rebounded faster than expected, seeing positive growth in Q4 2020 (IMF, 2021; Oyekanmi, 2021). Still, the economic consequences of COVID-19 continue to impact Nigerians, with unemployment growing to 33% in Q4 2020, up from 23% in Q3 2018, the last available data before COVID-19 (National Bureau of Statistics, 2021). Job losses were highest among Nigeria’s significant urban informal economy (Weber et al., 2020). Higher food prices have also strained communities. According to the SBM Jollof Index, the average cost of making the common dish jollof rice increased by nearly 8% between March 2020 and March 2021 due to COVID-19, security challenges, adverse weather and other disruptions (SBM Intel, 2021).

Nigeria adopted the Economic Sustainability Plan (ESP) to stimulate the economy in response to the COVID-19 pandemic (Economic Sustainability Committee, 2020). The ESP includes climate-related programmes, including the installation of five million solar homes and a national gas expansion programme to reduce reliance on oil.

Nigeria has tried, to pass comprehensive climate change legislation for over a decade, to no avail. In October 2021, the National Assembly passed a revised version of the bill, which will be sent to the President for assent. For more analysis on the draft bill, please see our Climate Governance country profile for Nigeria, which will be released soon: Governance Series.

Nigeria is developing a 2050 Long-Term Vision on climate change with support from the 2050 Pathways Platform and a long-term development plan, Agenda 2050 (Akinola, 2020; The Premium Times, 2020).

Energy supply

The energy sector is the largest source of emissions in Nigeria, responsible for more than 60% of the national total (Federal Ministry of Environment, 2021b). Fugitive emissions from oil and gas are the largest source of energy emissions, followed by transport, electricity generation, residential and industrial consumption.

Nigeria’s 2018 draft revised National Energy Policy (NEP) includes multiple targets related to the future of Nigeria’s energy mix and emissions (Energy Commission of Nigeria, 2018). The NEP includes a target to reduce energy-related GHG emissions to 15%; however, there is little detail on the nature of this target, such as a date by when it should be achieved.

The NEP also calls for a revival of Nigeria’s coal sector, which currently provides a negligible contribution to the country’s energy supply. The policy targets a 30% share of coal in the country’s energy mix, which we assume refers to the power mix. While the government has handed out 36 coal mining licences tied to 10,000 MW of coal capacity, none of the projects have been successful (Daily Trust, 2019). To be compatible with the Paris Agreement, coal power generation across Africa would need to be phased out by 2034 (Parra et al., 2019).

The government is in the process of finalising Nigeria’s Medium-Term National Development Plan (MTNDP) for 2021-2025. The current draft MTNDP includes strategies to expand gas and transmission and distribution infrastructure, promote renewables and increase commercialisation of upstream gas to reduce flaring (Ministry of Finance Budget and National Planning, 2021).

Oil & Gas

Nigeria, a member of OPEC, is the 11th largest oil producer in the world. Nigeria’s economy is highly dependent on its oil and gas sector, accounting for about 56% of government revenue in 2019 (Central Bank of Nigeria, 2020).

Nigeria’s COVID-19 stimulus plan, the Economic Sustainability Plan (ESP), includes a domestic gas utilisation programme aimed at reducing the country’s reliance on oil (Economic Sustainability Committee, 2020). This includes the promotion of compressed natural gas (CNG) for use in the transport sector.

Nigeria adopted its Gas Master Plan in 2008 with the goal of expanding its domestic, regional and export gas markets (Ukpohor, 2013). The plan has three main elements: a gas pricing policy to ensure affordable prices, a domestic gas supply obligation requiring all gas producers to set aside a predetermined amount for domestic use, and a gas infrastructure blueprint for production, processing and transmission infrastructure. Nigeria’s gas production has increased 37% from 2008 to 2019 (IEA, 2020b). However, to keep warming to 1.5˚C, gas must be phased out, not increased.

Globally, unabated natural gas in power generation needs to peak before 2030 and be halved by 2040 below 2010 levels. Further, according to the IEA, no new oilfield development is needed if we are serious about the world reaching net zero emissions in 2050 (IEA, 2021).

In August 2021, President Buhari signed the Petroleum Industry Bill (PIB) into law to improve transparency and accountability in the oil sector and ultimately attract more international investment in the sector (Esiedesa, 2021; Thomas, 2020). This comes after 20 years of attempts to pass the bill (Ene, 2018; Iroanusi, 2021a). However, increased expansion of oil infrastructure and production increases the risk of costly stranded assets as countries and private sector actors divest from fossil fuels.

Environmental groups have criticised the PIB for including exemptions that allow gas flaring to continue. Further, under the PIB, unlike with upstream fines, midstream gas flaring fines will be used for more gas investment rather than, for example, hosting community development or environmental remediation (EnviroNews Nigeria, 2021; KPMG in Nigeria, 2021).

Gas flaring

In 2000, Nigeria was flaring roughly 55% of the gas it was extracting. To reduce emissions from gas flaring, Nigeria set the goal of completely eliminating routine flaring by 2020, a decade ahead of the World Bank’s “Zero Routine Flaring by 2030” initiative. In 2018, Nigeria further adopted a gas flare commercialisation programme based on the “polluter pays” principle (Ogunleye, Banks, and Legarreta 2019). While Nigeria did not meet its 2020 target, it has made significant progress, now only flaring 10% of extracted gas.

Electricity

In the power sector, natural gas supplied about 83% of electricity generation in Nigeria in 2018 (IEA, 2020a). The remaining generation is supplied by hydropower and negligible shares of solar PV.

Nigeria’s electricity supply is one of the least reliable in Africa. It has the most frequent and prolonged power outages on the continent. In Nigeria’s Sustainable Energy for All (SE4ALL) Action Agenda, Nigeria aims to supply 90% of the population with access to electricity and 80% using modern cooking fuel by 2030 (Federal Republic of Nigeria, 2016). These reliability issues contribute to Nigeria’s high reliance on expensive oil-fired back-up generators (IEA, 2019).

Nigerians spend about USD 14bn per year on generators and fuel, producing an estimated 29 MtCO2e annually (Moss & Gleave, 2014; Olalekan, 2020). In 2019, Nigeria and Germany formed a partnership to upgrade Nigeria’s transmission and distribution infrastructure to secure 11,000 MW of reliable power supply by 2023 (The Premium Times, 2019).

Renewables

In 2015, Nigeria adopted its National Renewable Energy and Energy Efficiency Policy (NREEEP) (Ministry of Power, 2015). This policy set an ambitious target of over 23 GW of renewable capacity including large hydropower by 2030; however, Nigeria is not on track to meet this goal.

Nigeria’s renewable capacity, including large hydropower in 2019, was just over 2 GW, substantially less than the NREEEP’s interim 2020 target of over 8 GW (IRENA, 2020). Nigeria’s SE4ALL Action Agenda adopted a year later includes more conservative targets, though Nigeria is not on track to meet those either (Federal Republic of Nigeria, 2016). Based on IRENA estimates, Nigeria has only installed 12 MW of renewable capacity, mostly solar PV, since either plan was adopted (IRENA, 2020). The ESP, Nigeria’s short-term economic plan following COVID-19, includes measures to install solar power in five million homes (Economic Sustainability Committee, 2020).

Transport

Nigeria’s COVID-19 stimulus plan, the Economic Sustainability Plan (ESP), includes a domestic gas utilisation programme aimed at reducing the country’s reliance on oil (Economic Sustainability Committee, 2020). This includes the promotion of compressed natural gas (CNG) for use in the transport sector.

Nigeria’s National Action Plan to Reduce Short-lived Pollutants includes measures to limit emissions from the transport sector (Federal Republic of Nigeria, 2019). It aims to eliminate the use of high-emitting vehicles with a ban on vehicle imports more than 15 years old and increasingly stringent emission standards (Euro III by 2023, Euro IV by 2030). The plan also aims to renew the urban bus fleet in Lagos and adopt CNG buses across Nigeria, introduce low sulphur diesel and petrol, and promote a shift from road to rail and water transport.

In response to COVID-19, Nigeria also announced the removal subsidies for premium motor spirit fuels (Official Gazette, 2020). While pump prices in Lagos have risen from 145 to over 160 naira per litre, the government set price is still well below market value. The state-owned NNPC, the only gasoline importer in the country, has avoided the term “subsidy”, but has acknowledged the price difference which amounts to as much as NGN120 billion (USD294 million) in subsidies.

Nigeria had similarly announced the removal of subsidies in 2016 after a fall in oil prices, but returned to subsidising petrol in 2017 when crude prices rebounded. Uncertainty and confusion over government pricing has induced fuel shortages, likely due to a price hike by depot owners in anticipation of higher prices as international oil prices rebound (Olawoyin, 2021).

There is significant uncertainty around land use and forestry emissions estimates in Nigeria. The country’s Third National Communication (TNC) estimates LULUCF contributes to roughly half of Nigeria’s emissions (over 300 MtCO2e in 2016), while the NDC update reports land use emissions together with agriculture as about one quarter of emissions (approximately 87 MtCO2e in 2018) (Federal Ministry of Environment, 2020, 2021b).

Traditional biomass is Nigeria’s largest source of primary energy. In 2016, almost three quarters of households used fuelwood for cooking (Federal Ministry of Environment, 2020). Nigeria’s National Gas Expansion Programme, part of the Economic Sustainability Plan in response to COVID-19, aims to convert over 30 million homes from traditional fuels such as wood and kerosene to liquified petroleum gas to reduce emissions (Economic Sustainability Committee, 2020). Nigeria’s TNC estimated CO2 emissions from biomass consumption for energy production were about 70% of agriculture, forestry and other land use emissions (42% of total emissions) (Federal Ministry of Environment, 2020). The use of traditional biomass for cooking is linked to indoor air pollution and associated health risks as well as gender labour inequities (Addo & Olajide, 2021; Uchenna & Oluwabunmi, 2020).

In 2020, a new National Forest Policy was approved by the Federal Executive Council that is expected to boost climate efforts in the country, but the policy is not available online. It was reported that at the time of adoption by the National Council on Environment, the policy included a target to increase forest cover from the current 6% to 25% by 2030 (FME, 2019).

From 2001 to 2016, Nigeria’s tree cover decreased by 9.4%, largely due to shifting agricultural lands (Global Forest Watch, 2021). In July 2021, Nigeria launched its National Reducing Emissions from Deforestation and Degradation (REDD+) Strategy with the aim of reducing forest sector emissions by 20% by 2050 (Federal Ministry of Environment, 2021a; Olugbode, 2021). Pilot REDD+ activities have already progressed in Cross River State, home to half of Nigeria’s forests (FME & UNDP, 2019). Cross River State has developed its own REDD+ strategy and approach to safeguards and submitted its forest reference emission level to the UNFCCC.

Nigeria is a member state of the Great Green Wall (GWW) initiative. The initiative, launched in 2007 by the African Union, aims to restore degraded land, sequester carbon and create green jobs across in the Sahel region. Nigeria’s GWW programme has so far established a 1,359 km contiguous shelterbelt from Kebbi State in the northwest to Borno State in the northeast (UNCCD, n.d.). Other results so far include 2,801 hectares of reforested land and 1,396 jobs created.

Further analysis

Country-related publications

Stay informed

Subscribe to our newsletter