Policies & action

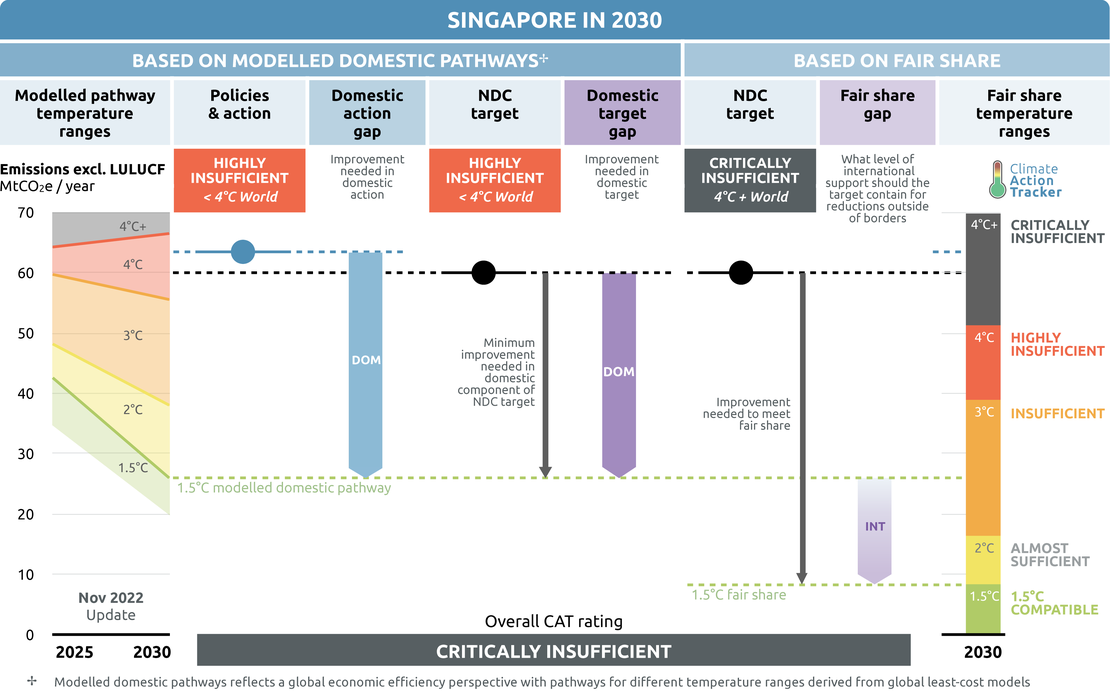

We rate Singapore’s policies and action as “Highly insufficient”. The “Highly insufficient” rating indicates that Singapore policies and action are not at all consistent with limiting warming to 1.5°C. If all countries were to follow Singapore’s approach, warming could reach over 3°C and up to 4°C.

Policy overview

According to our current policy emissions pathway, Singapore’s GHG emissions dipped in 2020 due to the economic impact of COVID-19 and will then steadily rise in the coming decades, reaching 63 MtCO2e in 2030. Despite the emissions growth beyond 2021 projected under current policies, Singapore’s emissions will be lower than its 2020 but above its 2030 emissions targets, demonstrating the inadequacy of the current policies to achieve target.

Even assuming Singapore cannot substantially strengthen its mitigation policies due to domestic factors like the limits to renewables, a more ambitious mitigation target – that could be reached by shifting to a cleaner energy supply through low-carbon energy imports - would demonstrate the government’s commitment to contributing its fair share to global climate change mitigation. Given the importance of green hydrogen in a 1.5°C compatible world, Singapore has an opportunity to take regional leadership in this space by becoming a regional hub of storage, trading and transportation of green hydrogen for other Asian countries (Somani, 2022).

From 1 January 2019, a carbon tax of SDG 5/tCO2e was applied covering LNG, power and industrial facilities which together emit more than 25 ktCO2e/yr, representing approximately 43% of emissions. According to the budget of 2022 tax rate will be increased to SGD 25/tCO2e in 2024-2025 and further SGD 45/tCO2e by 2026-2027, with a target of reaching SGD 50-80/tCO2e by 2030 (National Climate Change Secretariat, 2022b). The Finance Minister Heng Swee Keat has suggested the government expects to raise SGD 1bn over five years, which will be used to fund the Productivity Grant (Energy Efficiency) and the Energy Efficiency Fund (Tan, 2018). The IPCC (2018) Special Report suggests that a carbon price needs to be valued at a considerably higher price to be in line with a 1.5°C compatible pathway.[1]

A carbon tax can encourage more renewable energy in place of fossil fuel energy through changes in relative prices. The CAT planned policies projection now includes impact of this carbon tax. However, it is widely acknowledged that a higher carbon price would need to be implemented earlier, to shift incentives enough to set emissions on a downward trajectory, compatible with the Paris Agreement (Carbon Market Watch, 2017; Warren, 2014).

Singapore´s mitigation strategy is based on three areas: increasing energy and carbon efficiency, reducing carbon emissions in power generation, and developing low-carbon technology (Ministry of the Environment and Water Resources, 2016).

Improving energy efficiency across the economy is the backbone of Singapore’s mitigation strategy. In its latest National Climate Action Plan (Ministry of the Environment and Water Resources, 2016), the government listed a number of policies to improve energy efficiency across all sectors, including an Energy Conservation Act, Green Mark Certification and Energy Labelling schemes, and home appliances Energy Performance Standards, among others.

The Government has also implemented a target of 80% of buildings to be certified green buildings by 2030 (Building and Construction Authority, n.d.). In 2017, the Energy Conservation Act was enhanced, requiring energy users covered to have their monitoring plans verified by an independent third party and appoint a GHG manager (National Environment Agency, 2017).

[1] The IPCC (2018) report estimates for a below 1.5°C pathway would range from 135–6050 USD2010 tCO2-eq −1 in 2030. CAT calculates this to be a 1,250% to 40,233% difference from the Singapore carbon price in 2030. Although, pricing carbon needs to be understood in terms of national context, there is a large difference between Singapore’s price and the IPCC 1.5°C pathway range.

Sectoral pledges

In Glasgow, a number of sectoral initiatives were launched to accelerate climate action. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets. On forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”. The Beyond Oil & Gas Alliance (BOGA) seeks to facilitate a managed phase out of oil and gas production.

NDCs should be updated to include these sectoral initiatives, if they aren’t already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

| Signed? | Included in NDC? | Taking action to achieve? | |

|---|---|---|---|

| Methane | Yes | No | No |

| Coal Exit | Yes | No | Yes |

| Electric vehicles | No | N/A | N/A |

| Forestry | No | N/A | N/A |

| Beyond Oil and Gas Alliance | No | N/A | N/A |

- Methane pledge: Singapore is one of the signatories of the Global Methane Pledge and committed to reduce methane emissions by 30% by 2030 compared to the base year of 2020. The share of methane in Singapore’s total emissions is around 1.2% and absolute methane emissions have almost remained stable since 2010. Energy sector of Singapore contributes around 80% of its methane emissions.

- Coal exit: During COP26 Singapore joined a coalition of 190 countries that pledge to phase out coal-fired power generation and stop construction of new plants. Singapore has committed to continue phasing out the use of unabated coal in its electricity mix by 2050, and to restrict direct Government finance of unabated coal power internationally.

- 100% EVs: Singapore is not a signatory of the pledge on zero emissions car and vehicles by 2040 in COP26. Singapore’s transport sector is dominated by fossil fuel, oil accounts for 90% of the fuel mix of this sector. Singapore Green Plan 2030 includes a strong push for electric vehicle to achieve 100% electric vehicle by 2040.

- Forestry: Singapore is not a signatory of the declaration on forest and land use. Singapore is a city-state and because of those emissions from LULIUCF sector is negligible. Singapore intends that its green spaces would serve as sink, though no specific target is mentioned.

- Beyond oil and gas: this alliance was created with the aim of restricting any kind of fossil fuel expansion by ending licensing of new projects and phasing out existing oil and gas projects. Singapore has no hydrocarbon reserve and imports all its energy requirement. Singapore imports crude oil for its refining and petrochemical industries. Singapore’s petroleum refining, storage, and distribution infrastructure is key to its economy and to global energy trade. Natural gas generated nearly 96% of Singapore’s electricity. Also, Singapore is planning to become a LNG bunkering hub.

Energy supply

An urbanised, high population density coupled with severe land constraints remain a major challenge for Singapore to expand renewable energy projects. Singapore generates more than 96% of its electricity from LNG fired power plants with the full demand met through imports in the absence of any fossil gas reserves within the country (BP, 2022). Fossil gas needs to be phased out completely under a Paris-compatible pathway (Climate Analytics, 2021). The high dependency on fossil gas imports makes Singapore’s energy security vulnerable, and now even more so in the context of the current volatility of global energy market (Argus Media, 2022). Also, processes like gas liquefaction, transportation, and regasification significantly increase Singapore’s carbon footprint and reduce its emissions reduction potential.

Renewables play a role in the mitigation strategy for the power sector: in order to diversify its energy mix Singapore has expanded its solar energy capacity in recent years, going from 26 MW of installed Solar-PV capacity in 2014 to 350 MW in 2020 (APEC 2022). A 100 MW import trial with Malaysia is ongoing and a Sun Cable Project with Australia could bring in solar power. Residential PV solar and the development of floating PV on rivers and reservoirs and deploying on integrated industrial facilities will also be important (SG Green Plan, 2021).

Despite its land constraints, Singapore has achieved its goal of 350 MW of solar capacity in 2020, and aims to reach solar capacity of 1.5 GW by 2025 and 2 GW by 2030 (APEC, 2022). Recent announcements demonstrate that it is pursuing grid regionalisation and seeks to use recent LT-LEDS targets to develop regional power grids to access low-carbon electricity in other economies (National Climate Change Secretariat, 2020). Hence, Singapore has begun importing renewable energy from Laos through Thailand and Malaysia under the Lao PDR-Thailand-Malaysia-Singapore power integration project (LTMS-PIP) (Out Law News, 2022). It is also funding large-scale renewable projects internationally with the aim of meeting 30% of its electricity demand via imports in 2035 (APEC, 2022).

Singapore faces multiple challenges while exploring other renewable energy sources. Its potential for wind energy is low due to the mean wind speed of less than 2 m/sec, rendering commercial scale wind unviable, and it has no significant river resources to develop hydro energy (Energy Tracker Asia, 2022).

Mixed signals from policymakers to the public and industry around Singapore’s mitigation effort however have resulted in decisions that are expected to increase, rather than reduce emissions. This has been cemented in with Singapore’s aspiration to become a world LNG Bunker fuel and storage nation. With the implementation of a carbon tax, some of these mixed policy signals may become clearer in the future.

Additional policies in the power sector include multiple incentives to increase the share of renewable generation and the expansion of Waste-to-Energy (WTE) capacity. PUB, Singapore’s National Water Agency launched a 1 MW floating solar PV testbed at Tengeh Reservoir in October 2016. Building on this, PUB has plans for floating solar projects at reservoirs like a 1.5 MW system on both Bedok and Lower Seletar by 2020, and Sembcorp recently completed a 60 MW system on Tengeh by 2021 (Ang, 2019; Reuters, 2021).

However, this increased contribution of renewables is not sufficient to stop electricity emissions from rising, given the projected stable increase in power demand and generation (APEC, 2022).

Singapore could also demonstrate its commitment to mitigation by changing its investment behaviour in other countries. The government-controlled Development Bank of Singapore (DBS) in April 2019 announced that it would stop funding new coal-fired power stations globally. DBS has made further positive signals in recent media, committing to reducing thermal coal exposure and reaching net zero by 2039 (DBS Bank, 2021).

Singapore is exploring how emerging low-carbon solutions such as carbon capture, utilisation and storage technologies (CCUS), and green hydrogen can help it reduce its emissions intensity (National Climate Change Secretariat, 2020). The National University of Singapore, for example, has recently partnered with Sembcorp Industries, to establish a SGD 25 million research institute, aiming to produce green hydrogen and hydrogen carriers for storage and transport (The Straits Times, 2022c) . During the announcement of the net zero year, Prime Minister Lawrence Wong pointed to “low-carbon hydrogen” being an increasingly promising solution for Singapore, launching the National Hydrogen Strategy to scale up low-carbon hydrogen investment and deployment (The Straits Times, 2022b).

Industry

In 2020, Singapore’s industrial sector accounts for 44.4% of its emissions, 16.2% of which comes from process-related emissions (NCCS, 2021). Singapore´s mitigation strategy for the industry sector is based on increasing energy and carbon efficiency. The main policies are the Energy Conservation Act from 2013, which mandates monitoring and reporting energy usage and greenhouse emissions for large energy users; the Energy Efficiency Fund (E2F), which provided grants and tax incentives for energy efficiency investments in industrial processes; and the Energy Efficiency National Partnership Programme (EENP), which is a learning network for companies in the industrial sector to learn about energy efficiency ideas, technologies, practices, and standards (National Environment Agency, 2020).

In 2017, the Energy Conservation Act (ECA) was enhanced, requiring, from 2018 onwards, the energy users it covers to have their monitoring plans verified by an independent third party and appoint a GHG manager (National Environment Agency, 2017). From 2021 onwards, these companies must establish a structured energy management system, and periodically assess energy efficiency opportunities at existing industrial facilities. In 2018, minimum energy performance standards were introduced to phase out the least efficient industrial electric motors and expanded to other common industrial equipment and systems thereafter (National Environment Agency, 2018).

In the context of Singapore’s 2018 Climate Action Year, over 450 organisations, including industrial manufacturers, made voluntary commitments to improve their carbon footprint or increase awareness on climate change-related issues, such as upgrading existing equipment (e.g. chillers, lightings, appliances) with more energy efficient models, or starting recycling and waste management programmes. Given the voluntary nature of the pledges, and the lack of information to translate these targets into emission reductions targets, we have not included these in our current policy projections.

Singapore is considering carbon capture, utilisation and storage possibilities, in addition to onboarding green hydrogen as an energy carrier and industrial feedstock, posed in the public consultation on low emissions pathways document (Republic of Singapore, 2019).

Transport

Singapore’s transport sector in 2020 made up 13.7% of total emissions (NCCS, 2021). The sector’s energy demand and associated emissions are expected to flatten out as a result of multiple measures to promote public transport, modal shifts, and improve the emissions intensity of road transport.

Singapore aims to develop a greener and more sustainable land transport sector, reducing peak land transport emissions by 80%, by or around mid-century. The Singapore Green Plan 2030 includes a strong push to electrify the vehicle fleet, which would help Singapore achieve its vision of 100% cleaner energy vehicles by 2040 (Land Transport Authority, 2021). According to its Land Transport Masterplan 2040 Singapore is targeting an ICE vehicle phase-out by 2040 along with modal shift by creating more urban space for active travelling in form of walking and cycling (National Climate Change Secretariat, 2021).

Singapore’s plans to increase the length of the rail network from 230 km in 2019 to about 360 km by 2030 will enable eight in ten households to be within a ten-minute walk of a train station. Singapore’s target for the public transport modal share during morning and evening peak hours is to reach 70% by 2020 and 75% by 2030, up from 59% in 2008 and 67% in 2017 (National Environment Agency, 2018). Singapore is also encouraging active transport and modal shift in its Land Transport Master Plan 2040 through developing infrastructure for walking and cycling and MRTs.

The Land Transport Master Plan (LTMP) sets a goal for all public buses and taxis to run on cleaner energy sources by 2040 (Republic of Singapore, 2019). Since February 2018, the growth of private vehicles has been effectively capped, when the permissible growth rate of private vehicle population was reduced from 0.25% to 0% (National Environment Agency, 2018).

The Carbon-Emissions based Vehicle Scheme was replaced with the Vehicle Emissions Scheme (VES) in 2018, which accounts for the range of pollutants covered, to include hydrocarbons (HC), carbon monoxide (CO), nitrogen oxides (NOx), and particulate matter (PM) (Republic of Singapore, 2017). Under the new standards, CO2 emissions produced by electricity generation from fossil fuels has been accounted for by applying an emissions factor to the electricity consumption of electric vehicles (EVs) and plug-in hybrid vehicles (PHEVs) (National Climate Change Secretariat, 2018b).

Also, to help potential vehicle buyers make informed decisions, fuel economy labels has been redesigned to include information on each vehicle’s VES band. To further promote the adoption of cleaner vehicles, the VES was enhanced with increased rebates and higher surcharges from January 2021. Starting from 2021 all new and used petrol or diesel vehicles must comply with the Euro VI emission standards (National Environment Agency, 2021).

Singapore undertakes measures to encourage people to cycle or walk. By 2030, it aims to have cycling path networks in every public housing town and an off-road cycling path network of over 700 km. As of 2019, there are cycling networks in nine out of 24 public housing towns and 200 km of sheltered walkways (National Environment Agency, 2018). Singapore has a plan to develop 750 km of cycle paths by 2025 (CNA, 2020).

In 2016, Singapore trialled e-buses, and by 2018, 60 trial e-buses were on the roads (Republic of Singapore, 2019). The Land Transport Authority (LTA) aims to have half of its public bus fleet be electric by 2030 (Land Transport Guru, 2022). Around 700 electric taxis has been rolled out by the private taxi operators (The Straits Times, 2021, 2022d). To be compatible with the 1.5°C long-term temperature goal, the last fossil fuel car should be sold in 2035 at the latest (Climate Action Tracker, 2016).

Buildings

As of 2020, Singapore´s buildings sector accounted for 0.8% of emissions, from energy combustion related to commercial and residential sub sectors and their cooking and hot water systems (NCCS, 2021), notably, emissions from electricity such as air conditioning or appliance use is not accounted for in the buildings sector. The government’s mitigation strategy for the sector is based on increasing energy efficiency. The main policy for the sector is the Green Mark Scheme, which encourages developers and owners to build and maintain greener buildings and requires the achievement of a 28% energy efficiency improvement from 2005 building codes for new and existing buildings undergoing major retrofitting works (with a gross floor area of 2,000 m2 or more).

Singapore has adopted a Mandatory Energy Labelling Scheme and a Mandatory Energy Performance Standards which are improving energy efficiency in cooling, heating, and appliances. The Green Building Masterplan, first rolled out in 2006, has also been continually updated since then, contains several initiatives aimed at increasing energy efficiency and reducing energy demand in buildings (APEC, 2022).

In 2021, Green Building Masterplan aims to deliver three key targets of “80-80-80 in 2030”- greening 80% of Singapore’s buildings, 80% of new developments to be Super Low Energy (SLE) buildings from 2030 and achieving 80% improvement in energy efficiency for best-in-class green buildings by 2030 (Building and Construction Authority, 2021; SG Green Plan, 2021).

Since 2013, the Building Control Act has required all existing buildings with a gross floor area of 15,000 m2 or more to achieve the minimum Green Mark standard after retrofitting. Audits are conducted every three years and companies have to submit energy consumption and energy-related building data (National Climate Change Secretariat, 2018a). Singapore is aiming to raise the total gross floor area with a Green Buildings standard from around 34% in 2018 to at least 80% in 2030 (National Environment Agency, 2018).

In 2018, the Building Control Act launched the Super Low Energy (SLE) Building programme to encourage firms to go beyond the existing Green Mark Platinum standards and push the envelope of environmental sustainability in Singapore.

The Mandatory Energy Labelling Scheme (MELS) encourages households to buy energy-efficient appliances, while Minimum Energy Performance Standards (MEPS) will ensure energy inefficient appliances are discontinued (Republic of Singapore, 2019).

Waste

Singapore recovers heat from the incineration of waste to produce electricity. In 2017, 2.3% of Singapore’s energy supply came from the conversion of waste to energy (National Environment Agency, 2018). To raise awareness of waste issues and the need to recycle resources Singapore declared 2019 as “Year Towards Zero Waste“ (Ministry of the Environment and Water Resources, 2019a).

In the second half of 2019, the government launched the Zero Waste Masterplan detailing strategies to reduce waste sent to Semakau Landfill by 30% by 2030, extending the landfill’s lifespan beyond 2035 and reducing incineration emissions (Ministry of the Environment and Water Resources, 2019b). The government also introduced the Resource Sustainability Act 2019 to enforce mandatory packaging data reporting by 2020, Extended Producer Responsibilities for e-waste by 2021 and mandatory food waste segregation for treatment from 2024, and Extended Producer Responsibility for packaging, including plastics by 2025 (Ministry of the Environment and Water Resources, 2019b).

This strategy adds to the government aim to increase the recycling rate from 61% in 2017 to 70% by 2030 (National Environment Agency, 2018). Yet, the waste sector just accounts for 0.6% of Singapore’s total emissions.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter