Summary

Overview

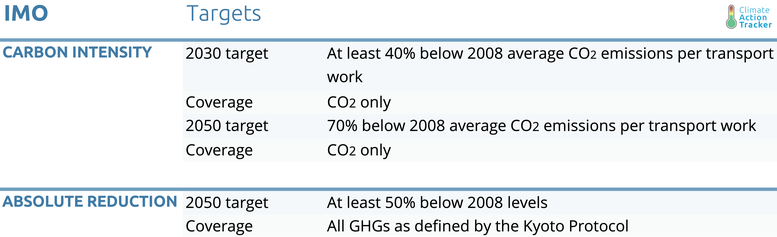

The international shipping industry - through the International Maritime Organization (IMO) - adopted an initial emissions reduction strategy in 2018: a 2030 target to reduce carbon intensity by at least 40% below 2008 levels, and a 2050 goal of at least halving emissions from 2008 levels. The IMO is revising its strategy, set to be adopted in 2023, and needs to adopt much stronger targets, especially for 2030, to become compatible with the Paris Agreement.

The COVID-19 crisis has slowed this process: the IMO has postponed a key session aimed at assessing short and medium-term measures to implement the strategy and adopting a resolution urging Member States to develop voluntary National Action Plans. A virtual, informal meeting will take place on 9 July. Despite limited and slow policy action, the shipping industry looks set to have already overachieved its 2030 intensity target (rated “Critically insufficient”) before being hit by COVID-19, but it is way off meeting its 2050 target (rated “insufficient”).

Pre COVID-19, international shipping accounted for about 2% - 3% of global GHG emissions, and they were projected to grow. As a result of the pandemic, global trade has slowed: the World Trade Organization estimates a drop from 13% to 32% in trade in 2020, and maritime passenger transport is at a virtual standstill with a number of countries imposing travel restrictions – tourist arrivals are expected to drop from 60% to 80% in 2020. Considering projected impacts on trade and tourist arrivals, we estimate that shipping emissions in 2020 could drop by around 18-35% from 2019. However, by 2030, emissions growth may have returned to its pre-COVID levels or have experienced a reduction of around 13% compared to pre-COVID projections, which equates to about 2019 levels.

The IMO has only undertaken limited policy action at a slow pace to achieve these targets and has focused primarily on requiring shipping companies to increase their vessels’ energy efficiency. Based on pre-COVID-19 current policies, the sector was set to overachieve its 2030 carbon intensity target and, in 2018, was already three quarters of the way there.

The 2008 baseline chosen to define IMO targets in 2018 was at the historical height of speed of ships generating a peak in emissions. Following the 2008 crisis, as a response to falling demand, carriers have reduced supply capacity by scrapping older vessels, cancelling orders for new ships and lowering ship speeds which drove to emissions reduction in 2009.

One key element of decarbonisation will be a shift away from heavy fuel oil (HFO), the most widely-used fuel for marine vessel propulsion. Renewable energy combined with battery storage technologies should be the focus for short distances, while electro-fuels such as hydrogen, ammonia, or methanol are more suitable for deep-sea fishing and long distances.

Liquified Natural Gas (LNG) is not an option to support the transition to alternative energy sources, notwithstanding a perception in the industry that it is a key bridging fuel. Studies have shown that instead of reducing emissions, adopting LNG could actually increase international shipping’s climate impact when the whole life cycle of all GHG gases are taken into account. Investments in LNG facilities are growing and could lead to stranded assets or perpetuate a carbon “lock-in” effect as ships and on shore LNG infrastructure will make it harder to transition to low-carbon fuel.

There have been a number of recent policy proposals to enhance regulations focusing on a limited scope, but more needs to be done to scale up climate action in the shipping sector.

In May 2019, the IMO’s Marine Environment Protection Committee (MEPC) approved draft amendments to the International Convention for the Prevention of Pollution from Ships (MARPOL) Annex VI, establishing more stringent energy efficiency requirements for individual ships by bringing forward the entry into force of the third phase of the Energy Efficiency Design Index (EEDI) requirements to 2022 instead of 2025 (ClassNK, 2019; IMO, 2019d). These amendments were due for adoption at the 75th session of the MEPC in April 2020, but this meeting has been postponed due to COVID-19 and, as of June 2020, has not yet been rescheduled. The 76th session is scheduled for October 2020 (IMO, 2020d). There will be an informal virtual consultation on July 9 2020.

In February 2020, the IMO agreed on draft amendments to MARPOL Annex I to ban heavy fuel oil (HFO) usage for ships travelling through the Arctic. While the adoption of this regulation is a positive development, the final version included an exemption for Arctic nations’ own ships for the next five years, a major weakening of the policy’s effectiveness as 68% of the fuel consumed come from just five of the Arctic Nations (Russia, United-States, Canada, Norway and Denmark) (Comer et al., 2017).

Black Carbon emitted by HFO is particularly critical in the Arctic because it directly warms the arctic atmosphere by absorbing solar radiation that should have been reflected into the space by the icy surfaces of this region. Potentially, this black carbon could have five times the warming effect than when emitted in lower latitudes (HFO-Free Arctic, 2016; Sand et al., 2013). A rising concern in the region is the impact of the new sulphur limit regulation - in force since January 2020 - that, with the implantation of low sulphur content fuels, could increase black carbon emissions from 10% to 85% compared to HFO (IMO, 2019e).

The IMO’s 2018 initial strategy contains a number of possible (“candidate” in IMO parlance) measures to meet the sector’s targets. However, there are no concrete signs of action taken to actually implement these measures such as fostering the development of low-carbon fuel and more efficient marine engines which would be needed to decarbonise to the level required by the Paris Agreement.

While some major shipping companies have undertaken commitments to work towards zero-carbon vessels, there is still a need to overcome barriers to implementation. The very structure of the shipping industry does not facilitate the implementation of an incentive system to foster investments in low-carbon technologies. Every ship is registered to a state of its own choice. The owner of the ship, its flag (the country where it is registered), and the operator can all be based in different countries (Kachi et al., 2019; Marine Insight, 2019). The fragmented nature of regulation within the shipping sector, the flagging system for ships and the unclear division of responsibility between ship owners and operators and port state regulation all create barriers to climate action.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter