Policies & action

Canada’s emissions are finally starting to trend downwards as the government continues to implement its climate policy agenda, but there remains a significant gap between current policies and Canada’s NDC target. Implementing planned policies will go some way to closing that gap, but further action is needed.

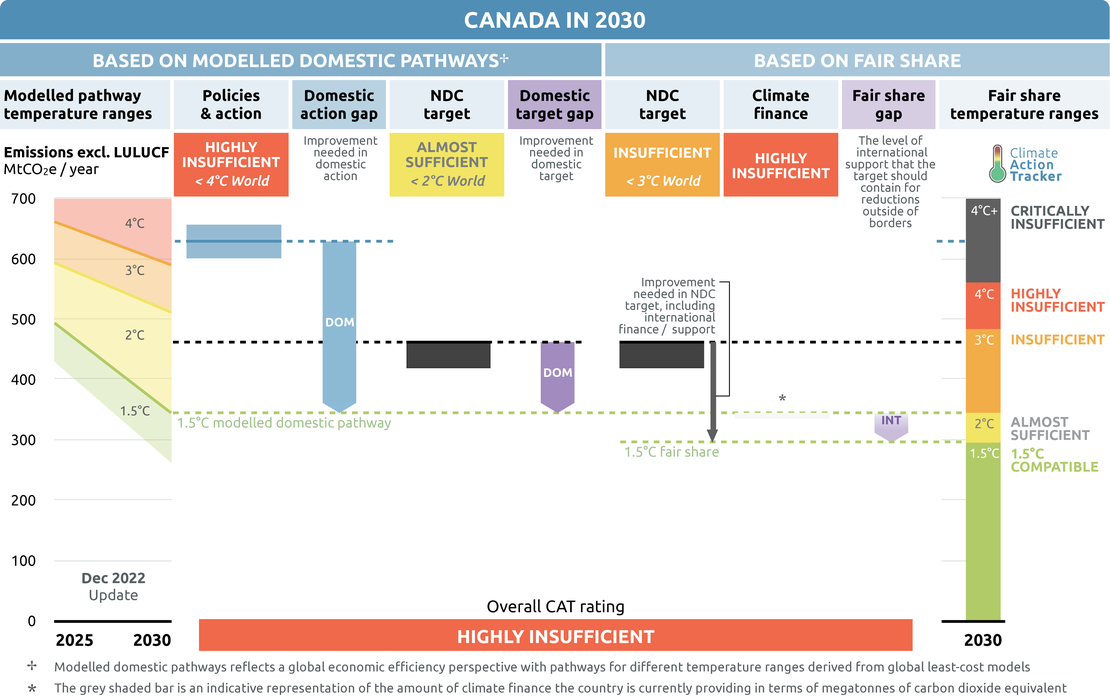

Our rating of Canada’s policies and action is unchanged at “Highly Insufficient”, however Canada is inching towards a rating improvement as emissions start to fall. That said, it is still far from 1.5°C compatibility on a global least cost basis as illustrated by the large blue ‘domestic action gap’ in the graph above. If all countries were to follow Canada’s approach, warming could reach over 3°C and up to 4°C.

If Canada can successfully implement all of the measures it has planned, it would go a long way to closing this ambition gap and its rating would improve to “Insufficient”. The emission levels resulting from planned policies are higher than in our previous assessment, resulting in a downgrade, as we assume some of the proposed measures to be less likely to actually deliver the emissions reductions ascribed to them (see the hydrogen section for more details).

Policy overview

The speed and scale of Canada’s climate policy implementation does not match the urgency of the climate crisis and much more work is needed. Emissions in 2030 are projected to be 602-656 MtCO2e (excl. LULUCF contributions) or 11-19% below 2005 levels, lower than our last update, due to the impact of the pandemic and continued policy implementation, but a far cry from the 419-462 MtCO2e level Canada needs to reach to meet its updated NDC target.

Emissions fell by 9% in 2020 compared to 2019 due to the economic impact of the pandemic. Our projections, which are based on government figures, show only about a 1% rebound in 2021; however, international sources suggest that Canada’s emissions may have exhibited a stronger rebound in 2021 of about 3%, driven by its energy sector (Gütschow & Pflüger, 2022). If that turns out to be the case, emissions projections in 2030 could be higher than presented here.

In November 2021, Canada’s Commissioner of the Environment and Sustainable Development issued a damning report outlining 30 years of the government’s failure to meet its targets and reduce greenhouse gas emissions (Commissioner of the Environment and Sustainable Development, 2021a; Office of the Auditor General of Canada, 2021b). The Commissioner stressed the need for strong plans and the implementation of those plans, and called out incoherence in policies, like the government’s purchase of the Trans Mountain Pipeline Expansion and the Emissions Reduction Fund which undermined existing oil and gas sector regulations. He called for stronger leadership and coordination within government.

In March 2022, Canada released its latest climate change plan, building on earlier strategies released in 2016 and 2020 (Environment and Climate Change Canada, 2020a, 2022a; Government of Canada, 2016b). The measures outlined in the plan are not yet sufficient to ensure Canada meets its NDC target, nor have all been implemented yet.

Carbon pricing

Mandatory carbon pricing has been in effect across Canada since 2019 (Government of Canada, 2018a). The legislation enacting the carbon pricing scheme, the Greenhouse Gas Pollution Pricing Act, was found to be constitutional by the country’s top court in March 2021 after three provinces challenged it (Supreme Court of Canada, 2021). A second challenge from the province of Manitoba was also dismissed by the Federal Court in October 2021.

Under the scheme, all Canadian provinces and territories must have a cap and trade system or carbon tax in place. Those jurisdictions that do not have such systems or taxes will fall under the federal backstop. The federal system has two components: a regulatory charge on fossil fuels and an output-based pricing system (OBPS), which applies to major emitting industrial facilities. It applies in full in one province and two territories and partially in four other provinces (Government of Canada, 2022f). The rest of the country falls under equivalent provincial systems. The federal government will review its carbon pricing benchmark in 2026.

The initial carbon price of CAD 20/tCO2e was set in 2019 and increased by CAD 10 per year, reaching CAD 50/tCO2e in 2022. In its latest climate plan, the government stated that it will further increase the carbon price by CAD 15 per year for the 2023-2030 period (Environment and Climate Change Canada, 2020a; Government of Canada, 2021k). With these increases, the carbon price will be CAD 170 in 2030. While the carbon price is heading in the right direction, it is still below the USD 170-290 (2015$) needed to be compatible with 1.5°C. At today’s values, CAD 170 is only around USD 125.

A 2022 audit of the scheme found that the government had taken steps to address some of the scheme’s weaknesses, but that requirements for large emitters were poor and could be strengthened (Commissioner of the Environment and Sustainable Development, 2022; Office of the Auditor General of Canada, 2022a).

National GHG Offset System

In June 2022, the federal government established a GHG Offset system for activities not covered by carbon pricing (Government of Canada, 2022d). Credits generated under the system can be used to reduce the compliance costs of industrial facilities covered by the OBPS. At present, the system only covers landfill methane recovery, but protocols are being developed for agriculture, forest management and refrigerant F-gases (Government of Canada, 2022b). In mid-2022, the environment ministry began to develop protocol requirements for direct air carbon capture and sequestration related projects. The ministry is also looking into ways to remove barriers and enhance participation in the system by Indigenous peoples (Government of Canada, 2022e).

Sectoral pledges

In Glasgow, a number of sectoral initiatives were launched to accelerate climate action. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets. On forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”. Members of the Beyond Oil & Gas Alliance (BOGA) seek to facilitate a managed phase out of oil and gas production.

NDCs should be updated to include these sectoral initiatives, if they're not already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

| CANADA | Signed? | Included in NDC? | Taking action to achieve? |

|---|---|---|---|

| Methane | Yes | Yes | Yes |

| Coal Exit | Yes | Yes | Yes |

| Electric vehicles | Yes | Yes | Neutral |

| Forestry | Yes | Yes | Yes |

| Beyond Oil and Gas Alliance | No, but one province is a member | N/A | Province is taking symbolic steps as it is not a producer |

- Methane pledge: Canada signed the methane pledge at COP26. It had already begun to take action in its oil and gas sector prior to signing the pledge, but has agreed to strengthen its methane reduction target for those emissions. In September 2022, it released its national methane strategy. The government estimates that it can cut methane emissions by more than 35% below 2020 levels by 2030, which is higher than the global pledge. Methane emissions were 14% of its total GHG emissions in 2020, primarily from its oil and gas sector, agriculture and waste.

- Coal exit: Canada co-founded the Powering Past Coal Alliance in 2017 to help accelerate the rapid phase-out of unabated coal-fired electricity. It has had a regulatory system in place to phase out unabated coal power by 2030 since 2018 and is on track to achieve this phase-out. Canada committed to banning thermal coal exports from the country by 2030, but has not implemented the necessary regulations to support this ban.

- 100% EVs: Canada adopted EV sales targets in 2019, strengthening its 100% target year to 2035 in 2021. The government has promised to adopt regulations to ensure that these targets are met, but has not yet done so.

- Beyond Oil and Gas Alliance (BOGA): The province of Quebec is a member of BOGA, but Canada as a whole is not. In April 2022, Quebec passed a law banning any further production and mandated that existing drill sites be shut down within three years (Government of Quebec, 2022). The move is largely symbolic as the province is not a producer of oil and gas (Canada Energy Regulator, 2022), though there had been efforts earlier in the year to resurrect an LNG project in light of Russia’s illegal invasion of Ukraine (Hosa, 2022)

Energy supply

Oil & Gas

At over a quarter of total emissions, oil and gas production represents Canada’s largest source of emissions (Environment and Climate Change Canada, 2022e). While the sector’s emissions dropped in 2020 due to the pandemic, they are projected to be around 2019 levels in 2030 under current policies. The government is planning to strengthen methane emission regulations in the sector, but this is currently only reflected in our planned policies scenario.

The government seems incapable of kicking its oil and gas addiction. In April 2022, it approved an offshore oil and gas megaproject, Bay du Nord (Impact Assessment Agency of Canada, 2022a). The project is required to be net zero from 2050 onwards, but production could continue until 2058 (Impact Assessment Agency of Canada, 2021, 2022a). The environment and energy ministers disagree over whether this will be the last development of its kind in Canada (CBC News, 2022). Whether the project will actually proceed is not clear: a final investment decision is a few years away and it faces opposition from environmental groups, including legal challenges. The Norwegian state is the majority stakeholder of the company behind the project (Equinor, 2022). The company dropped a similar project in Australia in 2020, which also faced local opposition (Singh, 2022).

The costs of current oil and gas expansion projects continue to rise. In February 2022, the Trans Mountain Corporation announced that the total costs of its oil pipeline expansion had increased by 70% from CAD 12.6bn to CAD 21.4bn (Trans Mountain Corporation, 2022). This is the pipeline project the federal government purchased in 2018 and granted regulatory approval for in 2019, one day after it declared a national climate emergency (Government of Canada, 2019c, 2019b). These cost estimates are four times higher than estimates when the government first purchased the pipeline (CAD 5.4 bn) (Lindsay, 2021). Following the announcement of ballooning costs, the government assured Canadian taxpayers that no further public money would be spent on the project, but it is providing a loan guarantee so that the corporation can secure third party financing (Department of Finance Canada, 2022a, 2022b). While questions about the financial viability of the project are not new (Lindsay, 2021), the chorus is getting lounder. In June 2022, a budget watchdog concluded that it was not viable and would cost the government around CAD 600m in net losses (Thurton, 2022). Others have estimated that losses will be much higher (The Energy Mix, 2022).

Costs associated with the pipeline for the country’s first LNG export terminal, on the country’s west coast, are also soaring (Jang, 2022; Simmons, 2022). The government does not own that one, but there are questions as to whether it will be able to recoup all of the subsidies provided (Simmons, 2022). While fossil gas prices are high now, the LNG project will only begin exporting fossil gas to Asia in 2025-2026. The latest Net Zero Emissions report from the IEA shows a significant drop in gas demand compared to its last report, as fossil gas loses out to renewables (IEA, 2022). The energy crisis in Europe, caused by Russia’s illegal invasion of Ukraine, has renewed interest in developing LNG export facilities on the country’s east coast. But the timelines do not match up (Christensen & Dusyk, 2022). Europe needs fossil gas now and these projects would only come online in 2025 at the earliest. The east coast does not produce fossil gas and so new pipelines would need to be built to transport gas to these facilities, which will undoubtedly be contentious. Yet the Prime Minister still considers this option ‘doable’ (Lum, 2022).

Methane emissions

14% of Canada’s emissions come from methane and of that the oil and gas sector is the largest source at 38%. Canada has committed to reducing methane emissions from the sector by 40–45% from 2012 levels by 2025 and at least 75% by 2030 (Environment and Climate Change Canada, 2018, 2021a). It adopted regulations to support the 2025 target in 2018 (Government of Canada, 2018b, 2020d, 2020b, 2020c). These started to come into effect in 2020, with further measures scheduled for 2023. The government began consulting on the further regulations that will be needed to achieve the 2030 target in the first half of 2022 (Government of Canada, 2022j). Draft regulations are expected in the first half of 2023 and final ones by 2024.

While strengthening its methane targets is a step in the right direct, the government has undermined its own regulatory efforts with incoherent policy. As part of its COVID-19 economic recovery package, the government announced a CAD 750m Emissions Reduction Fund to support the oil and gas sector in reducing methane emissions (Natural Resources Canada, 2021c). Yet, as industry was already required to start reducing emissions, the Fund essentially subsidised those efforts and it is questionable the extent to which any additional emission reductions were achieved. Canada’s Commission of the Environment and Sustainable Development considers the Fund to be poorly designed and found the government both misstated and overestimated the potential emission reduction benefits (Commissioner of the Environment and Sustainable Development, 2021b; Office of the Auditor General of Canada, 2021a, 2021c).

The need for more ambitious action in this sector is compounded by the fact that emissions could be even higher than currently reported. Canada reports on emissions from the sector using bottom-up methods based on internationally agreed standards (Environment and Climate Change Canada, 2021b). Research, based on atmospheric measurements rather than energy statistics, suggests that emissions could be much higher (Chan et al., 2020; Liggio et al., 2019; MacKay et al., 2021). Canada made improvements to its upstream oil and gas methane emissions estimate methods in its 2022 inventory, which resulted in an upwards revision of emissions between 31-39% over the last decade (Environment and Climate Change Canada, 2022e). It will continue to work to improve measuring and monitoring efforts as part of its national methane strategy (Environment and Climate Change Canada, 2022d).

Net-Zero Producers Forum

Canada is part of the ‘Net Zero Producers Forum’, along with other oil and gas majors: Norway, Qatar, Saudi Arabia, the UAE and the US (Natural Resources Canada, 2021a; U.S. Department of Energy, 2021). The forum’s stated aim is to develop ‘pragmatic net zero emission strategies’, including reducing methane emissions and supporting the use of CCS, but it does not tackle the core issue of phasing down production. Beyond holding its first Ministerial meeting and establishing a working group in March 2022, there is little evidence of concrete action more than a year after its formation. Meanwhile investors and international oil companies continue to exit Canada’s tars sands (Morgan, 2020; Reuters, 2021; The Canadian Press, 2020; Total, 2020; Tuttle, 2022).

Electricity generation

Electricity generation is responsible for around 8% of Canada’s emissions (Environment and Climate Change Canada, 2022e). Its share of the country’s emissions has been falling since 2015 as Canada shifts away from coal (Environment and Climate Change Canada, 2022b). Canada adopted the necessary regulations for the coal phase-out in 2018, as well as performance standards on fossil gas-fired power plants (Government of Canada, 2018e, 2018d). At the time, it was assumed that many of the coal-fired power stations affected by the phase-out, or that were otherwise nearing end of life, would be replaced with new fossil gas plants or coal-to-gas conversions (Government of Canada, 2018d).

During the last federal election (September 2021), the government committed to a net zero grid by 2035 (Liberal Party of Canada, 2021a). Draft regulations necessary to implement this commitment are expected by the end of 2022 (Government of Canada, 2022g).

These regulations will replace the coal and fossil gas regulations when they come into force in 2035. Any emissions that do occur after 2035 would need to be offset or will be subject to the federal carbon price (which will be a minimum of CAD 170/tCO2e by that time). Exemptions will apply in cases of emergencies, when unabated fossil gas may be used, and for remote northern communities (where much of the power is diesel generated).

The regulations may also provide flexibility for newer fossil gas units built prior to 2025, which would be allowed to continue to operate ‘for a short prescribed period’ after 2035 (Government of Canada, 2022i). Cascade Power, a 900 MW fossil gas plant, currently under construction could fall under such exception (Cascade Power, 2021). It will become operational in 2023. The final investment decision to build the plant was taken in 2020. SaskPower is also building new fossil gas plants to come online in 2024-2026 (SaskPower, 2022a).

While the commitment to decarbonise its power sector by 2035 is a positive step, the extent to which Canada continues to build and rely on fossil gas is concerning. The CAT cautioned in 2017 that natural gas had a limited role to play as a bridging fuel in the power sector, and this has since been confirmed by the IEA. While the CAT has not developed power sector benchmarks for Canada, other analysis suggests that Canada’s power sector needs to be decarbonised by 2030 with essentially zero unabated fossil gas by that time (Climate Analytics, 2022).

Abated coal-fired power generation

Canada, and the world’s, only commercial CCS abated coal-fired power plant in operation continues to face problems. Saskatchewan’s Boundary Dam CCS project, built at a cost of CAD 1.5bn in 2014, has never met its annual CO2 capture target (SaskPower, 2022b; Schlissel, 2021; Taylor, 2019). In 2021, it was offline for more than half the year due to technical issues, captured only a fraction of the CO2 emissions for which it was designed, and contributed to the utility missing its annual GHG emissions reduction target for that year (Rives, 2022; SaskPower, 2022a).

The Saskatchewan government decided against retrofitting two of the site’s other units with CCS in 2018 for economic reasons (CBC News, 2018; Dyer, 2021). CCS was still being put forward as an option for other plants for a few years after that, though it seems that the conversation has now shifted to small nuclear reactors (Dyer, 2021; Taylor, 2019; Willberg, 2022). The province’s other unabated coal plants will shut down in 2029 as part of the country’s coal phase-out.

Coal mining

In 2021, the government committed to banning thermal coal exports from and through Canada by 2030 (Liberal Party of Canada, 2021b; Prime Minister of Canada, 2021b). The reference to ‘through Canada’ is important, as many American west coast miners export their coal through Canada due to resistance to developing the export infrastructure in their own country (Institute for Energy Economics and Financial Analysis, 2021; Kuykendall, 2021). Environmental groups have called for the ban to be imposed much sooner: by 2023 (Ecojustice, 2022; Thomson, 2022). While establishing the ban is in the trade minister’s mandate letter, no action to implement the ban has yet been taken (Global Affairs Canada, 2022; Prime Minister of Canada, 2021a).

Canada had been criticised for its hypocritical stance on coal mining, and for not subjecting a thermal coal mine expansion to a federal impact assessment, notwithstanding its position in the Powering Past Coal Alliance (Rabson, 2020). In June 2021, Canada clarified its policy position on thermal coal mining, finding that any new mines or expansions of existing mines would likely cause unacceptable environmental effects (Government of Canada, 2021i). One coal mining expansion project is still attempting to get approval and is currently undergoing an environmental impact assessment (Impact Assessment Agency of Canada, 2022b).

Hydrogen

Canada released its Hydrogen Strategy in 2020 (Natural Resources Canada, 2020a). It sees the shift to hydrogen as a key contributor to meeting both its 2030 NDC and net zero goals. The Strategy estimates that Canada could reduce emissions by 22-45 MtCO2e by 2030 and 90-190 MtCO2e by 2050, at which point as much as 30% of Canada’s end-use energy would come from hydrogen. The Strategy is not limited to green hydrogen (produced with renewable energy only), but includes hydrogen produced from fossil fuels with CCUS.

Canada latest climate plan includes a 15 MtCO2e reduction from hydrogen use by 2030. This estimate uses a 7.3% hydrogen blending into fossil gas as its proxy to calculate emissions reductions, as measures to implement the Hydrogen Strategy have not been developed. As much of the hydrogen would be produced using fossil gas, an additional 30 Mt of CCUS capacity would be needed to capture the associated emissions (Office of the Auditor General of Canada, 2022b). To give you a sense of scale, Canada’s only commercial CCS abated coal-fired power plant in operation was designed to capture 1 Mt (see above for details).

Canada’s Commissioner for the Environment and Sustainable Development has heavily criticised these estimates, finding the assumptions underlying them to be ‘unrealistic’ (Commissioner of the Environment and Sustainable Development to the Parliament of Canada, 2022; Office of the Auditor General of Canada, 2022b). The Commissioner is particularly concerned about the credibility of modelling assumptions given Canada’s 30-year history of failing to achieve its targets and plans.

The Commissioner points out that the Clean Fuel Standard (see below for details), adopted in June 2022, only applies to liquids and not gas and so would not support the blending of hydrogen into fossil gas assumed in Canada’s climate plan and would require a carbon price of at least CAD 500 to make it economically viable (in contrast to Canada’s anticipated CAD 170 in 2030 carbon price). The Commissioner noted that one incremental demand modelling scenario that was not included in the Hydrogen Strategy found that hydrogen may only contribute 0.5% of the reductions needed for Canada’s 2030 target.

Russia’s illegal invasion of Ukraine has reinforced the need for securing green hydrogen production and supply. In August 2022, Canada and German established a Hydrogen Alliance through which Canada would aim to start exporting hydrogen to Germany in 2025 (Government of Canada & Government of the Federal Republic of Germany, 2022).

Transport

Transport is the second largest source of emissions in Canada, after oil and gas, representing about a quarter of the country’s emissions (Environment and Climate Change Canada, 2022e).

Canada is taking steps to reduce transport emissions, but not at the speed needed for such a large source of the country’s emissions. Some regulations were finally adopted this year, while we are still waiting on others. There are targets and financial support to build out the country’s EV charging infrastructure, but the government missed an opportunity to support home charging which is not addressed in the most recent building code revisions. Action on emissions standards is linked to progress in the US.

Electric Vehicles

Targets

In 2019, Canada adopted sales targets for zero-emissions passenger vehicles (ZEVs) of 10% by 2025, 30% by 2030 and 100% by 2040 (Transport Canada, 2019). In 2021, it strengthened its target, moving forward the 100% sales target date from 2040 to 2035 (Transport Canada, 2021). In March 2022, Canada established interim targets for 2026 of at least 20% and 2030 of at least 60% under its latest climate plan (Environment and Climate Change Canada, 2022a). Canada estimates that under these targets around 16% of the light-duty vehicle (LDV) stock would be electric in 2030. The government aims to electrify its own LDV fleet by 2030 (Natural Resources Canada, 2022a).

The government has promised to establish sales mandate regulations to ensure these targets are met. The mandate will set annual targets toward the 2035 100% goal, but it has yet to follow through on this promise.

The CAT has not developed EV benchmarks for Canada; however, our US benchmark suggests that Canada’s targets are not 1.5°C compatible: 95-100% of all US passenger cars and trucks sold in 2030 should be ZEVs. Under this pathway, the US EV stock would be 30-40% in 2030, more than double Canada’s estimate.

In 2021, 3.6% of LDV sales were battery electric, 10% when you include hybrids (Statistics Canada, 2022).

Canada has also set targets for its medium and heavy duty vehicles (MHDVs) with the goal of achieving a 35% sales target by 2030 and 100% by 2040 for some models. Regulations to support these targets have also not yet been developed.

Infrastructure and support programs

The government began supporting the development of EV-related infrastructure and charging networks in 2016 (Natural Resources Canada, 2021b, 2021e). While there were some early missteps in supporting fossil gas refuelling stations, current initiatives focus on EV and hydrogen infrastructure only (Natural Resources Canada, 2021b). Canada currently has just over 16,500 chargers at 7000 sites (Natural Resources Canada, 2022b). The government aims to build a further 84,500 chargers by 2027. Analysis suggests that Canada will need between 440,000-470,000 chargers in 2035 (Dunsky Energy + Climate Advisors, 2022).

The government missed an opportunity to support home charging infrastructure by not including them in the most recent building codes. Making buildings EV charging ready through minor changes at the time of construction can significantly reduce the costs when the necessary equipment is actually installed (Efficiency Canada & Carleton University, 2022).

Since 2019, the federal government has provided rebates for the purchase or lease of EVs and will continue to do so until March 2025 (Environment and Climate Change Canada, 2020a; Transport Canada, 2022a). In July 2022, it launched a four-year, half billion CAD programme to support the purchase of medium and heavy duty electric vehicles (Transport Canada, 2022b).

The government is also supporting programmes to raise awareness with respect to EV usage (Natural Resources Canada, 2020b). The higher upfront costs of EVs are becoming less of an issue for Canadians, no doubt a result of higher gas prices, but range anxiety and the lack of charging infrastructure remain a concern (EY, 2022).

Vehicle emission standards

Canadian fuel economy standards for light and heavy-duty vehicles are aligned with federal-level regulations in the US (Environment and Climate Change Canada, 2020a; Government of Canada, 2021h, 2018c). The Biden administration has been working on reversing the Trump era rollbacks, adopting new rules for emissions and fuel standards. It is not clear to the CAT whether these new rules have been incorporated by reference in Canada or will require regulatory amendments, though ultimately the standards will be aligned. There tends to be a slight delay between action in the US and Canada, when regulatory amendments are required (Government of Canada, 2021l, 2022n).

GHG standards for new trailers have been delayed for more than a year in response to legal challenges to those standards in the US (Government of Canada, 2022m, 2020a).

Fuel standards

Canada finally adopted Clean Fuel Regulations in June 2022 (Government of Canada, 2022r). The regulations require producers and importers of gasoline and diesel to reduce the carbon intensity of their fuels from 2016 levels from July 2023, with deeper annual reductions through to 2030.

The regulations create a credit market for compliance, which allows those not subject to the regulations (like EV charging stations or low carbon fuel producers (e.g. biofuels)) to participate. The regulations aim to improve production process in the oil and gas sector, foster production of low carbon fuels and enable end-use fuel switching in transport. The fuels used by remote communities, and in international shipping, and domestic and international aviation are exempt from the regulation. The renewable fuel content requirements, of 2% for diesel and 5% for gasoline, as set out in the Renewable Fuels Regulations, have been incorporated in these new regulations (Government of Canada, 2010).

These regulations were first proposed in 2016 as part of the Pan-Canadian Framework (Government of Canada, 2016a). Originally, standards were also supposed to be prepared for gaseous and solid fuels; however, these were delayed due to industry concerns over trade impacts and have since been shelved (Environment and Climate Change Canada, 2020a; Government of Canada, 2017). The liquid fuels only standard is anticipated to reduce emissions by 18Mt in 2030, down from the 30Mt annual reduction envisioned initially for all fuels.

Buildings

A little over a tenth of Canada’s emissions are from the buildings sector (excluding electricity) (Environment and Climate Change Canada, 2022e). Under its latest climate plan, the government hopes to cut emissions from the sector by close to 40% below 2005 levels, by 2030, yet emissions between 2015-2019 grew by close to 10% (Environment and Climate Change Canada, 2022b, 2022a). Provinces, and not the federal government, have jurisdiction over building regulations; however, there is much the federal government can still do to provide direction and support.

Under the 2016 Pan Canadian Framework, the federal government proposed to reduce emissions in the built environment through four main activities (Government of Canada, 2016b). First, new buildings would be required to be more efficient through the adoption of ever-more stringent building codes, beginning in 2020 and culminating in 2030 with a ‘net-zero energy ready’ building code. Second, existing buildings would be retrofitted and fuel switching encouraged. The government would begin by requiring building energy use labelling and adopting a code for energy-efficient renovations by 2022. Third, new energy efficiency standards for heating and other appliances would be established. Fourth, support would be provided to establish standards and renovation programmes in Indigenous communities. In 2021, it started consultations on a Green Buildings Strategy to be released in early 2023 (Government of Canada, 2021j). The Strategy will be updated every five years, starting in 2028, to align with the government’s broader net zero strategy.

The federal government has made some progress in the sector. The new building codes were adopted in 2022, after a two year delay (but are referred to as the ‘2020’ codes) (National Research Council Canada, 2020; National Research Council of Canada, 2022b, 2022a). These codes adopted a tiered system for the first time, which includes a ‘net zero energy ready’ level. (‘Net zero energy ready’ means that the building is efficient enough that a renewable energy system, once added, would be able to provide all of the building’s energy needs). The aim is to move to progressively more stringent tiers so that by 2030 all new buildings are net zero energy ready. Provinces have agreed to implement this code within the next two years (by March 2024) and subsequent updates with a year and a half from publication (Efficiency Canada & Carleton University, 2022).

While the codes are heading in the right direction, they are missing key elements (Efficiency Canada & Carleton University, 2022). There are no GHG emission requirements in the updated codes, nor provisions to support renewable or EV readiness, though GHG emissions will be addressed in the next update cycle (Efficiency Canada & Carleton University, 2022; Natural Resources Canada, 2022c).

The government has also been slowly updating its energy efficiency regulations for a number of residential and commercial products (water heaters, furnaces, etc) and is planning a further round of revisions (Government of Canada, 2022l, 2019e, 2019d). Often the regulatory updates seek to align with existing standards in the USA. As part of the Green Buildings Strategy, it will adopt regulations to prohibit the installation of new oil or fossil gas heating systems and will develop incentives to accelerate heat pump adoption.

As 80% of the buildings stock that will exist in 2030 has already been built (Environment and Climate Change Canada, 2022a), accelerating energy-efficient renovations and retrofits is crucial to decarbonising the sector. While we have not undertaken this analysis for Canada, the CAT estimates the USA and the EU would need to renovate 3.5% of the existing buildings stock per year to be compatible with the 1.5°C temperature limit. Canada’s current rate is less than 1% per year, but the government acknowledges it needs to increase the rate of deep retrofits to 3-5% of buildings annually by 2025 and this will likely be a core component of its new Strategy (Natural Resources Canada, 2022c).

Agriculture

Agriculture was responsible for around 8% of Canada’s total emissions in 2020 (Environment and Climate Change Canada, 2022e). The sector is projected to contribute around 4% of the emissions reductions in its latest 2030 climate plan. While the sector is responsible for 30% of the country’s methane emissions, it will contribute only about 1% of the reductions under Canada’s methane plan. Policy action is a mix of cross-cutting measures, individual targets and programmes and funding initiatives.

Some agricultural activities will be eligible for the federal government’s GHG offset system, which was finally established in June 2022 and covers activities not covered by the country’s carbon pricing system. Credits generated under the system can be used to reduce the compliance costs of industrial facilities covered by the government’s carbon pricing system (OBPS). Protocols for projects related to livestock feed management and enhancing soil organic carbon are currently being developed and ones for manure management and anaerobic digestions are planned (Environment and Climate Change Canada, 2022d; Government of Canada, 2022b).

Canada set a voluntary target of reducing emissions from fertiliser use by 30% below 2020 levels by 2030, a key source of N2O emissions (Environment and Climate Change Canada, 2020a). Its direct emissions from synthetic nitrogen fertiliser have increased substantially since 2005. The target was first announced in late in 2020. The government concluded consultations on the approaches to achieve the target in August 2022, but has not yet announced the next steps (Government of Canada, 2022b, 2022o, 2022p).

Avoiding food waste can contribute to reducing emissions from the agricultural sector. In 2020, the government launched the CAD 20m Food Waste Reduction Challenge to prevent or divert food waste, and support the development of technologies to extend the life of perishable food or convert potential waste into other products (Government of Canada, 2022k). Successful applicants receive progressively larger grants as they move through the Challenge, with finalists to be announced in 2023.

As part of its COVID-19 economic recovery package, the government had also implemented a temporary CAD 50m programme to redistribute surplus food as well as other measures to avoid food waste (Agriculture and Agri-Food Canada, 2020a, 2020b). Food banks have called for this programme to be reinstated as a record number of people are accessing their services as the cost of living increases (Billinger, 2022).

In early 2019, Health Canada released a new version of the Canada Food Guide (Government of Canada, 2019a). It is the first time the guide has not included a meat category, instead choosing to focus on “protein foods” (Health Canada, 2019). It recommends choosing plant-based protein more often than other sources. Reducing emissions from agriculture, including through shifting the system to a more plant-based diet, will be key to meeting the Paris Agreement’s temperature goal.

Waste

Waste sector emissions accounted for around 4% of Canada’s total emissions in 2020, but 28% of the country’s methane emissions (Environment and Climate Change Canada, 2022d, 2022e). Municipal landfills are the primary source of emissions. Efforts to reduce methane emissions to date have only been able to counteract the increased waste generated from a growing population and thus current methane levels from landfills are at about the same level as 20 years ago (Environment and Climate Change Canada, 2022d). Method improvements in Canada’s 2021 GHG inventory showed that emissions from the sector had been underestimated in the past and were, in fact, much higher (a 50% increase in recent years) (Environment and Climate Change Canada, 2021b).

Canada anticipates cutting methane emissions from the sector by 45% between 2020 and 2030 (Environment and Climate Change Canada, 2022d). It first announced that it would develop regulations on landfill methane emissions in late 2020, issuing a discussion paper in early 2022 and holding consultations until April 2022. A technical group to further develop the regulations was established in September, though it does not anticipate having draft regulations before 2024 and final regulations in force by 2025 (Environment and Climate Change Canada, 2022c). The regulations will seek to cut landfill methane by 50% from 2019 levels by 2030.

In June 2022, the government finalised the details around generating offset credits from landfill methane recovery and destruction projects (Government of Canada, 2022h). Credits generated from such projects can be used to reduce the compliance costs of industrial facilities covered by the government’s carbon pricing system (OBPS).

The Food Waste Reduction Challenge (discussed in the agriculture section) will also contribute to avoiding emissions in the sector.

Canada has a number of initiatives to support nature-based solutions (Environment and Climate Change Canada, 2020a, 2022a). Its flagship initiative is to plant two billion trees over the next ten years (Government of Canada, 2021a). Talk of the two billion commitment dates back to the 2019 election, but the programme itself was only launched in February 2021 (Liberal Party of Canada, 2019; Natural Resources Canada, 2021d). 29 million trees – or 1.5% of the target - were planted in the first year. The government says it is entering long-term agreements so that by 2026 it will be planting 250-350 million trees annually. If that planting level is reached by 2026, it will need to plant 55-180 million trees on average over the next four years to meet the two billion tree target (Natural Resources Canada, 2022d). Overall, Canada’s forestry activities are estimated to contribute between 11 - 17 MtCO2e of sequestration towards the country’s 2030 target (Environment and Climate Change Canada, 2022b, 2022a).

The federal GHG Offset system will eventually include voluntary projects in the forestry sector (Environment and Climate Change Canada, 2020b; Government of Canada, 2021f). An initial protocol is being developed and more project types will be included over time.

Canada’s net zero strategy assumes a 100 MtCO2e sink in 2050 to assist with achieving the country’s net zero target. In 2020, Canada had a 7 MtCO2e sink. The largest sink reported in its inventory was 74 MtCO2e in 1991; however, it has been averaging around 15 MtCO2e for the last decade. It will need significantly more action in this sector if it is to achieve such a large sink.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter