Policies & action

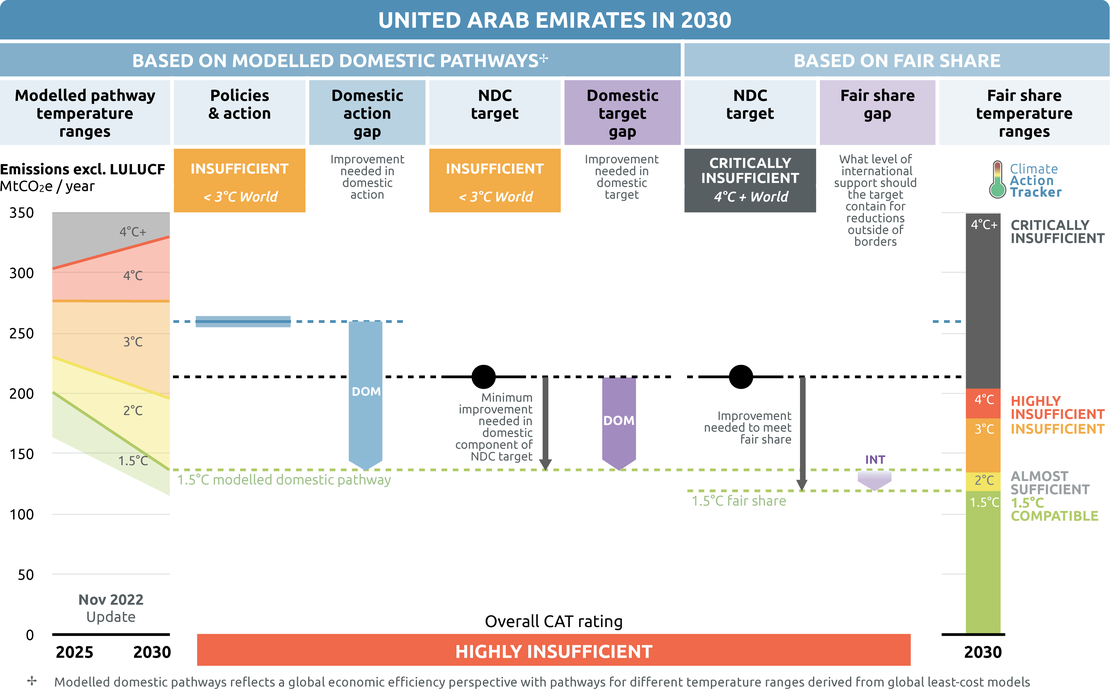

We rate the United Arab Emirates’ policies and actions as “Insufficient” when compared with modelled domestic emissions pathways. The “Insufficient” rating indicates that the United Arab Emirates’ policies and action need substantial improvements to be consistent with the 1.5°C temperature limit. If all countries were to follow the UAE’s approach, warming would reach over 2°C and up to 3°C.

Current policies are still set to lead to increasing rather than decreasing emissions in 2030, due to a continued expansion of fossil fuel use. The UAE is also currently developing both nuclear and solar power and is well on track to meet its 50% “clean” energy capacity target by 2050, but these developments are not sufficient to reverse emissions increase.

Emissions appear to have decreased between 2015 and 2020, notably due to efficiency increases in the use of gas in the electricity sector and more recently due to the COVID-19 pandemic. However, there are significant uncertainties when it comes to historical emissions. The UAE’s last GHG inventory dates from 2014, and there are large discrepancies in historical emissions reported by other sources, particularly for energy-related CO2 emissions. Using other data sources with higher historical emissions would also lead to an upwards revision of the projections under policies and action.

Policy overview

In 2021, emissions in the UAE increased by around 4% above 2020 levels, after dropping by almost 5% due to the COVID-19 pandemic. The CAT estimates that the UAE’s 2030 emissions under current policies are set to increase by 30–35% above 2010 levels. This means a 314–331% increase compared to 1990 levels.

With its current policies, the UAE will not be able to achieve its current NDC, missing it by a large margin. It would need to implement further policies and reduce its 2030 emissions by a further 16-19% in order to reach its unconditional NDC target.

The UAE is undertaking a push to reach gas self-sufficiency, and has invested heavily in ramping up its offshore gas production, after the discovery of up to 57 billion cubic metres (bcm) in February 2022 (AFP, 2022). These developments and the investment going towards new fossil fuel infrastructure are not consistent with limiting global warming to 1.5°C, instead are likely to lock the UAE into a high-emissions trajectory and undermine its transition towards renewable energy. Instead of ramping up its gas production towards self-sufficiency, the UAE should set out an ambitious plan to phase-out its dependency on gas for electricity and switch to renewables, which would reduce prices and price volatility for consumers, and avoid the risk of stranded assets (CAT, 2022).

In 2017, the UAE announced the Energy Strategy for 2050, a plan which aims at diversifying the energy mix and improving energy efficiency (WAM, 2017). The strategy foresees shares of 44% renewable energy, 38% gas, 12% coal and 6% nuclear in the country’s electricity installed capacity in 2050 (Government of the UAE, 2017). In August 2021, the UAE announced it would be “revising” the share of coal power capacity in its 2050 target (Technical Review Middle East, 2021), but without any further information as to what the new targets would be, or when the revision would be completed.

In February 2022, the UAE announced it would be switching its coal power plant to fossil gas, in support of its net zero target, and has reported that the plant, originally designed as a dual-fuel plant, has already done so (Global Energy Monitor, 2022).

The UAE also continues to develop both nuclear power and renewables. In October 2022, the third unit of the Barakah nuclear power plant came online, increasing total capacity to 4.2 GW (World Nuclear News, 2022). Following the construction of the approx. 1.2 GW Noor Abu Dhabi solar PV plant in 2019, the UAE has continued to develop utility scale PV plants . Currently 3.5 GW are in the pipeline for the near-term, with up to 5 GW more planned to go online by 2030 (Technical Review Middle East, 2022; Tollast, 2022).

Our current policy scenarios are based on the implementation of the UAE’s Energy Strategy 2050. We present a range based on how the UAE will implement this strategy: the upper bound shows emissions in 2030 if the UAE only implements its 2050 installed capacity targets, and the lower bound shows emissions in 2030 if in addition, the UAE implements its 40% efficiency target and phases out coal power generation in line with recent developments. For more information, please see the assumptions tab.

Sectoral pledges

In Glasgow, a number of sectoral initiatives were launched to accelerate climate action. At most, these initiatives may close the 2030 emissions gap by around 9% - or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets. On forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”. The Beyond Oil & Gas Alliance (BOGA) seeks to facilitate a managed phase out of oil and gas production.

NDCs should be updated to include these sectoral initiatives, if they’re not already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

| UAE | Signed? | Included in NDC? | Taking action to achieve? |

|---|---|---|---|

| Methane | Yes | Unclear | Not clear |

| Coal exit | No | N/A | N/A |

| Electric vehicles | No | N/A | N/A |

| Forestry | Yes | Unclear | Not clear |

| Beyond oil and gas | No | N/A | N/A |

- Methane pledge: the UAE signed the methane pledge at COP26. Methane is a significant source of GHG emissions in the country, representing ~23% in 2021, mostly stemming from upstream fossil fuel production and waste. The UAE already includes methane in its NDC, and has some plans in place to reduce both energy and waste-related methane.

However, the government has not set out any additional policies or measures following its participation on the methane pledge. If the UAE were to reduce its methane emissions by 30% below 2021 levels, this would result in a 15 MtCO2e or 7% reduction of its total emissions (excl. LULUCF). If this reduction was additional to current policies, it would reduce the gap between current policies and the NDC target by a third.

- Coal exit: the UAE has not adopted the coal exit. The UAE’s 2050 Energy Strategy outlines plans to develop coal power plants. However, in February 2022, the UAE announced that it would be switching its only coal power plant to fossil gas, in support of its net zero target. It is unclear whether it plans to develop any coal power plants in the future.

- 100% EVs: the UAE has not adopted the 100% EVs initiative.

- Forestry: the UAE signed the Leaders’ declaration on forest and land use at COP26. Land use and forestry emissions do not play a large role in the UAE. However, the sector is covered in the NDC, and the UAE has pledged to plant 100 million mangrove seedlings by 2030 in an effort to restore maritime ecosystems and sequester carbon.

- Beyond oil and gas: the UAE has not adopted the beyond oil and gas initiative, and is planning for a significant increase in oil and gas production.

Energy supply

Oil & gas production

The UAE continues to be one of the largest oil producers in the world. However, since 2019, production has decreased by 7%, from around 4.1 to 3.8 million barrels a day in 2020 and has not returned to pre-pandemic levels in 2021 (U.S. Energy Information Administration, 2022). Production in the near future is also likely to remain low compared to 2019, as OPEC+ decided in October 2022 to cut production by two million barrels per day in an effort to keep oil prices up (Deepthi Nair, 2022). However, the UAE has recently announced it was bringing forward its oil production capacity of five million barrels a day target, from 2030 to 2025, signalling its intent to ramp up production in the short term (Di Paola, 2022).

The UAE is also developing oil and gas offshore exploration and production. This is part of its efforts to reach gas self-sufficiency (ICLG, 2022). In February 2022, the first offshore fields were discovered, which are estimated to contain between 43 and 57 billion cubic metres of gas (AFP, 2022). During 2022, Adnoc Drilling was awarded almost USD 6bn in contracts to “maximise value from Abu Dhabi’s offshore oil and gas resources” (World-Energy, 2022).

According to the IEA, the development of new fossil fuel infrastructure beyond what was already committed in 2021 is incompatible with reaching net zero by 2050 (IEA, 2021c). We consider these developments and the investments into new fossil fuel infrastructure inconsistent with limiting global warming to 1.5°C. They are also likely to lock the UAE into a high-emissions trajectory and undermine its transition to renewable energy. Instead of ramping up its gas production towards self-sufficiency, the UAE should set out an ambitious plan to phase-out its dependency on gas for electricity and avoid the risk of stranded assets (CAT, 2022).

In a step in the right direction, the Abu Dhabi National Oil Company (Adnoc) announced in 2020 a 2030 target to reduce its GHG intensity by 25%. The company mentioned efficiency increases, zero routine flaring, and CCS as the main measures planned for the achievement of its target (Government of the UAE, 2022).

Electricity supply

In 2017, the UAE announced its Energy Strategy 2050, a plan which aims at diversifying the electricity mix and improving energy efficiency (Government of the UAE, 2017). The strategy foresees shares of 44% renewable energy, 38% gas, 12% “clean coal” and 6% nuclear in the country’s installed electricity capacity in 2050. As of 2020, gas accounted for 88.3% of installed capacity, nuclear for 4%, renewables for 6% and coal for 1.7% (IRENASTAT, 2022).

We estimate the implementation of this policy would lead to rising energy-related emissions due to the development of coal and an increase in gas-fired generation. In August 2021, the UAE announced it would be “revising” the share of coal power generation in its 2050 target (Technical Review Middle East, 2021), but without any further information as to what the new targets would be, or when the revision would be completed. If these targets were adjusted, our projections for the UAE could change.

Coal

In May 2020, the construction of the first phase of the UAE and the Middle-East first coal power plant was completed. This consisted of the first two units of the 2.4 GW ultra-supercritical Hassyan power plant, with the second phase planned for Q3 2023 (Global Energy Monitor, 2022). The development of coal in the UAE is inconsistent with the Paris Agreement. To keep the window open for a 1.5°C-consistent GHG emission pathway, no new coal-fired power plants should be built (Kuramochi et al., 2017). In 1.5°C compatible pathways for the Middle East and Africa region, coal power generation would need to be reduced by 80% in 2030 compared to 2010 levels, leading to a phase-out by 2034 (Yanguas Parra et al., 2019).

In February 2022, the UAE announced that it would be switching its coal power plant to fossil gas, in support of its net zero target, and has reported that the plant, originally designed as a dual-fuel plant, has now done so (Global Energy Monitor, 2022). However, the UAE has not yet revised its 2050 Energy Strategy and it is unclear whether it plans to develop any more coal power plants.

Nuclear

The UAE continues to develop nuclear power. In October 2022, the third unit of the Barakah nuclear power plant went online, increasing total capacity to 4.2 GW. The last unit of the project, awarded to a South Korean consortium, is scheduled to come online in 2023 (World Nuclear News, 2022).

Solar and other renewable energy

With its current and planned renewable energy developments, the UAE is expected to reach 9 GW of renewable power by 2030. Following the construction of the around 1.2 GW Noor Abu Dhabi solar PV plant in 2019, the UAE has continued to develop utility scale PV plants. The Al Dhafra Solar PV plant, planned to go fully online by the end of 2022, will add another 2 GW (Tollast, 2022). In May 2022, a third Solar PV project entered the tendering process. Once completed, the Al Ajban Solar PV will add 1.5 GW of capacity (Technical Review Middle East, 2022).

The Emirate of Dubai has also launched its own large-scale combined PV and CSP project: the Mohammed bin Rashid Al Maktoum Solar Park launched in 2012 should reach 5 GW of solar PV and CSP by 2030. The fifth tender round (900 MW) of this solar park, completed in October 2019, raised the total tendered capacity to nearly 2.9 GW (Gulf Today, 2019). DEWA, Dubai’s electric utility, has signed a power purchase agreement (PPA) for this 900 MW phase with commercial operation has started in Q3 2021 (Dubai Electricity & Water Authority (DEWA), 2022).

As part of its Energy Strategy 2050, the UAE has also committed to invest around USD 160bn over the next three decades in “clean” and renewable energy, which might include nuclear and gas. As part of this plan, the UAE has signed a preliminary agreement with Engie Solutions (subsidiary of Engie) to develop further clean energy projects (Benny, 2022).

In addition to these solar power projects, a contract for the UAE’s first pumped storage hydroelectric plant, with an expected capacity of 250 MW, was awarded in August 2019, and scheduled for commission in 2024 (Power Technology, 2022).

Hydrogen

During COP26, the UAE unveiled its “Hydrogen Leadership Roadmap”, a strategy aimed at developing the domestic production of green and blue hydrogen aimed at export markets in Asia and Europe. The roadmap already includes seven projects which are either completed or underway (including blue ammonia production). The overarching target of the strategy is to reach a 25% market share in key markets such as India, Japan, Germany and others (H2 World News, 2021).

Transport

The UAE has set out some policies to increase the fuel and emissions efficiency of its vehicle fleet, as well as to incentivise the use of public transport, and the uptake of EVs.

Current fuel quality standards in the UAE are Euro 5, and vehicle fuel efficiency standards are Euro 4, with a plan to transition to Euro 5/6. As part of its plan to increase fleet emission efficiency, the UAE has also taken up a federal plan to convert vehicles to compressed natural gas (CNG), especially aimed at public transport, government and commercial vehicles (Government of the UAE, 2022). While CNG may be seen as a cleaner alternative to oil-fuelled cars, it is by no means a solution for air pollution. CNG-fuelled cars emit a significant amount of particle pollution—both ultrafine and PM2.5 (Transport & Environment, 2020).

The emirates of Abu Dhabi and Dubai have also set out a series of urban transport policies, aimed among others at incentivising the uptake of public transport and EVs (Government of the UAE, 2021b). For example, in May 2022 the Abu Dhabi government set out a new EV charging station policy, defining standards and requirements in anticipation of growing demand for EVs. This is part of its 2016 Low Emission Vehicle Strategy, which is in place to support the transition towards electrification of the transport sector (The National News, 2022). In Dubai, the Green Mobility Strategy 2030 includes a target to reach 30% EVs and hybrids in the government vehicle fleet by 2030 (Government of the UAE, 2022).

The UAE is also currently developing its national train network, with a total of 1,200 km of planned railways. 264 km of railways for freight services have been operational since 2016 and a further 600 km are currently under construction (Government of the UAE, 2021a). Recently, the UAE has announced it will extend its railway network to connect with neighbouring Oman.

Buildings

As part of its Energy Strategy 2050, the UAE set out a target of reducing energy consumption by 40%. Several policies are in place to support this target in the buildings sector, including the National Water and Energy Demand Side Management Programme and a federal government building retrofit programme, aiming at 2000 retrofits by 2050. Some Emirates have also produced their own plans and policies to reduce energy consumption from the buildings sector, including Dubai’s plan to retrofit 30,000 buildings by 2030 (Government of the UAE, 2022).

Energy efficiency standards and labels for air conditioners and other electrical equipment have been introduced in the UAE, and inefficient light bulbs have been banned from import since 2014 (Ministry of Energy, 2015).

Waste

In January 2021, the UAE launched its Circular Economy Policy 2031, establishing a Circular Economy Council, tasked with supervising the implementation of waste reduction policies that also target the manufacturing sector. In May 2022, the Sharjah Waste-to-Energy plant was launched, with a capacity of 30 MW. A further 200 MW plant are planned in Dubai and expected to be operational in 2024 (Government of the UAE, 2022).

The UAE’s Circular Economy Policy has no concrete waste or emissions reduction targets. We were not able to check whether its previous target of diverting 75% of its waste from landfills by 2021 (Government of the UAE, 2019) has been achieved.

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter