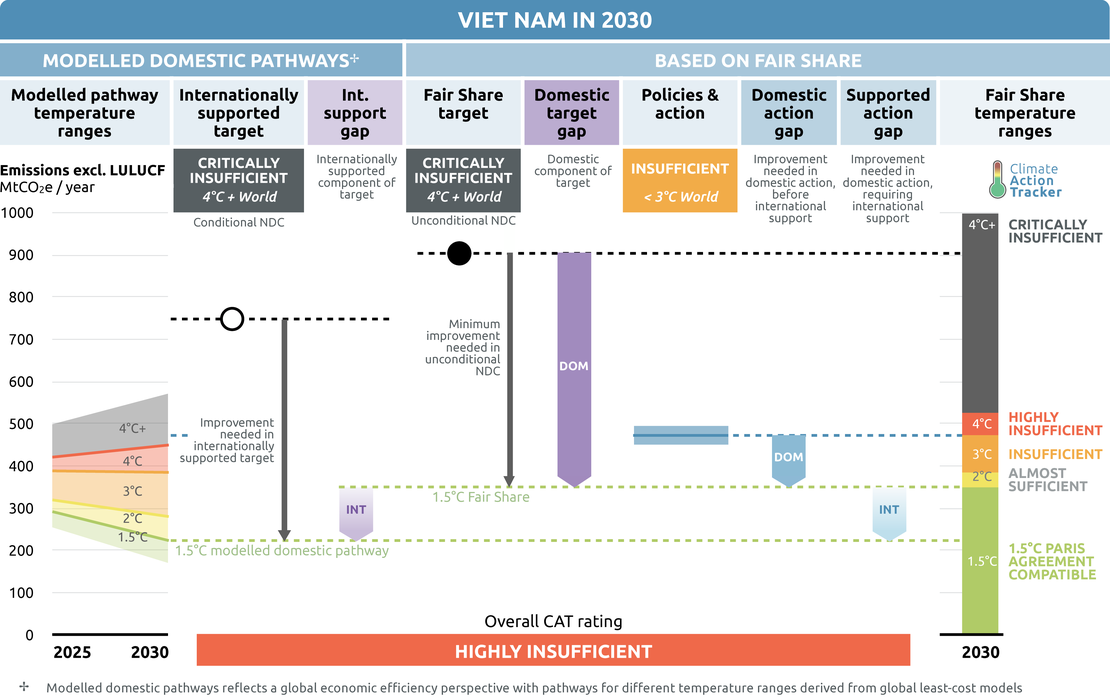

Policies & action

Viet Nam’s current policies are “Insufficient” when compared to their fair-share contribution. The “Insufficient” rating indicates that Viet Nam’s climate policies and action in 2030 need substantial improvements to be consistent with the Paris Agreement’s 1.5°C temperature limit. If all countries were to follow Viet Nam’s approach, warming would reach over 2°C and up to 3°C.

Viet Nam is further off track when compared with modelled domestic pathways and the extent of reductions that need to be taking place inside its borders with international support. Overall, Viet Nam needs to implement additional policies with its own resources but will also need international support to implement further policies in line with full decarbonisation.

The assessment below is from 30 November 2020 and has not been updated.

Policy overview

Viet Nam will overachieve its NDC target with currently implemented policies. The current policy projections estimate Viet Nam will overachieve the unconditional emissions target by 45% to 50% and the conditional target by 34% to 40% (excluding LULUCF). Viet Nam’s current policy trajectories are on course to reach 448-496 MtCO2e excluding LULUCF in 2030. This is a 63-80% increase from 2010 levels (excluding LULUCF) and an increase of 38-53% above 2014 levels (most recent historical data available).

Most GDP projections show economic growth for Viet Nam in 2020, but at a lower growth rate than projections estimated before COVID-19. Projections range from a 1% decline to a 4.2% growth for 2020, rebounding to up to a 6.8% growth by 2021 (ADB, 2020; IMF, 2020; Jennings, 2020; Onishi, 2020; VERP, 2020; World Bank, 2020). The Vietnamese economy is reliant on global trade and tourism so the economy will experience some negative impacts (Schwarz & Do, 2020).

The government has not mentioned renewable energy nor a green recovery in its economic recovery stimulus package. Viet Nam’s COVID-19 response has focused on tax reductions or extensions covering personal tax, VAT and business taxes; rather than on spending (EY, 2020; Schwarz & Do, 2020). The stimulus includes an assistance package for company tax breaks or tax extensions worth USD 1.16 billion (KPMG, 2020). There is also a credit support and fiscal package of USD 12 billion, focused on debt restrictions and preferential interest rates, with other spending details yet to be confirmed (KPMG, 2020). The short lockdown period had a limited impact on mobility, business and industry and the associated transport, energy and industry emissions.

In February, the Politburo issued Resolution No. 55 on the orientation of the National Energy Development Strategy of Vietnam to 2030, with a vision to 2045 (Viet Nam Government, 2020b). Resolution No.55 will be reflected in the PDP 8 (MDI, 2020). Resolution 55 is not represented in the CAT current policy projections as PDP8 has not yet been released. The Resolution sets several targets for primary energy levels, total capacity of electricity generation, the total primary energy share of renewables, total final energy consumption, primary energy intensity, energy efficiency in the total final energy consumption and GHG emissions for the energy sector compared to business-as-usual (BAU). The Resolution supports the uptake of renewables, yet it also continues the development of coal, and also building the capacity for scaling up gas imports (see the energy section for further details).

The Resolution 55 target to reduce greenhouse gases emission from energy activities by 15% by 2030 and 20% by 2045 from (an unspecified) BAU is not as ambitious as it appears at first glance. Assuming the BAU is the same as that listed in the updated NDC, the Resolution 55 GHG target is an improvement on the NDC, but neither target is ambitious. The NDC aims for an unconditional 6% reduction in energy-related emissions below BAU by 2030 (and an additional 11% based on international support). However, a 15% reduction in energy related emissions compared to the updated NDC BAU leads to around 509 MtCO2 by 2030, which 74% higher than the CAT energy sector current policy projections.

The draft PDP 8 plans for rapid growth of installed gas capacity by 2040, with a potential for 108 GW of LNG fired power plants, for predominately imported LNG (Brown & Vu, 2020). This is a huge step up from 19 GW of natural gas and LNG for 2030 set out in the revised PDP 7.

The Ministry of Natural Resources and Environment (MONRE) released a new draft law to replace the current Law on Environmental Protection. The draft law is on the National Assembly agenda in November 2020 (Hoang, 2020). If the law is passed, MONRE would need to create a national plan to reduce GHG emissions (Burke et al., 2020). Other ministries would be tasked to develop a plan to reduce GHGs under their jurisdiction, including The Ministry of Industry and Trade, the Ministry of Transport, the Ministry of Construction, and the Ministry of Agriculture and Rural Development. The draft calls for a national strategy with a vision to 2050, and plans for a scheme for Viet Nam to join international the carbon credit market, and guidelines for large emissions facilities (Burke et al., 2020).

Vietnam is highly vulnerable to the impacts of climate change at 1°C above pre-industrial levels. With further temperature increases, climate-associated risks also increase, such as extreme heat, droughts, flooding, and sea-level rise impacting coastal areas and some agricultural production areas such as the Mekong delta (Climate Analytics, 2019a). Vietnam is also a member of the Climate Vulnerable Forum which supports the full decarbonisation of member economies (Climate Vulnerable Forum, 2015).

Energy supply

Viet Nam has experienced a number of challenges in its energy sector in recent years. Final energy demand has grown over the past decade by 66% (from 2005 to 2015) (APERC, 2019b). Vietnam achieved universal electrification in 2015 and, with an increasing population and economic growth, it is not surprising there is mounting pressure for a secure energy supply (World Bank, 2019a). The energy sector represented 53% of emissions in 2014 based on the latest historical data (see assumptions).

The main policy reflected in the current policy scenario is the revised Power Development Plan 7 (PDP7) discussed below under each fuel category (Viet Nam Government, 2016b). The PDP 7 will be replaced by the PDP8 due for release in 2021.

Coal

Planned coal capacity is under revision in government plans, but the pipeline remains substantial. The revised PDP7 reports there will be a total capacity of 55.3 GW of coal power by 2030 (Viet Nam Government, 2016b). The draft PDP 8 suggests 9.5 GW of planned coal in the revised PDP 7 will be cancelled (Brown & Vu, 2020; MDI, 2020). The draft PDP 8 lists 18 GW of new coal (imported and domestic) will be developed between 2020-25, and a further 7.6 GW will be delayed until beyond 2030 (Brown & Vu, 2020; MDI, 2020). Cancelling or postponing over 17 GW of planned coal is substantial when the country currently has 20 GW installed.

Resolution 55 includes a guiding orientation towards scaling down coal-fired power generation, however, it also stipulates the development of a strategy for long-term coal imports, extending exploration activities, and increasing domestic coal extraction (Viet Nam Government, 2020b). The Resolution requires technology upgrades to existing coal plants to meet environmental standards, and develop capacity prioritising high efficiency units (Viet Nam Government, 2020b). The pipeline for coal is extensive and needs to be revised to avoid the risk of stranded assets, particularly given the need to phase out coal globally and in non-OECD Asia as a region by 2040 (Climate Analytics, 2019c, 2019b). Viet Nam’s coal plans are also not compatible with Sustainable Development Goals (Fujii, 2018).

The Viet Nam Business Forum has produced a business case for investment in clean energy, finding that coal powered generation creates financial, security, environmental and public health risks (Vietnam Business Forum, 2019). Six provinces out of 63 have called for coal power projects (totalling 17.39 GW) to be cancelled due to environmental concerns (MDI, 2020).

Oil and gas

Oil represents 25% of the total primary energy supply, and natural gas has declined slightly in recent years, representing 10% in 2017 (IEA, 2019). Domestic oil and gas are expected to be exhausted within 60 years (EREA & DEA, 2019).

Viet Nam is planning for rapid growth in natural gas and LNG imports for gas-fired power generation. The Revised PDP7 targets gas to represent 16.8% of electricity generation by 2030 down from 21% in 2017 (IEA, 2019; Viet Nam Government, 2017a). However, by 2040, the draft PDP8 indicates gas will dominate installed capacity, with over 50 GW of a total capacity of 222.5 GW (Brown & Vu, 2020). The draft PDP 8 outlines the potential for 108 GW of LNG fired generation capacity across Viet Nam (Brown & Vu, 2020). Resolution 55 aims to build capacity to import 8 billion of LNG m3 by 2030 and 15 billion m3 by 2045 (Viet Nam Government, 2020b).

Renewable energy

Renewable energy projects have continued despite the global supply chain disruptions caused by the COVID-19 pandemic. In October 2020, the largest solar farm (450 MW) in Southeast Asia commenced operation in the province of Ninh Thuan, worth USD 604 million (Reuters, 2020). BCG launched a 330 MW solar project in Binh Dinh province worth USD 265,000 to be completed in 2020 (Thoi, 2020). By the first half of 2020, solar output was more than 5 times higher than the first half of 2019, and represented nearly 4% of electricity supply, compared to negligible levels in 2017 (IEA, 2019; MDI, 2020).

Hydro power is the biggest renewable player in the energy mix. Hydro power represents 10% of the primary energy supply and 45% of the electricity generation mix (IEA, 2019). The potential for large and medium scale hydro power has geographical limitations. Hydro capacity is projected to expand from 18 GW in 2017 to 21.6 GW in 2020 (EREA & DEA, 2019). Biofuels and waste represent 19% of the total primary energy supply and wind and solar’s contribution is negligible (IEA, 2019).

The revised PDP7 set a target for 850 MW of solar PV in 2020, 4 GW by 2025 and 12 GW by 2030. By June 2019, Viet Nam had overachieved the 2025 solar target by 4.5 GW of solar (and wind represented 0.45 GW) (MOIT & DEA, 2019). The solar target under discussion for PDP 8 is 18 GW by 2030 (World Bank, 2019b).

The solar support mechanism that led to the upscale of solar power in Viet Nam expired in June 2019. The lack of a support mechanism created a 10 month period of policy uncertainty (Publicover, 2020). The government extended the solar feed in tariff with Decision 13/2020 which applies to utility scale, rooftop and floating solar (Publicover, 2020). Commercial projects will only receive the new rates if they are in operation by the end of December 2020, whereas new projects beyond December can enter into a competitive bidding process (auction) to determine the price (Publicover, 2020). The move from feed-in-tariff to auctions was pushed forward with two pilot auctions for floating solar (Bellini, 2020).

Viet Nam is leading the ASEAN region with floating solar plans, with 47 MW installed and 330 MW planned, whereas other ASEAN countries have less than 150 MW planned, and in 2019 most ASEAN countries had less than 1 MW of floating solar (Ahmed & Hamdi, 2020).

Feed-in-tariff mechanisms targeted to wind sources brought about new planned investment in wind power. Viet Nam has 10 GW (by 2030) of wind projects submitted, with 5 GW approved for additional planning so far (MOIT & DEA, 2019). Viet Nam has a potential for 16 GW of offshore wind within 5 to 100 km from the shore (Danish Energy Agency, 2020). In June 2020, the Prime Minister requested the Ministry of Industry and Trade to add more wind projects to the electricity development plan and extend the wind feed-in tariff deadline which currently applies to plants with operation dates before November 2021 (Massmann, 2020).

Resolution 55 supports policies to promote clean energy, such as increasing the share of wind and solar in the total primary energy supply, encouraging investment in waste-to-energy plants; development of renewable energy centres; supporting studies for geothermal, wave, tidal, ocean current energy; and supporting pilot projects for hydrogen (Viet Nam Government, 2020b). Resolution 55 includes a new renewable energy target for renewables to represent 15-20% in 2030 and 25-30% in 2045 in the total primary energy supply (TPES) (Viet Nam Government, 2020b).

Viet Nam has a Development Strategy on Renewable Energy, with plans to 2030 and a vision to 2050 (MNRE, 2019). The renewable energy targets in this strategy are reflected in the Revised PDP7 (included in the CAT current policy scenario) (MNRE, 2019).

The revised PDP7 set targets for electricity capacity and electricity production. Plans for renewable energy encompassing small hydro, wind, solar and biomass, to represent 6.5% of electricity produced or imported in 2020, 6.9% in 2025 and 10.7% by 2030 (Viet Nam Government 2017a). Additional large, medium and pumped hydro is projected to represent 12.4% of electricity production by 2030 (Viet Nam Government 2017a). In terms of electricity capacity, 30.1% will be large/medium hydro and 9.9% other renewables in 2020; 17.4% large/medium hydro and 6.9% other renewables by 2025; and 16.9% large/medium hydro, and 21% other renewables by 2030. Official decisions by the Prime Minster encourage the uptake of wind and solar energy in efforts to encourage and assist the development of projects (MNRE, 2019).

The draft PDP 8 shows rapid growth of solar and wind comprising 28% of the system capacity in 2030 and 41% in 2045, overtaking coal (Brown & Vu, 2020). The draft PDP 8 28% renewables capacity is much larger than the 21% capacity reported in the revised PDP 7 for 2030. Solar and wind have large potential in the central and south of the country, and a transmission link to north Viet Nam is planned from 2025 (Brown & Vu, 2020).

Viet Nam’s boom in renewable energy has led to pressure on the power grid (Allens, 2020). The state-owned company Vietnam Electricity (EVN) has curtailed renewables without compensation, creating risks for investors and impacting the bankability of renewable energy projects (Allens, 2020; MDI, 2020). Viet Nam’s transmission grid faces limitations because larger energy projects are installed far from main demand centres. Reportedly, 0.44 GW of over 4.5 GW of new wind and solar experienced forced curtailment between 30 June 2019 and January 2020 (MDI, 2020). These limitations will likely delay the onset of new solar projects in the near future (MOIT & DEA, 2019).

To solve the grid issues, solar panels can be paired with battery storage along with an improved transmission system and storage (MOIT & DEA, 2019). EVN has invested over USD 15.5 million in a substation to free up 300 MW of solar, and there have been numerous grid projects completed between August 2019 to 2020 (MDI, 2020).

The MOIT & DEA (2019) find that wind and solar will be cheaper than coal by 2030, with further cost reductions by 2050. Whereas a study by McKinsey and Company finds that Viet Nam is already at the tipping point where renewables are the lowest cost option to meet increased electricity demand compared to thermal power (Breau et al., 2019).

The potential for renewables is evidenced by a McKinsey and Company study, modelling a renewables-led pathway with five times more wind and solar than in the “Current Plan” (current policy pathway) (Breau et al., 2019). The renewables-led pathway includes gas and battery storage. The renewables-led pathway shows renewables representing over 50% renewable generation by 2030 compared to just 25% following current policy. Teske et al model renewable energy scenario with 50% renewable generation in 2030 and up to 90% by 2050 in Viet Nam (Teske et al., 2019).

The renewables-led scenario offers a “cheaper, cleaner, more secure” pathway compared to the current plan for Viet Nam’s energy sector (Breau et al., 2019). It is 10% cheaper (total cost from 2017 to 2030). The renewables-led pathway has less reliance on imported fuels improving energy security, reducing coal imports by 70%, and creates 465,000 additional jobs (from 2017 to 2030) (Breau et al., 2019). In addition, the renewables pathway is projected to reduce emissions by 1.1 Gt CO2e over the 2017-2030 period compared to the current plan (Breau et al., 2019).

Renewable energy can revive the rate of Viet Nam’s economic growth. A report by the World Bank that provides recommendations for the solar auction programme finds that the 12 GW solar target from the revised PDP 7 supports up to 45,000 full times jobs per year to 2030 in project development, services and operations and maintenance, and manufacturing (World Bank, 2019b). If the PDP 8 raises the capacity target for solar PV then further job creation would be expected.

Another report estimates the revised PDP 7 would create 315,000 jobs annually to 2030 (GreenID et al., 2019). Renewables produce double the jobs per average installed MW compared to the fossil fuel sector (GreenID et al., 2019). This evidence suggests the government should prioritise renewables over fossil fuels in the PDP 8.

There are many co-benefits between transitioning to renewable energy and sustainable development in Viet Nam, such as reducing fuel import dependency, improving the reliability of electricity supply, improving access to modern energy, reducing air pollution impacts both indoor (from switching from traditional biomass cooking) and outdoor (Climate Analytics, 2019a).

Energy Efficiency

One strategy to cope with the rising energy demand is to improve energy efficiency. The Viet Nam National Energy Efficiency Program 3 (VNEEP3) (2019-2030) has a target of reducing the total final energy consumption by 5-7% in 2025 below business as usual levels, and by 8-10% in 2030 (MOIT, 2018). The program also includes targets to reduce electricity losses, and industrial sub sector energy saving targets (MOIT, 2018). CAT current policy projections do not include the recent VNEEP3 which would further reduce energy demand (APERC, 2019b).

Industry

Industrial process emissions are mainly from cement production, but also steel and ammonia production (MNRE, 2019). This sector is projected to be the second largest sector in terms of emissions by 2030 based on the current policy pathway. Viet Nam’s first NDC excluded industrial processes emissions, but the updated 2020 NDC is inclusive of industry emissions.

In 2015 the Minister of Industry and Trade approved the Green Growth Action Plan 2015-2020 for the industry sector, and the Ministry of Construction has an action plan until 2020 to reduce cement industry GHG emissions (MNRE, 2019). The plan aims to reduce 20 MtCO2e by 2020 and 164 MtCO2e by 2030 compare to BAU levels (MNRE, 2019). The policy reduces energy-related emissions, but not process-related emissions. This policy has not been quantified in the current policy projections as we do not know the baseline used.

Although not included in the current policy scenario, the VNEEP3 (2019-2030) sets energy efficiency targets for the industry sector, to reduce average energy consumption in subsectors compared to the 2015-2018 levels (MOIT, 2018). For example, the chemical industry has a target to reduce average energy consumption by at least 10%, and the cement industry has a target to reduce average energy consumption to produce 1 tonne of cement from 87kgOE in 2015 to 81 kgOE in 2030 (MOIT, 2018). VNEEP3 sets targets for newly built industrial parks to apply energy efficiency and conservation solutions by 2025 among other targets (MOIT, 2018).

Transport

The transport sector accounted for 20% of the total final energy consumption in Viet Nam in 2017 (IEA, 2019). In APERC’s (2019b) Outlook, domestic transport demand has a sharp increase with a compound annual growth rate of 3.7% (from 2015-2050). Road transport accounts for 97% of domestic transport energy demand in the same period (APERC, 2019b).

In 2011, the Prime Minister approved a project to control transport pollution aiming to reduce GHG emissions (MNRE, 2019). In 2016, the Minister of Transport approved an Action Plan (2016-2020) relating to green growth in transport, and in 2016 he approved an action plan to reduce CO2 in civil aviation for 2016-2020 (MNRE, 2019). The government has a roadmap to mix A92 gasoline with at least 5% bioethanol, and compulsory energy labelling for LDVs and motorcycles, which is projected to encourage some renewables (4.6%) and electricity (minor levels) by 2050 (APERC, 2019b).

Viet Nam is trying to limit the number of motorcycles and cars to 36 million and 2 million, respectively, but this is not deemed feasible in the APERC (2019b) Energy Outlook as two or three wheel vehicles already reached 60 million in 2016. APERC’s BAU scenario (that includes current policies, see assumptions) projects that road transport will be dominated by fossil fuels to 2050 with 95% (APERC, 2019b). The VNEEP3 (2019-2030) aims to develop and implement energy conservation practice standards for all transport vehicles (MOIT, 2018). This is not quantified in the current policy pathway.

Buildings

Unsurprisingly, energy demand in the building sector has risen in the past decade as result of Viet Nam’s successful implementation of universal electrification (APERC, 2019b). The residential sector accounts for 18% of the total final energy consumption in 2017 (IEA, 2019). The government has introduced some energy efficiency policies, including the NEEP3 (MOIT, 2018). An official Prime Minister Decision (No.04/2017/QD-TTg) in 2017 sets out mandatory energy labelling and minimum energy efficiency standards roadmap for equipment and appliances (MOIT, 2018). In the National Green Growth Strategy there are specific tasks relating to the development of green buildings, and energy efficiency of buildings (MNRE, 2019).

Agriculture

The latest government data (in 2014) shows agriculture represents 28% of Viet Nam’s GHG emissions (MNRE, 2019). Energy demand in the agriculture sector is considered in the current policy scenario. An official Decision by the Minister of Agriculture and Rural Development approved a program to reduce GHG emissions in the agriculture sector to 2020, promoting low carbon agriculture (MNRE, 2019). In 2016, the Minister also approved the Action Plan to Respond to Climate Change of Agriculture and Rural Development for 2016-2020 with a vison to 2050, including mitigation projects to reduce emissions (MNRE, 2019). The Green Growth Action Plan (2017) aims to achieve an emissions reduction of 20% from the sector by 2020 below 2010 levels (MNRE, 2019).

Forestry

Viet Nam’s LULUCF sector is intended to play a large role in meeting Viet Nam’s updated NDC. Under the government reported business-as-usual scenario, the LULUCF sector is estimated to be a sink of 49 MtCO2e in 2030 and the NDC target will increase the sink by 9 MtCO2e in 2030 (Viet Nam Government, 2020a).

The 2017 Law on Forestry regulates the management of forests, and notes that an assessment is needed to limit forest loss and conserve the forests (MNRE, 2019). The National Action Programme on the Reduction of GHG Emissions Reduction of Deforestation and Forest Degradation, Sustainable Management of Forest Resources, and Conservation and Enhancement of Forest Carbon Stocks (REDD+) by 2030, was approved in 2017 (MNRE, 2019).

Waste

In 2014, the waste sector represented 7% of emissions (excluding LULUCF) (MNRE, 2019). In 2018 the Prime Minister approved the National Strategy for General Management of Solid Waste to 2025 with a 2050 vision, which included energy recover and GHG reduction (MNRE, 2019).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter